Key Tronic Corporation Announces Results for the Third Quarter of Fiscal Year 2017

May 02 2017 - 4:01PM

Winning Established Programs from

Competitors;Investing for Growth in Coming Fiscal

Year

Key Tronic Corporation (Nasdaq:KTCC), a provider

of electronic manufacturing services (EMS), today announced its

results for the quarter ended April 1, 2017.

For the third quarter of fiscal year 2017, Key Tronic reported

total revenue of $113.6 million, compared to $118.4 million in the

same period of fiscal year 2016. For the first nine months of

fiscal year 2017, total revenue was $349.3 million, compared to

$361.1 million in the same period of fiscal year 2016.

Net income for the third quarter of fiscal year 2017 was $1.0

million or $0.09 per share, compared to $1.8 million or $0.16 per

share for the third quarter of fiscal year 2016. For the first nine

months of fiscal year 2017, net income was $4.3 million or $0.39

per share, compared to $4.4 million or $0.39 per share for the same

period of fiscal year 2016.

For the third quarter of fiscal year 2017, gross margin was 8.0%

and operating margin was 1.6%, compared to 8.4% and 2.3%,

respectively, in the same period of fiscal 2016.

“During the third quarter of fiscal 2017, our new programs

continued to ramp, despite a slowdown in demand from a few

longstanding customers, which has also impacted our margins,” said

Craig Gates, President and Chief Executive Officer. “At the same

time, we continued to ramp significant new business from other EMS

competitors that we expect will set up revenue growth in fiscal

2018.”

“We recently won two new programs involving electronic

scheduling devices and pool controllers. Moving into the fourth

quarter, we continue to see a strong pipeline of potential new

business and our new programs continue to ramp, offsetting

softening demand for a few current programs. At the same time, we

continue to invest in expanding our SMT, sheet metal and plastic

molding capabilities in preparation for future growth.”

Business Outlook

For the fourth quarter of fiscal year 2017, the Company expects

to report revenue in the range of $112 million to $117 million, and

earnings in the range of $0.10 to $0.15 per diluted share. These

expected results assume an effective tax rate of 25% in the

quarter.

Conference Call

Key Tronic will host a conference call today to discuss its

financial results at 2:00 PM Pacific (5:00 PM Eastern). A broadcast

of the conference call will be available at

www.keytronic.com under “Investor Relations” or by calling

888-221-3894 or +1-913-312-0683 (Access Code: 8039313). A

replay will be available by calling 888-203-1112 or +1-719-457-0820

(Access Code: 8039313).

About Key Tronic

Key Tronic is a leading contract manufacturer offering

value-added design and manufacturing services from its facilities

in the United States, Mexico and China. The Company provides its

customers full engineering services, materials management,

worldwide manufacturing facilities, assembly services, in-house

testing, and worldwide distribution. Its customers include some of

the world’s leading original equipment manufacturers. For more

information about Key Tronic visit: www.keytronic.com.

Some of the statements in this press release are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include all passages

containing verbs such as aims, anticipates, believes, estimates,

expects, hopes, intends, plans, predicts, projects or targets or

nouns corresponding to such verbs. Forward-looking statements also

include other passages that are primarily relevant to expected

future events or that can only be fully evaluated by events that

will occur in the future. Forward-looking statements in this

release include, without limitation, the Company’s statements

regarding its expectations with respect to quarterly revenue and

earnings during fiscal year 2017. There are many factors, risks and

uncertainties that could cause actual results to differ materially

from those predicted or projected in forward-looking statements,

including but not limited to the future of the global economic,

legal and regulatory environment and its impact on our customers

and suppliers; the availability of parts from the supply chain; the

accuracy of customers’ forecasts; success of customers’ programs;

timing of new programs; success of new-product introductions;

acquisitions or divestitures of operations or facilities;

technology advances; changes in pricing policies by the Company,

its competitors, customers or suppliers; and the other risks and

uncertainties detailed from time to time in the Company’s SEC

filings.

| KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF INCOME(In

thousands, except per share amounts)(Unaudited) |

| |

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

April 1, 2017 |

|

April 2, 2016 |

|

April 1, 2017 |

|

April 2, 2016 |

| Net sales |

$ |

113,601 |

|

|

$ |

118,448 |

|

|

$ |

349,253 |

|

|

$ |

361,060 |

|

| Cost of sales |

104,462 |

|

|

108,493 |

|

|

320,793 |

|

|

333,076 |

|

| Gross

profit |

9,139 |

|

|

9,955 |

|

|

28,460 |

|

|

27,984 |

|

| Research, development

and engineering expenses |

1,569 |

|

|

1,634 |

|

|

4,756 |

|

|

4,696 |

|

| Selling, general and

administrative expenses |

5,721 |

|

|

5,564 |

|

|

16,518 |

|

|

16,348 |

|

| Total

operating expenses |

7,290 |

|

|

7,198 |

|

|

21,274 |

|

|

21,044 |

|

| Operating

income |

1,849 |

|

|

2,757 |

|

|

7,186 |

|

|

6,940 |

|

| Interest expense,

net |

566 |

|

|

620 |

|

|

1,707 |

|

|

1,674 |

|

| Income

before income taxes |

1,283 |

|

|

2,137 |

|

|

5,479 |

|

|

5,266 |

|

| Income tax

provision |

322 |

|

|

354 |

|

|

1,198 |

|

|

879 |

|

| Net

income |

$ |

961 |

|

|

$ |

1,783 |

|

|

$ |

4,281 |

|

|

$ |

4,387 |

|

| Net

income per share — Basic |

$ |

0.09 |

|

|

$ |

0.17 |

|

|

$ |

0.40 |

|

|

$ |

0.41 |

|

| Weighted

average shares outstanding — Basic |

10,759 |

|

|

10,711 |

|

|

10,755 |

|

|

10,709 |

|

| Net

income per share — Diluted |

$ |

0.09 |

|

|

$ |

0.16 |

|

|

$ |

0.39 |

|

|

$ |

0.39 |

|

| Weighted

average shares outstanding — Diluted |

10,957 |

|

|

11,068 |

|

|

10,916 |

|

|

11,298 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS(In

thousands)(Unaudited) |

| |

|

|

|

|

| |

|

April 1, 2017 |

|

July 2, 2016 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

911 |

|

|

$ |

1,018 |

|

| Trade

receivables, net of allowance for doubtful accounts of $138 and

$135 |

|

62,331 |

|

|

61,678 |

|

|

Inventories |

|

98,806 |

|

|

107,006 |

|

|

Other |

|

11,233 |

|

|

11,757 |

|

| Total

current assets |

|

173,281 |

|

|

181,459 |

|

| Property, plant and

equipment, net |

|

31,030 |

|

|

27,925 |

|

| Other assets: |

|

|

|

|

| Deferred

income tax asset |

|

8,507 |

|

|

8,982 |

|

|

Goodwill |

|

9,957 |

|

|

9,957 |

|

| Other

intangible assets |

|

5,082 |

|

|

5,928 |

|

|

Other |

|

1,821 |

|

|

1,673 |

|

| Total

other assets |

|

25,367 |

|

|

26,540 |

|

| Total assets |

|

$ |

229,678 |

|

|

$ |

235,924 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

49,390 |

|

|

$ |

58,967 |

|

| Accrued

compensation and vacation |

|

7,967 |

|

|

9,571 |

|

| Current

portion of debt |

|

5,841 |

|

|

5,000 |

|

|

Other |

|

12,167 |

|

|

10,572 |

|

| Total

current liabilities |

|

75,365 |

|

|

84,110 |

|

| Long-term

liabilities: |

|

|

|

|

| Term loan

- long term |

|

20,233 |

|

|

21,250 |

|

| Revolving

loan |

|

18,233 |

|

|

18,073 |

|

| Other

long-term obligations |

|

3,085 |

|

|

6,909 |

|

| Total

long-term liabilities |

|

41,551 |

|

|

46,232 |

|

| Total liabilities |

|

116,916 |

|

|

130,342 |

|

| Shareholders’

equity: |

|

|

|

|

| Common

stock, no par value—shares authorized 25,000; issued and

outstanding 10,760 and 10,725 shares, respectively |

|

45,629 |

|

|

45,227 |

|

| Retained

earnings |

|

72,209 |

|

|

67,928 |

|

|

Accumulated other comprehensive loss |

|

(5,076 |

) |

|

(7,573 |

) |

| Total

shareholders’ equity |

|

112,762 |

|

|

105,582 |

|

| Total liabilities and

shareholders’ equity |

|

$ |

229,678 |

|

|

$ |

235,924 |

|

| |

|

|

|

|

|

|

|

|

CONTACTS:

Brett Larsen

Chief Financial Officer

Key Tronic Corporation

(509) 927-5500

Michael Newman

Investor Relations

StreetConnect

(206) 729-3625

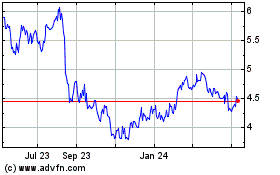

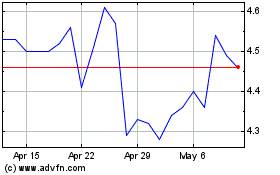

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Jun 2024 to Jul 2024

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Jul 2023 to Jul 2024