UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No . )

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☒ |

Soliciting

Material under §240.14a-12 |

PARKS!

AMERICA, INC.

(Name

of Registrant as Specified in its Charter)

(Name

Of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11 |

On

December 30, 2023, Parks! America, Inc. commenced mailing the below notice of a special meeting to its shareholders:

Parks!

America, Inc.

1300

Oak Grove Road

Pine

Mountain, Georgia 31822-1197

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

TO

BE HELD FEBRUARY 26, 2024

Dear

Shareholder:

You

are cordially invited to attend a Special Meeting of Shareholders (if held, including any adjournment, postponement or rescheduling thereof,

the “Special Meeting”) of Parks! America, Inc., a Nevada corporation (the “Company”). The

Special Meeting will be held on February 26, 2024 at 11:00 a.m. Eastern Time. The Special Meeting will be held in a virtual meeting format

only, via live audio webcast. Shareholders will be able to attend and participate in the Special Meeting by visiting a website to be

provided and will not be able to attend the Special Meeting in person.

As

you may know, on December 22, 2023, Focused Compounding Fund, LP (“Focused Compounding”) submitted documents to the Company

purporting to provide qualifying notice (the “Purported Notice”) as to a demand that the Company hold a special meeting of

shareholders.

Pursuant

to the Purported Notice, the Special Meeting is being held for the purpose of asking shareholders to consider and vote upon the following

purported proposals:

| |

1. |

Proposal

1: Repeal any provision of the Company’s

Bylaws, as adopted by the Company’s Board of Directors (the “Board”) on January 30, 2004, and as revised as of

June 12, 2012 (the “Bylaws”), including any amendments thereto, in effect at the time this Proposal becomes effective,

which was not included in the Bylaws that were in effect as of June 12, 2012 and were filed with the U.S. Securities and Exchange

Commission (the “SEC”) on July 16, 2012 (the “Bylaw Restoration Proposal”) to restore the Bylaws to their

current form if the Board attempts to amend them in any manner prior to the completion of Focused Compounding’s proxy solicitation; |

| |

|

|

| |

2. |

Proposal

2: Remove all seven (7) members of the Board

(Lisa Brady, Todd White, Dale Van Voorhis, John Gannon, Charles Kohnen, Jeffrey Lococo and Rick Ruffolo) pursuant to Section 4.9(a)

of the Bylaws (the “Removal Proposal”); |

| |

|

|

| |

3. |

Proposal

3: Amend and restate Section 4.7 of the Bylaws

(the “Bylaw Amendment Proposal”) to read as follows: |

“4.7 Vacancy

on Board of Directors. In case of a vacancy on the Board of Directors because of a director’s resignation, removal or

other departure from the board, or because of an increase in the number of directors, the remaining directors, by majority vote, may

elect a successor to hold office for the unexpired term of the director whose position is vacant, and until the election and

qualification of a successor. In the event any directors are removed by a vote of the shareholders, then the shareholders shall have

the right to elect successors to hold office for the unexpired term of the director or directors whose positions are vacant, and

until the election and qualification of their successors.”

| |

4. |

Proposal

4: Subject to the concurrent approval of the

Removal Proposal, elect as members of the Board each of (i) Andrew Kuhn, (ii) Geoff Gannon and (iii) James Ford (the “Election

Proposal”); and |

| |

|

|

| |

5. |

Proposal

5: Authorize Focused Compounding, or an authorized

representative thereof, to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation

and vote of proxies in the event there are insufficient votes for, or otherwise in connection with, any of the Bylaw Restoration

Proposal, the Removal Proposal, the Bylaw Amendment Proposal or the Election Proposal (the “Adjournment Proposal”). |

All

shareholders are cordially invited to attend the Special Meeting. It is important that your shares be represented at the Special Meeting,

regardless of whether or not you plan to virtually attend. Accordingly, we encourage you vote as instructed in the Company’s supplemental

materials. Giving your proxy will not affect your right to vote your shares if you choose to virtually attend the Special Meeting.

You will be able to attend and participate in the Special Meeting and vote your shares electronically during the Special Meeting. The

Company intends to supplement this Notice to provide, among other things, additional details as to how to attend and vote at the Special

Meeting.

The

Company is not responsible for the accuracy of any information provided by, or relating to, Focused Compounding that is contained in

any proxy solicitation materials, if and when filed or disseminated by, or on behalf of, Focused Compounding or any other statements

that Focused Compounding or its representatives have made or may otherwise make, including statements relating to (i) the Bylaw Restoration

Proposal, (ii) the Removal Proposal, (iii) the Bylaw Amendment Proposal, (iv) the Election Proposal and/or (v) the Adjournment Proposal

(collectively, the “Focused Compounding Proposals”). The Board does NOT support the Focused Compounding Proposals.

In

the event that the purported Removal Proposal fails to receive the required number of votes for approval by the Company’s shareholders

at the Special Meeting, all incumbent members of the Board will remain seated, and no additional directors will be added to the Board

at the Special Meeting, notwithstanding the outcome of the purported Election Proposal. The Company intends to supplement this Notice

to provide, among other things, additional details as to the Focused Compounding Proposals.

The

Board does NOT support the Removal Proposal and does NOT support the removal of any incumbent member of the Board. The

Board does NOT endorse any of the director nominees included in the Election Proposal, and the presence of their names herein

is NOT an approval of their character, suitability or other qualifications. You may receive solicitation materials from, or on

behalf of, Focused Compounding, including proxy materials. We are not responsible for the accuracy of any information provided by or

relating to Focused Compounding, including the Focused Compounding Proposals and the director nominees included in the Election Proposal.

If

you have any questions, please contact our proxy solicitor, Saratoga Proxy Consulting, LLC:

520

8th Avenue, 14th Floor

New

York, New York 10022

(212)

257-1311

Shareholders

call toll free at (888) 368-0379

info@saratogaproxy.com

We

thank you for your continued support of the Company.

BY

ORDER OF THE BOARD OF DIRECTORS

Important

Additional Information

The

Company, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from the

Company’s shareholders in connection with any matters that would be considered at the Special Meeting, if held. The Company intends

to file a definitive proxy statement and a WHITE proxy card with the SEC in connection with any solicitation of proxies from the

Company’s shareholders with respect to the Special Meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH

PROXY STATEMENT, THE ACCOMPANYING WHITE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. The Company’s annual report on Form 10-K for the fiscal

year ended October 1, 2023 contains information regarding the direct and indirect interests, by security holdings or otherwise, of the

Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their

holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4 and 5, which are available through the SEC’s

website at www.sec.gov. Updated information regarding the identity of potential participants, and their direct or indirect interests

in the matters to be considered at the Special Meeting, by security holdings or otherwise, would be set forth in the definitive proxy

statement and other materials that would be filed with the SEC in connection with the Special Meeting. Shareholders would be able to

obtain the definitive proxy statement with respect to the Special Meeting, any amendments or supplements to such proxy statement and

other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies would also be

available at no charge on the Company’s website at https://animalsafari.com/investor-relations/.

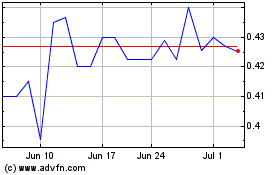

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From Apr 2024 to May 2024

Parks America (PK) (USOTC:PRKA)

Historical Stock Chart

From May 2023 to May 2024