Scott Wilson Study

September 16 2010 - 2:00AM

UK Regulatory

TIDMORM

RNS Number : 7802S

Ormonde Mining PLC

16 September 2010

16 September 2010

Ormonde Mining plc

("Ormonde" or "the Company")

Scott Wilson Study

Independent Study Indicates Substantial Net Cash Flows from Open-Pit Mine at

Barruecopardo Tungsten Project

The Board of Ormonde is pleased to report theresults of an Independent Technical

and Economic Review and Optimisation Study ("the Study") carried out by Scott

Wilson Mining ("Scott Wilson") on Ormonde's Barruecopardo Tungsten Project in

Salamanca, Spain.

Highlights

· A review of the May 2010 resource model has concluded that the optimum

approach to mining in the initial 10 year period based upon current Indicated

Resources would be by open pit at a design production capacity of 500,000 tonnes

per annum, an increase of 25% on previous estimated initial production rates.

· The Study shows the Base Case Project, based solely on current Indicated

Resources, is capable of generating Euro 9.3M per year of averaged pre-tax

operating cash flows for 10 years, at the current tungsten price of US$245/mtu

WO3.

· Market analysis suggests that the forecast tungsten market deficit could

result in prices moving to levels in line with the 2005/6 peak of just under

US$300/mtu in the next few years; at a tungsten price of US$290/mtu, averaged

pre-tax operating cash flows for the Base Case project rise to Euro 13.7M per

year.

· The initial capital cost for the Base Case is Euro 29.9M, an increase over

previous estimates (Euro 25M) resulting from the impact of the 25% increased

production rate on process plant capital and open pit waste pre-stripping

requirements. The average unit cash operating cost shown is Euro 80.4/mtu.

· The Study has also considered the possibility of further increasing the

open pit production rate to 800,000 tonnes per annum for 10 years (Expanded

Case) by the inclusion of the Inferred Resources. This could result in the

project generating Euro16.1M per year of averaged pre-tax operating cash flows,

at the current tungsten price of US$245/mtu WO3, with this cash flow rising

accordingly at the higher US$290/mtu price.

· Tungsten prices continue to rise(1) and projections from the EU Commission

in June 2010(2) suggest probable supply shortages of the metal to the EU into

the future.

Kerr Anderson, Ormonde's Managing Director, said:

"This is an excellent outcome for Ormonde Mining. The results have exceeded our

expectations both in terms of net cash flow projections and the life of the open

pit portion of the project.

The Study supports the Directors' view that Barruecopardo would be amongst the

largest producers of tungsten in the World outside of China, with real potential

to further increase production rates post start-up.

This is an exciting time for Ormonde with the Study underlining the potential

for the Project to bring significant and long term benefits to the local area

surrounding the project site, and to Ormonde shareholders. All this is

occurring against a backdrop of significant increases in the tungsten price. We

look forward to reporting regularly to shareholders as the Company progresses

Barruecopardo to production in late 2012".

Barruecopardo Project

Ormonde has a 90% interest in the Barruecopardo Project in joint venture with

the regional government affiliated company Sociedad de Investigación y

Explotación Minera de Castilla y León (SIEMCALSA) which holds 10%.

Barruecopardo has a current reported mineral resource (JORC compliant) totalling

10.9 million tonnes grading 0.45% WO3 (tungsten trioxide) at a 0.25% cut-off,

equating to 4.9 million metric tonne units ("mtu") or 49,000 tonnes of contained

WO3. Of the total resource, 6.5 million tonnes grading 0.46% tungsten trioxide

is in the Indicated Mineral Resource category. Based upon this Indicated

Resource, metallurgical testwork, and other engineering work carried out

to-date, Scott Wilson was commissioned to carry out a mine optimisation study

and a technical and economic review of the previous engineering work, to

facilitate this independent quantification of project economics.

Technical and Economic Review and Optimisation Study

The Independent Technical and Economic Review and Optimisation Study (accuracy

of ±25%) prepared by Scott Wilson included mine optimisation, design, scheduling

and costing studies. Scott Wilson retained Aker Solutions to carry out a review

of results from previous metallurgical testwork by various laboratories,

including Wardell Armstrong International, and to develop preliminary process

operating and capital cost estimates. All other aspects of the project,

including environmental studies, were reviewed by Scott Wilson, who also

prepared preliminary financial models based upon tungsten market price

information provided by the Company.

The preliminary open pit optimisation study was carried out only on the

Indicated portion of the May 2010 Mineral Resource estimate, prepared by CSA

Global Pty Ltd, Australia. This pit optimisation exercise captured potentially

mineable material of 3.9 million tonnes with an average life of mine grade of

0.43% WO3. The mine production from this pit was scheduled at 500kt of ore per

year and this was used as a Base Case for an initial mine life of 10 years. This

500ktpa represents a 25% increase on past production rate estimates.

The Base Case models contract open pit mining with averaged production of

130,000 mtus of WO3 per year (155,000 mtus average during the period of

operation at design production capacity) from a simple and low cost gravity

plant. This plant would comprise three stage crushing followed by jigs and

spirals for gravity pre-concentration, with flotation clean-up of the

pre-concentrate to produce an industry standard 65% WO3 (scheelite) concentrate.

Average life-of-mine metallurgical recoveries of 79% were adopted based on

existing testwork results. Most plant waste products will be produced in a "dry"

sand form.

The initial capital cost for the Base Case is Euro 29.9M, an increase over

previous estimates (Euro 25M) resulting from the impact of the 25% increased

production rate on process plant capital and open pit waste pre-stripping

requirements. The average unit cash operating cost shown is Euro 80.4/mtu.

The Base Case assumes that all WO3 concentrate produced is sold at prices

reflecting recent mid-prices for APT (ammonium paratungstate) of US$245/mtu.

Market analysis suggests that the forecast market deficit could result in prices

moving to levels in line with the 2005/6 peak of just under US$300/mtu in the

next few years (CRU, 2009). The impact on cash flows at a price of US$290/mtu

is also considered. The Study used a US$/EUR exchange rate of 1.35.

Mining could be continued by underground methods post completion of the Base

Case 10-year open pit, although this scenario was not addressed as part of the

current study.

Expanded Case

Scott Wilson has reported that, based upon the entire mineral resource

(Indicated and Inferred) a larger open pit operation at higher production rates

than the Base Case of 500ktpa may be possible if, after further infill drilling,

the Inferred Resources are upgraded to the Indicated category. This case, termed

the Expanded Case, models mining a larger open pit at a production rate of

800ktpa to yield averaged production of 200,000 mtus of WO3 per year (230,000

mtus average during the period of operation at design production capacity).

Scott Wilson noted that the level of geological confidence associated with

Mineral Resources classified under the Inferred category is low and consequently

there is no certainly that the economic forecasts on which the Expanded Case is

based will be realised.

For the Expanded Case, total initial project capital costs increase to Euro

40.3M with the average pre-tax operating cash flow over the first 10 years of

the operation (at prevailing metal prices) rising to Euro16.1M per year. At the

higher metal price, this cash flow could rise further to Euro 22.8M per year.

Continuation of this Expanded Case in an underground mining operation has not

been considered, as considerable deeper drilling would be required to support

such a scenario.

Study Results

+---------------+------------------------+--------------------+

| | OPERATING CASH FLOWS PER YEAR(I) |

+---------------+---------------------------------------------+

| |Current Tungsten Price | Higher Tungsten |

| | | Price |

+---------------+------------------------+--------------------+

| | US$245/mtu | US$290/mtu |

+---------------+------------------------+--------------------+

| | | |

+---------------+------------------------+--------------------+

| Base Case | Euro 9.3M | Euro 13.7M |

+---------------+------------------------+--------------------+

| | | |

+---------------+------------------------+--------------------+

| Expanded Case | Euro 16.1M | Euro 22.8M |

+---------------+------------------------+--------------------+

(I) Averaged pre-tax operating cash flows per year for first 10 years of

Project

Tungsten Outlook

Ammonium paratungstate (APT) prices, the product for which tungsten is priced

globally, have increased from US$180-190/mtu in mid 2009 to the current price of

US$246-253/mtu, a price increase of some 30%. This appears to be driven

primarily by increased demand for concentrates from China, which dominates both

the world's supply and consumption of tungsten. Recent commentary on tungsten

demand suggests that the requirement for tungsten in steels and alloys used in

critical sectors of China's economy is strong.

Barruecopardo, a historical tungsten producer closed in the early 1980's, is now

a recognised high grade, low capital cost, tungsten asset, situated close to the

major markets for Western processors and manufacturers of tungsten products.

Evaluation of this asset continues to progress against a backdrop of rising

world tungsten prices and it is anticipated that Barruecopardo will be developed

as a major tungsten producer in late 2012.

(1) Ammonium paratungstate (APT) prices, the tungsten product which is priced

globally, have increased steadily from US $180-190/mtu WO3 in mid 2009 to the

current price of US$ 246-253/mtu WO3. One mtu = 10 kg.

(2) EU Commission Report released in June 2010 entitled "Critical Raw Materials

for the EU".

Kerr Anderson PhD EurGeolPGeo, Managing Director of Ormonde Mining plc, and a

qualified person as defined in the Guidance Note for Mining, Oil and Gas

Companies, February 2007, of the London Stock Exchange, has reviewed and

approved the technical information contained in this announcement.

A glossary explaining technical terms contained in this announcement can be

found at www.ormondemining.com/en/investors/technical_glossary.

Enquiries to:

Ormonde Mining plc

Kerr Anderson, Managing Director Tel: +353 (0)46 9073623

Bankside Consultants

Simon Rothschild / Louise Mason Tel: +44 (0)20 7367 8888 Mob: +44 (0)7703

167065

Davy (Nomad / ESM Adviser)

Fergal Meegan/Roland French Tel: +353 (0)1 6796363

Fairfax I.S. PLC (Joint Broker)

Ewan Leggat/Katy Birkin Tel: +44 (0)207 598 5368

ENDS

About Ormonde

Ormonde Mining plc is quoted on the AIM in London and the ESM in Dublin. Ormonde

is a mineral development and exploration company focused on Spain, with a

principal objective of developing the Barruecopardo Tungsten Project to be a

major western tungsten mine by late 2012.

About Scott Wilson

Scott Wilson is now part of URS Corporation.

URS/Scott Wilson provides consulting services to the mining clients at all

stages of project development from exploration and resource evaluation through

scoping, prefeasibility and feasibility studies, financing, environment and

social assessment, permitting, construction, operation, closure and

rehabilitation.

For more information please visit www.ormondemining.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBLGDCISBBGGU

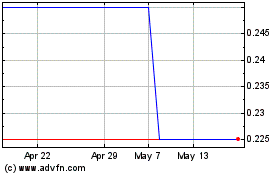

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jun 2024 to Jul 2024

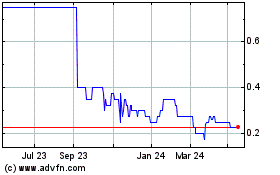

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jul 2023 to Jul 2024