Amended Current Report Filing (8-k/a)

April 14 2023 - 4:06PM

Edgar (US Regulatory)

0001892322

true

0001892322

2023-02-01

2023-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K/A

(Amendment

No. 2)

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): February 1, 2023

HEARTCORE

ENTERPRISES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41272 |

|

87-0913420 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1-2-33,

Higashigotanda, Shinagawa-ku, Tokyo, Japan

(Address

of principal executive offices)

+81-3-6409-6966

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions.

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HTCR |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory

Note

On

February 6, 2023, HeartCore Enterprises, Inc. (the “Company”) filed a Current Report on Form 8-K (the “February

8-K”) to disclose, among other things, the closing of the acquisition (the “Acquisition”) of 51% of the outstanding

shares of Sigmaways, Inc. (“Sigmaways”) by the Company, pursuant to the terms of the Share Exchange and Purchase Agreement

(the “Sigmaways Agreement”), dated as of September 6, 2022, as thereafter amended, by and among the Company, Sigmaways and

Prakash Sadasivam.

On

February 10, 2023, the Company filed an amendment to the February 8-K (the “8-K/A No. 1”) to update the February 8-K as explained in the 8-K/A No. 1.

As

previously disclosed in the Current Report on Form 8-K filed on March 28, 2023 (the “March 8-K”) by the Company, on March

22, 2023, the Company entered into a Warrant Exchange and Termination Agreement pursuant to which Mr. Sadasivam agreed to transfer the

Amended and Restated Warrant (as hereinafter defined) to the Company in exchange for the issuance by the Company to Mr. Sadasivam of

500,000 shares of the Company’s common stock. On March 22, 2023, the Company issued 500,000 shares of the Company’s common

stock to Mr. Sadasivam. As a result, the Amended and Restated Warrant was terminated, null and void, and of no further force or effect.

The

Company is filing this Amendment No. 2 (the “8-K/A No. 2”) to the February 8-K in order to (i) correct statements

made in Item 9.01 of the February 8-K, as amended; and (ii) update the disclosure in the February 8-K, as amended, to reflect

entry into the Warrant Exchange and Termination Agreement as disclosed in the March 8-K.

After

further analysis of the Acquisition and the requirements of Item 2.01, Item 9.01(a) and Item 9.01(b) of Form 8-K, the Company’s

management has determined (i) that the closing of the Acquisition did not trigger disclosure under Item 2.01 of Form 8-K, and (ii) financial

statements and pro forma financial information are not required to be provided pursuant to Item 9.01 and Item 9.01(b), respectively,

of Form 8-K. Therefore, the disclosure found under Item 2.01, Item 9.01(a) and Item 9.01(b) of the February 8-K, as amended, is

deleted in its entirety, and the February 8-K is amended and restated, in its entirety, as set forth herein. Except for the

changes noted in this Explanatory Note and certain conforming edits, no other changes have been made to the disclosure provided in the

8-K/A No. 1.

Item

1.01. Entry into a Material Definitive Agreement.

As

previously disclosed, on September 6, 2022, HeartCore Enterprises, Inc. (the “Company”) entered into that certain Share Exchange

and Purchase Agreement (the “Sigmaways Agreement”), dated as of September 6, 2022, as thereafter amended, by and among the

Company, Sigmaways, Inc. (“Sigmaways”) and Prakash Sadasivam. On February 1, 2023, the Company, Sigmaways and Mr. Sadasivam

entered into Amendment No. 2 (“Amendment No. 2”) to the Sigmaways Agreement. Pursuant to the terms of Amendment No. 2, among

other things, the Company agreed, in exchange for the Sigmaways shares, to (i) issue to Mr. Sadasivam 2,000,000 shares of the Company’s

common stock, (ii) pay to Mr. Sadasivam $1,000,000 (the “Cash Purchase Price”); and (iii) issue to Mr. Sadasivam a common

stock purchase warrant to acquire 1,900,000 shares of the Company’s common stock (the “Warrant”). In addition, the

Company agreed that following closing, it would deposit $2,000,000 into a dedicated account, which amount will be used to expand Sigmaways’

business.

On

February 1, 2023, the acquisition of 51% of Sigmaways’ outstanding shares by the Company (the “Acquisition”) closed.

At the closing, Mr. Sadasivam was appointed to serve as the Company’s Chief Strategy Officer. In addition, on February 1, 2023,

the Board expanded the size of the Board from seven persons to eight persons, and named Mr. Sadasivam to serve as a member of the Board,

to fill the vacancy created by the increase in the size of the Board. See Item 5.02 hereof, which information is incorporated herein

by reference. Also at the closing, two persons designated by the Company were named to Sigmaways’ Board of Directors. The sole

other member of the Sigmaways Board of Directors is Mr. Sadasivam.

The

Warrant issued pursuant to the Sigmaways Agreement was exercisable until February 12, 2025, at an exercise price of $1.17 per share,

subject to adjustment as set forth in the Warrant. The Warrant contained a 9.99% equity blocker.

On

February 6, 2023, subsequent to the closing of the Acquisition, the parties to the Sigmaways Agreement determined that there was an error

in the Sigmaways Agreement and in the warrant issued pursuant to the terms of the Sigmaways Agreement. As executed, among other things,

the Sigmaways Agreement incorrectly provided that the Company would issue to Mr. Sadasivam a warrant to acquire 1,900,000 shares of the

Company’s common stock. The parties had agreed, however, that the Company would issue to Mr. Sadasivam a warrant to acquire 737,500

shares of the Company’s common stock.

Accordingly,

in order to correct the error, on February 6, 2023, the Company issued to Mr. Sadasivam an amended and restated warrant (the “Amended

and Restated Warrant”) that reflected the correct number of shares (737,500) underlying the warrant, and Mr. Sadasivam agreed and

accepted the Amended and Restated Warrant. The Amended and Restated Warrant is exercisable until February 12, 2025, at an exercise price

of $1.17 per share, subject to adjustment as set forth in the Amended and Restated Warrant. The Amended and Restated Warrant contains

a 9.99% equity blocker.

On

February 8, 2023, the parties to the Sigmaways Agreement entered into an addendum to the Sigmaways Agreement pursuant to which the parties

acknowledged and agreed that (i) the references in the Sigmaways Agreement to a warrant to acquire 1,900,000 shares of common stock was

in error, and (ii) the warrant was intended to be for 737,500 shares of common stock. Except as set forth in the Addendum, the terms

of the Sigmaways Agreement remain in full force and effect.

On March 22, 2023, the

Company entered into a Warrant Exchange and Termination Agreement pursuant to which Mr. Sadasivam agreed to transfer the Amended and

Restated Warrant to the Company in exchange for the issuance by the Company to Mr. Sadasivam of 500,000 shares of the Company’s

common stock. On March 22, 2023, the Company issued 500,000 shares of the Company’s common stock to Mr. Sadasivam. As a result,

the Amended and Restated Warrant was terminated, null and void, and of no further force or effect.

The

foregoing description of Amendment No. 2, the Warrant, the Amended and Restated Warrant, the Addendum, and the Warrant Exchange and

Termination Agreement is qualified in its entirety by reference to Amendment No. 2, the Warrant, the Amended and Restated Warrant,

the Addendum, and the Warrant Exchange and Termination Agreement, copies of which are filed as Exhibits 10.1, 10.2, 10.4,

10.5 and 10.6, respectively, and which are incorporated herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

As

disclosed in Items 1.01 hereof, which disclosure is incorporated herein by reference, in exchange for the 229,500 shares of Sigmaways

stock acquired by the Company from Mr. Sadasivam, the Company (i) issued to Mr. Sadasivam 2,000,000 shares of the Company’s common

stock; (ii) paid to Mr. Sadasivam cash consideration of $1,000,000; and (iii) issued the Amended and Restated Warrant to Mr. Sadasivam.

See also the disclosure regarding the Warrant Exchange and Termination Agreement set forth in Item 1.01 above.

Following

the closing, there were 19,649,886 shares of the Company’s common stock outstanding.

The

Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”),

for the private placement of the equity securities pursuant to Section 4(a)(2) of the Securities Act and/or Regulation D promulgated

thereunder because, among other things, the transaction did not involve a public offering, the recipient is an accredited investor, the

recipient acquired the securities for investment and not resale, and the Company took appropriate measures to restrict the transfer of

the securities.

Item

5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

February 1, 2023, Mr. Sadasivam was appointed to serve as the Company’s Chief Strategy Officer. In addition, on February 1, 2023,

the Board expanded the size of the Board from seven persons to eight persons, and named Mr. Sadasivam to serve as a member of the Board,

to fill the vacancy created by the increase in the size of the Board.

Mr.

Sadasivam, age 49, has served as the CEO of Sigmaways since 2006. Since 2020, Mr. Sadasivam has served as an official member of the Forbes

Technology Council. He holds degrees from Vallore Institute of Technology in Vellore, India, and from UCLA’s Anderson School of

Management.

On

February 1, 2023, the Company and Mr. Sadasivam entered into an Employment Agreement (the “Employment Agreement”). The Employment

Agreement provides that he will serve as the Company’s Chief Strategy Officer, and that he will be paid an annual salary of $96,000.

In addition, on each annual anniversary of the effective date of the Employment Agreement during the term, the Company will issue to

Mr. Sadasivam a number of shares of common stock equal to (i) 30% of the base salary as of such date, divided by (ii) the volume weighted

average closing of the Company’s common stock for the five trading days immediately preceding such date. Mr. Sadasivam is also

eligible to receive discretionary bonuses as determined by the Board.

The

Employment Agreement has an initial term of 1 year, provided that the term of each agreement will automatically be extended for one or

more additional terms of one year each unless either the Company or Mr. Sadasivam provides notice to the other of their desire to not

so renew the initial term or renewal term (as applicable) at least 30 days prior to the expiration of then-current initial term or renewal

term (as applicable). The Employment Agreement provides that the employment with the Company shall be “at will,” meaning

that either Mr. Sadasivam or the Company may terminate employment at any time and for any reason, subject to the other provisions of

the Employment Agreement.

The

Employment Agreement may be terminated by the Company, either with or without “Cause” (as defined in the Employment Agreement),

or by Mr. Sadasivam, either with or without “Good Reason” (as defined in the Employment Agreement).

In

the event that the Company terminates the term of the Employment Agreement or employment with Cause, or if Mr. Sadasivam terminates his

Employment Agreement without Good Reason, then, subject to any other relevant agreements:

| |

○ |

the

Company will pay to Mr. Sadasivam any unpaid base salary and benefits then owed or accrued, and any unreimbursed expenses; |

| |

|

|

| |

○ |

any

unvested portion of any equity granted to Mr. Sadasivam under the Employment Agreement or any other agreements with the Company will

immediately be forfeited; and |

| |

|

|

| |

○ |

all

of the parties’ rights and obligations under the Employment Agreement will cease, other than those rights or obligations which

arose prior to the termination date or in connection with such termination, and subject to the survival provisions of the Employment

Agreement. |

In

the event that the Company terminates the term of the Employment Agreement or employment without Cause, or if Mr. Sadasivam terminates

the Employment Agreement with Good Reason, then, subject to any other relevant agreements:

| |

○ |

the

Company will pay to Mr. Sadasivam any base salary, bonuses, and benefits then owed or accrued, and any unreimbursed expenses; |

| |

|

|

| |

○ |

the

Company will pay to Mr. Sadasivam, in one lump sum, an amount equal to the base salary that would have been paid to Mr. Sadasivam

for the remainder of the initial term of the Employment Agreement (if the termination occurs during the initial term of the Employment

Agreement) or renewal term of the Employment Agreement (if the termination occurs during a renewal term of the Employment Agreement); |

| |

○ |

any

unvested portion of any equity granted to Mr. Sadasivam under the Employment Agreement or any other agreements with the Company will,

to the extent not already vested, be deemed automatically vested; and |

| |

|

|

| |

○ |

all

of the parties’ rights and obligations under the Employment Agreement will cease, other than those rights or obligations which

arose prior to the termination date or in connection with such termination, and subject to the survival provisions of the Employment

Agreement. |

In

the event of Mr. Sadasivam’s death or total disability during the term of the Employment Agreement, the term of the applicable

agreement and the applicable executive’s employment shall terminate on the date of death or total disability. In the event of such

termination, the Company’s sole obligations hereunder to Mr. Sadasivam shall be for unpaid base salary, accrued but unpaid bonus

and benefits (then owed or accrued and owed in the future), a pro-rata bonus for the year of termination based on the target bonus for

such year and the portion of such year in which Mr. Sadasivam was employed, and reimbursement of expenses pursuant to the terms hereon

through the effective date of termination, and any unvested portion of any equity grant will immediately be forfeited as of the termination

date.

In

the event that the term of the Employment Agreement is not renewed by either party, any unvested portion of any equity granted will immediately

be forfeited as of the expiration of the term of the Employment Agreement without any further action of the parties.

The

Employment Agreement contains customary representations and warranties.

The

foregoing description of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement, a copy of which

is filed as Exhibit 10.3 hereto and incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Exhibit

No. |

|

Description |

| 10.1 |

|

Amendment No. 2 to Share Exchange and Purchase Agreement, dated as of February 1, 2023, by and among the registrant, Sigmaways, Inc. and Prakash Sadasivam (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 6, 2023). |

| 10.2 |

|

Common Stock Purchase Warrant, dated February 1, 2023 (incorporated by reference to Exhibit 10.2 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 6, 2023). |

| 10.3 |

|

Employment Agreement, dated February 1, 2023, by and between the registrant and Prakash Sadasivam (incorporated by reference to Exhibit 10.3 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 6, 2023). |

| 10.4 |

|

Amended and Restated Common Stock Purchase Warrant, dated February 6, 2023 (incorporated by reference to Exhibit 10.4 to Amendment No. 1 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 10, 2023). |

| 10.5 |

|

Addendum to Share Exchange and Purchase Agreement, dated as of February 8, 2023, by and among the registrant, Sigmaways, Inc. and Prakash Sadasivam (incorporated by reference to Exhibit 10.5 to Amendment No. 1 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on February 10, 2023). |

10.6 |

|

Warrant Exchange and Termination Agreement, dated as of March 22, 2023, by and between the registrant and Prakash Sadasivam (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed with the Securities and Exchange Commission on March 28, 2023). |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HEARTCORE

ENTERPRISES, INC. |

| |

|

|

| Dated:

April 14, 2023 |

By: |

/s/

Sumitaka Yamamoto |

| |

Name: |

Sumitaka

Yamamoto |

| |

Title: |

Chief

Executive Officer |

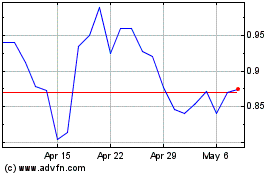

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Jul 2024 to Aug 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Aug 2023 to Aug 2024