false

Q1

--12-31

0001460602

0001460602

2024-01-01

2024-03-31

0001460602

2024-05-20

0001460602

2024-03-31

0001460602

2023-12-31

0001460602

us-gaap:RelatedPartyMember

2024-03-31

0001460602

us-gaap:RelatedPartyMember

2023-12-31

0001460602

us-gaap:NonrelatedPartyMember

2024-03-31

0001460602

us-gaap:NonrelatedPartyMember

2023-12-31

0001460602

2023-01-01

2023-03-31

0001460602

us-gaap:CommonStockMember

2023-12-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2023-12-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-12-31

0001460602

us-gaap:TreasuryStockCommonMember

2023-12-31

0001460602

us-gaap:RetainedEarningsMember

2023-12-31

0001460602

us-gaap:ParentMember

2023-12-31

0001460602

us-gaap:NoncontrollingInterestMember

2023-12-31

0001460602

us-gaap:CommonStockMember

2022-12-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2022-12-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001460602

us-gaap:TreasuryStockCommonMember

2022-12-31

0001460602

us-gaap:RetainedEarningsMember

2022-12-31

0001460602

us-gaap:ParentMember

2022-12-31

0001460602

us-gaap:NoncontrollingInterestMember

2022-12-31

0001460602

2022-12-31

0001460602

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2024-01-01

2024-03-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-01-01

2024-03-31

0001460602

us-gaap:TreasuryStockCommonMember

2024-01-01

2024-03-31

0001460602

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001460602

us-gaap:ParentMember

2024-01-01

2024-03-31

0001460602

us-gaap:NoncontrollingInterestMember

2024-01-01

2024-03-31

0001460602

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2023-01-01

2023-03-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001460602

us-gaap:TreasuryStockCommonMember

2023-01-01

2023-03-31

0001460602

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001460602

us-gaap:ParentMember

2023-01-01

2023-03-31

0001460602

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-03-31

0001460602

us-gaap:CommonStockMember

2024-03-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2024-03-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0001460602

us-gaap:TreasuryStockCommonMember

2024-03-31

0001460602

us-gaap:RetainedEarningsMember

2024-03-31

0001460602

us-gaap:ParentMember

2024-03-31

0001460602

us-gaap:NoncontrollingInterestMember

2024-03-31

0001460602

us-gaap:CommonStockMember

2023-03-31

0001460602

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001460602

ORGS:ReceiptsOnAccountOfSharesToBeAllotedMember

2023-03-31

0001460602

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001460602

us-gaap:TreasuryStockCommonMember

2023-03-31

0001460602

us-gaap:RetainedEarningsMember

2023-03-31

0001460602

us-gaap:ParentMember

2023-03-31

0001460602

us-gaap:NoncontrollingInterestMember

2023-03-31

0001460602

2023-03-31

0001460602

ORGS:OctomeraLLCMember

2024-01-29

0001460602

ORGS:ORGSMember

2024-03-31

0001460602

ORGS:AssetPurchaseAgreementMember

us-gaap:SubsequentEventMember

2024-04-05

2024-04-05

0001460602

ORGS:AssetPurchaseAgreementMember

2024-02-27

2024-02-27

0001460602

ORGS:AssetPurchaseAgreementMember

us-gaap:SubsequentEventMember

2024-04-01

2024-04-16

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

us-gaap:SubsequentEventMember

2024-05-10

2024-05-10

0001460602

us-gaap:SubsequentEventMember

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

2024-05-10

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:SubsequentEventMember

us-gaap:WarrantMember

2024-05-10

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:SubsequentEventMember

ORGS:WarrantOneMember

2024-05-10

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:SubsequentEventMember

2024-05-10

2024-05-10

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:SubsequentEventMember

us-gaap:WarrantMember

2024-05-10

2024-05-10

0001460602

ORGS:OctomeraMember

2024-01-01

2024-03-31

0001460602

ORGS:TherapiesMember

2024-01-01

2024-03-31

0001460602

ORGS:EliminationsMember

2024-01-01

2024-03-31

0001460602

ORGS:OctomeraMember

2023-01-01

2023-03-31

0001460602

ORGS:TherapiesMember

2023-01-01

2023-03-31

0001460602

ORGS:EliminationsMember

2023-01-01

2023-03-31

0001460602

ORGS:MetalmarkMember

ORGS:UnitPurchaseAgreementMember

2024-01-01

2024-03-31

0001460602

ORGS:UnitPurchaseAgreementMember

2024-01-01

2024-03-31

0001460602

ORGS:TenSecuredPromissoryNotesMember

2024-03-31

0001460602

ORGS:OctomeraMember

2024-03-31

0001460602

ORGS:OctomeraMember

2024-01-01

2024-03-31

0001460602

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

ORGS:OrgenesisBiotechIsraelLimitedMember

2024-01-01

2024-03-31

0001460602

ORGS:OctomeraMember

us-gaap:MeasurementInputDiscountRateMember

2024-01-31

0001460602

ORGS:OctomeraMember

us-gaap:MeasurementInputRiskFreeInterestRateMember

2024-01-31

0001460602

ORGS:OctomeraMember

us-gaap:MeasurementInputLongTermRevenueGrowthRateMember

2024-01-31

0001460602

ORGS:MeasurementInputStandardDeviationMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

us-gaap:MeasurementInputRiskFreeInterestRateMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

ORGS:MeasurementInputTriggerEventMember

us-gaap:FairValueInputsLevel3Member

2024-01-01

2024-03-31

0001460602

us-gaap:MeasurementInputLongTermRevenueGrowthRateMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

ORGS:MeasurementInputTriggerEventsMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

us-gaap:MeasurementInputRevenueMultipleMember

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001460602

ORGS:OrgenesisBiotechIsraelLimitedMember

2024-02-14

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

2024-03-03

2024-03-03

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

2024-03-03

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

us-gaap:WarrantMember

2024-03-03

0001460602

ORGS:SecuritiesPurchaseAgreementMember

us-gaap:PrivatePlacementMember

ORGS:WarrantOneMember

2024-03-03

0001460602

2024-01-25

2024-01-25

0001460602

2024-01-25

0001460602

ORGS:StrategicAdvisorAgreementMember

2024-03-07

2024-03-07

0001460602

ORGS:StrategicAdvisorAgreementMember

us-gaap:CommonStockMember

2024-03-07

0001460602

ORGS:ConvertibleLoansOneMember

2024-03-31

0001460602

ORGS:ConvertibleLoansOneMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansTwoMember

2024-03-31

0001460602

ORGS:ConvertibleLoansTwoMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansThreeMember

2024-03-31

0001460602

ORGS:ConvertibleLoansThreeMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansFourMember

2024-03-31

0001460602

ORGS:ConvertibleLoansFourMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansFiveMember

2024-03-31

0001460602

ORGS:ConvertibleLoansFiveMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansSixMember

2024-03-31

0001460602

ORGS:ConvertibleLoansSixMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansSevenMember

2024-03-31

0001460602

ORGS:ConvertibleLoansSevenMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansEightMember

2024-03-31

0001460602

ORGS:ConvertibleLoansEightMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansNineMember

2024-03-31

0001460602

ORGS:ConvertibleLoansNineMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansTenMember

2024-03-31

0001460602

ORGS:ConvertibleLoansTenMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansElevenMember

2024-03-31

0001460602

ORGS:ConvertibleLoansElevenMember

2024-01-01

2024-03-31

0001460602

ORGS:ConvertibleLoansMember

2024-03-31

0001460602

ORGS:ConvertibleLoansOneMember

2023-12-31

0001460602

ORGS:ConvertibleLoansOneMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansTwoMember

2023-12-31

0001460602

ORGS:ConvertibleLoansTwoMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansThreeMember

2023-12-31

0001460602

ORGS:ConvertibleLoansThreeMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansFourMember

2023-12-31

0001460602

ORGS:ConvertibleLoansFourMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansFiveMember

2023-12-31

0001460602

ORGS:ConvertibleLoansFiveMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansSixMember

2023-12-31

0001460602

ORGS:ConvertibleLoansSixMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansSevenMember

2023-12-31

0001460602

ORGS:ConvertibleLoansSevenMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansEightMember

2023-12-31

0001460602

ORGS:ConvertibleLoansEightMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansNineMember

2023-12-31

0001460602

ORGS:ConvertibleLoansNineMember

2023-01-01

2023-12-31

0001460602

ORGS:ConvertibleLoansMember

2023-12-31

0001460602

ORGS:OffshoreInvestorMember

2024-01-01

2024-01-31

0001460602

ORGS:OffshoreInvestorMember

2024-01-31

0001460602

ORGS:NonConvertibleLoansMember

2024-01-01

2024-01-31

0001460602

ORGS:NonConvertibleLoansMember

2024-01-31

0001460602

ORGS:SaiConvertibleLoanAgreementMember

ORGS:LenderMember

2023-09-29

0001460602

ORGS:OptionsGrantedToEmployeesMember

2024-01-01

2024-03-31

0001460602

ORGS:EmployeesMember

2024-01-01

2024-03-31

0001460602

ORGS:EmployeesMember

2024-03-31

0001460602

us-gaap:LongTermDebtMember

2024-03-31

0001460602

us-gaap:LongTermDebtMember

2024-01-01

2024-03-31

0001460602

us-gaap:LongTermDebtMember

2023-12-31

0001460602

us-gaap:ShortTermDebtMember

2024-03-31

0001460602

us-gaap:ShortTermDebtMember

2023-12-31

0001460602

ORGS:ShortTermDebtOneMember

2024-03-31

0001460602

ORGS:ShortTermDebtOneMember

2023-12-31

0001460602

ORGS:ShortTermDebtTwoMember

2024-03-31

0001460602

ORGS:ShortTermDebtTwoMember

2023-12-31

0001460602

ORGS:ShortTermDebtThreeMember

2024-03-31

0001460602

ORGS:ShortTermDebtThreeMember

2023-12-31

0001460602

ORGS:ShortTermDebtFourMember

2024-03-31

0001460602

ORGS:ShortTermDebtFourMember

2023-12-31

0001460602

ORGS:ShortTermDebtFiveMember

2024-03-31

0001460602

ORGS:ShortTermDebtFiveMember

2023-12-31

0001460602

ORGS:ShortTermDebtSixMember

2024-03-31

0001460602

ORGS:ShortTermDebtSixMember

2023-12-31

0001460602

ORGS:OptionsAndWarrantsMember

2024-01-01

2024-03-31

0001460602

ORGS:SharesUponConversionOfConvertibleLoansMember

2024-01-01

2024-03-31

0001460602

ORGS:OptionsAndWarrantsMember

2023-01-01

2023-03-31

0001460602

ORGS:SharesUponConversionOfConvertibleLoansMember

2023-01-01

2023-03-31

0001460602

ORGS:CellProcessDevelopmentServicesAndHospitalServicesMember

2024-01-01

2024-03-31

0001460602

ORGS:CellProcessDevelopmentServicesAndHospitalServicesMember

2023-01-01

2023-03-31

0001460602

ORGS:CustomerAMember

country:US

2024-01-01

2024-03-31

0001460602

ORGS:CustomerAMember

country:US

2023-01-01

2023-03-31

0001460602

ORGS:CustomerBMember

country:US

2024-01-01

2024-03-31

0001460602

ORGS:CustomerBMember

country:US

2023-01-01

2023-03-31

0001460602

2022-01-17

2022-01-18

0001460602

2023-09-06

0001460602

ORGS:SouthernIsraelBridgingFundTwoLPMember

ORGS:MrAmirHasidimMember

2023-10-25

2023-10-26

0001460602

ORGS:MrAmirHasidimMember

2023-10-26

0001460602

ORGS:UnsecuredConvertibleNoteAgreementsMember

2023-11-01

0001460602

ORGS:ConsultationAgreementMember

2023-11-01

0001460602

us-gaap:CommonStockMember

2018-03-31

2018-03-31

0001460602

us-gaap:CommonStockMember

2018-04-30

0001460602

2023-11-01

2023-11-01

0001460602

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

iso4217:ILS

ORGS:Segment

iso4217:EUR

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Quarterly Period Ended March 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Transition Period from ___________ to ___________

Commission

file number: 001-38416

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

98-0583166 |

(State or other jurisdiction

of incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

20271

Goldenrod Lane

Germantown,

MD 20876

(Address

of principal executive offices) (Zip Code)

(480)

659-6404

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbols(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of May 20, 2024, there were 34,430,280 shares of registrant’s common stock outstanding.

ORGENESIS

INC.

FORM

10-Q

FOR

THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

TABLE

OF CONTENTS

PART

I –FINANCIAL INFORMATION

Item

1. Financial Statements

ORGENESIS

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

Dollars, in thousands, except share and per share amounts)

(Unaudited)

| | |

| | |

| |

| | |

As of | |

| | |

March 31,

2024 | | |

December 31,

2023 | |

| Assets | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 80 | | |

$ | 837 | |

| Restricted cash | |

| 485 | | |

| 642 | |

| Accounts receivable, net of credit losses of $29,760 as of March 31, 2024 ($0 as of December 31, 2023) | |

| 245 | | |

| 88 | |

| Prepaid expenses and other receivables | |

| 1,112 | | |

| 2,017 | |

| Receivables from related parties | |

| - | | |

| 458 | |

| Inventory | |

| 34 | | |

| 34 | |

| TOTAL CURRENT ASSETS | |

| 1,956 | | |

| 4,076 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Deposits | |

$ | 255 | | |

$ | 38 | |

| Investments in associates | |

| 8 | | |

| 8 | |

| Property, plant and equipment, net | |

| 16,404 | | |

| 1,475 | |

| Intangible assets, net | |

| 8,950 | | |

| 7,375 | |

| Operating lease right-of-use assets | |

| 1,804 | | |

| 351 | |

| Goodwill | |

| 1,211 | | |

| 1,211 | |

| Other assets | |

| 332 | | |

| 18 | |

| TOTAL NON-CURRENT ASSETS | |

| 28,964 | | |

| 10,476 | |

| TOTAL ASSETS | |

$ | 30,920 | | |

$ | 14,552 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS (Continued)

(U.S.

Dollars, in thousands, except share and per share amounts)

(Unaudited)

| | |

As of | |

| | |

March 31,

2024 | | |

December 31,

2023 | |

| Liabilities net of (Capital Deficiency) | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

$ | 13,707 | | |

$ | 6,451 | |

| Accounts payable related Parties | |

| 2,697 | | |

| 133 | |

| Accounts payable | |

| 2,697 | | |

| 133 | |

| Accrued expenses and other payables | |

| 4,106 | | |

| 2,218 | |

| Income tax payable | |

| 786 | | |

| 740 | |

| Employees and related payables | |

| 1,529 | | |

| 1,079 | |

| Other payable related parties | |

| - | | |

| 52 | |

| Advance payments on account of grant | |

| 2,695 | | |

| 2,180 | |

| Short-term loans | |

| 626 | | |

| 650 | |

| Current maturities of finance leases | |

| 65 | | |

| 18 | |

| Current maturities of operating leases | |

| 476 | | |

| 216 | |

| Short-term and current maturities of convertible loans | |

| 2,344 | | |

| 2,670 | |

| TOTAL CURRENT LIABILITIES | |

| 29,031 | | |

| 16,407 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Non-current operating leases | |

$ | 1,274 | | |

$ | 96 | |

| Loans payable | |

| 2,696 | | |

| - | |

| Convertible loans | |

| 20,336 | | |

| 18,967 | |

| Retirement benefits obligation | |

| 98 | | |

| - | |

| Finance leases | |

| 14 | | |

| 4 | |

| Contingent liability (see note 4) | |

| 4,643 | | |

| - | |

| Other long-term liabilities | |

| 377 | | |

| 61 | |

| TOTAL LONG-TERM LIABILITIES | |

| 29,438 | | |

| 19,128 | |

| TOTAL LIABILITIES | |

| 58,469 | | |

| 35,535 | |

| | |

| | | |

| | |

| CAPITAL DEFICIENCY: | |

| | | |

| | |

| Common stock of $0.0001 par value: Authorized at March 31, 2024 and December 31, 2023: 145,833,334

shares; Issued at March 31, 2024 and December 31, 2023: 34,625,349 and 32,163,630 shares, respectively; Outstanding at March 31,

2024 and December 31, 2023: 34,338,782 and 31,877,063 shares, respectively. | |

| 4 | | |

| 3 | |

| Additional paid-in capital | |

| 159,650 | | |

| 156,837 | |

| Receipts on account of shares to be allotted | |

| 155 | | |

| - | |

| Accumulated other comprehensive income | |

| 126 | | |

| 65 | |

| Treasury stock, 286,567 shares as of March 31, 2024 and December 31, 2023 | |

| (1,266 | ) | |

| (1,266 | ) |

| Accumulated deficit | |

| (186,386 | ) | |

| (176,622 | ) |

| Equity attributable to Orgenesis Inc. | |

| (27,717 | ) | |

| (20,983 | ) |

| Non-controlling interest | |

| 168 | | |

| - | |

| TOTAL CAPITAL DEFICIENCY | |

| (27,549 | ) | |

| (20,983 | ) |

| TOTAL LIABILITIES AND CAPITAL DEFICIENCY | |

$ | 30,920 | | |

$ | 14,552 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(U.S.

Dollars in Thousands, Except Share and Loss Per Share Amounts)

(Unaudited)

| | |

| | |

| |

| |

Three Months Ended | |

| | |

March 31, | | |

March 31, | |

| |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue | |

$ | 141 | | |

$ | 142 | |

| Cost of revenues | |

| 492 | | |

| 2,722 | |

| Gross loss | |

| (351 | ) | |

| (2,580 | ) |

| Cost of development services and research and development expenses | |

| 2,370 | | |

| 3,281 | |

| Amortization of intangible assets | |

| 153 | | |

| 207 | |

| Selling, general and administrative expenses including credit losses, net of

$3,225 and $9,489 for the three months ended March 31, 2024 and 2023 respectively | |

| 6,056 | | |

| 13,528 | |

| Operating loss | |

| 8,930 | | |

| 19,596 | |

| Loss from deconsolidation | |

| 66 | | |

| - | |

| Other income, net | |

| - | | |

| (2 | ) |

| Loss from extinguishment in connection with convertible loan | |

| 141 | | |

| 283 | |

| Credit loss on convertible loan receivable | |

| - | | |

| 2,688 | |

| Financial expenses, net | |

| 852 | | |

| 681 | |

| Share in net loss of associated companies | |

| - | | |

| 2 | |

| Tax expense | |

| 16 | | |

| 129 | |

| Net loss | |

| 10,005 | | |

| 23,377 | |

| Net income (loss) attributable to non-controlling interests (including redeemable) | |

| (240 | ) | |

| (3,907 | ) |

| Net loss attributable to Orgenesis Inc. | |

| 9,765 | | |

| 19,470 | |

| Loss per share: | |

| | | |

| | |

Basic and diluted | |

$ | 0.29 | | |

$ | 0.87 | |

| | |

| | | |

| | |

| Weighted average number of shares used in computation of Basic and Diluted loss per share: | |

| | | |

| | |

| Basic and diluted | |

| 33,176,657 | | |

| 26,477,113 | |

| | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | |

| Net loss | |

$ | 10,005 | | |

$ | 23,377 | |

| Other Comprehensive loss (income) – Translation adjustment | |

| (61 | ) | |

| 41 | |

| Comprehensive loss | |

| 9,944 | | |

| 23,418 | |

| Comprehensive loss attributed to non-controlling interests | |

| (240 | ) | |

| (3,907 | ) |

| Comprehensive loss attributed to Orgenesis Inc. | |

$ | 9,704 | | |

$ | 19,511 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(U.S.

Dollars in thousands, except share amounts)

(Unaudited)

| | |

| Number | | |

Par

Value | | |

Capital | | |

Allotted | | |

Income

(Loss) | | |

Shares | | |

Deficit | | |

Inc. | | |

Interest | | |

Total | |

| | |

| Common

Stock | | |

Additional

Paid-in | | |

Receipts

on

Account of

Shares to

be | | |

Accumulated

Other

Comprehensive | | |

Treasury | | |

Accumulated | | |

Equity

Attributed to

Orgenesis | | |

Non-

Controlling | | |

| |

| | |

| Number | | |

Par

Value | | |

Capital | | |

Allotted | | |

Income

(Loss) | | |

Shares | | |

Deficit | | |

Inc. | | |

Interest | | |

Total | |

| Balance at January 1, 2024 | |

| 31,877,063 | | |

$ | 3 | | |

$ | 156,837 | | |

$ | - | | |

$ | 65 | | |

$ | (1,266 | ) | |

$ | (176,622 | ) | |

| (20,983 | ) | |

$ | - | | |

$ | (20,983 | ) |

| Changes during the three months ended March 31, 2024: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| - | | |

| - | | |

| 86 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 86 | | |

| - | | |

| 86 | |

| Issuance of Shares and warrants to service providers | |

| 164,000 | | |

| -* | | |

| 226 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 226 | | |

| - | | |

| 226 | |

| Issuance of shares and receipts on account of shares and

warrants to be allotted | |

| 2,272,719 | | |

| -* | | |

| 2,341 | | |

| 155 | | |

| - | | |

| - | | |

| - | | |

| 2,496 | | |

| - | | |

| 2,496 | |

| NCI arising from Octomera reconsolidation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 408 | | |

| 408 | |

| Issuance of Shares due to exercise of warrants | |

| 25,000 | | |

| -* | | |

| 19 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 20 | | |

| - | | |

| 20 | |

| Extinguishment in connection with convertible loan restructuring | |

| - | | |

| - | | |

| 141 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 141 | | |

| - | | |

| 141 | |

| Comprehensive income (loss) for

the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| 61 | | |

| - | | |

| (9,765 | ) | |

| (9,704 | ) | |

| (240 | ) | |

| (9,944 | ) |

| Balance at March 31, 2024 | |

| 34,338,782 | | |

$ | 4 | | |

$ | 159,650 | | |

$ | 155 | | |

$ | 126 | | |

$ | (1,266 | ) | |

$ | (186,386 | ) | |

$ | (27,717 | ) | |

$ | 168 | | |

$ | (27,549 | ) |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(U.S.

Dollars in thousands, except share amounts)

(Unaudited)

| | |

| Number | | |

Par

Value

| | |

Capital

| | |

(Loss)

| | |

Shares | | |

Deficit

| | |

Inc.

| | |

Interest

| | |

Total | |

| | |

| Common

Stock | | |

Additional

Paid-in | | |

Accumulated

Other

Comprehensive

Income | | |

Treasury | | |

Accumulated | | |

Equity

Attributed

to

Orgenesis | | |

Non-

Controlling | | |

| |

| | |

| Number | | |

Par

Value

| | |

Capital

| | |

(Loss)

| | |

Shares | | |

Deficit

| | |

Inc.

| | |

Interest

| | |

Total | |

| Balance

at January 1, 2023 | |

| 25,545,755 | | |

$ | 3 | | |

$ | 150,355 | | - |

$ | (270 | ) | |

$ | (1,266 | ) | |

$ | (121,261 | ) | |

$ | 27,561 | | |

$ | 1,510 | | |

$ | 29,071 | |

| Balance | |

| 25,545,755 | | |

$ | 3 | | |

$ | 150,355 | | - |

$ | (270 | ) | |

$ | (1,266 | ) | |

$ | (121,261 | ) | |

$ | 27,561 | | |

$ | 1,510 | | |

$ | 29,071 | |

| Changes during

the three months ended March 31, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stock-based

compensation | |

| - | | |

| - | | |

| 159 | | - |

| - | | |

| - | | |

| - | | |

| 159 | | |

| - | | |

| 159 | |

| Issuance of shares and warrants | |

| 1,947,368 | | |

| -* | | |

| 3,441 | | - |

| - | | |

| - | | |

| - | | |

| 3,441 | | |

| - | | |

| 3,441 | |

| Issuance of Shares due to exercise

of warrants | |

| 368,420 | | |

| -* | | |

| - | | |

| - | | |

| - | | |

| - | | |

|

-* | | |

| - | | |

| -* | |

| Issuance of

warrants with respect to convertible loans | |

| - | | |

| - | | |

| 449 | | |

| - | | |

| - | | |

| - | | |

| 449 | | |

| - | | |

| 449 | |

| Extinguishment

in connection with convertible loan restructuring | |

| - | | |

| - | | |

| 287 | | |

| - | | |

| - | | |

| - | | |

| 287 | | |

| - | | |

| 287 | |

| Adjustment

to redemption value of redeemable non-controlling interest | |

| - | | |

| - | | |

| (3,671 | ) | |

| - | | |

| - | | |

| - | | |

| (3,671 | ) | |

| - | | |

| (3,671 | ) |

| Comprehensive

loss for the period | |

| - | | |

| - | | |

| - | | - |

| (41 | ) | |

| - | | |

| (19,470 | ) | |

| (19,511 | ) | |

| (236 | ) | |

| (19,747 | ) |

| Balance

at March 31, 2023 | |

| 27,861,543 | | |

$ | 3 | | |

$ | 151,020 | | - |

$ | (311 | ) | |

$ | (1,266 | ) | |

$ | (140,731 | ) | |

$ | 8,715 | | |

$ | 1,274 | | |

$ | 9,989 | |

| Balance | |

| 27,861,543 | | |

$ | 3 | | |

$ | 151,020 | | - |

$ | (311 | ) | |

$ | (1,266 | ) | |

$ | (140,731 | ) | |

$ | 8,715 | | |

$ | 1,274 | | |

$ | 9,989 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(U.S.

Dollars in thousands)

(Unaudited)

| | |

2024 | | |

2023 | |

| | |

Three Months Ended | |

| | |

March 31, | | |

March 31, | |

| | |

2024 | | |

2023 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (10,005 | ) | |

$ | (23,377 | ) |

| Adjustments required to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 312 | | |

| 159 | |

| Loss from deconsolidation of OBI | |

| 66 | | |

| - | |

| Share in loss of associated entities, net | |

| - | | |

| 2 | |

| Depreciation and amortization expenses | |

| 381 | | |

| 578 | |

| Credit loss on Convertible Loan receivable | |

| - | | |

| 2,688 | |

| Credit loss related to OBI | |

| 2,049 | | |

| - | |

| Effect of exchange differences on inter-company balances | |

| (200 | ) | |

| 179 | |

| Net changes in operating leases | |

| (8 | ) | |

| (47 | ) |

| Change in interest expenses accrued on loans and convertible loans | |

| 637 | | |

| (274 | ) |

| Loss from extinguishment in connection with convertible loan restructuring | |

| 141 | | |

| 283 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (74 | ) | |

| 14,790 | |

| Prepaid expenses and other accounts receivable | |

| 1,438 | | |

| (2,183 | ) |

| Inventory | |

| - | | |

| (10 | ) |

| Other assets | |

| (1 | ) | |

| 2 | |

| Accounts payable | |

| 502 | | |

| (59 | ) |

| Accrued expenses and other payables | |

| 442 | | |

| 24 | |

| Employee and related payables | |

| (119 | ) | |

| 2 | |

| Deferred taxes, net | |

| (2 | ) | |

| 3 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

$ | (4,441 | ) | |

$ | (7,240 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (204 | ) | |

| (1,285 | ) |

| Cash acquired from acquisition of Octomera | |

| 139 | | |

| - | |

| Impact to cash resulting from deconsolidation

of OBI | |

| (5 | ) | |

| - | |

| Investment in long-term deposits | |

| 2 | | |

| (22 | ) |

| Net cash used in investing activities | |

$ | (68 | ) | |

$ | (1,307 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from issuance of shares and warrants net of transaction costs | |

| 2,360 | | |

| 3,441 | |

| Proceeds from issuance of convertible loans | |

| 75 | | |

| 5,485 | |

| Proceeds from receipts on account of shares to be allotted | |

| 155 | | |

| - | |

| Repayment of convertible loans and convertible bonds | |

| - | | |

| (3,000 | ) |

| Repayment of short and long-term debt | |

| (33 | ) | |

| (16 | ) |

| Proceeds from issuance of loans payable | |

| 307 | | |

| - | |

| Receipt from Germfree (see note 1 a) | |

| 750 | | |

| - | |

| Net cash provided by financing activities | |

$ | 3,614 | | |

$ | 5,910 | |

| | |

| | | |

| | |

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

$ | (895 | ) | |

$ | (2,637 | ) |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS AND RESTRICTED CASH | |

| (19 | ) | |

| (1 | ) |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF

PERIOD | |

| 1,479 | | |

| 6,369 | |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | |

$ | 565 | | |

$ | 3,731 | |

| | |

| | | |

| | |

| SUPPLEMENTAL NON-CASH FINANCING AND INVESTING ACTIVITIES | |

| | | |

| | |

| Right-of-use assets obtained in exchange for new operation lease liabilities | |

$ | - | | |

$ | 753 | |

| Increase (decrease) in accounts payable related to purchase of property, plant and equipment | |

$ | - | | |

$ | 14 | |

| Extinguishment in connection with convertible loan restructuring | |

$ | 141 | | |

$ | 287 | |

| | |

| | | |

| | |

| CASH PAID DURING THE YEAR FOR: | |

| | | |

| | |

| Interest | |

$ | - | | |

$ | 785 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

ORGENESIS

INC.

NOTES

TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For

the Three Months Ended March 31, 2024 and 2023

(Unaudited)

(U.S.

Dollars in thousands, except share amounts)

NOTE

1 – DESCRIPTION OF BUSINESS

Orgenesis

Inc. (the “Company”) is a global biotech company working to unlock the potential of Cell and Gene Therapies (“CGTs”)

in an affordable and accessible format. CGTs can be centered on autologous (using the patient’s own cells) or allogenic (using

master banked donor cells) and are part of a class of medicines referred to as advanced therapy medicinal products (“ATMPs”).

The Company is mostly focused on the development of autologous therapies that can be manufactured under processes and systems that are

developed for each therapy using a closed and automated approach that is validated for compliant production near the patient for treatment

of the patient at the point of care (“POCare”).

As

of the date of this report, the Company operates two segments:

| |

● |

The

“Octomera” segment which includes the Company’s POCare Services that are performed in decentralized hubs which

provide harmonized and standardized services to customers (“POCare Centers”). The Company’s subsidiary, Octomera

LLC, holds all of the Octomera segment activities. |

| |

● |

The

“Therapies” segment which includes therapies related activities. |

On

January 29, 2024, the Company and Metalmark Capital Partners (“Metalmark” or “MM”) entered into a Unit Purchase

Agreement (the “MM UPA”), pursuant to which the Company acquired all of the preferred units of Octomera LLC (“Octomera”)

previously owned by MM (the “MM Acquisition”), and effective that date, reconsolidated Octomera into its accounts. The Company

currently owns 100% of the equity interests of Octomera. The Company had previously, from June 30, 2023 (“date of deconsolidation”),

deconsolidated Octomera from its consolidated financial statements and had recorded its equity interest in Octomera as an equity method

investment.

These

consolidated financial statements include the accounts of Orgenesis Inc. and its subsidiaries.

The

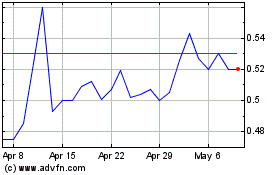

Company’s common stock, par value $0.0001 per share (the “Common Stock”), is listed and traded on the Nasdaq Capital

Market under the symbol “ORGS.” The Company must satisfy Nasdaq’s continued listing requirements, including, among

other things, a minimum closing bid price requirement of $1.00 per share for 30 consecutive business days. Because the Company’s

Common Stock has traded for 30 consecutive business days below the $1.00 minimum closing bid price requirement, Nasdaq sent a deficiency

notice to the Company. On April 17, 2024, the Company received a notice (the “Notice”) from Nasdaq stating that the Company’s

securities would be delisted from The Nasdaq Capital Market unless the Company timely requests a hearing before a Nasdaq Hearings Panel

(the “Panel”) to address the deficiencies and present a plan to regain compliance. As permitted by the Notice, the Company

has requested a hearing before the Panel, which request will stay any further delisting action by the Staff pending the ultimate outcome

of the hearing and the expiration of any extension that may be granted by the Panel. The Company’s common stock has remained listed

and eligible for trading on Nasdaq at least pending the ultimate conclusion of the hearing process.

As

used in this report and unless otherwise indicated, the term “Company” refers to Orgenesis Inc. and its Subsidiaries. Unless

otherwise specified, all amounts are expressed in United States Dollars.

Through

March 31, 2024, the Company had an accumulated deficit of $186,386

and for the three months ended March 31, 2024 incurred negative operating cashflows of $4,441. The Company’s activities have been

funded by generating revenue, through offerings of its securities, and through proceeds from loans. There is no assurance that the

Company’s business will generate sustainable positive cash flows to fund its activities.

The

Company will need to use mitigating actions such as to seek additional financing, refinance or amend the terms of existing loans or postpone

expenses that are not based on firm commitments. In order to fund its operations, until such time that we can generate sustainable positive

cash flows, the Company will need to raise additional funds. For the three months ended March 31, 2024 and as of the date of this report,

the Company assessed its financial condition and concluded that based on current and projected cash resources and commitments, as well

as other factors mentioned above, there is a substantial doubt about its ability to continue as a going concern. The Company is planning

to raise additional capital to continue its operations and to repay its outstanding loans when they become due, as well as to explore

additional avenues to increase revenues and reduce or delay expenditures. The Company may also exchange some of its outstanding loans

and accounts payable for securities of the Company. There can be no assurance that the Company will be able to raise additional capital

on acceptable terms, or at all, or be able to exchange its outstanding loans and accounts payable for securities of the Company.

The

Company’s common stock is listed for trading on the Nasdaq Capital Market. As mentioned above, the Company must satisfy Nasdaq’s

continued listing requirements. Failure to meet continuing listing requirements risk delisting, which may make it more difficult to raise

additional capital.

On

April 5, 2024, the Company entered into an Asset Purchase and Strategic Collaboration Agreement (the “Purchase

Agreement”) with Griffin Fund 3 BIDCO, Inc., (“Germfree”), for the sale by the Company of five Orgenesis

Mobile Processing Units and Labs (“OMPULs”) to Germfree, which will be incorporated into Germfree’s lease

fleet and leased back to the Company or third-party lessees designated by the Company. Pursuant to the Purchase Agreement, and upon

the terms and subject to the conditions set forth therein, in consideration for the purchase of the OMPULs, the Orgenesis Quality

Management Systems Framework (“OQMSF”) and related intellectual property rights, Germfree will pay an aggregate purchase

price of $8,340

subject to any final adjustment through the verification mechanism as set forth in the Purchase Agreement. Pursuant to the

Agreement, Germfree paid the Company $750

(for an exclusive manufacturing supply agreement) on February 27, 2024 and $5,538

during April 2024.

On

May 10, 2024, the Company entered into a Securities Purchase Agreement with certain accredited investors, pursuant to which the Company

agreed to issue and sell, in a private placement, 150,000 shares of the Company’s common stock, par value $0.0001 per share, at

a purchase price of $1.03 per share, and warrants to purchase up to 150,000 shares of Common Stock at an exercise price of $1.50 per

share and warrants to purchase up to 150,000 shares of Common Stock at an exercise price of $2.00 per share (collectively, the “Warrants”).

The Company received gross proceeds of approximately $154 before deducting related offering expenses. The Offering closed on May 10,

2024. The Warrants are exercisable immediately and expire five years from the date of issuance.

The

estimation and execution uncertainty regarding the Company’s future cash flows and management’s judgments and assumptions

in estimating these cash flows is a significant estimate. Those assumptions include reasonableness of the forecasted revenue, operating

expenses, and uses and sources of cash.

NOTE

2 – BASIS OF PRESENTATION

a. Basis of presentation

The

accompanying unaudited condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial

statements. In the opinion of management, the financial statements reflect all normal and recurring adjustments necessary to fairly state

the financial position and results of operations of the Company. The information included in this Quarterly Report on Form 10-Q should

be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (“SEC”) on April

15, 2024. The year-end balance sheet data was derived from the audited consolidated financial statements as of December 31, 2023, but

not all disclosures required by generally accepted accounting principles in the United States (“U.S. GAAP”) are included

in this Quarterly Report on Form 10-Q.

Use

of Estimates in the Preparation of Financial Statements

The

preparation of the Company’s consolidated financial statements in conformity with U.S. GAAP requires us to make estimates,

judgments and assumptions that may affect the reported amounts of assets, liabilities, equity, revenues and expenses and related

disclosure of contingent assets and liabilities. On an ongoing basis, the Company evaluates its estimates, judgments and

methodologies. The Company bases its estimates on historical experience and on various other assumptions that it believes are

reasonable, the results of which form the basis for making judgments about the carrying values of assets, liabilities and equity,

the amount of revenues and expenses, determination of loss on deconsolidation, valuation of investments, purchase price allocations,

goodwill impairment, and assessment of credit losses. Actual results could differ from those estimates.

NOTE

3 – SEGMENT INFORMATION

Segment

data for the three months ended March 31, 2024 is as follows:

SCHEDULE OF SEGMENT REPORTING

| | |

Octomera | | |

Therapies | | |

Eliminations | | |

Consolidated | |

| | |

(in thousands) | |

| Revenues | |

$ | 29 | | |

$ | 135 | | |

$ | (23 | ) | |

$ | 141 | |

| Cost of revenues* | |

| (937 | ) | |

| (150 | ) | |

| 710 | | |

| (377 | ) |

| Gross profit | |

| (908 | ) | |

| (15 | ) | |

| 687 | | |

| (236 | ) |

| Cost of development services and research and development expenses* | |

| (1,785 | ) | |

| (1,179 | ) | |

| 697 | | |

| (2,267 | ) |

| Operating expenses* | |

| (63 | ) | |

| (5,519 | ) | |

| (464 | ) | |

| (6,046 | ) |

| Loss from deconsolidation | |

| - | | |

| - | | |

| (66 | ) | |

| (66 | ) |

| Depreciation and amortization | |

| (430 | ) | |

| (194 | ) | |

| 243 | | |

| (381 | ) |

| Loss from extinguishment in connection with convertible loan | |

| - | | |

| (141 | ) | |

| - | | |

| (141 | ) |

| Financial income (expenses), net | |

| (290 | ) | |

| (686 | ) | |

| 124 | | |

| (852 | ) |

Segment

data for the three months ended March 31, 2023 is as follows:

| | |

Octomera | | |

Therapies | | |

Eliminations | | |

Consolidated | |

| | |

(in thousands) | |

| Revenues | |

$ | 12 | | |

$ | 130 | | |

$ | - | | |

$ | 142 | |

| Cost of revenues* | |

| (2,308 | ) | |

| (178 | ) | |

| - | | |

| (2,486 | ) |

| Gross profit | |

| (2,296 | ) | |

| (48 | ) | |

| - | | |

| (2,344 | ) |

| Cost of development services and research and development expenses* | |

| (2,081 | ) | |

| (1,076 | ) | |

| - | | |

| (3,157 | ) |

| Operating expenses* | |

| (11,203 | ) | |

| (2,314 | ) | |

| - | | |

| (13,517 | ) |

| Other income, net | |

| 2 | | |

| - | | |

| - | | |

| 2 | |

| Depreciation and amortization | |

| (385 | ) | |

| (193 | ) | |

| - | | |

| (578 | ) |

| Credit loss on convertible loan receivable | |

| - | | |

| (2,688 | ) | |

| - | | |

| (2,688 | ) |

| Loss from extinguishment in connection with convertible loan | |

| - | | |

| (283 | ) | |

| - | | |

| (283 | ) |

| Financial Expenses, net | |

| (266 | ) | |

| (415 | ) | |

| - | | |

| (681 | ) |

| Financial income (expenses), net | |

| (266 | ) | |

| (415 | ) | |

| - | | |

| (681 | ) |

| Share in net income of associated companies | |

| - | | |

| (2 | ) | |

| - | | |

| (2 | ) |

The

Company does not review assets by segment. Therefore, the measure of assets has not been disclosed for each segment.

NOTE

4 – RECONSOLIDATION OF OCTOMERA LLC

Pursuant

to the MM UPA signed on January 29, 2024, the Company and MM agreed to the following:

| |

● |

Royalty

Payments: If Octomera and its subsidiaries generate Net Revenue during the three year period 2025-2027, then the Company will pay

5% of Net Revenues to MM pursuant to the MM UPA. |

| |

|

|

| |

● |

Milestone

Payments: If the Company sells Octomera within ten years from the date of the Closing at a price that is more than $40 million excluding

consideration for certain Excluded Assets as per the UPA, the Company shall pay Seller 5% of the net proceeds. |

| 2. | MM’s

designated members of the Board of Managers of Octomera resigned and the Company amended

the Second Amended and Restated Limited Liability Company Agreement of Octomera (the “Octomera LLC Agreement”) to be a single member agreement

reflecting the transactions consummated under the UPA, such that MM no longer (i) is member of Octomera or a party to the Octomera

LLC Agreement, or (ii) has a right to appoint members of the board of managers of Octomera. |

| 3. | The

outstanding indebtedness payable from Orgenesis Maryland LLC to MM pursuant to an aggregate

of 10 secured promissory notes (the “Notes”) with a collective original principal

amount of $2,600, were amended to, among other things, extend the maturity thereof to January

29, 2034 and to terminate the security interest granted by Orgenesis Maryland in favor of

MM that secured the obligations under the Notes. |

Fair

Value of Consideration Transferred

Accounting

guidance provides that the allocation of the purchase price may be adjusted for up to one year from the date of the

acquisition to the extent that additional information is obtained about the facts and circumstances that existed as of the acquisition

date. The primary area of the purchase price allocation that is not yet finalized is related to intangible assets, property,

plant and equipment, and certain other assets and tax matters and the related impact on goodwill.

In

evaluating the fair value of the Octomera Equity Investment under the income approach, the Company used a discounted cash flow model

of the business, adjusted to the Company’s share in the investment. Key assumptions used to determine the estimated fair value included:

(a) internal cash flows forecasts for 5 years following the assessment date, including expected revenue growth, costs to produce, operating

profit margins and estimated capital needs; (b) an estimated terminal value using a terminal year long-term future growth determined

based on the growth prospects of the reporting units; and (c) a discount rate which reflects the weighted average cost of capital adjusted

for the relevant risk associated with the Company’s reporting unit operations and the uncertainty inherent in the Company’s

internally developed forecasts. The allocation of the purchase price to the net assets acquired and liabilities assumed resulted in the

recognition of other intangible assets, net, which comprised of technology. The useful life of the technology for amortization purposes

was determined by considering the period of expected cash flows generated by the assets used to measure the fair value of the intangible

assets, adjusted as appropriate for the entity-specific factors including legal, regulatory, contractual, competitive, economic, or other

factors that may limit the useful life of intangible assets.

The

following table summarizes the allocation of purchase price to the fair values of the assets acquired and liabilities assumed as

of the Transaction date:

SCHEDULE OF PURCHASE PRICE TO THE FAIR VALUES OF THE ASSETS ACQUIRED AND LIABILITIES ASSUMED

| | |

(in thousands) | |

| Total contingent liability to MM for royalty and milestone payments | |

$ | 4,643 | |

| | |

| | |

| Total assets acquired: | |

| | |

| Cash and cash equivalents | |

$ | 139 | |

| Property, plants and equipment, net | |

| 17,852 | |

| Other Assets | |

| 3,478 | |

| Total assets | |

$ | 21,469 | |

| | |

| | |

| Total liabilities assumed: | |

| | |

| Total current liabilities | |

$ | (12,518 | ) |

| Total long-term liabilities | |

| (5,628 | ) |

| Total liabilities | |

$ | (18,146 | ) |

| | |

| | |

| Know how Technology | |

| 1,728 | |

| | |

| | |

| Total Net Assets | |

$ | 5,051 | |

| Fair-Value of Non-controlling interests | |

| (408 | ) |

| Total liability to MM | |

$ | 4,643 | |

The allocation of the purchase price to the net assets acquired and liabilities

assumed resulted in the recognition of an intangible asset know-how of $1,728 and a liability to MM in the amount of $4,643. The know-how

has a useful life of 10 years. The useful life of the intangible asset for amortization purposes was determined considering the period

of expected cash flows generated by the assets used to measure the fair value of the intangible asset adjusted as appropriate for the

entity-specific factors, including legal, regulatory, contractual, competitive, economic or other factors that may limit the useful life

of intangible assets.

Key inputs for the fair values valuation are summarized below.

SCHEDULE OF

KEY INPUTS FOR THE FAIR VALUES VALUATION

| | |

| | |

| Key Valuation Inputs | |

Jan 31st, 2024 | |

| Discount rate | |

| 40 | % |

| Risk-free interest rate | |

| 4.4 | % |

| Average 5 years revenue growth | |

| 50 | % |

The Company incurred transaction costs of approximately $50 during the three months ended March 31, 2024, which were included in general

and administrative expenses in the condensed consolidated statements of operations.

The

revenues and net loss of Octomera from January 1, 2024 until the reconsolidation date were $23

and $1,244

respectively.

Fair

Value Assumptions Used in Accounting for Derivative Liabilities

ASC

815 requires assessing the fair market value of derivative liabilities at the end of each reporting period and recognize any change in

the fair market value as other income or expense.

In

January 29, 2024, in connection with the PPA study Octomera LLC the Company has recognize a liability to pay MM two components:

1.

Royalties (based on revenues in years 2, 4 and 4 as of Closing and;

2.

Earnout amount, which is dependent of a future trigger event- in case of an IPO or exit.

The

Company classified these derivative liabilities as a Level 3 fair value measurement and used the Monte Carlo pricing model to calculate

the fair value as of January 29, 2024 and March 31, 2024 $5,112.

Key

inputs for the simulation are summarized below.

SCHEDULE

OF KEY INPUTS

| Key Valuation Inputs | |

Jan 31st, 2024 and March 31 2024 | |

| Standard Deviation | |

| 13.5 | % |

| Risk-free interest rate | |

| 4.4 | % |

| Possible trigger event examination | |

| Year 10 | |

| Average 5 years revenue growth | |

| 50 | % |

| Trigger events | |

| 30 | % |

| Revenues multiple | |

| 10 | |

| * |

Based on a Monte Carlo simulation analysis of 30,000 iterations |

Deconsolidation

of Orgenesis Biotech Israel Limited (“OBI”)

On

February 14, 2024, following a claim for payment of past salaries due by employees of OBI, a fully owned subsidiary of Octomera, the

district court in Haifa, Israel, appointed a trustee to run the affairs of OBI with the intention of rehabilitating OBI to be able to

operate and pay OBI’s creditors under an arrangement with them. As a result of this appointment, effective February 14, 2024, the

Company no longer controls OBI and ceased to consolidate the results of OBI into its consolidated results. The Company recognized a loss

as a result of the deconsolidation of $66 . The Company does not currently believe that rehabilitation is possible and has submitted

a proposal to the trustee to purchase certain of OBI’s equipment, which has not yet been approved by the court.

The Company recorded $2,697 being what it owed to OBI on February 14, 2024

under Accounts payable related Parties on the balance sheet of March 31, 2024.

The

following table summarizes the deconsolidate assets and liabilities as of February 14, 2024:

SCHEDULE

OF DECONSOLIDATE ASSETS AND LIABILITIES

| | |

| | |

| Total assets acquired: | |

| | |

| Cash and cash equivalents | |

$ | 4 | |

| Property, plants and equipment, net | |

| 2,884 | |

| Other Assets | |

| 1,422 | |

| Total assets | |

$ | 4,310 | |

| | |

| | |

| Total liabilities assumed: | |

$ | 4,244 | |

| Total Net Assets deconsolidated | |

$ | 66 | |

| Loss from deconsolidation of OBI | |

$ | 66 | |

NOTE

5 – EQUITY

Private

Placement Offering

On

March 3, 2024, the Company entered into a Securities Purchase Agreement with certain accredited investors, pursuant to which the Company

agreed to issue and sell, in a private placement, 2,272,719 shares of the Company’s common stock, par value $0.0001 per share,

at a purchase price of $1.03 per share, and warrants to purchase up to 2,272,719 shares of Common Stock at an exercise price of $1.50

per share and warrants to purchase up to 2,272,719 shares of Common Stock at an exercise price of $2.00 per share (collectively, the

“Warrants”), all such Warrants exercisable immediately and expiring five years from

their date of issuance. The Company received gross proceeds of approximately $2.3 million before deducting related offering expenses.

The Offering closed on March 5, 2024. The Warrants are exercisable immediately and expire five years from the date of issuance.

Shares

and warrants issued to advisors

On

January 25, 2024, the Company issued, pursuant to the MM acquisition, 164,000 shares of the Company’s common stock, par value $0.0001

per share, in full consideration for a debt owed by Octomera to said advisor.

On

March 7, 2024 (the “Effective Date”), the Company entered into a strategic advisor agreement with an individual relating

to the provision of strategic advice and assistance to the Company for a term of 12 months, subject to earlier termination or extension

for an additional 12 months at the request of the advisor. In consideration for such services, the Company agreed to (i) pay such individual

$75 per quarter, (ii) issue 500,000 shares to such individual on the 90th day after the Effective Date if such individual

is providing services to the Company at such time and (iii) issue to such individual warrants to purchase up to 500,000 shares of Common

Stock at an exercise price of $1.03, which vests one third on the Effective Date, one third on the 90th day after the Effective

Date and one third on the 180th day after the Effective Date.

NOTE

6 – CONVERTIBLE LOANS

The

tables below summarize the Company’s outstanding convertible loans as of March 31, 2024 and December 31, 2023 respectively:

SCHEDULE OF LONG TERM CONVERTIBLE NOTES

| Principal Amount | | |

Issuance

Date | | |

Current

Interest

| | |

Current

Maturity | | |

Current

Conversion

Price of

loan into | | |

| |

| at Issuance | | |

(Year) | | |

Rate % | | |

(Year) | | |

equity $ | | |

Note | |

| Convertible Loans Outstanding as of March 31, 2024 | |

| $ | 750 | | |

| 2018 | | |

| 10 | % | |

| 2026 | | |

| 2.50 | | |

| | |

| | 1,500 | | |

| 2019 | | |

| 10 | % | |

| 2026 | | |

| 2.50 | | |

| | |

| | 100 | | |

| 2019 | | |

| 8 | % | |

| *2024 | | |

| 2.50 | | |

| | |

| | 5,000 | | |

| 2019 | | |

| 10 | % | |

| 2026 | | |

| 2.50 | | |

| | |

| | 100 | | |

| 2020 | | |

| 8 | % | |

| *2024 | | |

| 7.00 | | |

| | |

| | 5,000 | | |

| 2022 | | |

| 10 | % | |

| 2026 | | |

| 2.50 | | |

| | |

| | 1,150 | | |

| 2022 | | |

| 6 | % | |

| *2023 | | |

| 4.50 | | |

| | |

| | 5,000 | | |

| 2023 | | |

| 8 | % | |

| 2026 | | |

| 2.46 | | |

| | |

| | 735 | | |

| 2023 | | |

| 8 | % | |

| 2026 | | |

| 0.85 | | |

| 6a |

| | 325 | | |

| 2024 | | |

| 8 | % | |

| 2024 | | |

| 0.85 | | |

| 6b |

| | 75 | | |

| 2024 | | |

| 10 | % | |

| 2024 | | |

| 1.03 | | |

| | |

| $ | 19,735 | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Principal |

|

|

Issuance

Date |

|

|

Current

Interest

|

|

|

Current

Maturity |

|

|

Current

Conversion

Price of

loan into |

|

|

|

|

| Amount |

|

|

(Year) |

|

|

Rate % |

|

|

(Year) |

|

|

equity $ |

|

|

Note |

|

| Convertible

Loans Outstanding as of December 31, 2023 |

|

| $ |

750 |

|

|

|

2018 |

|

|

|

10 |

% |

|

|

2026 |

|

|

|

2.50 |

|

|

|

|

|

| |

1,500 |

|

|

|

2019 |

|

|

|

10 |

% |

|

|

2026 |

|

|

|

2.50 |

|

|

|

|

|

| |

100 |

|

|

|

2019 |

|

|

|

8 |

% |

|

|

2024 |

|

|

|

2.50 |

|

|

|

|

|

| |

5,000 |

|

|

|

2019 |

|

|

|

10 |

% |

|

|

2026 |

|

|

|

2.50 |

|

|

|

|

|

| |

100 |

|

|

|

2020 |

|

|

|

8 |

% |

|

|

2024 |

|

|

|

7.00 |

|

|

|

|

|

| |

5,000 |

|

|

|

2022 |

|

|

|

10 |

% |

|

|

2026 |

|

|

|

2.50 |

|

|

|

|

|

| |

1,150 |

|

|

|

2022 |

|

|

|

6 |

% |

|

|

**2023 |

|

|

|

4.50 |

|

|

|

|

|

| |

5,000 |

|

|

|

2023 |

|

|

|

8 |

% |

|

|

2026 |

|

|

|

2.46 |

|

|

|

|

|

| |

735 |

|

|

|

2023 |

|

|

|

8 |

% |

|

|

2024 |

|

|

|

|

|

|

|

6a |

|

| $ |

19,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

notes related to changes in convertible loans terms that occurred in 2024

6a.

In January 2024, the Company and Lender agreed to extend the maturity date of the loan amount to December 31, 2026. The Company awarded

warrants to purchase 840,000 of the Company’s Common Stock at a price of $0.85 per share. Based on its analysis, the Company concluded

that the change in terms referred to above should be accounted for as an extinguishment.

6b.

In January 2024, the Company and Lender agreed to extend the maturity date of a previously non-convertible loan amount to December 31,

2024. The Company awarded warrants to purchase 360,000 of the Company’s Common Stock at a price of $0.85 per share and granted

Lender the right to convert any part of the Outstanding amount into Common Stock of the Company at the conversion rate of $0.85 per share.

Based on its analysis, the Company concluded that the change in terms referred to above should be accounted for as a modification.

Koligo

convertible loan

On

September 29, 2023, Koligo entered into a convertible loan agreement with Sai Traders (the “Lender”), pursuant to which the

Lender agreed to loan the Borrower up to $25,000 (the “Sai Convertible Loan”). As of the date of this quarterly report on

Form 10-Q, none of the Sai Convertible Loan was received by the Company .

NOTE

7 – STOCK-BASED COMPENSATION

| a. | Options

Granted to Employees |

The

table below summarizes the terms of options for the purchase of shares in the Company granted to employees during the period from January

1, 2024 to March 31, 2024:

SCHEDULE OF EMPLOYEE STOCK OWNERSHIP PLAN DISCLOSURES

| | | |

No. of

Options

Granted | | |

Exercise

Price | | |

Vesting Period | |

Fair Value at

Grant

(in thousands) | | |

Expiration

Period | |

| Employees | | |

| 200,000 | | |

$ | 0.5 | | |

Quarterly over a period of two years | |

$ | 67 | | |

| 10 years | |

The

fair valuation of these option grants is based on the following assumptions:

SCHEDULE OF STOCK OPTIONS ACTIVITY

| | |

During the Period from

January 1, 2024 to

March 31, 2024 | |

| Value of one common share | |

$ | 0.49 | |

| Dividend yield | |

| 0 | % |

| Expected stock price volatility | |

| 79 | % |

| Risk free interest rate | |

| 3.86 | % |

| Expected term (years) | |

| 5.56 | |

NOTE

8 –LOANS

The

table below summarizes the Company’s outstanding Long-term loans as of March 31, 2024 and December 31, 2023, respectively:

SCHEDULE OF LONG TERM LOANS

Principal

Amount | |

Interest

Rate | | |

Year of

Maturity | | |

March 31,

2024 | | |

December 31,

2023 | |

| (in thousands) | |

% | | |

| | |

(in thousands) | |

| $ |

2,600 | |

| 10 | | |

| 2034 | | |

$ | 2,696 | | |

$ | - | |

See

note 4.

The

table below summarizes the Company’s outstanding short-term loans as of March 31, 2024 and December 31, 2023, respectively:

SCHEDULE OF SHORT TERM LOANS

| Currency | | |

Interest

Rate | | |

March 31,

2024 | | |

December 31,

2023 | |

| | | |

% | | |

(in thousands) | |

| USD | | |

| 8 | | |

$ | 263 | | |

$ | 258 | |

| USD | | |

| 10 | | |

| 42 | | |

| 41 | |

| USD | | |

| 10 | | |

| 250 | | |

| - | |

| USD | | |

| 10 | | |

| 57 | | |

| - | |

| USD | | |

| (*)8 | | |

| (**)- | | |

| 331 | |

| USD | | |

| 10 | | |

| - | | |

| 20 | |

| Euro | | |

| 8 | | |

| 14 | | |

| - | |

| | | |

| | | |

$ | 626 | | |

$ | 650 | |

NOTE

9 – LOSS PER SHARE

The

following table sets forth the calculation of basic and diluted loss per share for the period indicated:

SCHEDULE OF BASIC AND DILUTED LOSS PER SHARE

|

|

March 31,

2024 | | |

March 31,

2023 | |

|

| Three Months Ended | |

|

|

March 31,

2024 | | |

March 31,

2023 | |

|

|

| (in

thousands, except per share data) | |

| Basic and diluted: |

|

| | | |

| | |

| Net loss attributable to Orgenesis Inc. |

|

$ | 9,765 | | |

$ | 19,470 | |

| Adjustment of redeemable non-controlling interest to redemption amount |

|

| - | | |

| 3,671 | |

| Net loss attributable to Orgenesis Inc. for loss per share |

|

$ | 9,765 | | |

$ | 23,141 | |

| Weighted average number of common shares outstanding |

|

| 33,176,657 | | |

| 26,477,113 | |

| Net loss per share |

|

$ | 0.29 | | |

$ | 0.87 | |

For

the three months ended March 31, 2024 and March 31, 2023, all outstanding convertible notes, options and warrants have been excluded

from the calculation of the diluted net loss per share since their effect was anti-dilutive. Diluted loss per share does not include

11,513,836 shares underlying outstanding options and warrants and 8,270,398 shares upon conversion of convertible loans for the three

months ended March 31, 2024, because the effect of their inclusion in the computation would be antidilutive. Diluted loss per share does

not include 8,620,224 shares underlying outstanding options and warrants and 6,987,879 shares upon conversion of convertible loans for

the three months ended March 31, 2023, because the effect of their inclusion in the computation would be antidilutive.

NOTE

10 – REVENUES

Disaggregation

of Revenue

The

following table disaggregates the Company’s revenues by major revenue streams.

SCHEDULE OF DISAGGREGATION OF REVENUE

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

(in thousands) | |

| Revenue stream: | |

| | | |

| | |

| Cell process development services and hospital services | |

$ | 141 | | |

$ | 142 | |

| | |

| | | |

| | |

| Total | |

$ | 141 | | |

$ | 142 | |

A

breakdown of the revenues per customer constituted at least 10% of revenues is as follows:

SCHEDULE OF BREAKDOWN OF REVENUES PER CUSTOMER

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

(in thousands) | |

| Revenue earned: | |

| | | |

| | |

| Customer A (United States) | |

$ | 75 | | |

$ | 65 | |

| Customer B (United States) | |

$ | 60 | | |

$ | 65 | |

| Revenue earned | |

$ | 60 | | |

$ | 65 | |

Contract

Assets and Liabilities

Contract

assets are mainly comprised of trade receivables net of allowance for credit losses, which includes amounts billed and currently due

from customers.

The

activity for trade receivables is comprised of:

SCHEDULE OF ACTIVITY FOR TRADE RECEIVABLES

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

Three Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

(in thousands) | |

| Balance as of beginning of period | |

$ | 88 | | |

$ | 36,183 | |

| Reconsolidation of Octomera | |

| 82 | | |

| - | |

| Additions | |

| 150 | | |

| 155 | |

| Collections | |

| (75 | ) | |

| (5,454 | ) |

| Allowances for credit losses | |

| - | | |

| (9,514 | ) |

| Exchange rate differences | |

| - | | |

| (22 | ) |

| Balance as of end of period | |

$ | 245 | | |

$ | 21,348 | |

The

activity for contract liabilities is comprised of:

SCHEDULE OF ACTIVITY FOR CONTRACT LIABILITIES

| | |

March 31,

2024 | | |

March 31,