UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 23, 2014

|

Victory Energy Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2-76219-NY

|

|

87-0564462

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

3355 Bee Caves Road, Suite 608

Austin, Texas

|

|

78746

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(512) 347-7300

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.02 Termination of a Material Definitive Agreement

On September 23, 2014, Aurora Energy Partners, a Texas general partnership (“Aurora”) of which Victory Energy Corporation, a Delaware corporation (the “Company”), is the managing partner and owner of a 50% partnership interest, and TELA Garwood Limited, LP (“TELA”) mutually agreed to the termination of the Purchase and Sale Agreement dated June 30, 2014 between Aurora and TELA (the “PSA”), as permitted by the terms of the PSA.

As previously disclosed, the PSA provided for the acquisition of certain of TELA’s right, title and interest in certain oil and gas assets (the “Acquired Assets”) at two closings, the first of which occurred on June 30, 2014, on which date Aurora acquired a 10% working interest and a 7.5% net revenue interest in approximately 2,180 gross acres located in Glasscock County and Howard County. The remaining Acquired Assets were to be purchased by Aurora at a second closing (the “Second Closing”). Pursuant to the termination of the PSA, the Second Closing will no longer occur as the result of certain title impairment issues that were uncovered during the due diligence process and that were not satisfied to the satisfaction of the Company and TELA. No penalties or payments were due as a result of the termination of the PSA.

A copy of the PSA is incorporated by reference herein as Exhibit 10.1.

Item 7.01 Regulation FD Disclosure.

On September 30, 2014, the Company issued a press release announcing that it was concluding its Fairway Acquisition. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the foregoing information, including Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

|

10.1

|

Purchase and Sale Agreement dated as of June 30, 2014 between TELA Garwood Limited, LP and Aurora Energy Partners (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on July 8, 2014).

|

|

|

|

|

99.1

|

Press Release dated September 30, 2014

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Victory Energy Corporation

|

|

| |

|

|

|

|

Dated: September 30, 2014

|

By: |

/s/ Kenneth Hill

|

|

| |

|

Kenneth Hill

Chief Executive Officer

|

|

3

EXHIBIT 99.1

VICTORY ENERGY CONCLUDES FAIRWAY ACQUISITION

AUSTIN, Texas – (September 30, 2014). Victory Energy Corporation, (OTCQX: VYEY) (“Victory” or “the Company”) a rapidly growing, Permian Basin focused oil and gas company, today announced a conclusion to the Fairway Project acquisition.

Since the July 2, 2014 announcement of the Fairway acquisition, the Company has acquired a 10% WI and 7.5% NRI in approximately 2,180 gross acres located in Glasscock and Howard County Texas. This acreage is being held by production with ten (10) existing wells. Forty-(40) acre well spacing provides significant future drilling opportunity on the property. The company acquired its interest from Target Energy Limited (TELA) of Australia.

Victory had initially planned to acquire a 10% WI in the full 4,530 acres of the Fairway prospect. During its due diligence review the Company discovered significant title impairment issues in portions of the acreage. These issues were not resolved to Victory’s satisfaction. On September 23, 2014, after an extensive period of unsuccessfully trying to re-value the transaction in a commercially reasonable manner, the Company and TELA mutually agreed to terminate the PSA. Because of the mutual termination, all of the second closing acreage, with the exception of the acreage allocated to the Taree 193-1 well, is no longer part of the Fairway transaction. The Company will retain its 10% WI interest in the Taree 193-1 well as part of its termination Agreement with Tela. As of the date of this release, a closing date on the Taree 193-1 well acreage has not been scheduled.

“The termination is a result of unresolved issues relating to re-pricing evaluation methodology and the potential loss of future development and drilling rights on portions of the leases that are a part of the second closing,” said Kenny Hill, CEO of Victory Energy. “Victory’s acquisitions must meet our economic benchmarks and ownership must be deliverable by sellers before we are able to close. Because we were unable to meet these benchmarks on most of the second closing acreage, we were obligated to pass on the acreage and deploy capital to other projects.”

About Victory Energy

Victory Energy Corporation (OTCQX: VYEY), is a public held, growth-oriented oil and gas exploration and production company based in Austin, Texas, with additional resources located in Midland, Texas. The company is focused on the acquisition and development of stacked multi-pay resource play opportunities in the Permian Basin that offer predictable outcomes and long-lived reserve characteristics. The company presently utilizes low-risk vertical well development, which offers repeatable and profitable outcomes. Current Company assets include interest in proven formations such as the Spraberry, Wolfcamp, Wolfberry, Mississippian, Cline and Fusselman formations. For additional information on the company, please visit www.vyey.com .

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions made by the Company based on management’s experience, perception of historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. When used in this press release, the words “will,” “potential,” “believe,” “estimated,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “project,” or their negatives, other similar expressions or the statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Among these forward-looking statements are statements regarding EURs, estimated BOE, estimated future gross undiscounted cash flow and estimated drilling and completion costs. Such forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements, including but not limited to, our ability to successfully complete pending acquisitions, integrate them with our operations and realize the anticipated benefits from the acquisitions, any unexpected costs or delays in connection with the acquisitions, changes to drilling plans and schedules by the operators of prospects, overruns in costs of operations, hazards, delays, and any other difficulties related to drilling for and producing oil or gas, the price of oil, NGLs, and gas, results of marketing and sales of produced oil and gas, estimates made in evaluating reserves, competition, general economic conditions and the ability to manage and continue growth, and other factors described in the Company’s most recent Annual Report on Form 10-K and any updates to those risk factors set forth in the Company’s Quarterly Reports on Form 10-Q. Further information on such assumptions, risks and uncertainties is available in the Company’s other filings with the Securities and Exchange Commission (“SEC”) that are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.vyey.com. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Investor Relations Contact

Derek Gradwell

SVP Natural Resources

MZ Group North America

Phone: 512-270-6990

Email: dgradwell@mzgroup.us

Web: www.mzgroup.us

2

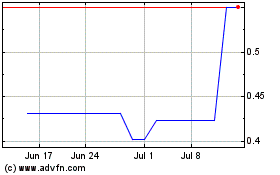

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

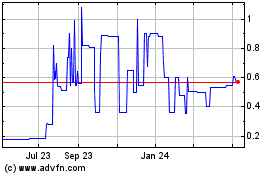

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jul 2023 to Jul 2024