Silver price increases past the $28.15 hurdle, up 0.45 percent on a day, during Wednesday’s session. The white metal leaps forward to the sixth month of gains also since it swung off in April. While the recent weakening risk-tone bias might contest the initial trajectories of the bullion, wide US dollar vulnerability and risk-safety chase retain the metal investors steady.

Key Levels

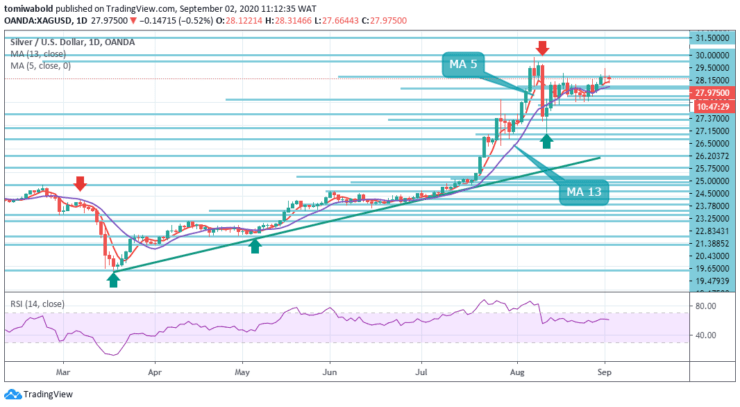

Resistance Levels: $30.00, $29.50, $28.15

Support Levels: $27.15, $26.50, $25.00

XAGUSD Long term Trend: Bullish

XAGUSD Long term Trend: Bullish

Considering the sustained break of the $28.15 resistance level, the August 18 high near $28.50 level and $29.00 round-figures are on the bulls’ radars ahead of the previous month’s peak near $29.85 level. Meanwhile, the MA 13 level of $27.37 questions the short-term sellers.

If at all the bears manage to sneak in around the $27.15 level, the August 25 low near $26.50 level and August 12 bottom close to $23.25 level could regain market attention. Meanwhile, the $28.00 mark and MA 13 near $27.37 level may offer immediate supports to the metal ahead of an ascending trend line from March 19 in the event of a bear market.

XAGUSD Short term Trend: Ranging

XAGUSD Short term Trend: Ranging

Looking at the 4-hour chart, the price looks to be heading to test the resistance at $28.15 level. A break of this level could mean that the recent high of $29.85 level might be the target for the bulls.

If this fails then the $26.20 level may stay as big thorn in the side for the bears as it is a very stubborn support zone. The indicators are staying in the positive zone at the moment as the MA 5 and MA 13 exhibit intact upside traction. The Relative Strength Index is beyond its 50 midlines with more space for a move higher.

Source: https://learn2.trade