Hackett Key Issues Study: As Volatility Becomes the Status Quo Understanding Regional Differences on a Global Basis is Key

February 22 2012 - 9:30AM

Business Wire

In 2012, many large companies expect to face significant

challenges dealing with the increased volatility and elements of

the "New Normal," according to new key issues research from The

Hackett Group, Inc. (NASDAQ:HCKT). The study found that companies

are heavily focused on improving accuracy and timeliness of

information to enable improved decision-making, and on leveraging

global standards, resources, and organizational models as they

struggle to "do more with less."

The Hackett Group's research also recommended that companies be

prepared to adapt their business models and priorities in response

to economic changes in regional global markets. This will require

companies to fully understand the benefit that comes from adopting

global standards and organizational models that allow optimal

execution by leveraging both skill and scale more broadly. But the

increased volatility in demand across global regions has also made

it more critical than ever for companies to truly understand how

each region should operate while still gaining the advantages that

comes from a global process operating platform.

The Hackett Group's Research Insight, "2012 Key Issues Agenda:

The 'New Normal' Has Become the 'Now Normal'" finds that CEOs and

others are acknowledging that the "New Normal" has been largely

accepted as the status quo. Increased volatility and uncertainty in

demand, cost of raw materials and energy, and availability of

talent show no signs of abating. Nearly one in five companies in

The Hackett Group's study expect to see 25 percent or more

volatility in these areas over the next two to three years.

Other elements of the "Now Normal" are also now quickly becoming

standard operating procedure. Revenue growth and improved operating

margins remains a priority, and the predominant opportunities for

revenue growth lies in emerging markets outside of Europe and North

America. The International Monetary Fund estimates that 61 percent

of global GDP growth in 2012 will come from Brazil, Russia, India

and China. Geographic barriers to doing business have been

dramatically reduced, making globalization both the principal

opportunity and threat to most organizations. Finally, technology

and data integration are acting as both enablers and accelerants of

disruptions of existing business operating models as well as within

business services.

In key business services areas such as corporate finance, IT,

HR, and procurement, The Hackett Group's research finds that the

globalization trend will continue to accelerate in 2012 and beyond.

If their current plans are successful, companies will more than

triple the level of globalization in these key areas within two to

three years. By that time, more than a third of all companies in

the study said they would have achieved a global operating

environment. The Hackett Group's assessment is that the required

changes are much more challenging than organizations realize and

that it will take most 5-10 years to reach their desired goals.

Companies will need to holistically revise their business models to

incorporate the capabilities needed to adapt to local or regional

economic changes within a global operating framework. Different

regions of the world are likely to require different business

responses as markets continue to shift.

In addition, these key business services areas will be required

to do more with less and drive an effective 5-6 percent increase in

productivity during 2012, significantly higher than the recent

historical average of 1-3 percent annualized improvement. Combined

with increased offshoring and automation, the result is almost

certainly a continued jobless recovery in some business services

areas, including corporate finance.

From a technology perspective, business services leaders are

recognizing that technology infrastructure plays a key role in

helping leadership act quickly in response to volatility and other

"Now Normal" pressures. Some top priorities in this area speak to

the issue of improving analysis and access, while others relate to

investments that will deliver a better, more unified data set.

Talent management is another key concern for 2012, with

executives stating that a clear priority is to work more closely

with HR to understand where skills gaps exist today and defining

and executing plans for attracting, developing and retaining key

skills that will provide a competitive edge.

The full study is available for complimentary download (with

registration) at:

http://www.thehackettgroup.com/research/2012/key2012es/

About The Hackett Group

The Hackett Group (NASDAQ:HCKT), a global strategic business

advisory and operations improvement consulting firm, is a leader in

best practice advisory, business benchmarking, and transformation

consulting services including strategy and operations, working

capital management, and globalization advice.

Utilizing best practices and implementation insights from more

than 7,500 benchmarking studies, executives use The Hackett Group's

empirically-based approach to quickly define and implement

initiatives that enable world-class performance. Through its REL

group, The Hackett Group offers working capital solutions focused

on delivering significant cash flow improvements. Through its

Archstone Consulting group, The Hackett Group offers Strategy &

Operations consulting services in the Consumer and Industrial

Products, Pharmaceutical, Manufacturing, and Financial Services

industry sectors. Through its Hackett Technology Solutions group,

The Hackett Group offers business application consulting services

that help maximize returns on IT investments. The Hackett Group has

completed benchmark studies with over 2,800 major corporations and

government agencies, including 97% of the Dow Jones Industrials,

86% of the Fortune 100, 90% of the DAX 30 and 48% of the FTSE

100.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com.

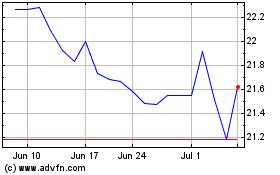

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

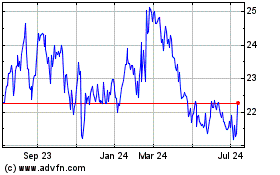

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jul 2023 to Jul 2024