false

0001235912

0001235912

2024-07-29

2024-07-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 29, 2024

CVRx,

Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40545 |

|

41-1983744 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

9201

West Broadway Avenue, Suite 650

Minneapolis,

MN 55445

(Address of principal executive offices) (Zip

Code)

(763)

416-2840

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

Common

stock, par value $0.01 per share |

|

CVRX |

|

The Nasdaq

Global Select Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02. Results of Operations and Financial Condition.

On July 29, 2024, CVRx, Inc. issued

a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached as

Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 2.02,

including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section and is not incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

CVRx, Inc. |

| |

|

| Date: July 29, 2024 |

By: |

/s/ Jared Oasheim |

| |

|

Name: Jared Oasheim |

| |

|

Its: Chief Financial Officer |

Exhibit 99.1

CVRx Reports Second Quarter 2024 Financial and

Operating Results

MINNEAPOLIS, July 29, 2024 (GLOBE NEWSWIRE) -- CVRx, Inc.

(NASDAQ: CVRX) (“CVRx”), a commercial-stage medical device company focused on developing, manufacturing and commercializing

innovative neuromodulation solutions for patients with cardiovascular diseases, today announced its financial and operating results for

the second quarter of 2024.

Recent Highlights

| · | Total revenue for the second quarter 2024 was $11.8 million, an increase of 24% over the prior year quarter |

| · | U.S. Heart Failure (HF) revenue for the second quarter of 2024 was $10.5 million, an increase of 27% over the prior year quarter |

| · | Active implanting centers in the U.S. were 189, an increase of 35% over the second quarter of 2023 |

| · | Hired

new Chief Revenue Officer and completed expansion of executive leadership team |

“We are pleased with our solid second quarter results, driven

by another record quarter in our U.S. Heart Failure business. We remain extremely optimistic about the Barostim technology and our market

opportunity. Our recent leadership appointments have significantly bolstered our executive team, positioning us well to address key market

development priorities,” said Kevin Hykes, President and Chief Executive Officer of CVRx. “Our focus is on continuing to broaden

therapy awareness, strengthen our clinical evidence, and improve patient access. With our innovative technology, expanding market presence,

and the depth of expertise on our expanded leadership team, we're well-positioned to drive Barostim towards becoming standard of care,

making a meaningful difference in the lives of those suffering from heart failure and other cardiovascular diseases.”

Second Quarter 2024 Financial and Operating Results

Revenue was $11.8 million for the three months ended June 30,

2024, an increase of $2.3 million, or 24%, over the three months ended June 30, 2023.

Revenue generated in the U.S. was $10.7 million for the three months

ended June 30, 2024, an increase of $2.4 million, or 29%, over the three months ended June 30, 2023. HF revenue units in the

U.S. totaled 339 and 265 for the three months ended June 30, 2024 and 2023, respectively. HF revenue in the U.S. totaled $10.5 million

and $8.3 million for the three months ended June 30, 2024 and 2023, respectively. The increases were primarily driven by continued

growth in the U.S. HF business as a result of the expansion into new sales territories, new accounts, and increased physician and patient

awareness of Barostim.

As of June 30, 2024, the Company had a total of 189 active implanting

centers, as compared to 190 as of March 31, 2024. Active implanting centers are customers that have completed at least one commercial

HF implant in the last 12 months. The number of sales territories in the U.S. increased by three to a total of 42 during the three months

ended June 30, 2024.

Revenue generated in Europe was $1.1 million for the three months ended

June 30, 2024, a decrease of $0.1 million, or 6%, over the three months ended June 30, 2023. Total revenue units in Europe increased

to 63 for the three months ended June 30, 2024 from 56 in the prior year period. The number of sales territories in Europe remained

consistent at six for the three months ended June 30, 2024.

Gross profit was $9.9 million for the three months ended June 30,

2024, an increase of $1.9 million, or 24%, over the three months ended June 30, 2023. Gross margin was 84% for each of the three

months ended June 30, 2024 and June 30, 2023.

R&D expenses decreased $0.5 million, or 16%, to $2.8 million for

the three months ended June 30, 2024 compared to the three months ended June 30, 2023. This change was driven by a $0.4 million

decrease in consulting expenses and a $0.1 million decrease in compensation expenses.

SG&A expenses increased $4.7 million, or 28%, to $21.1 million

for the three months ended June 30, 2024 compared to the three months ended June 30, 2023. This change was primarily driven

by a $2.6 million increase in compensation expenses, mainly as a result of increased headcount, a $1.0 million increase in non-cash stock-based

compensation expense, a $0.4 million increase in advertising expenses, a $0.2 million increase in travel expenses, and a $0.2 million

increase in consulting expenses.

Other income, net increased $0.3 million for the three months ended

June 30, 2024, compared to the three months ended June 30, 2023. This increase was primarily driven by greater interest income

on our interest-bearing accounts.

Net loss was $14.0 million, or $0.65 per share, for the three months

ended June 30, 2024, compared to a net loss of $11.6 million, or $0.56 per share, for the three months ended June 30, 2023.

Net loss per share was based on 21.6 million weighted average shares outstanding for three months ended June 30, 2024 and 20.7 million

weighted average shares outstanding for the three months ended June 30, 2023.

As of June 30, 2024, cash and cash equivalents were $70.4 million.

Net cash used in operating and investing activities was $10.2 million for the quarter ended June 30, 2024. This is compared to net

cash used in operating and investing activities of $11.8 million for the three months ended March 31, 2024.

Leadership Team Expansion

During the quarter, the Company strengthened its executive team to

drive market development priorities. Key appointments include Robert John as Chief Revenue Officer, bringing over 25 years of sales leadership

experience in the medical device industry; Dr. Philip Adamson as Chief Medical Officer; Bonnie Handke as SVP of Patient Access, Reimbursement,

and Healthcare Economics; Jennifer Englund as SVP of Global Clinical Research to enhance clinical evidence; and Tonya Austin as Chief

Human Resources Officer. These strategic hires position CVRx to effectively address awareness, clinical, and patient access barriers as

it drives Barostim towards becoming standard of care for heart failure.

Business Outlook

For the full year of 2024, the Company now expects:

| · | Total revenue between $50.0 million and $53.0 million; |

| · | Gross margin between 83.0% and 85.0%; and |

| · | Operating expenses between $95.0 million and $98.0 million, up from previously issued guidance of $92.0 million and $98.0 million |

For the third quarter of 2024, the Company expects to report total

revenue between $12.7 million and $13.7 million.

Webcast and Conference Call Information

The Company will host a conference call to review its results at 4:30

p.m. Eastern Time today. A live webcast of the investor conference call will be available online at the investor relations page of

the Company’s website at ir.cvrx.com. To listen to the conference call on your telephone, please dial 1-877-704-4453 for U.S. callers,

or 1-201-389-0920 for international callers, approximately ten minutes prior to the start time.

About CVRx, Inc.

CVRx is a commercial-stage medical device company focused on developing,

manufacturing and commercializing innovative neuromodulation solutions for patients with cardiovascular diseases. Barostim™ is the

first medical technology approved by FDA that uses neuromodulation to improve the symptoms of patients with heart failure. Barostim is

an implantable device that delivers electrical pulses to baroreceptors located in the wall of the carotid artery. The therapy is designed

to restore balance to the autonomic nervous system and thereby reduce the symptoms of heart failure. Barostim received the FDA Breakthrough

Device designation and is FDA-approved for use in heart failure patients in the U.S. It has also received the CE Mark for heart failure

and resistant hypertension in the European Economic Area. To learn more about Barostim, visit www.cvrx.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking

statements, including statements regarding our future financial performance (including our financial guidance regarding full year and

third quarter 2024 results), our anticipated growth strategies, anticipated trends in our industry, our business prospects and our opportunities.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “outlook,” “guidance,”

“intend,” “target,” “project,” “contemplate,” “believe,” “estimate,”

“predict,” “potential” or “continue” or the negative of these terms or other similar expressions,

although not all forward-looking statements contain these words.

The forward-looking statements in this press release are only predictions

and are based largely on our current expectations and projections about future events and financial trends that we believe may affect

our business, financial condition, and results of operations. These forward-looking statements speak only as of the date of this press

release and are subject to a number of known and unknown risks, uncertainties and assumptions, including, but not limited to, our history

of significant losses, which we expect to continue; our limited history operating as a commercial company and our dependence on a single

product, Barostim; our limited commercial sales experience marketing and selling Barostim; our ability to demonstrate to physicians and

patients the merits of our Barostim; any failure by third-party payors to provide adequate coverage and reimbursement for the use of Barostim;

our competitors’ success in developing and marketing products that are safer, more effective, less costly, easier to use or otherwise

more attractive than Barostim; any failure to receive access to hospitals; our dependence upon third-party manufacturers and suppliers,

and in some cases a limited number of suppliers; a pandemic, epidemic or outbreak of an infectious disease in the U.S. or worldwide; product

liability claims; future lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming and ultimately

unsuccessful; any failure to retain our key executives or recruit and hire new employees; impacts on adoption and regulatory approvals

resulting from additional long-term clinical data about our product; and other important factors that could cause actual results, performance

or achievements to differ materially from those that are found in “Part I, Item 1A. Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2023, as such factors may be updated from time to time in our other filings

with the Securities and Exchange Commission. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking

statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Investor Contact:

Mark Klausner or Mike Vallie

ICR Westwicke

443-213-0501

ir@cvrx.com

Media Contact:

Laura O’Neill

Finn Partners

402-499-8203

laura.oneill@finnpartners.com

CVRx, INC.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

(Unaudited)

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 70,400 | | |

$ | 90,569 | |

| Accounts receivable, net of allowances of $656 and $508, respectively | |

| 8,606 | | |

| 7,551 | |

| Inventory | |

| 11,224 | | |

| 10,983 | |

| Prepaid expenses and other current assets | |

| 1,762 | | |

| 2,987 | |

| Total current assets | |

| 91,992 | | |

| 112,090 | |

| Property and equipment, net | |

| 2,763 | | |

| 1,763 | |

| Operating lease right-of-use asset | |

| 1,200 | | |

| 1,349 | |

| Other non-current assets | |

| 26 | | |

| 27 | |

| Total assets | |

$ | 95,981 | | |

$ | 115,229 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,516 | | |

$ | 1,884 | |

| Accrued expenses | |

| 5,610 | | |

| 5,980 | |

| Total current liabilities | |

| 9,126 | | |

| 7,864 | |

| Long-term debt | |

| 29,319 | | |

| 29,222 | |

| Operating lease liability, non-current portion | |

| 1,023 | | |

| 1,160 | |

| Other long-term liabilities | |

| 1,265 | | |

| 1,036 | |

| Total liabilities | |

| 40,733 | | |

| 39,282 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.01 par value, 200,000,000 authorized as of June 30, 2024 and December 31, 2023; 21,712,357 and 20,879,199 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 217 | | |

| 209 | |

| Additional paid-in capital | |

| 568,837 | | |

| 553,326 | |

| Accumulated deficit | |

| (513,596 | ) | |

| (477,381 | ) |

| Accumulated other comprehensive loss | |

| (210 | ) | |

| (207 | ) |

| Total stockholders’ equity | |

| 55,248 | | |

| 75,947 | |

| Total liabilities and stockholders’ equity | |

$ | 95,981 | | |

$ | 115,229 | |

CVRx, INC.

Condensed Consolidated Statements of Operations

and Comprehensive Loss

(In thousands, except share and per share data)

(Unaudited)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue | |

$ | 11,807 | | |

$ | 9,500 | | |

$ | 22,577 | | |

$ | 17,479 | |

| Cost of goods sold | |

| 1,900 | | |

| 1,517 | | |

| 3,515 | | |

| 2,845 | |

| Gross profit | |

| 9,907 | | |

| 7,983 | | |

| 19,062 | | |

| 14,634 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,765 | | |

| 3,280 | | |

| 5,822 | | |

| 6,696 | |

| Selling, general and administrative | |

| 21,115 | | |

| 16,455 | | |

| 49,445 | | |

| 31,852 | |

| Total operating expenses | |

| 23,880 | | |

| 19,735 | | |

| 55,267 | | |

| 38,548 | |

| Loss from operations | |

| (13,973 | ) | |

| (11,752 | ) | |

| (36,205 | ) | |

| (23,914 | ) |

| Interest expense | |

| (959 | ) | |

| (481 | ) | |

| (1,919 | ) | |

| (721 | ) |

| Other income, net | |

| 944 | | |

| 616 | | |

| 1,988 | | |

| 1,678 | |

| Loss before income taxes | |

| (13,988 | ) | |

| (11,617 | ) | |

| (36,136 | ) | |

| (22,957 | ) |

| Provision for income taxes | |

| (41 | ) | |

| (34 | ) | |

| (79 | ) | |

| (68 | ) |

| Net loss | |

| (14,029 | ) | |

| (11,651 | ) | |

| (36,215 | ) | |

| (23,025 | ) |

| Cumulative translation adjustment | |

| — | | |

| 17 | | |

| (3 | ) | |

| 20 | |

| Comprehensive loss | |

$ | (14,029 | ) | |

$ | (11,634 | ) | |

$ | (36,218 | ) | |

$ | (23,005 | ) |

| Net loss per share, basic and diluted | |

$ | (0.65 | ) | |

$ | (0.56 | ) | |

$ | (1.69 | ) | |

$ | (1.11 | ) |

| Weighted-average common shares used to compute net loss per share, basic and diluted | |

| 21,628,542 | | |

| 20,711,850 | | |

| 21,430,276 | | |

| 20,702,589 | |

v3.24.2

Cover

|

Jul. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 29, 2024

|

| Entity File Number |

001-40545

|

| Entity Registrant Name |

CVRx,

Inc.

|

| Entity Central Index Key |

0001235912

|

| Entity Tax Identification Number |

41-1983744

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

9201

West Broadway Avenue

|

| Entity Address, Address Line Two |

Suite 650

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55445

|

| City Area Code |

763

|

| Local Phone Number |

416-2840

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.01 per share

|

| Trading Symbol |

CVRX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

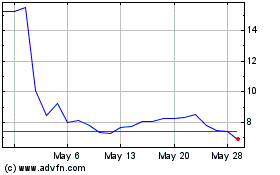

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

CVRx (NASDAQ:CVRX)

Historical Stock Chart

From Jul 2023 to Jul 2024