Corporate Debt Continues to Skyrocket As Companies do Little to Generate Cash By Optimizing Collections, Payables, and Invent...

June 16 2015 - 9:30AM

Business Wire

REL’s 2015 Working Capital Survey Finds Cash

Flow Improvement Opportunity of More Than $1 Trillion;Top

Performers Hold Half the Inventory, Collect from Customers Two

Weeks Faster, and Pay Suppliers More Than Two Weeks Slower

In today’s business world, the old adage “Cash is King” is being

replaced by “Debt is King,” according to the results of the 17th

annual working capital survey from REL a division of The Hackett

Group, Inc. (NASDAQ:HCKT), and CFO Magazine.

The study, which examines the working capital performance of

nearly 1000 of the largest public companies in the U.S., found that

companies continue to take on alarming amounts of debt. Debt rose

by over 9 percent in 2014 to nearly $4.6 trillion, with companies

leveraging low interest rates to fund increased investment

activities. At the same time, companies once again made almost no

improvement in working capital management, doing little to generate

cash internally by optimizing how they collect from customers, pay

suppliers, and manage inventory. A public excerpt of the survey

results is available on a complimentary basis with registration at

this link:

http://www.thehackettgroup.com/solutions/working-capital-management/.

Companies that doubled their debt or more since 2007 saw their

working capital performance worsen dramatically, REL’s research

found, while companies that decreased their debt over the same

period saw a significant improvement.

Cash on hand decreased for the first time in a decade in 2014,

largely due to expenditures on acquisitions, according to REL’s

research. But it has risen by 74 percent since 2007, and at $932

billion remains near its all-time high. Capex spending also

continued its comeback, rising by 11 percent in one year.

For 2014, REL found that companies in the study could improve

their cash flow by over $1 trillion, or 6 percent of the U.S. gross

domestic product, by matching the performance of top companies in

their industry. Inventory optimization represents the largest share

of this opportunity. Top performers, who are seven times faster at

converting cash into cash than typical companies, now hold less

than half the inventory (22.2 days vs 50.7 days), while collecting

from customers over two weeks faster (24.8 days vs 42.6 days) and

paying suppliers 40 percent slower (55.4 days vs 39.5 days). CCC

improved only marginally in 2014, shrinking by .7 days or 2

percent.

“U.S. companies are clearly enjoying all the benefits of the

recent economic acceleration. However, their addiction to debt, and

their apathy toward true cash flow management, is very

disconcerting. Today, money is cheap. But there’s no question that

interest rates will rise, possibly sooner rather than later. And

when that happens, companies focused on optimizing their CCC will

be best positioned to mitigate their risk, continue to fund

investment, and outperform their peers,” said REL Associate

Principal Analisa DeHaro.

For the first time this year, REL shifted from its historic

calculation of Days Working Capital (DWC) to measure how effective

companies are at receivables, payables, and inventory, to using

Cash Conversion Cycle (CCC) as its preferred metric. CCC more

accurately quantifies the time each dollar is tied up in the

buying, production, and sales process before it is converted to

cash through collection from customers. CCC has improved by only

3.9 percent (1 day) since 2007.

While some companies are focused on improving working capital

performance, even those find it challenging to sustain

improvements. Only 10 percent of the companies in the REL survey

improved working capital performance for three years running, and

only 2 percent improved it for five years running. Five companies

showed remarkable results, improving working capital for seven

years in a row: AmerisourceBergen, Diebold, EQT, Goodyear, and

Masco.

Several industries, including technology hardware and

biotechnology, appeared to go against the trend, significantly

improving working capital performance in 2014. Industries that

showed the largest decline in working capital performance in 2014

included diversified consumer goods, automobiles, and construction

and engineering.

The REL/CFO Working Capital Survey is the only one of its type

that publishes comprehensive performance information on working

capital and a comprehensive array of underlying metrics for 967 of

the largest companies in the U.S. A similar annual study from REL

looks at performance of the largest public companies in Europe.

The complete data and analysis package for this survey is

available for purchase from REL. More information is available via

email at info@relconsultancy.com

About REL

REL, a division of The Hackett Group, Inc. (NASDAQ: HCKT), is a

world-leading consulting firm dedicated to delivering sustainable

cash flow improvement from working capital and across business

operations. REL’s tailored working capital management solutions

balance client trade-offs between working capital, operating costs,

service performance and risk. REL’s expertise has helped clients

free up billions of dollars in cash, creating the financial freedom

to fund acquisitions, product development, debt reduction and share

buy-back programs. In-depth process expertise, analytical rigor,

and collaborative client relationships enable REL to deliver an

exceptional return on investment in a short timeframe. REL has

delivered work in over 60 countries for Fortune 500 and global

Fortune 500 companies.

More information on REL is available: by phone at (770)

225-3600; by e-mail at info@relconsultancy.com; or on the Web at

www.relconsultancy.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150616005337/en/

RELGary Baker, 917-796-2391Global Communications

Directorgbaker@relconsultancy.com

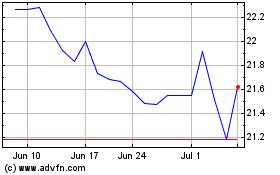

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

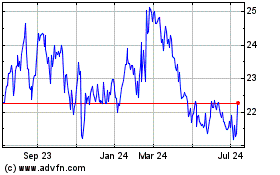

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jul 2023 to Jul 2024