BlackRock Latin Am Portfolio Update

March 30 2023 - 12:27PM

UK Regulatory

TIDMBRLA

The information contained in this release was correct as at 28 February 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (LEI - UK9OG5Q0CYUDFGRX4151)

All information is at 28 February 2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

month months year years years

% % % % %

Sterling:

Net asset value^ -5.7 -4.2 7.3 3.2 -6.0

Share price -4.4 2.5 5.3 7.3 2.1

MSCI EM Latin America -4.6 -2.7 10.5 13.0 1.8

(Net Return)^^

US Dollars:

Net asset value^ -7.3 -2.5 -3.1 -2.1 -17.4

Share price -6.0 4.2 -4.9 1.8 -10.2

MSCI EM Latin America -6.2 -1.1 -0.3 7.1 -10.5

(Net Return)^^

^cum income

^^The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a Gross or a Net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a

lower total return than indices where calculations are on a Gross basis (which

assumes that no withholding tax is suffered). As the Company is subject to

withholding tax rates for the majority of countries in which it invests, the NR

basis is felt to be the most accurate, appropriate, consistent and fair

comparison for the Company.

Sources: BlackRock, Standard & Poor's Micropal

At month end

Net asset value - capital only: 399.59p

Net asset value - including income: 408.50p

Share price: 366.00p

Total assets#: £128.1m

Discount (share price to cum income NAV): 10.4%

Average discount* over the month - cum income: 10.5%

Net gearing at month end**: 5.1%

Gearing range (as a % of net assets): 0-25%

Net yield##: 8.8%

Ordinary shares in issue(excluding 2,181,662 shares held in treasury): 29,448,641

Ongoing charges***: 1.1%

#Total assets include current year revenue.

##The yield of 5.7% is calculated based on total dividends declared in the last

12 months as at the date of this announcement as set out below (totalling 38.87

cents per share) and using a share price of 443.10 US cents per share

(equivalent to the sterling price of 366.00 pence per share translated in to US

cents at the rate prevailing at 28 February 2023 of $1.2107 dollars to £1.00).

2022 Q1 Interim dividend of 7.76 cents per share (paid on 16 May 2022).

2022 Q2 Interim dividend of 5.74 cents per share (paid on 12 August 2022).

2022 Q3 Interim dividend of 6.08 cents per share (paid on 9 November 2022).

2023 Q4 Interim dividend of 6.29 cents per share plus a Special Dividend of

13.00 cents per share (paid on 12 January 2023).

*The discount is calculated using the cum income NAV (expressed in sterling

terms).

**Net cash/net gearing is calculated using debt at par, less cash and cash

equivalents and fixed interest investments as a percentage of net assets.

*** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

December 2022.

Geographic Exposure % of Total % of Equity MSCI EM Latin

Assets Portfolio * America Index

Brazil 61.4 62.2 58.4

Mexico 26.4 26.8 30.6

Chile 5.4 5.5 6.8

Argentina 3.5 3.5 0.0

Panama 2.0 2.0 0.0

Peru 0.0 0.0 3.1

Colombia 0.0 0.0 1.1

Net current Assets(inc. 1.3 0.0 0.0

fixed interest)

----- ----- -----

Total 100.0 100.0 100.0

===== ===== =====

^Total assets for the purposes of these calculations exclude bank overdrafts,

and the net current assets figure shown in the table above therefore excludes

bank overdrafts equivalent to 6.5% of the Company's net asset value.

Sector % of Equity Portfolio % of Benchmark*

*

Financials 24.0 23.8

Materials 19.5 23.4

Consumer Staples 16.3 16.3

Industrials 13.2 8.7

Energy 9.3 10.2

Real Estate 5.8 0.8

Health Care 3.8 1.8

Consumer Discretionary 3.6 1.9

Communication Services 2.7 6.9

Information Technology 1.8 0.6

Utilites 0.0 5.6

----- -----

Total 100.0 100.0

===== =====

*excluding net current assets & fixed interest

Country % of % of

Company of Risk Equity Benchmark

Portfolio

Vale - ADS Brazil 8.6 11.3

Petrobrás - ADR: Brazil

Equity 4.6 3.7

Preference Shares 3.0 4.2

Banco Bradesco - ADR Brazil 6.1 3.1

Grupo Financiero Banorte Mexico 5.8 4.0

AmBev - ADR Brazil 5.1 2.2

FEMSA - ADR Mexico 5.0 3.3

B3 Brazil 4.5 2.2

Itaú Unibanco - ADR Brazil 3.3 4.3

Grupo Aeroportuario del Pacifico - ADS Mexico 3.2 1.0

América Movil - ADR Mexico 2.7 5.2

Commenting on the markets, Sam Vecht and Christoph Brinkmann, representing the

Investment Manager noted;

The Company's NAV was down 5.7% in February, underperforming the benchmark, the

MSCI EM Latin America Index, which returned -4.6% on a net basis over the same

period. All performance figures are in sterling terms with dividends

reinvested.1

Markets across the region were down in February, with majority of it due to

Brazil, as the country's fiscal policy remains unclear with a standoff between

the government and central bank. In terms of the Company's performance, Mexico

was the best performer from a country perspective, and not having any exposure

to Colombia helped in relative terms. An off-benchmark name in Panama also

contributed positively, while Brazil was the largest detractor.

Notable contributors in Mexico were Fibra Uno and GAPB. Fibra Uno is a

diversified real estate company that benefits from nearshoring demand for

industrial real estate. Mexican airport operator GAPB reported another quarter

of strong results, as the tourism boom in Mexico continues to drive up their

passenger numbers. Our holding in FEMSA, a convenience store operator in Mexico

was also another top contributor as they sold part of their equity stake in

Heineken, a move well received by the market as it likely leads to an increase

in shareholder distribution at the FEMSA level. Relative performance was helped

by not having any exposure to the benchmark name Eletrobras, electric power

generation company in Brazil which is seeing headwinds from declining

electricity prices.

The negative performance in Brazil was mainly led by financials including B3,

the stock exchange, XP Inc, investment manager and IRB Brasil, insurance

company. The share price of these were down due to earnings pressure, with both

B3 and XP Inc releasing earnings results in mid-February. Both sets of results

were below market expectations due to higher expenses and higher interest

rates. The off-benchmark name Arezzo, a footwear retailer, was also amongst the

top detractors as investors grew more concerned around discretionary consumer

spending in Brazil.

Changes in the month include a top up of our holding in Globant, software

exporter in Argentina, as the business should behave more defensive in case of

a global economic slowdown. We took some profit in FEMSA as our investment case

has partially played out. We increased our underweight in Chile, as we expect

growth to decelerate as excess consumption, from last years pension fund

withdrawals, is expected to revert in the face of inflation and rising interest

rates. To reflect this view, we reduced our exposure in Compania Cervecerias

Unidas (CCU) and Banco Santander Chile.

The uncertainty around fiscal policy in Brazil continued in February. Markets

were down following negative remarks by President Lula regarding high interest

rates set by the central bank. Despite the noise we still believe the outlook

for the equity market looks positive and we expect interest rates to come down,

especially with inflation currently at 5.77% and interest rates at 13.75%

In Mexico the central bank surprised the market on the hawkish side in February

when they raised interest rates by 50bps to 11% in response to increasing

consumer prices. High interest rates have attracted financial flows in the form

of carry trades and the Mexican peso has appreciated strongly year-to-date. The

country remains in a good position from both a fiscal and current account

perspective, however we have locked in some profits post the strong

performance.

We believe political uncertainty and social unrest will continue to weigh on

market performance in Peru.

We ended the month being overweight Brazil and continue to like the

off-benchmark names in Argentina and Panama for stock specific reasons. We

remain underweight Peru, Mexico, and Colombia.

1Source: BlackRock, as of 28 February 2023.

30 March 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brla on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

March 30, 2023 12:27 ET (16:27 GMT)

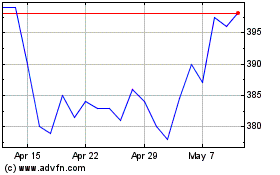

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

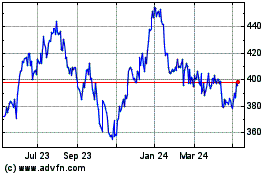

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jul 2023 to Jul 2024