SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2014

|

Victory Energy Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2-76219-NY

|

|

87-0564462

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

3355 Bee Caves Road, Suite 608

Austin, Texas

|

|

78746

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(512) 347-7300

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition.

On August 19, 2014, Victory Energy Corporation issued a press release announcing its financial and operating results for the three and six months ended June 30, 2014. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the foregoing information, including Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

99.1

|

Press Release dated August 19, 2014

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Victory Energy Corporation |

|

| |

|

|

|

|

Dated: August 19, 2014

|

By:

|

/s/ Kenneth Hill

|

|

| |

|

Kenneth Hill |

|

| |

|

Chief Executive Officer |

|

EXHIBIT 99.1

Victory Energy Announces Second Quarter 2014 Results

Conference Call at 11:00 am ET on August 19, 2014

AUSTIN, Texas – (August 19, 2014). Victory Energy Corporation, (OTCQX: VYEY) (“Victory” or “the Company”) a rapidly growing, Permian Basin focused oil and gas company, today announced financial and operating results for the three and six months ended June 30, 2014.

2014 Second Quarter Highlights:

|

·

|

Revenues increased 47% year-over-year to $237,978.

|

|

·

|

$1.2 million of cash and $5.0 million of total assets.

|

|

·

|

Successfully completed two (gross) wells with additional wells underway.

|

|

·

|

Sold its interest in the Lightnin’ property for approximately $4 million in cash and recorded a $2.2 million gain.

|

|

·

|

Completed the initial closing on a purchase of a 10% working interest in the Permian Basin Fairway Project from Target Energy for approximately $5 million in cash, growing daily production volumes and adding 4,560 gross acres for future drilling and development.

|

|

·

|

Engaged the MZ Group as our new investor relations firm for capital markets development and investor road shows.

|

|

·

|

Engaged Euro Pacific Capital as our Market Maker and stock certificate conversion point.

|

|

·

|

Upgraded our stock trading platform from the OTCQB to the more transparent and investor friendly OTCQX.

|

|

·

|

Added Dr. Ralph Kehle as a new independent board director effectively July 1, 2014

|

|

·

|

Added Fred J. Smith as new CFO to help guide the financial success of the company effective June 2, 2014.

|

|

·

|

Identified additional Permian production and development acquisition targets that will continue to increase reserves and cash flow for the remainder of 2014 and into 2015.

|

“We made significant progress toward our strategic goals,” said Kenny Hill, Victory's CEO. “For the first time in company history, we closed on almost $9 million of transactions in a single quarter. Our divestiture of the Lightnin’ Property ($4.0 million proceeds) provided a sound capital foundation for the acquisition of the 4,560 acre, Fairway Project, growing our production and our drilling inventory by at least forty additional well locations. These two transactions complement each other and illustrate our ability to increase shareholder value by increasing proved reserves on a net basis , adding significantly larger development acreage and leveraging our access to capital through our Navitus Energy Group relationship (up to $15M) and the Texas Capital Bank credit facility ($25M).”

Victory Energy is an independent, growth oriented oil and natural gas Company focused on acquiring, developing and producing oil and natural gas properties in the Permian Basin of Texas and southeast New Mexico. Through its partnership interest in Aurora Energy Partners, the company is able to acquire needed capital when ideal projects, with specific capital return and development profiles become available. This capital focused partnership is now complimented by a $25 million credit facility acquired in February 2014. At June 30, 2014, the Company held a working interest in 31 wells.

Revenues for the three months ended June 30, 2014 increased 47% year-over-year to $237,978 due primarily to higher production from the University 6 #1 and #2 wells in Bootleg Canyon and new production from the Chapman well. Total net production was 46.8 BOE/PD, up 11% from 42 BOE/PD in the first quarter of 2014. This daily rate does not include additional production associated with leases that were excluded from the first closing of the Fairway transaction.

Cost of production (LOE) for the second quarter of 2014 was $53,964, up 5% from $51,396 a year ago.

Net income attributable to Victory Energy was $272,189, or $0.01 per share, for the three months ended June 30, 2014 compared to a loss of ($311,719) and $0.01, respectively, in the second quarter of 2013. Victory recorded a $2,159,592 pretax gain on the sale of its interest in the Lightnin’ project in the second quarter of 2014. The weighted average shares outstanding at June 30, 2014 were 27.9 million shares compared to 27.6 million the same period a year ago.

General and administrative expenses were $981,713, up from $421,647 the prior quarter. General and administrative expenses were unusually high because of business growth related expenses associated with our combined acquisition and divestiture of approximately $9 million in property transactions, a significant expansion in our investors relations and capital markets awareness efforts, additional legal and accounting costs associated with public company reporting requirements, transaction fees associated with the move from the OTCQB to the OTCQX stock trading platform and director/employee stock based compensation utilized for key employee acquisition and retention (all noncash). Our share based compensation expense is associated with the shareholder approved 2014 Long Term Incentive Plan.

Victory had approximately $1.2 million of cash and $5.0 million of total assets at June 30, 2014. Total shareholders’ equity was $3.7 million at June 30, 2014. The company cash on hand is a reflection of management’s desire to only draw capital from its partner Navitus Energy Group and from the banking credit facility when needed for asset acquisitions or operations.

On February 24, 2014, Aurora Energy Partners, as borrower, closed a $25 million revolving credit facility with Texas Capital Bank. The credit facility includes a $1.45 million adjustable borrowing base, with the remainder available for acquisitions. The senior facility is secured by all the assets of Aurora Energy Partners, with pricing at prime plus 1%. Total debt outstanding at June 30, 2014 from its credit facility was $800,000. Aurora was in compliance with all related debt covenants at June 30, 2014.

Operational Updates

In addition to the producing wells included in the Fairway acquisition, five new Fairway wells are now in various stages of drilling and completion. The BOA #4, BOA North #5, Waga-Waga #2, Homar #1 and Ballarat #1 wells are expected to be Wolfberry producers. In addition, we anticipate completion of approximately four more wells and one re-entry well to be completed by year end, funded by a combination of internally generated cash, bank borrowings and Navitus contributions These new wells will grow our production and our reserves.

Completed First Major Acquisition in Permian Basin

On June 30, 2014, Aurora signed an agreement to acquire a 10% stake in the proved and producing Permian Basin Fairway Project from Target Energy Corporation (“Seller”) for $5.8 million in cash, subject to customary purchase price adjustments. The acquisition had an effective date of May 1, 2014. Due to external delays in completing conveyancing of titles, the purchase and sale agreement (“PSA”) closing provisions were split into two parts.

On June 30, 2014 Aurora completed the initial closing (“First Closing”) of its purchase of a 10% working and 7.5% net revenue interest in the Seller’s interest in Darwin, BOA and Wagga Wagga producing leases and one non-producing lease scheduled for future development, for approximately $2.5 million. On July 31, 2014, the Company paid an additional $558 thousand related to the required purchase price adjustments. The assets acquired in the First Closing includes 7 producing wells with 16 BOPD of oil production at the time the acquisition closed and 4 wells completed and awaiting production startup. Revenues for the six months ended June 30, 2014 from assets acquired in the First Closing were approximately $1.4 million. Management believes there are up to 30 additional drilling locations for future development in the First Closing assets acquired.

The second closing (“Second Closing”) will occur once the curative title work is completed in August 2014.

Outlook

Management’s strategy is to grow proved reserves through new drilling and acquisitions, while growing the value of those reserves by focusing on oil and liquids rich gas. The Company leverages both internal capabilities and strategic industry relationships to acquire working interest positions in low-to-moderate risk oil and natural gas prospects.

For the remainder of 2014, the company plans to;

|

1.

|

Grow proved reserves and cash flow by focusing on the development opportunities available at Fairway and other properties.

|

|

2.

|

In addition, the company anticipates making at least one more significant prospect acquisition with a focus toward proved producing reserves.

|

|

3.

|

Conclude the year with over $10 million in PV10 reserves

|

Conference Call

Management will host a conference call and webcast to discuss its second quarter 2014 financial results and provide an update on its operations.

Date: Tuesday, August 19, 2014

Time: 11:00 am ET

Dial-in (US): 1-888-395-3227

Dial-in (Intl.): 1-719-325-2484

Conference ID: 2691868

Webcast: http://public.viavid.com/index.php?id=110614

A replay of the call will be available from 2:00 pm ET August 19, 2014 to 11:59 pm ET September 19, 2014. To access the replay, use 877-870-5176 for U.S. callers and 858-384-5517 for international callers. The PIN number is 2691868.

About Victory Energy

Victory Energy Corporation (OTCQX: VYEY), is a public held, growth-oriented oil and gas exploration and production company based in Austin, Texas, with additional resources located in Midland, Texas. The company is focused on the acquisition and development of stacked multi-pay resource play opportunities in the Permian Basin that offer predictable outcomes and long-lived reserve characteristics. The company presently utilizes low-risk vertical well development, which offers repeatable and profitable outcomes. Current Company assets include interest in proven formations such as the Spraberry, Wolfcamp, Wolfberry, Mississippian, Cline and Fusselman formations. For additional information on the company, please visit www.vyey.com .

Safe Harbor Statement

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on certain assumptions made by the Company based on management’s experience, perception of historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. When used in this press release, the words “will,” “potential,” “believe,” “estimated,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “project,” or their negatives, other similar expressions or the statements that include those words, are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. Among these forward-looking statements are statements regarding EURs, estimated BOE, estimated future gross undiscounted cash flow and estimated drilling and completion costs. Such forward-looking statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements, including but not limited to, our ability to successfully complete pending acquisitions, integrate them with our operations and realize the anticipated benefits from the acquisitions, any unexpected costs or delays in connection with the acquisitions, changes to drilling plans and schedules by the operators of prospects, overruns in costs of operations, hazards, delays, and any other difficulties related to drilling for and producing oil or gas, the price of oil, NGLs, and gas, results of marketing and sales of produced oil and gas, estimates made in evaluating reserves, competition, general economic conditions and the ability to manage and continue growth, and other factors described in the Company’s most recent Annual Report on Form 10-K and any updates to those risk factors set forth in the Company’s Quarterly Reports on Form 10-Q. Further information on such assumptions, risks and uncertainties is available in the Company’s other filings with the Securities and Exchange Commission (“SEC”) that are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.vyey.com. Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Investor Relations Contact

Derek Gradwell

SVP Natural Resources

MZ Group North America

Phone: 512-270-6990

Email: dgradwell@mzgroup.us

Web: www.mzgroup.us

VICTORY ENERGY CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

June 30,

2014

|

|

|

December 31,

2013

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

1,224,482

|

|

|

$

|

20,858

|

|

|

Accounts receivable - less allowance for doubtful accounts of $200,000, and $200,000 for June 30, 2014 and December 31, 2013, respectively

|

|

|

39,032

|

|

|

|

116,542

|

|

|

Accounts receivable - affiliates

|

|

|

154,358

|

|

|

|

68,571

|

|

|

Prepaid expenses

|

|

|

23,111

|

|

|

|

38,663

|

|

|

Total current assets

|

|

|

1,440,983

|

|

|

|

244,634

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Assets

|

|

|

|

|

|

|

|

|

|

Furniture, equipment, and application software

|

|

|

46,883

|

|

|

|

43,173

|

|

|

Accumulated depreciation

|

|

|

(14,733)

|

|

|

|

(11,597

|

)

|

|

Total furniture and fixtures, net

|

|

|

32,150

|

|

|

|

31,576

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil gas properties (successful efforts method)

|

|

|

4,749,341

|

|

|

|

3,715,648

|

|

|

Accumulated depletion, depreciation and amortization

|

|

|

(1,309,763)

|

|

|

|

(1,517,836

|

)

|

|

Total oil and gas properties, net

|

|

|

3,439,578

|

|

|

|

2,197,812

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Assets

|

|

|

|

|

|

|

|

|

|

Deferred debt financing costs

|

|

|

108,295

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

5,021,006

|

|

|

$

|

2,474,022

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

196,703

|

|

|

$

|

351,435

|

|

|

Accrued liabilities

|

|

|

197,114

|

|

|

|

196,913

|

|

|

Accrued liabilities - affiliates

|

|

|

60,932

|

|

|

|

18,542

|

|

|

Liability for unauthorized preferred stock issued

|

|

|

9,283

|

|

|

|

9,283

|

|

|

Total current liabilities

|

|

|

464,032

|

|

|

|

576,173

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Liabilities

|

|

|

|

|

|

|

|

|

|

Asset retirement obligations

|

|

|

35,157

|

|

|

|

51,954

|

|

|

Long term note payable

|

|

|

800,000

|

|

|

|

-

|

|

|

Total long term liabilities

|

|

|

835,157

|

|

|

|

51,954

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

1,299,189

|

|

|

|

628,127

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 47,500,000 shares authorized, 28,598,619 shares and

27,563,619 shares issued and outstanding for June 30, 2014 and December 31, 2013, respectively

|

|

|

28,599

|

|

|

|

27,564

|

|

|

Additional paid-in capital

|

|

|

34,795,356

|

|

|

|

34,404,239

|

|

|

Accumulated deficit

|

|

|

(37,065,008)

|

|

|

|

(36,901,894

|

)

|

|

Total Victory Energy Corporation stockholders' deficit

|

|

|

(2,241,053)

|

|

|

|

(2,470,091

|

)

|

|

Non-controlling interest

|

|

|

5,962,870

|

|

|

|

4,315,986

|

|

|

Total stockholders' equity

|

|

|

3,721,817

|

|

|

|

1,845,895

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$

|

5,021,006

|

|

|

$

|

2,474,022

|

|

VICTORY ENERGY CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| |

|

For the Three Months Ended

|

|

|

For the Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL AND GAS REVENUES

|

|

$ |

237,977 |

|

|

$ |

161,910 |

|

|

$ |

432,960 |

|

|

$ |

255,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COSTS AND EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating expenses

|

|

|

53,963 |

|

|

|

51,396 |

|

|

|

115,632 |

|

|

|

74,986 |

|

|

Production taxes

|

|

|

15,127 |

|

|

|

11,655 |

|

|

|

25,262 |

|

|

|

20,603 |

|

|

Dry hole costs

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

3,610 |

|

|

Exploration

|

|

|

19,677 |

|

|

|

2,419 |

|

|

|

24,172 |

|

|

|

15,577 |

|

|

General and administrative expense

|

|

|

981,713 |

|

|

|

421,647 |

|

|

|

1,463,628 |

|

|

|

900,443 |

|

|

Depletion, depreciation, and amortization

|

|

|

92,040 |

|

|

|

59,324 |

|

|

|

170,071 |

|

|

|

77,899 |

|

|

Total cost and expenses

|

|

|

1,162,520 |

|

|

|

546,441 |

|

|

|

1,798,765 |

|

|

|

1,093,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) FROM OPERATIONS

|

|

|

(924,543 |

) |

|

|

(384,531 |

) |

|

|

(1,365,805 |

|

|

|

(837,440 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of oil and gas properties

|

|

|

2,159,592 |

|

|

|

- |

|

|

|

2,159,592 |

|

|

|

- |

|

|

Management fee income

|

|

|

84,993 |

|

|

|

- |

|

|

|

88,892 |

|

|

|

- |

|

|

Amortization of debt financing costs and interest expense

|

|

|

(22,223 |

) |

|

|

(501 |

) |

|

|

(31,008 |

|

|

|

(946 |

) |

|

Total net other income and expense

|

|

|

2,222,362 |

|

|

|

(501 |

) |

|

|

2,217,476 |

|

|

|

(946 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE TAX EXPENSE

|

|

|

1,297,819 |

|

|

|

(385,032 |

) |

|

|

851,671 |

|

|

|

(838,386 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX EXPENSE

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS)

|

|

|

1,297,819 |

|

|

$ |

(385,032 |

) |

|

$ |

851,671 |

|

|

$ |

(838,386 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: net income (loss) attributable to non-controlling interest

|

|

|

1,025,630 |

|

|

|

(73,313 |

) |

|

|

1,014,785 |

|

|

|

(112,289 |

) |

|

NET INCOME (LOSS) ATTRIBUTABLE TO VICTORY ENERGY CORPORATION

|

|

|

272,189 |

|

|

$ |

(311,719 |

) |

|

$ |

(163,114 |

) |

|

$ |

(726,097 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

28,230,612 |

|

|

|

27,563,619 |

|

|

|

27,898,958 |

|

|

|

27,563,619 |

|

|

Diluted

|

|

|

28,835,476 |

|

|

|

27,563,619 |

|

|

|

27,898,958 |

|

|

|

27,563,619 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, basic and diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

.0.01 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

|

|

$ |

(0.03 |

) |

|

Diluted

|

|

$ |

0.01 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

|

|

$ |

(0.03 |

) |

VICTORY ENERGY CORPORATION AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| |

|

For the Six Months Ended June 30,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

851,671 |

|

|

$ |

(838,386 |

) |

|

Adjustments to reconcile net income (loss) from operations to net cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Amortization of debt financing costs

|

|

|

14,174 |

|

|

|

|

|

|

Accretion of asset retirement obligation

|

|

|

1,395 |

|

|

|

1,998 |

|

|

Gain from sale of oil and gas properties

|

|

|

(2,159,592 |

) |

|

|

- |

|

|

Depletion, depreciation, and amortization

|

|

|

170,071 |

|

|

|

77,899 |

|

|

Stock based compensation

|

|

|

370,700 |

|

|

|

43,325 |

|

|

Warrants for services

|

|

|

- |

|

|

|

16,500 |

|

|

Restricted stock in exchange for services

|

|

|

20,417 |

|

|

|

- |

|

|

Change in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

77,510 |

|

|

|

17,234 |

|

|

Accounts receivable - affiliates

|

|

|

(85,787 |

) |

|

|

(22,500 |

) |

|

Prepaid expense

|

|

|

15,552 |

|

|

|

68,693 |

|

|

Accounts payable

|

|

|

(154,732 |

) |

|

|

254,882 |

|

|

Accrued liabilities

|

|

|

201 |

|

|

|

(42,294 |

) |

|

Accrued interest

|

|

|

- |

|

|

|

(25,639 |

) |

|

Accrued liabilities – affiliates

|

|

|

42,390 |

|

|

|

37,885 |

|

|

Net cash used in operating activities

|

|

|

(836,030 |

) |

|

|

(410,403 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Drilling and completion costs

|

|

|

(772,801 |

) |

|

|

(1,335,922 |

) |

|

Acquisition of oil and gas properties

|

|

|

(2,491,888 |

) |

|

|

(81,550 |

) |

|

Proceeds from the sale of assets

|

|

|

4,021,000 |

|

|

|

- |

|

|

Purchase of furniture and fixtures

|

|

|

(3,710 |

) |

|

|

- |

|

|

Renewal of leaseholds

|

|

|

(22,577 |

|

|

|

- |

|

|

Sale-farm out of leaseholds

|

|

|

- |

|

|

|

160,000 |

|

|

Net cash from (used in) in investing activities

|

|

|

730,024 |

|

|

|

(1,257,472 |

) |

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Non-controlling interest contributions

|

|

|

890,000 |

|

|

|

1,869,000 |

|

|

Non-controlling interest distributions

|

|

|

(257,901 |

) |

|

|

- |

|

|

Debt financing costs

|

|

|

(122,469 |

) |

|

|

- |

|

|

Proceeds from debt financing

|

|

|

1,233,000 |

|

|

|

- |

|

|

Principal payments on debt financing

|

|

|

(433,000 |

) |

|

|

- |

|

|

Net cash provided by financing activities

|

|

|

1,309,630 |

|

|

|

1,869,000 |

|

| |

|

|

|

|

|

|

|

|

|

Net change in cash

|

|

$ |

1,203,624 |

|

|

$ |

201,125 |

|

| |

|

|

|

|

|

|

|

|

|

Beginning cash

|

|

|

20,858 |

|

|

|

158,165 |

|

| |

|

|

|

|

|

|

|

|

|

Ending cash

|

|

$ |

1,224,482 |

|

|

$ |

359,290 |

|

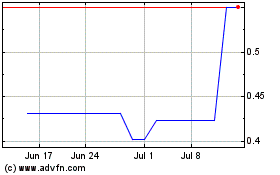

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

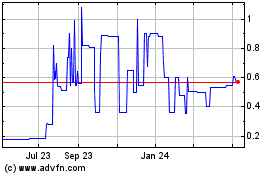

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jul 2023 to Jul 2024