New Hackett Research Quantifies Growing IT Services Gap; Demand to Increase by 17% through 2010 as Budgets Remain Flat

May 12 2009 - 9:30AM

Business Wire

IT budgets and staffing levels are expected to remain nearly

flat over the next two years, in large part due to the global

economic downturn. But demand for IT services will increase by more

than 17%, creating a significant gap that companies will need to

address with improved efficiency and productivity, according to a

new study published by The Hackett Group, Inc. (NASDAQ: HCKT).

Hackett�s research, which looks at results from more than 80

global companies, details best practices in three key areas that

companies can use to close this gap: IT cost control strategies,

demand management, and discretionary cuts.

Demand management is one particular area of potential efficiency

improvement the research cites as neglected by many companies. Only

about a third of all companies in the study use cost allocation or

charge backs to bill internal users based on the volume of IT

services consumed, or for IT work done on their behalf. In

addition, less than 30% have a service catalog in place that

defines a set of discrete service offerings with an associated

price per unit.

�Demand for IT services has always exceeded supply capacity,�

said Hackett IT Advisory Practice Leader David Ackerman. �But the

global economic downturn has put more pressure than ever before on

IT organizations to �do more with less.� The growing gap between

demand and budgets requires companies to broaden their mix of

techniques. IT organizations that stick to traditional

discretionary cuts are unlikely to truly solve the problem, and

also risk significantly damaging their ability to provide strategic

value to their company.�

According to Hackett Senior IT Research Director Erik Dorr,

�What we see here is that there�s significant untapped potential

for companies to cut costs and manage demand. While most companies

in our study have implemented basic IT cost control strategies,

other areas, such as demand management, have been largely ignored.

And even in traditional areas like discretionary cuts, which are

fairly inevitable in the current environment, there�s room for an

increased level of sophistication to reduce the stress on the IT

organization and to ensure that the cuts are sustainable.�

According to Hackett�s research, companies forecast that IT

budgets and staffing levels will each grow by only about 1.0 %

annually over the next two years, down from the annual growth rates

of 5.3% (for budgets) and 4.3% (for staff) seen over the past three

years. This 75% decline in budget growth contrasts sharply with

companies� projections for IT demand, which will shrink by only

15%, to 8.6% annually for the next two years, resulting in an

increase of more than 17% by the end of 2010.

Hackett�s research found that the drivers of IT demand are also

shifting, with organic business growth dropping significantly as a

priority while needs driven by process transformation and business

reorganization increase. Two other IT demand drivers, regulatory

compliance and M&A activity, are expected to remain fairly

stable.

Hackett�s research outlines best practices in three key areas

that companies can use to close the gap between flat budgets and

rising demand. The first, IT cost control, is a well-understood and

mature approach that has the greatest potential to reduce IT costs,

and includes key tactics such as: offshoring and outsourcing; IT

reorganization; technology rationalization; productivity and

process improvements; and supplier and contract management. In this

area, Hackett found that offshoring and outsourcing offer the

largest opportunity for cost control, more than three times the

savings of other IT cost control strategies, primarily because it

affects the largest share of the overall IT budget. But the study

also found that an across the board goal of 10% cost reductions in

this area is both realistic and achievable.

The study found that the second area, IT demand management, is a

highly underutilized technique by most companies. IT has

traditionally been more focused on how to meet ever-growing demand

than on implementing processes to curb that demand and ensure that

the highest value work gets done. As a result, demand management

techniques are less mature than other cost control techniques. The

study found that few companies use tactics such as charge backs,

service catalogs, or IT portfolio management to reduce costs,

despite the fact that these techniques can drive real savings.

This research also reinforces findings from a previous Hackett

study on IT Business Value Management that identified top

performing IT organization�s ability to directly link its

discretionary budget to the highest priority business objectives of

the enterprise � in and of itself, the most effective form of

demand management.

The final strategy -- discretionary cuts, which generally

involve mandated budget and staff reductions without underlying

process improvement or rationalization, is widely used by most

companies. But it is also the riskiest of the three approaches.

Unless process improvements are an integrated part of any

discretionary cuts, Hackett warns that they are likely to result in

degraded service levels and reduced overall effectiveness. It can

also be very challenging to sustain discretionary cuts on an

ongoing basis, the research found, as many companies quickly find

that they have very little fat left to trim.

About The Hackett Group

The Hackett Group, Inc. (NASDAQ: HCKT), a global strategic

advisory firm, is a leader in best practice advisory, benchmarking,

and transformation consulting services, including shared services,

offshoring and outsourcing advice. Utilizing best practices and

implementation insights from more than 4,000 benchmarking

engagements, executives use Hackett's empirically based approach to

quickly define and prioritize initiatives to enable world-class

performance. Through its REL brand, Hackett offers working capital

solutions focused on delivering significant cash flow improvements.

Through its Hackett Technology Solutions group, Hackett offers

business application consulting services that helps maximize

returns on IT investments. Hackett has worked with 2,700 major

corporations and government agencies, including 97% of the Dow

Jones Industrials, 73% of the Fortune 100, 73% of the DAX 30 and

45% of the FTSE 100.

Founded in 1991, The Hackett Group was acquired by Answerthink,

Inc. in 1997. Answerthink was renamed The Hackett Group, Inc. in

2008. The Hackett Group has global offices in the United States,

Europe and Asia/Pacific.

More information on The Hackett Group is available: by phone at

(770) 225-7300; by e-mail at info@thehackettgroup.com; or on the

Web at www.thehackettgroup.com.

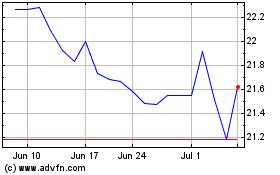

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jun 2024 to Jul 2024

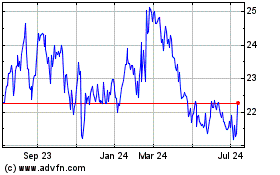

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Jul 2023 to Jul 2024