Transparency notification

September 19 2019 - 4:01PM

Transparency notification

Mechelen, Belgium; 19 september 2019; 22.01 CET;

regulated information – Galapagos NV (Euronext & NASDAQ: GLPG)

received a transparency notification from Sands Capital Management,

LLC.

Pursuant to Belgian transparency legislation1, Galapagos

received a transparency notification on 16 September 2019 from

Sands Capital Management, LLC, who notified that it holds 2,803,887

of Galapagos’ voting rights in American Depository Receipts. This

represents 4.55% of Galapagos’ currently outstanding 61,652,086

shares. Sands Capital Management, LLC, thus crossed passively below

the 5% threshold of Galapagos’ voting rights, due to the share

issuance by Galapagos on 23 August 2019. The full transparency

notice is available on the Galapagos website.

About Galapagos

Galapagos (Euronext & NASDAQ: GLPG)

discovers and develops small molecule medicines with novel modes of

action, three of which show promising patient results and are

currently in late-stage development in multiple diseases. The

company’s pipeline comprises Phase 3 through to discovery programs

in inflammation, fibrosis, osteoarthritis and other indications.

Galapagos’ ambition is to become a leading global biopharmaceutical

company focused on the discovery, development and commercialization

of innovative medicines. More information at www.glpg.com.

| Galapagos

Contacts |

|

|

Investors: |

Media: |

| Elizabeth

Goodwin |

Carmen

Vroonen |

| VP IR |

Senior Director

Communications |

| +1 781 460

1784 |

+32 473 824

874 |

|

|

|

| Sofie Van Gijsel

|

Evelyn Fox |

| Director

IR |

Director

Communications |

| +32 485 19 14

15 |

+31 6 53 591

999 |

|

ir@glpg.com |

communications@glpg.com |

1 Belgian Act of 2 May 2007 on the disclosure

of major shareholdings in issuers whose shares are admitted to

trading on a regulated market.

- Sands Capital TN Sep 2019_EN

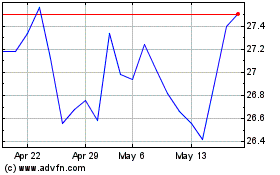

Galapagos (EU:GLPG)

Historical Stock Chart

From Jun 2024 to Jul 2024

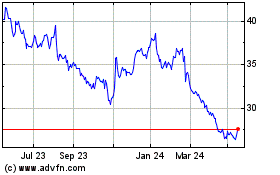

Galapagos (EU:GLPG)

Historical Stock Chart

From Jul 2023 to Jul 2024