ITT Tech's Bankruptcy Trustee Seeks to Fend Off SEC, CFPB

October 11 2016 - 4:20PM

Dow Jones News

The bankruptcy trustee sifting through the wreckage left when

the ITT Technical Institute chain of schools collapsed says the

Consumer Financial Protection Bureau and other government agencies

are getting in her way.

Deborah Caruso, the trustee, wants the CFPB sidelined by court

order, along with the Securities and Exchange Commission and

attorneys general for Massachusetts and New Mexico, as well as

others that sued the troubled for-profit educational company before

it filed for bankruptcy last month.

On Tuesday in U.S. Bankruptcy Court in Indianapolis, Judge James

Carr set the matter for a hearing Nov. 2. Ms. Caruso is asking for

an injunction barring government agencies from continuing their

legal march on ITT Tech. Additionally, she wants a halt to lawsuits

aimed at the company's former executives.

Ms. Caruso is particularly concerned about a Freedom of

Information Act request to the CFPB, which seeks information that

ITT Tech indicated it would rather not see become public, court

papers say.

Ms. Caruso's lawyers say they haven't had a chance to evaluate

the "threatened production" of information ITT Tech handed over to

the CFPB. However, the information being sought by an unidentified

news organization likely constitutes property of the bankruptcy

estate, they contend.

According to the trustee, she needs breathing room to assess ITT

Tech's legal and financial picture.

The CFPB and SEC declined to comment Tuesday on the motion,

which was filed Monday in bankruptcy court.

"The Office of Attorney General Hector Balderas is doing all it

can to ensure that New Mexico students and families who were harmed

by ITT's unlawful practices and subsequent closure are protected

and given every opportunity to transition their education and

pursue loan forgiveness," James Hallinan, a spokesman for the New

Mexico attorney general's office, said Tuesday. "We continue to

evaluate the best options for representing the State of New Mexico

and its families in the pending litigation and in ITT's

bankruptcy."

ITT Tech's parent company, ITT Educational Services Inc., closed

its doors abruptly and filed for bankruptcy after federal

authorities cut off its access to taxpayer-backed student loans.

The action followed years of litigation and accusations of fraud

from the CFPB, SEC and others.

Ms. Caruso's lawyers say if the lawsuits are allowed to

continue, she will have to spend time fielding requests for

documents and attempting to safeguard the $40 million worth of

insurance that is one of the major sources of value in the

case.

Litigation reprieves are a normal part of most corporate

bankruptcies, provided by law to allow distressed companies time to

reorganize, or at least get their affairs in shape for an orderly

liquidation.

ITT Tech's bankruptcy has the trustee and her advisers

scrambling to make sense of a failed business that, until Sept. 6,

served nearly 40,000 students, employed 8,000 people and operated

137 locations.

In ITT Tech's case, the onslaught of fraud litigation could have

an unusual side effect that could help some students resist

attempts by ITT Tech to collect alleged debts from them. The CFPB,

for example, sued back in 2014 seeking to block the education

company from trying to collect some private loans from

students.

According to the CFPB suit, ITT Tech knew federal loans would

not cover its entire tuition, so it offered cash-strapped students

zero-interest temporary loans to cover the gap. Students unable to

pay off the temporary loans in nine months—most ITT Tech students,

the CFPB said—were then pushed into pricey private loans.

The private loans only appeared to be offered by third parties,

the suit says, noting that ITT Tech was behind the private loan

system.

If bankruptcy stalls the CFPB litigation, individual students

that could be hit with demands for payment from the bankruptcy

trustee will be on their own when it comes to challenging the

validity of the loans.

Uncollected student debts are one of ITT Tech's major assets,

lawyers said at a hearing early in the proceeding.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

October 11, 2016 16:05 ET (20:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

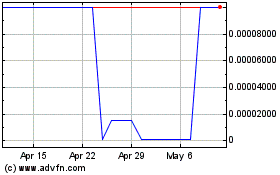

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Jun 2024 to Jul 2024

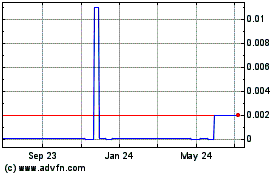

ITT Educational Services (CE) (USOTC:ESINQ)

Historical Stock Chart

From Jul 2023 to Jul 2024