false000161724200016172422024-06-182024-06-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 18, 2024

KEARNY FINANCIAL CORP.

(Exact Name of Registrant as Specified in its Charter)

|

MD

|

|

001-37399

|

|

30-0870244

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

120 Passaic Avenue, Fairfield, NJ

|

|

07004

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (973) 244-4500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

KRNY

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Promotion of Keith Suchodolski

On June 20, 2024, Kearny Financial Corp. (the “Company”), the

holding company of Kearny Bank (the “Bank”), announced that the Company’s Board of Directors promoted Keith Suchodolski to Senior Executive Vice President and Chief Operating Officer of the Company and the Bank effective July 1, 2024. Mr.

Suchodolski has served as the Company and Bank’s Senior Executive Vice President and Chief Financial Officer since July 2022. In connection with the Executive’s promotion

to Senior Executive Vice President and Chief Operating Officer, the Company and the Bank entered into an amendment to Mr. Suchodolski’s employment agreement, effective as of July 1, 2024 (the “Amendment”). The Amendment is solely to replace all

references to “Senior Executive Vice President and Chief Financial Officer” with “Senior Executive Vice President and Chief Operating Officer.”

Promotion of Sean Byrnes

On June 20, 2024, the Company and Bank announced

that the Company’s Board of Directors promoted Sean Byrnes to Executive Vice President, Chief Financial Officer and Principal Accounting Officer of the Company and the Bank effective July 1, 2024. Mr. Byrnes has served as the Company’s Executive

Vice President and Deputy Chief Financial Officer since July 2023. In connection with Mr. Byrnes’ promotion to Executive Vice President and Chief Financial Officer, Mr. Byrnes and the Bank entered into a change in control agreement, effective as of

July 1, 2024 (the “CIC Agreement”). The CIC Agreement provides, in the event of a change in control of the Company or the Bank followed within twenty-four (24) months by an involuntary termination of employment for any reason other than cause or a

termination for good reason, Mr. Byrnes will be entitled to a severance payment equal to two times annual base salary and two times the bonus earned in the fiscal year immediately preceding the date of a change in control, payable in a lump sum

within ten days of his termination of employment, and continued participation in medical and dental coverage for two years.

Amended and Restated Executive Management Incentive Compensation Program

On June 18, 2024, the

Bank approved an Amended and Restated Executive Management Incentive Compensation Program (“Amended Program”), which will replace the prior Executive Management Incentive Compensation Program (“Prior Program”). The terms of the Amended Program are

similar to the Prior Program except the Amended Program removes section 5(c) – Performance Gate from the Prior Program.

The press release issued by the Company related to the

promotions of Mr. Suchodolski and Mr. Byrnes is included in this filing as Exhibit 99.1. The foregoing descriptions of the Amendment, CIC Agreement and Amended Program do not purport to be complete and are qualified in their entirety by

reference to the Amendment, CIC Agreement and Amended Program, which are attached hereto as Exhibits 10.1, 10.2 and 10.3 of this Current Report on Form 8-K and are incorporated by reference into this Item 5.02.

Item 9.01

|

Financial Statements and Exhibits

|

|

(a)

|

Financial Statements of Businesses Acquired. Not applicable.

|

|

(b)

|

Pro Forma Financial Information. Not applicable.

|

|

(c)

|

Shell Company Transactions. Not applicable.

|

Exhibit No. Description

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

| |

|

KEARNY FINANCIAL CORP.

|

|

DATE: June 20, 2024

|

By:

|

/s/ Craig L. Montanaro

|

| |

|

Craig L. Montanaro

|

| |

|

President and Chief Executive Officer

|

EXHIBIT 10.1

AMENDMENT NUMBER ONE

EMPLOYMENT AGREEMENT WITH KEITH SUCHODOLSKI

This Amendment Number One (the “Amendment”)

to the employment agreement (the “Employment Agreement”) between Kearny Bank (the “Bank”) and Keith Suchodolski (“Executive”) is made effective as of July 1, 2024. Capitalized terms

which are not defined herein shall have the same meaning as set forth in the Employment Agreement.

WHEREAS, Executive was promoted

to the position of Senior Executive Vice President and Chief Operating Officer of Kearny Financial Corp. (the “Company”) and the Bank effective

July 1, 2024; and

WHEREAS, in recognition of

Executive’s promotion, the Bank and Executive desire to amend the Employment Agreement to replace the title “Senior Executive Vice President and Chief Financial Officer” with “Senior Executive Vice President and Chief Operating Officer”; and

WHEREAS, Section 10(a) of the

Employment Agreement provides that the Employment Agreement may be amended.

NOW, THEREFORE, in consideration

of the premises, the mutual agreements herein set forth and such other consideration the sufficiency of which is hereby acknowledged, the Employment Agreement is hereby amended as follows:

Section 1. New Title. All references to “Senior Executive Vice President and Chief Financial Officer” are hereby replaced with “Senior Executive Vice President and Chief Operating Officer.”

Section 2. Effectiveness.

This Amendment shall be deemed effective as of the date first above written, as if executed on such date. Except as expressly set forth herein, this Amendment shall not by implication or otherwise alter, modify, amend or in any way affect any of

the terms, conditions, obligations, covenants or agreements contained in the Employment Agreement, all of which are ratified and affirmed in all respects and shall continue in full force and effect and shall be otherwise unaffected.

Section 3. Governing Law.

This Amendment and the rights and obligations hereunder shall be governed by and construed in accordance with the laws of the State of New Jersey.

Section 4. Counterparts.

This Amendment may be executed in any number of counterparts, each of which shall for all purposes be deemed an original, and all of which together shall constitute but one and the same instrument.

IN WITNESS WHEREOF,

the Bank and Executive have signed this Amendment as of June 18, 2024.

KEARNY BANK

By: /s/ Craig L. Montanaro

President and Chief Executive Officer

KEARNY FINANCIAL CORP.

By: /s/ Craig L. Montanaro

President and Chief Executive Officer

EXECUTIVE

/s/ Keith Suchodolski

Keith Suchodolski

EXHIBIT 10.2

TWO YEAR CHANGE IN CONTROL AGREEMENT

This Change in Control Agreement (the “Agreement”)

is made effective as of the 1st day of July, 2024 (the “Effective Date”), by and between Kearny Bank (the “Bank”) and Sean Byrnes (the “Executive”). Any reference to the Company

hereunder shall mean Kearny Financial Corp., (together with its successors and assigns), a Maryland corporation and the stock holding company of the Bank.

WITNESSETH

WHEREAS, Executive is a party to

a change in control agreement effective as of October 1, 2020 (the “Prior Agreement”); and

WHEREAS, in connection with Executive’s promotion to Executive Vice President and Chief Financial Officer, the Bank desires to enter into this Agreement with

Executive, which shall replace and supersede the Prior Agreement in its entirety; and

WHEREAS, the Executive is willing to serve the Bank on the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration

of the mutual covenants herein contained, and upon the terms and conditions hereinafter provided, the parties hereby agree as follows:

The initial term of this Agreement will begin as of the Effective Date and will continue for twenty-four (24) full calendar months.

Commencing on July 1, 2025 and on each subsequent July 1 (each, an “Anniversary Date”), the term of this Agreement will renew such that the

remaining term will be twenty-four (24) months from such Anniversary Date; provided, however, that in order for the term of this Agreement to renew, the disinterested members of the Board of Directors of the Bank (the “Board”) must take the following actions within the time frames set forth below prior to each Anniversary Date: (i) conduct or review a performance evaluation of Executive for

purposes of determining whether to extend the term of this Agreement; and (ii) affirmatively approve the renewal of the term of this Agreement and include such decision in the minutes of the Board’s meeting. If the disinterested members of the Board

decide not to renew the term of this Agreement, then the Board will provide Executive with a written notice of non-renewal (“Non-Renewal Notice”)

no later than five business days after such action is taken, in which event this Agreement will terminate twelve (12) months from the next Anniversary Date. The failure of the disinterested members of the Board to take the actions set forth herein

before any Anniversary Date will result in the automatic non-renewal of this Agreement, even if the Board fails to affirmatively issue the Non-Renewal Notice to Executive. If the Board fails to inform Executive of its determination regarding the

renewal or non-renewal of this Agreement, the Executive may request that the Board provide Executive with the reason(s) for its action (or non-action), and the Board will respond to Executive within 30 days of the receipt of such request. Reference

herein to the term of this Agreement will refer to both such initial term and such extended terms.

Notwithstanding the foregoing, in the event that the Company or the Bank has entered into an agreement to effect a transaction which

would be considered a Change in Control as defined below, then the term of this Agreement shall automatically be extended with no action by the Board and shall terminate twenty-four (24) months following the date on which the Change in Control

occurs.

(a) Change in Control. For purposes of this Agreement, a “Change in Control” means any of

the following events:

|

(1) |

Merger: The Company or the Bank merges into or consolidates with another

entity, or merges another Bank or corporation into the Bank or the Company, and as a result, less than a majority of the combined voting power of the resulting corporation immediately after the merger or consolidation is held by persons who

were stockholders of the Company or the Bank immediately before the merger or consolidation;

|

|

(2) |

Acquisition of Significant Share Ownership: A person or persons acting in

concert has or have become the beneficial owner of 25% or more of a class of the Company’s or the Bank’s voting securities; provided, however, this clause (2) shall not apply to beneficial ownership of the Company’s or the Bank’s voting

shares held in a fiduciary capacity by an entity of which the Company directly or indirectly beneficially owns 50% or more of its outstanding voting securities;

|

|

(3) |

Change in Board Composition: During any period of two consecutive years,

individuals who constitute the Company’s or the Bank’s Board of Directors at the beginning of the two-year period cease for any reason to constitute at least a majority of the Company’s or the Bank’s Board of Directors; provided, however,

that for purposes of this clause (3), each director who is first elected by the board (or first nominated by the board for election by the stockholders or corporators) by a vote of at least two-thirds (2/3) of the directors who were directors

at the beginning of the two-year period shall be deemed to have also been a director at the beginning of such period; or

|

|

(4) |

Sale of Assets: The Company or the Bank sells to a third party all or

substantially all of its assets.

|

(b) Good Reason shall mean a termination by Executive following a Change in Control if,

without Executive’s express written consent, any of the following occurs:

|

(1)

|

failure to elect or reelect or to appoint or reappoint Executive to the position and title that the Executive maintained immediately prior to a

Change in Control;

|

|

(2)

|

a material change in Executive’s authority, duties or responsibilities to

|

|

become one of lesser authority, duty or responsibilities then the position Executive held immediately prior to the Change in Control;

|

|

(3)

|

a material reduction in Executive’s base salary and benefits; or

|

|

(4)

|

a relocation of Executive’s principal place of employment by more than 35 miles from its location as of the date of this Agreement;

|

provided, however, that prior to any termination of employment for Good Reason, Executive must first provide written notice to the Bank

(or its successor) within ninety (90) days following the initial existence of the condition, describing the existence of such condition, and the Bank shall thereafter have the right to remedy the condition within thirty (30) days of the date the Bank

received the written notice from Executive. If the Bank remedies the condition within such thirty (30) day cure period, then no Good Reason shall be deemed to exist with respect to such condition. If the Bank does not remedy the condition within

such thirty (30) day cure period, then Executive may deliver a Notice of Termination for Good Reason at any time within sixty (60) days following the expiration of such cure period.

(c) Termination for Cause shall mean termination because of, in the good faith

determination of the Board, Executive’s:

|

(1)

|

material act of dishonesty or fraud in performing Executive’s duties on behalf of the Bank;

|

|

(2)

|

incompetence (in determining incompetence, the acts or omissions shall be measured against standards generally prevailing in the banking

industry) in performing Executive’s duties on behalf of the Bank;

|

|

(3)

|

willful misconduct that in the judgment of the Board will likely cause economic damage to the Bank or injury to the business reputation of the

Bank;

|

|

(4)

|

breach of fiduciary duty involving personal profit;

|

|

(5)

|

intentional failure to perform stated duties under this Agreement after written notice thereof from the Board;

|

|

(6)

|

willful violation of any law, rule or regulation (other than traffic violations or similar offenses which results only in a fine or other

non-custodial penalty) that reflect adversely on the reputation of the Bank, any felony conviction, any violation of law involving moral turpitude, or any violation of a final cease-and-desist order; any violation of the policies or

procedures of the Bank as outlined in the Bank’s employee handbook,

|

which would result in termination of a Bank employee, as from time to time amended and incorporated herein by reference; or

|

(7)

|

material breach by Executive of any provision of this Agreement.

|

A determination of whether Executive’s employment shall be terminated for Cause shall be made at a meeting of the Board called and held

for such purpose, at which the Board makes a finding that in good faith opinion of the Board an event set forth in clauses (1), (2), (3), (4), (5), (6), or (7) above has occurred and specifying the particulars thereof in detail.

3. BENEFITS UPON TERMINATION IN CONNECTION WITH A CHANGE IN CONTROL

(a) If Executive’s employment by the Bank, or its successor, shall be terminated at the effective time or within two years after a Change in Control and during the term of this

Agreement by (1) the Bank, or its successor, for other than Cause, or (2) Executive for Good Reason, then the Bank, or its successor, shall:

|

(1)

|

pay Executive, or in the event of Executive’s subsequent death, Executive’s beneficiary or beneficiaries or estate, as applicable, a cash

severance amount equal to (i) twenty-four (24) months of the Executive’s base salary in effect as of the Date of Termination, or if higher, the base salary in effect immediately prior to the date of a Change in Control, and (ii) two times

the bonus earned by the Executive from the Bank in the fiscal year immediately preceding the year in which the termination occurs, or if higher, the bonus earned in the fiscal year immediately preceding the date of a Change in Control, less

applicable withholding taxes, payable by lump sum within ten (10) business days of the Date of Termination, and

|

|

(2)

|

cause to be continued at no cost to Executive, non-taxable medical and dental coverage substantially identical to the coverage maintained by the

Bank for Executive prior to Executive’s termination for twenty-four (24) months. If the Bank cannot provide one or more of the benefits set forth in this Section 3(a)(2) because Executive is no longer an employee, applicable rules and

regulations prohibit such benefits or the payment of such benefits in the manner contemplated, or it would subject the Bank to penalties, then the Bank shall pay Executive a cash lump sum payment reasonably estimated to be equal to the

value of such benefits or the value of the remaining benefits at the time of such determination. Such cash payment shall be made in a lump sum within ten (10) days after the later of Executive’s Date of Termination or the effective date of

the rules or regulations prohibiting such benefits or subjecting the Bank to penalties.

|

(b) In no event shall the payments or benefits to be made or provided to Executive under Section 3 hereof (the “Termination Benefits”) constitute an “excess parachute payment” under

Section 280G of the Code or any successor thereto, and in order to avoid such a result,

Termination Benefits will be reduced, if necessary, to an amount, the value of which is one dollar ($1.00) less than an amount equal to three (3) times

Executive’s “base amount,” as determined in accordance with Section 280G of the Code. The reduction of the Termination Benefits provided by this Section 3 shall be applied to the cash severance benefits otherwise payable under Section 3(a) hereof.

Any purported termination by the Bank or by Executive in connection with or following a Change in Control shall be communicated by Notice of Termination to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a

written notice which shall indicate the Date of Termination and, in the event of termination by Executive, the specific termination provision in this Agreement relied upon and shall set forth in reasonable detail the facts and circumstances claimed

to provide a basis for termination of Executive’s employment under the provision so indicated. “Date of Termination” shall mean the date specified in the Notice of Termination (which, in the case of a termination for Cause, shall be immediate).

All payments provided in this Agreement shall be timely paid in cash or check from the general funds of the Bank.

(a) The Board may terminate Executive’s employment at any time, but any termination by the Board other than termination for Cause shall not prejudice Executive’s right to

compensation or other benefits under this Agreement. Executive shall have no right to receive compensation or other benefits for any period after Executive’s termination for Cause.

(b) If Executive is suspended from office and/or temporarily prohibited from participating in the conduct of the Bank’s affairs by a notice served under Section 8(e)(3) (12 USC

§1818(e)(3)) or 8(g)(1) (12 USC §1818(g)(1)) of the Federal Deposit Insurance Act (“FDIA”), the Bank’s obligations under this Agreement shall be suspended as of the date of service, unless stayed by appropriate proceedings. If the charges in the

notice are dismissed, the Bank may in its discretion (i) pay Executive all or part of the compensation withheld while its contract obligations were suspended and (ii) reinstate (in whole or in part) any of its obligations which were suspended.

(c) If Executive is removed and/or permanently prohibited from participating in the conduct of the Bank’s affairs by an order issued under Section 8(e)(4) (12 U.S.C. §1818(e)(4)) or

8(g)(1) (12 U.S.C. §1818(g)(1)) of FDIA, all obligations of the Bank under this Agreement shall terminate as of the effective date of the order, but vested rights of the contracting parties shall not be affected.

(d) If the Bank is in default as defined in Section 3(x)(1) (12 U.S.C. §1813(x)(1)) of FDIA, all obligations under this Agreement shall terminate as of the date of default, but this

paragraph shall not affect any vested rights of the contracting parties.

(e) All obligations under this Agreement shall be terminated, except to the extent determined that continuation of this Agreement is necessary for the continued operation of the

Bank, (i) by either the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System or the New Jersey Department of Banking and Insurance (collectively, the “Regulator”) or his or her designee, at the time the FDIC enters into an agreement to provide assistance to or on behalf of the Bank under the authority contained in Section 13(c) (12 U.S.C.

§1823(c)) of FDIA; or (ii) by the Regulator or his or her designee at the time the Regulator or his or her designee approves a supervisory merger to resolve problems related to operations of the Bank or when the Bank is determined by the Regulator

or his or her designee to be in an unsafe or unsound condition. Any rights of the parties that have already vested, however, shall not be affected by such action.

(f) Notwithstanding anything herein to the contrary, any payments to Executive pursuant to this Agreement or otherwise are subject to and conditioned upon their compliance with

12 U.S.C. Section 1828(k) and the regulations promulgated thereunder in 12 C.F.R. Part 359.

(g) For purposes of this Agreement, any termination of Executive’s employment shall be construed to require a “Separation from Service” in accordance with Code Section 409A and the

regulations promulgated thereunder, such that the Bank and Executive reasonably anticipate that the level of bona fide services Executive would perform after termination of employment would permanently decrease to a level that is less than 50% of the

average level of bona fide services performed (whether as an employee or an independent contractor) over the immediately preceding thirty-six (36)-month period.

(h) Notwithstanding the foregoing, in the event Executive is a Specified Employee (as defined herein), then, solely, to the extent required to avoid penalties under Code Section

409A, Executive’s payments shall be delayed until the first day of the seventh month following Executive’s Separation from Service. A “Specified Employee” shall be interpreted to comply with Code Section 409A and shall mean a key employee within

the meaning of Code Section 416(i) (without regard to paragraph 5 thereof), but an individual shall be a “Specified Employee” only if the Bank or Company is or becomes a publicly traded company.

Except as required by law, no right to receive payments under this Agreement shall be subject to anticipation, commutation, alienation,

sale, assignment, encumbrance, charge, pledge, or hypothecation, or to execution, attachment, levy, or similar process or assignment by operation of law, and any attempt, voluntary or involuntary, to effect any such action shall be null, void, and of

no effect.

|

8.

|

ENTIRE AGREEMENT; MODIFICATION AND WAIVER

|

(a) This Agreement contains the entire understanding between the parties hereto and supersedes the Prior Agreement in its entirety, except that this Agreement shall not affect or

operate to reduce any benefit or compensation inuring to Executive of a kind elsewhere

provided. For purposes of clarity, the Prior Agreement is terminated as of the Effective Date without further notice.

(b) This Agreement may not be modified or amended except by an instrument in writing signed by the parties hereto.

(c) No term or condition of this Agreement shall be deemed to have been waived, nor shall there be any estoppel against the enforcement of any provision of this Agreement, except by

written instrument of the party charged with such waiver or estoppel. No such written waiver shall be deemed a continuing waiver unless specifically stated therein, and each such waiver shall operate only as to the specific term or condition waived

and shall not constitute a waiver of such term or condition for the future or as to any act other than that specifically waived.

If, for any reason, any provision of this Agreement, or any part of any provision, is held invalid, such invalidity shall not affect any

other provision of this Agreement or any part of such provision not held so invalid, and each such other provision and part thereof shall to the full extent consistent with law continue in full force and effect.

|

10.

|

HEADINGS FOR REFERENCE ONLY

|

The headings of sections and paragraphs herein are included solely for convenience of reference and shall not control the meaning or

interpretation of any of the provisions of this Agreement.

This Agreement shall be governed by the laws of the State of New Jersey but only to the extent not superseded by federal law.

Any dispute or controversy arising under or in connection with this Agreement shall be settled exclusively by binding arbitration, as an

alternative to civil litigation and without any trial by jury to resolve such claims, conducted by a single arbitrator, mutually acceptable to the Bank and Executive, sitting in a location selected by the Bank within fifty (50) miles from the main

office of the Bank, in accordance with the rules of the American Arbitration Bank’s National Rules for the Resolution of Employment Disputes then in effect. Judgment may be entered on the arbitrator’s award in any court having jurisdiction.

|

13.

|

PAYMENT OF LEGAL FEES

|

To the extent that such payment(s) may be made without triggering penalty under Code Section 409A, all reasonable legal fees paid or

incurred by Executive pursuant to any dispute or question of interpretation relating to this Agreement shall be paid or reimbursed by the Bank, provided that the dispute or interpretation has been resolved in Executive’s favor, and such

reimbursement shall occur no later than sixty (60) days after the end of the year in which the dispute is settled or resolved in Executive’s favor.

The termination of Executive’s employment, other than following a Change in Control, shall not result in any obligation of the Bank

under this Agreement.

|

15.

|

SUCCESSORS AND

ASSIGNS

|

The Bank shall require any successor or assignee, whether direct or indirect, by purchase, merger, consolidation or otherwise, to all or

substantially all the business or assets of the Bank, expressly and unconditionally to assume and agree to perform the Bank’s obligations under this Agreement, in the same manner and to the same extent that the Bank would be required to perform if no

such succession or assignment had taken place.

[Signature Page Follows]

IN WITNESS WHEREOF,

the Bank has caused this Agreement to be executed by its duly authorized Executive, and Executive has signed this Agreement, as of the Effective Date.

KEARNY BANK

By: /s/ Craig L. Montanaro

Craig L. Montanaro

President and Chief Executive Officer

EXECUTIVE

By: /s/ Sean Byrnes

Sean Byrnes

9

EXHIBIT 10.3

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

This document outlines the Kearny Bank Amended and Restated Executive Management Incentive Compensation Program (the “Program”) by and between Kearny

Financial Corp. (“Kearny”), its subsidiary Kearny Bank (the “Bank”), and the Executive (the “Participant”).

The Program is designed to recognize and reward executives for their contribution to the Bank’s performance. The Program is designed to reward predefined

performance goals that are critical to the Bank’s profitability, growth and prudent management of business risk. The Program is further intended to assist Kearny in its ability to motivate, attract and retain qualified executives.

The Program is in effect July 1, 2024 through June 30, 2025, and will continue to renew for successive one-year periods (each year being a “Program Year”)

unless otherwise terminated or modified in accordance with the Program and specifically approved by the Compensation Committee (the “Committee”) of the Kearny Board of Directors (the “Board”).

Participation is limited to those executives recommended by the Chief Executive Officer and approved by the Committee during the first 90 days of each Program

Year. The Committee shall retain the discretion to include as a Participant any otherwise-eligible executive hired or promoted after the commencement of a Program Year.

|

4.

|

Basis of Incentive Compensation Award

|

The Participant’s incentive compensation award under the Program is based on an incentive target that is approved at the beginning of the Program Year by the

Committee (or its delegee) in its discretion. The incentive award is expressed as a percentage of the Participant’s base salary, and may be awarded if either or both the Kearny corporate goals (the “Corporate Goals”) and the Participant’s individual

goals (the “Individual Goals”) are achieved. In no event shall a Participant receive payment under the Program that exceeds 200% of the Participant’s base salary for the Program Year.

The amount of incentive compensation that the Participant is entitled to receive under the Program is determined based on the Participant’s award target and

weighting and achievement of the approved performance goals. The performance period for achievement of any performance goal(s) is the Program Year.

|

a.

|

Award Targets and Weightings

|

Each Participant shall be assigned an incentive award target, calculated as a percentage of the Participant’s base salary, which may be awarded if Kearny and

the Participant achieve targeted performance goals.

Target awards shall be weighted between Corporate Goals and Individual Goals. The weightings for the two goal categories shall be recommended by the Chief

Executive Officer and presented to the

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

Committee for review and approval. Threshold, Target and Superior achievement levels for each Corporate Goal and Individual Goal will be recommended by the

Chief Executive Officer and presented to the Committee for review and approval. The payout for the Threshold achievement level will be not less than 0% of the target payout, and the payout for the Superior achievement level will be not more than 200%

of the target payout.

A funding trigger is in place for the program. The Program is funded if Kearny has positive operating earnings for the Program Year. The incentive awards

paid are then determined by the Committee using the performance measures selected for the Program Year.

The Corporate Goals for the Program Year will be recommended by the Chief Executive Officer and approved in writing by the Committee within the first 90 days of the Program Year.

Individual Goals for the Program Year will be established for each Participant in conjunction with their direct supervisor and will be presented to the

Committee for review and approval.

|

e.

|

Determination of Incentive

Compensation Award

|

The Committee will review performance against the Corporate Goals and any Individual Goals established for the Participant once the financial results are

confirmed, certify in writing that the applicable performance goals were satisfied, and determine the amount of the incentive compensation award, if any, to be paid to each Participant under the Program. Notwithstanding any provision of the Program

to the contrary, in making this determination, the Committee may, in its discretion, in light of such considerations as it may deem relevant, increase or decrease any payments to which a Participant would otherwise be entitled by such amount or

percentage as the Committee deems appropriate. The program and its various financial inputs, goals, metrics and targets may be adjusted for extraordinary items at the discretion of the Compensation Committee.

|

6.

|

Administrative Matters

|

|

a.

|

Administration of the

Program

|

Responsibility for the administration of the Program, as described herein, rests with the Committee. The Chief Executive Officer shall monitor for accuracy

the performance reporting of the Participant and make recommendations to the Committee concerning the amount of the Participant’s awards under the Program. In addition, the Committee, and ultimately the Board, is responsible for the overall

oversight, supervision and existence of the Program. The Committee has been delegated the sole discretion to interpret the terms of the Program, to determine eligibility for benefits, and to calculate and render final incentive compensation awards

under the Program. The Committee shall also be empowered to make any and all of the determinations not herein specifically authorized which may be necessary or desirable for the effective administration of the Program.

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

The Committee may withhold or adjust any incentive compensation award in its sole discretion as it deems appropriate and will notify the Participant of its

decision to withhold or adjust an incentive compensation award.

Any decision or interpretation of any provision of the Program adopted by the Committee shall be final and conclusive.

|

b.

|

Active Participation

Required

|

|

i.

|

New Hires, Promotions, and Transfers

|

Participants who are not employed by the Bank at the beginning of the Program Year will receive a pro-rata incentive award based on their length of employment

during a given year.

A Participant whose work schedule changes during the year will be eligible for pro-rated treatment that reflects their time in the different schedules.

If a Participant changes their role or is promoted during the Program Year, they will be eligible for the new role’s target incentive award on a pro rata

basis (i.e. the award will be prorated based on the number of months employed in the respective positions.)

|

ii.

|

Termination of Employment – General

|

Unless otherwise specified in this Program, and as the Program is designed to encourage employees to remain in the employment of the Bank or its affiliates, a

Participant must be an active employee of the Bank at the time the award is paid.

|

iii.

|

Termination of Employment without Cause

|

Unless otherwise noted in the Program, if a Participant is involuntarily terminated by the Bank or Kearny without “cause” (as defined below), the

Participant’s potential incentive award may, in the sole discretion of the Compensation Committee, be prorated. The Compensation Committee will consider the following factors in its pro-ration process: (i) reason for termination of employment,

(ii) level of achievement of the Participant’s goals as of the Participant’s date of termination, and (iii) other factors the Committee deems relevant to the specific situation.

For purposes of this Program, a termination for “cause” shall mean termination because of a Participant’s personal dishonesty, incompetence, willful

misconduct, breach of fiduciary duty involving personal profit, intentional failure to perform their job functions, willful violation of any law, rule, regulations (other than a traffic violation or similar offenses) or the Participant’s breach of

any cease and desist order issued by any banking regulatory agency which has oversight of Kearny or the Bank, or the U.S. Securities and Exchange Commission.

|

iv.

|

Voluntary Resignation of Employment or Termination for Cause

|

If a Participant voluntarily resigns or is terminated by the Bank for cause, no incentive award will be paid to the Participant.

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

|

v.

|

Voluntary Resignation for Good Reason

|

If a Participant maintains an employment or change in control agreement with the Bank or Kearny and terminates their employment with the Bank for Good Reason

(as defined in the applicable employment or change in control agreement), the Participant will receive a pro-rated incentive award. The Compensation Committee will prorate the award based on the Participant’s base salary earned as of their

termination date or other factors the Compensation Committee deems relevant to the proration process.

|

vi.

|

Disability, Death and Retirement

|

A Participant that is receiving long-term disability benefits will not be considered “actively employed” for the purposes of the Program and therefore will

not be eligible to receive incentive awards during the period in which the Participant is on long-term disability, but may earn a pro-rata portion based on their period of active service. A Participant that is receiving short-term disability

benefits may be eligible to participate in the Program during the period the Participant is on short-term disability, at the discretion of the Compensation Committee.

In the event of death, the Bank will pay to the Participant’s estate the pro-rata portion of the award that had been earned by the Participant as of their

date of death. The Compensation Committee will determine what portion of the award had been earned based on: (i) the base salary earned by the Participant as of their date of death and (ii) such other factors as the Committee deems relevant.

Individuals who retire during the Program Year will receive a prorated award based on their base salary earned as of their retirement date and other factors

the Committee deems relevant. For the purposes of this Program, retirement is defined as age 55 with a minimum of 5 years of service.

Upon the occurrence of a Change in Control (as defined in Kearny’s employment agreement with its President and Chief Executive Officer) of Kearny or the Bank,

the Bank will pay a Participant the pro-rata portion of the award that had been earned by the Participant as of the date of the Change in Control. The Compensation Committee will determine what portion of the award had been earned based on: (i) the

base salary earned by the Participant as of the date of the Change in Control and (ii) such other factors as the Committee deems relevant.

The Compensation Committee, in its sole discretion, may elect to distribute all or a portion of an incentive award in Kearny common stock and/or cash to

further align Participants’ interests with those of the Kearny shareholders. Payment of awards, less deferrals and applicable federal, state and local taxes, will be made as soon as practicable following the end of the Program Year (the “Payment

Date”), but in no event before certification of the Committee or later than September 30th following the end of the Program Year.

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

|

8.

|

Modification and Termination of Program

|

The Program may be modified or changed at any time by the Committee in its discretion, followed by written notification to the Participant as soon as

reasonably practicable. The Program may be terminated at any time by the Committee in its discretion, followed by written notification to the Participant as soon as reasonably practicable. In the event of a Program termination, the Participant shall

continue to be eligible for incentive compensation awards for the Program Year prorated through the Program’s termination date, unless the Committee determines in its discretion that no incentive compensation should be paid. Any incentive

compensation awards shall be calculated through the date of the Program termination on such basis as the Committee deems appropriate in its discretion and will be payable as soon as practicable after the termination of the Program but in no event

later than September 30th following the end of the Program Year.

|

9.

|

Participant Rights Not Assignable; Program not a Contract

|

Any awards made pursuant to the Program shall not be subject to assignment, pledge or other disposition.

Nothing contained in the Program shall confer upon any employee any right to continued employment or to receive or continue to receive any rate of pay or

other compensation, nor does the Program affect the right of Kearny or the Bank to terminate a Participant’s employment. Participation in the Program does not confer rights to participation in other Kearny or Bank programs, including annual or long-term incentive programs, non-qualified retirement or deferred compensation programs or other executive perquisite programs.

The altering, inflating, and/or inappropriate manipulation of performance/financial results or any other infraction of recognized ethical business standards,

will subject the employee to disciplinary action up to and including termination of employment. In addition, any incentive compensation as provided by the Program to which the employee would otherwise be entitled will be revoked.

Participants who have willfully engaged in any activity, injurious to the Bank, will upon termination of employment, death, or retirement, forfeit any

incentive award earned during the award period in which the termination occurred.

The parties agree that the interpretation and enforcement of the Program shall be governed by the laws of the state of New Jersey. The Participant consents and waives any objection to personal jurisdiction and venue in such court. The Program, and

any payments thereunder, shall not be subject to the Employee Retirement Income Security Act.

|

12.

|

Attorney’s Fees and Costs

|

The parties agree that in the event of any legal action arising out of or relating to the interpretation or enforcement of the Program, Kearny and the Bank

shall be entitled to recover their attorney’s fees and costs in the event that they are (or either of them is) the prevailing party.

|

Amended and Restated Executive Management Incentive

Compensation Program

|

|

|

13.

|

No Oral or Written Representations

|

The parties agree that they have relied on no oral or written representation or promises not set forth herein, and that the terms of the Program are set forth

solely in the written Program document and it constitutes the complete and entire agreement of the parties relating to the subject matter hereof.

Participant, while employed by the Bank and in the conduct of their duties as an employee, shall not expose Kearny or the Bank to any unreasonable or

unnecessary risk. All incentive compensation awards under the Program are subject to the terms of Kearny’s or the Bank’s recoupment, clawback or similar policy as such may be in effect from time to time, as well as any similar provisions of

applicable law, which could in certain circumstances require repayment of an incentive compensation award or portion thereof.

|

15.

|

Banking Regulatory Provision

|

All incentive compensation awards under the Program are subject to any condition, limitation or prohibition under any financial institution regulatory policy

or rule to which Kearny or the Bank is subject.

Approved by the Board of Directors of Kearny Financial Corp. on June 18, 2024.

6

EXHIBIT 99.1

FOR IMMEDIATE RELEASE

June 20, 2024

For further information contact:

Craig L. Montanaro, President and Chief Executive Officer, or

Keith Suchodolski, Senior Executive Vice President and Chief Financial Officer

Kearny Financial Corp.

(973) 244-4500

KEARNY FINANCIAL CORP. NAMES CHIEF OPERATING OFFICER AND

CHIEF FINANCIAL OFFICER

Fairfield, N.J., June 20, 2024 – Kearny Financial Corp. (NASDAQ GS: KRNY) (the “Company”), the holding company for Kearny Bank (the “Bank”), announced

today that the Board of Directors promoted Keith Suchodolski to Senior Executive Vice President and Chief Operating Officer, effective July 1, 2024. Mr. Suchodolski has held progressive leadership roles within the Company since 2013, most recently

serving as Chief Financial Officer since July 2018. In his new role, Mr. Suchodolski’s range of responsibilities will broaden to include strategic oversight of retail & business banking, human resources, marketing, corporate finance and corporate

administration.

Craig L. Montanaro, President and Chief Executive Officer said, “Keith is an accomplished leader with a track record of success throughout his time with

the Company. His knowledge and experience will play a critical role in shaping and implementing the Company’s strategic vision in the years ahead.”

Concurrently, Sean Byrnes has been promoted to Executive Vice President and Chief Financial Officer, effective July 1, 2024. Mr. Byrnes, a Certified Public

Accountant and CFA charterholder, joined the Bank in September 2020 as Chief Accounting Officer and currently holds the position of Deputy Chief Financial Officer. In his new role as the Company's senior financial leader, Mr. Byrnes will be

responsible for all aspects of corporate finance and will partner with the Company’s senior leadership team to execute on the Company’s short- and long-term strategic goals.

Mr. Montanaro added, “I am pleased to congratulate Keith and Sean on their respective promotions, and I look forward to continuing to work closely with

them. We are fortunate to have such talented leaders within the Company to take on these critical roles.”

About Kearny Financial Corp.

Kearny Financial Corp. is the parent company of Kearny Bank which operates from its administrative headquarters in Fairfield, New Jersey, and a total of

43 retail branch offices located throughout northern and central New Jersey and Brooklyn and Staten Island, New York. At March 31, 2024, Kearny Financial Corp. had approximately $7.8 billion in total assets.

Statements contained in this news release that are not historical facts are forward-looking statements as that term

is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties which could cause actual results

to differ materially from those

currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time. The Company does not undertake and

specifically disclaims any obligation to update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

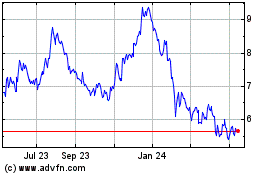

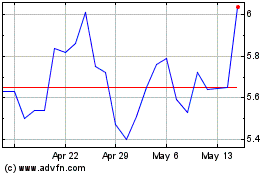

Kearny Financial (NASDAQ:KRNY)

Historical Stock Chart

From Jul 2024 to Jul 2024

Kearny Financial (NASDAQ:KRNY)

Historical Stock Chart

From Jul 2023 to Jul 2024