As

filed with the Securities and Exchange Commission on September 18, 2023

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| ☒ |

Preliminary Information Statement |

☐ |

Confidential,

For Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ |

Definitive

Information Statement |

| TRAQIQ,

INC. |

|

|

| (Name

of Registrant as Specified in its Charter) |

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| ☐ |

Fee

paid previously with preliminary materials: |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-1l(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its

filing. |

| |

(1) |

Amount Previously Paid:

$ |

| |

(2) |

Form, Schedule or Registration

Statement No.: |

| |

(3) |

Filing Party: |

| |

(4) |

Date Filed: |

TRAQIQ,

INC.

1931

Austin Drive

Troy,

Michigan 48083

NOTICE

OF SHAREHOLDER ACTION BY WRITTEN CONSENT

Dear

Shareholder:

The

purpose of this letter is to inform you that the board of directors of TraQiQ, Inc., a California corporation (“we”, “us”

or “our company”), and the holders of a majority of the outstanding shares of our issued and outstanding common stock, par

value $0.0001 per share (our “Common Stock”), pursuant to a written consent in lieu of a meeting in accordance with our articles

of incorporation and Section 1113 of the California General Corporation Law (the “CGCL”), approved the following actions:

| (i) | a

reincorporation of our company in the state of Nevada (the “Reincorporation”)

through the merger (the “Reincorporation Merger”) of our company with and into

Titan Environmental Solutions Inc., a wholly-owned, newly-formed Nevada subsidiary formed

specifically for this purpose (“Titan Environmental”); |

| (ii) | the

adoption by Titan Environmental of the Titan Environmental Solutions Inc. 2023 Equity Incentive

Plan (the “Titan Incentive Plan”) effective upon the consummation of the Reincorporation

Merger (see “Titan Environmental Solutions Inc. 2023 Equity Incentive Plan” in

the attached Information Statement for additional information); and |

| (iii) | the

authorization of an amendment to the Articles of Incorporation of Titan Environmental (the

“Charter”) following the effective date of the Reincorporation Merger to (a)

effect a reverse stock split (the “Reverse Stock Split”) of the common stock

of Titan Environmental on the basis of one new share of common stock for up to 50 shares

of old common stock, at the discretion of the board of directors of Titan Environmental at

any time prior to the first anniversary of the effective date of the Reincorporation Merger

and (b) at the discretion of the board of directors of Titan Environmental in connection

with effecting the Reverse Stock Split, to reduce the number of authorized shares of common

stock of Titan Environmental to number of shares not less than 110% of the number of outstanding

shares of Titan Environmental common stock on a fully-diluted basis after effecting the Reverse

Stock Split, as determined by the board of directors of Titan Environmental (see “The

Reverse Stock Split” in the attached Information Statement for additional information). |

Our

board of directors and such shareholders approved the Reincorporation, the Titan Incentive Plan and the Reverse Stock Split in an effort

to better position our company to attract capital as we seek to grow the business of our company in the waste management industry. Our

board and such shareholders believe the actions taken will provide us with a more flexible capital structure and simplicity in corporate

governance under Nevada law.

Implementing

the Reincorporation will have, among other things, the following effects:

| |

● |

our corporate name will be changed to “Titan Environmental

Solutions, Inc.”; |

| |

|

|

| |

● |

each share of our Common Stock issued and outstanding immediately

prior to the effective time of the Reincorporation Merger will be converted into one share of common stock of Titan Environmental; |

| |

|

|

| |

● |

each share of our Series C Convertible Preferred Stock, par

value $0.0001 per share (our “Series C Preferred Stock”) immediately prior to the effective time of the Reincorporation Merger,

which is convertible into 100 shares of our Common Stock, will be converted into one share of Series A Convertible Preferred Stock of

Titan Environmental, which has substantially the same rights and preferences as our Series C Preferred Stock; |

| ● | each

Series A Right to Receive Common Stock issued and outstanding immediately prior to the effective

time of the Reincorporation Merger will be converted into one Series A Right to Receive Common

Stock of Titan Environmental, which has substantially the same rights and preferences as

our Series A Rights to Acquire Common Stock; |

| | | |

| ● | each

Series B Right to Receive Common Stock issued and outstanding immediately prior to the effective

time of the Reincorporation Merger will be converted into one Series B Right to Receive Common

Stock of Titan Environmental, which has substantially the same rights and preferences as

our Series B Rights to Acquire Common Stock; |

| | | |

| ● | our

outstanding warrants to purchase our Common Stock will automatically be assumed by Titan

Environmental and will represent a warrant to acquire shares of common stock of Titan Environmental; |

| | | |

| ● | our

authorized capital stock will be increased to 425,000,000 total shares, consisting of 400,000,000

shares of common stock, par value $0.0001 per share, and 25,000,000 shares of “blank

check” preferred stock, par value $0.0001 per share, of which 701,000 shares shall

be designated “Series A Convertible Preferred Stock”; |

| | | |

| ● | we

will adopt the “Titan Environmental Solutions Inc. 2023 Equity Incentive Plan”; |

| | | |

| ● | our

board of directors will be authorized to effect the Reverse Stock Split on the basis of one

new share of common stock for up to 50 shares of old common stock, at the discretion of the

board of directors, at any time prior to the first anniversary of the effective date of the

Reincorporation Merger; |

| | | |

| ● | in

connection with effecting the Reverse Stock Split, our board of directors will be authorized

to amend the articles of incorporation of Titan Environmental to reduce the number of authorized

shares of common stock to a number of shares, as determined by our board of directors, that

is not less than 110% of the number of outstanding shares of common stock on a fully-diluted

basis after giving effect to the Reverse Stock Split; |

| | | |

| |

● |

the persons presently serving as our executive officers and

directors will continue to serve in such respective capacities following the effective time of the Reincorporation Merger; and |

| |

|

|

| |

● |

Our company will be governed by the laws of the State of Nevada

and Articles of Incorporation and Bylaws will be adopted under the laws of the State of Nevada in the forms attached hereto as Exhibits

B and C, respectively. |

Notwithstanding

approval of the Reincorporation by our shareholders, our board of directors may, in its sole discretion, determine not to effect, and

to abandon, the Reincorporation without further action by our shareholders.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

accompanying Information Statement, which describes the above corporate action in more detail, is being furnished to our shareholders

for informational purposes only pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and the rules and regulations prescribed thereunder. Pursuant to Rule 14c-2 under the Exchange Act, these corporate actions will not

be effective until twenty (20) calendar days after the mailing of this Information Statement to our shareholders, at which time we may

file with the California Secretary of State and the Nevada Secretary of State one or more certificates of merger and incorporation to

effectuate the actions described above. The Reincorporation will be effective at such time after the expiration of the aforementioned

twenty (20)-day period as our board of directors determines to be the appropriate effective time.

I

encourage you to read the enclosed Information Statement, which is being provided to all of our shareholders. It describes the proposed

corporate actions in detail.

|

Sincerely, |

| |

|

| |

/s/

Glen Miller |

| |

Glen Miller |

| |

Chief Executive Officer |

| |

September [__], 2023 |

This

Information Statement is dated September [__], 2023 and is first being mailed to shareholders of record of TraQiQ, Inc. on September

[__], 2023.

TraQiQ,

Inc.

1931

Austin Drive

Troy,

MI 48083

INFORMATION

STATEMENT

PURSUANT

TO SECTION 14(C)

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

RULE 14C-2 THEREUNDER

NO

VOTE OR OTHER ACTION OF SHAREHOLDERS IS REQUIRED

IN

CONNECTION WITH THIS INFORMATION STATEMENT.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED

NOT

TO SEND US A PROXY

We

are distributing this Information Statement to shareholders of TraQiQ, Inc. (sometimes hereinafter referred to as “we”, “us”,

“our company” or “TraQiQ”) in full satisfaction of any notice requirements we may have under the Securities and

Exchange Act of 1934, as amended (the “Exchange Act”), and the California General Corporation Law (sometimes referred to

herein as the “CGCL”). No additional action will be undertaken by us with respect to the receipt of written consents, and

no dissenters’ rights under the CGCL are afforded to our shareholders as a result of the corporate action described in this Information

Statement. The record date for determining the shareholders entitled to receive this Information Statement has been established as of

the close of business on September [__], 2023 (the “Record Date”).

OUTSTANDING

VOTING SECURITIES

As

of the Record Date, we had issued and outstanding 15,134,545 shares of common stock, par value $0.0001 per share (the “Common

Stock”), and 701,000 shares of Series C Convertible Preferred Stock, par value $0.0001 per share (the “Series C Preferred

Stock”), constituting all of our company’s issued and outstanding capital stock. The Series C Preferred Stock is convertible

into shares of our Common Stock on a one-for-one hundred basis, and each share of Series C Preferred Stock is entitled to 100 votes on

all matters submitted to our common shareholders for approval. No other class of our preferred stock, par value $0.0001 per share (the

“Preferred Stock”), was issued and outstanding at such date.

Section

603(a) of the CGCL provides that the written consent of the holders of outstanding shares of voting capital stock having not less than

the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote

thereon were present and voted can approve an action in lieu of conducting a special stockholders’ meeting convened for the specific

purpose of such action. The CGCL, however, requires that in the event an action is approved by written consent, a company must provide

notice of the taking of any corporate action without a meeting to all stockholders who were entitled to vote upon the action but who

have not consented to the action. On September [__], 2023, our board of directors approved, and on or about September [__], 2023,

the holders of our Common Stock and Series C Preferred Stock representing more than a majority of the votes that would be necessary to

approve the Reincorporation (as defined below) consented in writing without a meeting to, the matters described herein.

CORPORATE

ACTIONS

The

corporate actions described in this Information Statement will not afford shareholders the opportunity to dissent from the actions described

herein or to receive an agreed or judicially appraised value for their shares.

The

purpose of this letter is to inform you that our board of directors and the holders of our issued and outstanding shares of Common Stock

and Series C Preferred Stock, which are our only classes of capital stock entitled to vote on such matters, representing a majority of

the total votes entitled to be cast by our shareholders, pursuant to a written consent in lieu of a meeting in accordance with our articles

of incorporation and Section 603 of the CGCL, approved the following actions:

| (i) | a

reincorporation of our company in the state of Nevada (the “Reincorporation”)

through the merger (the “Reincorporation Merger”) of our company with and into

Titan Environmental Solutions Inc., a wholly-owned, newly-formed Nevada subsidiary formed

specifically for this purpose (“Titan Environmental”); |

| (ii) | the

adoption by Titan Environmental of the Titan Environmental Solutions Inc. 2023 Equity Incentive

Plan (the “Titan Incentive Plan”) effective upon the consummation of the Reincorporation

Merger (see “Titan Environmental Solutions Inc. 2023 Equity Incentive Plan” in

the attached Information Statement for additional information); and |

| (iv) | the

authorization of an amendment to the Articles of Incorporation of Titan Environmental (the

“Charter”) following the effective date of the Reincorporation Merger to (a)

effect a reverse stock split (the “Reverse Stock Split”) of the common stock

of Titan Environmental on the basis of one new share of common stock for up to 50 shares

of old common stock, at the discretion of the board of directors of Titan Environmental at

any time prior to the first anniversary of the effective date of the Reincorporation Merger

and (b) at the discretion of the board of directors of Titan Environmental in connection

with effecting the Reverse Stock Split, to reduce the number of authorized shares of common

stock of Titan Environmental to number of shares not less than 110% of the number of outstanding

shares of Titan Environmental common stock on a fully-diluted basis after effecting the Reverse

Stock Split, as determined by the board of directors of Titan Environmental (see “The

Reverse Stock Split” for additional information). |

Our

board of directors and such shareholders approved the Reincorporation, the Titan Incentive Plan and the Reverse Stock Split in an effort

to better position our company to attract capital as we seek to grow the business of our company in the waste management industry. Our

board and such shareholders believe the actions taken will provide us with a more flexible capital structure and simplicity in corporate

governance under Nevada law.

Implementing

the Reincorporation will have, among other things, the following effects:

| |

● |

our corporate name will be changed to “Titan

Environmental Solutions, Inc.”; |

| |

● |

each share of our Common Stock issued and outstanding

immediately prior to the effective time of the Reincorporation Merger will be converted into one share of common stock of Titan Environmental; |

| |

● |

each share of our Series C Preferred Stock, which is convertible into 100 shares of our Common Stock,

will be converted into one share of Series A Convertible Preferred Stock of Titan Environmental, which has substantially the same rights

and preferences as our Series C Preferred Stock; |

| |

● |

each of our Series A Rights to Receive Common Stock

issued and outstanding immediately prior to the effective time of the Reincorporation Merger will be converted into one Series A Right

to Receive Common Stock of Titan Environmental, which has substantially the same rights and preferences as our Series A Rights to Acquire

Common Stock; |

| ● | each

of our Series B Rights to Receive Common Stock issued and outstanding immediately prior to

the effective time of the Reincorporation Merger will be converted into one Series B Right

to Receive Common Stock of Titan Environmental, which has substantially the same rights and

preferences as our Series B Rights to Acquire Common Stock; |

| ● | our

outstanding warrants to purchase our Common Stock will automatically be assumed by Titan

Environmental and will represent a warrant to acquire shares of common stock of Titan Environmental; |

| ● | our

authorized capital stock will be increased to 425,000,000 total shares, consisting of 400,000,000

shares of common stock, par value $0.0001 per share, and 25,000,000 shares of “blank

check” preferred stock, par value $0.0001 per share, of which 701,000 shares shall

be designated “Series A Convertible Preferred Stock”; |

| ● | we

will adopt the Titan Incentive Plan (see “Titan Environmental Solutions Inc. 2023 Equity

Incentive Plan” below for additional information); |

| ● | our

board of directors will be authorized to effect the Reverse Stock Split on the basis of one

new share of common stock for up to 50 shares of old common stock, at the discretion of the

board of directors, at any time prior to the first anniversary of the effective date of the

Reincorporation Merger; |

| ● | in

connection with effecting the Reverse Stock Split, our board of directors will be authorized

to amend the articles of incorporation of Titan Environmental to reduce the number of authorized

shares of common stock to a number of shares, as determined by our board of directors, that

is not less than 110% of the number of outstanding shares of common stock on a fully-diluted

basis after giving effect to the Reverse Stock Split; |

| |

● |

the persons presently serving as our executive officers

and directors will continue to serve in such respective capacities following the effective time of the Reincorporation Merger; and |

| |

● |

Our company will be governed by the laws of the State of Nevada

and Articles of Incorporation and Bylaws will be adopted under the laws of the State of Nevada in the forms attached hereto as Exhibits

B and C, respectively. |

Notwithstanding

approval of the Reincorporation by our shareholders, our board of directors may, in its sole discretion, determine not to effect, and

to abandon, the Reincorporation without further action by our shareholders.

We

will pay the expenses of furnishing this Information Statement to our shareholders, including the cost of preparing, assembling and mailing

this Information Statement.

Capital

Stock

As

of the Record Date, there were issued and outstanding 15,134,545 shares of Common Stock (with the holder of each share having

one vote) and 701,000 shares of Series C Preferred Stock (with the holder of each share having 100 votes). Pursuant to the CGCL, at least

a majority of the voting equity of our company, or at least 42,617,273 votes (out of 85,234,545 total votes comprised of

15,134,545 Common Stock votes and 70,100,000 Series C Preferred Stock votes), is required to approve the Reincorporation by written

consent. Stockholders who collectively hold 6,765,605 shares of Common Stock and 701,000 shares of Series C Preferred Stock (approximately

90.2% of the total voting equity of our company), have voted in favor of the Reincorporation, thereby satisfying the requirement

under Section 603(a) of the CGCL that at least a majority of the voting equity vote in favor of a corporate action by written consent.

The

following table sets forth the name of the stockholders that voted in favor of the Reincorporation the Titan Incentive Plan and the Reverse

Stock Split, the number of shares of Common Stock and Series C Preferred Stock held by such stockholders, the total number of votes that

each such stockholder voted in favor of the Reincorporation, and the percentage of the issued and outstanding voting equity of our company

voted in favor thereof.

Name of Stockholder | |

Number of

Shares of Common

Stock Held | | |

Number of Shares of Series C Preferred

Stock Held | | |

Number of Votes held by Such Stockholder | | |

Number of Votes that Voted in favor of

the

Reincorporation | | |

Percentage of the Voting Equity that Voted in favor of the Reincorporation(1) | |

| Titan 5, LLC | |

| - | | |

| 205,326 | | |

| 20,532,600 | | |

| 20,532,600 | | |

| 24.1 | % |

| Titan Holdings 2, LLC | |

| - | | |

| 159,826 | | |

| 15,982,600 | | |

| 15,982,600 | | |

| 18.8 | |

| Jeffrey Rizzo | |

| - | | |

| 251,710 | | |

| 25,171,000 | | |

| 25,171,000 | | |

| 29.6 | |

| William McCauley | |

| - | | |

| 14,038 | | |

| 1,403,800 | | |

| 1,403,800 | | |

| 1.6 | |

| Glen Miller | |

| - | | |

| 70,100 | | |

| 7,010,000 | | |

| 7,010,000 | | |

| 8.2 | |

| Ajay Sikka | |

| 6,765,605 | | |

| - | | |

| 6,765,605 | | |

| 6,765,605 | | |

| 7.9 | |

| Total | |

| 6,765,605 | | |

| 701,000 | | |

| 76,865,605 | | |

| 76,865,605 | | |

| 90.2 | % |

| (1) | Based

on 15,134,545 shares of Common Stock and 701,000 shares of Series C Preferred Stock

issued and outstanding as of September [__], 2023, representing an aggregate of 85,234,545

votes that may be cast on any matter to be voted on by our equityholders. |

REINCORPORATION

IN NEVADA

Background

Prior

to January 1, 2023, our operations were concentrated in India, Southeast Asia and Latin America, and involved servicing business supply

chains with last mile delivery and mobile commerce. In December 2022, we sold a substantial portion of that legacy business. On January

5, 2023, we acquired certain aerobic digestion technology solutions for the disposal of food waste at the point of generation and related

data analytics with respect to food waste with the intention of engaging in the business of reducing the environmental impact of the

waste management industry through the development and deployment of cost-effective technology solutions. On May 19, 2023, we acquired

Titan Trucking, LLC, a company in the business of providing transportation and waste hauling services. We intend to continue to acquire

assets or operating businesses in the waste management industry.

Our

board of directors desires to execute the Reincorporation described herein for several reasons, including renaming our company to a name

more suitable for our new business focus, reverse splitting our outstanding capital stock to prepare for future fundraising and the listing

of our Common Stock on a national stock exchange and increased flexibility in connection with the operation and administration of our

company as a result of certain statutory provisions and existing case law. We would like, in part, to be able to take advantage of certain

provisions of Nevada law that, we believe, will give our planning more surety than available in California.

On

September [__], 2023, our board of directors approved, and on or about September __, 2023, the Consenting Shareholders consented in writing

without a meeting to, the Reincorporation.

Questions

and Answers

The

following questions and answers are intended to respond to frequently asked questions concerning the Reincorporation in Nevada. These

questions do not, and are not intended to, address all the questions that may be important to you. You should carefully read the entire

Information Statement, as well as its exhibits.

| Q: |

Why does TraQiQ want to change its state of incorporation

from California to Nevada? |

| A: | Our

board of directors desires to execute the Reincorporation described herein for several reasons,

including renaming our company to a name more suitable for our new business focus, reverse

splitting our outstanding capital stock to prepare for future fundraising and the listing

of our Common Stock on a national stock exchange and increased flexibility in connection

with the operation and administration of TraQiQ as a result of certain statutory provisions

and existing case law. We would like, in part, to be able to take advantage of certain provisions

of Nevada law that we believe will give our planning more surety than available in California.

Also, the Delaware courts have provided extensive case law with respect to corporate matters,

which will provide our company greater predictability and reduce certain uncertainties and

risks in conducting our business. |

| Q: |

Why is TraQiQ not holding a meeting to approve the Reincorporation? |

| A: | Our

board of directors has already approved the Reincorporation plan and the Reverse Merger,

having received approval from the holders of issued and outstanding Common Stock and Series

C Preferred Stock representing more than 50% of the votes entitled to be cast on the Reincorporation,

Titan Incentive Plan and Reverse Stock Split proposals. Under the CGCL, our articles of incorporation

and pertinent securities law standards, this transaction may be approved by written consent

of a majority of the votes entitled to be cast. Since we have already received written consents

representing the necessary number of votes, a meeting is not necessary and represents a substantial

and avoidable expense. |

| Q: |

What are the principal features of the Reincorporation? |

| A: | The

Reincorporation will be accomplished by a merger of our company with and into Titan Environmental,

a wholly-owned, newly-formed subsidiary. In the merger, one share of common stock, par value

$0.0001 per share, of Titan Environmental will be issued for each share of our Common Stock,

and one share of Series A convertible preferred stock, par value $0.0001 per share, of Titan

Environmental will be issued for each share of our Series C Preferred Stock, in either case

that is held by our shareholders at the effective time of the Reincorporation. |

Following

the Reincorporation, the shares of our Common Stock will cease to trade on the OTC QB and shares of common stock of Titan Environmental

issued to you in lieu thereof will begin trading in their place, under the new trading symbol “TESI”.

The

Reincorporation will also change our corporate name to “Titan Environmental Solutions, Inc.” and increase our authorized

capital stock to 425,000,000 shares, of which 400,000,000 will be common stock and 25,000,000 will be preferred stock, of which 701,000

shares will be designated Series A Convertible Preferred Stock.

In

connection with the Reincorporation, we will adopt the Titan Incentive Plan, which will be a new equity incentive plan available for

the issuance of equity incentives to our officers, directors, employees and consultants. Our board of directors will also be authorized

to effect a reverse stock split of our common stock on the basis of one share for up to 50 outstanding shares, at the discretion of the

board, at any time prior to the first anniversary of the effective date of the Reincorporation.

| Q: |

How does the Reincorporation affect my ownership of TraQiQ? |

| A: | After

the Reincorporation Merger becomes effective, you will own the same percentage of the outstanding

shares of common stock on a fully diluted basis, and the same percentage of the outstanding

preferred stock, that you held immediately prior to the Reincorporation Merger. The terms

of out outstanding common stock and outstanding preferred stock after the Reincorporation

will be nearly identical to the terms of such classes of capital stock prior to the Reincorporation,

except that such securities will be governed by Nevada law rather than by California law. |

| Q: | How

does the Reincorporation affect the owners, officers, directors and employees of TraQiQ? |

| A: | Our

officers, directors and employees will become the officers, directors and employees of Titan

Environmental after the Reincorporation. |

| Q: |

How does the Reincorporation affect the business of TraQiQ? |

| A: | Like

our company now, immediately following the Reincorporation, Titan Environmental will continue

at the same location and with the same assets under the name “Titan Environmental Solutions,

Inc.” TraQiQ will cease to exist at the effective time of the Reincorporation Merger. |

| Q: |

How do I exchange certificates of TraQiQ for certificates

of Titan Environmental? |

| A: | After

the Reincorporation, our transfer agent will send you documents necessary to exchange your

stock certificates. |

| Q: |

What happens if I do not surrender my certificates of TraQiQ? |

| A: | YOU

ARE NOT REQUIRED TO SURRENDER CERTIFICATES REPRESENTING SHARES OF TRAQIQ TO RECEIVE SHARES

OF TITAN ENVIRONMENTAL. All shares of our company outstanding after the effective date of

the Reincorporation Merger continue to be valid. Until you receive exchange shares of our

company, you are entitled to receive notice of or vote at shareholder meetings or receive

dividends or other distributions on the shares of our company. |

| Q: |

What if I have lost my TraQiQ stock certificates? |

| A: | If

you have lost your TraQiQ certificates, you should contact our transfer agent as soon as

possible to have a new certificates issued. You may be required to post a bond or other security

to reimburse us for any damages or costs if the certificate is later delivered for conversion.

Our transfer agent may be reached at: |

Equity

Stock Transfer

237

West 37th Street, Suite 602

New

York, NY 10018

Telephone:

(212) 575-5757

E-Mail:

nora@equitystock.com

| Q: |

Can I require TraQiQ to purchase my stock? |

| A: | No.

Under the CGCL, you are not entitled to appraisal and purchase of your stock as a result

of the reincorporation. |

| Q: |

Who paid the costs of Reincorporation? |

| A: | Our

company will pay all of the costs of Reincorporation in Nevada, including the costs of printing

and distributing this Information Statement and related legal and accounting services. We

may also pay brokerage firms and other custodians for their reasonable expenses for forwarding

information materials to the beneficial owners of our common stock. We do not anticipate

contracting for other services in connection with the Reincorporation. |

| Q: |

Will I have to pay taxes on the new certificates? |

| A: | We

believe that the Reincorporation is not a taxable event and that you will be entitled to

the same tax basis in the shares of Titan Environmental that you had in our Common Stock

or Series C Preferred Stock, as the case may be. OF COURSE, EVERYONE’S TAX SITUATION

IS DIFFERENT AND YOU SHOULD CONSULT WITH YOUR PERSONAL TAX ADVISOR REGARDING THE TAX EFFECT

OF THE REINCORPORATION. |

The

following discussion summarizes certain aspects of the Reincorporation of our company into Delaware. This summary does not include all

of the provisions of the Plan and Agreement of Merger between our company and Titan Environmental, the form of which is attached hereto

as Exhibit A (the “Merger Agreement”), the articles of incorporation of Titan Environmental (the “Titan Environmental

Articles”), the form of which is attached hereto as Exhibit B , or the by-laws of Titan Environmental (the “Titan

Environmental By-laws”), the form of which is attached hereto as Exhibit C. Copies of the articles of incorporation, as

amended, and the by-laws of TraQiQ (the “TraQiQ Certificate” and the “TraQiQ By-laws,” respectively) are available

for inspection at the principal office of our company and copies will be sent to shareholders upon request. THE DISCUSSION CONTAINED

IN THIS INFORMATION STATEMENT IS QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE MERGER AGREEMENT, THE TITAN ENVIRONMENTAL ARTICLES, THE

TITAN ENVIRONMENTAL BY-LAWS, AND THE APPLICABLE PROVISIONS OF CALIFORNIA CORPORATE LAW AND CHAPTER 78 OF NEVADA REVISED STATUTES.

Principal

Reasons for the Reincorporation in Nevada

We

believe that the Reincorporation will give us a greater measure of flexibility and simplicity in corporate governance than is available

under Nevada law. Chapter 78 of Nevada Revised Statutes (the “NV Corporate Law”) is generally recognized as one of the most

comprehensive and progressive state corporate statutes. Accordingly, to the extent the NV Corporate Law addresses matters of corporate

concern more thoroughly than the corporate statutes of other states and is more reflective of current trends and developments in the

business community, by reincorporating our company in Nevada, our company (through its successor, Titan Environmental) will be better

suited to take advantage of business opportunities as they arise and to provide for its ever-changing business needs. In addition, there

exists in Nevada a substantial body of case law with respect to corporate matters, including the governance of the internal affairs of

a corporation and its relationships and contacts with others. This has brought about greater predictability under Nevada law and has

therefore reduced the uncertainties and risks commonly associated with resolving disputes of a corporate nature and structuring the internal

affairs of a corporation and its relationships and contacts with others. As a result, many major corporations have initially incorporated

in Nevada or have changed their corporate domiciles to Nevada in a manner similar to that which we are proposing. For a discussion of

some differences in shareholders’ rights and powers of management under Nevada law and California law, see “Significant Differences

Between California Law and Nevada Law.”

Principal

Features of the Reincorporation

The

Reincorporation will be effected by the merger of TraQiQ with and into Titan Environmental pursuant to a merger agreement by and between

TraQiQ and Titan Environmental (“Merger Agreement”), resulting in a change in our state of incorporation from California

to Nevada and a change in our corporate name from “TraQiQ, Inc.” to “Titan Environmental Solutions, Inc.” Titan

Environmental was recently formed as a wholly-owned subsidiary of TraQiQ, incorporated under the DGCL for the sole purpose of effecting

the Reincorporation. The Reincorporation will become effective at 12:01 a.m., Eastern time, on or about such date as the board of directors,

in its sole discretion, determines to file the required merger documents in Nevada and California and such documents are accepted by

the Secretary of State of the State of Nevada and the Secretary of State of the State of California (the “Effective Time”).

Following the Reincorporation Merger, Titan Environmental will be the surviving corporation.

Implementing

the Reincorporation will have, among other things, the following effects:

| |

● |

our corporate name will be changed to “Titan Environmental

Solutions, Inc.”; |

| |

● |

each share of our Common Stock issued and outstanding immediately

prior to the effective time of the Reincorporation Merger will be converted into one share of common stock of Titan Environmental; |

| |

● |

each share of our Series C Preferred Stock, which is convertible

into 100 shares of our Common Stock, will be converted into one share of Series A Convertible Preferred Stock of Titan Environmental,

which has substantially the same rights and preferences as our Series C Preferred Stock; |

| |

● |

each of our Series A Rights to Receive Common Stock issued

and outstanding immediately prior to the effective time of the Reincorporation Merger will be converted into one Series A Right to Receive

Common Stock of Titan Environmental, which has substantially the same rights and preferences as our Series A Rights to Acquire Common

Stock; |

| ● | each

of our Series B Rights to Receive Common Stock issued and outstanding immediately prior to

the effective time of the Reincorporation Merger will be converted into one Series B Right

to Receive Common Stock of Titan Environmental, which has substantially the same rights and

preferences as our Series B Rights to Acquire Common Stock; |

| ● | our

outstanding warrants to purchase our Common Stock will automatically be assumed by Titan

Environmental and will represent a warrant to acquire shares of common stock of Titan Environmental; |

| ● | our

authorized capital stock will be increased to 425,000,000 total shares, consisting of 400,000,000

shares of common stock, par value $0.0001 per share, and 25,000,000 shares of “blank

check” preferred stock, par value $0.0001 per share, of which 701,000 shares shall

be designated “Series A Convertible Preferred Stock”; |

| ● | we

will adopt the Titan Incentive Plan (see “Titan Environmental Solutions Inc. 2023 Equity

Incentive Plan” below for additional information); |

| ● | our

board of directors will be authorized to effect the Reverse Stock Split on the basis of one

new share of common stock for up to 50 shares of old common stock, at the discretion of the

board of directors, at any time prior to the first anniversary of the effective date of the

Reincorporation Merger; |

| ● | in

connection with effecting the Reverse Stock Split, our board of directors will be authorized

to amend the articles of incorporation of Titan Environmental to reduce the number of authorized

shares of common stock to a number of shares, as determined by our board of directors, that

is not less than 110% of the number of outstanding shares of common stock on a fully-diluted

basis after giving effect to the Reverse Stock Split; |

| |

● |

the persons presently serving as our executive officers and

directors will continue to serve in such respective capacities following the effective time of the Reincorporation Merger; and |

|

● |

Our company will be governed by the laws of the

State of Nevada and Articles of Incorporation and Bylaws will be adopted under the laws of the State of Delaware in the forms attached

hereto as Exhibits B and C, respectively. |

After

the Effective Time, Titan Environmental will be governed by the Titan Environmental Articles of Incorporation, the Titan Environmental

By-laws and the NV Corporate Law, which include a number of provisions that are not present in the TraQiQ Certificate, the TraQiQ By-laws

or the CGCL. Accordingly, as described below, a number of significant changes in shareholders’ rights will be effected in connection

with the Reincorporation, some of which may be viewed as limiting the rights of shareholders. See “Significant Differences Between

California Law and Nevada Law.”

No

federal or state regulatory requirements must be complied with and no approvals must be obtained in order to consummate the Reincorporation.

The

Reincorporation will not materially change the proportionate equity interests of our shareholders, nor will the respective voting rights

and other rights of shareholders be altered. The common stock and preferred stock issued pursuant to the Reincorporation will remain

fully paid and non-assessable. We will continue to be subject to the periodic reporting requirements of the Exchange Act.

Effective

Date of Merger

The

effectiveness of the Reincorporation Merger is conditioned upon the filing of a Certificate of Merger with the State of California and

Articles of Merger with the State of Nevada. We anticipate filing documents in the respective states at such time as our board of directors,

in its discretion, deems appropriate at least twenty (20) days after the date of mailing of this Information Statement, at which time

the Reincorporation Merger will become effective. As a result of the Reincorporation, we will cease our corporate existence in the State

of California.

Pursuant

to the terms of the Merger Agreement, the merger may be abandoned by the board of directors of TraQiQ and Titan Environmental at any

time prior to the Effective Time. In addition, the board of directors of TraQiQ may amend the form of Merger Agreement at any time prior

to the Effective Time, but no amendment may, without approval of the holders of the outstanding shares of our Common Stock and Series

C Preferred, voting together as a single class, representing a majority of the aggregate votes entitled to be cast, change the proposed

range or type of consideration to be received in exchange for our Common Stock or Series C Convertible Preferred Stock, change any term

of the form of Titan Environmental Articles, or change any of the terms and conditions of the form of Merger Agreement if such change

would adversely affect the holders of our Common Stock or Series C Preferred Stock.

No

Change in Business, Management or Board Members

After

the Effective Time, the business operations of Titan Environmental will continue as they are presently conducted by TraQiQ. The members

of the board of directors of Titan Environmental will be the same persons presently serving on the board of directors of TraQiQ. The

individuals who will serve as executive officers of Titan Environmental will be the same persons who currently serve as executive officers

of TraQiQ. Our daily business operations will continue at our principal executive offices at 1931 Austin Drive, Troy, MI 48083.

Name

Change

Our

board of directors and the Consenting Shareholders have approved a change of our corporate name to “Titan Environmental Solutions,

Inc.” The voting and other rights that accompany our Common Stock or Series C Preferred Stock or the Titan Environmental common

stock or Titan Environmental Series A Convertible Preferred Stock (as defined below), as the case may be, and the rights that accompany

our Series A Rights to Acquire Common Stock or Series B Rights to Acquire Common Stock or the Titan Series A Rights or Titan Series B

Rights (as defined below), as the case may be, will not be affected by the change in our corporate name. Shareholders and holders of

rights to acquire common stock will not be required to have new stock or rights certificates reflecting the name change. New stock certificates

or rights certificates will be issued in due course as old certificates are tendered to our transfer agent. The proposed name change

will not have any material effect on our business, operations, reporting requirements or stock price.

Change

in Authorized Capital

The

authorized capital of TraQiQ on the Record Date consisted of 300,000,000 shares of Common Stock, par value $0.0001 per share, and 10,000,000

shares of Preferred Stock, par value $0.0001 per share, of which 2,000,000 shares have been designated as Series B Convertible Preferred

Stock, par value $0.0001 per share, and 1,000,000 shares have been designated as Series C Preferred Stock. As of the Record Date, approximately

15,134,545 shares of our Common Stock, no shares of our Series B Convertible Preferred Stock and 701,000 shares of our Series

C Preferred Stock were outstanding and no other class of Preferred Stock was outstanding. The authorized capital of Titan Environmental,

which will be the authorized capital of our company after the Reincorporation, consists of 400,000,000 shares of common stock, par value

$0.0001 per share, and 25,000,000 shares of preferred stock, par value $0.0001 per share (“Titan Environmental Preferred Stock”),

of which approximately 701,000 shares will be designated as Series A Convertible Preferred Stock, par value $0.0001 per share (“Titan

Environmental Series A Preferred Stock”).

After

the Effective Time, Titan Environmental will have approximately 400,000,000 shares of Titan Environmental Common Stock and approximately

701,000 shares of Titan Environmental Series A Preferred Stock issued and outstanding. Titan Environmental will also have outstanding

[__] Series A Rights to Acquire Common Stock (“Titan Series A Rights”) and [__] Series B Rights to Acquire Common Stock (“Titan

Series B Rights”), each to acquire one share of Titan Environmental Common Stock. Therefore, at the Effective Time, our company

will have approximately 385,165,455 shares of Titan Environmental Common Stock and approximately 24,299,000 shares of Titan Environmental

Preferred Stock available for issuance, of which ___ shares of Titan Environmental Common Stock will be reserved for issuance upon the

conversion of the Titan Environmental Series A Preferred Stock, the Titan Series A Rights and the Titan Series B Rights. The Reincorporation

will not materially affect total stockholder equity or total capitalization of our company.

After

the Reincorporation, the board of directors of Titan Environmental will be authorized, without further action by the stockholders, to

fix the designations, powers, preferences and other rights and the qualifications, limitations or restrictions of the unissued Titan

Environmental Preferred Stock. After the Reincorporation, the board of directors of Titan Environmental also will be authorized, without

further action by our stockholders, to effect the Reverse Stock Split on the basis of one new share of Titan Environmental Common Stock

for up to 50 shares of old Titan Environmental Common Stock, at the discretion of the board of directors, at any time prior to the first

anniversary of the effective date of the Reincorporation Merger.

The

Reincorporation will result in an increase in the relative proportion of authorized shares to issued shares of our Common Stock and an

increase in the authorized shares of our Preferred Stock. While we expect to issue shares of Titan Environmental Common Stock, and potentially,

shares of Titan Environmental Preferred Stock, in connection with potential asset acquisition or merger transactions or the financing

thereof during the remainder of 2023, we do not currently have a definitive agreement in place for any such potential transaction that

would involve the issuance of the shares that result from the proportional increase in authorized shares of our Common Stock or additional

authorized shares of our Preferred Stock.

Anti-Takeover

Effects

The

increase in the number of authorized shares of our Preferred Stock and the proportional increase in the authorized shares of our Common

Stock that will result from the Reincorporation could have an anti-takeover effect, although this is not the intent of our board of directors

in taking these corporate actions. The issuance of Preferred Stock and/or additional shares of Common Stock could adversely affect the

voting power and other rights of the holders of our Common Stock. In addition, shares of Preferred Stock and/or Common Stock could be

issued quickly with terms calculated to discourage, make more difficult, delay or prevent a change in control of our company or make

the removal of our management more difficult. For example, we could issue additional shares to dilute the stock ownership or voting rights

of persons seeking to obtain control of our company. Similarly, the issuance of additional shares to certain persons allied with our

management and/or our directors could have the effect of making it more difficult to remove our current management and directors by diluting

the stock ownership or voting rights of persons seeking to cause such removal. As stated above, the Reincorporation was not approved

with the intent that it be utilized as a type of anti-takeover device.

Exchange

of Stock Certificates

After

the Effective Time, and upon surrender for cancellation of a stock certificate representing our Common Stock or Series C Preferred Stock

(a “TraQiQ Stock Certificate”), the holder of such stock certificate will be entitled to receive a stock certificate for

Titan Environmental Common Stock or Titan Environmental Series A Preferred Stock, as the case may be (a “Titan Environmental Stock

Certificate”). The Titan Environmental Stock Certificate will represent that number of shares of Titan Environmental Common Stock

or Titan Environmental Series A Preferred Stock, as the case may be, into which our Common Stock or Series C Preferred Stock represented

by the surrendered TraQiQ Stock Certificate have been converted in the merger, and the surrendered TraQiQ Stock Certificate, will be

cancelled.

Although

we encourage you to exchange your TraQiQ Stock Certificates for Titan Environmental Stock Certificates, holders of our Common Stock or

Series C Preferred Stock are not required to do so. Dividends and other distributions declared after the Effective Time with respect

to Titan Environmental Common Stock or Titan Environmental Series A Preferred Stock and payable to holders of record thereof after the

Effective Time, will be paid to the holder of any unsurrendered TraQiQ Stock Certificate with respect to the shares of Titan Environmental

Common Stock or Titan Environmental Series A Preferred Stock which by virtue of the Reincorporation Merger are represented by such TraQiQ

Stock Certificate. Such holder of an unsurrendered TraQiQ Stock Certificate will also be entitled to exercise all voting and other rights

as a holder of Titan Environmental Common Stock or conversion and other rights of Titan Environmental Series A Preferred Stock. Upon

consummation of the merger, the Titan Environmental Common Stock will trade on the OTC QB under the symbol “TESI”. Titan Environmental will also file with the Securities and Exchange Commission and provide to its shareholders the same types of

reports and information that our company previously filed and provided.

Effect

of Failure to Exchange Stock Certificates.

Upon

the effectiveness of the Reincorporation, each certificate representing shares of our capital stock outstanding prior to the that time

will, unless and until surrendered and exchanged as described above, be deemed, for all corporate purposes, to evidence ownership of

the whole number of shares of capital stock of Titan Environmental into which the shares of our common stock evidenced by such certificate

have been converted by the Reincorporation.

Dissenters’

Appraisal Rights

Under

California law shareholders are not entitled to dissenters’ appraisal rights in a merger between a parent corporation and its subsidiary

when the shareholders immediately before the merger will own (immediately after the merger) equity securities of the surviving corporation

possessing more than five-sixths of the voting power of the surviving corporation.

Federal

Income Tax Consequences of the Reincorporation

The

following is a summary of certain material federal income tax consequences of the Reincorporation, and does not purport to be complete.

It does not discuss any state, local, foreign or minimum income or other U.S. federal tax consequences. Also, it does not address the

tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies,

personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and tax-exempt entities. The discussion is

based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as

well as prospectively. This summary also assumes that the shares of Common Stock or Series C Preferred Stock were, and the shares of

the Titan Environmental Common Stock and Titan Environmental Series A Preferred Stock will be, held as a “capital asset,”

as defined in the Internal Revenue Code of 1986, as amended (the “Code”), generally, property held for investment. The tax

treatment of a shareholder may vary depending upon the particular facts and circumstances of such shareholder.

No

gain or loss should be recognized by a shareholder upon such shareholder’s exchange of Common Stock for Titan Environmental Common

Stock or exchange of Series C Preferred Stock for Titan Environmental Series A Preferred Stock pursuant to the Reincorporation. The aggregate

tax basis of the Titan Environmental Common Stock Titan Environmental Series A Preferred Stock received in the Reincorporation, including

any fraction of a Nevada Share deemed to have been received, will be the same as the shareholder’s aggregate tax basis in our Common

Stock or Series C Preferred Stock exchanged therefor. A shareholder’s holding period for the Titan Environmental Common Stock or

Titan Environmental Series A Preferred Stock will include the period during which the shareholder held our Common Stock or Series C Preferred

Stock, as the case may be, surrendered in the Reincorporation. EACH SHAREHOLDER IS URGED TO CONSULT WITH SUCH SHAREHOLDER’S

OWN TAX ADVISOR WITH RESPECT TO THE CONSEQUENCES OF THE REINCORPORATION.

Significant

Differences Between California Law and Nevada Law

Our

company is governed by California law. After the Effective Time of the Reincorporation, the shareholders of Titan Environmental will

be governed by Nevada law, the Titan Environmental Articles and the Titan Environmental By-laws. The change in application of the law

governing Titan Environmental will result in certain changes to our company’s rights, governance and structure and changes in the

rights and obligations of our company’s shareholders. Below is a table showing some of the differences between the CGCL and the

Nevada Corporate Law, including some of the changes to the Company’s Articles and Bylaws that will be effected as part of the Reincorporation.

This table does not list all of the possible differences and similarities; shareholders are encouraged to review the Nevada Articles

of Incorporation and Nevada Bylaws.

| Provision |

|

California |

|

Nevada |

| Ability

of Shareholders to Call Special Meetings |

|

Under

the CGCL, a special meeting of the shareholders may be called by the chairman of the Board, the board of directors, the president,

or the holders of shares entitled to cast not less than 10% of the votes at such meeting and such persons as are authorized by the

articles of incorporation or bylaws. |

|

Under

the NV Corporate Law, a special meeting of the shareholders may be called by the board of directors, by any person authorized in

the certificate of incorporation or bylaws or by at least 5% of the shareholders. |

| Provision |

|

California |

|

Nevada |

| Cumulative

Voting |

|

The

CGCL allows cumulative voting for the election of directors if the shareholder provides advance notice of the intent to exercise

its cumulative voting rights. The CGCL also permits public companies to eliminate cumulative voting by the approval of the shareholders. |

|

Under

the NV Corporate law, cumulative voting is not mandatory, and a corporation must provide for cumulative voting rights in its articles

of incorporation if it wishes to adopt cumulative voting. Further, shareholders can adopt a bylaw amendment that specifies the vote

necessary for the election of directors, such as a plurality vote. |

| |

|

|

|

|

| Change

in the Number of Directors on the Board |

|

Under

the CGCL a change in the number of directors must be approved by the shareholders, but the Board of directors may fix the exact number

of directors within a stated range set forth in the Articles of Incorporation or the bylaws, if such range has been approved by the

shareholders. |

|

Under

the NV Corporate Law, the number of directors shall be fixed by or in the manner provided in the bylaws or in the articles of incorporation. |

| |

|

|

|

|

| Filling

Vacancies on the Board of Directors |

|

Under

the CGCL, any vacancy on the board of directors other than one created by removal of a director may be filled by the board. If the

number of directors is less than a quorum, a vacancy may be filled by the unanimous written consent of the directors then in office,

by the affirmative vote of a majority of the directors at a meeting held pursuant to notice or waivers of notice, or by a sole remaining

director. A vacancy created by removal of a director may be filled by the board only if authorized by a corporation’s articles

of incorporation or by a bylaw approved by the corporation’s shareholders. |

|

Under

the NV Corporate Law, vacancies and newly-created directorships may be filled by a majority of the directors then in office (even

though less than a quorum) or by a sole remaining director, unless otherwise provided in the articles of incorporation. |

| |

|

|

|

|

| Classified

Board of Directors |

|

Under

the CGCL a corporation may create and elect a classified board. |

|

Under

the NV Corporate Law, a board of directors may be classified into any number of classes as long as at least one-fourth of the total

number of directors is elected annually. |

| Provision |

|

California |

|

Nevada |

| Interested

Shareholders Transaction and Business Combination |

|

The

CGCL does not provide any specific restrictions on interested shareholders effecting a business combination. |

|

Under

Nevada law, unless a corporation elects in its articles of incorporation for the following laws not to apply, a corporation is not

permitted to engage in any “business combination” with a 10% or greater stockholder for a period of three years following

the time that such stockholder obtained such ownership, unless the board of directors approved either the business combination or

the transaction which resulted in the stockholder’s ownership before the stockholder obtained such ownership. After those three

years, a corporation may only engage in a business combination with that stockholder if the combination meets all of the requirements

of the corporation’s articles of incorporation, and (i) the combination itself or the transaction by which the stockholder

obtained 10% was pre-approved by the board of directors; (ii) the combination is approved by a majority of “disinterested”

stockholders; or (iii) the form and amount of consideration is considered “fair” under Nevada law and, with limited exceptions,

the interested stockholder has not become the beneficial owner of additional voting shares of the corporation after becoming an interested

stockholder and before the business combination is consummated. |

| |

|

|

|

|

| Removal

of Directors |

|

Under

the CGCL any director, or the entire board of directors, may be removed, with or without cause, with the approval of a majority of

the outstanding shares entitled to vote. If the corporation allows cumulative voting, no director may be removed (unless the entire

board is removed) if the number of votes cast against the removal would be sufficient to elect the director under cumulative voting

rules. |

|

The

NV Corporate Law provides that any director may be removed from office, with our without cause, by a vote of not less than two-thirds

of the corporation’s stockholders entitled to vote, and a new director or directors may be elected by a vote of the remaining

directors. |

| |

|

|

|

|

| Plurality

Voting; Elimination of Cumulative Voting |

|

The

CGCL provides that if any shareholder has given notice of his or her intention to cumulate votes for the election of directors, all

other shareholders of the corporation are also entitled to cumulate their votes at such election. |

|

Under

the NV Corporate law, cumulative voting is not mandatory, and a corporation must provide for cumulative voting rights in its articles

of incorporation if it wishes to adopt cumulative voting. Further, shareholders can adopt a bylaw amendment that specifies the vote

necessary for the election of directors, such as a plurality vote. |

| Provision |

|

California |

|

Nevada |

| Shareholder

Vote Required to Approve Merger or Sale of Company |

|

The

CGCL requires that the holders of the outstanding shares representing a majority of the voting power of both the acquiring and target

corporation approve a statutory merger. Additionally, the CGCL requires that a sale of all or substantially all of the assets of

a corporation be approved by the holders of the outstanding shares representing a majority of the voting power of the corporation

selling its assets. |

|

The

Nevada Corporate Law is similar to the CGCL in that the holders of the outstanding shares representing a majority of the voting power

of both the acquiring and the target company are required to approve a statutory merger. Similarly, when selling all or substantially

all of the corporation’s assets, a vote of the majority of the outstanding voting shares are required to approve the sale. |

| |

|

|

|

|

| 50/90

Rule Related to Mergers |

|

In

California, if one party to a merger or its parent owns, directly or indirectly, more than 50% of the voting power of the other merging

party, the non-redeemable common shares or non-redeemable common equity of the acquired company may be converted only into non-redeemable

common shares of the surviving entity or its parent. This rule does not apply if all of the shareholders of the class consent; if

the transaction is a short-form merger; or if the Commissioner of Corporations, Commissioner of Financial Institutions, or the Public

Utility Commission approves the merger. |

|

Nevada

does not have an analogous provision in the Nevada Corporate Law. |

| |

|

|

|

|

| Dividends

and Repurchases of Shares |

|

Under

the CGCL, a corporation may not make a distribution to its shareholders unless (i) the amount

of retained earnings immediately prior to the distribution equals or exceeds the amount intended

to be distributed plus all accrued but unpaid preferential dividends, and (ii) immediately

after the distribution the value of the corporation’s assets equals or exceeds its

liabilities plus any preferential distribution rights.

A

corporation may redeem any or all shares which are redeemable at its option by (i) giving notice to shareholders required by the

CGCL and its articles of incorporation and (ii) paying for such redeemed shares. Shares redeemed by the corporation are restored

to the status of authorized but unissued shares unless the articles require otherwise. |

|

Nevada

law provides that no distribution (including dividends on, or redemption or repurchases of, shares of capital stock) may be made

if, after giving effect to such distribution, the corporation would not be able to pay its debts as they become due in the usual

course of business, or, except as specifically permitted by the articles of incorporation, the corporation’s total assets would

be less than the sum of its total liabilities plus the amount that would be needed at the time of a dissolution to satisfy the preferential

rights of stockholders whose preferential rights are superior to those receiving the distribution. |

| Provision |

|

California |

|

Nevada |

| Indemnification |

|

The

CGCL allows indemnification of officers and directors provided that each meets a certain standard of conduct. The CGCL requires indemnification

when the indemnitee has successfully defended the action on its merits. Indemnification is permitted under the CGCL only for acts

taken in good faith and believed to be in the best interests of the company and its shareholders. |

|

The

NV Corporate Law generally permits indemnification of expenses, including attorneys’ fees, actually and reasonably incurred

in the defense or settlement of a derivative or third party action, provided there is a determination by a majority vote of a disinterested

quorum of the directors, by independent legal counsel or by the shareholders that the person seeking indemnification acted in good

faith and in a manner reasonably believed to be in the best interests of the corporation. Expenses incurred by an officer or director

in defending an action may be paid in advance if the officer or director undertakes to repay such amounts if it is ultimately determined

that he or she is not entitled to indemnification. Nevada law authorizes a corporation to purchase indemnity insurance for the benefit

of its directors, officers, employees and agents whether or not the corporation would have the power to indemnify against the liability

covered by the policy. The NV Corporate Law allows a Nevada corporation to provide indemnification in excess of that provided by

statute. |

| |

|

|

|

|

| Dissolution |

|

Under

the CGCL, a corporation may be dissolved on the approval of a majority vote of the outstanding shares entitled to vote. |

|

Under

the Nevada Corporate Law, if approved by the Board, a corporation may be dissolved on the vote of a majority of the outstanding shares

of stock entitled to vote. |

THE

REVERSE STOCK SPLIT

Our

board of directors and the holders of a majority of the voting power of our stockholders have approved the Reverse Stock Split in connection

with the Reincorporation on the basis of one post-Reverse Stock Split share of common stock for up to 50 pre-Reverse Stock Split shares

of common stock, with the Reverse Stock Split to be implemented by the board of directors of Titan Environmental at any time prior to

the first anniversary of the consummation of the Reincorporation Merger. Approval of the Reverse Stock Split does not automatically mean

that the Reverse Stock Split will occur, rather such approval will give the board of directors of Titan Environmental the authority,

should they decide that it is in the best interest of Titan Environmental, to complete the Reverse Stock Split for the any of the reasons

set out under the caption “Reasons for the Reverse Stock Split” below. The following table outlines the number of shares

of common stock that would exist following the Reverse Stock Split. Any reverse stock split remains subject to all required regulatory

approvals. As of the date of this Information Statement, there are 15,134,545 shares of our common stock issued and outstanding,

which will convert into an identical number of shares of Titan Environmental Common Stock in the Reincorporation Merger, assuming we

issue no additional shares of our common stock prior to consummation of the Reincorporation Merger. The following table outlines the

number shares of Titan Environmental common stock that would exist following the Reverse Stock Split at various theoretical ratios:

| Ratio | |

Number of Shares

Post-Reverse

Stock Split(1) | |

| 1:5 | |

| 3,026,909 | |

| 1:10 | |

| 1,513,455 | |

| 1:20 | |

| 756,728 | |

| 1:30 | |

| 504,485 | |

| 1:40 | |

| 378,364 | |

| 1:50 | |

| 302,691 | |

| (1) | Numbers

are approximate and do not give effect to any additional shares to be issued in respect of

fractional shares that result from the reverse stock split. |

Reasons

for the Reverse Stock Split

Our

board of directors believes that effecting the Reverse Stock Split is desirable for a number of reasons, including:

Contemplated

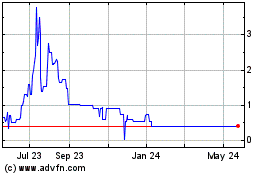

listing on a principal national securities exchange. Our Common Stock is currently traded on the over-the-counter market

and quoted on the OTC QB under the symbol “TRAQ”. On September [__], 2023, the last sale price of our Common Stock was $[__]

per share. Presently, our Common Stock trades sporadically. Following the Reincorporation, we intend to apply for listing of the Titan

Environmental Common Stock on a principal national securities exchange. We expect that the Reverse Stock Split will increase the market

price of the Titan Environmental Common Stock so that we will be able to meet the minimum bid price requirement of the listing rules

of such an exchange, which is generally $4.00 per share. We cannot assure you we will be able complete an uplisting.

Broadening

our investor base. We believe that by increasing the price of the Titan Environmental Common Stock or potentially decreasing

its volatility, the Reverse Stock Split may allow a broader range of institutional investors to invest in the Titan Environmental Common

Stock. For example, many funds and institutions have investment guidelines and policies that prohibit them from investing in stocks trading

below a certain threshold. We believe that increased institutional investor interest in our company and the Titan Environmental Common

Stock will potentially increase the overall market for the Titan Environmental Common Stock.

Increase

in Analyst and Broker Interest. We believe the Reverse Stock Split would help increase analyst and broker-dealer interest in

the Titan Environmental Common Stock as many brokerage and investment advisory firms’ policies can discourage analysts, advisors,

and broker-dealers from following or recommending companies with low stock prices. Because of the trading volatility and lack of liquidity

often associated with lower-priced stocks, many brokerage houses have adopted investment guidelines, policies and practices that either

prohibit or discourage them from investing in or trading such stocks or recommending them to their customers. Some of those guidelines,

policies and practices may also function to make the processing of trades in lower-priced stocks economically unattractive to broker-dealers.

While we recognize that we may remain a “penny stock” under the rules of the Securities and Exchange Commission (the “SEC”),

if the Titan Environmental Common Stock is not listed on a national securities exchange, we expect that the increase in the stock price

resulting from the Reverse Stock Split will position us better if our business continues to grow as we anticipate. Additionally, because

brokers’ commissions and dealer mark-ups/mark-downs on transactions in lower-priced stocks generally represent a higher percentage

of the stock price than commissions and mark-ups/mark-downs on higher-priced stocks, the current average price per share of the Titan

Environmental Common Stock can result in shareholders or potential shareholders paying transaction costs representing a higher percentage

of the total share value than would otherwise be the case if the share price were substantially higher.

Certain

Risks Associated with the Reverse Split

If

the Reverse Stock Split does not result in a proportionate increase in the price of the Titan Environmental Common Stock, we may be unable

to meet the initial listing requirements of a principal national securities exchange.

We

expect that the Reverse Stock Split will increase the market price of the Titan Environmental Common Stock so that we will be able to

meet the minimum bid price requirement under the listing rules of a principal national securities exchange. However, the effect of the

Reverse Stock Split on the market price of the Titan Environmental Common Stock cannot be predicted with certainty, and the results of

reverse stock splits by companies under similar circumstances have varied. It is possible that the market price of the Titan Environmental

Common Stock following the Reverse Stock Split will not increase sufficiently for us to meet the minimum bid price requirement. If we

are unable meet the minimum bid price requirement, we may not be unable to list our common stock on a principal national securities exchange.

Even

if the Reverse Stock Split results in the requisite increase in the market price of the Titan Environmental Common Stock, there is no

assurance that we will be able to continue to comply with the minimum bid price requirement.

Even

if the Reverse Stock Split results in the requisite increase in the market price of the Titan Environmental Common Stock to be in compliance

with the minimum bid price requirements of a principal national securities exchange, there can be no assurance that the market price

of the Titan Environmental Common Stock following the Reverse Stock Split will remain at the level required for continued compliance

with such requirement. It is not uncommon for the market price of a company’s common stock to decline in the period following a

reverse stock split. If the market price of our common stock declines following the implementation of the Reverse Stock Split following

the Reincorporation, the percentage decline may be greater than would occur in the absence of the Reverse Stock Split. In any event,

other factors unrelated to the number of shares of the Titan Environmental Common Stock outstanding, such as negative financial or operational

results, could adversely affect the market price of the Titan Environmental Common Stock and jeopardize our ability to meet or continue

to comply with the minimum bid price requirement.

The

Reverse Stock Split may decrease the liquidity of the Titan Environmental Common Stock.

The

liquidity of the Titan Environmental Common Stock may be adversely affected by the Reverse Stock Split given the reduced number of shares

that will be outstanding following the Reverse Stock Split and the Reincorporation, especially if the market price of the Titan Environmental

Common Stock does not sufficiently increase as a result of the Reverse Stock Split. In addition, the Reverse Stock Split may increase

the number of shareholders who own odd lots (less than 100 shares) of the Titan Environmental Common Stock, creating the potential for

such shareholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

The