TIDMORM

RNS Number : 2665N

Ormonde Mining PLC

27 September 2012

27 September 2012

Ormonde Mining plc

("Ormonde" or "the Company")

Interim Results for the Six Months Ended 30 June 2012

Ormonde Mining plc, the development and exploration company

operating in Spain, is pleased to announce its unaudited interim

results for the six months ended 30 June 2012.

Highlights:

Barruecopardo

-- Definitive Feasibility Study completed demonstrating exceptional economics

-- Final Permitting documentation submitted

-- Capital funding negotiations with selected parties ongoing

and expected to be completed in coming months

Exploration

-- Antofagasta JV drilling on new permits completed and being assessed

-- Aurum Mining JV drilling at the El Facho and Peralonso

Prospects delivered encouraging results; further drilling now

underway at Peralonso

Michael Donoghue, Chairman of Ormonde, commented,

"Throughout 2012, we have been putting in place the essential

building blocks to enable the transformation of the Company to take

place next year with development of our flagship Barruecopardo

Tungsten Project, Spain. Following completion of the Definitive

Feasibility Study and submission of documentation for Final

Permitting, we have moved to advance capital funding arrangements

and are currently in discussions with selected parties. These

discussions are progressing and on completion in the coming months

will pave the way for the development plan to be implemented at

Barruecopardo in 2013."

Enquiries to:

Ormonde Mining plc

Kerr Anderson, Managing Director Tel: +353 (0)1 8253570

Bankside Consultants

Simon Rothschild Tel: +44 (0)20 7367 8888 Mob: +44 (0)7703 167065

Murray Consultants

Ed Micheau Tel: +353 (0)1 4980300 Mob: +353 (0)86 803 7155

Davy (Nomad / ESM Adviser)

Eugenée Mulhern / Roland French Tel: +353 (0)1 6796363

Fairfax I.S. PLC (Joint Broker)

Ewan Leggat / Katy Birkin Tel: +44 (0)207 598 5368

CHAIRMAN'S STATEMENT

Progress on the advancement of our Barruecopardo Tungsten

Project in Salamanca Province, Spain, towards development and

production continued during the first half of 2012. Completion of

the Definitive Feasibility Study in Q1 led to the submission of the

second and final permitting documentation and facilitated the

commencement of a formal phase of capital funding and offtake

negotiations. Meanwhile our copper exploration endeavours in joint

venture with Antofagasta Minerals in the Andalucía Province and our

gold exploration in joint venture with Aurum Mining in the

Salamanca and Zamora Provinces continued to make progress, with the

latter leading to the discovery of a new and most encouraging zone

of gold mineralisation at the Peralonso Prospect in the Salamanca

Province.

The Definitive Feasibility Study for Barruecopardo, based upon

an averaged 227,000 metric tonne units of tungsten trioxide (WO(3)

) production per year from a nine year open pit operation,

confirmed both the technical viability and very strong economics of

this major tungsten project, delivering a pre-tax NPV (8% discount

rate) of EUR120M, averaged annual pre-tax net operating cash flows

of EUR29M and an IRR of 52.0% at an APT price of US$350/mtu.

During Q2 the final documentation for the permitting process at

Barruecopardo was compiled in conjunction with our Spanish

consultants. This led to the submission in July 2012 of a number of

detailed reports: the Environmental Impact Study, the Exploitation

Plan, the Restoration Plan and the Financial Plan, to the Mining

Department in Salamanca, and these documents are now being reviewed

to ensure they meet all regulatory requirements to enable the

granting of a Mining Concession. The first stage submission (the

Documento Inicial) was presented in January 2011 and was reviewed

and processed by the regional authorities in a timely manner. We

have worked closely with the various regulatory bodies since that

initial submission and have taken their views and recommendations

into account in our final submission.

Work on the pre-EPCM engineering design also commenced during

the period. This comprised testing on bulk samples to finalise the

design and equipment selection for both the comminution and gravity

circuits and to enable equipment performance guarantees to be

provided by appropriate suppliers. This work is essentially

complete with the detailed engineering work to follow.

Completion of the various technical studies facilitated an

emphasis being placed on the capital funding, offtake and detailed

engineering stages. Negotiations with selected parties in relation

to capital funding are advancing, as are external economic and

technical evaluations. Negotiations on offtake are also in process

but as a matter of strategy offtake arrangements will only be

concluded in tandem with or following the finalisation of the

capital funding package. We now expect these funding activities to

run to completion in the coming months as we seek to maintain

flexibility to ensure the optimum funding package for the

Project.

In parallel with this technical work, the strong relationship

developed with the Barruecopardo Municipality was formally

recognised through a Collaboration Agreement signed with the local

Council in July 2012, which included a commitment by Ormonde to

provide an annual contribution towards the activities of the

Council. These funds will be allocated by the Council to areas

which benefit the local community.

Tungsten prices softened somewhat during the period as a

response to some uncertainty in the short term outlook for the

global economy. Nevertheless, the outlook for tungsten remains very

positive, with end-users interested in establishing a strategic and

secure long-term supply in a situation where new mine developments

remain constrained and supply of tungsten as APT is forecast to

contract (as did the tungsten concentrate supply previously) as

China continues to develop and move downstream into tungsten

product manufacturing.

Elsewhere, exploration activity in the joint venture with

Antofagasta on the new permits awarded in 2011 continued, with

3,048 metres of drilling recently completed on several targets as a

follow-up to a ground gravity survey and an airborne

electro-magnetic survey. This programme was funded by Antofagasta

and data is now being assessed by them. Further announcements in

relation to the outcome of this programme will be made in due

course.

Ormonde's gold exploration activities in Zamora and Salamanca

Provinces generated encouraging results during the period. This

work was fully funded as part of an earn-in joint venture with

Aurum Mining Plc, with Ormonde acting as Manager. Drilling on the

El Facho Prospect in Zamora established continuity of the gold

mineralised zone over a strike length of some 600 metres and

enabled a preliminary non-compliant resource estimate of some

120-145k ounces of gold at average grades of around 1g/t gold. The

first drilling on the Peralonso Prospect in the Salamanca Province

yielded very encouraging results with broad zones of potentially

economic mineralisation encountered in one of the holes and this

Prospect has become a priority target with further drilling now

underway.

Ormonde incurred an operating loss for the period of EUR499k

(EUR445k for the 6 months to June 2011), which reflects a continued

control of administrative expenses. The Company raised GBP3.4

million (before expenses) through a placement at the beginning of

March, to progress work at Barruecopardo and for general working

capital purposes.

In concluding I would like to thank shareholders for their

support during the period. I look forward to finalising

arrangements for the development of our Barruecopardo Project in

the period ahead.

Michael J. Donoghue

Chairman

27 September 2012

Ormonde Mining PLC

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2012

unaudited unaudited audited

6 months 6 months

ended ended Year ended

30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Turnover 0 0 0

Administration expenses (499) (445) (981)

________ ________ ________

Operating loss (499) (445) (981)

Interest receivable 13 8 15

______ ______ ______

Loss on Ordinary Activities (486) (437) (966)

Minority Interest 0 0 0

______ ______ ______

Loss for the Period (486) (437) (966)

Loss per share

Basic loss per share -EUR0.0014 -EUR0.0014 -EUR0.0030

Diluted loss per share -EUR0.0013 -EUR0.0014 -EUR0.0029

Ormonde Mining PLC

Consolidated Statement of Financial Position

As at 30 June 2012

unaudited unaudited audited

30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Assets

Non current assets

Intangible assets - Exploration

& Evaluation costs 18,128 14,195 16,763

Property, plant & equipment 4 18 4

_______ _______ _______

Total Non Current Assets 18,132 14,213 16,767

Current assets

Trade & other receivables 269 513 427

Cash & cash equivalents 3,526 3,885 1,990

_______ _______ _______

Total current assets 3,795 4,398 2,417

_______ _______ _______

Total assets 21,927 18,611 19,184

_______ _______ _______

Equity & liabilities

Equity

Called up share capital 10,998 10,151 10,151

Share premium account 27,185 24,174 24,174

Share based payment reserve 777 664 777

Other capital reserves 36 36 36

Foreign currency translation

reserve 0 0 1

Retained losses (17,798) (16,783) (17,313)

Minority interest 0 0 0

_______ _______ _______

Total equity - attributable

to the owners of the Company 21,198 18,242 17,826

Current liabilities

Trade & other payables 729 369 1,358

_______ _______ _______

Total liabilities 729 369 1,358

_______ _______ _______

Total equity & liabilities 21,927 18,611 19,184

_______ _______ _______

Ormonde Mining PLC

Consolidated Statement of Cashflows

Six months ended 30 June 2012

unaudited unaudited audited

6 months 6 months Year

ended ended ended

30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Cashflows from operating

activities

Net loss for period before

interest & tax (486) (436) (967)

Adjustments for:

Depreciation 1 4 3

Movement on Share-based payment

reserve 0 0 114

Investment income recognised

in P&L 0 (1) (15)

________ ________ ________

(485) (433) (865)

Movement in Working Capital

(Increase) in receivables 158 (363) (277)

Increase/(decrease) in liabilities (629) 96 1,087

Income taxes paid 0 0 (1)

________ ________ ________

Net Cash (used in) operations (956) (700) (56)

Cashflows from financing

activities

Proceeds from issue of share

capital 3,858 4,394 4,394

Investing activities

Movement in plant & equipment (1) 0 14

Expenditure on intangible

assets (1,364) (1,752) (4,321)

Interest received 0 (1) 15

________ ________ ________

Net cash used in investing

activities (1,365) (1,753) (4,292)

________ ________ ________

Net increase in cash and

cash equivalents 1,536 1,941 46

Cash and cash equivalents

at beginning of period 1,990 1,944 1,944

______ ______ ______

Cash and cash equivalents

at end of period 3,526 3,885 1,990

Ormonde Mining PLC

Consolidated Statement of Changes in Equity

Share

based

payment

reserve

Share Share Other Retained Total

Capital Premium Reserves Losses

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

At 1 January 2011 9,042 20,889 663 37 (16,346) 14,285

Proceeds of share

issue 1,109 3,285 - - - 4,394

Loss for the period - - - - (437) (437)

______ ______ ______ ______ _______ ______

At 30 June 2011 10,151 24,174 663 37 (16,783) 18,242

Proceeds of share

issue - - - - - 0

Recognition of share

based payments - - 114 - - 114

Loss for the period - - - - (529) (529)

______ ______ ______ ______ _______ ______

At 31 December 2011 10,151 24,174 777 37 (17,312) 17,827

Proceeds of share

issue 847 3,011 - - 0 3,858

Recognition of share

based payments - - - - - 0

Loss for the period - - - - (486) (486)

______ ______ ______ ______ _______ ______

At 30 June 2012 10,998 27,185 777 37 (17,798) 21,199

______ ______ ______ ______ _______ ______

Notes to the Interim Financial Statements

1. Segmental Analysis

The Group is engaged in one business segment only, exploration

of mineral resource projects. Therefore only an analysis by

geographical segment has been presented. The Group has geographic

segments in Ireland and Spain.

The segment results for the period ended 30(th) June 2012 are as

follows:

Ireland Spain

Loss for 6 months to

30 June 12 EUR000s EUR000s

Segment loss for period 0 (486)

______ ______

0 (486)

______ ______

2. Loss per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

Loss per share 30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Loss for period (486) (437) (966)

Weighted average number

of ordinary shares

for the purpose of basic

earnings per share 359,604,555 308,642,582 324,122,481

______ ______ ______

Basic loss per ordinary

shares (in cent) (0.14) (0.14) (0.30)

______ ______ ______

Diluted earnings per share

The weighted average number of ordinary shares used in the

calculation of diluted earnings per share are as follows:

Loss per share 30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Loss for period (486) (437) (966)

Weighted average number

of ordinary shares

for the purpose of basic

earnings per share 359,604,555 308,642,582 324,122,481

Shares deemed to be issued

for no consideration

in respect of Employee

Options 6,356,175 2,704,688 6,957,464

Weighted average number

of ordinary shares

for the purpose of diluted

earnings per share 365,960,730 311,347,270 331,079,945

______ ______ ______

Diluted loss per ordinary

shares (in cent) (0.13) (0.14) (0.29)

______ ______ ______

Notes to the Interim Financial Statements (continued)

3. Intangible assets - Exploration costs

Exploration

Total & Evaluation

Assets

EUR000s EUR000s

Cost

At 1 January 2012 16,764 16,764

Additions 1,364 1,364

______ ______

At 30 June 2012 18,128 18,128

______ ______

4. Property, Plant and Equipment

Fixtures Computer Motor Total

& Fittings Equipment Vehicles

EUR000s EUR000s EUR000s EUR000s

Cost

At 1 January 2012 26 45 18 89

Additions 1 0 0 1

Disposals (2) (19) 0 (21)

_____ _____ _____ _____

At 30 June 2012 25 26 18 69

_____ _____ _____ _____

Accumulated Depreciation

& Impairment

At 1 January 2012 (23) (44) (18) (85)

Depreciation expense (1) 0 0 (1)

Disposals 2 19 0 21

_____ _____ _____ _____

At 30 June 2012 (22) (25) (18) (65)

_____ _____ _____ _____

Net Book Value at 1 January

2012 3 1 0 4

_____ _____ _____ _____

Net Book Value at 30

June 2012 3 1 0 4

_____ _____ _____ _____

Notes to the Interim Financial Statements (continued)

5. Share Capital

Share Capital 30-Jun-12 30-Jun-11 31-Dec-11

EUR000s EUR000s EUR000s

Authorised Equity

450,000,000 ordinary shares

of 2.5c each 11,250 11,250 11,250

100,000,000 deferred shares

of 3.809214c each 3,809 3,809 3,809

______ ______ ______

15,059 15,059 15,059

______ ______ ______

Issued Capital

Share Capital 10,998 10,151 10,151

Share Premium 27,185 24,174 24,174

______ ______ ______

38,183 34,325 34,325

______ ______ ______

On 12 March 2012, the Company placed 33,910,896 new ordinary

shares of nominal value of EUR0.025 each in the capital of the

Company at a price of Stg10p per share, raising in aggregate

StgGBP3.39 million (approximately EUR4.04 million) before

expenses.

The financial information has been prepared under International

Financial Reporting Standards using accounting policies consistent

with those in the last Annual Report.

No dividends were paid or proposed in respect of the six months

ended 30 June 2012.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SEMFMMFESELU

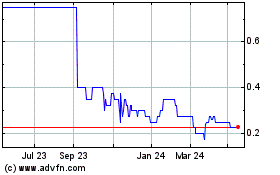

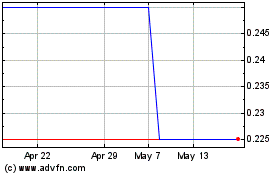

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jul 2024 to Aug 2024

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Aug 2023 to Aug 2024