UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 3, 2023

NUVASIVE, INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50744 |

|

33-0768598 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number ) |

12101 Airport Way, Broomfield, Colorado 80021

(Address of principal executive offices) (Zip Code)

(800) 455-1476

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.001 |

|

NUVA |

|

The NASDAQ Stock Market LLC

(NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

Representatives of NuVasive, Inc. (“NuVasive”) may present to certain investors, analysts and proxy advisory firms from time-to-time a presentation (“Investor Presentation”) in connection with the upcoming special meeting of NuVasive stockholders (the “Special Meeting”) to

consider and vote upon a proposal to adopt the Agreement and Plan of Merger, dated as of February 8, 2023, by and among NuVasive, Globus Medical, Inc. (“Globus Medical”) and Zebra Merger Sub, Inc., and certain other related matters.

The Special Meeting is scheduled to be held on April 27, 2023. A copy of the Investor Presentation is available on the Investor Relations section of NuVasive’s website at www.nuvasive.com and is being furnished as Exhibit 99.1 hereto.

The information contained in this Current Report and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1+ |

|

Investor Presentation, dated April 3, 2023 |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* * *

*

No Offer or Solicitation

This current report is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or

sell, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer

of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. This current report also does not constitute a

solicitation of proxy.

Important Information About the Transaction and Where To Find It

This communication relates to a proposed business combination of NuVasive and Globus Medical. In connection with the proposed transaction, Globus Medical

filed a registration statement on Form S-4 with the SEC on March 10, 2023, which was amended on March 24, 2023 and that includes a joint proxy statement/prospectus. The registration statement on Form S-4, including the joint

proxy statement/prospectus, provides details of the proposed transaction and the attendant benefits and risks. The registration statement was declared effective on March 28, 2023, and Globus Medical and NuVasive commenced mailing of the definitive

joint proxy statement/prospectus to their respective stockholders on March 29, 2023. Globus Medical and NuVasive may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy

statement statement/prospectus or the registration statement on Form S-4 or any other document which Globus Medical or NuVasive may file with the SEC. INVESTORS AND SECURITY HOLDERS OF GLOBUS MEDICAL AND

NUVASIVE ARE URGED TO READ THE REGISTRATION STATEMENT, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. The documents filed by Globus Medical or NuVasive with

the SEC will be available free of charge at the SEC’s website (www.sec.gov) and from Globus Medical and NuVasive, as applicable. Requests for copies of the joint proxy statement/ prospectus and other documents filed by Globus Medical with the

SEC may be made by contacting Keith Pfeil, Chief Financial Officer by phone at (610) 930-1800 or by email at kpfeil@globusmedical.com, and request for copies of the joint proxy statement/prospectus and other

documents filed by NuVasive may be made by contacting Matt Harbaugh, Chief Financial Officer, by phone at (858) 210-2129 or by email at investorrelations@nuvasive.com.

Participants in the Solicitation

Globus Medical,

NuVasive, their respective directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from Globus Medical’s and NuVasive’s shareholders in connection with the

proposed transaction. Information about the directors and executive officers of Globus Medical and their ownership of Globus Medical stock is set forth in Globus Medical’s annual report on Form 10-K and

Form 10-K/A for the fiscal year ended December 31, 2022, which was filed with the SEC on February 21, 2023 and March 16, 2023, respectively. Information regarding NuVasive’s directors and

executive officers is contained in NuVasive’s annual report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 22, 2023, and its proxy statement

for its 2022 annual meeting of stockholders, which was filed with the SEC on March 30, 2022. Certain directors and executive officers of Globus Medical and NuVasive may have a direct or indirect interest in the transaction due to securities

holdings, vesting of equity awards and rights to severance payments. Additional information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Globus Medical’s and NuVasive’s

shareholders in connection with the proposed transaction is included in the joint proxy statement/prospectus. These documents can be obtained free of charge from the sources indicated above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NUVASIVE, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

| April 3, 2023 |

|

|

|

By: |

|

/s/ Matthew K. Harbaugh |

|

|

|

|

|

|

Matthew K. Harbaugh |

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1 Delivering compelling shareholder value: NuVasive’s

combination with Globus Medical April 2023 1 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Safe harbor statements Cautionary notes on forward-looking statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” and similar expressions and variations or negatives of these words. Forward-looking

statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. These and other forward-looking statements are not

guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statements, including the failure to consummate the proposed

transaction or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a difference include, but are not limited to: (i) the proposed transaction may

not be completed on anticipated terms and timing or at all, (ii) a condition to closing of the transaction may not be satisfied, including obtaining shareholder and regulatory approvals, (iii) the anticipated tax treatment of the transaction may not

be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and

management strategies for the management, expansion and growth of the combined business after the consummation of the transactions, (v) potential litigation relating to the proposed transaction that could be instituted against Globus Medical,

NuVasive or their respective directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transactions, (vii) any negative effects of the announcement, pendency or consummation

of the transactions on the market price of Globus Medical’s or NuVasive’s common stock and on Globus Medical’s or NuVasive’s businesses or operating results, (viii) risks associated with third party contracts containing

consent and/or other provisions that may be triggered by the proposed transaction, (ix) the risks and costs associated with the integration of, and the ability of Globus Medical and NuVasive to integrate, their businesses successfully and to achieve

anticipated synergies, (x) the risk that disruptions from the proposed transaction will harm Globus Medical’s or NuVasive’s business, including current plans and operations, (xi) the ability of Globus Medical or NuVasive to retain and

hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, and (xiii) the other risks described in Globus Medical’s and NuVasive’s most recent annual reports on Form

10-K and quarterly reports on Form 10-Q. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the joint proxy statement/prospectus included in the registration statement on Form S-4 initially

filed by Globus Medical with the U.S. Securities and Exchange Commission (“SEC”) on March 10, 2023, as amended on March 24, 2023, in connection with the proposed transaction. While the list of factors presented here is, and the list of

factors presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional

obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational

problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Globus Medical’s or NuVasive’s consolidated financial condition, results of operations, credit rating or

liquidity. Neither Globus Medical nor NuVasive assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable laws. Non-GAAP financial measures This communication includes certain non-GAAP measures not based on generally accepting accounting principles. These non-GAAP measures are in addition

to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP measures used by Globus Medical and/or NuVasive may differ from the non-GAAP measured used by other companies. 2 ©2023.

NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Safe harbor statements Important information about the transaction and

where to find it This communication relates to a proposed business combination of Globus Medical and NuVasive. In connection with the proposed transaction, Globus Medical filed a registration statement on Form S-4 with the SEC on March 10, 2023,

which was amended on March 24, 2023 and that includes a joint proxy statement/prospectus. The registration statement on Form S-4, including the joint proxy statement/prospectus, provides details of the proposed transaction and the attendant benefits

and risks. The registration statement was declared effective on March 28, 2023, and Globus Medical and NuVasive commenced mailing of the definitive joint proxy statement/prospectus to their respective stockholders on March 29, 2023. Globus Medical

and NuVasive may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement statement/prospectus or the registration statement on Form S-4 or any other document which

Globus Medical or NuVasive may file with the SEC. INVESTORS AND SECURITY HOLDERS OF GLOBUS MEDICAL AND NUVASIVE ARE URGED TO READ THE REGISTRATION STATEMENT, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE

FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. The

documents filed by Globus Medical or NuVasive with the SEC will be available free of charge at the SEC’s website (www.sec.gov) and from Globus Medical and NuVasive, as applicable. Requests for copies of the joint proxy statement/ prospectus

and other documents filed by Globus Medical with the SEC may be made by contacting Keith Pfeil, Chief Financial Officer by phone at (610) 930-1800 or by email at kpfeil@globusmedical.com, and request for copies of the joint proxy

statement/prospectus and other documents filed by NuVasive may be made by contacting Matt Harbaugh, Chief Financial Officer, by phone at (858) 210-2129 or by email at investorrelations@nuvasive.com. Participants in the solicitation Globus Medical,

NuVasive, their respective directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from Globus Medical’s and NuVasive’s shareholders in connection with the

proposed transaction. Information about the directors and executive officers of Globus Medical and their ownership of Globus Medical stock is set forth in Globus Medical’s annual report on Form 10-K and Form 10-K/A for the fiscal year ended

December 31, 2022, which was filed with the SEC on February 21, 2023 and March 16, 2023, respectively. Information regarding NuVasive’s directors and executive officers is contained in NuVasive’s annual report on Form 10-K for the fiscal

year ended December 31, 2022, which was filed with the SEC on February 22, 2023, and its proxy statement for its 2022 annual meeting of stockholders, which was filed with the SEC on March 30, 2022. Certain directors and executive officers of Globus

Medical and NuVasive may have a direct or indirect interest in the transaction due to securities holdings, vesting of equity awards and rights to severance payments. Additional information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of Globus Medical’s and NuVasive’s shareholders in connection with the proposed transaction is included in the joint proxy statement/prospectus. These documents can be obtained free of charge

from the sources indicated above. No offer or solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for,

buy or sell, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with

applicable law. 3 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Agenda • Executive summary • NuVasive’s journey of

innovation • Combination with Globus Medical: Deep strategic rationale • Compelling value for NuVasive shareholders • Offer is attractive and in line with precedents • A rigorous process led by NuVasive’s independent,

highly experienced Board 4 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Executive summary 5 ©2023. NuVasive, Inc. or one of its

subsidiaries. All rights reserved.

Executive summary Proposed transaction with Globus Medical delivers a

unique and compelling opportunity for NuVasive shareholders • Combines two of the leading innovators in spine to target $50 billion musculoskeletal market opportunity Accelerates and strengthens our strategy • Pairs Globus

Medical’s and NuVasive’s complementary spine, orthopedics solutions, and enabling technologies to create one of the most comprehensive, innovative offerings in the industry for the benefit of our shareholders • Increases global

scale and expands customer reach with minimal overlap Strong financial • Anticipate above market mid- to high-single digit revenue growth value creation with • Significant synergies anticipated to be achieved over time significant upside

• Expected to be accretive to Non-GAAP EPS* in year one; achieve mid-30% adjusted EBITDA margins* by year three; potential for generate significant annual free cash flow our shareholders • Discussions with Globus Medical began in

September 2021; negotiations in earnest started in early December 2022 Rigorous process • Rigorous process led by independent, highly experienced Board of Directors, supported by skilled financial and legal advisors led by independent, highly

experienced Board • Thoroughly considered alternatives and stand-alone path, and evaluated merits of the combination with Globus Medical to maximize shareholder value *See Non-GAAP financial measures on slide 2. 6 ©2023. NuVasive, Inc. or

one of its subsidiaries. All rights reserved.

Executive summary Transaction overview Structure • Stock-for-stock

merger • NuVasive shareholders will receive a fixed exchange ratio of 0.75 Globus Medical’s shares for each NuVasive share Anticipated Post- • Globus Medical shareholders: 72% Closing Ownership • NuVasive shareholders: 28%

Governance • Executive Chairman: David Paul • Chief Executive Officer: Dan Scavilla • Chief Financial Officer: Keith Pfeil • Chris Barry to support integration planning efforts • Board: Globus Medical’s current

8-member board will be expanded to include 3 NuVasive board members, in line with pro forma ownership Name / Ticker, Exchange and • Name: Combined company name to be announced at or prior to closure Corporate Office • Ticker and

exchange: GMED (NYSE) • Primary corporate office: Audubon, PA • Other key offices (including but not limited to): San Diego, CA and Methuen, MA Closing Conditions / Timing • Globus Medical and NuVasive shareholder approvals •

HSR Act clearance and other customary closing conditions • Expected closing: Mid-2023 7 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation 8 ©2023. NuVasive, Inc. or

one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation Back pain is a growing, global

problem Global population 60 years and 1.4 billion older—expected to double by 2050 Lower back pain affects 540 million 1 in 10 people globally Costs of annual treatment and $560+ billion loss of productivity in the U.S. alone Back pain is the

primary #1 cause of disability in the U.S. Annual global market for hardware ~$12 billion used in spinal surgery Sources: World Health Organization, Ageing and Health, 2021; Global Burden of Disease Study 2010, Lancet, 2012, Al Mazroa, Mohammad A.,

Taimela S, Kujala U; Buchbinder R, et al, Lancet, 2018; National Institutes of Health, Prevalence of Chronic Pain and High-impact Chronic pain Among Adults, U.S., 2016; Institute of Medicine, Relieving Pain in America, Washington D.C. National

Academies Press, 2011; company estimates. Market size estimates based on third-party market estimates and internal NUVA management estimates. 9 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation NuVasive’s growth has been

driven by innovation Focused on introducing advanced technologies in spine and specialized orthopedics Expanding into new spine and orthopedic segments to drive above-market growth Pursuing globalization through expansion of portfolio into select

markets outside of the U.S. $1.2 billion in 2022 net sales International net sales ~23% ~3,000 employees worldwide 10 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation Introducing advanced

technologies to compete more broadly Expanding the NUVA portfolio in Core Spine surgery Investing outside of through the introduction of innovative procedural solutions traditional spine surgery Specialized Orthopedics Anterior Cervical Magnetic

growing rod technology Mod-EX XLIF Simplify Cervical Disc Posterior Complex Intelligent Surgery Integrated technologies NuVasive Tube System Reline 3D in one platform Some products not commercially released; NuVasive may not make these products

available for commercial sale. For important product safety information please visit nuvasive.com/eifu. 11 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation Globalization is a core focus

~$280 million in 2022 net sales from outside the U.S. Global presence in 50+ countries 25+ office locations Surgeon education centers in San Diego, New Jersey, and Singapore Multiple regional distribution centers across the globe, including Memphis,

Amsterdam, Tokyo, Sao Paolo and Sydney Key market presence Surgeon education Key office location centers 12 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation NuVasive’s strategy

focuses on growth and expansion NUVA Today Expansion Potential Continue momentum in the core business: Extend presence in lateral to greater share in other core spine segments (e.g., cervical) Globalize the business: Expand reach and breadth of

portfolio available to NUVA’s ~50 global markets Invest in Intelligent Surgery: Introduce enabling technologies to improve outcomes Leading position Increasing share in core for patients and surgeons in pre-, intra- and post-surgery: the Pulse

platform in lateral spine spine sub-segments Growing orthopedic Creating durable growth Pursue scale in attractive markets outside of traditional spine surgery: Invest to scale franchise internationally NuVasive’s position in Specialized

Orthopedics, expand product portfolio Advancing Intelligent Driving operational Drive durable efficiencies through manufacturing and operations, enhancing Surgery vision efficiencies operating profit as we scale 13 ©2023. NuVasive, Inc. or one

of its subsidiaries. All rights reserved.

NuVasive’s journey of innovation Standalone strategy requires

significant investment and scale to achieve potential Drivers of Potential Requirements to achieve potential Continue momentum Extending strength in lateral to other Dependent on comprehensive and core segments (cervical, anterior) differentiated

portfolio to fully compete in the core Globalize Young and fast-growth global footprint, Limited OUS portfolio requires investment with significant runway to achieve efficient scale the business Invest in Opportunity to participate in an evolution

Late mover in robotics; investment in surgical technology and capability required to realize vision Intelligent Surgery Scale Growth vector in scaling a stand-out Differentiated but niche technology needs orthopedics technology a complete

“bag” to achieve scale orthopedics Operational Volume growth to drive meaningful Density of business a key to achieving manufacturing efficiencies operational savings efficiencies 14 ©2023. NuVasive, Inc. or one of its subsidiaries.

All rights reserved.

Combination with Globus Medical: Deep strategic rationale 15

©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale Combining with Globus Medical greatly

accelerates NuVasive’s standalone strategy Requirements under standalone plan How combination delivers Continue momentum Dependent on comprehensive and Comprehensive suite of best-in-class differentiated portfolio to fully compete technology

(incl. expandables, robot) in the core Globalize Limited OUS portfolio requires investment Larger portfolio available OUS and greater to achieve efficient scale density in OUS footprint the business Invest in Late mover in robotics; investment

Globus Medical’s ExcelsiusGPS system delivers and capability required to realize vision proven platform and capability Intelligent Surgery Scale Differentiated but niche technology needs Globus Medical’s suite of orthopedic products a

complete “bag” to achieve scale expands orthopedics portfolio orthopedics Density of business a key to achieving Nearly 2x commercial expansion drives Operational operational savings greater efficiencies in NUVA efficiencies 16

©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale Globus Medical is a highly regarded spine and

orthopedics leader Focused on developing innovative solutions across the continuum of care Pioneer in expandables and robotics Consistent share-taker driven by innovation Strong financial profile and operational rigor $1.0 billion in 2022 net sales

International net sales ~15% ~2,600 employees worldwide 17 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale Globus Medical’s exceptional performance

is Stock Price Performance 5-Year 3-Year 1-Year recognized and rewarded by investors GMED 77.7% 44.3% 10.9% NUVA (0.5%) (39.7%) (10.5%) 1 (21.5%) (24.9%) (25.8%) Spine Peers GMED +10.9% NUVA (10.5%) Spine Peers (25.8%) Source: FactSet as of 2/8/23.

1. Spine Peers include ATEC, OFIX and ZIMV. 18 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – continue momentum in the core business

Globus NuVasive Combination creates a broad and competitive spine portfolio with little commercial overlap Simplify cervical disc NuVasive ACP system ® Quartex • Combination brings together a number of Fixation System MAGEC system

complementary and differentiated products, creating one of the most broadly competitive spine portfolios ® FORTIFY Corpectomy in the industry (Expandables, Simplify Cervical Disc, System Excelsius, X360, MAGEC) ® HEDRON Interbody Fusion

® SABLE • Highly complementary sales channel (mid-single Interbody ® CREO MIS Fusion digits of each company’s net sales exist with surgeons Fixation System where both businesses have similar revenue - and Reline over 60% have

no overlap) system ® RISE-L Interbody Fusion • Combined company has strong salesforce and one XLIF of the most compelling portfolios in the spine industry Modulus ALIF *Illustrative only – does not include all product offerings. 19

©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – globalize the business Accelerates

globalization strategies to win in high-value markets Combined presence in over 50 countries, with more than $400 million in combined 2022 net sales Complementary international footprint in key markets incl. Japan, Australia/New Zealand, Brazil,

Germany, Italy, U.K. Creates immediate scale globally and ability to effectively invest in high-growth markets 20 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – invest in intelligent surgery De-risks

and accelerates Intelligent Surgery vision Pre-op Intra-op Post-op Patient assessment Procedure selection Procedure execution Healing & recovery Outcome evaluation & optimization & planning & verification monitoring & continual

learning The combined company has the portfolio, footprint and capability to address the full continuum of patient care via Intelligent Surgery with the addition of robotics, imaging and other smart technologies 21 ©2023. NuVasive, Inc. or one

of its subsidiaries. All rights reserved.

Deep strategic rationale – scale orthopedics Globus NuVasive

® ANTHEM Small Fragment Fracture Combination greatly advances System ® CAPTIVATE ® Compression ANTHEM Screw System Mini Fragment orthopedic portfolio and brings Fracture System ® ANTHEM ® ANTHEM Clavicle Fracture scale to a

key growth vector Proximal Humerus System System outside of traditional spine ® ® AUTOBAHN PROVIDENT Trochanteric Hip System • The NuVasive Specialized Orthopedics (NSO) magnetic Nailing System growing rod technology is highly

differentiated but ® ANTHEM ® PRECICE currently addresses limited orthopedic indications Distal Radius Magnetic System Adjustable System • NSO’s strategy is to introduce a broader set of orthopedic ® AUTOBAHN ANTHEM®

EVO Femoral Distal Femur solutions to create efficiencies in the commercial channel Nailing System Fracture System ® GENflex2 Total ® • Globus Medical’s orthopedic offerings have many ANTHEM Knee Replacement Proximal Tibia

System complementary products which align well with the NSO Fracture System technology sale ® ® AUTOBAHN ARBOR Tibial Nailing External Fixation System System • The combined orthopedics business adds further scale to a highly

differentiated technology franchise, and targets ® ® ANTHEM ANTHEM Ankle Fracture a substantial addressable market for future growth Distal Tibia System Fracture System *Illustrative only – does not include all product offerings. 22

©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – operational efficiencies Improves

operational efficiencies Combination unlocks manufacturing capacity and increases asset utilization to drive meaningful operational efficiencies Further vertical integration supported by strong third-party vendor partners allows for scale

efficiencies and improved customer service levels Leverage NuVasive's Increase utilization of NuVasive's Expertise from Globus Medical’s ~100,000-square foot ~180,000-square foot >300,000 square foot manufacturing plants in Memphis, TN West

Carrollton, OH Limerick, PA, Audubon, PA & San Antonio, TX global distribution center to manufacture manufacturing plant 80+% implants in-house 23 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – benefits of scale Combination provides

rapid and valuable scale for the benefit of shareholders of the combined company Greater scale - 2022A ~$2 billion in a $50 billion market $1.2 billion in a $13 billion addressable market Net Sales Expanding presence in underpenetrated core segments

Broad and highly competitive spine portfolio More competitive Highly differentiated technology serving niche orthopedic segment High-value orthopedic portfolio addressing a large TAM portfolio Greater efficiency Advanced manufacturing capability,

but underutilized Increased scale drives greater efficiencies in manufacturing, in operations at current production levels supply and distribution Robust financial ~3x 2022A net debt leverage with growing cash flow generation Immediate positive net

cash position with strong cash flow profile under standalone strategy generation inclusive of synergy capture Note: Estimated financials based on NuVasive management projections and synergy schedule, available in the definitive proxy statement.

Market size of $13 billion for 2023 based on management estimates and third-party data. 24 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Deep strategic rationale – customer and industry perspectives

Customers and industry executives see the value of combining NuVasive and Globus Medical Surgeon Customers Industry Executives Survey “The Globus-NuVasive merger expands patient and surgeon “Spine-focused deal with little overlap and

complementary access to a broader array of complementary medical devices positions in key segments…” and technologies. I am better positioned to achieve best outcomes for my patients more efficiently” “Knowledgeable and

spine-focused leadership...” David Okonkwo, MD, PhD Professor of Neurological Surgery “Any company that thinks this merger will not work should Clinical Director of Brain Trauma Research Center rethink that…” University of

Pittsburgh Medical Center Quotes from “Faith in the operational excellence of the GMED team as well “The merger of two best-in-class companies like NuVasive and Customers and as the combined company's scale and portfolio breadth as

Globus Medical will not only provide spectacular innovation to Industry Executives obvious positives, making the deal a smart decision from a long- spine surgeons, but most importantly enhance patient care by term perspective despite nearer-term

integration challenges….” any measurable metric.” Steve Ludwig, MD Chief of Spine Surgery University of Maryland “This integration of technologies, their talented people and discipline will serve the ultimate goal: value care

to our patients.” Reg Haid, MD Atlanta Brain and Spine Care Past President, American Association of Neurological Surgeons Note: Industry Executive quotes from Canaccord Genuity survey results (3/26/23). 25 ©2023. NuVasive, Inc. or one of

its subsidiaries. All rights reserved.

Deep strategic rationale – Wall Street perspectives Wall Street

research analysts recognize the strategic merits of the combination March 19, 2023 February 23, 2023 Combined Company Better Positioned to Compete Integration Risks Mitigated by Direct Salesforce “… with a combined portfolio and

increased market share -- NewCo GMED & Lack of Overlap can now take aim at, and more effectively compete with, Spine market “In addition to the relatively small amount of account overlap between the leader, MDT. Specifically, with the

Excelsius3D imaging system as an two sales organizations, [management] sees other factors as helping to alternative to MDT’s well-established and broadly adopted O-Arm, some mitigate the risk of sales dis-synergies for the proposed

combination. One KOLs we spoke with commented that GMED is now well-positioned as a factor is that the majority of both sales organizations are now comprised direct threat to MDT” of direct sales reps, whereas the majority of most spine sales

organizations were comprised of independent third-party distributors or agents” Quotes from Wall Street Research Analysts February 22, 2023 March 1, 2023 Complementary Portfolios Offers Compelling Case OUS to Remain a Growth Driver for

Combined Business “Forcibly growing the company’s footprint is a viable strategy against the “The OUS portfolios seem complementary, with NuVasive being a No. 2 backdrop of the lower-growth spine market and larger multinational

competitor in Japan while Globus has historically been weaker in that competitors. NuVasive benefits from the addition of Excelcius given the market according to management. Both teams highlighted a focus on challenges it has seen with its own

robotic ambitions while Globus gains deepening penetration in existing OUS geographies versus expanding into access to compelling MiS offerings like C360 and X360 and the addition of new ones, particularly in large-population markets like Brazil,

Australia, and NSO to its trauma business, all while expanding the footprint of both New Zealand” companies in the US and OUS” 26 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Compelling value for NuVasive shareholders 27 ©2023. NuVasive,

Inc. or one of its subsidiaries. All rights reserved.

Compelling value for NuVasive shareholders Standalone vs. pro forma

combined company Combined company is larger, faster growing, and more profitable than standalone Standalone Pro Forma Combined NOTE: Standalone NUVA Revenue Pro Forma Combined Revenue NUVA Standalone $3,224 CAGR: 7.3% $3,009 $2,776 $2,534 $24 $2,344

$9 $1,695 $1,607 $1,509 GMED $1,408 $1,279 $3,200 $3,000 Standalone $2,804 $2,600 $2,379 CAGR: 8.2% $1,695 $1,607 $1,509 $1,408 $1,279 ($35) ($29) ($66) 20 23 20 24 20 25 20 26 20 27 20 23 20 24 20 25 20 26 20 27 NOTE: NUVA Standalone Standalone

NUVA Pro Forma Combined $924 $846 margin bps Adj. Operating Income Adj. Operating Income $734 $172 increase from $163 $604 $120 2023-2027: $488 $61 480bps $323 $294 $752 $20 $257 $683 $221 $614 $182 $543 $467 $323 $294 $257 GMED $221 $182 Standalone

20 23 20 24 20 25 20 26 20 27 20 23 20 24 20 25 20 26 20 27 margin bps increase from 20.8% 23.8% 26.5% 28.1% 28.7% 14.2% 15.7% 17.1% 18.3% 19.0% 2023-2027: 784bps Net Synergies % Margin Note: Based on internal NuVasive and Globus Medical management

projections. 28 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved. 8.3% CAGR 7.3% CAGR

Compelling value for NuVasive shareholders Experienced integration team

pursuing significant synergy potential An experienced integrations team… Confident in capturing synergies… To achieve a shared mission • Established Integration Management • High degree of confidence in achieving •

Primary shared goal of both teams is Office led by seasoned industry positive net synergies by year 2 to be successful in creating a world-class managers and senior executives of combined company; recognition that we both companies with decades of

need the best parts of each company to • Detailed analysis of each company combined spine industry experience realize our potential and shared vision showed little sales overlap at the surgeon level, limiting potential for commercial •

Significant engagement and activity disruption seen in prior large spine deals • Both companies have highly engaged to date using proven tools adapted for workforces sharing the same purpose- industry and company based on actual driven mission

and similar journeys: • Significant opportunity for cross-selling integration experience leading with innovation to better serve by commercial team of combined patients in spine and orthopedics. company’s differentiated product “We

are more alike than different” • Cross-functional integration team is portfolio highly experienced, having managed or participated in dozens of integrations, • Teams are diligently focused on the • Clear path to communicated

including large public company medtech work at hand: how to maintain the cost synergies integrations (BD/CareFusion, relative strengths of each organization Medtronic/Covidien, DePuy/Synthes) 29 ©2023. NuVasive, Inc. or one of its subsidiaries.

All rights reserved.

Compelling value for NuVasive shareholders Investors recognize Globus

Medical’s exceptional performance Historical NTM P/E • Globus Medical’s stock price has traded above NuVasive’s stock price in the past few years • An all-equity transaction allows GMED NuVasive shareholders to benefit

32.4x in the potential upside as a combined company • Combining with Globus Medical’s best-in- class operational and financial rigor should NUVA result in the pro forma combined 19.8x company trading at a blended NTM P/E multiple and

significant subsequent value creation for NuVasive shareholders Source: Wall Street research and FactSet as of 2/8/23. Globus Medical and NuVasive announced their intent to merge on 2/9/23. Note: Based on internal NuVasive and Globus Medical

management projections. 30 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Compelling value for NuVasive shareholders Significant value upside

based on strength of combined company operating profile Based on P/E Value Creation Analysis – $ per share NuVasive’s share of the combined company will result in significant value creation $111.24 opportunity for NuVasive shareholders

$83.43 26% Premium At 0.75x exchange ratio • Implied future share price of combined $66.46 company exceeds $80/share for NuVasive shareholders at 0.75x exchange ratio $45.78 • This represents a 26% premium to NuVasive’s standalone

projected future share price Standalone NuVasive Share Price on Standalone Projected NuVasive Future Projected Pro Forma Future Share Price 2/8/2023 Share Price on 1/1/2025 on 1/1/2025 • NuVasive shareholders are being fully Adj. EPS: $3.35 PF

Adj. EPS: $3.96 compensated for standalone execution with additional upside potential NTM P/E: 19.8x Pro Forma NTM P/E: 28.1x Note: Pro Forma Share Price on 1/1/2025 of $83.43 represents NuVasive’s share of the Pro Forma Share Price on

1/1/2025 calculated as expected pro forma NTM P/E multiple of 28.1x multiplied by pro forma 2025E EPS of $3.96 multiplied by the exchange ratio of 0.750x. Note: Based on internal NuVasive and Globus Medical management projections. 31 ©2023.

NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Offer is attractive and in line with precedents 32 ©2023.

NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Offer is attractive and in line with precedents Transaction multiple

consistent with other selected precedent spine / orthopedic M&A transactions 1 Transaction Value / LTM EBITDA 26.0x 2 Transaction Multiple at Announcement: 13.7x Median Transaction Multiple: 12.3x 16.4x 11.7x 11.3x 12.3x 4/27/11 2/3/14 4/24/14

10/23/17 11/19/18 Source: Public filings, press releases; Wall Street research. 1. Other selected precedents were reviewed but excluded from the Transaction Value / LTM EBITDA analysis as either the multiple was not material or was a negative value.

2. Implied consideration value based on GMED share price on 2/8/23. 33 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

Offer is attractive and in line with precedents Premium to unaffected

trading level and premium to current price NuVasive Share Price $65.00 $57.72/Share 26% Premium Implied Over Unaffected $60.00 2 Consideration at Share Price 1 Announcement $55.00 $50.00 Precedent premiums paid analysis for all-stock $45.00

transactions between $1 billion - $10 billion where $40.00 Unaffected Date the target pro forma ownership is between 25% - $35.00 35% had a median premium of 16% $30.00 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22

Jan-23 Feb-23 Source: FactSet as of 2/8/23. 1. Based on the transaction exchange ratio of 0.750x and Globus Medical share price of $76.96 on 2/8/23 at signing. 2. Based on NuVasive stock price on 2/8/23. 34 ©2023. NuVasive, Inc. or one of its

subsidiaries. All rights reserved.

Offer is attractive and in line with precedents Market reaction to the

transaction likely overstated and short-term Share Price Performance Since Transaction Overview Announcement • We believe the market reaction to the transaction is likely transitory o Short-term reaction from all-equity nature of transaction o

NUVA stock now tethered to GMED stock 2/9/23: Merger with Globus Medical Announced • As the anticipated merits of the deal are realized, we expect Globus Medical stock should recover, creating value for NUVA shareholders NUVA (9.8%) GMED March

29, 2023 (27.4%) Sell-off Is Overdone At These Levels “GMED shares have traded down ~30% since the Feb. 9th merger announcement – a selloff that we believe more than captures a worst-case scenario and the near/long-term uncertainty

related to the integration of NuVasive….The merger is likely a sound long-term strategy for all parties involved, and the pullback in shares creates a buying opportunity for long-term investors.” Source: Wall Street research and FactSet

as of 3/31/23. 35 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board 36 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board Process overview The NuVasive Board met 10+ times from December 2022 - February 2023 with management and the company’s financial and legal advisors to discuss the proposed combination and to evaluate alternatives for

maximizing shareholder value Process led by highly Thoroughly considered Negotiated terms to Board unanimously qualified, independent alternatives and stand-alone achieve best possible deal approved transaction and Board of Directors focused path,

and evaluated merits for NuVasive and its remains supportive and on delivering of the combination with shareholders, taking into enthusiastic about the shareholder value Globus Medical to maximize account the significant transaction and its

potential shareholder value synergies that could be for NuVasive's stockholders unlocked from the combination 37 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board World-class, highly qualified, independent board of directors focused on delivering shareholder value Chris Barry Daniel Wolterman Vickie Capps Robert Friel John DeFord Chief Executive Officer Independent Chair Independent Director

Independent Director Independent Director — Director since February 2018 — Director since July 2015 — Director since June 2015 — Director since February 2016 — Director since February 2018 — Relevant Experience: —

Relevant Experience: — Relevant Experience: — Relevant Experience: — Relevant Experience: Former SVP and President of Surgical Former CEO of ColubrisMX, X-Cath, Former EVP, CFO and Treasurer Former Chairman and CEO Former EVP and CTO

of Becton, Innovations at Medtronic; President and Memorial Hermann Health of DJO Global of PerkinElmer Dickinson and Company of Advanced Surgical Technologies of System — Committees: Audit (C), Nominating — Committees: Compensation —

Committees: Nominating Covidien — Committees: Compensation (C) HC LE G HC I HO HC LE F G HC LE F G HC LE I G Leslie Norwalk Scott Huennekens Siddhartha Kadia Amy Belt Raimundo 8 of 9 Directors are Independent Independent Director Independent

Director Independent Director Independent Director Skills and Experience — Director since May 2014 — Director since October 2018 — Director since February 2021 — Director since August 2021 G Global HC Healthcare — Relevant

Experience: Former Acting — Relevant Experience: — Relevant Experience: — Relevant Experience: LA Law LE Public Co. Leadership Administrator for CMS; Chairman of Envista; Former CEO of PhenomeX; Former President Managing Partner of

Kaiser Director of Neurocrine Biosciences, President, CEO and Chairman of Verb and CEO of EAG Laboratories Permanente Ventures F Finance B Government Arvinas and Modivcare Surgical and CEO of Volcano Corp. — Committees: Nominating —

Committees: Compensation — Committees: Nominating (C), Audit — Committees: Audit HO Hospital I Innovation HC LA B HC LE F I HC LE I G HC LE F G 38 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board NuVasive’s Board is committed to good governance practices Accountability and Independence of NuVasive’s Board Governance Highlights Independent directors meet frequently Directors elected by majority vote in executive

session Chair and CEO roles are separated Board and Committees engage in annual self-evaluations Independent compensation consultant engaged by 8 of 9 (89%) directors are independent Compensation Committee; compensation risk assessment conducted

annually Mandatory director retirement age of 72 Stock Ownership Guidelines for directors and senior management including claw back provisions 4 independent directors added in last 5 years Hedging transactions prohibited under the Company’s

Average director tenure of 5.4 years Insider Trading Policy Say-on-Pay received ~96% shareholder support at the 2022 Annual Meeting and has averaged ~94% shareholder support since 2018 39 ©2023. NuVasive, Inc. or one of its subsidiaries. All

rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board NuVasive conducted thoughtful, robust and deliberate process Early discussions in September 2021 with negotiations Active involvement by independent and experienced in earnest starting in early December 2022 Board, led by

independent Board Chair Thorough Board review of potential strategic alternatives Supported by experienced financial and legal advisors to maximize shareholder value in BofA and Wachtell Lipton Sept. 2021 – Sept. 2022 Oct. – Nov. 2022

Dec. 2022 Jan. – Feb. 2023 • Discussions started in September • NuVasive receives inquiry from Globus • NuVasive receives a further revised • NuVasive continues comprehensive 2021 with Globus Medical about a Medical in

October 2022 about a indication of interest from Globus diligence process including numerous possible business combination possible business combination Medical diligence calls, meetings and information exchange • In October 2021, NuVasive

received • NuVasive receives indication of interest • NuVasive Board and management an indication of interest from Globus from Globus Medical, which was not discuss with advisors the strategic and • NuVasive and BofA perform

financial Medical; after media reports leaked accepted financial merits of the potential and synergy analyses the potential transaction in November combination, including risks and • NuVasive Board and management • Robust negotiations

continue with 2021, both parties ended discussions opportunities as a standalone vs. evaluates merits and risks of a merger NuVasive obtaining improved deal combined entity • After the leak, occasional dialogue with Globus Medical, potential

terms, including for “window shop”, occurred between the parties on alternative transactions and stand- • After aligning on the proposed exchange antitrust efforts, and voting industry trends and developments, alone path ratio of

0.75x, extensive negotiations of commitment but no substantive discussion terms ensued, including exclusivity, • NuVasive receives a revised indication • Both NuVasive and Globus Medical regarding a combination termination rights,

termination fees, of interest from Globus Medical, which Boards unanimously approve antitrust efforts and voting commitment was not accepted transaction; execute merger from Globus Medical’s Executive agreement • Both parties continue to

discuss the Chairman and controlling shareholder merits of a business combination 40 ©2023. NuVasive, Inc. or one of its subsidiaries. All rights reserved.

A rigorous process led by NuVasive’s independent, highly

experienced Board Favorable deal terms • Exchange Ratio resulting in ~28% ownership in the combined company Share of the • Opportunity for NuVasive shareholders to participate in a higher margin and faster growing pro forma combined

company vs standalone Pro Forma Company • Participation in synergy realization by the combined company • Rigorous review of alternative strategic transactions and standalone path • No other offers or inbound interest following

November 2021 media reports Comprehensive • Exclusivity not granted to Globus Medical, despite requests, to allow maximum flexibility and Open Process • Negotiated a “window shop” period with reduced break fees in event a

bidder emerged post signing of merger agreement • No offers or inbound interest received since signing and announcement of merger agreement • Limited closing conditions; the only antitrust closing condition under the merger agreement is

HSR clearance • The outside date for HSR clearance is October 8, 2023 and can be extended to February 8, 2024 Focus on • Limited termination rights; Globus Medical is required to pay NuVasive a termination fee of up to $120 million if

Globus Medical Deal Closing terminates the merger agreement under certain conditions • Voting commitment from Globus Medical’s Executive Chairman and controlling shareholder 41 ©2023. NuVasive, Inc. or one of its subsidiaries. All

rights reserved.

Key takeaways Proposed transaction with Globus Medical delivers a

unique and compelling opportunity for NuVasive shareholders • Combines two of the leading innovators in spine to target $50 billion musculoskeletal market opportunity Accelerates and strengthens • Pairs Globus Medical’s and

NuVasive’s complementary spine, orthopedics solutions, and enabling technologies to create one of the our strategy for the benefit of most comprehensive, innovative offerings in the industry our shareholders • Increases global scale and

expands customer reach with minimal overlap • Anticipate above market mid- to high-single digit revenue growth Strong financial value creation • Significant synergies anticipated to be achieved over time with significant upside potential

for our shareholders • Expected to be accretive to Non-GAAP EPS* in year one; achieve mid-30% adjusted EBITDA margins* by year three; generate significant annual free cash flow • Discussions with Globus Medical began in September 2021;

negotiations in earnest started in early December 2022 Rigorous process led by • Rigorous process led by independent, highly experienced Board of Directors, supported by experienced financial and legal advisors independent, highly experienced

Board • Thoroughly considered alternatives and stand-alone path, and evaluated merits of the combination with Globus Medical to maximize shareholder value *See Non-GAAP financial measures on slide 2. 42 ©2023. NuVasive, Inc. or one of its

subsidiaries. All rights reserved.

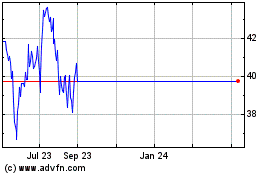

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

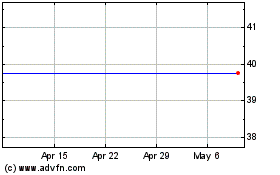

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Jul 2023 to Jul 2024