Q1false0001643154--12-31UnlimitedUnlimitedP1Yone year10001643154us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-05-172023-05-170001643154ithuf:WriteDownsAndOtherChargesMemberus-gaap:AccountsReceivableMember2023-01-012023-03-310001643154ithuf:LendersMemberithuf:DeferredProfessionalFeesMembersrt:MinimumMember2024-01-012024-03-310001643154us-gaap:PropertyPlantAndEquipmentMemberithuf:WriteDownsAndOtherChargesMember2023-01-012023-03-310001643154ithuf:AdditionalSecuredDebenturesMemberithuf:SecuredDebenturePurchaseAgreementMember2023-01-012023-03-310001643154ithuf:IanthusBrandedProductsMember2023-01-012023-03-310001643154us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-022024-04-020001643154ithuf:TwoThousandTwentyFourNewJerseyAmendmentMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2024-02-162024-02-160001643154srt:ChiefFinancialOfficerMemberithuf:SeparationAgreementMemberithuf:PhilippeFarautMember2024-01-012024-03-3100016431542024-03-310001643154us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-03-310001643154ithuf:EquityIncentivePlanMember2024-01-012024-03-310001643154us-gaap:AdditionalPaidInCapitalMember2023-03-310001643154ithuf:OtherMember2023-12-310001643154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001643154us-gaap:OtherLongTermInvestmentsMemberithuf:IslandThymeLlcMember2024-01-012024-03-310001643154us-gaap:StockOptionMember2023-12-310001643154ithuf:NevadaManagementAgreementMember2024-02-232024-02-230001643154srt:MinimumMember2024-01-012024-03-310001643154ithuf:OtherLongTermDebtMember2024-03-310001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2024-02-160001643154us-gaap:CommonStockMember2024-01-012024-03-310001643154ithuf:OtherMember2023-01-012023-03-310001643154us-gaap:AdditionalPaidInCapitalMember2024-03-310001643154ithuf:TwoThousandTwentyFourNewJerseyAmendmentMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2024-01-012024-03-310001643154us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-03-310001643154ithuf:SeparationAgreementMemberithuf:RobertGalvinMemberithuf:InterimChiefExecutiveOfficerPresidentAndDirectorMember2024-01-012024-03-310001643154ithuf:JuneUnsecuredDebenturesMemberithuf:IAnthusNewJerseyLlcMember2022-06-242022-06-240001643154ithuf:LendersMemberithuf:OtherEquityMethodInvesteesMemberithuf:JuneSecuredDebenturesMembersrt:MinimumMember2022-06-240001643154ithuf:ClaimByHimedLlcAnEquityHolderAndHolderOfUnsecuredDebenturesMember2020-05-190001643154srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2023-05-172023-05-170001643154srt:ChiefFinancialOfficerMemberithuf:SeparationAgreementMemberithuf:PhilippeFarautMember2023-01-012023-12-310001643154srt:MaximumMember2024-01-012024-03-310001643154us-gaap:OtherIncomeMemberithuf:SubleaseMember2024-01-012024-03-310001643154ithuf:WesternRegionMember2023-12-310001643154ithuf:OtherLongTermDebtMember2023-12-310001643154us-gaap:PropertyPlantAndEquipmentMemberithuf:WriteDownsAndOtherChargesMember2024-01-012024-03-310001643154us-gaap:RestrictedStockUnitsRSUMemberithuf:RobertGalvinMemberithuf:InterimChiefExecutiveOfficerPresidentAndDirectorMember2023-10-112023-10-110001643154us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-03-310001643154ithuf:LendersMember2023-12-310001643154ithuf:JuneSecuredDebenturesMember2022-06-242022-06-240001643154us-gaap:UnsecuredDebtMember2022-06-240001643154us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2024-03-310001643154ithuf:FrontVentureCorpMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2021-12-310001643154ithuf:ClaimByHimedLlcAnEquityHolderAndHolderOfUnsecuredDebenturesMember2023-12-310001643154us-gaap:SecuredDebtMember2024-03-310001643154us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-04-022024-04-020001643154us-gaap:RestrictedStockUnitsRSUMember2023-01-032023-01-030001643154ithuf:ProspectiveDefaultMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2021-02-020001643154ithuf:JuneUnsecuredDebenturesMember2023-01-012023-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2024-02-022024-02-020001643154us-gaap:RestrictedStockUnitsRSUMember2023-03-032023-03-030001643154ithuf:JuneSecuredDebenturesMember2023-12-310001643154ithuf:OtherEquityMethodInvesteesMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-10-202023-10-200001643154us-gaap:SecuredDebtMemberithuf:RecapitalizationTransactionMemberithuf:SecuredLendersMember2022-06-242022-06-240001643154ithuf:MassachusettsPurchaseAgreementMember2024-02-092024-02-0900016431542023-12-310001643154ithuf:JuneSecuredDebenturesMembersrt:MinimumMember2022-06-240001643154ithuf:TwoThousandTwentyFourNewJerseyAmendmentMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2023-01-012023-03-310001643154ithuf:LendersMembersrt:MaximumMemberithuf:DeferredProfessionalFeesMember2024-01-012024-03-310001643154ithuf:NewJerseySeniorSecuredBridgeNotesMember2024-02-272024-02-2700016431542024-05-010001643154srt:ChiefFinancialOfficerMember2024-03-310001643154ithuf:EasternRegionMember2023-12-310001643154ithuf:OtherLongTermDebtMember2023-12-310001643154ithuf:JuneSecuredDebenturesMember2022-06-240001643154srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2023-11-152023-11-150001643154ithuf:OtherMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-08-312023-08-310001643154us-gaap:RestrictedStockUnitsRSUMember2024-03-310001643154srt:ChiefFinancialOfficerMember2023-12-310001643154ithuf:AdditionalSecuredDebenturesMemberithuf:SecuredDebenturePurchaseAgreementMember2022-06-242022-06-240001643154ithuf:JuneSecuredDebenturesMember2024-03-3100016431542021-01-012021-12-3100016431542023-01-012023-12-310001643154ithuf:UnsecuredDebenturesMember2023-12-310001643154us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001643154us-gaap:OtherLongTermInvestmentsMemberithuf:IslandThymeLlcMember2023-12-310001643154ithuf:JuneSecuredDebenturesMember2024-03-310001643154ithuf:SecuredDebtAndUnsecuredDebtMember2023-12-3100016431542022-12-310001643154ithuf:FrontVentureCorpMember2024-01-012024-03-310001643154ithuf:OtherLongTermDebtMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2024-01-052024-01-050001643154ithuf:JuneUnsecuredDebenturesMembersrt:MaximumMember2022-06-240001643154us-gaap:CommonStockMember2023-01-012023-03-310001643154ithuf:JuneUnsecuredDebenturesMembersrt:MinimumMember2022-06-240001643154us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-03-310001643154ithuf:RecapitalizationTransactionMemberus-gaap:UnsecuredDebtMemberithuf:UnsecuredLendersMember2022-06-242022-06-240001643154us-gaap:CommonStockMember2023-12-310001643154ithuf:UnsecuredDebenturesMember2024-03-310001643154srt:SubsidiariesMember2021-12-310001643154ithuf:LendersMemberithuf:DeferredProfessionalFeesMember2024-03-310001643154us-gaap:BankTimeDepositsMember2023-12-310001643154ithuf:SeparationAgreementMemberithuf:RobertGalvinMemberithuf:InterimChiefExecutiveOfficerPresidentAndDirectorMember2023-01-012023-12-310001643154us-gaap:OtherIntangibleAssetsMember2023-01-012023-03-310001643154srt:MaximumMemberithuf:JuneSecuredDebenturesMember2022-06-240001643154us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-3100016431542023-04-052023-04-050001643154ithuf:RecapitalizationTransactionMemberithuf:ExistingShareholdersMember2022-06-240001643154ithuf:JuneUnsecuredDebenturesMember2022-06-242022-06-240001643154ithuf:LendersMemberithuf:AdditionalSecuredDebenturesMemberithuf:OtherEquityMethodInvesteesMembersrt:MinimumMember2022-06-240001643154ithuf:RecapitalizationTransactionMemberus-gaap:SecuredDebtMember2022-06-242022-06-2400016431542023-01-012023-03-310001643154ithuf:JuneUnsecuredDebenturesMember2023-12-310001643154ithuf:RecapitalizationTransactionMemberus-gaap:UnsecuredDebtMemberithuf:UnsecuredLendersMember2022-06-240001643154us-gaap:StockOptionMember2024-03-310001643154us-gaap:RetainedEarningsMember2023-03-310001643154ithuf:LendersMemberithuf:DeferredProfessionalFeesMember2024-04-050001643154ithuf:NevadaPurchaseAgreementMember2024-02-232024-02-230001643154ithuf:MassachusettsPurchaseAgreementMember2024-02-090001643154ithuf:JuneSecuredDebenturesMember2024-01-012024-03-310001643154ithuf:AdditionalSecuredDebenturesMember2023-12-310001643154ithuf:WholesaleBulkOtherProductsMember2023-01-012023-03-310001643154ithuf:AdditionalSecuredDebenturesMember2024-03-310001643154srt:MinimumMember2024-03-310001643154ithuf:ThirdPartyBrandedProductsMember2023-01-012023-03-310001643154srt:MaximumMemberus-gaap:SecuredDebtMemberithuf:RecapitalizationTransactionMember2022-06-242022-06-240001643154srt:ChiefFinancialOfficerMemberus-gaap:SubsequentEventMember2024-04-050001643154ithuf:WholesaleBulkOtherProductsMember2024-01-012024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001643154srt:MaximumMemberithuf:AdditionalSecuredDebenturesMemberithuf:SecuredDebenturePurchaseAgreementMember2022-06-240001643154ithuf:LendersMemberithuf:JuneUnsecuredDebenturesMemberithuf:OtherEquityMethodInvesteesMembersrt:MinimumMember2022-06-240001643154ithuf:ClaimAgainstIchmpxUlcAndMpxMember2024-03-310001643154us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001643154ithuf:NevadaManagementAgreementMember2024-02-230001643154us-gaap:AdditionalPaidInCapitalMember2022-12-310001643154ithuf:JuneSecuredDebenturesMember2023-12-310001643154ithuf:WesternRegionMember2024-01-012024-03-310001643154ithuf:WriteDownsAndOtherChargesMember2023-01-012023-03-310001643154us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberithuf:CustomerMember2024-01-012024-03-3100016431542024-01-012024-03-310001643154srt:MaximumMember2024-03-310001643154ithuf:RecapitalizationTransactionMember2022-06-240001643154ithuf:AdditionalSecuredDebenturesMemberithuf:SecuredDebenturePurchaseAgreementMember2024-01-012024-03-310001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2021-02-022021-02-020001643154ithuf:JuneUnsecuredDebenturesMember2024-01-012024-03-310001643154ithuf:RecapitalizationTransactionMemberus-gaap:UnsecuredDebtMember2022-06-242022-06-240001643154ithuf:ClaimByPriorShareholdersOfGrowHealthyHoldingsLlcMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2023-11-152023-11-150001643154ithuf:NewJerseySeniorSecuredBridgeNotesMember2022-06-242022-06-240001643154ithuf:WriteDownsAndOtherChargesMember2024-01-012024-03-310001643154us-gaap:RetainedEarningsMember2024-01-012024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-06-272023-06-270001643154ithuf:AdditionalSecuredDebenturesMember2024-01-012024-03-310001643154ithuf:HiMedSettlementAgreementMember2024-01-022024-01-020001643154ithuf:CounterclaimAgainstCanaccordMember2024-01-012024-03-310001643154ithuf:RecapitalizationTransactionMemberus-gaap:SecuredDebtMemberithuf:SecuredLendersMember2022-06-240001643154us-gaap:RestrictedStockUnitsRSUMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-03-310001643154us-gaap:CommonStockMember2023-03-310001643154ithuf:ServiceContractsMember2024-03-310001643154ithuf:ShareIssuanceMemberithuf:WriteDownsAndOtherChargesMember2023-01-012023-03-310001643154us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2024-03-310001643154ithuf:IanthusBrandedProductsMember2024-01-012024-03-310001643154us-gaap:RetainedEarningsMember2023-12-310001643154ithuf:TwoThousandTwentyFourNewJerseyAmendmentMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2024-02-160001643154ithuf:LendersMemberithuf:DeferredProfessionalFeesMember2023-12-310001643154ithuf:LongTermDebtCommitmentMember2024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-11-152023-11-150001643154us-gaap:PendingLitigationMemberithuf:LmsWellnessBenefitLlcMemberithuf:WilliamHuberMember2022-05-230001643154us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001643154srt:MaximumMember2021-08-192021-08-190001643154us-gaap:StockOptionMember2022-12-310001643154srt:SubsidiariesMember2020-12-310001643154us-gaap:SecuredDebtMember2022-06-240001643154ithuf:RecapitalizationTransactionMember2022-06-242022-06-2400016431542022-01-012022-12-310001643154ithuf:AdditionalSecuredDebenturesMembersrt:MinimumMemberithuf:SecuredDebenturePurchaseAgreementMember2022-06-240001643154ithuf:RecapitalizationTransactionMemberus-gaap:SecuredDebtMember2022-06-240001643154ithuf:OperatingLeaseRightOfUseAssetsMember2024-01-012024-03-310001643154ithuf:ProspectiveRecapitalizationTransactionMemberithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2021-02-020001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2023-01-012023-03-310001643154ithuf:JuneUnsecuredDebenturesMember2024-03-310001643154ithuf:WriteDownsAndOtherChargesMemberithuf:OperatingLeaseRightOfUseAssetsMember2024-01-012024-03-310001643154srt:ChiefFinancialOfficerMemberithuf:SeparationAgreementMemberithuf:PhilippeFarautMember2024-04-052024-04-050001643154srt:ChiefFinancialOfficerMemberithuf:SeparationAgreementMemberithuf:RobertGalvinMember2023-10-112023-10-110001643154us-gaap:RetainedEarningsMember2023-01-012023-03-310001643154us-gaap:RetainedEarningsMember2022-12-310001643154ithuf:WriteDownsAndOtherChargesMemberus-gaap:AccountsReceivableMember2024-01-012024-03-310001643154ithuf:EasternRegionMember2024-01-012024-03-310001643154ithuf:SecuredNotesMember2024-03-310001643154us-gaap:SecuredDebtMember2023-12-310001643154srt:MinimumMember2021-08-192021-08-190001643154ithuf:JuneUnsecuredDebenturesMember2024-01-012024-03-310001643154ithuf:JuneSecuredDebenturesMember2023-01-012023-03-310001643154ithuf:OtherMember2024-01-012024-03-310001643154us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2024-03-310001643154ithuf:ThirdPartyBrandedProductsMember2024-01-012024-03-310001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2021-02-020001643154us-gaap:PropertyPlantAndEquipmentMember2024-01-012024-03-310001643154us-gaap:CommonStockMember2022-12-310001643154us-gaap:OtherIntangibleAssetsMember2024-01-012024-03-310001643154ithuf:WesternRegionMember2024-03-310001643154us-gaap:BankTimeDepositsMember2024-03-310001643154us-gaap:CommonStockMember2024-03-310001643154ithuf:EasternRegionMember2024-03-310001643154ithuf:OperatingLeaseRightOfUseAssetsMember2023-01-012023-03-310001643154ithuf:EasternRegionMember2023-01-012023-03-310001643154ithuf:FrontVentureCorpMember2023-12-310001643154ithuf:WriteDownsAndOtherChargesMemberithuf:OperatingLeaseRightOfUseAssetsMember2023-01-012023-03-310001643154ithuf:OtherLongTermDebtMember2024-01-012024-03-3100016431542023-03-310001643154ithuf:JuneUnsecuredDebenturesMember2022-06-240001643154ithuf:OperatingLeasesMember2024-03-310001643154ithuf:ShareIssuanceMemberithuf:WriteDownsAndOtherChargesMember2024-01-012024-03-310001643154ithuf:RecapitalizationTransactionMemberus-gaap:UnsecuredDebtMember2022-06-240001643154us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-03-310001643154us-gaap:OtherIncomeMemberithuf:SubleaseMember2023-01-012023-03-310001643154ithuf:SecuredNotesMember2023-12-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-05-172023-05-170001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2024-01-012024-03-310001643154us-gaap:RestrictedStockUnitsRSUMember2023-05-170001643154us-gaap:AdditionalPaidInCapitalMember2023-12-3100016431542023-06-202023-06-200001643154us-gaap:RestrictedStockUnitsRSUMember2022-12-310001643154us-gaap:RetainedEarningsMember2024-03-310001643154ithuf:AdditionalSecuredDebenturesMemberithuf:SecuredDebenturePurchaseAgreementMember2022-06-240001643154ithuf:WesternRegionMember2023-01-012023-03-310001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2023-02-020001643154us-gaap:RestrictedStockUnitsRSUMember2022-06-230001643154us-gaap:OtherLongTermInvestmentsMemberithuf:IslandThymeLlcMember2024-03-310001643154ithuf:JuneSecuredDebenturesMember2024-01-012024-03-310001643154us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherLongTermInvestmentsMember2023-12-310001643154ithuf:IAnthusNewJerseyLlcMemberithuf:NewJerseySeniorSecuredBridgeNotesMember2023-02-022023-02-020001643154us-gaap:RestrictedStockUnitsRSUMember2023-12-310001643154ithuf:LendersMember2024-03-310001643154us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-310001643154us-gaap:SecuredDebtMember2024-01-012024-03-310001643154ithuf:IAnthusNewJerseyLlcMember2024-01-012024-03-31ithuf:Daysxbrli:pureithuf:Customerxbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 000-56228

IANTHUS CAPITAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

British Columbia, Canada |

98-1360810 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

214 King Street, Suite 314 Toronto, Ontario M5H 3S6 |

M5H 3S6 |

(Address of principal executive offices) |

(Zip Code) |

(646) 518-9418

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of common shares outstanding as of May 1, 2024 was 6,615,326,267.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Quarterly Report on Form10-Q contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements in this Quarterly Report on Form 10-Q about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common shares and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statements.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout our most recent Annual Report on Form 10-K and any updates described in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as may be amended, supplemented or superseded from time to time by other reports we file with the U.S. Securities and Exchange Commission (the “SEC”). You should read this Quarterly Report on Form 10-Q and the documents that we referenced herein and have filed as exhibits to the reports we file with the SEC, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Quarterly Report on Form 10-Q is accurate as of the date hereof. Because the risk factors in our SEC reports could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Quarterly Report on Form 10-Q, and particularly our forward-looking statements, by these cautionary statements.

ITEM 1. FINANCIAL STATEMENTS

iANTHUS CAPITAL HOLDINGS, INC.

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars or shares)

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

2024 (Unaudited) |

|

2023 (Audited) |

Assets |

|

|

|

|

|

|

Cash |

|

$ |

13,620 |

|

$ |

13,104 |

Restricted cash |

|

|

108 |

|

|

71 |

Accounts receivable, net of allowance for credit losses of $596

(December 31, 2023 - $384) |

|

|

6,554 |

|

|

4,609 |

Prepaid expenses |

|

|

2,603 |

|

|

2,100 |

Inventories, net |

|

|

24,763 |

|

|

25,382 |

Other current assets |

|

|

1,516 |

|

|

243 |

Current Assets |

|

|

49,164 |

|

|

45,509 |

Investments |

|

|

876 |

|

|

735 |

Property, plant and equipment, net |

|

|

92,219 |

|

|

94,003 |

Operating lease right-of-use assets, net |

|

|

25,230 |

|

|

27,377 |

Other long-term assets |

|

|

4,385 |

|

|

4,411 |

Intangible assets, net |

|

|

101,902 |

|

|

105,372 |

Total Assets |

|

$ |

273,776 |

|

$ |

277,407 |

Liabilities and Shareholders' (Deficit) |

|

|

|

|

|

|

Accounts payable |

|

$ |

14,446 |

|

$ |

14,399 |

Accrued and other current liabilities |

|

|

106,572 |

|

|

103,261 |

Current portion of long-term debt, net of issuance costs |

|

|

55 |

|

|

55 |

Current portion of operating lease liabilities |

|

|

7,585 |

|

|

7,716 |

Current Liabilities |

|

|

128,658 |

|

|

125,431 |

Long-term debt, net of issuance costs |

|

|

168,358 |

|

|

165,221 |

Deferred income tax |

|

|

17,914 |

|

|

20,412 |

Long-term portion of operating lease liabilities |

|

|

27,001 |

|

|

28,009 |

Uncertain tax position liabilities |

|

|

5,220 |

|

|

— |

Total Liabilities |

|

|

347,151 |

|

|

339,073 |

Commitments (Refer to Note 9) |

|

|

|

|

|

|

Shareholders' (Deficit) |

|

|

|

|

|

|

Common shares - no par value. Authorized - unlimited number. 6,615,002 -

issued and outstanding (December 31, 2023 - 6,510,527 - issued and outstanding) |

|

|

— |

|

|

— |

Additional paid-in capital |

|

|

1,268,267 |

|

|

1,265,978 |

Accumulated deficit |

|

|

(1,341,642) |

|

|

(1,327,644) |

Total Shareholders' (Deficit) |

|

$ |

(73,375) |

|

$ |

(61,666) |

Total Liabilities and Shareholders' (Deficit) |

|

$ |

273,776 |

|

$ |

277,407 |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

iANTHUS CAPITAL HOLDINGS, INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands of U.S. dollars, except per share amounts)

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

Revenues, net of discounts |

|

$ |

41,564 |

|

$ |

36,753 |

Costs and expenses applicable to revenues (exclusive of depreciation and amortization expense shown separately below) |

|

|

(24,363) |

|

|

(21,241) |

Gross profit |

|

|

17,201 |

|

|

15,512 |

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

17,518 |

|

|

17,869 |

Depreciation and amortization |

|

|

5,883 |

|

|

6,454 |

Write-downs and other charges, net |

|

|

397 |

|

|

516 |

Total operating expenses |

|

|

23,798 |

|

|

24,839 |

|

|

|

|

|

|

|

Loss from operations |

|

|

(6,597) |

|

|

(9,327) |

|

|

|

|

|

|

|

Interest and other income |

|

|

652 |

|

|

565 |

Interest expense |

|

|

(4,152) |

|

|

(3,735) |

Accretion expense |

|

|

(1,072) |

|

|

(978) |

Loss on debt extinguishment (Refer to Note 4) |

|

|

(114) |

|

|

(1,288) |

Gains/(losses) from changes in fair value of financial instruments |

|

|

7 |

|

|

(33) |

Loss before income taxes |

|

|

(11,276) |

|

|

(14,796) |

|

|

|

|

|

|

|

Income tax expense |

|

|

2,722 |

|

|

3,799 |

Net loss |

|

$ |

(13,998) |

|

$ |

(18,595) |

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

|

$ |

(0.00) |

|

$ |

(0.00) |

Weighted average number of common shares outstanding - basic and diluted |

|

|

6,573,595 |

|

|

6,419,395 |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

iANTHUS CAPITAL HOLDINGS, INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ (DEFICIT)

(In thousands of U.S. dollars or shares)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

|

|

Number of

Common Shares ('000) |

|

Additional Paid-in-Capital |

|

Accumulated Deficit |

|

Total Shareholders’ (Deficit) |

Balance – January 1, 2024 |

|

|

6,510,527 |

|

$ |

1,265,978 |

|

$ |

(1,327,644) |

|

$ |

(61,666) |

Share-based compensation |

|

|

25,461 |

|

|

434 |

|

|

— |

|

|

434 |

Shares settlement for taxes paid related to restricted stock units |

|

|

(2,300) |

|

|

(46) |

|

|

— |

|

|

(46) |

Shares issued for legal settlement - (Refer to Note 10) |

|

|

20,000 |

|

|

320 |

|

|

— |

|

|

320 |

Shares issued for 2024 NJ Amendment |

|

|

61,314 |

|

|

1,581 |

|

|

— |

|

|

1,581 |

Net loss |

|

|

— |

|

|

— |

|

|

(13,998) |

|

|

(13,998) |

Balance – March 31, 2024 |

|

|

6,615,002 |

|

$ |

1,268,267 |

|

$ |

(1,341,642) |

|

$ |

(73,375) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2023 |

|

|

Number of

Common Shares ('000) |

|

Additional Paid-in-Capital |

|

Accumulated Deficit |

|

Total Shareholders’ Equity (Deficit) |

Balance – January 1, 2023 |

|

|

6,403,289 |

|

$ |

1,262,012 |

|

$ |

(1,251,023) |

|

$ |

10,989 |

Share-based compensation |

|

|

43,558 |

|

|

1,489 |

|

|

— |

|

|

1,489 |

Share settlement for taxes paid related to restricted stock units |

|

|

(7,776) |

|

|

(201) |

|

|

— |

|

|

(201) |

Net loss |

|

|

— |

|

|

— |

|

|

(18,595) |

|

|

(18,595) |

Balance – March 31, 2023 |

|

|

6,439,071 |

|

$ |

1,263,300 |

|

$ |

(1,269,618) |

|

$ |

(6,318) |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

iANTHUS CAPITAL HOLDINGS, INC.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of U.S. dollars)

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

CASH FLOW FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

Net loss |

|

$ |

(13,998) |

|

$ |

(18,595) |

Adjustments to reconcile net loss to net cash provided by (used in) operations: |

|

|

|

|

|

|

Interest income |

|

|

(1) |

|

|

(4) |

Interest expense |

|

|

4,152 |

|

|

3,735 |

Accretion expense |

|

|

1,072 |

|

|

978 |

Depreciation and amortization |

|

|

6,371 |

|

|

6,991 |

Write-downs and other charges, net |

|

|

397 |

|

|

516 |

Inventory reserve |

|

|

(24) |

|

|

249 |

Share-based compensation |

|

|

434 |

|

|

1,489 |

(Gains)/losses from changes in fair value of financial instruments |

|

|

(7) |

|

|

33 |

Loss on debt extinguishment (Refer to Note 4) |

|

|

114 |

|

|

1,288 |

Loss on equity method investments |

|

|

62 |

|

|

— |

Change in operating assets and liabilities (Refer to Note 12) |

|

|

2,935 |

|

|

2,533 |

NET CASH FLOW PROVIDED BY (USED IN) OPERATING ACTIVITIES |

|

$ |

1,507 |

|

$ |

(787) |

CASH FLOW FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(878) |

|

|

(1,002) |

Acquisition of other intangible assets |

|

|

(16) |

|

|

(5) |

Cash impact of deconsolidation of subsidiaries |

|

|

— |

|

|

(30) |

NET CASH USED IN INVESTING ACTIVITIES |

|

$ |

(894) |

|

$ |

(1,037) |

CASH FLOW FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

Repayment of debt |

|

|

(14) |

|

|

(13) |

Taxes paid related to net share settlement of restricted stock units |

|

|

(46) |

|

|

(201) |

NET CASH USED IN FINANCING ACTIVITIES |

|

$ |

(60) |

|

$ |

(214) |

CASH AND RESTRICTED CASH |

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND RESTRICTED CASH DURING THE PERIOD |

|

|

553 |

|

|

(2,038) |

CASH AND RESTRICTED CASH, BEGINNING OF PERIOD (Refer to Note 12) |

|

|

13,175 |

|

|

14,406 |

CASH AND RESTRICTED CASH, END OF PERIOD (Refer to Note 12) |

|

$ |

13,728 |

|

$ |

12,368 |

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

Note 1 – Organization and Description of Business

(a) Description of Business

iAnthus Capital Holdings, Inc. (“ICH”), together with its consolidated subsidiaries (the “Company”) was incorporated under the laws of British Columbia, Canada, on November 15, 2013. The Company is a vertically-integrated multi-state owner and operator of licensed cannabis cultivation, processing and dispensary facilities in the United States. Through the Company’s subsidiaries, licenses, interests and contractual arrangements, the Company has the capacity to operate dispensaries and cultivation/processing facilities, and manufacture and distribute cannabis across the states in which the Company operates in the U.S.

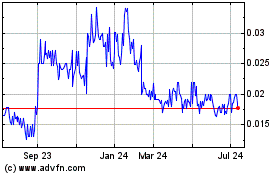

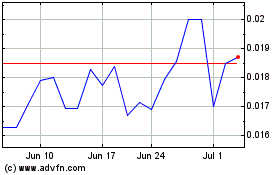

The Company’s registered office is located at 1055 West Georgia Street, Suite 1500, Vancouver, British Columbia, V6E 4N7, Canada. The Company is listed on the Canadian Securities Exchange (the “CSE”) under the ticker symbol “IAN” and on the OTCQB Tier of the OTC Markets Group Inc. under the symbol “ITHUF.”

The Company’s business activities, and the business activities of its subsidiaries, which operate in jurisdictions where the use of marijuana has been legalized under state and local laws, currently are illegal under U.S. federal law. The U.S. Controlled Substances Act classifies marijuana as a Schedule I controlled substance. Any proceeding that may be brought against the Company could have a material adverse effect on the Company’s business plans, financial condition and results of operations.

(b) Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements (the “financial statements”) have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements and, therefore, certain information, footnotes and disclosures normally included in the annual financial statements, prepared in accordance with U.S. GAAP, have been condensed or omitted in accordance with SEC rules and regulations.

The financial data presented herein should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year ended December 31, 2023, included in the Company’s Annual Report on the Form 10-K filed with the SEC on March 28, 2024. In the opinion of management, the financial data presented includes all adjustments necessary to present fairly the financial position, results of operations and cash flows for the periods presented. These unaudited interim condensed consolidated financial statements include estimates and assumptions of management that affect the amounts reported on the unaudited interim condensed consolidated financial statements. Actual results could differ from these estimates.

The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the entire year ending December 31, 2024, or any other period.

Except as otherwise stated, these unaudited interim condensed consolidated financial statements are presented in U.S. dollars.

(c) Consummation of Recapitalization Transaction

On June 24, 2022 (the “Closing Date”), the Company completed its previously announced recapitalization transaction (the “Recapitalization Transaction”) pursuant to the terms of the Restructuring Support Agreement (the “Restructuring Support Agreement”) dated July 10, 2020, as amended on June 15, 2021, by and among the Company, all of the holders (the “Secured Lenders”) of the 13.0% senior secured convertible debentures (the “Secured Notes”) issued by iAnthus Capital Management, LLC (“ICM”), a wholly-owned subsidiary of the Company, and a majority of the holders (the “Consenting Unsecured Lenders”) of the Company’s 8.0% unsecured convertible debentures (the “Unsecured Debentures”).

In connection with the closing of the Recapitalization Transaction, the Company issued an aggregate of 6,072,580 common shares to the Secured Lenders and the Unsecured Lenders. Specifically, the Company issued 3,036,290 common shares (the “Secured Lender Shares”), or 48.625% of the outstanding common shares of the Company, to the Secured Lenders and 3,036,290 common shares (the “Unsecured Lender Shares” and together with Secured Lender Shares, the “Shares”), or 48.625% of the outstanding common shares of the Company, to the Unsecured Lenders. As of the Closing Date, there were 6,244,298 common shares of the Company issued and outstanding. As of the Closing Date, the then existing holders of the Company’s common shares collectively held 171,718 common shares, or 2.75% of the outstanding common shares of the Company.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

As of the Closing Date, the outstanding principal amount of the Secured Notes (including the interim financing secured notes in the aggregate principal amount of approximately $14.7 million originally due on July 13, 2025) together with interest accrued and fees thereon were forgiven in part and exchanged for (A) the Secured Lender Shares, (B) the issuance of the 8.0% secured debentures (the "June Secured Debentures") by ICM to the New Secured Lenders (as defined below) in the aggregate principal amount of $99.7 million and (C) the issuance of the 8.0% unsecured debentures (the “June Unsecured Debentures”) by ICM to the Secured Lenders in the aggregate principal amount of $5.0 million. Also, as of the Closing Date, the outstanding principal amount of the Unsecured Debentures together with interest accrued and fees thereon were forgiven in part and exchanged for (A) the Unsecured Lender Shares and (B) the June Unsecured Debentures in the aggregate principal amount of $15.0 million. Furthermore, all existing options and warrants to purchase common shares of the Company, including certain debenture warrants and exchange warrants previously issued to the Secured Lenders, the warrants previously issued in connection with the Unsecured Debentures and all other Affected Equity (as defined in the amended and restated plan of arrangement (the "Plan of Arrangement"), were cancelled and extinguished for no consideration.

(d) Going Concern

These unaudited interim condensed consolidated financial statements have been prepared under the assumption that the Company will be able to continue its operations and will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. For the three months ended March 31, 2024, the Company reported a net loss of $14.0 million, operating cash inflow of $1.5 million, a working capital deficiency of $79.5 million, and an accumulated deficit of $1,341.6 million as of March 31, 2024.

The Company believes it may continue to generate positive cash flows from operations in the near future, notwithstanding the foregoing, the substantial losses and working capital deficiency cast substantial doubt on the Company’s ability to continue as a going concern for a period of no less than 12 months from the date of this report. These unaudited interim condensed consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

(e) Basis of Consolidation

The unaudited interim condensed consolidated financial statements include the accounts of ICH together with its consolidated subsidiaries, except for subsidiaries which ICH has identified as variable interest entities where ICH is not the primary beneficiary.

(f) Use of Estimates

The preparation of the unaudited interim condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and judgments that affect the application of accounting policies and the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of unaudited interim condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Estimates and assumptions are continuously evaluated and are based on management’s experience and other factors, including expectations regarding future events that are believed to be reasonable under the circumstances. Actual results may differ significantly from these estimates.

Significant estimates made by management include, but are not limited to: economic lives of leased assets; inputs used in the valuation of inventory; allowances for potential uncollectability of accounts receivable, provisions for inventory obsolescence; impairment assessment of long-lived assets; depreciable lives of property, plant and equipment; useful lives of intangible assets; accruals for contingencies including tax contingencies; valuation allowances for deferred income tax assets; estimates of fair value of identifiable assets and liabilities acquired in business combinations; estimates of fair value of derivative instruments; and estimates of the fair value of stock-based payment awards.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

(g) Recently Issued FASB Accounting Standard Updates

In November 2023, the FASB issued ASU 2023-07 Segment Reporting (Topic 280). All public entities will be required to report segment information in accordance with the new guidance starting in annual periods beginning after December 15, 2023. The amendments improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The Company is in the process of determining the effects adoption will have on its condensed consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09 Income Taxes (Topic 740). For public business entities, the amendments are effective for annual periods beginning after December 15, 2024. The amendments address investor requests for more transparency about income tax information through improvements to income tax disclosures primarily related to the rate reconciliation and income taxes paid information. This amendment also looks to improve the effectiveness of income tax disclosures. The Company is in the process of determining the effects adoption will have on its condensed consolidated financial statements.

The Company does not believe any other recently issued, but not yet effective, accounting standards will have a material effect on our condensed consolidated financial statements.

Note 2 – Leases

The Company mainly leases office space and cannabis cultivation, processing and retail dispensary space. Leases with an initial term of less than 12 months are not recorded on the unaudited interim condensed consolidated balance sheets. The Company recognizes operating lease right-of-use assets and operating lease liabilities based on the present value of future minimum lease payments over the lease term at commencement date and lease expense for these leases on a straight-line basis over the lease term. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to five years or more. The Company has determined that it was reasonably certain that the renewal options on the majority of its cannabis cultivation, processing and retail dispensary space would be exercised based on operating history and knowledge, current understanding of future business needs and the level of investment in leasehold improvements, among other considerations. The incremental borrowing rate used in the calculation of the lease liability is based on the rate available to the parent company. The depreciable life of assets and leasehold improvements are limited by the expected lease term. The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants. Certain subsidiaries of the Company rent or sublease certain office space to/from other subsidiaries of the Company. These intercompany subleases are eliminated on consolidation and have lease terms ranging from less than one year to 15 years.

Maturities of lease liabilities for operating leases as of March 31, 2024, were as follows:

|

|

|

|

|

|

|

|

|

|

Operating Leases |

2025 |

|

|

|

$ |

7,585 |

2026 |

|

|

|

|

7,800 |

2027 |

|

|

|

|

7,694 |

2028 |

|

|

|

|

7,272 |

2029 |

|

|

|

|

7,186 |

Thereafter |

|

|

|

|

47,171 |

Total lease payments |

|

|

|

$ |

84,708 |

Less: interest expense |

|

|

|

|

(50,122) |

Present value of lease liabilities |

|

|

|

$ |

34,586 |

Weighted-average remaining lease term (years) |

|

|

|

|

10.7 |

Weighted-average discount rate |

|

|

|

|

19% |

For the three months ended March 31, 2024, the Company recorded operating lease expenses of $2.2 million (March 31, 2023 – $1.9 million), which are included in costs and expenses applicable to revenues and selling, general and administrative expenses on the unaudited interim condensed consolidated statements of operations.

The Company has entered into multiple sublease agreements pursuant to which it serves as lessor to the sublessees. The gross rental income and underlying lease expense are presented gross on the Company’s unaudited interim condensed consolidated statements of operations. For the three months ended March 31, 2024, the Company recorded sublease income of $0.2 million (March 31, 2023 – $0.2 million), which is included in interest and other income on the unaudited interim condensed consolidated statements of operations.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

Operating cash flows from operating leases for the three months ended March 31, 2024 was $1.9 million (March 31, 2023 - $2.0 million).

Supplemental balance sheet information related to leases are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Information |

|

Classification |

|

March 31, 2024 |

|

December 31, 2023 |

Operating lease right-of-use assets, net |

|

Operating leases |

|

$ |

25,230 |

|

$ |

27,377 |

Lease liabilities |

|

|

|

|

|

|

|

|

Current portion of operating lease liabilities |

|

Operating leases |

|

$ |

7,585 |

|

$ |

7,716 |

Long-term portion of operating lease liabilities |

|

Operating leases |

|

|

27,001 |

|

|

28,009 |

Total |

|

|

|

$ |

34,586 |

|

$ |

35,725 |

Note 3 - Inventories, net

Inventories are comprised of the following items:

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

2024 |

|

2023 |

Supplies |

|

$ |

5,317 |

|

$ |

5,331 |

Raw materials |

|

|

7,637 |

|

|

7,110 |

Work in process |

|

|

5,720 |

|

|

6,351 |

Finished goods |

|

|

6,089 |

|

|

6,614 |

Inventory reserve |

|

|

— |

|

|

(24) |

Total |

|

$ |

24,763 |

|

$ |

25,382 |

Inventories are written down for any obsolescence or when the net realizable value considering future events and conditions is less than the carrying value. For the three months ended March 31, 2024, the Company recorded $Nil (March 31, 2023 – $0.9 million), related to spoiled inventory in costs and expenses applicable to revenues on the unaudited interim condensed consolidated statements of operations.

Note 4 - Long-Term Debt

The following table summarizes long term debt outstanding as of March 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured Notes |

|

June Secured Debentures |

|

Additional Secured Debentures |

|

June Unsecured Debentures |

|

Other |

|

Total |

As of January 1, 2024 |

|

$ |

15,565 |

|

$ |

101,856 |

|

$ |

28,247 |

|

$ |

18,856 |

|

$ |

752 |

|

$ |

165,276 |

Fair value of financial

liabilities issued |

|

|

14,346 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

14,346 |

Paid-in-kind interest |

|

|

239 |

|

|

2,279 |

|

|

571 |

|

|

457 |

|

|

— |

|

|

3,546 |

Accretion of balance |

|

|

94 |

|

|

735 |

|

|

— |

|

|

243 |

|

|

— |

|

|

1,072 |

Debt extinguishment |

|

|

(15,813) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(15,813) |

Repayment |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(14) |

|

|

(14) |

As of March 31, 2024 |

|

$ |

14,431 |

|

$ |

104,870 |

|

$ |

28,818 |

|

$ |

19,556 |

|

$ |

738 |

|

$ |

168,413 |

As of March 31, 2024, the total and unamortized debt discount costs were $21.9 million and $15.0 million, respectively (December 31, 2023— $20.4 million and $14.6 million, respectively).

As of March 31, 2024, the total interest accrued on both current and long-term debt was $0.3 million (December 31, 2023 - $Nil).

iAnthus New Jersey, LLC Senior Secured Bridge Notes

On February 2, 2021, INJ issued an aggregate of $11.0 million of Senior Secured Bridge Notes which initially matured on the earlier of (i) February 2, 2023, (ii) the date on which the Company closes a Qualified Financing (as defined below) and (iii) such earlier

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

date that the principal amount may become due and payable pursuant to the terms of such notes. The Senior Secured Bridge Notes initially accrued interest at a rate of 14.0% per annum, decreasing to 8.0% upon the closing of the Recapitalization Transaction (increasing to 25.0% per annum in the event of default). “Qualified Financing” means a transaction or series of related transactions resulting in net proceeds to the ICH of not less than $10 million from the subscription of the ICH's securities, including, but not limited to, a private placement or rights offering.

On February 2, 2023, ICH and INJ entered into an amendment (the “Amendment”) to the Senior Secured Bridge Notes with all of the holders of the Senior Secured Bridge Notes. Pursuant to the Amendment, the maturity date of the Senior Secured Bridge Notes was extended until February 2, 2024, the interest on the principal amount outstanding was increased to a rate of 12.0% per annum, and an amendment fee equal to 10.0% of the principal amount outstanding of the Senior Secured Bridge Notes as of February 2, 2023 or $1.4 million in the aggregate, was added to such notes such that it will become due and payable on the extended maturity date.

On February 2, 2024, in order to facilitate the 2024 New Jersey Amendment, the parties agreed to a short-term extension of the maturity date from February 2, 2024 to February 16, 2024. On February 16, 2024, ICH and INJ entered into another amendment (the "2024 NJ Amendment") to the Senior Secured Bridge Notes. Pursuant to the 2024 NJ Amendment, the maturity date of the Senior Secured Bridge Notes was extended from February 16, 2024 to February 16, 2026 and the interest rate of the Senior Secured Bridge Notes remained at 12% per annum, but the interest accruing after February 16, 2024 will be payable in quarterly cash payments (the first interest payment being on May 16, 2024). In addition, the 2024 NJ Amendment provides for an amendment fee equal to 10% of the principal amount of the Senior Secured Bridge Notes as of the date of the 2024 NJ Amendment, or $1.6 million in the aggregate, which is satisfied through the issuance of ICH's common shares at a price per share equal to the volume-weighted average trading price of ICH's common shares on the CSE for the twenty (20) consecutive trading days immediately prior to the date of the 2024 NJ Amendment. Lastly, ICH and INJ agreed to utilize twenty-five percent (25%) of Non-Operational Receipts in excess of $5.0 million to make payments towards the principal amount outstanding under the Senior Secured Bridge Notes, without penalty. For purposes of the 2024 NJ Amendment, "Non-Operational Cash Receipts" means cash ICH received which is not derived from the sale of cannabis products in the ordinary course of business of ICH, whether through retail, wholesale or otherwise.

In accordance with debt extinguishment accounting guidance outlined in ASC 470, the terms of the Senior Secured Bridge Notes were materially modified pursuant to both the Amendment and 2024 NJ Amendment and as such, for the three months ended March 31, 2024 and 2023 the Company recorded a loss on debt extinguishment of $0.1 million and $1.3 million, respectively, on the unaudited interim condensed consolidated statements of operations.

The amended host debt, classified as a liability using the guidance of ASC 470, was recognized at the fair value of $14.3 million.

For the three months ended March 31, 2024, interest expense of $0.5 million (March 31, 2023 - $0.4 million), and accretion expense of $0.1 million (March 31, 2023 - less than $0.1 million), were recorded on the unaudited interim condensed consolidated statements of operations.

The Senior Secured Bridge Notes are secured by a security interest in certain assets of INJ. ICH provided a guarantee in respect of all of the obligations of INJ under the Senior Secured Bridge Notes, and the Company is in compliance with the terms of the Senior Secured Bridge Notes as of March 31, 2024. The Senior Secured Bridge Notes are classified as long-term debt, net of issuance costs on the unaudited interim condensed consolidated balance sheets.

Certain of the Secured Lenders, including Gotham Green Fund II, L.P., Gotham Green Fund II (Q), L.P., Oasis Investments II Master Fund LTD., Senvest Global (KY), LP, Senvest Master Fund, LP and Hadron Healthcare and Consumer Special Opportunities Master Fund, held greater than 5.0% of the outstanding common shares of the Company upon closing of the Recapitalization Transaction. As principal owners of the Company, these lenders are considered to be related parties.

(a) June Secured Debentures

On June 24, 2022 in connection with the closing of the Recapitalization Transaction, the Company entered into the Secured Debenture Purchase Agreement (the "Secured DPA"), between ICM, the other Credit Parties (as defined in the Secured DPA), the Collateral Agent, and the lenders party thereto (the “New Secured Lenders”) pursuant to which ICM issued the June Secured Debentures in the aggregate principal amount of $99.7 million which accrue interest at the rate of 8.0% per annum increasing to 11.0% per annum upon the occurrence of an Event of Default (as defined in the Secured DPA), with a maturity date of June 24, 2027. The June Secured Debentures may be prepaid on a pro rata basis from and after the third anniversary of the Closing Date of the Recapitalization Transaction upon prior written notice to the New Secured Lenders without premium or penalty.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

The host debt, classified as a liability using the guidance of ASC 470, was recognized at the fair value of $84.5 million.

Interest is to be paid in kind by adding the interest accrued on the principal amount on the last day of each fiscal quarter (the first such interest payment date being June 30, 2022) and such amount thereafter becoming part of the principal amount, which will accrue additional interest. Interest paid in kind will be payable on the date when all of the principal amount is due and payable.

For the three months ended March 31, 2024, interest expense of $2.3 million (March 31, 2023 - $2.1 million), and accretion expense of $0.7 million (March 31, 2023 - $0.7 million), were recorded on the unaudited interim condensed consolidated statements of operations.

The terms of the Secured DPA impose certain restrictions on the Company’s operating and financing activities, including certain restrictions on the Company’s ability to: incur certain additional indebtedness; grant liens; make certain dividends and other payment restrictions affecting the Company’s subsidiaries; issue shares or convertible securities; and sell certain assets. The June Secured Debentures are secured by all current and future assets of the Company and ICM. The terms of the Secured DPAs do not have any financial covenants or market value test and ICM is in compliance with the terms of the June Secured Debentures as of March 31, 2024. The June Secured Debentures are classified as long-term debt, net of issuance costs on the unaudited interim condensed consolidated balance sheets.

Certain of the New Secured Lenders that hold the June Secured Debentures, including Gotham Green Fund 1, L.P., Gotham Green Fund 1 (Q), L.P., Gotham Green Fund II, L.P., Gotham Green Fund II (Q), Gotham Green Credit Partners SPV 1, L.P., Gotham Green Partners SPV V, L.P., L.P., and Parallax Master Fund, LP, held greater than 5.0% of the outstanding common shares of the Company upon the closing of the Recapitalization Transaction. As principal owners of the Company, certain of the New Secured Lenders are considered to be related parties.

(b) June Unsecured Debentures

On June 24, 2022 in connection with the closing of the Recapitalization Transaction, the Company entered into the Unsecured Debenture Purchase Agreement (the "Unsecured DPA"), pursuant to which ICM issued June Unsecured Debentures in the aggregate principal amount of $20.0 million which accrue interest at the rate of 8.0% per annum increasing to 11.0% per annum upon the occurrence of an Event of Default (as defined in the Unsecured DPA), with a maturity date of June 24, 2027. The June Unsecured Debentures may be prepaid on a pro rata basis from and after the third anniversary of the Closing Date of the Recapitalization Transaction upon prior written notice to the Unsecured Lender without premium or penalty.

The host debt, classified as a liability using the guidance of ASC 470, was recognized at the fair value of $14.9 million.

Interest is to be paid in kind by adding the interest accrued on the principal amount on the last day of each fiscal quarter (the first such interest payment date being June 30, 2022) and such amount thereafter becoming part of the principal amount, which will accrue additional interest. Interest paid in kind will be payable on the date when all of the principal amount is due and payable.

For the three months ended March 31, 2024, interest expense of $0.5 million (March 31, 2023 - $0.4 million), and accretion expense of $0.2 million (March 31, 2023 - $0.2 million), were recorded on the unaudited interim condensed consolidated statements of operations.

The terms of the Unsecured DPA impose certain restrictions on the Company’s operating and financing activities, including certain restrictions on the Company’s ability to: incur certain additional indebtedness; grant liens; make certain dividends and other payment restrictions affecting the Company’s subsidiaries; issue shares or convertible securities; and sell certain assets. The terms of the Unsecured DPA do not have any financial covenants or market value test, and ICM is in compliance with the terms of the June Unsecured Debentures as of March 31, 2024. The June Unsecured Debentures are classified as long-term debt, net of issuance costs on the unaudited interim condensed consolidated balance sheets.

Certain of the Secured Lenders and Consenting Unsecured Lenders, including Gotham Green Fund 1, L.P., Gotham Green Fund 1 (Q), L.P., Gotham Green Fund II, L.P., Gotham Green Fund II (Q), L.P., Gotham Green Credit Partners SPV 1, L.P., Gotham Green Partners SPV V, L.P., Oasis Investments II Master Fund LTD., Senvest Global (KY), LP, Senvest Master Fund, LP, Parallax Master Fund, L.P. and Hadron Healthcare and Consumer Special Opportunities Master Fund, held greater than 5.0% of the outstanding common shares of the Company upon the closing of the Recapitalization Transaction. As principal owners of the Company, certain of the Consenting Unsecured Lenders are considered to be related parties.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

(c) Additional Secured Debentures

Pursuant to the terms of the Secured DPA, ICM issued an additional $25.0 million of June Secured Debentures (the "Additional Secured Debentures") on June 24, 2022 which accrue interest at the rate of 8.0% per annum increasing to 11.0% per annum upon the occurrence of an Event of Default (as defined in the Secured DPA), with a maturity date of June 24, 2027.

The host debt, classified as a liability using the guidance of ASC 470, was recognized at the fair value of $25.0 million.

Interest is to be paid in kind by adding the interest accrued on the principal amount on the last day of each fiscal quarter (the first such interest payment date being June 30, 2022) and such amount thereafter becoming part of the principal amount, which will accrue additional interest. Interest paid in kind will be payable on the date when all of the principal amount is due and payable.

For the three months ended March 31, 2024, interest expense of $0.6 million (March 31, 2023— $0.5 million), was recorded on the unaudited interim condensed consolidated statements of operations.

The terms of the Secured DPA impose certain restrictions on the Company’s operating and financing activities, including certain restrictions on the Company’s ability to: incur certain additional indebtedness; grant liens; make certain dividends and other payment restrictions affecting the Company’s subsidiaries; issue shares or convertible securities; and sell certain assets. The Additional Secured Debentures are secured by all current and future assets of the Company and ICM. The terms of the Secured DPAs do not have any financial covenants or market value test, and ICM is in compliance with the terms of the Additional Secured Debentures as of March 31, 2024. The Additional Secured Debentures are classified as long-term debt, net of issuance costs on the unaudited interim condensed consolidated balance sheets.

Certain of the New Secured Lenders that hold Additional Secured Debentures, including Gotham Green Fund 1, L.P., Gotham Green Fund 1 (Q), L.P., Gotham Green Fund II, L.P., Gotham Green Fund II (Q), L.P., Oasis Investments II Master Fund LTD., Senvest Global (KY), LP, Senvest Master Fund, LP and Hadron Healthcare and Consumer Special Opportunities Master Fund, held greater than 5.0% of the outstanding common shares of the Company upon the closing of the Recapitalization Transaction. As principal owners of the Company, certain of the New Secured Lenders are considered to be related parties.

Note 5 - Share Capital

Authorized: Unlimited common shares. The shares have no par value.

The Company’s common shares are voting and dividend-paying. The following is a summary of the common share issuances for the three months ended March 31, 2024:

•On January 2, 2024, the Company issued common shares totaling 20,000 for the Hi-Med Settlement Agreement (Refer to Note 10).

•On January 5, 2024, the Company issued 23,461 common shares for vested restricted stock units (“RSUs”). The Company withheld 2,300 common shares to satisfy employees’ tax obligations of less than $0.1 million.

•On February 2, 2024, the Company issued common shares totaling 2,000 for vested RSUs.

•On February 27, 2024, the Company issued 61,314 common shares to the holders of the Senior Secured Bridge Notes to satisfy the amendment fee pertaining to the 2024 NJ Amendment.

The following is a summary of the common share issuances for the three months ended March 31, 2023:

•On January 3, 2023, the Company issued common shares totaling 15,628 for vested RSUs, out of which the Company withheld 7,776 shares to satisfy employees’ tax obligations with respect thereto of $0.2 million.

•On March 3, 2023, the Company issued common shares totaling 27,930 for vested RSUs.

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

(b)Potentially Dilutive Securities

The following table summarizes potentially dilutive securities, and the resulting common share equivalents outstanding as of March 31, 2024 and December 31, 2023:

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

Common share options |

|

7,877 |

|

7,877 |

Restricted stock units |

|

287,646 |

|

325,643 |

Total |

|

295,523 |

|

333,520 |

(c)Equity Incentive Plans

On December 31, 2021, the Board approved the Company’s Amended and Restated Omnibus Incentive Plan (the “Omnibus Incentive Plan”) dated October 15, 2018, whereas, the Company may award stock options or RSUs (the "Awards") to board members, officers, employees or consultants of the Company. The Omnibus Incentive Plan authorizes the issuance of up to 20% of the number of outstanding shares of common stock of the Company,

Awards generally vest over a three year period and the estimated fair value of the Awards at issuance is recognized as compensation expense over the related vesting period.

Stock Options

The Company's stock options are currently held by two former officers of the Company which have fully vested on July 10, 2023. Share-based compensation expense related to stock options for the three months ended March 31, 2024 was $Nil (March 31, 2023 - less than $0.1 million), and is presented in selling, general and administrative expenses on the unaudited interim condensed consolidated statements of operations.

The following table summarizes certain information in respect of option activity during the period:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

Three Months Ended March 31, 2024 |

|

|

Year Ended December 31, 2023 |

|

|

Units |

|

|

Weighted Average

Exercise Price |

|

Weighted Average Contractual Life |

|

|

Units |

|

|

Weighted Average

Exercise Price |

|

Weighted Average Contractual Life |

Options outstanding, beginning |

|

7,877 |

|

$ |

0.05 |

|

7.78 |

|

|

7,877 |

|

$ |

0.05 |

|

7.78 |

Granted |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

Cancellations |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

Forfeitures |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

Expirations |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

Options outstanding, ending (1) |

|

7,877 |

|

$ |

0.05 |

|

6.78 |

|

|

7,877 |

|

$ |

0.05 |

|

6.78 |

(1)As of March 31, 2024, 7,877 of the stock options outstanding were exercisable (December 31, 2023 - 7,877).

iANTHUS CAPITAL HOLDINGS, INC.

NOTES TO UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Tabular U.S. dollar amounts and shares in thousands, unless otherwise stated)

The Company used the Black-Scholes option pricing model to estimate the fair value of the options at the grant date using the following assumptions:

The expected volatility was estimated by using the historical volatility of the Company. The expected life in years represents the period of time that options granted are expected to be outstanding. In accordance with SAB Topic 14, the Company uses the simplified method for estimating the expected term. The Company believes the use of the simplified method is appropriate due to the employee stock options qualifying as “plain-vanilla” options under the criteria established by SAB Topic 14. The risk-free rate was based on the United States bond yield rate at the time of grant of the award. Expected annual rate of dividends is based on the fact that the Company has never paid cash dividends and does not expect to pay any cash dividends in the foreseeable future.

There was no stock option activity for the three months ended March 31, 2024 and the year ended December 31, 2023.

Restricted Stock Units

On December 31, 2021, the Board approved a long-term incentive program, pursuant to which, on July 26, 2022, the Company issued certain employees of the Company and its subsidiaries, RSUs, under the Omnibus Incentive Plan. RSUs represent a right to receive a single common share that is both non-transferable and forfeitable until certain conditions are satisfied.

On December 31, 2021 and June 23, 2022, the Board approved the allocation of 363,921 and 26,881 RSUs, respectively, to Board members, directors, officers, and key employees of the Company. The RSUs granted by the Company vest upon the satisfaction of both a service-based condition of three years and a liquidity condition, the latter of which was not satisfied until the closing of the Recapitalization Transaction. As the liquidity condition was not satisfied until the closing of the Recapitalization Transaction, in prior periods, the Company had not recorded any expense related to the grant of RSUs. Share-based compensation expense in relation to the RSUs is recognized using the graded vesting method, in which compensation costs for each vesting tranche is recognized ratably from the service inception date to the vesting date for that tranche. The fair value of the RSUs is determined using the Company’s closing stock price on the grant date.

Certain RSU recipients were also holders of the Original Awards, which were cancelled upon closing the Recapitalization Transaction. The RSUs granted to these employees have been treated as replacement awards (the “Replacement RSUs”) and are accounted for as a modification to the Original Awards. As the fair value of the Original Awards was $Nil on the modification dates, the incremental compensation cost recognized is equal to the fair value of the Replacement RSUs on the modification date, which shall be recognized over the remaining requisite service period.

On May 17, 2023, the Board awarded 25,977 RSUs to employees and one Board member. Of the RSUs awarded, 5,587 were fully vested on issuance and 20,391 shall vest over a period of one to three years. The fair value of RSUs is determined on the grant date and is amortized over the vesting period on a straight-line basis.

On June 27, 2023, the Board awarded 12,950 RSUs to an employee. The RSUs shall vest over a period of three years. The fair value of RSUs is determined on the grant date and is amortized over the vesting period on a straight-line basis.

On August 31, 2023, the Board awarded 207,194 RSUs to two officers. The RSUs shall vest over a period of three years. The fair value of RSUs is determined on the grant date and is amortized over the vesting period on a straight-line basis.

On October 20, 2023, the Board awarded 15,487 RSUs to Robert Galvin, a former officer of the Company, for compensation owed. The fair value of the RSUs was determined on the grant date and became fully vested as of January 4, 2024 per the October Separation Agreement.

On November 15, 2023, the Board awarded 42,604 RSUs to four Board members, and an officer. The RSUs shall vest over a period of one to three years. The fair value of the RSUs is determined on the grant date and is amortized over the vesting period on a straight-line basis.

There was no RSUs awarded during the three months ended March 31, 2024.