UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

| Check the appropriate

box: |

| ☐ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for use of the Commission only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☒ |

Definitive

Information Statement |

| SMARTMETRIC,

INC. |

| (Name of

Registrant As Specified In Charter) |

| |

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| |

|

|

| ☐ |

Fee computed on

table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

|

|

| |

1) |

Title of each class of securities

to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities

to which transaction applies: |

| |

|

|

| |

3) |

Per unit

price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing

fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate

value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

1) |

Amount Previously

Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration

Statement No: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

SMARTMETRIC,

INC.

3960

Howard Hughes Parkway, Suite 500

Las Vegas, NV 89109

Tel:

(702) 990-3687

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU

ARE REQUESTED NOT TO SEND US A PROXY

THIS

IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO

STOCKHOLDERS’

MEETING WILL BE HELD TO CONSIDER ANY MATTER

DESCRIBED

HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED

TO

YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS

DESCRIBED

HEREIN.

Dear

Stockholders:

The enclosed information statement

(the “Information Statement”) is provided on or about July 18, 2022 to the stockholders of record on June 24, 2022 (the “Record

Date”) of SmartMetric, Inc., a Nevada corporation (the “Company,” “we,” “our” or “us”),

to advise them that, on the Record Date, the stockholders holding a majority of the voting power of the Company (the “Majority Stockholders”)

approved (i) the re-election of the three (3) director nominees named in this Information Statement to hold office until the next annual

meeting of stockholders, (ii) the increase of the number of shares of the Company’s common stock, par value $0.001 per share (the

“Common Stock”), the Company is authorized to issue from 1,200,000,000 to 2,400,000,000 as provided for herein (the “Increase

in Authorized Shares”) and the filing of an amendment to the Company’s Articles of Incorporation, as amended from time to

time (as amended, the “Articles of Incorporation”), to effect the Increase in Authorized Shares, (iii) the ratification of

the appointment of Boyle CPA, LLC as the Company’s independent auditing firm for the fiscal year ending June 30, 2022, and (iv)

the compensation of the Company’s named executive officers, pursuant to an action by written consent, in accordance with the Nevada

Revised Statutes and the Company’s Amended and Restated Bylaws. Such matters are collectively referred to herein as the “Approved

Matters.”

Under the federal securities

laws, although the Majority Stockholders approved the Approved Matters by written consent, such actions will not be effective until at

least 20 calendar days after the Information Statement is sent or given to the stockholders of record of the Company as of the Record

Date. The re-election of the three (3) director nominees, the ratification of the appointment of our independent auditing firm for the

fiscal year ending June 30, 2022, and the approval of the compensation of the Company’s named executive officers will become effective

on the 20th calendar after the Information Statement is sent to the stockholders of record of the Company. The Increase in

Authorized Shares will be effected by filing an amendment to the Articles of Incorporation with the Secretary of State of the State of

Nevada, which is expected to occur approximately twenty (20) days after the mailing of this Information Statement. The Increase in Authorized

Shares will become effective upon such filing.

The

Information Statement is provided to the Company’s stockholders of record on the Record Date only for informational purposes in

connection with the Approved Matters pursuant to and in accordance with Section 14(c) of the Securities Exchange Act of 1934, as amended,

and Rule 14c and Schedule 14C thereunder. This Information Statement will serve as written notice to stockholders of the Company pursuant

to Section 78.370 of the Nevada Revised Statutes.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

We

appreciate your continued support of the Company. Thank you.

| |

By Order of the

Board of Directors |

| |

|

| Date: July 18, 2022 |

/s/

Chaya Hendrick |

| |

Chaya Hendrick |

| |

Chief Executive Officer |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF THE INFORMATION STATEMENT

A

copy of this Notice of Corporate Action and the accompanying Information Statement is available on our website at www.smartmetric.com

SMARTMETRIC,

INC.

3960

Howard Hughes Parkway, Suite 500

Las

Vegas, NV 89109

Tel:

(702) 990-3687

INFORMATION

STATEMENT

(Preliminary)

PURSUANT

TO SECTION 14(c) OF THE

SECURITIES

EXCHANGE ACT OF 1934, AS AMENDED

This information statement (this

“Information Statement”) is being furnished to the stockholders of SmartMetric, Inc., a Nevada corporation (the “Company,”

“we,” “our” or “us”), as of June 24, 2022 (the “Record Date”) in connection with the approval

of (i) the re-election of the three (3) director nominees named in this Information Statement to hold office until the next annual meeting

of stockholders, (ii) the increase of the number of shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), the Company is authorized to issue from 1,200,000,000 to 2,400,000,000 as provided for herein (the “Increase in Authorized

Shares”) and the filing of an amendment to the Company’s Articles of Incorporation, as amended from time to time (as amended,

the “Articles of Incorporation”), to effect the Increase in Authorized Shares, (iii) the ratification of the appointment of

Boyle CPA, LLC as the Company’s independent auditing firm for the fiscal year ending June 30, 2022, and (iv) the compensation of

the Company’s named executive officers, pursuant to an action by written consent, in accordance with the Nevada Revised Statutes

and the Company’s Amended and Restated Bylaws. Such matters are collectively referred to herein as the “Approved Matters.”

Section 78.320 of the Nevada

Revised Statutes and our Amended and Restated Bylaws each permits that any action which may be taken at any annual or special meeting

of stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting

forth the action so taken, is signed by the holders of outstanding stock having not less than the minimum number of votes that would

be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

On July 6, 2022, the Board approved

the Approved Matters. On July 6, 2022, the stockholders owning a majority of the Company’s then issued and outstanding common stock

(the “Majority Stockholders”) approved the Approved Matters by written consent, in accordance with Section 78.320 of the Nevada

Revised Statutes and the Company’s Amended and Restated Bylaws then in effect.

The Record Date for determining

stockholders entitled to receive this Information Statement is June 24, 2022, the date that the Company’s stockholders approved

the Approved Matters by written consent. As of the close of business on the Record Date, we had 647,886,336 shares of our common stock

outstanding and entitled to vote on the matters acted upon in the action by written consent of our stockholders. Each share of our common

stock outstanding as of the close of business on the Record Date was entitled to one vote.

In accordance with the rules

and regulations of the Securities and Exchange Commission (“SEC”), the proposals regarding the Approved Matters, which were

approved by written consent of our stockholders, will not be effective until at least 20 calendar days after the Information Statement

is sent or given to the stockholders of record of the Company as of the Record Date.

THE APPROXIMATE DATE ON WHICH

THIS INFORMATION STATEMENT IS FIRST BEING SENT OR GIVEN TO THE HOLDERS OF OUR COMMON STOCK ON JUNE 24, 2022 IS JULY 18, 2022.

This

Information Statement is provided to the Company’s stockholders of record on the Record Date only for informational purposes in

connection with the Approved Matters pursuant to and in accordance with Section 14(c) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and Rule 14c and Schedule 14C thereunder.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians,

fiduciaries, and other like parties to forward this Information Statement to the beneficial owners of the Common Stock held of record

by them.

The

following table sets forth the name of the Majority Stockholder, the number of shares of Common Stock held by the Majority Stockholder,

the total number of votes that the Majority Stockholder voted in favor of the Actions and the percentage of the issued and outstanding

voting equity of the Company that voted in favor thereof.

| Name of Majority Stockholder | |

Number of Shares of Common Stock held | | |

Number of Shares of Series B Preferred held | | |

Number of Votes held by Majority Stockholder | | |

Number of Votes that Voted in favor of the Actions | | |

Percentage of the Voting Equity that Voted in favor of the Actions | |

| Chaya Hendrick | |

| 58,627,778 | | |

| 610,000 | | |

| 520,083,767 | (1) | |

| | | |

| 57.4795% | |

| TOTAL | |

| 58,627,778 | | |

| 610,000 | | |

| 520,083,767 | | |

| | | |

| 57.4795% | |

| (1) |

The votes held by the Majority Stockholder include (i) 58,627,778 of Common Stock and; (ii) 610,000 shares of Series B Convertible Preferred Stock held by Applied Cryptography, Inc. (“ACI”). The 610,000 shares of Series B Convertible Preferred Stock represent 100% of the issued and outstanding shares of Series B Convertible Preferred Stock. The outstanding shares of Series B Convertible Preferred Stock are entitled to vote on any matter with the holders of Common Stock voting together as one (1) class and shall have that number of votes equal to that number of shares of Common Stock which is not less than 51% of the vote required to approve any action, which Nevada law provides may or must be approved by vote or consent of the shares of Common Stock or the holders of other securities entitled to vote, if any. As of the Record Date there were 647,886,336 shares of Common Stock outstanding. Accordingly, 610,000 shares of Series B Convertible Preferred Stock are equivalent to the votes of 30,500,000 shares of Common Stock. |

ACTION

ONE

RE-ELECTION

OF THREE DIRECTORS

On July 6, 2022, the Board authorized

the re-election of the nominees (the “Nominees”) listed below to hold office until the next annual meeting of stockholders

and until their successors are duly elected and qualified, and on July 6, 2022, the Majority Stockholder approved such re-election by

way of the written consent. All the Nominees are currently serving as directors.

Information

With Respect to Director Nominees

The

following table sets forth the names and ages of the members of our Board of Directors and the positions held by each as of the Record

Date:

| Name |

|

Age |

|

Position |

| Chaya Hendrick |

|

66 |

|

President, Chief Executive Officer, Chairman of the Board |

| Jay M. Needelman, CPA |

|

54 |

|

Chief Financial Officer, Director |

| Elizabeth Ryba |

|

71 |

|

Director |

CHAYA HENDRICK has been

President, Chief Executive Officer, and Chairman of the Board of Directors of SmartMetric since the Company’s inception in 2002.

Ms. Hendrick has served as President and CEO of Smart Micro Chip, Inc., an Australian corporation from 2000 to 2002. From 1999 to 2001,

Ms. Hendrick was President and Chief Executive Officer of Smarticom Inc. and FastEcom, Inc., Australian corporations. From 1994 to 1998,

Ms. Hendrick served as executive officer of Applied Computing Science (Australia), an Australian company involved in e-commerce systems,

research and development. Ms. Hendrick founded Asset Developments a property development company that created and sold regional residential

land subdivisions. The last being a 1,000-acre subdivision named Claire Valley Estates in the Canberra region of Australia. All of the

property development projects were funded by Ms. Hendrick and were financially profitable. Ms. Hendrick attended Dandenong College in

Australia.

We

believe Ms. Hendrick is qualified to serve on our Board due to her extensive experience in technology development and as an executive

at technology companies.

JAY M. NEEDELMAN, CPA,

has been the Chief Financial Officer and a director of SmartMetric since 2007. Mr. Needelman has over 28 years of experience in public

accounting. A 1991 graduate of Florida State University in Tallahassee, FL, Mr. Needelman began his career in public accounting in Miami,

FL, in 1991. After working for two different firms, Mr. Needelman founded his own firm in late 1992.

We

believe Mr. Needelman is qualified to serve on our Board due to his financial expertise.

ELIZABETH

RYBA has been a director of SmartMetric since April 5, 2006. From 2015 to the present, Ms. Ryba has been Vice President of Marketing

at the Design and Decoration Building in New York, one of the premier destinations for luxury interior design showrooms in the country.

From 2006 to 2015, Ms. Ryba had marketing positions at two luxury home decor brands. Ms. Ryba was a promotion director at Hearst Publishing

from 2002 through 2005. Between 2001 and 2004, Ms. Ryba was a consultant at Stratus Rewards Credit Cards where she launched a Visa Luxury

credit card where points were redeemable on private jets. Between 2000 and 2001, Ms. Ryba worked as a Marketing Consultant for SpaFinder.

From 1991 through 1999, Ms. Ryba worked at Master Card where she launched a Smart Card in Australia. Ms. Ryba received her M.S. in Marketing

from the University of Illinois, and her B.A. in English from the State University of New York at Stony Brook.

We

believe Ms. Ryba is qualified to serve on our Board due to her extensive experience in the credit card industry as well as her extensive

experience in marketing in the luxury sector which we believe is a sector to which we may be able to sell our products.

Family

Relationships

There

are no family relationships among the Nominees or officers of the Company.

Director

Experience

Our Board believes that each

of the Nominees should possess the highest personal and professional ethics, integrity and values, and be committed to representing the

long-term interests of the Company’s stockholders. When evaluating candidates for election to the Board, the Board has sought candidates

with certain qualities that it believes are important, including integrity, an objective perspective, good judgment, and leadership skills.

The Nominees are highly educated and have diverse backgrounds and talents and extensive track records of success in what we believe are

highly relevant positions.

Legal

Proceedings

To

our knowledge, during the last ten years, none of the Nominees has:

| |

● |

been convicted

in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

|

|

| |

● |

had any bankruptcy petition

filed by or against the business or property of the person, or of any partnership, corporation or business association of which he

was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| |

|

|

| |

● |

been subject to any order,

judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state

authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business,

securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons

engaged in any such activity; |

| |

|

|

| |

● |

been found by a court of

competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or

state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

● |

been the subject

of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed,

suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation

of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance

companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty

or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire

fraud or fraud in connection with any business entity; or |

| |

|

|

| |

● |

been the subject of, or

a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined

in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or

any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated

with a member. |

Committees

of the Board

Our business, property, and

affairs are managed by or under the direction of the Board. Members of the Board are kept informed of our business through discussion

with the chief executive and financial officers and other officers, by reviewing materials provided to them and by participating at meetings

of the Board. We have not previously had an audit committee, compensation committee, or nominations and governance committee.

Audit

Committee

We

currently do not have an acting audit committee, and our Board of Directors currently acts as our audit committee.

Audit

Committee Financial Expert

We

do not have an audit committee and thus do not have an audit committee financial expert.

Compensation

Committee

We

do not presently have a compensation committee. Our Board currently acts as our compensation committee.

Director

Independence

For

purposes of determining independence, we have adopted the definition of “independence” contained in the Nasdaq Listing Rules. Pursuant

to the definition, the Company has determined that Elizabeth Ryba qualifies as independent.

Code

of Ethics

The

Company has adopted a Code of Ethics that applies to its Chief Executive Officer and Chief Financial Officer. A copy of the Company’s

code of ethics is available to any person without charge upon written request to the Company at SmartMetric, Inc., 3960 Howard Hughes

Parkway, Suite 500, Las Vegas, NV, 89109. Attn: Secretary.

Executive

Compensation

Summary

Compensation Table

The table below sets forth,

for the fiscal years ended June 30, 2021 and 2020, the compensation earned by each person acting as our Chief Executive Officer and Chief

Financial Officer. The Company’s only employee is our Chief Executive Officer.

| Name and Principal Position | |

Fiscal

Year Ended | |

Salary

($) | | |

Bonus

($) | | |

Stock

Awards

($) | | |

Option

Awards

($) | | |

Non-equity

Incentive

Plan

Compensation

($) | | |

Nonqualified

Deferred

Compensation

Earnings

($) | | |

All Other

Compensation

($) | | |

Total

($) | |

Chaya Hendrick

(President, Chief Executive Officer, | |

2021 | |

$ | | (2) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

$ | | (4) | |

$ | 190,000 | |

| Chairman of the Board (1) | |

2020 | |

$ | 174,167 | (3) | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

$ | 15,833 | (5) | |

$ | 190,000 | |

| | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

Jay Needelman

(Chief and Principal Financial Officer, | |

2021 | |

$ | 15,000 | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

$ | 15,000 | |

| Director) (6) | |

2020 | |

$ | 15,000 | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

| -0- | | |

$ | 15,000 | |

| (1) |

Chaya Hendrick

has been President, Chief Executive Officer and director of the Company since inception. Chaya Hendrick also has a car allowance

in her employment agreement which she has forgone for the years ended June 30, 2021 and 2020. |

| (2) |

The Company paid Chaya Hendrick $174,167 for the year ended June 30, 2020 out of her total aggregate salary of $190,000, with the remainder being accrued but unpaid. As of June 30, 2021 the Company has accrued $737,642 of unpaid salary, which includes previously accrued but unpaid salary for periods not covered under this Summary Compensation Table. |

| (3) |

The Company paid Chaya Hendrick $190,000 for the year ended June 30, 2021 out of her total aggregate salary of $190,000. |

| |

|

| (4) |

Includes $0 in accrued but unpaid salary for the

year end June 30, 2021. As of June 30, 2021, the Company has accrued $737,642 of unpaid salary, which includes previously accrued but

unpaid salary for periods not covered under this Summary Compensation Table.

|

| (5) |

Jay Needelman has served as our Chief Financial Officer since 2007. Mr. Needelman receives annual compensation of $15,000 for his services as our Chief Financial Officer. |

Outstanding

Equity Awards at Fiscal Year End

None.

Chaya

Hendrick Employment

Previous

Employment Agreement

On

July 1, 2012, the Company entered into an employment agreement (the “Prior Agreement”) with Chaya Hendrick, the Company’s

Chief Executive Officer that expired on July 1, 2017. Pursuant to the Prior Agreement, Ms. Hendrick received an annual base salary of

$190,000 per year. Ms. Hendrick was also entitled to receive a management fee equal to $50,000 per year beginning with the Company’s

fiscal year ended June 30, 2012 and each fiscal year thereafter during the term of the Agreement provided that the Company has manufactured

its first product. This fee was to increase by 25% per annum at the conclusion of each calendar year and was based on the continued manufacturing

and sales of products by the Company. As of the end of the term of the Prior Agreement, no compensation was paid pursuant to this management

fee.

Ms.

Hendrick was also entitled to participate in any and all benefit plans, from time to time, in effect for senior management, along with

vacation, sick and holiday pay in accordance with the Company’s policies established and in effect from time to time. The Company

also provided Ms. Hendrick with the use of an automobile of Ms. Hendrick’s choice at a purchase price not to exceed $60,000. Executive’s

employment with the Company was subject to termination at any time, with cause, as such terms are defined in the Prior Agreement.

The

Prior Agreement may be terminated on 30 days’ notice by Ms. Hendrick but may only be terminated by the Company for “cause.”

In the event that Ms. Hendrick’s employment was terminated by the Company, the Company was obligated to pay to Ms. Hendrick an

amount equal to $350,000 plus salary remaining on the term of the Prior Agreement.

Addendum

to Prior Agreement

On September 30, 2015, the

Company and Ms. Hendrick entered into an Addendum to the Agreement (the “Addendum”) pursuant to which in consideration for

the issuance of 200,000 shares of the Company’s Series B Convertible Preferred Stock, Ms. Hendrick granted the Company the first

right to purchase or license any patents (the “Patent Option”) relating to “Smartcards” which Ms. Hendrick (i)

shall apply for with the relevant patent authorities during the term of the Agreement, and (ii) are currently applied for with the relevant

patent authorities or pending as of the date of the Prior Agreement (the “Patent Rights”). In exchange for the Patent Option

the Company agrees, during the term of the Prior Agreement, to pay for any fees and/or expenses related to the application for the Ms.

Hendrick’s Patent Rights with the relevant patent authorities, including, but not limited to, legal or filing fees. If, upon the

Company’s receipt of notice of any Patent Rights of Ms. Hendrick’s in writing (“Patent Notification”) the parties

fail to successfully negotiate and execute a purchase or license agreement as it relates to the Patent Right that is the subject of such

Patent Notification within 60 calendar days of the receipt of such Patent Notification, Ms. Hendrick shall be permitted to retain or

transfer the Patent Rights to a third party without any subsequent notice to the Company.

Amended

and Restated Employment Agreement

On

July 1, 2017, the Company and Ms. Hendrick entered into an amended and restated employment agreement (“Agreement”) with a

duration of sixty (60) months. Pursuant to the Agreement, Ms. Hendrick shall receive (i) an annual base salary of $190,000, subject to

adjustment at the end of each fiscal year at the discretion of the board of directors, with a minimum increase of 10% per annum for the

duration of the term, (ii) an incentive management fee equal to $50,000 upon the Company manufacturing its first product, which shall

increase by 25% per annum and based on the continued manufacturing and sales of products by our Company.

Additionally,

Ms. Hendrick shall maintain certain rights to initiate, write, invent and / or create inventions separate from SmartMetric, Inc. and

to retain the intellectual property rights of such patents, inventions, or new products.

The

Agreement may be terminated on 30 days’ notice by Ms. Hendrick but may only be terminated by the Company for “cause.”

In the event that Ms. Hendrick’s employment is terminated by the Company for such “cause,” the Company is obligated

to pay to Ms. Hendrick an amount equal to $350,000 plus the remaining salary on the term of the Agreement.

Jay

Needelman Contract

We

currently have an oral agreement with Jay Needelman, our part-time Chief Financial Officer, whereby we pay Mr. Needelman an annual fee

of $15,000 for his services, payable in quarterly installments of $3,750.

Director

Compensation

Directors

did not receive compensation for their services as directors during the year ended June 30, 2021.

ACTION

TWO

INCREASE

IN AUTHORIZED SHARES OF THE COMPANY’S COMMON STOCK.

On July 6, 2022, the Majority

Stockholder authorized the increase of the Company’s shares of authorized Common Stock from 1,200,000,000 to 2,400,000,000.

The

Majority Stockholder believes that it is advisable and in the best interests of the Company and its stockholders to effect an Increase

of Authorized Shares in order to provide additional shares that could be issued in order to raise additional equity capital or other

financing activities, stock dividends or the exercise of stock options and warrants and to provide additional shares that could be issued

in an acquisition or other form of business combination and to better position the Company for future trading should a transaction be

entered into and completed. The future issuance of additional shares of Common Stock on other than a pro rata basis to existing stockholders

will dilute the ownership of the current stockholders, as well as their proportionate voting rights.

Attached

as Appendix A and incorporated herein by reference is the text of the Certificate of Amendment to Articles of Incorporation

(the “Amended Certificate”) as approved by the Majority Stockholder. The Increase in Authorized Shares will be effected by

filing the Amended Certificate with the Secretary of State of Nevada, which is expected to occur approximately twenty (20) days after

the mailing of this Information Statement. The Increase in Authorized Shares will become effective upon such filing.

Effects

of Amendment.

The

following table summarizes the principal effects of the Increase in the Authorized Shares:

| | |

Pre-Increase | | |

Post-Increase | |

| Common Stock | |

| | | |

| | |

| Issued and Outstanding | |

| 647,886,336 | | |

| 647,886,336 | |

| Authorized | |

| 1,200,000,000 | | |

| 2,400,000,000 | |

Potential

Anti-takeover effects of the increase in authorized shares.

The implementation of the

Increase in Authorized Shares will have the effect of increasing the proportion of unissued authorized shares to issued shares. Under

certain circumstances, this may have an anti-takeover effect. These authorized but unissued shares could be used by the Company to oppose

a hostile takeover attempt or to delay or prevent a change of control or changes in or removal of the Board, including a transaction that

may be favored by a majority of our stockholders or in which our stockholders might receive a premium for their shares over then-current

market prices or benefit in some other manner. For example, without further stockholder approval, the Board could issue and sell shares,

thereby diluting the stock ownership of a person seeking to effect a change in the composition of our Board or to propose or complete

a tender offer or business combination involving us and potentially strategically placing shares with purchasers who would oppose such

a change in the Board or such a transaction.

Although

an increased proportion of unissued authorized shares to issued shares could, under certain circumstances, have a potential anti-takeover

effect, the proposed amendments to our Articles of Incorporation is not in response to any effort of which we are aware to accumulate

the shares of our Common Stock or obtain control of the Company. There are no plans or proposals to adopt other provisions or enter into

other arrangements that may have material anti-takeover consequences.

The Board does not intend

to use the consolidation as a part of or a first step in a “going private” transaction pursuant to Rule 13e-3 under the Securities

Exchange Act of 1934, as amended. Moreover, we are currently not engaged in any negotiations or otherwise have no specific plans to use

the additional authorized shares for any acquisition, merger, or consolidation.

No

Dissenter’s Rights

No

dissenters’ or appraisal rights are available to our stockholders under the Nevada Revised Statutes in connection with the proposed

amendment to our Articles of Incorporation to effect the Increase in Authorized Shares.

ACTION

THREE

RATIFICATION

OF THE APPOINTMENT OF INDEPENDENT AUDITORS

On July 6, 2022, the Board authorized

the selection of Boyle CPA, LLC as the independent registered public accounting firm of the Company for the fiscal year ending June 30,

2022, and on July 6, 2022 the Majority Stockholder approved such selection by way of the written consent. Boyle CPA, LLC was first engaged

by us on March 23, 2021. Prior to such engagement, Prager Metis CPAs LLC audited our financial statements for the 2019 and 2020 fiscal

years.

The

following is a summary and description of fees for services for the fiscal years ended June 30, 2021 and 2020.

| Services | |

2021 | | |

2020 | |

| Audit Fees | |

$ | 23,000 | | |

$ | 19,546 | |

| Audit-Related Fees | |

| 0 | | |

| 0 | |

| Tax Fees | |

| 0 | | |

| 0 | |

| All Other Fees | |

| 0 | | |

| 0 | |

| Total | |

$ | 23,000 | | |

$ | 19,546 | |

Audit

Fee

The Company incurred, in the

aggregate, approximately $23,000 and $19,546 for professional services rendered by its registered independent public accounting firms

for the audit of the Company’s annual financial statements for the years ended June 30, 2021 and 2020, respectively, and for the

reviews of the financial statements included in its quarterly reports on Form 10-Q during those fiscal years.

Audit-Related

Fees

The

Company incurred approximately $0 and $0 in fees from its registered independent public accounting firms for audit-related services

during the years ended June 30, 2021 and 2020, respectively.

Tax

Fees

The

Company incurred approximately $0 and $0 in fees from its registered independent public accounting firms for tax compliance or tax consulting

services during the years ended June 30, 2021 and 2020, respectively.

All

Other Fees

The Company incurred $0 and

$0 for fees from its registered independent public accounting firms for services rendered to the Company, other than the services covered

in “Audit Fees,” “Audit-Related Fees,” and “Tax Fees” for the fiscal years ended June 30, 2021 and

2020, respectively.

Audit

Committee Pre-Approval Policies and Procedures

We

do not have an audit committee. Our Board performs the function of an audit committee. Section 10A(i) of the Exchange Act prohibits our

auditors from performing audit services for us as well as any services not considered to be audit services unless such services are pre-approved

by our audit committee or, in cases where no such committee exists, by our Board (in lieu of an audit committee) or unless the services

meet certain de minimis standards.

In

order to assure continuing auditor independence, the Board periodically considers the independent auditor’s qualifications, performance

and independence and whether there should be a regular rotation of our independent external audit firm. We believe the continued retention

of Boyle CPA, LLC to serve as the Company’s independent auditor is in the best interests of the Company and its stockholders.

ACTION

FOUR

ADVISORY

VOTE APPROVING EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform

and Consumer Protection Act of 2010 and Section 14A of the Exchange Act entitle SmartMetric’s stockholders to vote to approve,

on an advisory basis, the compensation of SmartMetric’s named Executive Officers—meaning Chaya Hendrick, our President and

Chief Executive Officer, and Jay Needelman, our Chief Financial Officer (the “Named Executive Officers”).

As

described in detail in this Information Statement under the heading “Action One—Re-election of Three Directors—Executive

Compensation,” SmartMetric strives to provide our Named Executive Officers with a competitive base salary in line with their roles

and responsibilities when compared to peer companies of comparable size in similar locations.

We

plan to implement a more comprehensive compensation program, which takes into account other elements of compensation, including, without

limitation, short and long term compensation, cash and non-cash, and other equity-based compensation such as stock options. We expect

that this compensation program will be comparable to the programs of our peer companies and aimed to retain and attract talented individuals.

We

will also consider forming a compensation committee to oversee the compensation of our Named Executive Officers. The majority of the

members of the Compensation Committee would be independent directors.

The

Board continually reviews the compensation programs for SmartMetric’s Named Executive Officers to ensure they achieve the desired

goals.

On June 24, 2022, the Majority Stockholder approved, on an advisory basis, the Named Executive Officer compensation disclosed in this

Information Statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to

express their views on SmartMetric’s executive compensation. This vote is not intended to address any specific item of compensation,

but rather the overall compensation of SmartMetric’s Named Executive Officers and the philosophy, policies, and practices described

in this Information Statement.

The

say-on-pay vote is advisory, and therefore not binding on SmartMetric or the Board.

RECORD DATE AND VOTING SECURITIES

Only stockholders of record

at the close of business on the Record Date are entitled to notice of the information disclosed in this Information Statement. The following

table represents the voting securities as of the Record Date:

| Class of Shares Entitled to Vote |

|

Number of Shares Outstanding |

|

|

Number of Votes to which the Class is entitled |

|

| Common Stock |

|

|

647,886,336 |

|

|

|

647,886,336 |

|

| |

|

|

|

|

|

|

|

|

| Series B Preferred Stock |

|

|

610,000 |

|

|

|

30,500,000 |

|

| |

|

|

|

|

|

|

|

|

| Total: |

|

|

648,496,336 |

|

|

|

678,386,336 |

|

SECURITY

OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth,

as of July 6, 2022, certain information regarding beneficial ownership of our Common Stock (a) by each person known by us to be the

beneficial owner of more than five percent of the outstanding shares of Common Stock, (b) by each director of the Company, (c) by the

named executive officers (determined in accordance with Item 402 of Regulation S-K) and (d) by all of our current executive officers and

directors as a group.

We have determined beneficial

ownership in accordance with the rules of the Securities and Exchange Commission (“SEC”). Except as indicated by the footnotes

below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and

investment power with respect to all shares of Common Stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership

is based on 647,886,336 shares of Common Stock outstanding as of June 24, 2022. In computing the number of shares of Common Stock beneficially

owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of Common Stock subject to options

held by that person or entity that are currently exercisable or that will become exercisable within 60 days of June 24, 2022, if any.

Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o SmartMetric, Inc., 3960 Howard Hughes

Parkway, Suite 500, Las Vegas, NV.

| Title of Class |

|

Name and Address of Beneficial Owner |

|

Director/Officer |

|

|

Number of

Shares

of Common

Stock (1) |

|

|

Percentage

of Class (1) |

|

| |

|

Directors and Executive Officers |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

Chaya Hendrick (2)

27 Via Corvina

Henderson, NV 89109 |

|

Chief Executive Officer,

Chairman of the Board of Directors |

|

|

89,127,778 |

|

|

|

20 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

Jay Needelman, CPA

520 West 47th Street

Miami Beach, FL 33140 |

|

Director; Chief Financial Officer |

|

|

0 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stock |

|

Elizabeth Ryba

4207 65th Terrace E

Sarasota, FL 34243

|

|

Director |

|

|

40,000 |

|

|

|

* |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

All Executive Officers and Directors as a Group (3 persons) |

|

|

|

|

89,167,778 |

|

|

|

18.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

5% Stockholders |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Chaya Hendrick (2)

27 Via Corvina

Henderson, NV 89109 |

|

|

|

|

89,127,778 |

|

|

|

20 |

% |

| * |

Less than one

percent (1%) |

| (1) |

In determining beneficial ownership of our common

stock as of a given date, the number of shares shown includes shares of common stock which may be acquired on exercise of warrants or

options or conversion of convertible securities within 60 days of that date. In determining the percent of common stock owned by a person

or entity on June 30, 2021, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including

shares which may be acquired within 60 days on exercise of warrants or options and conversion of convertible securities, and (b) the

denominator is the sum of (i) 472,859,208, the total shares of common stock outstanding on September 24, 2021, and (ii) the total

number of shares that the beneficial owner may acquire upon conversion of any preferred stock and on exercise of the warrants and options.

Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares.

|

| (2) |

The

89,127,778 shares of common stock include (i) 58,627,778 of Common Stock and; (ii) 610,000 shares of Series B Convertible Preferred Stock

convertible into 30,500,000 shares of common stock held by Applied Cryptography, Inc. (“ACI”) and / or Chaya Hendrick. The

outstanding shares of Series B Convertible Preferred Stock are entitled to vote on any matter with the holders of Common Stock

voting together as one (1) class and shall have that number of votes (identical in every other respect to the voting rights of the holder

of common stock entitled to vote at any regular or special meeting of Stockholders) equal to that number of common shares which is not

less than 51% of the vote required to approve any action, which Nevada law provides may or must be approved by vote or consent of the

common shares or the holders of other securities entitled to vote, if any. Each share of Series B Convertible Preferred Stock is

convertible, at the option of the holder, into fifty (50) shares of Common Stock upon the satisfaction of certain conditions and for

purposes of determining a quorum of a shareholder meeting, the outstanding shares of Series B Convertible Preferred Stock shall be deemed

the equivalent of 51% of all shares of the Company’s Common Stock entitled to vote at such meetings. Our Chairman and Chief

Executive Officer, has sole voting and dispositive power over all of the shares beneficially owned by ACI.

|

DELIVERY

OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

If

hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders

who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate

copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered.

You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address, and

(iii) the address to which the Company should direct the additional copy of the Information Statement, to SmartMetric, Inc., 3960 Howard

Hughes Parkway, Suite 500 Las Vegas, NV 89109.

If

multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would

prefer the Company to mail each stockholder a separate copy of future mailings, you may mail notification to, or call the Company at,

its principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information

Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared

address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

Information Statement may contain “forward-looking statements” made under the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. The statements include, but are not limited to, statements concerning the effects of

the stockholder approval and statements using terminology such as “expects,” “should,” “would,” “could,”

“intends,” “plans,” “anticipates,” “believes,” “projects” and “potential.”

Such statements reflect the current view of the Company with respect to future events and are subject to certain risks, uncertainties,

and assumptions. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those

contemplated by the statements.

In

evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially

from any forward-looking statements. You should carefully review the risks listed, as well as any cautionary language, in this Information

Statement and the risk factors detailed under “Risk Factors” in the documents we file with the SEC, which provide examples

of risks, uncertainties, and events that may cause our actual results to differ materially from any expectations we describe in our forward-looking

statements. There may be other risks that we have not described that may adversely affect our business and financial condition. We disclaim

any obligation to update or revise any of the forward-looking statements contained in this Information Statement. We caution you not

to rely upon any forward-looking statement as representing our views as of any date after the date of this Information Statement. You

should carefully review the information and risk factors set forth in other reports and documents that we file from time to time with

the SEC.

ADDITIONAL

INFORMATION

We

are subject to the disclosure requirements of the Exchange Act, and in accordance therewith, file reports, information statements and

other information, including annual and quarterly reports on Form 10-K and 10-Q, respectively, with the SEC. Reports and other information

filed by the Company can be inspected and copied at the public reference facilities maintained by the SEC, 100 F Street, N.E., Washington,

DC 20549. In addition, the SEC maintains a web site on the Internet (http://www.sec.gov) that contains reports, information statements

and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval

System.

A

copy of any public filing is also available, at no cost, by writing to SmartMetric, Inc., 3960 Howard Hughes Parkway, Suite 500 Las Vegas,

NV 89109. Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes to

the extent that a statement contained in this Information Statement (or in any other document that is subsequently filed with the SEC

and incorporated by reference) modifies or is contrary to such previous statement. Any statement so modified or superseded will not be

deemed a part of this Information Statement except as so modified or superseded.

Appendix

A

Form

of Certificate of Amendment

FORM

OF CERTIFICATE OF AMENDMENT TO

ARTICLES

OF INCORPORATION

OF

SMARTMETRIC, INC.

| 1. |

Name of the Corporation: |

SmartMetric,

Inc. (the “Corporation”)

| 2. |

The articles

have been amended as follows (provide article numbers, if available): |

The

first paragraph of ARTICLE III is amended and restated in its entirety to read as follows.

ARTICLE

III

The total authorized capital

stock of the Corporation shall be 2,450,000,000 shares consisting of two billion four hundred million (2,400,000,000) shares of common

stock, par value $0.001 per share (the “Common Stock”), and five million (5,000,000) shares of preferred stock, par value

$0.001 per share (the “Preferred Stock”).

| 3. |

The vote by

which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such

greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the

provisions of the articles of incorporation have voted in favor of the amendment is: 57% |

| 4. |

Effective date

of filing (optional): Upon filing |

| 5. |

Officer Signature

(Required): |

| /s/ Chaya Hendrick |

|

| Chaya Hendrick, Chief Executive Officer |

|

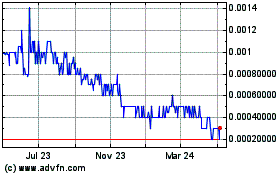

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From Apr 2024 to May 2024

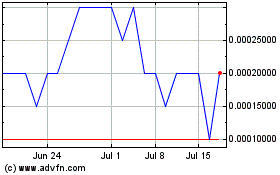

SmartMetric (PK) (USOTC:SMME)

Historical Stock Chart

From May 2023 to May 2024