Filed by NuVasive, Inc. Pursuant to Rule 425 under the Securities Act of

1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: NuVasive, Inc. Commission File No.: 000-50744 Combining to create an innovative, global musculoskeletal company focused on patient care February

9, 2023 1

Our vision Diversified, leading musculoskeletal technology company

Innovation in imaging, Thought and industry leadership in spine navigation, and robotics Build strong foundation in trauma and total joint arthroplasty Continue to expand in other musculoskeletal areas, including regenerative biologics, sports

medicine, power tools and extremities 2 2

Value creation for key stakeholders PATIENTS SURGEONS EMPLOYEES

SHAREHOLDERS • Continued focus on • Expands product • Shared commitment • Expected to be accretive to improving patient outcomes offerings in procedures to patient-focused innovation adjusted non-GAAP EPS and enabling

technologies within year 1 post-close • Access to best-in-class • Strong sense of urgency product portfolio • Leverages talent from • Financial discipline • Opportunities for career both organizations anticipated to

drive EBITDA • Combined resources for advancement to mid-30s by year 3 future innovation to solve • Enhanced sales distribution • Integrates infrastructure and unmet clinical needs networks • ROIC expected to exceed resources

the cost of capital by year 3 • Commitment to global • Passionate workforce surgeon education and research 3

Combination creates innovative, global musculoskeletal company

Complementary global Comprehensive and Continued commitment footprint to support more innovative portfolio in spine to product development patients and surgeons and orthopedics and surgeon education Expands operational Strong financial profile and

Compelling upside capabilities value creation opportunity revenue potential for shareholders 4

Employees • Shared commitment to patient-focused innovation •

Strong sense of urgency • Opportunities for career advancement • Integrates infrastructure and resources • Passionate workforce 5

Combining to create an innovative, global musculoskeletal company focused

on patient care February 9, 2023 6

Legal disclaimers No Offer or Solicitation This communication is for

informational purposes only and is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or sell, or an invitation to subscribe for, buy or sell any securities or a

solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, invitation, sale or solicitation would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with

applicable law. Cautionary Notes on Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as

“expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” similar

expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated

benefits thereof. These and other forward- looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any

forward-looking statements, including the failure to consummate the proposed transaction or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a

difference include, but are not limited to: (i) the proposed transaction may not be completed on anticipated terms and timing, (ii) a condition to closing of the transaction may not be satisfied, including obtaining shareholder and regulatory

approvals, (iii) the anticipated tax treatment of the transaction may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance,

indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the transactions, (v) potential litigation relating

to the proposed transaction that could be instituted against Globus Medical, NuVasive or their respective directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the

transactions, (vii) any negative effects of the announcement, pendency or consummation of the transactions on the market price of Globus Medical’s or NuVasive’s common stock and on Globus Medical’s or NuVasive’s operating

results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (ix) the risks and costs associated with the integration of, and the ability of Globus Medical

and NuVasive to integrate, the businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the proposed transaction will harm Globus Medical’s or NuVasive’s business, including current plans and

operations, (xi) the ability of Globus Medical or NuVasive to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic developments, and (xiii) the other risks described in Globus

Medical’s and NuVasive’s most recent annual reports on Form 10-K and quarterly reports on Form 10- Q. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the joint proxy

statement/prospectus that will be included in the registration statement on Form S- 4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented

in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the

realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial

loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Globus Medical’s or NuVasive’s consolidated financial condition, results of operations, credit rating or liquidity. Neither

Globus Medical nor NuVasive assumes any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise

required by securities and other applicable laws. 1

Legal disclaimers Important Information About the Transaction and Where To

Find It In connection with the proposed transaction, Globus Medical will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a joint proxy statement of Globus Medical and

NuVasive and that will also constitute a prospectus of Globus Medical for shares of its class A common stock to be offered in the proposed transaction. Globus Medical and NuVasive may also file other documents with the SEC regarding the proposed

transaction. This document is not a substitute for the joint proxy statement statement/prospectus or registration statement or any other document which Globus Medical or NuVasive may file with the SEC. INVESTORS AND SECURITY HOLDERS OF GLOBUS

MEDICAL AND NUVASIVE ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE THE JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. The registration statement, definitive joint proxy statement/ prospectus and other

documents filed by Globus Medical and NuVasive with the SEC will be available free of charge at the SEC’s website (www.sec.gov) and from Globus Medical and NuVasive. Requests for copies of the joint proxy statement/ prospectus and other

documents filed by Globus Medical with the SEC may be made by contacting Keith Pfeil, Chief Financial Officer by phone at (610) 930-1800 or by email at kpfeil@globusmedical.com, and request for copies of the joint proxy statement/prospectus and

other documents filed by NuVasive may be made by contacting Matt Harbaugh, Chief Financial Officer, by phone at (858) 210-2129 or by email at investorrelations@nuvasive.com. Participants in the Solicitation Globus Medical, NuVasive, their respective

directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from Globus Medical’s and NuVasive’s shareholders in connection with the proposed transaction.

Information about the directors and executive officers of Globus Medical and their ownership of Globus Medical stock is set forth in Globus Medical’s annual report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with

the SEC on February 17, 2022 and its proxy statement for its 2022 annual meeting of stockholders, which was filed with the SEC on April 21, 2022. Information regarding NuVasive’s directors and executive officers is contained in

NuVasive’s annual report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on February 23, 2022, and its proxy statement for its 2022 annual meeting of stockholders, which was filed with the SEC on March

30, 2022. Certain directors and executive officers of Globus Medical and NuVasive may have a direct or indirect interest in the transaction due to securities holdings, vesting of equity awards and rights to severance payments. Additional information

regarding the persons who, may under the rules of the SEC, be deemed participants in the solicitation of Globus Medical’s and NuVasive’s shareholders in connection with the proposed transaction will be included in the joint proxy

statement/prospectus. These documents can be obtained free of charge from the sources indicated above. Non-GAAP Measures This communication includes certain non-GAAP measures not based on generally accepting accounting principles. These non-GAAP

measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP measures used by Globus Medical and/or NuVasive may differ from the non-GAAP measured used by other

companies. 2

NuVasive Company Broadcast – February 9, 2023

Chris Barry:

Good afternoon.

Thanks for tuning in today.

By now, I’m assuming

you’ve all heard the message.

And as we continue to process, I wanted to reach out in person, let you hear it from me so to speak and echo some

exciting news to reinforce some of the key points as to why we were compelled and why we’re excited about this opportunity.

So, what was announced

is what you see on the screen. We’re combining to create an innovative global musculoskeletal company focused on patient care with the combination with Globus Medical and NuVasive.

There’s been a lot of conversation. I’ve been having a conversation on this subject for a couple of months. The vision of this deal makes a ton of

sense. If you look at our vision compared to where when I sit down and talk to Globus and their vision, it lines up consistently across the board. Thought leadership and spine, enabling technology, foundation in diversification in areas like trauma

and broader orthopedics. So, this opportunity truly combines the two industry leaders. Creates a world class spine company, gives us scale, creates the opportunity to diversify and continue to build.

If you remember the three things I’ve talked about in the past — really the four things: core growth, intelligent surgery, attractive market

opportunities, and profitable growth. If you think about what this does, this accelerates all four of those areas and those dimensions of our strategy, — so it makes a lot of sense.

For all the shareholders and the and the stakeholders, from the patients, clearly I think both organizations are very patient centric organizations focused on

patient care.

For surgeons, I’ll tell you I had the chance to talk to a number of surgeons today, and I would say the one word I would use would

just be “excited” — that they’re excited about the opportunity and they see how these two organizations will be complementary and synergistic coming together.

For employees, I think the organization that we can build, that we can embrace, truly will be a place to be a destination employer, with opportunities for

personal development, personal growth and really combining the best of what I think Globus has developed, complemented with what NuVasive does really well.

For shareholders, I’ve been watching the stock market today with some level of fascination. You know, I

would just say you’re going to see movement and volatility in the stock price from a shareholders. I wouldn’t pay attention to that. We didn’t do this for a stock price. We did this to create long-term value across all of the

stakeholders. So, I’m confident in the decisions we have made and the opportunity that is represented.

And really, we looked at this, there was four

or five things, six things here that we thought were compelling and why we believe this combination makes the most sense: #1, complementary global footprint to support more patients and surgeons. You know when we looked at this, we looked at the

commercial organizations and what we’ve identified is there’s very little overlap. A lot of people have said, how can that be? But when we really dug down at the surgeon level, there was very, very little overlap.

Clearly comprehensive portfolios — obviously they’ve got their enabling technology. I had a chance to view some of their newer technology today and

I can tell you I was excited, I’m impressed.

The continued commitment and dedication to product development and surgeon education — clearly the

DNA of innovation is embedded in both organizations.

Expands our operational capability. I think this is something that they’ve talked a lot about

over the last 24 to 40 hours, our West Carrollton facility and the expansion of our in-house manufacturing, our distribution center in Memphis. I can tell you they were looking to put their own distribution

center in Memphis, so this is a great opportunity to use that location to truly synergize and create value for the new company. And then strong financial profile — you’re looking at a 2 plus billion-dollar company. Great financial health,

generating a lot of free cash flow. What that means is a lot of investment to pump back into the business — things that independently we just didn’t have. So, a compelling opportunity.

And for the employees of the organization, I know change can be challenging. It can be daunting. I know there’s lots likely, there’s a lot of

questions, but I can tell you the employees of both organizations, I’ve had a chance to meet some of the folks here, obviously I know our team well, the shared commitment to patient focused innovation, the strong sense of urgency, as I talked

about before the opportunities for career advancement, infrastructure and resources in the passion we all bring — creating and putting these two companies together just creates a larger, focused organization, carries our values and like we said

before, continues to work hard to treat and reach more patients.

So let me just talk for a few minutes here. I think that’s the last slide I had.

Listen, I’ll just be honest that the timing of this announcement can be tricky. I just stood on stage about a week ago and talked to our global sales team at the global sales meeting in Denver, CO. We’re in the middle of goal setting so,

the timing was probably not the most optimal. We worked very hard, but the fact is we’ve been working hard and these things just happen when they happen. So, we’ve got a lot of opportunity, we need to continue to focus on the things that

we focus on. What happens next? What happens next is quite frankly business as usual. I recognize the impact this has had on our go-forward business decisions, but we have to stay focused on the execution and

our day-to-day responsibilities.

There’s going to be a significant period between now and when we ultimately close this transaction and

truly get into the integration execution between now and then, we’ll be planning a lot, but for most of the people in the organization, we’ve got to stay focused on what we can go do and that is go out, sell our products, support our

surgeons and ultimately keep focus on the patients.

Listen, I know you’re going to have a lot of questions, and I know the questions and the

concerns will likely vary by function. There’s likely more questions today than I can answer, but that’s the nature of this kind of deal. We’ll be working through a frequently asked questions document that we’re putting together

over the next several days and weeks that will grow.

If you have questions, please do ask and we’ll try to get answers for those questions.

We will be coming to San Diego next week and doing a town hall, maybe a series of town halls. I need to get Mike and the team to really plan this out. With me

will be the Globus leadership, including David Paul and Dan Scavilla. So they’ll be on campus. So for Thursday and if you’re out there listening and you’re local, please plan to come to the campus on Thursday if your remote worker,

work in the office that day, I’d like to have as many people as I can to meet and greet. You get a chance to hear from them. You get a further chance to hear from me, and hopefully by then we’ll have some answers to some of your questions

and at least start to formulate some timelines of what you can expect.

Listen, in closing, I’ll just say I know that change can be challenging. I

would just say don’t allow yourself to react. I think this is an opportunity that we should embrace. I’ll remind you, we’ll detail our comp plan and things of that nature in the coming weeks, but we’ve got an opportunity. I think

we started out the year fairly strong. And so, we got to keep that momentum going. I want to stress that the strategic direction of the company is accelerated by 5 to 10 years by this transaction. It’s a truly transformational opportunity for

our company.

I want you to take time to process. I understand. It’s new that these types of messages can be daunting. Talk to your leaders.

I’ve had a chance to talk to most of the leadership within the organization. I’ve asked them to be open, to be transparent, and to make sure they’re spending time leading through this change.

Listen, I want to thank everyone for your patience. Thank you in advance for being open minded. We’re going to work through a smooth transition.

While we continue to do so, we need to continue to focus on what we can control. Continue to do what we do. Execute our plans and ultimately go out like we

talked about, support our surgeons, support each other and ultimately treat patients around the world.

With that, I’m going to sign off for today. It’s been a long few weeks. I look forward to seeing a

lot of you next week. If I don’t see you next week and you’re not San Diego, you have my commitment I will be in person at your location in the near future. Memphis, West Carrollton, some of our global locations. I plan on coming out and

having conversation with as many people as I can.

With that, again, I want to thank you. Have a great Super Bowl weekend and we’ll talk to you

guys’ next week.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to subscribe for, buy or sell, or the solicitation of an offer to subscribe for, buy or

sell, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance

with applicable law.

Important Information About the Transaction and Where To Find It

In connection with the proposed transaction, Globus Medical will file with the U.S. Securities and Exchange Commission (“SEC”) a registration

statement on Form S-4 that will include a joint proxy statement of Globus Medical and NuVasive and that will also constitute a prospectus of Globus Medical for shares of its class A common stock to be offered

in the proposed transaction. Globus Medical and NuVasive may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the joint proxy statement statement/prospectus or registration statement or

any other document which Globus Medical or NuVasive may file with the SEC. INVESTORS AND SECURITY HOLDERS OF GLOBUS MEDICAL AND NUVASIVE ARE URGED TO READ THE REGISTRATION STATEMENT, WHICH WILL INCLUDE THE JOINT PROXY STATEMENT/PROSPECTUS, AND ANY

OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION AND RELATED MATTERS. The registration statement, definitive joint proxy statement/ prospectus and other documents filed by Globus Medical and NuVasive with the SEC will be available free of charge at the SEC’s website (www.sec.gov)

and from Globus Medical and NuVasive. Requests for copies of the joint proxy statement/ prospectus and other documents filed by Globus Medical with the SEC may be made by contacting Keith Pfeil, Chief Financial Officer by phone at (610) 930-1800 or by email at kpfeil@globusmedical.com, and request for copies of the joint proxy statement/prospectus and other documents filed by NuVasive may be made by contacting Matt Harbaugh, Chief Financial

Officer, by phone at (858) 210-2129 or by email at investorrelations@nuvasive.com.

Participants in the

Solicitation

Globus Medical, NuVasive, their respective directors and certain of their executive officers and other employees may be deemed to be

participants in the solicitation of proxies from Globus Medical’s and NuVasive’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Globus Medical and their ownership of

Globus Medical stock is set forth in Globus Medical’s annual report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on February 17, 2022 and its proxy

statement for its 2022 annual meeting of stockholders, which was filed with the SEC on April 21, 2022. Information regarding NuVasive’s directors and executive officers is contained in NuVasive’s annual report on Form 10-K for the fiscal year ended December 31, 2021, which was filed with the SEC on February 23, 2022, and its proxy statement for its 2022 annual meeting of stockholders, which was filed with the SEC on

March 30, 2022. Certain directors and executive officers of Globus Medical and NuVasive may have a direct or indirect interest in the transaction due to securities holdings, vesting of equity awards and rights to severance payments. Additional

information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Globus Medical’s and NuVasive’s shareholders in connection with the proposed transaction will be included in the joint

proxy statement/prospectus. These documents can be obtained free of charge from the sources indicated above.

Cautionary Notes on Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and

often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” and

similar expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the

anticipated benefits thereof. These and other forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any

forward-looking statements, including the failure to consummate the proposed transaction or to make any filing or take other action required to consummate such transaction in a timely matter or at all. Important risk factors that may cause such a

difference include, but are not limited to: (i) the proposed transaction may not be completed on anticipated terms and timing, (ii) a condition to closing of the transaction may not be satisfied, including obtaining shareholder and

regulatory approvals, (iii) the anticipated tax treatment of the transaction may not be obtained, (iv) the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic

performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the transactions, (v) potential

litigation relating to the proposed transaction that could be instituted against Globus Medical, NuVasive or their respective directors, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or

completion of the transactions, (vii) any negative effects of the announcement, pendency or consummation of the transactions on the market price of Globus Medical’s or NuVasive’s common stock and on Globus Medical’s or

NuVasive’s businesses or operating results, (viii) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (ix) the risks and costs associated with the

integration of, and the ability of Globus Medical and NuVasive to integrate, their businesses successfully and to achieve anticipated synergies, (x) the risk that disruptions from the proposed transaction will harm Globus Medical’s or

NuVasive’s business, including current plans and operations, (xi) the ability of Globus Medical or NuVasive to retain and hire key personnel and uncertainties arising from leadership changes, (xii) legislative, regulatory and economic

developments, and (xiii) the other risks described in Globus Medical’s and NuVasive’s most recent annual reports on Form 10-K and quarterly reports on Form

10-Q.

These risks, as well as other risks associated with the proposed transaction, will be more fully discussed

in the joint proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors

presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the

forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Globus Medical’s

or NuVasive’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Globus Medical nor NuVasive assumes any obligation to publicly provide revisions or updates to any forward looking statements, whether as

a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Jun 2024 to Jul 2024

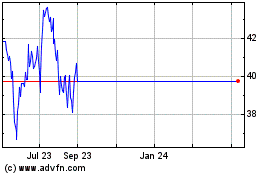

Nuvasive (NASDAQ:NUVA)

Historical Stock Chart

From Jul 2023 to Jul 2024