TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

Proposed return of capital to Ordinary Shareholders

of up to US$30 million by way of Tender Offer and resultant Off-Market

Acquisitions

to purchase Ordinary Shares at US$9.39 per Ordinary Share

and

Recommended Proposals to approve:

The Company's proposed disposals of ownership interests in each of

Jordan Health Products, LLC ("Avante"), MERS Holdings, LLC ("MERS") and Tech

Industries, LLP ("Orizon") to Edgewater Growth Capital Partners and related

additional investments in Avante, MERS and Orizon

and

Amendments to the Articles of Incorporation of the Company

and

Notice of Extraordinary General Meeting

26 July 2019

Unless otherwise defined herein, capitalised terms used in this document have

the meanings given to them in the Circular of the Company dated 26 July 2019.

The Company announces today that it is posting a Circular to Shareholders

containing details of a Tender Offer pursuant to which the Company proposes to

return capital to Ordinary Shareholders of up to US$30 million by way of Tender

Offer and resultant Off-Market Acquisitions to purchase Ordinary Shares at

US$9.39 per Ordinary Share (in each case, such US Dollar amounts to be

translated to Pounds Sterling).

In addition to containing details of the Tender Offer, the Circular also

convenes an Extraordinary General Meeting of the Company to consider and, if

thought fit, approve the following proposals:

(a) the Company's proposed disposals of ownership interests in Jordan

Health Products, LLC ("Avante") and MERS Holdings, LLC ("MERS") to Edgewater

Growth Capital Partners ("Edgewater"), and related additional investments in

Avante and MERS with Edgewater (the "Avante-MERS Proposal");

(b) the Company's proposed disposal of ownership interest in Tech

Industries, LLP ("Orizon") to Edgewater, and related additional investments in

Orizon with Edgewater (the "Orizon Proposal"); and

(c) certain proposed amendments to the Articles of Incorporation of the

Company, and the adoption of new Articles of the Company in substitution for,

and to the exclusion of, the Company's existing Articles (the "Articles

Amendments"),

(together, the "Proposals").

Tender Offer and resultant Off-Market Acquisitions

Details of the Tender Offer and resultant Off-Market Acquisitions

As announced by the Company on 8 May 2019, among other strategic initiatives,

the Company intends to return, by way of a Tender Offer (or a series of Tender

Offers), approximately US$100 million of capital to Ordinary Shareholders at a

maximum discount to NAV of 5 per cent. On 29 May 2019, the Company posted a

circular to Shareholders seeking such Shareholder approval for, among other

things, a Market Acquisition Authority and an Off-Market Acquisition Authority,

being the Buy Back Authorities, in order to carry out a tender offer (or series

of tender offers) in relation to the Company's Ordinary Shares and which were

subsequently approved at an extraordinary general meeting of the Company held

on 27 June 2019.

The Board is now pleased to announce the details of a Tender Offer pursuant to

which the Company proposes to return capital to Ordinary Shareholders via the

Tender Offer and resultant Off-Market Acquisitions of up to US$30 million

(translated into Pounds Sterling at the Buy Back Exchange Rate), being the Buy

Back Amount, by purchasing Ordinary Shares at US$9.39 per Ordinary Share (also

translated into Pounds Sterling at the Buy Back Exchange Rate), being the

Tender Price. The maximum number of Ordinary Shares that may be bought back by

the Company pursuant to the same will depend on the Buy Back Exchange Rate

(being the USD/GBP exchange rate quoted by Bloomberg as at market close on the

Tender Closing Date) but will be determined by such number of Ordinary Shares

as is equal to the Buy Back Amount divided by the Tender Price, being the

Maximum Buy Back Shares.

Tender Offer Price

The Tender Price of US$9.39 per Ordinary Share is equivalent to 95 per cent. of

the Company's nearest monthly NAV publicly available at the time of announcing

the Tender Offer, which is in line with the Buy Back Authorities approved by

Shareholders and the Company's previously stated intention to undertake tender

offers at prices no wider than a five per cent. discount to NAV.

In addition to the Tender Price of US$9.39 per Ordinary Share representing a

discount of five per cent. to the relevant NAV, the Tender Price would also,

based on an illustrative Buy Back Exchange Rate as at 25 July 2019, being the

the Latest Practicable Date, of 1 USD : 0.80 GBP, represent a premium of 56.17

per cent. to the closing price of GBP 4.81 per Ordinary Share as at the Latest

Practicable Date.

Structure and Size of the Tender Offer and resultant Off-Market Acquisitions

The Tender Offer is being made to Eligible Ordinary Shareholders, being holders

of Ordinary Shares on the register of members of the Company as at 6.30 p.m. on

23 August 2019, being the Tender Record Date. The Tender Offer will unless

extended close at 1.00 p.m. on 23 August 2019, being the Tender Closing Date.

Eligible Ordinary Shareholders may participate in the Tender Offer by tendering

all or some of their Ordinary Shares at the Tender Price of US$9.39 per

Ordinary Share (translated into Pounds Sterling at the Buy Back Exchange Rate)

and tenders may be made at the Tender Price only.

Shareholders should however note that, whilst the Tender Offer is available to

all Eligible Ordinary Shareholders, certain US Ordinary Shareholders, being

David W. Zalaznick and affiliates, John (Jay) W. Jordan II and affiliates,

Edgewater and Leucadia Financial Corporation, have irrevocably undertaken not

to participate in the Tender Offer. Those US Ordinary Shareholders will instead

have Ordinary Shares bought back from them as a result of the Tender Offer via

the resultant Off-Market Acquisitions under the Articles of Incorporation of

the Company. Such Off-Market Acquisitions are to be made pursuant to, and as

required by, the terms of the Articles (and the arrangement known as the "CFC

Buy Back Arrangement" included therein) and are expected to be made at the same

Tender Price offered to Eligible Ordinary Shareholders participating in the

Tender Offer. Further details of the CFC Buy Back Arrangement are included in

the Circular as well as the separate circulars of the Company posted to

Shareholders on 29 May 2019 and 20 April 2017.

For those other Eligible Ordinary Shareholders, each such Shareholder will be

entitled to sell pursuant to the Tender Offer up to their Tender Offer

Entitlement. An Eligible Ordinary Shareholder's Tender Offer Entitlement will

depend on the Buy Back Exchange Rate but will be determined by such percentage

of the Ordinary Shares registered in his, her or its name at 6.00 p.m. on the

Tender Record Date that is equal to approximately the Maximum Buy Back Shares

divided by the existing issued Ordinary Share capital of the Company multiplied

by one hundred (100), rounded down to the nearest whole number of Ordinary

Shares.

Eligible Ordinary Shareholders will also have an opportunity to sell more than

their Tender Offer Entitlement to the extent that other Eligible Ordinary

Shareholders tender less than their Tender Offer Entitlements, and subject to a

cap that the Company has set as the limit for the maximum number of Ordinary

Shares that the Company may purchase pursuant to the Tender Offer.

That cap set as the limit for the maximum number of Ordinary Shares that may be

purchased by the Company pursuant to the Tender Offer will be such number of

Ordinary Shares as is equal to the Maximum Tender Offer Shares, which is to be

determined by reference to a proportion of the Buy Back Amount equivalent to an

amount of up to US$12,930,012 (translated into Pounds Sterling at the Buy Back

Exchange Rate) that the Company is proposing to return to Ordinary Shareholders

via the Tender Offer, being the Tender Offer Amount. The Maximum Tender Offer

Shares will depend on the Buy Back Exchange Rate but will be determined by such

number of Ordinary Shares as is equal to the Tender Offer Amount divided by the

Tender Price.

The cap has been set by the Company having regard to the fact that the

aforementioned US Ordinary Shareholders have irrevocably undertaken not to

participate in the Tender Offer. Specifically, the cap has been set by

reference to a Tender Offer Amount that would be needed by the Company if all

Eligible Ordinary Shareholders (other than those US Ordinary Shareholders) were

to sell their Tender Offer Entitlements (or otherwise have them taken up as

excess by other Eligible Ordinary Shareholders). As such, the cap of the

Maximum Tender Offer Shares is less than the number of Ordinary Shares which

would otherwise be purchased by the Company were all Eligible Ordinary

Shareholders (including those US Ordinary Shareholders) to sell their full

Tender Offer Entitlements.

The rationale for this is because, as mentioned above, the US Ordinary

Shareholders who have irrevocably undertaken not to participate in the Tender

Offer will instead have Ordinary Shares bought back from them as a result of

the Tender Offer via the resultant Off-Market Acquisitions pursuant to, and as

required by, the terms of the Company's Articles. As such, the remaining

proportion of the Buy Back Amount (referred to below) and the number of

Ordinary Shares which would otherwise have been available for repurchase from

those US Ordinary Shareholders through the Tender Offer (and were they to have

sold their full Tender Offer Entitlements) may instead be made available to

them via the resultant Off-Market Acquisitions. As the resultant Off-Market

Acquisitions are made in response to the Tender Offer, the ultimate number of

Ordinary Shares repurchased by the Company pursuant to such Off-Market

Acquisitions (and therefore the amount of the remaining proportion of the Buy

Back Amount needed to repurchase such Ordinary Shares) will depend on the

number of Ordinary Shares repurchased via the Tender Offer. However, assuming

the Maximum Tender Offer Shares are bought back pursuant to the Tender Offer,

then the full amount of the remaining proportion of the Buy Back Amount will be

used and those US Ordinary Shareholders will have such number of Ordinary

Shares repurchased from them pursuant to the resultant Off-Market Acquisitions

which would have otherwise been equivalent to their Tender Offer Entitlements.

As a consequence, the resultant Off-Market Acquisitions also have a limit for

the maximum number of Ordinary Shares that may be purchased by the Company

pursuant to such Off-Market Acquisitions, being such number of Ordinary Shares

as is equal to the Maximum Off-Market Acquisition Shares. The Maximum

Off-Market Acquisition Shares is to be determined by reference to the remaining

proportion of the Buy Back Amount which is equivalent to an amount of up to

US$17,069,988 (translated into Pounds Sterling at the Buy Back Exchange Rate)

that the Company is proposing to return to Ordinary Shareholders via the

resultant Off-Market Acquisitions, being the Off-Market Acquisition Amount (and

also being the amount that would be needed by the Company for such Off-Market

Acquisitions if the Maximum Tender Offer Shares are bought back pursuant to the

Tender Offer). The Maximum Off-Market Acquisition Shares will similarly depend

on the Buy Back Exchange Rate but will be determined by such number of Ordinary

Shares as is equal to the Off-Market Acquisition Amount divided by the Tender

Price.

On the above basis, the overall maximum number of Ordinary Shares that the

Company may purchase pursuant to the Tender Offer and resultant Off-Market

Acquisitions is the aggregate of the Maximum Tender Offer Shares and the

Maximum Off-Market Acquisition Shares (that is, as earlier mentioned, the

Maximum Buy Back Shares, being such number of Ordinary Shares as is equal to

the Buy Back Amount of US$30 million divided by the Tender Price of US$9.39 per

Ordinary Share (in each case, such US Dollar amounts translated into Pounds

Sterling at the Buy Back Exchange Rate).

If the maximum number of Ordinary Shares is purchased pursuant to the Tender

Offer and resultant Off-Market Acquisitions, that will result in an amount

equal to the aggregate of the Tender Offer Amount of US$12,930,012 and the

Off-Market Acquisition Amount of US$17,069,988, being equivalent to the Buy

Back Amount of US$30 million (in each case, such US Dollar amounts translated

into Pounds Sterling at the Buy Back Exchange Rate), being returned by the

Company to Ordinary Shareholders. The actual number of Ordinary Shares

repurchased by the Company pursuant to the Tender Offer and expected resultant

Off-Market Acquisitions, together with the amounts to be expended on

repurchasing the same is intended to be announced by the Company by way of a

Regulatory Information Service on 27 August 2019. It is intended that Ordinary

Shares purchased under the Tender Offer and resultant Off-Market Acquisitions

will be cancelled.

Currency Election Facility

A Currency Election Facility is also being made available to Eligible Ordinary

Shareholders under which Eligible Ordinary Shareholders will be able to elect

(subject to the terms and conditions of the Currency Election Facility) to

receive the Tender Offer consideration in US Dollars or Pounds Sterling at the

Buyback Exchange Rate (after deduction of any transaction or dealings costs

associated with the conversion). Further details of the Currency Election

Facility are included in the Circular. For those US Ordinary Shareholders

having their Ordinary Shares repurchased through the resultant Off-Market

Acquisitions, those Shareholders will receive their consideration in US Dollars

unless otherwise agreed by the Company to be paid in Pounds Sterling.

Conditions to the Tender Offer and resultant Off-Market Acquisitions

The Tender Offer is conditional on:

(a) the Board being satisfied on reasonable grounds that the Company

will, immediately after completion of the Tender Offer and resultant Off-Market

Acquisitions, satisfy the solvency test prescribed by the Guernsey Companies

Law; and

(b) the Tender Offer not having been terminated in accordance with the

terms and conditions of the Tender Offer prior to 1.00 p.m. on 23 August 2019,

being the Tender Closing Date.

If these conditions are not satisfied, the Tender Offer will lapse and the

Company will not purchase any Ordinary Shares pursuant to the Tender Offer. The

resultant Off-Market Acquisitions are conditional on completion of the Tender

Offer and the Company's purchase of Ordinary Shares thereunder.

Timetable

A timetable of principal events in connection with the Tender Offer and

resultant Off Market Acquisitions is set out at the end of this announcement.

Action to be taken by Eligible Ordinary Shareholders

Further details in relation to the action to be taken by Eligible Ordinary

Shareholders are also included in the Circular. However Eligible Ordinary

Shareholders do not have to tender any of their Ordinary Shares if they do not

wish to do so. Eligible Ordinary Shareholders who do not wish to participate in

the Tender Offer do not need to take any action. Shareholders should also note

that the Board makes no recommendation to Eligible Ordinary Shareholders as to

whether they should tender Ordinary Shares in the Tender Offer or whether they

should participate in the Company's proposed return of capital through either

the Tender Offer or the resultant Off-Market Acquisitions. Whether Eligible

Ordinary Shareholders decide to tender Ordinary Shares or participate in the

resultant Off-Market Acquisitions will depend, among other things, on their

view of the Company's financial position and prospects and their own individual

circumstances, including their tax position. Eligible Ordinary Shareholders who

are in any doubt as to the action they should take should consult an

appropriate independent professional adviser without delay.

The Proposals

Avante-MERS Proposal and Orizon Proposal

In addition to the Tender Offer and resultant Off-Market Acquisitions, the

Board is also seeking Shareholder approval for the Company's proposed disposals

of ownership interests in each of Avante, MERS and Orizon to Edgewater, a

Related Party of the Company, and related additional investments in each of

those entities with Edgewater.

The Avante-MERS Proposal concerns: (i) the Company's proposed disposals to

Edgewater of 80 per cent. of its ownership interest in Avante (being equivalent

to a 40 per cent. ownership interest in Avante) and 80 per cent. of its

ownership interest in MERS (being equivalent to a 20 per cent. ownership

interest in MERS); and (ii) the Company making, at its discretion, related

additional investments in Avante and MERS jointly with Edgewater in response to

calls for capital contributions from Avante and MERS respectively. Shareholders

should also note that Avante itself has an ownership interest of 50 per cent.

in MERS and accordingly the Company will in effect be disposing of a further 20

per cent indirect ownership interest in MERS through its disposal of ownership

interests in Avante. The Company's disposals of ownership interests in each of

Avante and MERS form part of the same transaction and accordingly the

consideration for the disposals is an aggregate amount of approximately US$37.5

million.

Similarly, the Orizon Proposal concerns: (i) the Company's proposed disposal to

Edgewater of 80 per cent. of its ownership interest in Orizon (being equivalent

to a 9.5 per cent. ownership interest in Orizon) for consideration of

approximately US$28 million; and (ii) the Company making, at its discretion,

related additional investments in Orizon jointly with Edgewater in response to

calls for capital contributions from Orizon.

The Avante-MERS and Orizon Proposals would each be considered Related Party

Transactions of the Company under Chapter 11 of the Listing Rules (with which

the Company voluntarily complies and insofar as the Listing Rules are

applicable to the Company by virtue of its voluntary compliance). Edgewater is

a substantial shareholder of the Company as it is entitled to exercise, or

exercise the control of, 10 per cent. or more of the votes able to be cast at a

general meeting of the Company and, as such, is considered to be a Related

Party of the Company. The Company's proposed disposals of ownership interests

in Avante, MERS and Orizon to Edgewater, and related additional investments in

each of those entities with Edgewater, would each be considered to be

transactions between the Company and a Related Party. Accordingly, given

Edgewater is a Related Party of the Company, the Avante-MERS and Orizon

Proposals as transactions between them would be considered Related Party

Transactions under Chapter 11 of the Listing Rules, again, insofar as the

Listing Rules are applicable to the Company by virtue of its voluntary

compliance with the same.

Shareholders should however also note that with respect to each of the

Avante-MERS and Orizon Proposals, whilst the Listing Rules provide for written

confirmation to be obtained from a sponsor that the terms of a Related Party

Transaction are fair and reasonable as far as shareholders are concerned, such

a confirmation has not been received in relation to these Proposals.

Shareholders are reminded that the Company also departed from the same

requirement in relation to the Deflecto and Water Treatment Proposals

undertaken by the Company last year, both of which were approved by

Shareholders. The reason for this being the case is because, as was the same

for the Deflecto and Water Treatment Proposals, whilst the Company has sought

to obtain a fair and reasonable written confirmation for the Avante-MERS and

Orizon Proposals, it has been unable to do so at a cost which can be justified

relative to their size and within the time constraints needed to be met in

order to transact on and complete the transactions on the terms negotiated. The

Company again reiterates its understanding that the costs and time for

obtaining such a confirmation can be greater for a Related Party Transaction

that concerns an acquisition or disposal, such as the Avante-MERS and Orizon

Proposals.

The Company has therefore decided to depart from the requirement to obtain a

fair and reasonable written confirmation on this occasion but notwithstanding

that, and as was the case with the Deflecto and Water Treatment Proposals, the

Company's Investment Adviser, JZAI has instead provided written confirmation to

the Company that the terms of the Avante-MERS and Orizon Proposals are fair and

reasonable as far as Ordinary Shareholders are concerned. JZAI has a selective

and disciplined approach to investing which is applied across all investments

including in the case of Avante, MERS and Orizon. In addition, JZAI considers

the Avante-MERS and Orizon Proposals to have been negotiated on arm's length

terms. Those negotiations have been undertaken on the Company's behalf by JZAI,

the founders and principals of which (David W. Zalaznick and (Jay) W. Jordan

II, together with their respective affiliates) are also substantial

Shareholders of the Company and whose combined shareholding in the Company

exceeds that of Edgewater's.

Shareholder approval for the Avante-MERS and Orizon Proposals will be sought at

the Extraordinary General Meeting of the Company described in further detail

below. The Company notes that it has received irrevocable undertakings to vote

in favour of each Resolutions the subject of the Avante-MERS and Orizon

Proposals from each of David W. Zalaznick and affiliates, John (Jay) W. Jordan

II and affiliates, Leucadia Financial Corporation and Arnhold LLC, in respect

of which they are entitled to vote, totalling 40.8 per cent. of the current

issued Ordinary Share capital of the Company. The irrevocable undertakings to

vote in favour of each of the Resolutions also equate to 52.1 per cent. in

aggregate of the voting rights of the Ordinary Shares taking account of the

fact that Edgewater, as a Related Party of the Company with respect to the

Resolutions, has undertaken not to vote, and has taken all reasonable steps to

ensure that its associates will not vote.

Articles Amendments

Lastly, the Board is also seeking Shareholder approval for the Company to amend

the existing Articles of Incorporation of the Company by approving and adopting

the new Articles of the Company in substitution for, and to the exclusion of,

the Company's existing Articles. The Articles Amendments concern amendments to

the Articles relating to the methodology for the calculation of eligible votes

for the appointment and removal of Directors in order for the Company to remain

a "foreign private issuer" for US securities law purposes.

Shareholder approval for the Articles Amendments will also be sought at the

Extraordinary General Meeting of the Company described in further detail below.

The Company notes that it has received irrevocable undertakings to vote in

favour of the Resolution the subject of the Articles Amendments from each of

David W. Zalaznick and affiliates, John (Jay) W. Jordan II and affiliates,

Edgewater, Leucadia Financial Corporation and Arnhold LLC totalling 62.7 per

cent. of the current issued Ordinary Share capital of the Company.

Notice of EGM and Shareholder Circular

Notice is hereby given that the Extraordinary General Meeting of the Company

will be held at the offices of Northern Trust International Fund Administration

Services (Guernsey) Limited, Trafalgar Court, Les Banques, St Peter Port,

Guernsey GY1 3QL, Channel Islands at 12.30 p.m. on 16 August 2019.

A timetable of principal events in connection with the Proposals (being the

Avante-MERS and Orizon Proposals and the Articles Amendments) and the

Extraordinary General Meeting is set out at the end of this announcement.

Further details of the Proposals are included in the Notice convening the

Extraordinary General Meeting and in the Circular.

The Notice convening the Extraordinary General Meeting is being distributed to

members of the Company and will shortly be uploaded to the Company's website at

www.jzcp.com. Copies of the Circular the Company is posting to Shareholders are

available for viewing, during normal business hours, at the registered office

of the Company at Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL

and will shortly be available for viewing at www.morningstar.co.uk/uk/nsm. The

notice convening the Extraordinary General Meeting is also included within the

Circular.

For further information:

Ed Berry / Kit Dunford +44 (0) 20 3727 1046 / 1143

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers,

Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International

Fund Administration Services

(Guernsey) Limited

About JZCP

JZ Capital Partners ("JZCP") is one of the oldest closed-end investment

companies listed on the London Stock Exchange. It seeks to provide shareholders

with a return by investing selectively in US and European microcap companies

and US real estate. JZCP receives investment advice from Jordan/Zalaznick

Advisers, Inc. ("JZAI") which is led by David Zalaznick and Jay Jordan. They

have worked together for more than 35 years and are supported by teams of

investment professionals in New York, Chicago, London and Madrid. JZAI's

experts work with the existing management of microcap companies to help build

better businesses, create value and deliver strong returns for investors. For

more information please visit www.jzcp.com.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Tender Offer and resultant Off-Market Acquisitions

Publication and posting of this 26 July 2019

document and the accompanying

Tender Form for use by Eligible

Ordinary Shareholders who hold

their Ordinary Shares in

certificated form in connection

with the Tender Offer

Tender Offer opens

Latest time and date for 1.00 p.m. on 23

receipt of the Tender Form and August 2019

TTE Instructions / the Tender

Closing Date

Tender Record Date 6.00 p.m. on 23

August 2019

Announcement of the results of 27 August 2019

the Tender Offer and expected

resultant Off-Market

Acquisitions

CREST accounts credited with By 28 August 2019 (or

uncertificated Ordinary Shares as promptly as

unsuccessfully tendered practicable

thereafter)

Purchase of Ordinary Shares 29 August 2019

successfully tendered pursuant

to the Tender Offer

CREST accounts credited in By 3 September 2019

respect of proceeds for (or as promptly as

uncertificated Ordinary Shares practicable

purchased pursuant to the thereafter)

Tender Offer

Cheques despatched for By 5 September 2019

certificated Ordinary Shares (or as promptly as

purchased pursuant to the practicable

Tender Offer thereafter)

Despatch of balance share By 5 September 2019

certificate(s) and/or other (or as promptly as

document(s) of title for unsold practicable

certificated Ordinary Shares thereafter)

and share certificate(s) and/or

other document(s) of title for

unsuccessful tenders of

certificated Ordinary Shares

Purchase of Ordinary Shares via Immediately after

resultant Off-Market completion of the

Acquisitions pursuant to, and Tender Offers (or as

as required by, the terms of promptly as

the Company's Articles of practicable

Incorporation as a result of thereafter)

the Tender Offer

Payments in respect of Ordinary Immediately after

Shares purchased pursuant to completion of the

the resultant Off-Market Tender Offers (or as

Acquisitions promptly as

practicable

thereafter)

Proposals and Extraordinary General Meeting

Publication and posting of this 26 July 2019

document and the accompanying

Form of Proxy for use by

Ordinary Shareholders in

connection with the

Extraordinary General Meeting

Latest time and date for 12.30 p.m. on 14

receipt of the Form of Proxy August 2019

for the Extraordinary General

Meeting

Extraordinary General Meeting 12.30 p.m. on 16

August 2019

Announcement of the results of 16 August 2019

the Extraordinary General

Meeting

END

(END) Dow Jones Newswires

July 26, 2019 03:39 ET (07:39 GMT)

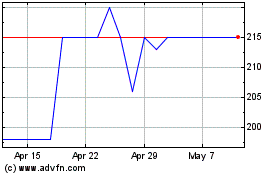

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

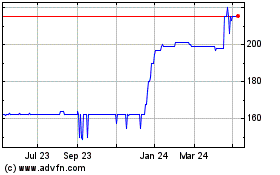

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024