Virtus Tactical Allocation Fund

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2013 (Unaudited)

($ reported in thousands)

|

|

|

|

|

|

|

Country Weightings †

|

|

|

United States

|

|

|

72

|

%

|

|

Japan

|

|

|

3

|

|

|

Canada

|

|

|

2

|

|

|

France

|

|

|

2

|

|

|

Luxembourg

|

|

|

2

|

|

|

United Kingdom

|

|

|

2

|

|

|

Netherlands

|

|

|

1

|

|

|

Other

|

|

|

16

|

|

|

|

|

|

|

|

|

Total

|

|

|

100

|

%

|

|

|

|

|

|

|

† % of total investments as of December 31, 2013

11

The following table provides a summary of inputs used to value the Fund’s investments as of

December 31, 2013 (See Security Valuation Note 1A in the Notes to Schedules of Investments):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Value at

December 31, 2013

|

|

|

Level 1

Quoted Prices

|

|

|

Level 2

Significant

Observable

Inputs

|

|

|

Debt Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset-Backed Securities

|

|

$

|

2,615

|

|

|

$

|

—

|

|

|

$

|

2,615

|

|

|

Corporate Bonds

|

|

|

43,057

|

|

|

|

—

|

|

|

|

43,057

|

|

|

Foreign Government Securities

|

|

|

6,711

|

|

|

|

—

|

|

|

|

6,711

|

|

|

Loan Agreements

|

|

|

9,551

|

|

|

|

—

|

|

|

|

9,551

|

|

|

Mortgage-Backed Securities

|

|

|

5,362

|

|

|

|

—

|

|

|

|

5,362

|

|

|

Equity Securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

|

125,700

|

|

|

|

125,700

|

|

|

|

—

|

|

|

Preferred Stock

|

|

|

1,973

|

|

|

|

1,973

|

|

|

|

—

|

|

|

Securities Lending Collateral

|

|

|

3,819

|

|

|

|

3,819

|

|

|

|

—

|

|

|

Short-Term Investments

|

|

|

2,231

|

|

|

|

2,231

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments

|

|

$

|

201,019

|

|

|

$

|

133,723

|

|

|

$

|

67,296

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

There are no Level 3 (significant unobservable inputs) priced securities.

There were no transfers between Level 1 and Level 2 for the period.

VIRTUS EQUITY TRUST

NOTES TO SCHEDULES OF INVESTMENTS

DECEMBER 31,2013 (UNAUDITED)

NOTE 1—SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Virtus Equity Trust, a trust consisting of 11 diversified Funds (each a “Fund”), in the preparation of

the Schedules of Investments. The preparation of the Schedules of Investments in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the Schedules of Investments. Actual results could differ from those estimates and those differences could be significant.

A. SECURITY VALUATION

Security

valuation procedures for each Fund, which include, nightly price variance, as well as back-testing such as bi-weekly unchanged price, monthly secondary source and transaction analysis, have been approved by the Board of Trustees (the

“Board” or the “Trustees”). All internally fair valued securities are approved by a valuation committee (the “Valuation Committee”) appointed by the Board. The Valuation Committee is comprised of certain members of

management as identified by the Board, and convenes independently from portfolio management. All internally fair valued securities, referred to below, are updated daily and reviewed in detail by the valuation committee monthly unless changes occur

within the period. The valuation committee reviews the validity of the model inputs and any changes to the model. Fair valuations are ratified by the Board of Directors at least quarterly.

Each Fund utilizes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels.

|

|

•

|

|

Level 1 – quoted prices in active markets for identical securities

|

|

|

•

|

|

Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment

speeds, credit risk, etc.)

|

|

|

•

|

|

Level 3 – prices determined using significant unobservable inputs (including the valuation committee’s own assumptions in determining the

fair value of investments)

|

A description of the valuation techniques applied to the Funds major categories of assets and

liabilities measured at fair value on a recurring basis is as follows:

Equity securities are valued at the official closing price (typically

last sale) on the exchange on which the securities are primarily traded, or if no closing price is available, at the last bid price and are categorized as Level 1 in the hierarchy. Restricted Equity Securities and Private Placements that are not

widely traded, are illiquid or are internally fair valued by the valuation committee are generally categorized as Level 3 in the hierarchy.

Certain non-U.S. securities may be fair valued in cases where closing prices are not readily available or are deemed not reflective of readily available

market prices. For example, significant events (such as movement in the U.S. securities market, or other regional and local developments) may occur between the time that non-U.S. markets close (where the security is principally traded) and the time

that the Fund calculates its net asset value (‘NAV’) (generally 4 p.m. Eastern time, the close of the New York Stock Exchange (“NYSE”)) that may impact the value of securities traded in these non-U.S. markets. In such cases the

Funds fair value non-U.S. securities using an independent pricing service which considers the correlation of the trading patterns of the non-U.S. security to the intraday trading in the U.S. markets for investments such as ADRs, financial futures,

exchange traded funds, and certain indexes as well as prices for similar securities. Such fair valuations are categorized as Level 2 in the hierarchy. Because the frequency of significant events is not predictable, fair valuation of certain Foreign

Common Stocks may occur on a frequent basis.

Other information regarding each Fund is available in the Fund’s most

recent Report to Shareholders

VIRTUS EQUITY TRUST

NOTES TO SCHEDULES OF INVESTMENTS

JUNE 30, 2013 (UNAUDITED) (CONTINUED)

Debt securities, including restricted securities, are valued based on evaluated quotations received

from independent pricing services or from dealers who make markets in such securities. For most bond types, the pricing service utilizes matrix pricing which considers one or more of the following factors: yield or price of bonds of comparable

quality, coupon, maturity, current cash flows, type, and current day trade information, as well as dealer supplied prices. These valuations are generally categorized as Level 2 in the hierarchy. Structured debt instruments such as Mortgage-Backed

and Asset-Backed Securities, may also incorporate collateral analysis and utilize cash flow models for valuation, and are generally categorized as Level 2 in the hierarchy. Pricing services do not provide pricing for all securities and therefore

indicative bids from dealers are utilized which are based on pricing models used by market makers in the security and are generally categorized as Level 2 in the hierarchy. Debt securities that are not widely traded, are illiquid, or are internally

fair valued by the valuation committee are generally categorized as Level 3 in the hierarchy.

Listed derivatives that are actively traded are

valued based on quoted prices from the exchange and are categorized as Level 1 in the hierarchy. Over the counter (OTC) derivative contracts, which include Forward Currency Contracts and Equity Linked instruments, do not require material

subjectivity as pricing inputs are observed from actively quoted markets and are categorized as Level 2 in the hierarchy.

Investments in

open-end mutual funds are valued at NAV. Investment in closed-end mutual funds are valued as of the close of regular trading on the NYSE, generally 4 p.m. Eastern time, each business day. Both are categorized as Level 1 in the hierarchy.

Short-term notes having a remaining maturity of 60 days or less are valued at amortized cost, which approximates market and are generally categorized as

Level 2 in the hierarchy.

A summary of the inputs used to value the Funds’ major categories of assets and liabilities, which primarily

include investments of the Fund, by each major security type is disclosed at the end of the Schedule of Investments for each Fund. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with

investing in those securities.

B. Derivative Financial Instruments

Disclosures on derivatives instruments and hedging activities are intended to improve financial reporting for derivative instruments by enhanced disclosure that enables the investors to understand how and

why a fund uses derivatives, how derivatives are accounted for, and how derivative instruments affect a fund’s results of operations and financial position. Summarized below are specific types of derivative instruments used by certain Funds.

Options contracts:

An options contract provides the purchaser with the right, but not the obligation, to buy (call option) or sell

(put option) a financial instrument at an agreed upon price. The Fund may purchase or write both put and call options on portfolio securities. The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The

Fund may use options contracts to hedge against changes in the values of equities.

When the Fund purchases an option, it pays a premium and

an amount equal to that premium is recorded as an asset. When the Fund writes an option, it receives a premium and an amount equal to that premium is recorded as a liability. The asset or liability is adjusted daily to reflect the current market

value of the option. Holdings of the Fund designated to cover outstanding written options are noted in the Schedules of Investments.

The risk

in writing call options is that the Fund gives up the opportunity for profit if the market price of the security increases and the option is exercised. The risk in writing put options is that the Fund may incur a loss if the market price of the

security decreases and the option is exercised. The risk in buying options is that the Fund pays a premium whether or not the option is exercised. The use of such instruments may involve certain additional risks as a result of unanticipated

movements in the market. Writers (sellers) of

Other

information regarding each Fund is available in the Fund’s most recent Report to Shareholders

VIRTUS EQUITY TRUST

NOTES TO SCHEDULES OF INVESTMENTS

JUNE 30, 2013 (UNAUDITED) (CONTINUED)

options are subject to unlimited risk of loss, as the seller will be obligated to deliver or take

delivery of the security at a predetermined price which may, upon exercise of the option, be significantly different from the then-market value.

C. Credit Risk

In countries with limited or developing markets, investments may present

greater risks than in more developed markets and the prices of such investments may be volatile. The consequences of political, social or economic changes in these markets may have disruptive effects on the market prices of these investments and the

income they generate, as well as a Fund’s ability to repatriate such amounts.

High-yield/high-risk securities typically entail greater

price volatility and/or principal and interest rate risk. There is a greater chance that an issuer will not be able to make principal and interest payments on time. Analysis of the creditworthiness of issuers of high-yield securities may be complex,

and as a result, it may be more difficult for the Adviser and/or Subadviser to accurately predict risk.

D. Securities Lending

Certain Funds may loan securities to qualified brokers through an agreement with Brown Brothers Harriman (“BBH”), as a third

party lending agent. Under the terms of agreement, the Fund is required to maintain collateral with a market value not less than 100% of the market value of loaned securities. Collateral is adjusted daily in connection with changes in the market

value of securities on loan. Collateral may consist of cash and securities issued by the U.S. Government or its agencies. Cash collateral is invested in a short-term money market fund. Dividends earned on the collateral and premiums paid by the

broker are recorded as income by the Fund net of fees and rebates charged by BBH for its services as securities lending agent and in connection with this securities lending program. Lending portfolio securities involves a risk of delay in the

recovery of the loaned securities or in the declining value of the collateral. At December 31, 2013, the following Funds had securities on loan ($ reported in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Value

|

|

|

Cash Collateral

|

|

|

Balanced Fund

|

|

$

|

13,668

|

|

|

$

|

13,996

|

|

|

Growth and Income Fund

|

|

$

|

287

|

|

|

$

|

295

|

|

|

Mid-Cap Growth Fund

|

|

$

|

2,171

|

|

|

$

|

2,215

|

|

|

Tactical Allocation Fund

|

|

$

|

3,819

|

|

|

$

|

3,902

|

|

NOTE 2—ILLIQUID AND RESTRICTED SECURITIES

Investments are generally considered illiquid if they cannot be disposed of within seven days in the ordinary course of business at the approximate amount at which such securities have been valued by the

Fund. Additionally, the following information is also considered in determining liquidity: the frequency of trades and quotes for the investment, whether the investment is listed for trading on a recognized domestic exchange and/or whether two or

more brokers are willing to purchase or sell the security at a comparable price, the extent of market making activity in the investment and the nature of the market for investment. Illiquid securities are footnoted as such at the end of each

Fund’s Schedule of Investments where applicable. However, a portion of such footnoted securities could be liquid where liquidity is based on average trading volumes that require more than seven days for disposal of such securities.

Restricted securities are not registered under the Securities Act of 1933. Generally, 144A securities are excluded from this category, except where

defined as illiquid.

At December 31, 2013, there were no illiquid and restricted securities held by the funds.

Other

information regarding each Fund is available in the Fund’s most recent Report to Shareholders

VIRTUS EQUITY TRUST

NOTES TO SCHEDULES OF INVESTMENTS

JUNE 30, 2013 (UNAUDITED) (CONTINUED)

The Funds will bear any costs, including those involved in registration under the Securities Act of

1933, in connection with the disposition of such securities.

NOTE 3—FEDERAL INCOME TAX INFORMATION ($ reported in thousands)

At December 31, 2013, federal tax cost and aggregate gross unrealized appreciation (depreciation) of securities held by the funds

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Unrealized

|

|

|

|

|

Federal

|

|

|

Unrealized

|

|

|

Unrealized

|

|

|

Appreciation

|

|

|

Fund

|

|

Tax Cost

|

|

|

Appreciation

|

|

|

(Depreciation)

|

|

|

(Depreciation

|

|

|

Balanced Fund

|

|

$

|

524,404

|

|

|

$

|

106,120

|

|

|

$

|

(8,697

|

)

|

|

$

|

97,423

|

|

|

Growth & Income Fund

|

|

|

131,606

|

|

|

|

19,010

|

|

|

|

(674

|

)

|

|

|

18,336

|

|

|

Mid-Cap Core Fund

|

|

|

3,338

|

|

|

|

1,174

|

|

|

|

(8

|

)

|

|

|

1,166

|

|

|

Mid-Cap Growth Fund

|

|

|

76,255

|

|

|

|

19,700

|

|

|

|

(978

|

)

|

|

|

18,722

|

|

|

Mid-Cap Value Fund

|

|

|

285,786

|

|

|

|

152,296

|

|

|

|

(2,581

|

)

|

|

|

149,715

|

|

|

Quality Large-Cap Value Fund

|

|

|

44,782

|

|

|

|

22,903

|

|

|

|

—

|

|

|

|

22,903

|

|

|

Quality Small-Cap Fund

|

|

|

171,707

|

|

|

|

116,155

|

|

|

|

(506

|

)

|

|

|

115,649

|

|

|

Small-Cap Core Fund

|

|

|

408,622

|

|

|

|

120,403

|

|

|

|

(820

|

)

|

|

|

119,583

|

|

|

Small-Cap Sustainable Growth Fund

|

|

|

98,229

|

|

|

|

38,058

|

|

|

|

(163

|

)

|

|

|

37,895

|

|

|

Strategic Growth Fund

|

|

|

292,401

|

|

|

|

140,592

|

|

|

|

(453

|

)

|

|

|

140,139

|

|

|

Tactical Allocation Fund

|

|

|

167,243

|

|

|

|

36,406

|

|

|

|

(2,630

|

)

|

|

|

33,776

|

|

NOTE 4—SUBSEQUENT EVENTS

Management has evaluated the impact of all subsequent events on the Funds through the date the Schedules of Investments (“N-Q”) were available for filing, and has determined that there are no

subsequent events that require recognition or disclosure in the financial statements.

Other

information regarding each Fund is available in the Fund’s most recent Report to Shareholders

Item 2. Controls and Procedures.

|

|

(a)

|

The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the

registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR

270.30a-3(c)))

are effective, as of a

date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rule

13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

|

|

|

(b)

|

There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR

270.30a-3(d)) that occurred during the registrant’s last fiscal quarter that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

|

Item 3. Exhibits.

Certifications

pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant)

Virtus Equity

Trust

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ George R. Aylward

|

|

|

|

George R. Aylward, President

|

|

|

|

(principal executive officer)

|

Date

02/27/14

Pursuant to the

requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ George R. Aylward

|

|

|

|

George R. Aylward, President

|

|

|

|

(principal executive officer)

|

Date

02/27/14

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ W. Patrick Bradley

|

|

|

|

W. Patrick Bradley, Senior Vice President, Chief Financial Officer,

and Treasurer

|

|

|

|

(principal financial officer)

|

Date

02/27/14

*

Print the name and title of each signing officer under his or her signature.

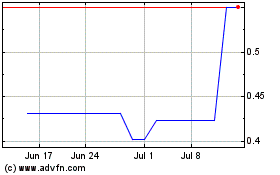

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

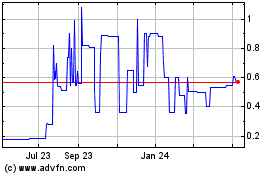

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jul 2023 to Jul 2024