Ormonde Mining PLC - Final Results

November 24 1999 - 4:57AM

UK Regulatory

RNS Number:3497B

Ormonde Mining PLC

24 November 1999

23 November 1999 Shares on Issue: 43,917,841

Press Release Fully Diluted: 43,917,841

Irish Stock Exchange Share Price: 7 cents

Vancouver Stock Exchange (OMP) Market Cap:Euro 3.07 M, C$4.63M

PRELIMINARY STATEMENT OF RESULTS FOR THE YEAR ENDED 30 JUNE, 1999

Ormonde Mining Plc ("Ormonde") has today released its financial results and

Annual Report for the year ended 30 June, 1999.

Ormonde, in common with most other junior exploration companies, has had a

difficult year during 1998/99. Pressure on metal prices continued with a

subsequent knock-on effect on share prices. Equity raising remained difficult

and the need to conserve funds resulted in a world-wide cut-back in

exploration and development activity.

Fortunately metal prices firmed during the third quarter of 1999. The

decision by the European central banks to formalise their gold sales, and,

particularly their decision to control the gold available for leasing, has had

an immediate beneficial impact on the gold price. We would expect to see a

continuing firming trend in the gold price over the next couple of years.

The stock markets have reacted favourably to this change, but it will take

some time to shake off the recent adverse sentiment and see the full effect of

this change reflected in the markets and particularly in the junior

exploration sector. However the critical fact is that the gold market has

bottomed and the industry cycle is starting on the upward swing.

The earlier adverse market conditions have forced Ormonde to curtail its

activities towards the middle of 1999. However significant advances were made

in Tanzania during the first half of the year.

The initial reconnaissance drilling programme was carried out on the Mgusu

property where a 271,000 ounces inferred gold resource was defined by earlier

drilling. This property lies adjacent to the multi-million ounce deposits

presently being evaluated and developed by Ashanti at Geita and Kukuluma and

Ridge 8 by Anglo American. Four of the seven targets at Mgusu were subjected

to first-pass rotary-air-blast (RAB) drilling. Results from three of these

targets were disappointing, but the drilling on Mgusu III revealed that gold

mineralisation is present in this area. Follow-up drilling is warranted on

this target in addition to the drilling required on the other untested Mgusu

targets.

Exploration activity on the Bukoli property, Lake Victoria Goldfield, during

1998/99 consisted of two programmes of reconnaissance drilling along a 3.3km

long mineralised zone. The results to date have been very encouraging with

several holes encountering economic widths and grades of gold mineralisation,

including 21m at 2.04 grams per tonne (g/t), 8m @8.75g/t, 5m @3.51g/t and 13m

@ 1.68g/t. However the holes were very shallow, generally less than 40m deep,

and the lines were widely spaced. Much tighter spaced deeper holes will be

required to allow us to establish the economic potential of this area.

Exploration activity continued elsewhere in Tanzania, at the Ikoka, Karumwa,

Mrangi, Ikina, and Chunya projects, but at a lower level then we would have

wished.

The programme and prospects for 1999/2000 are at this time of writing not

finalised, reflecting the interim stage of a number of commercial and funding

opportunities currently being assessed by Ormonde. Corporate activity on

project acquisitions is also finally on the increase and in the last quarter

we have been very active in pursuing some interesting opportunities. Now that

the gold price has recovered and the gold equity markets are showing some

signs of life, your Directors expect to be in a position to raise funds and

enter into other transactions which should lead to a step up in the company's

activities.

The report of the auditors on the financial statements for the year ended 30

June, 1999 draws the readers attention to the uncertainty of the carrying

value of intangible assets disclosed in the financial statements, largely

comprising capitalised exploration costs and to the uncertainty surrounding

the availability of adequate finance for future operations but the auditors

opinion is not qualified in respect of these matters.

In the interim we have completed a joint venture on our Siga Hills, Karumwa

and Magamba properties in Tanzania and we are presently negotiating a second

joint venture on other licences. At this point the company has farmed out

almost half of its Tanzanian portfolio of properties.

Overall we believe that 1999/2000 has the makings of a turnaround in the

company's fortunes. We look forward to the millennium.

Financial Results

The company has posted a loss of IR#51,103 (Canadian $109,406) before tax.

Profit and Loss Statement for the year ended 30 June, 1999 is appended.

Desmond J. Burke

Managing Director

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE YEARS ENDED 30 JUNE 1999 AND 1998

1999 1998

IR# IR#

Administrative expenses (27,036) (33,427)

Write-down of exploration costs (26,477) (147,885)

-----------------------

OPERATING LOSS (53,513) (181,312)

Other income 2,410 8,942

-----------------------

LOSS ON ORDINARY ACTIVITIES BEFORE TAXATION (51,103) (172,370)

Taxation - -

-----------------------

LOSS ON ORDINARY ACTIVITIES AFTER TAXATION (51,103) (172,370)

Profit and loss account brought forward - (deficit) (4,523,317) (4,350,947)

-----------------------

Profit and loss account carried forward - (deficit) (4,574,420) (4,523,317)

=======================

Loss per share (IR#0.0013) (IR#0.0053)

=======================

The group has no recognised gains or losses other than those reflected in the

profit and loss accounts above.

The financial statements were approved by the Board of Directors on 17

November, 1999.

For further information contact:

Desmond J. Burke Esq

2 St. Canice's Court

Dean Street

Kilkenny City

Kilkenny

Ireland

Tel: 353-56-52411

Fax: 353-56-52433

23 November, 1999

END

FR ASOKKKKKAURA

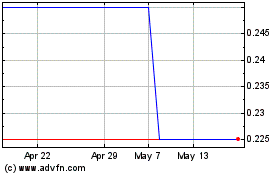

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jun 2024 to Jul 2024

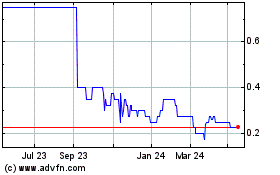

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jul 2023 to Jul 2024