UPDATE: Chile's Mining Sector Faces Rising Labor Costs -Antofagasta

March 15 2012 - 6:27PM

Dow Jones News

Cost inflation in the Chilean mining industry is a growing

concern particularly in terms of sourcing skilled labor, said a

senior executive at Chilean miner Antofagasta PLC (ANTO.LN)

Thursday.

"I think labor will be a key driver" in the future, Hussein

Barma, the chief financial officer of Antofagasta's London office,

told an audience at the Jefferies copper conference here.

"There is a big investment pipeline in Chile" that will be

developed over the coming decade, he said. This pipeline is already

driving up the cost of skilled labor. "Competition is high," he

said.

Labor accounts for a little over 10% of Antofagasta's total cost

base, Barma said, and a limited pool of skilled labor is already

having an affect on Antofagasta's operations.

The group's Chief Financial Officer Alejandro Rivera said

Tuesday the U.K.-listed miner is about a month away from completing

negotiations with four contractors that will determine how much it

will cost to develop its $1.3 billion Antucoya copper project in

Chile. The mine will be able to produce 80,000 tons of copper

annually and will start production in the second half of 2014,

Barma said. Although negotiations haven't been finalized yet,

Rivera said the company already expects the project's total capital

cost to rise.

In a similar vein, the limited pool of skilled labor has

prompted Antofagasta to stagger the construction of its Telegrafo

and Caracoles projects in Chile, Barma said. Each project has the

potential to produce as much copper annually as the recently

commissioned Esperanza mine, or 150,000 tons of copper a year, but

the limited labor pool has played a role in Antofagasta decision to

prioritize the construction of Telegrafo and then Caracoles in

order to use one project team to develop both mines, Barma

said.

The Telegrafo project is forecast to start construction in 2014

and copper production in 2017.

"The quality of engineering is a big [issue]," said Barma,

referring to the difficulty in finding skilled labor for

projects.

Barma also said rising costs for energy, sulfuric acid,

explosives and other input material were also putting upward

pressure on mining costs.

He wasn't able to say at what rate costs are likely to rise in

the future but he said cash costs, excluding credits from the sale

of by-products such as gold, have been rising at around an average

of 7% to 10% a year historically.

Water scarcity in Chile is also an issue, he noted. The company

is seeking to address this by pumping sea water to mines such as

Esperanza. While the sea water is basically free, the energy cost

involved in pumping up the water is notable.

Antofagasta has committed about 40 megawatts or a third of its

120 megawatt of power generation capacity to pump sea water 140

kilometers inland and up 2,200 meters to Esperanza, Barma said.

The cost of building that infrastructure was about $300 million

or roughly 10% of the overall capital expenditure for the Esperanza

project, he added.

-By Alex MacDonald, Dow Jones Newswires; +44 (0)20 7842 9328;

alex.macdonald@dowjones.com

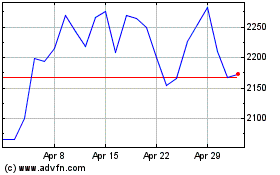

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Jul 2023 to Jul 2024