Filed pursuant

to Rule 424(b)(3)

Registration Statement No. 333-273515

PROSPECTUS SUPPLEMENT

(To

Prospectus dated August 31, 2023)

NaaS Technology

Inc.

Class A

Ordinary Shares

Preferred Shares

Warrants

Subscription

Rights

Units

This prospectus

supplement is being filed to update and supplement the information contained in the prospectus dated August 31, 2023 (we refer to

such prospectus, as supplemented or amended from time to time, as the “Prospectus”), which forms a part of our Registration

Statement on Form F-3 (Registration No. 333-273515), as amended and supplemented, including by Pre-Effective Amendment

No. 1 thereto (Registration Statement No. 333-273515) filed with the Securities and Exchange Commission on August 31,

2023.

The Prospectus relates

to (i) the offer and sale from time to time by us of up to US$200,000,000, or its equivalent in any other currency, currency units,

or composite currency or currencies, of our Class A ordinary shares, par value US$0.01 per share, including in the form of American

depositary shares, or ADSs, preferred shares, warrants to purchase Class A ordinary shares and preferred shares, subscription rights

and a combination of such securities, separately or as units, in one or more offerings, and (ii) the sale or other distribution

from time to time by a certain selling shareholder described in the Prospectus of up to an aggregate of 1,647,547,772 Class A ordinary

shares. Capitalized terms used herein but not otherwise defined shall have the meanings set forth in the Prospectus.

This prospectus

supplement is provided solely to update information in the “Selling Shareholder” section of the Prospectus to reflect the

transfer of 204,813,949 of our Class B ordinary shares and 1,152,190,983 of our Class C ordinary shares held by Newlinks Technology

Limited, as the selling shareholder originally identified in the Prospectus, to Newlink Envision Limited, a wholly-owned subsidiary of

Newlinks Technology Limited, in exchange for 10,000 ordinary share issued by Newlink Envision Limited pursuant to a share exchange agreement

dated December 21, 2023.

This prospectus

supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized

except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read

in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement,

you should rely on the information in this prospectus supplement.

The ADSs, each representing 200 Class A ordinary shares, are listed

on the Nasdaq Stock Market under the ticker symbol “NAAS.” On June 17, 2024, the closing price of the ADSs on Nasdaq

was US$5.53 per ADS.

We may further amend

or supplement the Prospectus and this prospectus supplement from time to time by filing amendments or supplements as required. You should

read the entire Prospectus, this prospectus supplement and any amendments or supplements carefully before you make your investment decision.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 16

of the Prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S.

Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus

supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus supplement is June 18, 2024.

SELLING SHAREHOLDERS

This prospectus

covers the offer, sale, lending, distribution or other disposal from time to time by the selling shareholders identified in the table

herein and/or their affiliates of up to an aggregate of 1,647,547,772 Class A ordinary shares, in the form of ADSs or otherwise,

held by, or convertible from the Class B ordinary shares and Class C ordinary shares held by, the selling shareholders, pursuant

to this prospectus and the applicable prospectus supplement, if any.

We have no assurance

that the selling shareholders will offer, sell, lend, distribute, transfer or otherwise dispose of any of the securities registered hereunder.

The selling shareholders may sell, transfer or otherwise dispose of such securities to or through underwriters, dealers or agents or

directly to purchasers or otherwise. See “Plan of Distribution.” The selling shareholders may also sell, transfer or otherwise

dispose of some or all such securities in transactions exempt from the registration requirements of the Securities Act. Accordingly,

we cannot estimate the number of Class A ordinary shares, in the form of ADSs or otherwise, that the selling shareholders will sell,

transfer or otherwise dispose of under this prospectus.

The table below

provides information about the ownership of the selling shareholders of our shares and the maximum number of Class A ordinary shares

that may be sold from time to time by the selling shareholders hereunder. The selling shareholders may sell or otherwise dispose of less

than all of the shares listed in the table below.

The information

in the following table and the related notes is based on information filed with the SEC or supplied to us by the selling shareholders.

We have not sought to verify such information. Information about the selling shareholders may change over time. Any changed or new information

given to us by the selling shareholders will be set forth in supplements to this prospectus, the accompanying prospectus or amendments

to the registration statement, if and when necessary.

The

calculations of percentage of ownership and voting power in the shareholder table below are based on 2,578,845,893 ordinary shares

issued and outstanding as of March 31, 2024, comprising (i) 971,298,121 Class A ordinary shares, excluding

Class A ordinary shares issued to JPMorgan Chase Bank, N.A., the depositary of our ADS program, for bulk issuance of ADSs

reserved for future issuances upon the exercise or vesting of awards granted under our stock incentive plans, (ii) 242,662,399

Class B ordinary shares, and (iii) 1,364,885,373 Class C ordinary shares.

| Selling Shareholders: |

|

Class A

Ordinary

Shares† |

|

Class B

Ordinary

Shares† |

|

|

Class C

Ordinary

Shares† |

|

|

Percent

Ownership†† |

|

|

Percent

Voting

Power††† |

|

|

Percent

Voting

Power

(Upon Full

Distribution

by

NewLink)†††† |

|

|

Shares

Registered

Pursuant

to this

Registration

Statement

(Maximum Number

of Shares

That May

Be Sold) |

|

| Newlinks Technology Limited (1) |

|

— |

|

37,848,450 |

|

|

212,694,390 |

|

|

9.72 |

% |

|

13.12 |

% |

|

12.81 |

% |

|

290,542,840 |

|

| Newlink Envision Limited (2) |

|

— |

|

204,813,949 |

|

|

1,152,190,983 |

|

|

52.62 |

% |

|

71.03 |

% |

|

69.35 |

% |

|

1,357,004,932 |

|

| † | Each Class B

ordinary share and each Class C ordinary share is convertible into one Class A

ordinary share at any time by the holder thereof, subject to certain conditions. Class A

ordinary shares are not convertible into Class B ordinary shares or Class C ordinary

shares under any circumstances. |

| †† | A

total of 2,578,845,893 ordinary shares are outstanding as of March 31, 2024. |

| ††† | Holders of Class A ordinary shares are entitled to one vote per

share. Holders of Class B ordinary shares and Class C ordinary shares are entitled to ten votes per share and two votes

per share, respectively. NewLink and Newlink Envision Limited, a wholly-owned subsidiary of NewLink, directly hold Class B

ordinary shares and Class C ordinary shares, with the voting power of all Class B ordinary shares controlled by

Mr. Dai and the voting power of Class C ordinary shares controlled by shareholders of NewLink other than Mr. Dai on a

look-through basis proportional to those shareholders’ relative shareholding percentage in NewLink. This column sets out the

voting power percentages on the foregoing basis, prior to NewLink’s distribution of any Class B ordinary shares or

Class C ordinary shares to its own shareholders. |

| †††† | Class B ordinary shares and Class C ordinary shares will be

automatically and immediately converted into an equal number of Class A ordinary shares upon the occurrence of any direct or

indirect sale, transfer, assignment or disposition of such number of Class B ordinary shares or Class C ordinary shares by

the holder thereof or the direct or indirect transfer or assignment of the voting power attached to such number of Class B

ordinary shares or Class C ordinary shares through voting proxy or otherwise to any person that is not Mr. Dai or his

affiliates (Newlinks Technology Limited being deemed not to be his affiliate for this purpose only). Therefore, all Class B

ordinary shares distributed by NewLink to Mr. Dai or his affiliates will remain Class B ordinary shares, and all

Class C ordinary shares distributed by NewLink to its own shareholders (other than Mr. Dai and his affiliates) will be

automatically converted into Class A ordinary shares. This column sets out the voting power percentages assuming full

distribution by NewLink of Class B ordinary shares to Mr. Dai or his affiliates and of Class C ordinary shares to its

own shareholders (other than Mr. Dai and his affiliates). Whether and to what extent to conduct such distribution would be a

corporate decision by NewLink that requires approval by the board of directors and/or shareholders of NewLink, as

applicable. |

| (1) | Directors and

executive officers of Newlink beneficially owning more than 1% of its outstanding shares

include Zhen Dai, Yang Wang and Weilin Sun. Principal beneficial owners of the shares of

Newlink, meaning shareholders beneficially owning more than 5% of its outstanding shares,

include Zhen Dai, entities affiliated with Joy Capital (namely Joy Vigorous Management Limited,

Joy Capital III L.P. and Joy Capital Opportunity, L.P.) and BCPE Nutcracker Cayman, L.P.

The registered address of Newlink is at 4th Floor, Harbour Place, 103 South Church Street,

P.O. Box 10240, Grand Cayman KY1-1002, Cayman Islands. |

| (2) | Newlink Envision

Limited is a wholly-owned subsidiary of Newlink. Zhen Dai is the sole director and executive

officer of Newlink Envision Limited. The registered address of Newlink Envision Limited is at 4th Floor, Harbour Place, 103 South Church Street, P.O. Box 10240, Grand Cayman

KY1-1002, Cayman Islands. |

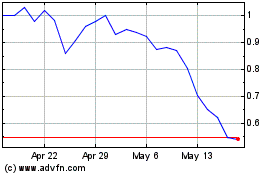

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From Jun 2024 to Jul 2024

NaaS Technology (NASDAQ:NAAS)

Historical Stock Chart

From Jul 2023 to Jul 2024