FVCBankcorp, Inc. (NASDAQ:FVCB) (the “Company”) today reported

second quarter 2020 net income of $2.9 million, or $0.21 diluted

earnings per share, compared to $4.1 million, or $0.28 diluted

earnings per share, for the quarter ended June 30, 2019, the

decrease in net income primarily a result of increased provision

for loan losses totaling $1.8 million recorded during the second

quarter of 2020 and one-time branch closure costs of $676 thousand.

Net revenues, which includes net interest income plus noninterest

income, for the three months ended June 30, 2020 were $13.4

million, an increase of $472 thousand, from $12.9 million for the

year ago quarter ended June 30, 2019. For the six months ended June

30, 2020, the Company reported net income of $6.6 million, or $0.46

diluted earnings per share, compared to $8.0 million or $0.54

diluted earnings per share, for the same period of 2019, the

decrease in net income attributable to an increase in loan loss

provisioning of $2.8 million year-over-year and $676 thousand in

one-time branch closure costs. Net revenues for the six months

ended June 30, 2020 were $26.3 million, an increase of $875

thousand, from $25.4 million for the six months ended June 30,

2019.

Certain non-operating items impacted the financial results for

the quarter and year to date periods reported above. During the

second quarter of 2020, the Company decided to close two branch

office locations. Because of the COVID-19 pandemic, more clients

have transitioned to the Company’s electronic banking products,

reducing the need to have physical branch locations to serve its

customers. The operating leases and leasehold improvements written

off as a result of closing these locations totaled $676 thousand

pre-tax ($534 thousand after tax). As the branches will not close

until early fourth quarter 2020, the Company does not anticipate

cost savings until that time. Annual cost savings for the closure

of these locations related to occupancy expense is expected to be

approximately $350 thousand. Other savings of approximately $250

thousand include salaries and benefits expense as the employees for

each of these locations will be filling current vacant positions

within the Company, reducing the need to hire additional personnel.

The Company is proactively working with those customers impacted by

these branch closures to minimize their business interruption.

The Company believes the reporting of non-generally accepted

accounting principles (“non-GAAP”) earnings to exclude branch

closing impairment charges, gains on sales of securities, and

merger and acquisition expenses are more reflective of the

Company’s operating performance (“Operating Earnings”). Operating

Earnings for the three months ended June 30, 2020 were $3.4

million, or $0.25 diluted earnings per share, compared to $4.1

million, or $0.28 diluted earnings per share for the three months

ended June 30, 2019. Operating Earnings for the six months ended

June 30, 2020 were $7.1 million, or $0.50 diluted earnings per

share, compared to $8.1 million, or $0.55 diluted earnings per

share for the six months ended June 30, 2019. As mentioned

previously, both the three and six month periods ended June 30,

2020 have been impacted by elevated provision for loan losses

expense.

Second Quarter Selected Highlights

- Increased Pre-Tax Pre-Provision Income. For the three

months ended June 30, 2020 and 2019, pre-tax pre-provision income

was $6.1 million and $5.6 million, respectively, an increase of

$426 thousand or 7.6%. On a linked quarter basis, pre-tax

pre-provision income was $5.6 million for the three months ended

March 31, 2020. Pre-tax pre-provision return on average assets for

the three months ended June 30, 2020 and 2019 were 1.41% and 1.56%,

respectively. For the six months ended June 30, 2020 and 2019,

pre-tax pre-provision income were $11.7 million and $11.2 million,

respectively, an increase of $429 thousand. A reconciliation of

pre-tax pre-provision, a non-GAAP financial measure, can be found

in the tables below.

- Reduced Levels of Past Due and Nonperforming loans.

Loans past due 30 days or more totaled $3.3 million at June 30,

2020, of which $1.4 million are over 90 days past due. Past due

loans at June 30, 2020 reflect a decrease of $11.4 million from

$14.7 million at December 31, 2019 and a decrease of $13.1 million

from $16.3 million at March 31, 2020. Nonperforming loans and loans

past due 90 days or more and still accruing were $8.5 million, or

0.48% of total assets, at June 30, 2020, compared to $10.7 million,

or 0.70% of total assets at December 31, 2019, and $8.9 million, or

0.56% of total assets, at March 31, 2020.

- Responsiveness to Customers During COVID-19 Pandemic.

Initially, total loans with payment deferrals comprising

approximately 24.4% of the total loan portfolio, or $360.2 million,

were made as a result of the Company’s goal to help customers with

COVID-19 related financial issues. At July 20, 2020, approximately

18.5% of the total loan portfolio, or $273.6 million, continue

under COVID-19 deferrals. For 90-day payment deferrals that have

matured to date, approximately 9% have been approved for a second

90-day payment deferral. In addition, the Company originated 755

loans totaling $169.4 million in the U.S. Small Business

Administration’s (“SBA”) Paycheck Protection Program (“PPP”) net of

deferred fees and costs during the second quarter of 2020. Of the

755 PPP loans originated, 226 loans were originated to new

customers of the Company’s subsidiary bank, FVCBank, and represent

future deposit and loan growth opportunities. The Company has net

deferred fees of $4.6 million related to PPP loans which are being

recognized in interest income over the remaining lives of the PPP

loans, or sooner, upon PPP loan forgiveness or repayment.

- Strong Core Deposit Growth. Core deposits, which

excludes wholesale deposits, increased $233.3 million, to $1.42

billion at June 30, 2020, an increase of 19.7%, from December 31,

2019. Noninterest-bearing deposits represent 31.2% of the core

deposit base at June 30, 2020.

- Increased Net Interest Income. Net interest income

increased $324 thousand to $12.7 million for the second quarter of

2020, compared to $12.4 million for the same 2019 period. Compared

to the first quarter of 2020, net interest income increased $484

thousand. Net interest margin decreased 43 basis points to 3.16%

for the quarter ended June 30, 2020 compared to 3.59% for the

quarter ended June 30, 2019. Excluding the impact of PPP loans,

which was 4 basis points, and excluding excess liquidity, which was

11 basis points, during the second quarter of 2020, net interest

margin for the three months ended June 30, 2020 would have been

3.31%.

- Increased Provision for Loan Losses. As a result of the

current economic conditions related to COVID-19, the Company

recorded a provision for loan losses of $1.8 million during the

second quarter of 2020, compared to $1.1 million at March 31, 2020,

increasing the allowance for loan losses to total loans, excluding

PPP loans, 11 basis points to 0.99% at June 30, 2020. Compared to

the year ago quarter, provision for loan losses increased $1.2

million. The Company increased reserves for loans identified as

pandemic impacted and payment deferred loans and separately and

appropriately reserved for possible future losses on the overall

portfolio that may be incurred based on qualitative economic

data.

- Well-Capitalized Bank. The capital ratios at FVCbank

remain at a well-capitalized level at June 30, 2020 with a leverage

ratio of 11.05%.

- Improved Efficiency Ratio. Efficiency ratio, excluding

the one-time branch closure charges mentioned above and gains on

sales of securities recorded during the first quarter of 2020, for

the three months ended June 30, 2020 was 54.7%, an improvement from

56.3% for the quarter ended March 31, 2020.

“Our focus this past quarter has been to help our existing and

new customers’ businesses persist during the COVID-19 pandemic

while managing our credit risk exposure. We were flexible with

customers with our initial loan payment deferral programs. We are

seeing customers resume contractual payments and believe this will

continue as businesses open up and government stimulus such as PPP

provides support to their businesses. We believe we have

appropriately reserved for potential losses in our loan portfolio

and have a capital position that will continue to support the Bank

as we weather this storm. I want to thank our employees who have

worked under some of the most difficult circumstances, helping our

customers through such unprecedented times and assisting new

customers in our community who needed bank support,” stated David

W. Pijor, Chairman and CEO.

COVID-19 Pandemic Impact to Loan Portfolio

As a result of the COVID-19 pandemic, the Company implemented

loan payment deferral programs to allow customers who were required

to close or reduce business operations to defer loan principal and

interest payments primarily for 90 days. During the second quarter

of 2020, the Company modified 277 loans for a total outstanding

principal balance of $360.2 million, or 24.4% of the total loan

portfolio. At July 20, 2020, loans modified reduced to 218 loans

for a total outstanding principal balance of $273.6 million, or

18.5% of the total loan portfolio. For those commercial real estate

loans with approved payment deferrals, these loans are

collateralized and well secured. The table below shows the number

of loans modified and not modified and their respective outstanding

loan balances by asset class, excluding PPP loans.

COVID Payment Deferral By

Asset Class Asset Class

Number of

Loans

Total Loans Modified

($ in thousands)

Number of Loans Not

Modified

Outstanding Balance of

Loans Not Modified

($ in thousands)

Commercial Real Estate - Retail

31

$

88,109

80

$

114,874

Commercial Real Estate - Mixed Use

21

47,730

31

38,309

Specialty Use-Hotel/Lodging/Motel

6

45,945

5

12,044

Commercial Real Estate - Office

14

35,654

100

80,393

Multi-Family First Lien

11

32,541

69

75,019

Commercial Real Estate - Industrial

10

22,338

53

73,998

Commercial Real Estate - Special Use/Church

6

12,026

19

34,705

Special Purpose

10

11,718

13

18,341

Other Loan Categories

168

64,116

2,148

497,973

At June 30, 2020

277

$

360,177

2,518

$

945,656

At July 20, 2020

218

$

273,631

The Company is closely and proactively monitoring the effects of

the pandemic on its loan and deposit customers and is focused on

assessing risks within the loan portfolio and working with

customers to minimize losses. The Company considers pandemic

impacted loans to include commercial real estate loans to hotels,

churches, and certain retail and special purpose asset classes.

During its assessment of the allowance for loan losses, the Company

addressed the credit risks associated with these pandemic impacted

segments and those loans that have requested payment deferrals.

The Company believes that as a result of its conservative

underwriting discipline at loan origination coupled with the active

dialogue the Company has had with its borrowers, the Company has

the ability and necessary flexibility to assist its customers

through this pandemic.

Balance Sheet

Total assets increased to $1.78 billion at June 30, 2020

compared to $1.54 billion at December 31, 2019, an increase of

$243.9 million, or 15.9%. Year-over-year, total assets increased

$296.5 million, or 20.0% from $1.48 billion at June 30, 2019.

Loans receivable, net of deferred fees, totaled $1.48 billion at

June 30, 2020, compared to $1.27 billion at December 31, 2019, an

increase of $207.6 million, or 16.3%, and compared to $1.23 billion

at June 30, 2019, a year-over-year increase of $243.7 million, or

19.7%. PPP loans originated and funded, net of fees, totaled $169.4

million during the quarter assisting both existing and new clients.

During the second quarter of 2020, loan originations, excluding PPP

loans, totaled approximately $82.5 million, of which $46.7 million

funded during the quarter. While commercial & industrial loans

decreased $9.0 million during the first six months of 2020, PPP

loans to this segment totaled approximately $93.3 million. On April

1, 2020, the Company reclassified its consumer unsecured loans held

for sale portfolio to held for investment at the lower of cost or

market as the market for these types of loans receded due to

current economic conditions. This portfolio totaled $8.8 million at

June 30, 2020, compared to $11.2 million at December 31, 2019.

Investment securities decreased $19.5 million to $122.1 million

at June 30, 2020, compared to $141.6 million at December 31, 2019.

The Company sold $10.1 million in mortgage-backed securities

available-for-sale, recording gains of $97 thousand during the

first quarter of 2020. Year-over-year, investment securities

decreased $14.2 million, or 10.4%, from $136.2 million at June 30,

2019.

Total deposits increased to $1.52 billion at June 30, 2020

compared to $1.29 billion at December 31, 2019, an increase of

$233.3 million, or 18.2%. Year-over-year, total deposits increased

$249.7 million, or 19.7%, from $1.27 billion at June 30, 2019. Core

deposits, which represent total deposits less wholesale deposits,

increased $233.3 million, or 19.7%, to $1.42 billion at June 30,

2020 compared to $1.19 billion at December 31, 2019, and increased

$231.9 million, or 19.5% from $1.19 billion at June 30, 2019. The

increase in core deposits reflects a combination of deposits from

remaining PPP funds and new customer relationships as well as

growth in existing customer accounts. Wholesale deposits totaled

$100.0 million, or 6.6% of total deposits at June 30, 2020, a

decrease of $24.5 million from March 31, 2020. Noninterest-bearing

deposits increased $136.2 million, or 44.5%, to $442.4 million at

June 30, 2020 from $306.2 million at December 31, 2019, and

represented 29.1% of total deposits, or 31.2% of core deposits, at

June 30, 2020.

Income Statement

Net income for the three months ended June 30, 2020 was $2.8

million, compared to $4.1 million for the same period of 2019, and

$3.7 million for the quarter ended March 31, 2020. For the six

months ended June 30, 2020, net income was $6.6 million, compared

to $8.0 million for the same period of 2019. Both the three and six

months’ periods of 2020 were impacted by increased provision for

loan losses and the aforementioned branch closing impairment

charges.

Net interest income totaled $12.7 million, an increase of $324

thousand, for the quarter ended June 30, 2020, compared to the year

ago quarter, and increased by $484 thousand, or 4%, compared to the

first quarter of 2020, a result of significant decreases in the

cost of deposits. Interest expense on deposits decreased $1.0

million for the three months ended June 30, 2020 compared to the

same period of 2019, and decreased $1.0 million compared to the

three months ended March 31, 2020. The impact to interest income

from the accretion of loan marks on acquired loans was $126

thousand and $352 thousand for the three months ended June 30, 2020

and 2019, respectively. In addition, net interest income for the

three months ended June 30, 2020 benefited from PPP loan

origination, which contributed $801 thousand to interest income.

For the six months ended June 30, 2020 and 2019, net interest

income was $24.9 million and $24.1 million, respectively, an

increase of $771 thousand.

The Company’s net interest margin decreased 43 basis points to

3.16% for the quarter ended June 30, 2020 compared to 3.59% for the

quarter ended June 30, 2019, impacted by the decreases in the

targeted fed funds rate of 225 basis points over the past 12

months. On a linked quarter basis, net interest margin decreased 21

basis points from 3.37% for the three months ended March 31, 2020.

The average yield for the loan portfolio for the second quarter of

2020 was 4.52% (excluding PPP loans) compared to 5.24% for the year

ago quarter, and 4.88% for the quarter ended March 31, 2020. The

Company’s variable rate portfolio makes up approximately 49% of the

total portfolio, and of those variable rate loans that have rate

floors, substantially all have hit their rate floors. Cost of

deposits, which include noninterest-bearing deposits, for the

second quarter of 2020 was 0.87%, compared to 1.36% for the second

quarter of 2019, a decrease of 49 basis points, primarily as a

result of the Company having aggressively decreased its deposit

rates during the second quarter in order to offset the repricing of

the variable rate loan portfolio.

Noninterest income totaled $687 thousand and $539 thousand for

the quarters ended June 30, 2020 and 2019, respectively. Fee income

from loans was $46 thousand, for the quarter ended June 30, 2020

compared to $53 thousand for the same period of 2019. Service

charges on deposit accounts and other fee income totaled $223

thousand for the second quarter of 2020, compared to $229 thousand

from the year ago quarter. Income from bank-owned life insurance

increased $172 thousand to $282 thousand for the three months ended

June 30, 2020 compared to $110 thousand for the same period of

2019, primarily as a result of purchasing additional policies

during 2019. Noninterest income for the year-to-date period ended

June 30, 2020 was $1.4 million, compared to $1.3 million for the

2019 year-to-date period, an increase of $104 thousand, or 8%,

which was primarily driven by an increase in income from bank-owned

life insurance.

Noninterest expense totaled $8.0 million for the quarter ended

June 30, 2020, compared to $7.3 million for the same three-month

period of 2019. Excluding the impairment charge on branch closings,

noninterest expense for the three months ended June 30, 2020 would

have been $7.3 million. On a linked quarter basis, noninterest

expense, excluding impairment charges, increased $113 thousand from

the three months ended March 31, 2020. This increase was primarily

related to planned upgrades in the Company’s network

infrastructure. For the six months ended June 30, 2020 and 2019,

noninterest expense, excluding impairment charges, was $14.5

million and $14.2 million, respectively. The Company continues its

efforts to maintain or reduce certain expenses where possible.

The efficiency ratio, excluding impairment charges, for the

quarter ended June 30, 2020 was 54.7%, a decrease from 56.2% for

the year ago quarter and a decrease from 56.3% for the three months

ended March 31, 2020. The efficiency ratios for the six months

ended June 30, 2020 and 2019, excluding impairment charges were

54.4% and 55.5%, respectively.

The Company recorded a provision for income taxes of $754

thousand for the three months ended June 30, 2020, compared to $1.0

million for the same period of 2019. The effective tax rates for

the three months ended June 30, 2020 and 2019 were 20.8% and 20.4%,

respectively. The effective tax rates for the 2020 and 2019 periods

presented are less than the Company’s combined federal and state

statutory rate of 21.5% primarily because of discrete tax benefits

recorded as a result of exercises of nonqualified stock options.

For the six months ended June 30, 2020 and 2019, provision for

income taxes was $1.7 million and $2.2 million, respectively.

Asset Quality

The Company recorded a provision for loan losses of $1.8 million

for the three months ended June 30, 2020, compared to $505 thousand

for the year ago quarter. The increase in the provision for loan

losses for the three months ended June 30, 2020 is primarily

related to growth in the loan portfolio and increases in

qualitative factors related to the economic uncertainties caused by

the COVID-19 pandemic. The Company is not required to implement the

provisions of the current expected credit losses accounting

standard until January 1, 2023, and is continuing to account for

the allowance for loans losses under the incurred loss model.

Provision for loan losses for the six months ended June 30, 2020

and 2019 were $2.8 million and $1.0 million, respectively.

The allowance for loan losses to total loans, excluding PPP

loans, was 0.99% at June 30, 2020, compared to 0.81% at December

31, 2019. The allowance for loan losses to total loans on the

Company’s originated loan portfolio, excluding PPP loans and

excluding acquired loans, was 1.05% at June 30, 2020. Net

charge-offs recorded during the second quarter of 2020 were

primarily related to overdrawn consumer accounts.

Nonperforming loans and loans 90 days or more past due at June

30, 2020 totaled $8.5 million, or 0.48% of total assets. This

compares to $10.7 million in nonperforming loans and loans 90 days

or more past due at December 31, 2019, or 0.70% of total assets.

All of the Company’s nonperforming loans are secured and have

specific reserves totaling $364 thousand, representing the expected

losses associated with those loans. The Company has one troubled

debt restructuring at June 30, 2020 totaling $99 thousand which is

a consumer residential loan. Nonperforming assets (including other

real estate owned) to total assets was 0.69% at June 30, 2020

compared to 0.95% for December 31, 2019.

About FVCBankcorp, Inc.

FVCBankcorp, Inc. is the holding company for FVCbank, a

wholly-owned subsidiary that commenced operations in November 2007.

FVCbank is a $1.78 billion asset-sized Virginia-chartered community

bank serving the banking needs of commercial businesses, nonprofit

organizations, professional service entities, their owners and

employees located in the greater Baltimore and Washington D.C.,

metropolitan areas. FVCbank is based in Fairfax, Virginia, and has

11 full-service offices in Arlington, Ashburn, Fairfax, Manassas,

Reston and Springfield, Virginia, Washington D.C., and Baltimore,

Bethesda, Rockville and Silver Spring, Maryland.

For more information on the Company’s selected financial

information, please visit the Investor Relations page of

FVCBankcorp, Inc.’s website, www.fvcbank.com.

Caution about Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements include, but are not limited, statements of

goals, intentions, and expectations as to future trends, plans,

events or results of the Company’s operations and policies and

regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,”

“estimates,” “potential,” “continue,” “should,” and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company’s market,

interest rates and interest rate policy, competitive factors, and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward-looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. These forward-looking statements are

based on current beliefs that involve significant risks,

uncertainties, and assumptions. Factors that could cause the

Company’s actual results to differ materially from those indicated

in these forward-looking statements, include, but are not limited

to, the risk factors and other cautionary language included in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2019 and in other periodic and current reports filed with the

Securities and Exchange Commission. Because of these uncertainties

and the assumptions on which the forward-looking statements are

based, actual operations and results in the future may differ

materially from those indicated herein. Readers are cautioned

against placing undue reliance on any such forward-looking

statements. The Company’s past results are not necessarily

indicative of future performance.

FVCBankcorp, Inc. Selected Financial Data (Dollars

in thousands, except share data and per share data)

(Unaudited)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

For the Three Months

Ended

2020

2019

2020

2019

3/31/2020

12/31/2019

Selected Balances Total assets

$

1,781,149

$

1,484,600

$

1,602,611

$

1,537,295

Total investment securities

128,690

141,611

133,586

147,606

Loans held for sale

- -

- -

9,640

11,198

Total loans, net of deferred fees

1,478,120

1,234,372

1,282,142

1,270,526

Allowance for loan losses

(12,894)

(9,996)

(11,226)

(10,231)

Total deposits

1,519,036

1,269,374

1,344,044

1,285,722

Subordinated debt

24,527

24,447

24,507

24,487

Other borrowings

25,000

- -

25,000

25,000

Total stockholders’ equity

180,652

170,163

177,688

179,078

Summary Results of Operations Interest income

$

16,281

$

16,990

$

33,212

$

32,950

$

16,931

$

16,777

Interest expense

3,586

4,619

8,306

8,815

4,720

4,941

Net interest income

12,695

12,371

24,906

24,135

12,211

11,836

Provision for loan losses

1,750

505

2,816

1,020

1,066

465

Net interest income after provision for loan losses

10,945

11,866

22,090

23,115

11,145

11,371

Noninterest income - loan fees, service charges and other

405

429

1,170

1,062

764

485

Noninterest income - bank owned life insurance

282

110

565

215

283

249

Noninterest income - gain (loss) on sales of securities

available-for-sale

- -

- -

97

- -

97

- -

Noninterest income - gain (loss) on loans held for sale

- -

- -

(451)

- -

(451)

(145)

Noninterest expense

7,998

7,276

15,207

14,180

7,209

7,334

Income before taxes

3,634

5,129

8,167

10,212

4,629

4,626

Income tax expense

754

1,044

1,651

2,201

896

902

Net income

2,880

4,085

6,516

8,011

3,733

3,724

Per Share Data Net income, basic

$

0.21

$

0.30

$

0.49

$

0.58

$

0.27

$

0.27

Net income, diluted

$

0.21

$

0.28

$

0.46

$

0.54

$

0.26

$

0.25

Book value

$

13.42

$

12.30

$

13.21

$

12.88

Tangible book value (1)

$

12.79

$

11.70

$

12.57

$

12.26

Shares outstanding

13,459,317

13,839,772

13,451,678

13,902,067

Selected Ratios Net interest margin (2)

3.16

%

3.59

%

3.26

%

3.62

%

3.37

%

3.28

%

Return on average assets (2)

0.67

%

1.13

%

0.80

%

1.14

%

0.96

%

0.98

%

Return on average equity (2)

6.41

%

9.78

%

7.24

%

9.76

%

8.29

%

8.39

%

Efficiency (3)

59.77

%

56.36

%

58.06

%

55.80

%

55.87

%

59.03

%

Loans, net of deferred fees to total deposits

97.31

%

97.24

%

95.39

%

98.82

%

Noninterest-bearing deposits to total deposits

29.13

%

21.33

%

21.41

%

23.82

%

Reconciliation of Net Income (GAAP) to Operating Earnings

(Non-GAAP) (4) Net income (from above)

$

2,880

$

4,085

$

6,516

$

8,011

$

3,733

$

3,724

Add: Merger and acquisition expense

- -

16

- -

83

- -

- -

Add: Impairment on branch closures

676

- -

676

- -

- -

- -

Subtract: Gains on sales of securities available-for-sale

- -

- -

(97)

- -

(97)

- -

Less: provision for income taxes associated with non-GAAP

adjustments

(142)

(4)

(122)

(19)

20

- -

Net income, as adjusted

$

3,414

$

4,097

$

6,973

$

8,075

$

3,656

$

3,724

Net income, diluted, on an operating basis

$

0.25

$

0.28

$

0.50

$

0.55

$

0.25

$

0.25

Return on average assets (non-GAAP operating earnings)

0.79

%

1.13

%

0.86

%

1.15

%

0.94

%

0.98

%

Return on average equity (non-GAAP operating earnings)

7.60

%

9.81

%

7.86

%

9.84

%

8.12

%

8.64

%

Efficiency ratio (non-GAAP operating earnings) (3)

54.72

%

56.24

%

54.35

%

55.47

%

56.29

%

58.35

%

Capital Ratios - Bank Tangible common equity (to tangible

assets)

9.71

%

10.97

%

10.61

%

11.15

%

Tier 1 leverage (to average assets)

11.05

%

12.10

%

12.06

%

12.15

%

Asset Quality Nonperforming loans and loans 90+ past due

$

8,493

$

9,989

$

8,896

$

10,725

Performing troubled debt restructurings (TDRs)

99

- -

- -

- -

Other real estate owned

3,866

3,866

3,866

3,866

Nonperforming loans and loans 90+ past due to total assets (excl.

TDRs)

0.48

%

0.67

%

0.56

%

0.70

%

Nonperforming assets to total assets

0.69

%

0.93

%

0.80

%

0.95

%

Nonperforming assets (including TDRs) to total assets

0.70

%

0.93

%

0.80

%

0.95

%

Allowance for loan losses to loans

0.87

%

0.81

%

0.88

%

0.81

%

Allowance for loan losses to nonperforming loans

151.82

%

100.07

%

126.19

%

95.39

%

Net charge-offs

$

82

$

20

$

153

$

182

$

71

$

303

Net charge-offs to average loans (2)

0.02

%

0.01

%

0.02

%

0.03

%

0.02

%

0.10

%

Selected Average Balances Total assets

$

1,721,612

$

1,444,588

$

1,636,284

$

1,399,949

$

1,550,958

$

1,514,124

Total earning assets

1,615,125

1,384,516

1,536,659

1,346,110

1,458,308

1,430,397

Total loans, net of deferred fees

1,415,383

1,207,933

1,347,021

1,173,134

1,281,969

1,234,183

Total deposits

1,459,834

1,228,595

1,370,263

1,188,841

1,280,693

1,270,821

Other Data Noninterest-bearing deposits

$

442,443

$

270,711

$

287,801

$

306,235

Interest-bearing checking, savings and money market

655,959

596,701

581,005

525,138

Time deposits

320,628

319,740

350,712

354,362

Wholesale deposits

100,006

82,222

124,526

99,987

(1) Non-GAAP

Reconciliation

For the Period Ended June

30,

(Dollars in thousands, except per share data)

2020

2019

Total stockholders’ equity

$

180,652

$

170,163

Less: goodwill and intangibles, net

(8,525)

(8,223)

Tangible Common Equity

$

172,127

$

161,940

Book value per common share

$

13.42

$

12.30

Less: intangible book value per common share

(0.63)

(0.60)

Tangible book value per common share

$

12.79

$

11.70

(2)

Annualized.

(3)

Efficiency ratio is calculated as

noninterest expense divided by the sum of net interest income and

noninterest income. On a non-GAAP operating basis, the Company

excludes gains (losses) on sales of investment securities.

(4)

Some of the financial measures

discussed throughout the press release are "non-GAAP financial

measures." In accordance with SEC rules, the Company classifies a

financial measure as being a non-GAAP financial measure if that

financial measure excludes or includes amounts, or is subject to

adjustments that have the effect of excluding or including amounts,

that are included or excluded, as the case may be, in the most

directly comparable measure calculated and presented in accordance

with GAAP in our statements of income, balance sheets or statements

of cash flows.

FVCBankcorp, Inc. Summary Consolidated Statements of

Condition (Dollars in thousands) (Unaudited)

% Change

% Change

Current

From

6/30/2020

3/31/2020

Quarter

12/31/2019

6/30/2019

Year Ago

Cash and due from banks $

25,613

$

23,158

10.6

%

$

14,916

$

15,201

68.5

%

Interest-bearing deposits at other financial institutions

64,989

62,402

4.1

%

18,226

29,149

123.0

%

Investment securities

122,082

126,978

-3.9

%

141,589

136,232

-10.4

%

Restricted stock, at cost

6,608

6,608

0.0

%

6,017

5,379

22.8

%

Loans held for sale, at fair value

- -

9,640

-100.0

%

11,198

- -

0.0

%

Loans, net of fees: Commercial real estate

779,036

763,767

2.0

%

747,993

662,173

17.6

%

Commercial and industrial

105,957

106,302

-0.3

%

114,924

134,466

-21.2

%

Paycheck protection program

169,425

- -

100.0

%

- -

- -

100.0

%

Commercial construction

227,746

220,798

3.1

%

214,949

217,105

4.9

%

Consumer real estate

177,366

180,977

-2.0

%

181,369

196,114

-9.6

%

Consumer nonresidential

18,590

10,298

80.5

%

11,291

24,514

-24.2

%

Total loans, net of fees

1,478,120

1,282,142

15.3

%

1,270,526

1,234,372

19.7

%

Allowance for loan losses

(12,894

)

(11,226

)

14.9

%

(10,231

)

(9,996

)

29.0

%

Loans, net

1,465,226

1,270,916

15.3

%

1,260,295

1,224,376

19.7

%

Premises and equipment, net

1,818

2,090

-13.0

%

2,084

2,049

-11.3

%

Goodwill and intangibles, net

8,525

8,612

-1.0

%

8,689

8,223

3.7

%

Bank owned life insurance (BOLI)

37,633

37,352

0.8

%

37,069

26,621

41.4

%

Other real estate owned

3,866

3,866

0.0

%

3,866

3,866

0.0

%

Other assets

44,789

50,989

-12.2

%

33,346

33,504

33.7

%

Total Assets $

1,781,149

$

1,602,611

11.1

%

$

1,537,295

$

1,484,600

20.0

%

Deposits: Noninterest-bearing $

442,443

$

287,801

53.7

%

$

306,235

$

270,711

63.4

%

Interest-bearing checking

387,683

309,458

25.3

%

302,755

301,319

28.7

%

Savings and money market

268,276

271,547

-1.2

%

222,383

295,382

-9.2

%

Time deposits

320,628

350,712

-8.6

%

354,362

319,740

0.3

%

Wholesale deposits

100,006

124,526

-19.7

%

99,987

82,222

21.6

%

Total deposits

1,519,036

1,344,044

13.0

%

1,285,722

1,269,374

19.7

%

Other borrowed funds

25,000

25,000

0.0

%

25,000

- -

100.0

%

Subordinated notes, net of issuance costs

24,527

24,507

0.1

%

24,487

24,447

0.3

%

Other liabilities

31,934

31,372

1.8

%

23,008

20,616

54.9

%

Stockholders’ equity

180,652

177,688

1.7

%

179,078

170,163

6.2

%

Total Liabilities & Stockholders' Equity $

1,781,149

$

1,602,611

11.1

%

$

1,537,295

$

1,484,600

20.0

%

FVCBankcorp, Inc. Summary Consolidated Income

Statements (In thousands, except per share data)

(Unaudited) For the Three Months Ended

% Change % Change Current From

6/30/2020 3/31/2020 Quarter 6/30/2019

Year Ago Net interest income $

12,695

$

12,211

4.0

%

$

12,371

2.6

%

Provision for loan losses

1,750

1,066

64.2

%

505

246.5

%

Net interest income after provision for loan losses

10,945

11,145

-1.8

%

11,866

-7.8

%

Noninterest income: Fees on loans

46

396

-88.4

%

53

-13.2

%

Service charges on deposit accounts

223

239

-6.7

%

229

-2.6

%

Gain on sale of securities available-for-sale

- -

97

-100.0

%

- -

0.0

%

Loss on loans held for sale

- -

(451

)

-100.0

%

- -

0.0

%

BOLI income

282

283

-0.4

%

110

156.4

%

Other fee income

136

129

5.4

%

147

-7.5

%

Total noninterest income

687

693

-0.9

%

539

27.5

%

Noninterest expense: Salaries and employee benefits

3,982

4,028

-1.1

%

4,245

-6.2

%

Occupancy and equipment expense

859

855

0.5

%

873

-1.6

%

Data processing and network administration

494

434

13.8

%

343

44.0

%

State franchise taxes

466

466

0.0

%

426

9.4

%

Professional fees

207

225

-8.0

%

274

-24.5

%

Merger and acquisition expense

- -

- -

0.0

%

16

-100.0

%

Impairment on branch closures

676

- -

100.0

%

- -

100.0

%

Other operating expense

1,314

1,201

9.4

%

1,099

19.6

%

Total noninterest expense

7,998

7,209

10.9

%

7,276

9.9

%

Net income before income taxes

3,634

4,629

-21.5

%

5,129

-29.1

%

Income tax expense

754

896

-15.8

%

1,044

-27.8

%

Net Income $

2,880

$

3,733

-22.9

%

$

4,085

-29.5

%

Earnings per share - basic $

0.21

$

0.27

-21.1

%

$

0.30

-27.7

%

Earnings per share - diluted $

0.21

$

0.26

-19.1

%

$

0.28

-25.0

%

Weighted-average common shares outstanding - basic

13,455,053

13,751,768

13,802,712

Weighted-average common shares outstanding - diluted

13,924,239

14,595,447

14,817,462

Reconciliation of Net Income (GAAP) to Operating Earnings

(Non-GAAP):

GAAP net income reported above $

2,880

$

3,733

$

4,085

Add: Merger and acquisition expense

- -

- -

16

Add: Impairment loss

676

- -

- -

Subtract: Gain on sales of securities available-for-sale

- -

(97

)

- -

Subtract: provision for income taxes associated with non-GAAP

adjustments

(142

)

20

(4

)

Net Income, excluding above merger and acquisition charges $

3,414

$

3,656

$

4,097

Earnings per share - basic (excluding Non-GAAP items) $

0.25

$

0.27

$

0.30

Earnings per share - diluted (excluding Non-GAAP items) $

0.25

$

0.25

$

0.28

Return on average assets (non-GAAP operating earnings)

0.79

%

0.94

%

1.13

%

Return on average equity (non-GAAP operating earnings)

7.60

%

8.12

%

9.81

%

Efficiency ratio (non-GAAP operating earnings)

54.72

%

56.29

%

56.24

%

Reconciliation of Net Income (GAAP)

to Pre-Tax Pre-Provision Income (Non-GAAP): GAAP net

income reported above $

2,880

$

3,733

$

4,085

Add: Provision for loan losses

1,750

1,066

505

Add: Impairment losses

676

- -

- -

Subtract: Gain on sales of securities available-for-sale

- -

(97

)

- -

Add: Income tax expense

754

896

1,044

Pre-tax pre-provision income $

6,060

$

5,598

$

5,634

Earnings per share - basic (excluding Non-GAAP items) $

0.45

$

0.41

$

0.41

Earnings per share - diluted (excluding Non-GAAP items) $

0.44

$

0.38

$

0.38

Return on average assets (non-GAAP operating earnings)

1.41

%

1.44

%

1.56

%

Return on average equity (non-GAAP operating earnings)

13.49

%

12.43

%

13.49

%

FVCBankcorp, Inc. Summary Consolidated Income

Statements (In thousands, except per share data)

(Unaudited)

For the Six Months

Ended

% Change

From

6/30/2020

6/30/2019

Year Ago

Net interest income $

24,906

$

24,135

3.2

%

Provision for loan losses

2,816

1,020

176.1

%

Net interest income after provision for loan losses

22,090

23,115

-4.4

%

Noninterest income: Fees on loans

442

400

10.5

%

Service charges on deposit accounts

463

411

12.7

%

Gain on sale of securities available-for-sale

97

- -

100.0

%

Loss on loans held for sale

(451

)

- -

100.0

%

BOLI income

565

215

162.8

%

Other fee income

265

251

5.6

%

Total noninterest income

1,381

1,277

8.1

%

Noninterest expense: Salaries and employee benefits

8,010

8,183

-2.1

%

Occupancy and equipment expense

1,715

1,700

0.9

%

Data processing and network administration

928

782

18.7

%

State franchise taxes

932

848

9.9

%

Professional fees

432

404

6.9

%

Merger and acquisition expense

- -

83

-100.0

%

Impairment on branch closures

676

- -

100.0

%

Other operating expense

2,514

2,180

15.3

%

Total noninterest expense

15,207

14,180

7.2

%

Net income before income taxes

8,264

10,212

-19.1

%

Income tax expense

1,651

2,201

-25.0

%

Net Income $

6,613

$

8,011

-17.5

%

Earnings per share - basic $

0.49

$

0.58

-16.3

%

Earnings per share - diluted $

0.46

$

0.54

-14.3

%

Weighted-average common shares outstanding - basic

13,603,411

13,763,472

Weighted-average common shares outstanding - diluted

14,259,843

14,798,708

Reconciliation of Net Income (GAAP)

to Operating Earnings (Non-GAAP): GAAP net income

reported above $

6,613

$

8,011

Add: Merger and acquisition expense

- -

83

Add: Impairment loss

676

- -

Subtract: Gain on sales of securities available-for-sale

(97

)

- -

Subtract: provision for income taxes associated with non-GAAP

adjustments

(122

)

(19

)

Net Income, excluding above merger and acquisition charges $

7,070

$

8,075

Earnings per share - basic (excluding merger and acquisition

charges) $

0.52

$

0.59

Earnings per share - diluted (excluding merger and acquisition

charges) $

0.50

$

0.55

Return on average assets (non-GAAP operating earnings)

0.86

%

1.15

%

Return on average equity (non-GAAP operating earnings)

7.86

%

9.84

%

Efficiency ratio (non-GAAP operating earnings)

54.35

%

55.47

%

Reconciliation of Net Income (GAAP)

to Pre-Tax Pre-Provision Income (Non-GAAP): GAAP net

income reported above $

6,613

$

8,011

Add: Provision for loan losses

2,816

1,020

Add: Impairment losses

676

- -

Subtract: Gain on sales of securities available-for-sale

(97

)

- -

Add: Income tax expense

1,651

2,201

Pre-tax pre-provision income $

11,659

$

11,232

Earnings per share - basic (excluding Non-GAAP items) $

0.86

$

0.82

Earnings per share - diluted (excluding Non-GAAP items) $

0.82

$

0.76

Return on average assets (non-GAAP operating earnings)

1.43

%

1.60

%

Return on average equity (non-GAAP operating earnings)

12.96

%

13.68

%

FVCBankcorp, Inc. Average Statements of Condition and

Yields on Earning Assets and Interest-Bearing Liabilities

(Dollars in thousands) (Unaudited)

For the Three Months Ended 6/30/2020 3/31/2020

6/30/2019 Average Average Average

Average Average Average Balance

Yield Balance Yield Balance

Yield Interest-earning assets: Loans receivable, net

of fees (1) Commercial real estate (2) $

844,774

4.37

%

$

832,545

4.77

%

$

717,248

4.86

%

Commercial and industrial

103,226

4.99

%

110,186

5.70

%

135,335

6.07

%

Paycheck protection program

121,843

2.63

%

- -

0.0

%

- -

0.0

%

Commercial construction

222,685

4.65

%

220,104

5.09

%

198,927

5.71

%

Consumer real estate

103,335

4.47

%

108,454

4.53

%

129,605

5.25

%

Consumer nonresidential

19,520

7.37

%

10,680

4.81

%

26,818

7.70

%

Total loans

1,415,383

4.36

%

1,281,969

4.88

%

1,207,933

5.24

%

Investment securities (3)(4)

128,797

2.65

%

143,634

2.70

%

144,056

2.73

%

Loans held for sale, at fair value

- -

0.0

%

10,492

8.99

%

- -

0.0

%

Interest-bearing deposits at other financial institutions

70,945

0.12

%

22,213

1.48

%

32,527

2.39

%

Total interest-earning assets

1,615,125

4.03

%

1,458,308

4.65

%

1,384,516

4.91

%

Non-interest earning assets: Cash and due from banks

19,645

13,431

7,597

Premises and equipment, net

2,050

1,941

2,152

Accrued interest and other assets

96,362

87,560

60,016

Allowance for loan losses

(11,570

)

(10,282

)

(9,693

)

Total Assets $

1,721,612

$

1,550,958

$

1,444,588

Interest-bearing liabilities: Interest checking $

341,081

0.70

%

$

273,976

1.29

%

$

301,132

1.28

%

Savings and money market

263,588

0.66

%

227,497

1.12

%

275,129

1.54

%

Time deposits

321,775

2.15

%

353,809

2.35

%

299,551

2.17

%

Wholesale deposits

132,072

1.23

%

121,047

1.92

%

88,064

2.52

%

Total interest-bearing deposits

1,058,516

1.20

%

976,329

1.72

%

963,876

1.74

%

Other borrowed funds

25,000

0.50

%

39,141

1.53

%

4,754

2.65

%

Subordinated notes, net of issuance costs

24,514

6.48

%

24,494

6.49

%

24,434

6.48

%

Total interest-bearing liabilities

1,108,030

1.30

%

1,039,964

1.83

%

993,064

1.87

%

Noninterest-bearing liabilities: Noninterest-bearing

deposits

401,318

304,364

264,719

Other liabilities

32,585

26,476

19,776

Stockholders’ equity

179,679

180,154

167,029

Total Liabilities and Stockholders' Equity $

1,721,612

$

1,550,958

$

1,444,588

Net Interest Margin

3.16

%

3.37

%

3.59

%

(1)

Non-accrual loans are included in average balances.

(2)

Includes loans for residential 1-4 trust investment purposes

totaling $75.0 million, $75.3 million and $71.2 million at June 30,

2020, March 31, 2020 and June 30, 2019, respectively. These loans

are reported as Consumer Real Estate on the summary balance sheet.

(3)

The average yields for investment securities are reported on a

fully taxable-equivalent basis at a rate of 21% .

(4)

The average balances for investment securities includes restricted

stock.

FVCBankcorp, Inc. Average Statements of Condition

and Yields on Earning Assets and Interest-Bearing Liabilities

(Dollars in thousands) (Unaudited)

For the Six Months Ended 6/30/2020 6/30/2019

Average Average Average Average

Balance Yield Balance Yield

Interest-earning assets: Loans receivable, net of fees (1)

Commercial real estate (2) $

838,660

4.57

%

$

698,363

4.79

%

Commercial and industrial

106,705

5.36

%

135,070

6.35

%

Paycheck protection program

60,921

2.63

%

- -

0.0

%

Commercial construction

221,395

4.87

%

179,014

5.71

%

Consumer real estate

105,895

4.50

%

131,760

5.25

%

Consumer nonresidential

13,445

7.26

%

28,927

7.64

%

Total loans

1,347,021

4.61

%

1,173,134

5.23

%

Investment securities (3)(4)

136,160

2.68

%

144,082

2.72

%

Loans held for sale, at fair value

6,899

6.84

%

- -

0.0

%

Interest-bearing deposits at other financial institutions

46,579

0.44

%

28,894

2.20

%

Total interest-earning assets

1,536,659

4.32

%

1,346,110

4.90

%

Non-interest earning assets: Cash and due from banks

16,537

6,707

Premises and equipment, net

1,996

2,223

Accrued interest and other assets

92,018

54,284

Allowance for loan losses

(10,926

)

(9,375

)

Total Assets $

1,636,284

$

1,399,949

Interest-bearing liabilities: Interest checking $

307,528

0.97

%

$

298,585

1.28

%

Savings and money market

245,542

0.88

%

255,636

1.51

%

Time deposits

337,792

2.27

%

303,643

2.07

%

Wholesale deposits

126,560

1.57

%

81,459

2.49

%

Total interest-bearing deposits

1,017,422

1.45

%

939,323

1.70

%

Other borrowed funds

32,071

1.14

%

7,015

2.67

%

Subordinated notes, net of issuance costs

24,504

6.48

%

24,424

6.52

%

Total interest-bearing liabilities

1,073,997

1.56

%

970,762

1.83

%

Noninterest-bearing liabilities: Noninterest-bearing

deposits

352,841

249,518

Other liabilities

29,529

15,498

Stockholders’ equity

179,917

164,171

Total Liabilities and Stockholders' Equity $

1,636,284

$

1,399,949

Net Interest Margin

3.26

%

3.62

%

(1)

Non-accrual loans are included in average balances.

(2)

Includes loans for residential 1-4 trust investment purposes

totaling $75.0 million and $71.2 million at June 30, 2020 and June

30, 2019, respectively. These loans are reported as Consumer Real

Estate on the summary balance sheet.

(3)

The average yields for investment securities are reported on a

fully taxable-equivalent basis at a rate of 21%.

(4)

The average balances for investment securities includes restricted

stock.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200723005845/en/

David W. Pijor, Chairman and Chief Executive Officer Phone:

(703) 436-3802 Email: dpijor@fvcbank.com

Patricia A. Ferrick, President Phone: (703) 436-3822 Email:

pferrick@fvcbank.com

FVCBankcorp (NASDAQ:FVCB)

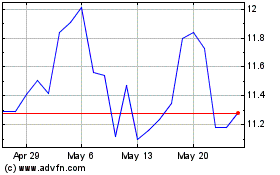

Historical Stock Chart

From Jun 2024 to Jul 2024

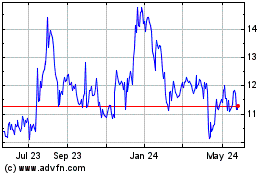

FVCBankcorp (NASDAQ:FVCB)

Historical Stock Chart

From Jul 2023 to Jul 2024