U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

☑

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period of June 30, 2023

or

|

☐

|

TRANSITION QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 333-168195

FIRSTHAND TECHNOLOGY VALUE FUND, INC.

(Exact Name of Registrant as Specified in Charter)

MARYLAND

(State or Other Jurisdiction of

Incorporation or Organization) |

27-3008946

(I.R.S. Employer

Identification No) |

| |

|

150 Almaden Boulevard, Suite 1250

San Jose, California

(Address of Principal Executive Offices) |

95113

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (408) 886-7096

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

☐ Large Accelerated Filer

☑ Non-accelerated Filer

(Do not check if smaller reporting company) |

☐ Accelerated Filer

☐ Smaller Reporting Company |

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐Yes ☑ No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class |

Outstanding at June 30, 2023 |

Common Stock, $0.001 par value per share |

6,893,056 |

TABLE OF CONTENTS |

|

PART I. FINANCIAL INFORMATION |

2 |

Item 1. Financial Statements |

2 |

Consolidated Statements of Assets and Liabilities as of June 30, 2023 (Unaudited) and December 31, 2022 |

3 |

Consolidated Statements of Operations (Unaudited) for the Three Months Ended June 30, 2023, and June 30, 2022, and for the Six Months Ended June 30, 2023, and June 30, 2022 |

4 |

Consolidated Statements of Cash Flows (Unaudited) for the Three Months Ended June 30, 2023, and June 30, 2022, and for the Six Months Ended June 30, 2023, and June 30, 2022 |

5 |

Consolidated Statements of Changes in Net Assets (Unaudited) for the Three Months Ended June 30, 2023, and June 30, 2022, and for the Six Months Ended June 30, 2023, and June 30, 2022 |

6 |

Selected Per Share Data and Ratios for the Six Months Ended June 30, 2023 (Unaudited) (Consolidated), for the Year Ended December 31, 2022 (Consolidated), for the Year Ended December 31, 2021 (Consolidated), for the Year Ended December 31, 2020 (Consolidated), for the Year Ended December 31, 2019 (Consolidated), and for the Year Ended December 31, 2018 (Consolidated) |

7 |

Consolidated Schedule of Investments as of June 30, 2023 (Unaudited) and for the Year Ended December 31, 2022 |

9 |

Notes to Consolidated Financial Statements (Unaudited) |

24 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 |

Item 3. Quantitative and Qualitative Disclosures About Market Risk |

52 |

Item 4. Controls and Procedures |

54 |

PART II. OTHER INFORMATION |

55 |

Item 1. Legal Proceedings |

56 |

Item 1A. Risk Factors |

56 |

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds |

56 |

Item 3. Defaults Upon Senior Securities |

56 |

Item 4. Mine Safety Disclosures |

56 |

Item 5. Other Information |

56 |

Item 6. Exhibits |

56 |

SIGNATURES |

57 |

1

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

See accompanying notes to financial statements

2

Firsthand Technology Value Fund, Inc.

Consolidated Statements of Assets and Liabilities

| |

|

AS OF

JUNE 30, 2023

(UNAUDITED) |

|

|

AS OF

DECEMBER 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

Investment securities: |

|

|

|

|

|

|

|

|

Unaffiliated investments at acquisition cost |

|

$ |

1,667,150 |

* |

|

$ |

1,772,422 |

* |

Affiliated investments at acquisition cost |

|

|

662,235 |

|

|

|

662,235 |

|

Controlled investments at acquisition cost |

|

|

132,091,932 |

|

|

|

140,355,353 |

|

Total acquisition cost |

|

$ |

134,421,317 |

|

|

$ |

142,790,010 |

|

Unaffiliated investments at market value |

|

$ |

667,150 |

* |

|

$ |

772,422 |

* |

Affiliated investments at market value |

|

|

266,091 |

|

|

|

337,500 |

|

Controlled investments at market value |

|

|

19,679,716 |

|

|

|

39,012,002 |

|

Total Market value** (Note 6) |

|

|

20,612,957 |

|

|

|

40,121,924 |

|

Foreign currency at value (cost $2,629 and $3,235) |

|

|

2,703 |

|

|

|

3,404 |

|

Receivable from dividends and interest |

|

|

279,358 |

|

|

|

14,463 |

|

Other assets |

|

|

47,203 |

|

|

|

64,066 |

|

Total Assets |

|

|

20,942,221 |

|

|

|

40,203,857 |

|

LIABILITIES |

|

|

|

|

|

|

|

|

Payable to affiliates (Note 4) |

|

|

9,586,630 |

|

|

|

9,188,187 |

|

Trustees’ fees payable |

|

|

34,586 |

|

|

|

50,000 |

|

Consulting fee payable |

|

|

46,000 |

|

|

|

46,000 |

|

Accrued expenses and other payables |

|

|

175,949 |

|

|

|

310,079 |

|

Total Liabilities |

|

|

9,843,165 |

|

|

|

9,594,266 |

|

NET ASSETS |

|

$ |

11,099,056 |

|

|

$ |

30,609,591 |

|

| |

|

|

|

|

|

|

|

|

Net Assets consist of: |

|

|

|

|

|

|

|

|

Common Stock, par value $0.001 per share 100,000,000 shares authorized |

|

$ |

6,893 |

|

|

$ |

6,893 |

|

Paid-in-capital |

|

|

176,770,722 |

|

|

|

176,770,722 |

|

Total distributable earnings (loss) |

|

|

(165,678,559 |

) |

|

|

(146,168,024 |

) |

NET ASSETS |

|

$ |

11,099,056 |

|

|

$ |

30,609,591 |

|

| |

|

|

|

|

|

|

|

|

Shares of Common Stock outstanding |

|

|

7,016,432 |

|

|

|

7,016,432 |

|

Shares of Treasury Stock outstanding |

|

|

(123,376 |

) |

|

|

(123,376 |

) |

Total Shares of Common Stock outstanding |

|

|

6,893,056 |

|

|

|

6,893,056 |

|

Net asset value per share (Note 2) |

|

$ |

1.61 |

|

|

$ |

4.44 |

|

|

*

|

Includes Fidelity Investment Money Market Treasury Portfolio - Class I, which invests primarily in U.S. Treasury securities. The yields as of 06/30/23 and 12/31/22 were 4.98% and 4.13%, respectively. Please see https://fundresearch.fidelity.com/mutual-funds/summary/316175504 for additional information.

|

|

**

|

Includes warrants whose primary risk exposure is equity contracts.

|

See accompanying notes to financial statements

3

Firsthand Technology Value Fund, Inc.

Consolidated Statements of Operations (Unaudited)

| |

|

FOR THE THREE MONTHS ENDED |

|

|

FOR THE SIX MONTHS ENDED |

|

| |

|

JUNE 30, 2023 |

|

|

JUNE 30, 2022 |

|

|

JUNE 30, 2023 |

|

|

JUNE 30, 2022 |

|

INVESTMENT INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaffiliated interest |

|

$ |

(18,808 |

) |

|

$ |

(45,718 |

) |

|

$ |

23,471 |

|

|

$ |

(10,480 |

) |

Affiliated/controlled interest |

|

|

150,484 |

|

|

|

(3,767,193 |

) |

|

|

299,467 |

|

|

|

(1,866,141 |

) |

TOTAL INVESTMENT INCOME |

|

|

131,676 |

|

|

|

(3,812,911 |

) |

|

|

322,938 |

|

|

|

(1,876,621 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment advisory fees (Note 4) |

|

|

146,723 |

|

|

|

386,024 |

|

|

|

339,543 |

|

|

|

875,796 |

|

Administration fees |

|

|

29,001 |

|

|

|

28,348 |

|

|

|

57,504 |

|

|

|

57,927 |

|

Custody fees |

|

|

4,440 |

|

|

|

8,308 |

|

|

|

6,600 |

|

|

|

14,115 |

|

Transfer agent fees |

|

|

12,633 |

|

|

|

2,420 |

|

|

|

20,511 |

|

|

|

12,397 |

|

Registration and filing fees |

|

|

8,801 |

|

|

|

8,427 |

|

|

|

17,505 |

|

|

|

16,761 |

|

Professional fees |

|

|

96,540 |

|

|

|

116,483 |

|

|

|

162,309 |

|

|

|

185,705 |

|

Printing fees |

|

|

85,923 |

|

|

|

26,203 |

|

|

|

100,471 |

|

|

|

44,943 |

|

Trustees fees |

|

|

3,336 |

|

|

|

50,000 |

|

|

|

22,086 |

|

|

|

100,000 |

|

Compliance fees |

|

|

29,612 |

|

|

|

29,613 |

|

|

|

58,900 |

|

|

|

58,900 |

|

Miscellaneous fees |

|

|

21,770 |

|

|

|

24,320 |

|

|

|

42,701 |

|

|

|

46,467 |

|

TOTAL GROSS EXPENSES |

|

|

438,779 |

|

|

|

680,146 |

|

|

|

828,130 |

|

|

|

1,413,011 |

|

NET INVESTMENT INCOME/(LOSS) |

|

|

(307,103 |

) |

|

|

(4,493,057 |

) |

|

|

(505,192 |

) |

|

|

(3,289,632 |

) |

Net Realized and Unrealized Gain (Loss) on Investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gains (losses) from security transactions on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliated/controlled |

|

|

— |

|

|

|

(5,113,635 |

) |

|

|

(7,864,997 |

) |

|

|

(4,929,722 |

) |

Foreign currency |

|

|

16 |

|

|

|

(714 |

) |

|

|

16 |

|

|

|

1,946 |

|

Net realized gains (losses) |

|

|

16 |

|

|

|

(5,114,349 |

) |

|

|

(7,864,981 |

) |

|

|

(4,927,776 |

) |

Net change in unrealized appreciation (depreciation) on: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-affiliated investments |

|

|

— |

|

|

|

(87,762 |

) |

|

|

— |

|

|

|

104,114 |

|

Affiliated/controlled investments and foreign currency |

|

|

(13,505,591 |

) |

|

|

(27,284,454 |

) |

|

|

(10,948,320 |

) |

|

|

(36,322,228 |

) |

Affiliated/controlled warrants investments (1) |

|

|

(955,633 |

) |

|

|

(628,865 |

) |

|

|

(192,042 |

) |

|

|

(522,907 |

) |

Net change in unrealized (depreciation) |

|

|

(14,461,224 |

) |

|

|

(28,001,081 |

) |

|

|

(11,140,362 |

) |

|

|

(36,741,021 |

) |

Net Realized and Unrealized (Loss) on Investments |

|

|

(14,461,208 |

) |

|

|

(33,115,430 |

) |

|

|

(19,005,343 |

) |

|

|

(41,668,797 |

) |

Net Decrease In Net Assets Resulting From Operations |

|

$ |

(14,768,311 |

) |

|

$ |

(37,608,487 |

) |

|

$ |

(19,510,535 |

) |

|

$ |

(44,958,429 |

) |

Net Decrease In Net Assets Per Share Resulting From Operations (2) |

|

$ |

(2.14 |

) |

|

$ |

(5.45 |

) |

|

$ |

(2.83 |

) |

|

$ |

(6.52 |

) |

|

(1)

|

Primary exposure is equity risk.

|

|

(2)

|

Per share results are calculated based on weighted average shares outstanding for each period.

|

See accompanying notes to financial statements

4

Firsthand Technology Value Fund, Inc.

Consolidated Statements of Cash Flows (Unaudited)

| |

|

FOR THE THREE

MONTHS ENDED

JUNE 30, 2023 |

|

|

FOR THE THREE

MONTHS ENDED

JUNE 30, 2022 |

|

|

FOR THE SIX

MONTHS ENDED

JUNE 30, 2023 |

|

|

FOR THE SIX

MONTHS ENDED

JUNE 30, 2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in Net Assets resulting from operations |

|

$ |

(14,768,311 |

) |

|

$ |

(37,608,487 |

) |

|

$ |

(19,510,535 |

) |

|

$ |

(44,958,429 |

) |

Adjustments to reconcile net increase (decrease) in Net Assets derived from operations to net cash provided by (used in) operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of investments |

|

|

(100,000 |

) |

|

|

— |

|

|

|

(100,000 |

) |

|

|

— |

|

Proceeds from disposition of investments |

|

|

— |

|

|

|

2,693,092 |

|

|

|

498,425 |

|

|

|

3,502,047 |

|

Net purchases/sales from short-term investments |

|

|

387,743 |

|

|

|

(2,955,459 |

) |

|

|

105,273 |

|

|

|

(3,382,103 |

) |

Increase (decrease) in dividends, interest, and reclaims receivable |

|

|

(96,581 |

) |

|

|

3,827,456 |

|

|

|

(264,896 |

) |

|

|

2,003,270 |

|

Increase (decrease) in due to Custodian |

|

|

(10,000 |

) |

|

|

(13,589 |

) |

|

|

— |

|

|

|

(13,589 |

) |

Increase (decrease) in receivable in investment sold |

|

|

— |

|

|

|

339,624 |

|

|

|

— |

|

|

|

— |

|

Increase (decrease) in payable to affiliates |

|

|

176,336 |

|

|

|

415,637 |

|

|

|

398,443 |

|

|

|

934,697 |

|

Increase (decrease) in other assets |

|

|

25,426 |

|

|

|

25,852 |

|

|

|

16,863 |

|

|

|

17,619 |

|

Increase (decrease) in accrued expenses and other payables |

|

|

(76,387 |

) |

|

|

96,303 |

|

|

|

(149,544 |

) |

|

|

227,691 |

|

Net realized gain (loss) from investments |

|

|

— |

|

|

|

5,114,349 |

|

|

|

7,864,995 |

|

|

|

4,927,776 |

|

Net unrealized appreciation (depreciation) from investments, other assets, and warrants transactions |

|

|

14,461,135 |

|

|

|

28,001,081 |

|

|

|

11,140,275 |

|

|

|

36,741,021 |

|

Net cash (used in) operating activities |

|

|

(639 |

) |

|

|

(64,141 |

) |

|

|

(701 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash |

|

|

(639 |

) |

|

|

64,141 |

|

|

|

(701 |

) |

|

|

— |

|

Cash and foreign currency - beginning of period |

|

|

3,342 |

|

|

|

(64,141 |

) |

|

|

3,404 |

|

|

|

— |

|

Cash and foreign currency - end of period |

|

$ |

2,703 |

|

|

$ |

— |

|

|

$ |

2,703 |

|

|

$ |

— |

|

See accompanying notes to financial statements

5

Firsthand Technology Value Fund, Inc.

Consolidated Statements of Changes in Net Assets (Unaudited)

| |

|

FOR THE THREE

MONTHS ENDED

JUNE 30, 2023 |

|

|

FOR THE THREE

MONTHS ENDED

JUNE 30, 2022 |

|

|

FOR THE SIX

MONTHS ENDED

JUNE 30, 2023 |

|

|

FOR THE SIX

MONTHS ENDED

JUNE 30, 2022 |

|

FROM OPERATIONS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss) |

|

$ |

(307,103 |

) |

|

|

(4,493,057 |

) |

|

|

(505,192 |

) |

|

|

(3,289,632 |

) |

Net realized gain (loss) from security transactions and foreign currency |

|

|

16 |

|

|

|

(5,114,349 |

) |

|

|

(7,864,981 |

) |

|

|

(4,927,776 |

) |

Net change in unrealized (depreciation) on investments, other assets, and warrants transactions |

|

|

(14,461,224 |

) |

|

|

(28,001,081 |

) |

|

|

(11,140,362 |

) |

|

|

(36,741,021 |

) |

Net decrease in net assets from operations |

|

|

(14,768,311 |

) |

|

|

(37,608,487 |

) |

|

|

(19,510, 535 |

) |

|

|

(44,958,429 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL DECREASE IN NET ASSETS |

|

|

(14,768,311 |

) |

|

|

(37,608,487 |

) |

|

|

(19,510, 535 |

) |

|

|

(44,958,429 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of period |

|

|

25,867,367 |

|

|

|

87,404,682 |

|

|

|

30,609,591 |

|

|

|

94,754,624 |

|

End of period |

|

$ |

11,099,056 |

|

|

$ |

49,796,195 |

|

|

$ |

11,099,056 |

|

|

$ |

49,796,195 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCK ACTIVITY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding, beginning of period |

|

|

6,893,056 |

|

|

|

6,893,056 |

|

|

|

6,893,056 |

|

|

|

6,893,056 |

|

Shares outstanding, end of period |

|

|

6,893,056 |

|

|

|

6,893,056 |

|

|

|

6,893,056 |

|

|

|

6,893,056 |

|

See accompanying notes to financial statements

6

Firsthand Technology Value Fund, Inc.

Consolidated Financial Highlights

Selected per share data and ratios for a share outstanding throughout each period

| |

|

FOR THE

SIX MONTHS

ENDED

JUNE 30, 2023

(Unaudited) |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2022 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2021 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2020 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2019 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2018 |

|

Net asset value at beginning of period |

|

$ |

4.44 |

|

|

$ |

13.75 |

|

|

$ |

14.82 |

|

|

$ |

17.70 |

|

|

$ |

26.69 |

|

|

$ |

23.83 |

|

Income from investment operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income (loss), before deferred taxes |

|

|

(0.07 |

) |

|

|

(1.81 |

) |

|

|

0.44 |

(1) |

|

|

0.09 |

(1) |

|

|

0.90 |

(1) |

|

|

(1.29 |

)(1) |

Deferred tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.08 |

) |

|

|

0.07 |

|

Net investment gain (losses) |

|

|

(0.07 |

) |

|

|

(1.81 |

) |

|

|

0.44 |

|

|

|

0.09 |

|

|

|

0.82 |

|

|

|

(1.22 |

) |

Net realized and unrealized gains (losses) on investments, before deferred taxes |

|

|

(2.76 |

) |

|

|

(7.50 |

) |

|

|

(1.51 |

) |

|

|

(2.30 |

) |

|

|

(12.15 |

) |

|

|

5.13 |

|

Deferred tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.13 |

) |

|

|

2.34 |

|

|

|

(1.23 |

) |

Net realized and unrealized gains (losses) on investments, after deferred taxes |

|

|

(2.76 |

) |

|

|

(7.50 |

) |

|

|

(1.51 |

) |

|

|

(3.43 |

) |

|

|

(9.81 |

) |

|

|

3.90 |

|

Total from investment operations |

|

|

(2.83 |

) |

|

|

(9.31 |

) |

|

|

(1.07 |

) |

|

|

(3.34 |

) |

|

|

(8.99 |

) |

|

|

2.68 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized capital gains |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.03 |

) |

Anti-dilutive effect from capital share transactions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.46 |

|

|

|

— |

|

|

|

0.21 |

|

Net asset value at end of period |

|

$ |

1.61 |

|

|

$ |

4.44 |

|

|

$ |

13.75 |

|

|

$ |

14.82 |

|

|

$ |

17.70 |

|

|

$ |

26.69 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

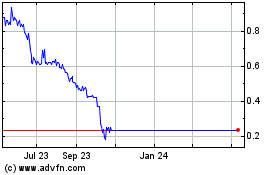

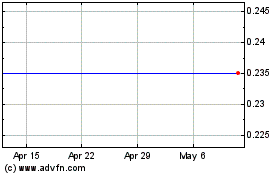

Market value at end of period |

|

$ |

0.63 |

|

|

$ |

0.95 |

|

|

$ |

4.01 |

|

|

$ |

4.47 |

|

|

$ |

6.43 |

|

|

$ |

11.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on Net Asset Value |

|

|

(63.74 |

)%(A) |

|

|

(67.71 |

)% |

|

|

(7.22 |

)% |

|

|

(16.27 |

)% |

|

|

(33.68 |

)% |

|

|

12.39 |

% |

Based on Market Value |

|

|

(33.68 |

)%(A) |

|

|

(76.31 |

)% |

|

|

(10.29 |

)% |

|

|

(30.48 |

)% |

|

|

(42.59 |

)% |

|

|

25.43 |

% |

Net assets at end of period (millions) |

|

$ |

11.1 |

|

|

$ |

30.6 |

|

|

$ |

94.8 |

|

|

$ |

102.1 |

|

|

$ |

127.1 |

|

|

$ |

191.6 |

|

See accompanying notes to financial statements

7

Firsthand Technology Value Fund, Inc.

Consolidated Financial Highlights - continued

Selected per share data and ratios for a share outstanding throughout each period

| |

|

FOR THE

SIX MONTHS

ENDED

JUNE 30, 2023

(Unaudited) |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2022 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2021 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2020 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2019 |

|

|

FOR THE

YEAR ENDED

DECEMBER 31,

2018 |

|

Ratio of total expenses to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before tax (benefit)/expense |

|

|

7.16 |

%(B) |

|

|

4.11 |

% |

|

|

3.12 |

% |

|

|

3.10 |

% |

|

|

(2.84 |

)%(2) |

|

|

6.75 |

%(2) |

Deferred tax (benefit)/expense(3)(4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8.02 |

%(5) |

|

|

(9.91 |

)% |

|

|

4.43 |

% |

Total expenses |

|

|

7.16 |

%(B) |

|

|

4.11 |

% |

|

|

3.12 |

% |

|

|

11.12 |

% |

|

|

(12.75 |

)%(2) |

|

|

11.18 |

%(2) |

Total expenses, excluding incentive fees and deferred tax expense |

|

|

7.16 |

%(B) |

|

|

4.11 |

% |

|

|

3.12 |

% |

|

|

3.10 |

% |

|

|

2.80 |

% |

|

|

2.77 |

% |

Ratio of net investment income (loss) to average net assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before tax benefit |

|

|

(4.37 |

)%(B) |

|

|

(20.96 |

)% |

|

|

2.94 |

% |

|

|

0.64 |

% |

|

|

3.93 |

%(2) |

|

|

(4.93 |

)%(2) |

Deferred tax benefit (4)(6) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.33 |

)% |

|

|

0.28 |

% |

Net investment income (loss) |

|

|

(4.37 |

)%(B) |

|

|

(20.96 |

)% |

|

|

2.94 |

% |

|

|

0.64 |

% |

|

|

3.60 |

% |

|

|

(4.65 |

)% |

Portfolio turnover rate |

|

|

0 |

%(A)(C) |

|

|

15 |

% |

|

|

16 |

% |

|

|

13 |

% |

|

|

18 |

% |

|

|

44 |

% |

|

(1)

|

Calculated using average shares outstanding.

|

|

(2)

|

Amount includes the incentive fee. For the years ended December 31, 2019 and December 31, 2018, the ratio of the incentive fee to average net assets was (5.64)% and 3.98%, respectively.

|

|

(3)

|

Deferred tax expense estimate is derived from net investment income (loss), and realized and unrealized gains (losses).

|

|

(4)

|

The deferred tax expense and tax benefit are based on average net assets.

|

|

(5)

|

As restated to reflect the removal of parenthetical notation to appropriately present ratio as deferred tax expense.

|

|

(6)

|

Deferred tax benefit estimate for the ratio calculation is derived from net investment income (loss) only.

|

See accompanying notes to financial statements

8

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

COST BASIS |

|

VALUE |

|

EQX CAPITAL, INC. |

Common Stock *(1)(2)(4) |

|

6/10/2016 |

|

|

100,000 |

|

$ |

20,000 |

|

$ |

1,880 |

|

(3.5%) Equipment Leasing |

Preferred Stock - Series A *(1)(2)(4) |

|

6/10/16-11/7/16 |

|

|

1,950,000 |

|

|

1,950,000 |

|

|

383,756 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

385,636 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

HERA SYSTEMS, INC. (68.7%) Aerospace |

Convertible Note Matures December 2024 Interest Rate 10% (1)(2)(4) |

|

12/29/2022 |

|

|

5,359,791 |

|

|

5,359,791 |

|

|

5,359,791 |

|

| |

Convertible Note Matures December 2024 Interest Rate 5% (1)(2)(4) |

|

12/29/2022 |

|

|

1,200,000 |

|

|

1,200,000 |

|

|

1,200,000 |

|

| |

Preferred Stock - Series B *(1)(2)(4) |

|

8/7/17-2/1/19 |

|

|

7,039,203 |

|

|

6,587,102 |

|

|

219,233 |

|

| |

Preferred Stock - Series C *(1)(2)(4) |

|

8/7/19-2/12/20 |

|

|

2,650,000 |

|

|

2,650,000 |

|

|

82,533 |

|

| |

Preferred Stock - Series A *(1)(2)(4) |

|

9/18/2015 |

|

|

3,642,324 |

|

|

2,000,000 |

|

|

2,566 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

2/1/2019 |

|

|

5,250,000 |

|

|

0 |

|

|

163,082 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

7/9/18-9/4/18 |

|

|

12,250,000 |

|

|

0 |

|

|

380,524 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

8/7/2017 |

|

|

6,214,922 |

|

|

0 |

|

|

193,055 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

9/28/2017 |

|

|

700,000 |

|

|

0 |

|

|

21,744 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

7,622,528 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

INTRAOP MEDICAL CORP. (45.4%) Medical Devices |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

10/11/2019 |

|

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

10/22/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

181,078 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

10/29/2019 |

|

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

See accompanying notes to financial statements

9

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

SHARES/PAR

VALUE ($) |

|

COST BASIS |

|

VALUE |

|

INTRAOP MEDICAL CORP. (continued) |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

10/6/2021 |

|

500,000 |

|

$ |

500,000 |

|

$ |

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

11/12/2021 |

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

11/29/2021 |

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

12/31/2018 |

|

10,961,129 |

|

|

10,961,129 |

|

|

1,984,819 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

2/27/2020 |

|

1,000,000 |

|

|

1,000,000 |

|

|

181,078 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

2/28/2022 |

|

200,000 |

|

|

200,000 |

|

|

36,216 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

3/25/2020 |

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

3/30/2022 |

|

150,000 |

|

|

150,000 |

|

|

27,162 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

4/20/2021 |

|

1,000,000 |

|

|

1,000,000 |

|

|

181,078 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

4/6/2022 |

|

350,000 |

|

|

350,000 |

|

|

63,377 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

5/8/2020 |

|

400,000 |

|

|

400,000 |

|

|

72,431 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

6/10/2021 |

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

See accompanying notes to financial statements

10

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

INTRAOP MEDICAL CORP. (continued) |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4) |

|

6/10/2022 |

|

|

700,000 |

|

$ |

700,000 |

|

$ |

126,755 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

7/12/2019 |

|

|

1,300,000 |

|

|

1,300,000 |

|

|

235,401 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

7/16/2021 |

|

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

7/31/2020 |

|

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

8/28/2020 |

|

|

750,000 |

|

|

750,000 |

|

|

135,809 |

|

| |

Convertible Note Matures December 2023 Interest Rate 15% (1)(2)(4)(6) |

|

9/22/2021 |

|

|

500,000 |

|

|

500,000 |

|

|

90,539 |

|

| |

Preferred Stock - Series C *(1)(2)(4) |

|

7/12/2013 |

|

|

26,856,187 |

|

|

26,299,939 |

|

|

0 |

|

| |

Term Note Matures December 2023 Interest Rate 8% (1)(2)(4) |

|

2/10/2017 |

|

|

2,000,000 |

|

|

2,000,000 |

|

|

362,156 |

|

| |

Term Note Matures December 2023 Interest Rate 8% (1)(2)(4) |

|

2/28/2014 |

|

|

3,000,000 |

|

|

3,000,000 |

|

|

543,234 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

5,035,984 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

KYMA, INC. (0.9%) Advanced Materials |

Convertible Note Matures March 2024 Interest Rate 10% (1)(4) |

|

3/11/2019 |

|

|

100,000 |

|

|

100,000 |

|

|

100,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LYNCEAN TECHNOLOGIES, INC. (0.0%) |

Preferred Stock - Series B *(1)(4) |

|

7/3/2018 |

|

|

869,792 |

|

|

1,000,000 |

|

|

0 |

|

Semiconductor Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements

11

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

REVASUM, INC. (33.4%) |

CDIs *(2) |

|

11/14/16-10/3/22 |

|

|

39,774,889 |

|

$ |

9,268,218 |

|

$ |

3,709,446 |

|

Semiconductor Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

UCT COATINGS, INC. (2.4%) |

Common Stock *(1)(3)(4) |

|

4/18/2011 |

|

|

1,500,000 |

|

|

662,235 |

|

|

266,091 |

|

Advanced Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

WRIGHTSPEED, INC. (26.3%) |

Common Stock *(1)(2)(4) |

|

6/7/2019 |

|

|

69,102 |

|

|

7,460,851 |

|

|

311 |

|

Automotive |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

1/10/2023 |

|

|

100,000 |

|

|

100,000 |

|

|

9,750 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

10/13/2020 |

|

|

1,050,000 |

|

|

1,050,000 |

|

|

102,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

10/20/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

10/21/2022 |

|

|

135,000 |

|

|

135,000 |

|

|

13,162 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

10/5/2021 |

|

|

700,000 |

|

|

700,000 |

|

|

68,250 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

11/11/2020 |

|

|

400,000 |

|

|

400,000 |

|

|

39,000 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

11/14/2022 |

|

|

165,000 |

|

|

165,000 |

|

|

16,088 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

11/23/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

11/24/2020 |

|

|

375,000 |

|

|

375,000 |

|

|

36,562 |

|

See accompanying notes to financial statements

12

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

WRIGHTSPEED, INC.(continued) |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

12/11/2020 |

|

|

400,000 |

|

$ |

400,000 |

|

$ |

39,000 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

12/23/2020 |

|

|

2,000,000 |

|

|

2,000,000 |

|

|

195,000 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

12/28/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

12/9/2022 |

|

|

125,000 |

|

|

125,000 |

|

|

12,188 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

2/23/2021 |

|

|

1,400,000 |

|

|

1,400,000 |

|

|

136,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

2/23/2022 |

|

|

200,000 |

|

|

200,000 |

|

|

19,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

3/11/2022 |

|

|

185,000 |

|

|

185,000 |

|

|

18,037 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

4/12/2021 |

|

|

1,200,000 |

|

|

1,200,000 |

|

|

117,000 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

4/14/2022 |

|

|

65,000 |

|

|

65,000 |

|

|

6,337 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

5/10/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

5/18/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

5/26/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

See accompanying notes to financial statements

13

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

WRIGHTSPEED, INC.(continued) |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

6/10/2022 |

|

|

250,000 |

|

$ |

250,000 |

|

$ |

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

6/22/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

6/28/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

6/7/2019 |

|

|

4,929,015 |

|

|

4,929,015 |

|

|

480,579 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

7/13/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

7/26/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

7/28/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

8/12/2020 |

|

|

750,000 |

|

|

750,000 |

|

|

73,125 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

8/12/2022 |

|

|

250,000 |

|

|

250,000 |

|

|

24,375 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

8/19/2021 |

|

|

1,000,000 |

|

|

1,000,000 |

|

|

97,500 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

9/10/2020 |

|

|

900,000 |

|

|

900,000 |

|

|

87,750 |

|

| |

Convertible Note Matures June 2024 Interest Rate 12% (1)(2)(4)(6) |

|

9/22/2021 |

|

|

300,000 |

|

|

300,000 |

|

|

29,250 |

|

See accompanying notes to financial statements

14

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

JUNE 30, 2023 (UNAUDITED)

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

WRIGHTSPEED, INC.(continued) |

Preferred Stock - Series AA *(1)(2)(4) |

|

6/7/19-7/20/20 |

|

|

60,733,693 |

|

$ |

17,355,887 |

|

$ |

573,233 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

2,926,122 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENT COMPANY (5.1%) |

Fidelity Investments Money Market Treasury Portfolio - Class I (5) |

|

Various |

|

|

567,150 |

|

|

567,150 |

|

|

567,150 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS (Cost $134,421,317) — 185.7% |

|

|

|

|

|

|

|

|

|

|

$ |

20,612,957 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES IN EXCESS OF OTHER ASSETS — (85.7)% |

|

|

|

|

|

|

|

|

|

|

|

(9,513,901 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS — 100.0% |

|

|

|

|

|

|

|

|

|

|

$ |

11,099,056 |

|

|

All investments except the Fidelity Investments Money Market Portfolio are considered qualifying investments.

CDI CHESS Depositary Interests

|

*

|

Non-income producing security.

|

|

(1)

|

Restricted security. Fair Value is determined by or under the direction of the Company’s Board of Directors (see Note 3). At June 30, 2023, we held $16,336,361 (or 147.2% of net assets) in restricted securities (see Note 2).

|

|

(2)

|

Controlled investments.

|

|

(4)

|

Fair Value Level 3 security (147.2% of net assets).

|

|

(5)

|

The Fidelity Investments Money Market Treasury Portfolio invests primarily in U.S. Treasury securities.

|

|

(6)

|

Security whose interest accrues until maturity however, based on June 30, 2023 valuation no such interest accrued during period ended June 30, 2023.

|

See accompanying notes to financial statements

15

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

DECEMBER 31, 2022

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

EQX CAPITAL, INC.

(2.9%) |

Common Stock *(1)(2)(4) |

|

|

6/10/2016 |

|

|

|

100,000 |

|

|

$ |

20,000 |

|

|

$ |

11,130 |

|

Equipment Leasing |

Preferred Stock - Series A *(1)(2)(4) |

|

|

6/10/16-11/7/16 |

|

|

|

1,950,000 |

|

|

|

1,950,000 |

|

|

|

865,995 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

877,125 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERA SYSTEMS, INC.

(25.8%)

Aerospace |

Convertible Note Matures December 2024 Interest Rate 5% (1)(2)(4) |

|

|

12/29/2022 |

|

|

|

1,200,000 |

|

|

|

1,200,000 |

|

|

|

1,200,000 |

|

| |

Convertible Note Matures December 2022 Interest Rate 10% (1)(2)(4) |

|

|

12/29/2022 |

|

|

|

5,359,791 |

|

|

|

5,359,791 |

|

|

|

5,359,791 |

|

| |

Preferred Stock - Series A *(1)(2)(4) |

|

|

9/18/2015 |

|

|

|

3,642,324 |

|

|

|

2,000,000 |

|

|

|

4,735 |

|

| |

Preferred Stock - Series B *(1)(2)(4) |

|

|

8/7/17 - 2/1/19 |

|

|

|

7,039,203 |

|

|

|

6,587,102 |

|

|

|

275,585 |

|

| |

Preferred Stock - Series C *(1)(2)(4) |

|

|

8/7/19-2/12/20 |

|

|

|

2,650,000 |

|

|

|

2,650,000 |

|

|

|

103,748 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

|

7/9/18 - 9/4/18 |

|

|

|

12,250,000 |

|

|

|

0 |

|

|

|

478,608 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

|

2/1/2019 |

|

|

|

5,250,000 |

|

|

|

0 |

|

|

|

205,117 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

|

8/7/2017 |

|

|

|

6,214,922 |

|

|

|

0 |

|

|

|

242,817 |

|

| |

Preferred Stock Warrants - Series B *(1)(2)(4) |

|

|

9/28/2017 |

|

|

|

700,000 |

|

|

|

0 |

|

|

|

27,349 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,897,750 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTRAOP MEDICAL CORP.

(55.9%)

Medical Devices |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

12/31/2018 |

|

|

|

10,961,129 |

|

|

|

10,961,129 |

|

|

|

6,746,169 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

7/12/2019 |

|

|

|

1,300,000 |

|

|

|

1,300,000 |

|

|

|

800,102 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

10/11/2019 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,731 |

|

See accompanying notes to financial statements

16

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

DECEMBER 31, 2022

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

INTRAOP MEDICAL CORP.

(continued) |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

10/29/2019 |

|

|

|

500,000 |

|

|

$ |

500,000 |

|

|

$ |

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

2/27/2020 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

615,463 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

3/25/2020 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

5/8/2020 |

|

|

|

400,000 |

|

|

|

400,000 |

|

|

|

246,185 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

7/31/2020 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,731 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

8/28/2020 |

|

|

|

750,000 |

|

|

|

750,000 |

|

|

|

461,597 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

4/20/2021 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

615,463 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

6/10/2021 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

7/16/2021 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

9/22/2021 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,731 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

10/6/2021 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,731 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

10/22/2021 |

|

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

615,463 |

|

See accompanying notes to financial statements

17

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

DECEMBER 31, 2022

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

INTRAOP MEDICAL CORP.

(continued) |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

11/12/2021 |

|

|

|

500,000 |

|

|

$ |

500,000 |

|

|

$ |

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

11/29/2021 |

|

|

|

500,000 |

|

|

|

500,000 |

|

|

|

307,732 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

2/28/2022 |

|

|

|

200,000 |

|

|

|

200,000 |

|

|

|

123,093 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

3/30/2022 |

|

|

|

150,000 |

|

|

|

150,000 |

|

|

|

92,319 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

4/6/2022 |

|

|

|

350,000 |

|

|

|

350,000 |

|

|

|

215,412 |

|

| |

Convertible Note Matures December 2022 Interest Rate 15% (1)(2)(4)(6) |

|

|

6/10/2022 |

|

|

|

700,000 |

|

|

|

700,000 |

|

|

|

430,824 |

|

| |

Preferred Stock - Series C *(1)(2)(4) |

|

|

7/12/2013 |

|

|

|

26,856,187 |

|

|

|

26,299,938 |

|

|

|

0 |

|

| |

Term Note Matures December 2022 Interest Rate 8% (1)(2)(4)(6) |

|

|

2/28/2014 |

|

|

|

3,000,000 |

|

|

|

3,000,000 |

|

|

|

1,846,389 |

|

| |

Term Note Matures December 2022 Interest Rate 8% (1)(2)(4)(6) |

|

|

2/10/2017 |

|

|

|

2,000,000 |

|

|

|

2,000,000 |

|

|

|

1,230,926 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17,116,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KYMA, INC.

(0.3%)

Advanced Materials |

Convertible Note Matures March 2023 Interest Rate 10% (1)(4) |

|

|

3/11/2019 |

|

|

|

100,000 |

|

|

|

100,000 |

|

|

|

100,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LYNCEAN TECHNOLOGIES, INC.

(0.0%) |

Preferred Stock - Series B *(1)(4) |

|

|

7/3/2018 |

|

|

|

869,792 |

|

|

|

1,000,000 |

|

|

|

0 |

|

Semiconductor Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements

18

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

DECEMBER 31, 2022

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

REVASUM, INC.

(11.5%) |

CDIs *(2) |

|

|

11/14/16 - 10/3/22 |

|

|

|

39,774,889 |

|

|

$ |

9,268,219 |

|

|

$ |

3,520,496 |

|

Semiconductor Equipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SILICON GENESIS CORP.

(2.4%) |

Preferred Stock - Series 1-E *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

5,704,480 |

|

|

|

2,372,403 |

|

|

|

320,592 |

|

Intellectual Property |

Preferred Stock - Series 1-C *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

82,914 |

|

|

|

109,518 |

|

|

|

962 |

|

| |

Preferred Stock - Series 1-D *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

850,830 |

|

|

|

431,901 |

|

|

|

2,552 |

|

| |

Common Stock *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

921,892 |

|

|

|

169,045 |

|

|

|

111 |

|

| |

Common Stock Warrants *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

37,982 |

|

|

|

6,678 |

|

|

|

1 |

|

| |

Preferred Stock - Series 1-F *(1)(2)(4) |

|

|

4/18/2011 |

|

|

|

912,453 |

|

|

|

456,389 |

|

|

|

70,806 |

|

| |

Preferred Stock - Series 1-G *(1)(2)(4) |

|

|

3/10/2016 |

|

|

|

48,370,793 |

|

|

|

3,880,592 |

|

|

|

306,671 |

|

| |

Preferred Stock - Series 1-H *(1)(2)(4) |

|

|

3/10/2016 |

|

|

|

837,942 |

|

|

|

936,895 |

|

|

|

35,529 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

737,224 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UCT COATINGS, INC.

(1.1%) |

Common Stock *(1)(3)(4) |

|

|

4/18/2011 |

|

|

|

1,500,000 |

|

|

|

662,235 |

|

|

|

337,500 |

|

Advanced Materials |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WRIGHTSPEED, INC.

(29.0%) |

Common Stock *(1)(2)(4) |

|

|

4/11/2013 - 5/6/2019 |

|

|

|

69,102 |

|

|

|

7,460,851 |

|

|

|

546 |

|

Automotive |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

6/7/2019 |

|

|

|

4,929,015 |

|

|

|

4,929,015 |

|

|

|

1,601,930 |

|

| |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

8/12/2020 |

|

|

|

750,000 |

|

|

|

750,000 |

|

|

|

243,750 |

|

| |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

9/10/2020 |

|

|

|

900,000 |

|

|

|

900,000 |

|

|

|

292,500 |

|

See accompanying notes to financial statements

19

Firsthand Technology Value Fund, Inc.

Consolidated Schedule of Investments - continued

DECEMBER 31, 2022

PORTFOLIO

COMPANY

(% OF NET

ASSETS)

AND INDUSTRY |

TYPE OF INVESTMENT |

|

ACQUISITION DATE |

|

|

SHARES/PAR

VALUE ($) |

|

|

COST BASIS |

|

|

VALUE |

|

WRIGHTSPEED, INC.

(continued) |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

10/13/2020 |

|

|

|

1,050,000 |

|

|

$ |

1,050,000 |

|

|

$ |

341,250 |

|

| |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

11/11/2020 |

|

|

|

400,000 |

|

|

|

400,000 |

|

|

|

130,000 |

|

| |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

11/24/2020 |

|

|

|

375,000 |

|

|

|

375,000 |

|

|

|

121,875 |

|

| |

Convertible Note Matures June 2023 Interest Rate 12% (1)(2)(4)(6) |

|

|

12/11/2020 |

|

|

|

400,000 |

|

|

|

400,000 |

|

|

|

130,000 |

|

| |