Victory Energy Corporation Acquires Interest in Alwan West Natural Gas Prospect

April 25 2011 - 11:30AM

Marketwired

As part of its continuing corporate rebuilding strategy, Victory

Energy Corporation (PINKSHEETS: VYEY), through its partnership with

Aurora Energy Partners, today announced the acquisition of a

working interest in the Alwan West natural gas prospect.

The Alwan West prospect will be the largest natural gas well

drilled by Victory Energy to date. This prospect's potential

reservoir covers an area of 175 acres. It has a reserve potential

of 8.75 billion cubic feet (BCF) of natural gas and 43.75 thousand

barrels of gas condensate. The reserve potential is based on 50

feet of reservoir sand, one million cubic feet per acre-foot of

natural gas and five barrels per million cubic feet of gas

condensate. These reserve estimates are for the first Yegua sand

only, which is the primary objective, and do not include potential

in the secondary objectives.

The Alwan West prospect is located in far western Wharton

County, Texas, near the Jackson County line. There are two natural

gas lines that cross the lease within 1,000 feet of the proposed

location. Victory Energy acquired the prospect, which includes a 5

percent working interest (WI) and a 3.8 percent net revenue

interest (NRI), from Miramar Petroleum, Inc. of Corpus Christi,

Texas, who will be the operator and who also owns a significant

working interest in the well. The well is anticipated to spud in

early June of this year.

This area produces from the Frio and Yegua (Oligocene)

formations. The lease area is surrounded on all sides by gas

condensate production. The first Yegua sand is the primary

objective. Secondary objectives are the Frio and second Yegua sand.

Alwan West lies on strike between two Yegua fields, Lost Fork (one

mile west) and AVO Grande (3,000 feet east). Lost Fork has produced

over 42 BCF, while AVO Grande has produced 7 BCF of natural gas.

Both of these fields are stratigraphic traps, as is the Alwan West

prospect.

Robert Miranda, Victory Energy's chairman and CEO, stated, "This

prospect represents our largest gas play to date and it has the

potential to deliver a stable and predictable gas flow to the

company. Unlike many other gas sands, the Yegua sand is known for

its consistent production and very low annual decline rates. This

well is supported by both significant nearby production and quality

seismic data."

About Victory Energy Corporation Victory

Energy Corporation is engaged in the exploration, acquisition,

development, and exploitation of oil and gas properties. The

company endeavors to utilize its broad range of oil and gas

industry relationships to acquire small interests in a large volume

of low- to moderate-risk oil and gas prospects. A cornerstone of

this strategy is an emphasis on developing and maintaining

relationships with proven, well established oil and gas exploration

and development companies.

Prospect acquisitions are ideally weighted toward oil, although

natural gas projects with high btu content, favorable above-market

pricing and modest decline rates will also be targeted. Targeted

prospects generally provide the company with a rapid return of

capital while offering multiple well locations for additional

drilling on an established trend. The model asset portfolio is

geologically and geographically diversified. The company's current

producing oil and gas assets are located in the United States.

For more information, please visit our website

http://www.vyey.com

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995 There are

forward-looking statements contained in this news release. They use

such words as "intend," "will," "may," "expect," "believe," "plan,"

or other similar terminology. These statements involve known and

unknown risks, uncertainties and other factors, which may cause the

actual results to be materially different than those expressed or

implied in such statements. These factors include, but are not

limited to: risks associated with the implementation of the

Company's strategic growth plan; legislation and government

regulation including the ability to obtain satisfactory regulatory

approvals; conditions beyond the Company's control such as weather,

natural disasters, disease outbreaks, epidemics or pandemics

impacting the Company's customer base or acts of war or terrorism;

availability and cost of materials and labor; demand for natural

gas; cost and availability of capital; competition; the Company's

overall marketing, operational and financial performance; economic

and political conditions; the continued service of the Company's

executive officer; adverse developments in and increased or

unforeseen legal costs related to the Company's litigation; the

success of the Company's strategic partnerships and joint venture

relationships; the Company's ability to pay certain debts; adoption

of new, or changes in, accounting policies and practices; adverse

court rulings; results of other litigation in which the company is

involved; and other factors discussed from time to time in the

Company's news releases, public statements and/or filings with the

Securities and Exchange Commission. Forward-looking information is

provided by Victory Energy Corporation pursuant to the safe harbor

established under the Private Securities Litigation Reform Act of

1995 and should be evaluated in the context of these factors. In

addition, the Company disclaims any intent or obligation to update

these forward-looking statements.

Add to Digg Bookmark with del.icio.us Add to Newsvine

CONTACT: Robert J. Miranda Chairman and Chief Executive Officer

714.480.0305 Investor Relations 714.227.0391

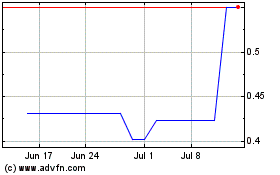

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

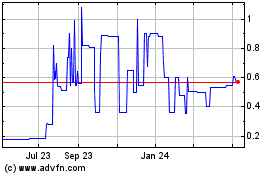

Victory Oilfield Tech (PK) (USOTC:VYEY)

Historical Stock Chart

From Jul 2023 to Jul 2024