Dime Community Bancshares, Inc. (NASDAQ: DCOM) (the "Company" or

"Dime"), the parent company of The Dime Savings Bank of

Williamsburgh (the "Bank"), today reported financial results for

the quarter ended June 30, 2013. Consolidated net income for the

quarter ended June 30, 2013 was $12.0 million, or $0.34 per diluted

share, compared to $10.6 million, or $0.30 per diluted share, for

the quarter ended March 31, 2013, and $11.5 million, or $0.34 per

diluted share, for the quarter ended June 30, 2012.

Vincent F. Palagiano, Chairman and Chief Executive Officer of

Dime, commented, "Second quarter earnings benefitted from both

higher prepayment fees and lower credit costs. Core net interest

margin, which excludes prepayment fees, declined only slightly, to

3.06%, and we just completed one of the highest quarterly periods

of loan originations in our history, closing $325.6 million of

loans during the June 2013 quarter. The loan pipeline at June 30,

2013 remained strong at $222.1 million. The annualized growth rate

in the real estate loan portfolio was approximately 6% during the

first six months of 2013, putting the Company on track to meet its

2013 goal."

"More importantly," continued Mr. Palagiano, "the yield curve is

steepening, and interest rate offerings in the multifamily sector

have now turned up from their historic lows in this cycle. Although

margin may continue to soften in the short term, the new higher

rates on loans should be beneficial to spread lenders like Dime

thereafter."

Loan amortization and satisfactions, including refinances of

existing loans, increased from a 23% annualized rate during the

March 2013 quarter to 33.2% during the June 2013 quarter.

Prepayment fee income, which is generally proportional to

amortization levels, also grew from $2.3 million (or $0.04 per

diluted share after-tax) during the March 2013 quarter to $4.6

million (or $0.08 per diluted share after tax) during the June 2013

quarter.

Mr. Palagiano concluded, "At the end of the previous quarter,

the Bank had a surplus liquidity position which was causing a

slight drag on net interest margin. In the most recent quarter,

cash was reduced by approximately $80 million and redeployed into

mortgages, which helped optimize the quarterly core net interest

margin. As stated at the outset of the calendar year, we anticipate

that balance sheet growth, now combined with a steeper yield curve,

will partially offset the earnings contraction that might be

expected from a declining net interest margin."

OPERATING RESULTS FOR THE QUARTER ENDED JUNE

30, 2013

Net Interest Margin Net interest margin

("NIM") was 3.55% during the quarter ended June 30, 2013 compared

to 3.44% during the March 2013 quarter. For forecasting purposes,

the "core" NIM, excluding the effect of loan prepayment fees,

decreased from 3.19% during the March 2013 quarter to 3.06% during

the June 2013 quarter, reflecting a reduction of 15 basis points in

the average yield on interest earning assets (primarily caused by a

reduction of 21 basis points in the average yield on real estate

loans exclusive of the effects of prepayment fee income), that was

partially offset by a reduction of 4 basis points in the average

cost of interest bearing liabilities.

A 3 basis point decline in the average cost of deposits helped

to reduce the average cost of all interest bearing liabilities, as

bank deposit rates (mainly short term) remained low in the Bank's

market area.

As previously mentioned, NIM benefitted from the re-deployment

of $80.4 million of cash into loans, at a positive spread of

approximately 300 basis points. The 21 basis point decline in the

average yield on real estate loans (excluding the effects of

prepayment fee income) on a linked quarter basis resulted from the

cumulative effect of increased portfolio refinance and amortization

activities experienced during the period July 2012 through June

2013, as U.S. Treasury yields hovered at historically low levels,

and loans repriced at lower rates. During the June 2013 quarter,

these yields began to rise from their cyclical lows. Rates offered

on prime (low loan-to-value) 5-year repricing multifamily loans are

now in the range of 3.50% to 3.75%.

Net Interest Income Net interest income

was $33.8 million in the quarter ended June 30, 2013, up $1.4

million from the March 2013 quarter and down $746,000 from the

$34.5 million reported in the June 2012 quarter. Prepayment fee

income on loans totaled $4.6 million during the June 2013 quarter,

compared to $2.3 million recognized in the March 2013 quarter and

$3.5 million during the June 2012 quarter. Absent the impact of

loan prepayment fee income, net interest income was $29.1 million

during the June 30, 2013 quarter, down $894,000 from the March 31,

2013 quarter and $2.0 million from the June 30, 2012 quarter. The

decline in net interest income (excluding loan prepayment fee

income) from the March 2013 quarter resulted primarily from a

decline of 15 basis points in the average yield earned on the

Company's interest earning assets, reflecting the ongoing loan

refinancing activity.

Provision/Allowance For Loan Losses The

Company recognized net charge-offs of $57,000 and provisioned

$28,000 for loan losses during the June 2013 quarter. This led to a

net reduction of $28,000 in the allowance for loan losses from

March 31, 2013 to June 30, 2013. The quarterly loan loss provision

dropped from $157,000 in the March 2013 quarter to $28,000 in the

June 2013 quarter.

At June 30, 2013, the allowance for loan losses as a percentage

of total loans stood at 0.57%, down slightly from 0.58% at the

close of the prior quarter, primarily attributable to growth in the

loan portfolio and the small reduction in the allowance for loan

losses during the June 2013 quarter. The reduction in both the

period end allowance and the quarterly provision for loan losses

reflected the improvement in the overall credit quality of the loan

portfolio from December 31, 2012 to June 30, 2013.

Non-Interest Income Non-interest income

was $1.7 million for the quarter ended June 30, 2013, a reduction

of $176,000 from the previous quarter. Net gains on the sale of

securities and other assets fell $110,000 from the March 2013

quarter, resulting from a gain related to mutual fund investments

during the March 2013 quarter. Mortgage banking income decreased

$49,000 from the March 2013 quarter to the June 2013 quarter, due

primarily to a reduction of $46,000 in loan servicing fee income,

reflecting an ongoing reduction in the portfolio of serviced

loans.

Non-Interest Expense Non-interest expense

was $15.3 million in the quarter ended June 30, 2013, down $1.0

million from the prior quarter, and generally in line with the

forecasted level of $15.5 million. Absent unforeseen items or

events, non-interest expense is anticipated to approximate the

$15.5 million average quarterly level forecasted for the year

ending December 31, 2013.

Non-interest expense was 1.53% of average assets during the most

recent quarter. The efficiency ratio approximated 43.2% during the

same period.

Income Tax Expense The effective tax rate

approximated 40.1% during the most recent quarter, generally in

line with the 40.0% forecasted level.

BALANCE SHEET Total assets were $3.95

billion at June 30, 2013, down $31.1 million from March 31, 2013.

Cash balances decreased by $80.4 million, partially offset by an

increase of $59.9 million in real estate loans.

Retail deposits remained relatively flat during the most recent

quarter, and the Company elected to not replace $10.0 million of

Federal Home Loan Bank of New York ("FHLBNY") advances that matured

during the June 2013 quarter, instead utilizing the additional

liquidity generated during the March 2013 quarter to meet funding

obligations. While this led to a slight decline in total assets

during the most recent quarter, assets have grown by approximately

2.5% on an annualized basis during the first six months of 2013,

and remain forecasted to grow approximately 5% during the year

ending December 31, 2013.

Real Estate Loans Real estate loan

originations were $325.6 million during the June 2013 quarter, at a

weighted average interest rate of 3.30%. Of this amount, $136.7

million represented loan refinances from the existing portfolio.

Loan amortization and satisfactions, including the $136.7 million

of refinances of existing loans, totaled $296.4 million during the

quarter, or 33.2% of the average portfolio balance on an annualized

basis. The average rate on amortized and satisfied loan balances

during the most recent quarter was 5.35%. Total loan commitments

stood at $222.1 million at June 30, 2013, with a weighted average

rate of 3.28%. The average yield on the loan portfolio (excluding

prepayment fee income) during the quarter ended June 30, 2013 was

4.44%, compared to 4.65% during the March 2013 quarter and 5.16%

during the June 2012 quarter.

Credit Summary Non-performing loans

(excluding loans held for sale) were $9.5 million, or 0.26% of

total loans, at June 30, 2013, up from $8.2 million, or 0.23% of

total loans, at March 31, 2013. Loans delinquent between 30 and 89

days and accruing interest fell to $159,000, or approximately

0.004% of total loans, at June 30, 2013, compared to $2.0 million,

or 0.06% of total loans, at March 31, 2013.

At June 30, 2013, non-performing assets represented 2.9% of the

sum of tangible capital plus the allowance for loan losses (this

statistic is otherwise known as the "Texas Ratio"). This number

compares very favorably to both industry and regional averages.

Within the pool of serviced loans previously sold to Fannie Mae

with recourse exposure, total loans delinquent 30 days or more

approximated $700,000 at June 30, 2013, relatively unchanged from

March 31, 2013. The remaining pool of loans serviced for Fannie Mae

totaled $229.2 million as of June 30, 2013, down from $244.2

million as of March 31, 2013. Due to both ongoing amortization and

stabilization of problem loans within the Fannie Mae portfolio, the

Company determined that its liability for the first loss position

could be reduced by $102,000, which was recognized during the

quarter ended June 30, 2013.

Deposits and Borrowed Funds Retail

deposits increased $6.3 million from March 31, 2013 to June 30,

2013, due primarily to net inflows of $14.9 million in money market

deposits. The Bank did not implement any significant promotional

deposit activities during the June 2013 quarter, and enacted slight

reductions in rates that resulted in a reduction of 3 basis points

in the average cost of deposits during the June 2013 quarter. At

June 30, 2013, average deposit balances approximated $100.3 million

per branch. The Bank remains selective in the products, rates and

terms on which it competes for deposits, focusing on products that

encourage long-term customer retention, and discouraging renewals

of promotional deposits in cases where customer relationships have

not proved durable.

As previously discussed, as a result of successful deposit

gathering efforts, the Company did not elect to replace $10.0

million of FHLBNY borrowings that matured during the quarter ended

June 30, 2013. The Company intends to use FHLBNY advances to

supplement deposit funding when deemed appropriate.

Capital The Company's consolidated

tangible common equity ratio (Tier 1 core leverage) grew during the

most recent quarter as a result of increased retained earnings.

Consolidated tangible capital was 9.31% of tangible assets at June

30, 2013, an increase of 29 basis points from March 31, 2013. The

Company also had approximately $70.7 million of trust preferred

debt securities outstanding at June 30, 2013, which, when added to

Tier 1 (tangible) capital, increased its consolidated Tier 1

(tangible) capital ratio to approximately 11.1%.

The Bank's tangible capital ratio was 10.27% at June 30, 2013,

up from 9.97% at March 31, 2013. The Bank's Total Risk-Based

Capital Ratio was 13.95% at June 30, 2013, compared to 13.76% at

March 31, 2013.

Reported EPS exceeded the quarterly cash dividend rate per share

by 143%, equating to a 41% payout ratio. Additions to capital from

earnings and stock option exercises during the most recent

quarterly period caused tangible book value per share to increase

$0.19 sequentially during the most recent quarter, to $10.06 at

June 30, 2013.

OUTLOOK FOR THE QUARTER ENDING SEPTEMBER 30,

2013 At June 30, 2013, Dime had outstanding loan commitments

totaling $222.1 million (of which $77 million related to loan

refinances from the existing portfolio), all of which are likely to

close during the quarter ending September 30, 2013, at an average

expected interest rate approximating 3.3%.

As discussed earlier in the release, the Company has

transitioned into a period of measured loan portfolio and balance

sheet growth, in part to utilize capital efficiently and in part to

mitigate the effects of a contracting margin. For the year ending

December 31, 2013, balance sheet growth is targeted to approximate

5.0%, subject to change to reflect market conditions. Loan

prepayments and amortization remained elevated during the most

recent quarter, however, are currently anticipated to fall below

their recent levels for the remainder of 2013, and are expected to

approximate 20% - 25% on an annualized basis during the September

2013 quarter.

On the liability side, deposit funding costs are expected to

remain near current historically low levels through the third

quarter of 2013. The Bank has $138.4 million of certificates of

deposit ("CDs") maturing at an average cost of 1.14% during the

quarter ending September 30, 2013. Offering rates on 12-month term

CDs currently approximate 50 basis points. The Company has $25.0

million of borrowings due to mature during the quarter ending

September 30, 2013 at an average cost of 2.80%. FHLBNY advance

rates for 3-year and 4-year borrowings were 1.00% and 1.50%

respectively, as of July 17, 2013. In the coming quarter,

management expects to utilize advances rather than deposits to fund

growth as a long-term interest rate hedge against future higher

rates.

Loan loss provisioning will likely continue to be a function of

loan portfolio growth, incurred losses and the overall credit

quality of the loan portfolio.

Absent any unforeseen items, non-interest expense is expected to

approximate $15.5 million during the September 2013 quarter.

The Company projects that the consolidated effective tax rate

will approximate 40.0% in the September 2013 quarter.

ABOUT DIME COMMUNITY BANCSHARES, INC. The

Company (NASDAQ: DCOM) had $3.95 billion in consolidated assets as

of June 30, 2013, and is the parent company of the Bank. The Bank

was founded in 1864, is headquartered in Brooklyn, New York, and

currently has twenty-six branches located throughout Brooklyn,

Queens, the Bronx and Nassau County, New York. More information on

the Company and Dime can be found on the Dime's Internet website at

www.dime.com.

This News Release contains a number of forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"). These statements may be

identified by use of words such as "anticipate," "believe,"

"could," "estimate," "expect," "intend," "may," "outlook," "plan,"

"potential," "predict," "project," "should," "will," "would" and

similar terms and phrases, including references to assumptions.

Forward-looking statements are based upon various assumptions

and analyses made by the Company in light of management's

experience and its perception of historical trends, current

conditions and expected future developments, as well as other

factors it believes are appropriate under the circumstances. These

statements are not guarantees of future performance and are subject

to risks, uncertainties and other factors (many of which are beyond

the Company's control) that could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. These factors include, without

limitation, the following: the timing and occurrence or

non-occurrence of events may be subject to circumstances beyond the

Company's control; there may be increases in competitive pressure

among financial institutions or from non-financial institutions;

changes in the interest rate environment may reduce interest

margins; changes in deposit flows, loan demand or real estate

values may adversely affect the business of Dime; changes in

accounting principles, policies or guidelines may cause the

Company's financial condition to be perceived differently; changes

in corporate and/or individual income tax laws may adversely affect

the Company's financial condition or results of operations; general

economic conditions, either nationally or locally in some or all

areas in which the Company conducts business, or conditions in the

securities markets or the banking industry may be less favorable

than the Company currently anticipates; legislation or regulatory

changes may adversely affect the Company's business; technological

changes may be more difficult or expensive than the Company

anticipates; success or consummation of new business initiatives

may be more difficult or expensive than the Company anticipates; or

litigation or other matters before regulatory agencies, whether

currently existing or commencing in the future, may delay the

occurrence or non-occurrence of events longer than the Company

anticipates.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(In thousands except share amounts)

June 30, March 31, December 31,

2013 2013 2012

------------ ------------ ------------

ASSETS:

Cash and due from banks $ 61,291 $ 141,656 $ 79,076

Investment securities held to

maturity 5,617 5,746 5,927

Investment securities available

for sale 18,309 18,330 32,950

Trading securities 5,127 4,978 4,874

Mortgage-backed securities

available for sale 38,193 43,383 49,021

Real Estate Loans:

One-to-four family and

cooperative apartment 81,110 86,012 91,876

Multifamily and loans underlying

cooperatives (1) 2,780,897 2,706,854 2,670,973

Commercial real estate (1) 737,593 747,035 735,224

Construction and land

acquisition 338 416 476

Unearned discounts and net

deferred loan fees 4,309 4,070 4,836

------------ ------------ ------------

Total real estate loans 3,604,247 3,544,387 3,503,385

------------ ------------ ------------

Other loans 2,517 1,967 2,423

Allowance for loan losses (20,502) (20,530) (20,550)

------------ ------------ ------------

Total loans, net 3,586,262 3,525,824 3,485,258

------------ ------------ ------------

Loans held for sale 232 469 560

Premises and fixed assets, net 29,894 30,065 30,518

Federal Home Loan Bank of New York

capital stock 40,288 40,736 45,011

Goodwill 55,638 55,638 55,638

Other assets 110,392 115,500 116,566

------------ ------------ ------------

TOTAL ASSETS $ 3,951,243 $ 3,982,325 $ 3,905,399

============ ============ ============

LIABILITIES AND STOCKHOLDERS'

EQUITY:

Deposits:

Non-interest bearing checking $ 170,432 $ 172,254 $ 159,144

Interest Bearing Checking 90,496 92,981 95,159

Savings 379,367 379,341 371,792

Money Market 1,092,281 1,077,409 961,359

------------ ------------ ------------

Sub-total 1,732,576 1,721,985 1,587,454

------------ ------------ ------------

Certificates of deposit 875,083 879,330 891,975

------------ ------------ ------------

Total Due to Depositors 2,607,659 2,601,315 2,479,429

------------ ------------ ------------

Escrow and other deposits 86,028 119,452 82,753

Federal Home Loan Bank of New York

advances 737,500 747,500 842,500

Trust Preferred Notes Payable 70,680 70,680 70,680

Other liabilities 40,471 42,878 38,463

------------ ------------ ------------

TOTAL LIABILITIES 3,542,338 3,581,825 3,513,825

------------ ------------ ------------

STOCKHOLDERS' EQUITY:

Common stock ($0.01 par,

125,000,000 shares authorized,

52,198,771 shares, 52,178,819

shares and 52,021,149 shares

issued at June 30, 2013, March

31, 2013 and December 31,

2012,respectively, and 36,054,813

shares, 35,871,939 shares, and

35,714,269 shares outstanding at

June 30, 2013, March 31, 2013 and

December 31, 2012, respectively) 522 522 520

Additional paid-in capital 242,605 241,464 239,041

Retained earnings 391,989 384,855 379,166

Unallocated common stock of

Employee Stock Ownership Plan (2,892) (2,950) (3,007)

Unearned Restricted Stock Award

common stock (4,192) (2,596) (3,122)

Common stock held by the Benefit

Maintenance Plan (9,013) (8,800) (8,800)

Treasury stock (16,143,958 shares,

16,306,880 shares and 16,306,880

shares at June 30, 2013, March

31, 2013 and December 31, 2012,

respectively) (200,550) (202,574) (202,584)

Accumulated other comprehensive

loss, net of deferred taxes (9,564) (9,421) (9,640)

------------ ------------ ------------

TOTAL STOCKHOLDERS' EQUITY 408,905 400,500 391,574

------------ ------------ ------------

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 3,951,243 $ 3,982,325 $ 3,905,399

============ ============ ============

(1) While the loans within both of these categories are often considered

"commercial real estate" in nature, multifamily and loans underlying

cooperatives are here reported separately from commercial real estate

loans in order to emphasize the residential nature of the collateral

underlying a significant component of the total loan portfolio.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars In thousands except share and per share amounts)

For the Three Months Ended

-------------------------------------

June 30, March 31, June 30,

2013 2013 2012

----------- ----------- -----------

Interest income:

Loans secured by real estate $ 44,692 $ 43,148 $ 47,259

Other loans 25 25 28

Mortgage-backed securities 354 459 832

Investment securities 103 129 505

Federal funds sold and other

short-term investments 462 544 639

----------- ----------- -----------

Total interest income 45,636 44,305 49,263

----------- ----------- -----------

Interest expense:

Deposits and escrow 5,132 5,201 5,422

Borrowed funds 6,752 6,790 9,343

----------- ----------- -----------

Total interest expense 11,884 11,991 14,765

----------- ----------- -----------

Net interest income 33,752 32,314 34,498

Provision for loan losses 28 157 2,275

----------- ----------- -----------

Net interest income after provision

for loan losses 33,724 32,157 32,223

----------- ----------- -----------

Non-interest income:

Service charges and other fees 827 712 802

Mortgage banking income, net 112 161 1,095

Other than temporary impairment

("OTTI") charge on securities

(1) - - -

Gain on sale of securities and

other assets - 110 44

Gain (loss) on trading securities (17) 100 (36)

Other 799 815 1,083

----------- ----------- -----------

Total non-interest income 1,721 1,898 2,988

----------- ----------- -----------

Non-interest expense:

Compensation and benefits 9,298 9,951 9,477

Occupancy and equipment 2,506 2,532 2,434

Federal deposit insurance

premiums 445 511 457

Other 3,098 3,315 3,308

----------- ----------- -----------

Total non-interest expense 15,347 16,309 15,676

----------- ----------- -----------

Income before taxes 20,098 17,746 19,535

Income tax expense 8,059 7,176 8,004

----------- ----------- -----------

Net Income $ 12,039 $ 10,570 $ 11,531

=========== =========== ===========

Earnings per Share ("EPS"):

Basic $ 0.34 $ 0.30 $ 0.34

=========== =========== ===========

Diluted $ 0.34 $ 0.30 $ 0.34

=========== =========== ===========

Average common shares outstanding for

Diluted EPS 35,048,063 34,879,239 34,229,202

(1) Total OTTI charges on securities are summarized as follows for the

periods presented:

Credit component (shown above) $ - $ - $ -

Non-credit component not included in

earnings - - -

----------- ----------- -----------

Total OTTI charges $ - $ - $ -

----------- ----------- -----------

For the Six Months

Ended

------------------------

June 30, June 30,

2013 2012

----------- -----------

Interest income:

Loans secured by real estate $ 87,840 $ 97,772

Other loans 50 48

Mortgage-backed securities 813 1,779

Investment securities 232 820

Federal funds sold and other

short-term investments 1,006 1,313

----------- -----------

Total interest income 89,941 101,732

----------- -----------

Interest expense:

Deposits and escrow 10,332 11,148

Borrowed funds 13,542 22,692

----------- -----------

Total interest expense 23,874 33,840

----------- -----------

Net interest income 66,067 67,892

Provision for loan losses 185 3,732

----------- -----------

Net interest income after provision

for loan losses 65,882 64,160

----------- -----------

Non-interest income:

Service charges and other fees 1,539 1,596

Mortgage banking income, net 273 1,216

Other than temporary impairment

("OTTI") charge on securities

(1) - (181)

Gain on sale of securities and

other assets 110 44

Gain (loss) on trading securities 83 70

Other 1,614 2,033

----------- -----------

Total non-interest income 3,619 4,778

----------- -----------

Non-interest expense:

Compensation and benefits 19,249 19,416

Occupancy and equipment 5,038 4,905

Federal deposit insurance

premiums 956 1,055

Other 6,413 6,708

----------- -----------

Total non-interest expense 31,656 32,084

----------- -----------

Income before taxes 37,844 36,854

Income tax expense 15,235 15,076

----------- -----------

Net Income $ 22,609 $ 21,778

=========== ===========

Earnings per Share ("EPS"):

Basic $ 0.65 $ 0.64

=========== ===========

Diluted $ 0.65 $ 0.64

=========== ===========

Average common shares outstanding

for Diluted EPS 34,964,249 34,180,096

(1) Total OTTI charges on securities are summarized as follows for the

periods presented:

Credit component (shown above) $ - $ 181

Non-credit component not included in

earnings - 6

----------- -----------

Total OTTI charges $ - $ 187

----------- -----------

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SELECTED FINANCIAL HIGHLIGHTS

(Dollars In thousands except per share amounts)

For the Three Months Ended

----------------------------------

June 30, March 31, June 30,

2013 2013 2012

---------- ---------- ----------

Performance Ratios:

Reported EPS (Diluted) $ 0.34 $ 0.30 $ 0.34

Return on Average Assets 1.20% 1.07% 1.17%

Return on Average Stockholders' Equity 11.93% 10.63% 12.39%

Return on Average Tangible Stockholders'

Equity 13.53% 12.07% 14.17%

Net Interest Spread 3.34% 3.21% 3.37%

Net Interest Margin 3.55% 3.44% 3.63%

Non-interest Expense to Average Assets 1.53% 1.65% 1.59%

Efficiency Ratio 43.24% 47.97% 41.83%

Effective Tax Rate 40.10% 40.44% 40.97%

Book Value and Tangible Book Value Per

Share:

Stated Book Value Per Share $ 11.34 $ 11.16 $ 10.65

Tangible Book Value Per Share 10.06 9.87 9.33

Average Balance Data:

Average Assets $4,009,237 $3,945,321 $3,944,607

Average Interest Earning Assets 3,803,526 3,759,778 3,801,149

Average Stockholders' Equity 403,604 397,594 372,283

Average Tangible Stockholders' Equity 355,823 350,277 325,523

Average Loans 3,602,249 3,507,830 3,394,100

Average Deposits 2,615,213 2,571,771 2,377,079

Asset Quality Summary:

Net charge-offs $ 57 $ 177 $ 1,562

Non-performing Loans (1) 9,507 8,172 13,318

Non-performing Loans/ Total Loans 0.26% 0.23% 0.40%

Nonperforming Assets (2) $ 10,987 $ 9,651 $ 14,233

Nonperforming Assets/Total Assets 0.28% 0.24% 0.37%

Allowance for Loan Loss/Total Loans 0.57% 0.58% 0.60%

Allowance for Loan Loss/Non-performing

Loans 215.65% 251.22% 152.00%

Loans Delinquent 30 to 89 Days at period

end $ 159 $ 1,985 $ 7,536

Consolidated Tangible Stockholders'

Equity to Tangible Assets at period end 9.31% 9.02 % 8.63%

Regulatory Capital Ratios (Bank Only):

Leverage Capital Ratio 10.27% 9.97% 9.93%

Tier One Risk Based Capital Ratio 13.22% 13.02% 13.10%

Total Risk Based Capital Ratio 13.95% 13.76% 13.83%

For the Six Months

Ended

----------------------

June 30, June 30,

2013 2012

---------- ----------

Performance Ratios:

Reported EPS (Diluted) $ 0.65 $ 0.64

Return on Average Assets 1.14% 1.09%

Return on Average Stockholders' Equity 11.29% 11.81%

Return on Average Tangible Stockholders'

Equity 12.81% 13.51%

Net Interest Spread 3.28% 3.29%

Net Interest Margin 3.49% 3.55%

Non-interest Expense to Average Assets 1.59% 1.60%

Efficiency Ratio 45.55% 44.11%

Effective Tax Rate 40.26% 40.91%

Book Value and Tangible Book Value Per

Share:

Stated Book Value Per Share $ 11.34 $ 10.65

Tangible Book Value Per Share 10.06 9.33

Average Balance Data:

Average Assets $3,977,279 $3,998,861

Average Interest Earning Assets 3,781,652 3,822,816

Average Stockholders' Equity 400,599 368,822

Average Tangible Stockholders' Equity 352,888 322,431

Average Loans 3,555,040 3,417,899

Average Deposits 2,593,492 2,367,640

Asset Quality Summary:

Net charge-offs $ 233 $ 3,825

Non-performing Loans (1) 9,507 13,318

Non-performing Loans/ Total Loans 0.26% 0.40%

Nonperforming Assets (2) $ 10,987 $ 14,233

Nonperforming Assets/Total Assets 0.28% 0.37%

Allowance for Loan Loss/Total Loans 0.57% 0.60%

Allowance for Loan Loss/Non-performing

Loans 215.65% 152.00%

Loans Delinquent 30 to 89 Days at period

end $ 159 $ 7,536

Consolidated Tangible Stockholders'

Equity to Tangible Assets at period end 9.31% 8.63%

Regulatory Capital Ratios (Bank Only):

Leverage Capital Ratio 9.93% 9.93%

Tier One Risk Based Capital Ratio 13.22% 13.10%

Total Risk Based Capital Ratio 13.95% 13.83%

(1) Amount excludes $270 of loans held for sale that were on non-accrual

status at March 31, 2013.

(2) Amount comprised of total non-accrual loans and the recorded balance of

pooled bank trust preferred security investments forwhich the Bank had

not received any contractual payments of interest or principal in over

90 days.

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED AVERAGE BALANCES AND NET INTEREST INCOME

(Dollars In thousands)

For the Three Months Ended

----------------------------------------

June 30, 2013

----------------------------------------

Average

Average Yield/

Balance Interest Cost

------------ ------------ -----------

Assets:

Interest-earning assets:

Real estate loans $ 3,600,154 $ 44,692 4.97%

Other loans 2,095 25 4.77

Mortgage-backed securities 39,669 353 3.56

Investment securities 29,101 104 1.43

Other short-term investments 132,507 462 1.39

------------ ------------ -----------

Total interest earning

assets 3,803,526 $ 45,636 4.80%

------------ ------------

Non-interest earning assets 205,711

------------

Total assets $ 4,009,237

============

Liabilities and Stockholders'

Equity:

Interest-bearing liabilities:

Interest Bearing Checking

accounts $ 92,502 $ 70 0.30%

Money Market accounts 1,082,789 1,406 0.52

Savings accounts 381,137 64 0.07

Certificates of deposit 883,881 3,592 1.63

------------ ------------ -----------

Total interest bearing

deposits 2,440,309 5,132 0.84

Borrowed Funds 813,565 6,752 3.33

------------ ------------ -----------

Total interest-bearing

liabilities 3,253,874 $ 11,884 1.46%

------------ ------------

Non-interest bearing checking

accounts 174,904

Other non-interest-bearing

liabilities 176,855

------------

Total liabilities 3,605,633

Stockholders' equity 403,604

------------

Total liabilities and

stockholders' equity $ 4,009,237

============

Net interest income $ 33,752

============

Net interest spread 3.34%

===========

Net interest-earning assets $ 549,652

============

Net interest margin 3.55%

===========

Ratio of interest-earning assets

to interest-bearing liabilities 116.89%

============

Deposits (including non-interest

bearing checking accounts) $ 2,615,213 $ 5,132 0.79%

----------------------------------------------------------------------------

SUPPLEMENTAL INFORMATION

Loan prepayment and late payment

fee income $ 4,692

------------ ------------ -----------

Borrowing prepayment costs -

------------ ------------ -----------

Real estate loans (excluding

prepayment and late payment

fees) 4.44%

------------ ------------ -----------

Interest earning assets

(excluding prepayment and late

payment fees) 4.31%

------------ ------------ -----------

Net Interest income (excluding

loan prepayment and late payment

fees and borrowing prepayment

costs) $ 29,060

------------ ------------ -----------

Net Interest margin (excluding

loan prepayment and late payment

fees and borrowing prepayment

costs) 3.06%

------------ ------------ -----------

For the Three Months Ended

----------------------------------------

March 31, 2013

----------------------------------------

Average

Average Yield/

Balance Interest Cost

------------ ------------ -----------

Assets:

Interest-earning assets:

Real estate loans $ 3,505,646 $ 43,148 4.92%

Other loans 2,184 25 4.58

Mortgage-backed securities 45,477 459 4.04

Investment securities 42,807 129 1.21

Other short-term investments 163,664 544 1.33

------------ ------------ -----------

Total interest earning

assets 3,759,778 $ 44,305 4.71%

------------ ------------

Non-interest earning assets 185,543

------------

Total assets $ 3,945,321

============

Liabilities and Stockholders'

Equity:

Interest-bearing liabilities:

Interest Bearing Checking

accounts $ 93,219 $ 70 0.30%

Money Market accounts 1,059,236 1,490 0.57

Savings accounts 375,374 101 0.11

Certificates of deposit 881,883 3,540 1.63

------------ ------------ -----------

Total interest bearing

deposits 2,409,712 5,201 0.88

Borrowed Funds 837,402 6,790 3.29

------------ ------------ -----------

Total interest-bearing

liabilities 3,247,114 $ 11,991 1.50%

------------ ------------

Non-interest bearing checking

accounts 162,059

Other non-interest-bearing

liabilities 138,554

------------

Total liabilities 3,547,727

Stockholders' equity 397,594

------------

Total liabilities and

stockholders' equity $ 3,945,321

============

Net interest income $ 32,314

============

Net interest spread 3.21%

===========

Net interest-earning assets $ 512,664

============

Net interest margin 3.44%

===========

Ratio of interest-earning assets

to interest-bearing liabilities 115.79%

============

Deposits (including non-interest

bearing checking accounts) $ 2,571,771 $ 5,201 0.82%

----------------------------------------------------------------------------

SUPPLEMENTAL INFORMATION

Loan prepayment and late payment

fee income $ 2,360

------------ ------------ -----------

Borrowing prepayment costs -

------------ ------------ -----------

Real estate loans (excluding

prepayment and late payment

fees) 4.65%

------------ ------------ -----------

Interest earning assets

(excluding prepayment and late

payment fees) 4.46%

------------ ------------ -----------

Net Interest income (excluding

loan prepayment and late payment

fees and borrowing prepayment

costs) $ 29,954

------------ ------------ -----------

Net Interest margin (excluding

loan prepayment and late payment

fees and borrowing prepayment

costs) 3.19%

------------ ------------ -----------

For the Three Months Ended

--------------------------------------

June 30, 2012

--------------------------------------

Average

Average Yield/

Balance Interest Cost

------------ ------------ -----------

Assets:

Interest-earning assets:

Real estate loans $ 3,391,986 $ 47,259 5.57%

Other loans 2,114 28 5.30

Mortgage-backed securities 97,719 832 3.41

Investment securities 108,939 505 1.85

Other short-term investments 200,391 639 1.28

------------ ------------ -----------

Total interest earning assets 3,801,149 $ 49,263 5.18%

------------ ------------

Non-interest earning assets 143,458

------------

Total assets $ 3,944,607

============

Liabilities and Stockholders'

Equity:

Interest-bearing liabilities:

Interest Bearing Checking

accounts $ 96,453 $ 43 0.18%

Money Market accounts 797,802 1,046 0.53

Savings accounts 363,941 139 0.15

Certificates of deposit 967,503 4,194 1.74

------------ ------------ -----------

Total interest bearing

deposits 2,225,699 5,422 0.98

Borrowed Funds 1,058,271 9,343 3.55

------------ ------------ -----------

Total interest-bearing

liabilities 3,283,970 $ 14,765 1.81%

------------ ------------

Non-interest bearing checking

accounts 151,380

Other non-interest-bearing

liabilities 136,974

------------

Total liabilities 3,572,324

Stockholders' equity 372,283

------------

Total liabilities and stockholders'

equity $ 3,944,607

============

Net interest income $ 34,498

============

Net interest spread 3.37%

===========

Net interest-earning assets $ 517,179

============

Net interest margin 3.63%

===========

Ratio of interest-earning assets to

interest-bearing liabilities 115.75%

Deposits (including non-interest

bearing checking accounts) $ 2,377,079 $ 5,422 0.92%

----------------------------------------------------------------------------

SUPPLEMENTAL INFORMATION

Loan prepayment and late payment fee

income $ 3,488

------------ ------------ -----------

Borrowing prepayment costs -

------------ ------------ -----------

Real estate loans (excluding

prepayment and late payment fees) 5.16%

------------ ------------ -----------

Interest earning assets (excluding

prepayment and late payment fees) 4.82%

------------ ------------ -----------

Net Interest income (excluding loan

prepayment and late payment fees

and borrowing prepayment costs) $ 31,010

------------ ------------ -----------

Net Interest margin (excluding loan

prepayment and late payment fees

and borrowing prepayment costs) 3.26%

------------ ------------ -----------

DIME COMMUNITY BANCSHARES, INC. AND SUBSIDIARIES

UNAUDITED SCHEDULE OF NON-PERFORMING ASSETS AND TROUBLED DEBT RESTRUCTURINGS

(Dollars In thousands)

At June 30, At March 31, At June 30,

Non-Performing Loans 2013 2013 2012

------------ ------------ ------------

One- to four-family and

cooperative apartment $ 1,164 $ 697 $ 1,161

Multifamily residential and

mixed use residential real

estate (1) 1,688 809 3,622

Mixed use commercial real estate

(1) 1,150 1,159 720

Commercial real estate 5,500 5,500 7,813

Construction - - -

Other 5 7 2

------------ ------------ ------------

Total Non-Performing Loans (2) $ 9,507 $ 8,172 $ 13,318

------------ ------------ ------------

Other Non-Performing Assets (3)

Other real estate owned 585 585 -

Pooled bank trust preferred

securities 895 894 915

Non-performing loans held for

sale:

Mixed use commercial real

estate - 270 -

Multifamily residential and

mixed use residential real

estate - - -

------------ ------------ ------------

Total Non-Performing Assets $ 10,987 $ 9,921 $ 14,233

------------ ------------ ------------

Troubled Debt Restructurings ("TDRs") not

included in non-performing loans (2)

One- to four-family and

cooperative apartment 941 944 623

Multifamily residential and

mixed use residential real

estate (1) 1,524 1,538 2,434

Mixed use commercial real estate

(1) 718 724 741

Commercial real estate 35,516 38,238 39,924

------------ ------------ ------------

Total Performing TDRs $ 38,699 $ 41,444 $ 43,722

------------ ------------ ------------

(1) Includes loans underlying cooperatives. While the loans within these

categories are often considered "commercial real estate" in nature,

they are classified separately in the statement above to provide

further emphasis of the discrete composition of their underlying real

estate collateral.

(2) Total non-performing loans include some loans that were modified in a

manner that met the criteria for a TDR. These non-accruing TDRs, which

totaled $5,893 at June 30, 2013, $5,895 at March 31, 2013 and $7,813 at

June 30, 2012, are included in the non-performing loan table, but

excluded from the TDR amount shown above.

(3) These assets were deemed non-performing since the Company had, as of

the dates indicated, not received any payments of principal or interest

on them for a period of at least 90 days.

PROBLEM ASSETS AS A PERCENTAGE OF TANGIBLE CAPITAL AND RESERVES

At June 30, At March 31, At June 30,

2013 2013 2012

------------ ------------ ------------

Total Non-Performing Assets $ 10,987 $ 9,921 $ 14,233

Loans 90 days or more past due

on accrual status (4) 974 186 2,634

------------ ------------ ------------

TOTAL PROBLEM ASSETS $ 11,961 $ 10,107 $ 16,867

------------ ------------ ------------

Tier One Capital - The Dime

Savings Bank of Williamsburgh $ 398,710 $ 390,129 $ 378,191

Allowance for loan losses 20,502 20,530 20,243

------------ ------------ ------------

TANGIBLE CAPITAL PLUS

RESERVES $ 419,212 $ 410,659 $ 398,434

------------ ------------ ------------

PROBLEM ASSETS AS A PERCENTAGE

OF TANGIBLE CAPITAL AND

RESERVES 2.9% 2.5% 4.2%

(4) These loans were, as of the respective dates indicated, expected to be

either satisfied, made current or re-financed within the following

twelve months, and were not expected to result in any loss of

contractual principal or interest. These loans are not included in non-

performing loans.

Contact: Kenneth Ceonzo Director of Investor Relations

718-782-6200 extension 8279

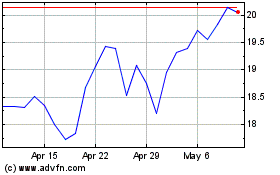

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Jun 2024 to Jul 2024

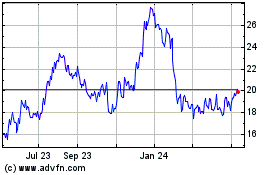

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Jul 2023 to Jul 2024