As filed with the Securities and Exchange Commission on March 15, 2012

Registration No.333-147368

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST EFFECTIVE AMENDMENT NO. 8

TO FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HINTO ENERGY, INC.

(FORMERLY KNOWN AS GARNER INVESTMENTS, INC.)

(Exact name of registrant as specified in its charter)

WYOMING 1381 84-1384961

------------------------------ ---------------------------- -------------------

(State or jurisdiction of (Primary Standard Industrial (I.R.S. Employer

incorporation or organization) Classification Code Number) Identification No.)

|

7609 RALSTON ROAD, ARVADA, COLORADO 80002/ PHONE (303)647-4850

(Address and telephone number of principal executive offices)

George Harris, Chief Financial Officer

7609 RALSTON ROAD, ARVADA, COLORADO 80002/ PHONE (303)647-4850

(Name, address and telephone number of agent for service)

COPIES OF ALL COMMUNICATIONS TO:

Michael A. Littman, Attorney at Law

7609 Ralston Road, Arvada, CO, 80002 phone 303-422-8127 / fax 303-431-1567

Approximate date of commencement of proposed sale to the public: As soon as

possible after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective

registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

If this Form is a post effective amendment filed pursuant to Rule 462(d) under

the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act.

--------------------------- ----------- -------------------------- ------------

Large accelerated filer [___] Accelerated filer [___]

--------------------------- ----------- -------------------------- ------------

--------------------------- ----------- -------------------------- ------------

Non-accelerated filer [___] Smaller reporting company [_X_]

(Do not check if a smaller

reporting company)

--------------------------- ----------- -------------------------- ------------

|

CALCULATION OF REGISTRATION FEE

---------------------------- ------------------ ------------------------- --------------------------- ----------------

TITLE OF EACH CLASS OF AMOUNT TO BE PROPOSED MAXIMUM PROPOSED MAXIMUM AMOUNT OF

SECURITIES TO BE REGISTERED REGISTERED OFFERING PRICE PER SHARE AGGREGATE OFFERING REGISTRATION

PRICE(1) FEE

---------------------------- ------------------ ------------------------- --------------------------- ----------------

Common Stock by Selling 1,030,000 $0.10 $103,000 $4.05(2)

Shareholders

---------------------------- ------------------ ------------------------- --------------------------- ----------------

|

(1) Estimated solely for the purpose of computing the registration fee

pursuant to Rule 457(o) under the Securities Act.

(2) A Registration Fee of $4.05 was paid in November 2007 for the original

registration of 1,030,000 shares of common stock by Selling

Shareholders.

The registrant hereby amends this registration statement on such date or dates

as may be necessary to delay its effective date until the registrant shall file

a further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

ii

EXPLANATORY NOTE

This Post-Effective Amendment No. 8 to the Registration Statement on Form S-1,

Registration No. 333-147368, is filed for the purposes of business disclosures

and including updated financial statements as a result of the Registrant's

acquisition of South Uintah Gas Properties, Inc.

iii

(SUBJECT TO COMPLETION)

PROSPECTUS

HINTO ENERGY, INC.

1,030,000 SHARES OF COMMON STOCK OF SELLING SHAREHOLDERS

We are registering 1,030,000 shares listed for sale on behalf of selling

shareholders.

THIS OFFERING INVOLVES A HIGH DEGREE OF RISK; SEE "RISK FACTORS" BEGINNING ON

PAGE 7 TO READ ABOUT FACTORS YOU SHOULD CONSIDER BEFORE BUYING SHARES OF THE

COMMON STOCK.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND

EXCHANGE COMMISSION (THE "SEC") OR ANY STATE OR PROVINCIAL SECURITIES

COMMISSION, NOR HAS THE SEC OR ANY STATE OR PROVINCIAL SECURITIES COMMISSION

PASSED UPON THE ACCURACY OR ADEQUACY OF THIS AMENDED PROSPECTUS. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

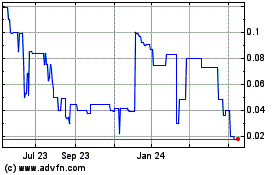

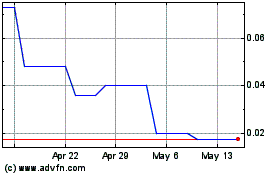

Our common stock is presently quoted on the OTC Bulletin Board under the symbol

"HENI" On March 13, 2012, the last reported bid price of our common stock on the

OTC Bulletin Board was $1.50 per share (rounded to the nearest penny). Our

common stock having been recently listed has a limited trading history. See

"DESCRIPTION OF COMMON STOCK--Common Stock." These prices will fluctuate based

on the demand for the shares of our common stock and other factors.

This offering will be on a delayed and continuous basis only for sales of

selling shareholders shares. The selling shareholders are not paying any of the

offering expenses and we will not receive any of the proceeds from the sale of

the shares by the selling shareholders (See "Description of Securities -

Shares").

The information in this amended prospectus is not complete and may be changed.

We may not sell these securities until the date that the registration statement

relating to these securities, which has been filed with the Securities and

Exchange Commission, becomes effective. This amended prospectus is not an offer

to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

The date of this Prospectus is March 15, 2012.

-1-

TABLE OF CONTENTS

============================================ ================================================================ =============

PART I - INFORMATION REQUIRED IN Page No.

PROSPECTUS

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 1. Front of Registration Statement and Outside Front Cover Page

of Prospectus

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 2. Prospectus Cover Page 1

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 3. Prospectus Summary Information, Risk Factors and Ratio of 3

Earnings to Fixed Charges

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 4. Use of Proceeds 12

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 5. Determination of Offering Price 12

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 6. Dilution 13

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 7. Selling Security Holders 13

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 8. Plan of Distribution 15

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 9. Description of Securities 15

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 10. Interest of Named Experts and Counsel 16

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 11. Information with Respect to the Registrant 16

a. Description of Business 16

b. Description of Property 25

c. Legal Proceedings 26

d. Market for Common Equity and Related Stockholder Matters 26

e. Financial Statements 27

f. Selected Financial Data 28

g. Supplementary Financial Information 28

h. Management's Discussion and Analysis of Financial Condition 28

and Results of Operations

i. Changes In and Disagreements With Accountants on Accounting 33

and Financial Disclosure

j. Quantitative and Qualitative Disclosures About Market Risk 33

k. Directors and Executive Officers 33

l. Executive and Directors Compensation 36

m. Security Ownership of Certain Beneficial Owners and 39

Management

n. Certain Relationships, Related Transactions, Promoters And 40

Control Persons

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 11 A. Material Changes 43

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 12. Incorporation of Certain Information by Reference 43

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 12 A. Disclosure of Commission Position on Indemnification for 44

Securities Act Liabilities

-------------------------------------------- ---------------------------------------------------------------- -------------

PART II - INFORMATION NOT REQUIRED IN

PROSPECTUS

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 13. Other Expenses of Issuance and Distribution 45

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 14. Indemnification of Directors and Officers 45

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 15. Recent Sales of Unregistered Securities 46

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 16. Exhibits and Financial Statement Schedules 47

-------------------------------------------- ---------------------------------------------------------------- -------------

ITEM 17. Undertakings 48

-------------------------------------------- ---------------------------------------------------------------- -------------

Signatures 49

-------------------------------------------- ---------------------------------------------------------------- -------------

|

-2-

ITEM 3. PROSPECTUS SUMMARY INFORMATION, RISK FACTORS AND RATIO OF EARNINGS TO

FIXED CHARGES

OUR COMPANY

Hinto Energy, Inc. ("We," "Us," "Our") was organized under the laws of the State

of Wyoming on February 13, 1997, as Garner Investments, Inc. On August 18, 2012,

we amended our Articles of Incorporation to change our name to Hinto Energy,

Inc. and to authorize 25,000,000 shares of preferred stock. We were organized to

engage in the acquisition, exploration, and if warranted, development of oil and

gas prospects in the rocky mountain region.

Prior to January 2012, we had minimal operations that were focused mainly on

administrative activities and the identification of potential oil and gas

prospects. On January 23, 2012, we acquired 100% of the issued and outstanding

common stock of South Uintah Gas Properties, Inc. ("South Uintah") pursuant to

the Share Purchase and Exchange Agreement ("the Share Exchange Agreement")

entered into on July 27, 2011, at the time South Uintah was our majority

shareholder, as discussed below.

On July 11, 2011, prior to entering into the Share Exchange Agreement, South

Uintah had purchased 3,000,000 shares of the Company from its then majority

shareholder Ms. Sharon Fowler. After such purchase, South Uintah held

approximately 70% of the issued and outstanding common stock of the Company.

Prior to closing of the acquisition of South Uintah, South Uintah transferred

300,000 shares to an unrelated third party as partial consideration for the

acquisition of the gas prospect in Utah. As part of the Share Exchange

Agreement, South Uintah has agreed to return the remaining 2,700,000 shares of

common stock to the Company. We have retired such shares to treasury, concurrent

with the transaction.

SHARE ACQUISITION AND EXCHANGE AGREEMENT

On July 27, 2011, we entered into a Share Exchange and Acquisition Agreement

with South Uintah and the South Uintah shareholders. On January 23, 2012, we

entered into an Amended Share Exchange and Acquisition Agreement ("the Amended

Share Exchange Agreement"). Pursuant to the Amended Share Exchange Agreement, we

agreed to issue shares of our restricted common stock for 100% of the issued and

outstanding common stock of South Uintah. The shares are to be exchanged on a

one for one basis. As a result, South Uintah became a wholly-owned subsidiary of

the Company.

In addition to the exchange of common stock, we have agreed to exchange on a one

for one basis the following outstanding equity documents with those of our own.

The table below sets forth the equity that is being exchanged.

Type of Equity South Uintah Balance To Be Issued By Hinto

-------------------------- ------------------------ -------------------------

Common Stock 11,446,931 shares 11,446,931 shares

Warrants (1) 6,700,000 6,700,000

Promissory Note (2) $375,000 $375,000

--------------------------

|

(1) The warrants have exercise prices ranging from $0.50 to $3.00 per share and

terms ranging from 2 to 5 years.

(2) The promissory note has a provision to convert into shares of common stock

at $0.20 per share.

At the time of the acquisition, George Harris, Gary Herick, Max Sommer and Kevin

Blair, officers and directors of Hinto, were and are officers, directors and

shareholders of South Uintah. Mr. David Keller, a director of Hinto, was also a

shareholder of South Uintah.

The effective date of the acquisition is December 31, 2011, with Hinto being the

legal acquirer. However, since Hinto is a public company, which had nominal

activity, the acquisition has been treated as a recapitalization of South

Uintah. Though Hinto was the legal acquirer in the merger, South Uintah was the

accounting acquirer since its shareholders gained control of Hinto. Therefore at

the date of the merger the historical financial statements of South Uintah

became those of Hinto. As a result, the historical financial statements of South

Uintah supersede any prior financial statements of Hinto.

-3-

CURRENT PRIVATE OFFERING EFFORTS

We have conducted a Private Offering of shares of our restricted Common Stock

for capital. We intend to raise up to $5,000,000 in the next twelve months with

a structure not yet determined in debt or equity. As of March 9, 2012, the

Company had sold approximately 830,000 shares, raising a total of $415,000. We

cannot give any assurances that we will be able to raise the full $5,000,000.

Further, we will need to raise additional funds to support not only our expected

budget, but our continued operations.

ADDITIONAL REGISTRATION STATEMENT

The Company does intend to file a Registration Statement on Form S-1 pursuant to

Rule 429 of the Securities Act of 1933 to register 4,758,080 shares of the

Company's common stock held by existing shareholders and 2,000,000 shares

underlying warrants exercisable for shares of the Company's common stock at

$0.50 per share. The Company expects to file such Registration Statement in the

next 30 days.

SOUTH UINTAH

South Uintah was incorporated in the State of Colorado in March 2011 and is

headquartered in Denver, Colorado. South Uintah has interests in oil and gas

properties. South Uintah has acquired interests in approximately 5,600 gross

acres in the Central part of the Uintah Basin, at Natural Buttes, Utah from a

farmout. The acreage is located in a prolific gas production area from multiple

hydrocarbon reservoirs such as: Castlegate, Mancos, Dakota, Buck Tongue, Emery,

Frontier and Prairie Canyon. The upper zones above 9,800 feet (approximately)

are precluded in the farmout and the overall targets will be zones from 9,800

feet to 16,000 feet.

Our Auditors have issued a going concern opinion and the reasons noted for

issuing the opinion are our lack of revenues and modest capital.

Factors that make this offering highly speculative or risky are:

o There is a limited market for any securities;

o We have no revenues or sales;

o We are a start up company; and

o We are undercapitalized.

Our executive offices are now located at 7609 Ralston Road, Arvada, Colorado

80002 and the telephone number is (303)647-4850.

SUMMARY OF FINANCIAL INFORMATION

The effective date of the South Uintah acquisition is December 31, 2011. Since

Hinto is a public company, which had nominal activity, the acquisition has been

treated as a recapitalization of South Uintah. Though Hinto was the legal

acquirer in the merger, South Uintah was the accounting acquirer since its

shareholders gained control of Hinto. Therefore at the date of the merger the

historical financial statements of South Uintah became those of Hinto. As a

result, the historical financial statements of South Uintah supersede any prior

financial statements of Hinto. Therefore, the Summary Financial Information

presented below is that of South Uintah at September 30, 2011.

------------------------------- ----------------------------------------------

As at September 30, 2011

------------------------------- ----------------------------------------------

Total Assets $581,455

------------------------------- ----------------------------------------------

Current Liabilities $1,123,974

------------------------------- ----------------------------------------------

Shareholders' Equity $ (542,519)

------------------------------- ----------------------------------------------

------------------------------- ----------------------------------------------

From March 8, 2011 through September 30, 2011

------------------------------- ----------------------------------------------

Revenues $0

------------------------------- ----------------------------------------------

Net Loss at September 30, 2011 $ (599,275)

------------------------------- ----------------------------------------------

|

As of September 30, 2011, the accumulated deficit for was $(599,275). We

anticipate that we will operate in a deficit position and continue to sustain

net losses for the foreseeable future.

-4-

THE OFFERING

We are registering 1,030,000 shares listed for sale on behalf of selling

shareholders.

We will NOT receive any proceeds from sales of shares by selling shareholders.

=================================================================== ===========

Common shares outstanding before this offering 13,925,931

------------------------------------------------------------------- -----------

Maximum common shares being offered by our existing

selling shareholders 1,030,000

=================================================================== ===========

|

We are authorized to issue 50,000,000 shares of common stock and 25,000,000

shares of preferred stock. Our current shareholders, officers and directors

collectively own 13,806,931 shares of restricted common stock. These shares were

issued at a price of $.01 per share for 1,580,000 shares, $0.001 for 11,446,931

shares and $0.50 for 780,000 shares.

The common stock is presently traded on the over-the-counter market on the OTC

Bulletin Board maintained by the Financial Industry Regulatory Authority (the

"FINRA"). The OTCBB symbol for the Common Stock is "HENI."

GLOSSARY

The following are definitions of terms used in this Memorandum:

BBL. An abbreviation for the term "barrel" which is a unit of

measurement of volume of oil or related petroleum products. One barrel (one bbl)

is the equivalent of 42 U.S. gallons or approximately 159 liters.

BONUS PAYMENT. Usually a one time payment made to a mineral owner as

consideration for the execution of an oil and gas lease.

CASING POINT. That point in time during the drilling of an oil well at

which a decision is made to install well casing and to attempt to complete the

well as an oil producer.

COMPLETION. The procedure used in finishing and equipping an oil or gas

well for production.

DELAY RENTAL. Payment made to the lessor under a nonproducing oil and

gas lease at the end of each year to continue the lease in force for another

year during its primary term.

DEVELOPMENT WELL. A well drilled to a known producing formation in a

previously discovered field, usually offsetting a producing well on the same or

an adjacent oil and gas lease.

EXPLORATORY WELL. A well drilled either (a) in search of a new and as

yet undiscovered pool of oil or gas or (b) with the hope of significantly

extending the limits of a pool already developed (also known as a "wildcat

well").

FARMIN. An agreement which allows a party earn a full or partial

working interest (also known as an "earned working interest") in an oil and gas

lease in return for providing exploration or development funds.

FARMOUT. An agreement whereby the owner of the leasehold or working

interest agrees to assign a portion of his interest in certain acreage subject

to the drilling of one or more specific wells or other performance by the

assignee as a condition of the assignment. Under a farmout, the owner of the

leasehold or working interest may retain some interest such as an overriding

royalty interest, an oil and gas payment, offset acreage or other type of

interest.

GROSS ACRE. An acre in which a working interest is owned. The number of

gross acres is the total number of acres in which an interest is owned (see "Net

Acre" below).

GROSS WELL. A well in which a working interest is owned. The number of

gross wells is the total number of wells in which a working interest is owned.

LANDOWNER ROYALTY. That interest retained by the holder of a mineral

interest upon the execution of an oil and gas lease which usually ranges from

1/8 to 1/4 of all gross revenues from oil and gas production unencumbered with

an expenses of operation, development or maintenance.

-5-

LEASES. Full or partial interests in oil or gas properties authorizing

the owner of the lease to drill for, produce and sell oil and gas upon payment

of rental, bonus, royalty or any of them. Leases generally are acquired from

private landowners (fee leases) and from federal and state governments on

acreage held by them.

LEASE PLAY. A term used to describe lease acquisition activity in a

prospect or geologically defined area.

MCF. An abbreviation for "1,000 cubic feet," which is a unit of

measurement of volume for natural gas.

NET WELL OR ACRE. A net well or acre exists when the sum of the

fractional ownership working interests in gross wells or acres equals one. The

number of net wells or acres is the sum of the factional working interests owned

in gross wells or acres expressed as whole number and fractions thereof.

NET REVENUE INTEREST. The fractional undivided interest in the oil or

gas or in the revenues from the sale of oil or gas attributable to a particular

working interest after reduction for a proportionate share of landowner's

royalty interest and overriding royalty interest.

OVERRIDING ROYALTY. An interest in the gross revenues or production

over and above the landowner's royalty carved out of the working interest and

also unencumbered with any expenses of operation, development or maintenance.

PAYOUT. The point in time when the cumulative total of gross income

from the production of oil and gas from a given well (and any proceeds from the

sale of such well) equals the cumulative total cost and expenses of acquiring,

drilling, completing and operating such well, including tangible and intangible

drilling and completion costs.

PROSPECT. A geological area which is believed to have the potential for

oil or gas production.

PROVED DEVELOPED RESERVES. The reserves which can be expected to be

recovered through existing wells with existing equipment and operating methods.

Such reserves include the reserves which are expected to be produced from the

existing completion interval(s) now open for production in existing wells and in

addition to those reserves which exist behind the casing (pipe) of existing

wells, or at minor depths below the present bottom of such wells, which are

expected to be produced through these wells in the predictable future where the

cost of making such oil and gas available for production is relatively small

compared to the cost of drilling a new well.

PROVED UNDEVELOPED RESERVES. Proved reserves which are expected to be

recovered from new wells on undrilled acreage, or from existing wells where a

relatively major expenditure is required for a recompletion. Reserves on

undrilled acreage are limited to those drilling tracts offsetting productive

units which are reasonable certain of production when drilled. Proved reserves

for other undrilled tracts are claimed only where it can be demonstrated with

certainty that there is continuity of production from the existing productive

formation.

REVERSIONARY INTEREST. The portion of the working interest in an oil

and gas lease which will be returned to its former owner when payout occurs or

after a predetermined amount of production and income has been produced.

UNDEVELOPED LEASEHOLD ACREAGE. Leased acreage on which wells have not

been drilled or completed to a point that would permit the production of

commercial quantities of oil and gas.

WORKING INTEREST. An interest in an oil and gas lease entitling the

holder at its expense to conduct drilling and production operations on the

leased property and to receive the net revenues attributable to such interest,

after deducting the landowner's royalty, any overriding royalties, production

costs, taxes and other costs.

-6-

RISK FACTORS RELATED TO OUR COMPANY

Our securities, as offered hereby, are highly speculative and should be

purchased only by persons who can afford to lose their entire investment in us.

Each prospective investor should carefully consider the following risk factors,

as well as all other information set forth elsewhere in this prospectus, before

purchasing any of the shares of our common stock.

OUR BUSINESS IS A DEVELOPMENT STAGE COMPANY AND UNPROVEN AND THEREFORE RISKY.

We have only very recently begun operations under the business plan discussed

herein. Potential investors should be made aware of the risk and difficulties

encountered by a new enterprise in the oil and gas industry, especially in view

of the intense competition from existing businesses in the industry.

WE HAVE A LACK OF REVENUE HISTORY AND INVESTORS CANNOT VIEW OUR PAST PERFORMANCE

SINCE WE ARE A START-UP COMPANY.

We were formed on February 13, 1997 for the purpose of engaging in any lawful

business and have adopted a plan to engage the acquisition, exploration, and if

warranted, development of natural resource properties. We have had no revenues

in the last five years. We are not profitable and the business effort is

considered to be in an early development stage. We must be regarded as a new or

development venture with all of the unforeseen costs, expenses, problems, risks

and difficulties to which such ventures are subject.

WE ARE NOT DIVERSIFIED AND WE WILL BE DEPENDENT ON ONLY ONE BUSINESS.

Because of the limited financial resources that we have, it is unlikely that we

will be able to diversify our operations. Our probable inability to diversify

our activities into more than one area will subject us to economic fluctuations

within the energy industry and therefore increase the risks associated with our

operations due to lack of diversification.

WE CAN GIVE NO ASSURANCE OF SUCCESS OR PROFITABILITY TO OUR INVESTORS.

There is no assurance that we will ever operate profitably. There is no

assurance that we will generate revenues or profits, or that the market price of

our common stock will be increased thereby.

WE MAY HAVE A SHORTAGE OF WORKING CAPITAL IN THE FUTURE WHICH COULD JEOPARDIZE

OUR ABILITY TO CARRY OUT OUR BUSINESS PLAN.

Our capital needs consist primarily of expenses related to geological

evaluation, general and administrative and potential exploration participation

and could exceed $750,000 in the next twelve months. Such funds are not

currently committed, and we have cash of approximately $400,000 as of the date

of this Post-Effective Amendment No. 8.

We will not receive any proceeds from the sale of the common shares held by the

Selling Shareholders.

We have issued a total of 6,700,000 shares of common stock underlying Warrants

exercisable at exercise prices ranging from $0.50 to $3.00 per share, which if

exercised; we would receive proceeds totaling approximately $9,900,000 from the

exercise of the Warrants. Warrants exercisable for 4,700,000 shares are subject

to vesting terms and are not eligible for exercise for at least one year. We

cannot provide any assurances that such warrants will be exercised or when they

will be exercised.

If we find oil and gas reserves to exist on a prospect we will need substantial

additional financing to fund the necessary exploration and development work.

Furthermore, if the results of that exploration and development work are

successful, we will need substantial additional funds for continued development.

We will not receive proceeds from this offering to conduct such work and,

therefore, we will need to obtain the necessary funds either through debt or

equity financing, some form of cost-sharing arrangement with others, or the sale

of all or part of the property. There is no assurance that we will be successful

in obtaining any financing. These various financing alternatives may dilute the

interest of our shareholders and/or reduce our interest in the properties. (See

"Use of Proceeds" and "Our Business")

WE WILL NEED ADDITIONAL FINANCING FOR WHICH WE HAVE NO COMMITMENTS, AND THIS MAY

JEOPARDIZE EXECUTION OF OUR BUSINESS PLAN.

We have limited funds, and such funds may not be adequate to carry out the

business plan in the oil and gas industry. Our ultimate success depends upon our

ability to raise additional capital. We have not investigated the availability,

source, or terms that might govern the acquisition of additional capital and

will not do so until it determines a need for additional financing. If we need

additional capital, we have no assurance that funds will be available from any

source or, if available, that they can be obtained on terms acceptable to us. If

not available, our operations will be limited to those that can be financed with

our modest capital.

-7-

WE MAY IN THE FUTURE ISSUE MORE SHARES WHICH COULD CAUSE A LOSS OF CONTROL BY

OUR PRESENT MANAGEMENT AND CURRENT STOCKHOLDERS.

We may issue further shares as consideration for the cash or assets or services

out of our authorized but unissued common stock that would, upon issuance,

represent a majority of the voting power and equity of our Company. The result

of such an issuance would be those new stockholders and management would control

our Company, and persons unknown could replace our management at this time. Such

an occurrence would result in a greatly reduced percentage of ownership of our

Company by our current shareholders, which could present significant risks to

investors.

WE HAVE WARRANTS ISSUED AND OUTSTANDING WHICH ARE CONVERTIBLE INTO OUR COMMON

STOCK. A CONVERSION OF SUCH EQUITY INSTRUMENTS COULD HAVE A DILUTIVE EFFECT TO

EXISTING SHAREHOLDERS.

At March 12, 2012, we have warrants issued and outstanding exercisable into

6,700,000 shares of our common stock at ranges from $0.50 to $3.00 per share. We

will be registering 2,000,000 shares underlying our $0.50 Warrants in a separate

registration statement. We do not intend to register warrants held by our

officers and directors. The warrants are exercisable in whole or in part. The

2,000,000 shares underlying our warrants that will be separately registered,

upon the effectiveness of that registration statement, will be free trading

shares and available for immediate transfer. The exercise of the warrants into

shares of our common stock could have a dilutive effect to the holdings of our

existing shareholders.

WE WILL DEPEND UPON MANAGEMENT BUT WE WILL HAVE LIMITED PARTICIPATION OF

MANAGEMENT.

Our directors are also acting as our officers. We will be heavily dependent upon

their skills, talents, and abilities, as well as several consultants to us, to

implement our business plan, and may, from time to time, find that the inability

of the officers, directors and consultants to devote their full-time attention

to our business results in a delay in progress toward implementing our business

plan. Consultants may be employed on a part-time basis under a contract to be

determined.

Our directors and officers are, or may become, in their individual capacities,

officers, directors, controlling shareholder and/or partners of other entities

engaged in a variety of businesses. Thus, our officers and directors may have

potential conflicts including their time and efforts involved in participation

with other business entities. Each officer and director of our business is

engaged in business activities outside of our business, and the amount of time

they devote as Officers and Directors to our business will be up to 25 hours per

week. (See "Executive Team") Because investors will not be able to manage our

business, they should critically assess all of the information concerning our

officers and directors.

We do not know of any reason other than outside business interests that would

prevent them from devoting full-time to our Company, when the business may

demand such full-time participation.

OUR OFFICERS AND DIRECTORS MAY HAVE CONFLICTS OF INTERESTS AS TO CORPORATE

OPPORTUNITIES WHICH WE MAY NOT BE ABLE OR ALLOWED TO PARTICIPATE IN.

Presently there is no requirement contained in our Articles of Incorporation,

Bylaws, or minutes which requires officers and directors of our business to

disclose to us business opportunities which come to their attention. Our

officers and directors do, however, have a fiduciary duty of loyalty to us to

disclose to us any business opportunities which come to their attention, in

their capacity as an officer and/or director or otherwise. Excluded from this

duty would be opportunities which the person learns about through his

involvement as an officer and director of another company. We have no intention

of merging with or acquiring business opportunity from any affiliate or officer

or director. (See "Conflicts of Interest" at page 27)

WE HAVE AGREED TO INDEMNIFICATION OF OFFICERS AND DIRECTORS AS IS PROVIDED BY

WYOMING STATUTE.

Wyoming Statutes provide for the indemnification of our directors, officers,

employees, and agents, under certain circumstances, against attorney's fees and

other expenses incurred by them in any litigation to which they become a party

arising from their association with or activities our behalf. We will also bear

the expenses of such litigation for any of our directors, officers, employees,

or agents, upon such person's promise to repay us therefore if it is ultimately

determined that any such person shall not have been entitled to indemnification.

This indemnification policy could result in substantial expenditures by us that

we will be unable to recoup.

OUR DIRECTORS' LIABILITY TO US AND SHAREHOLDERS IS LIMITED

Wyoming Revised Statutes exclude personal liability of our directors and our

stockholders for monetary damages for breach of fiduciary duty except in certain

specified circumstances. Accordingly, we will have a much more limited right of

-8-

action against our directors that otherwise would be the case. This provision

does not affect the liability of any director under federal or applicable state

securities laws.

RISK FACTORS RELATING TO OUR BUSINESS

Any person or entity contemplating an investment in the securities offered

hereby should be aware of the high risks involved and the hazards inherent

therein. Specifically, the investor should consider, among others, the following

risks:

OUR BUSINESS, THE OIL AND GAS BUSINESS HAS NUMEROUS RISKS WHICH COULD RENDER US

UNSUCCESSFUL.

The search for new oil and gas reserves frequently results in unprofitable

efforts, not only from dry holes, but also from wells which, though productive,

will not produce oil or gas in sufficient quantities to return a profit on the

costs incurred. There is no assurance we will find or produce oil or gas from

any of the undeveloped acreage farmed out to us or which may be acquired by us,

nor are there any assurances that if we ever obtain any production it will be

profitable. (See "Business and Properties")

WE HAVE SUBSTANTIAL COMPETITORS WHO HAVE AN ADVANTAGE OVER US IN RESOURCES AND

MANAGEMENT.

We are and will continue to be an insignificant participant in the oil and gas

business. Most of our competitors have significantly greater financial

resources, technical expertise and managerial capabilities than us and,

consequently, we will be at a competitive disadvantage in identifying and

developing or exploring suitable prospects. Competitor's resources could

overwhelm our restricted efforts to acquire and explore oil and gas prospects

and cause failure of our business plan.

WE WILL BE SUBJECT TO ALL OF THE MARKET FORCES IN THE ENERGY BUSINESS, MANY OF

WHICH COULD POSE A SIGNIFICANT RISK TO OUR OPERATIONS.

The marketing of natural gas and oil which may be produced by our prospects will

be affected by a number of factors beyond our control. These factors include the

extent of the supply of oil or gas in the market, the availability of

competitive fuels, crude oil imports, the world-wide political situation, price

regulation, and other factors. Current economic and market conditions have

created dramatic fluctuations in oil prices. Any significant decrease in the

market prices of oil and gas could materially affect our profitability of oil

and gas activities.

There generally are only a limited number of gas transmission companies with

existing pipelines in the vicinity of a gas well or wells. In the event that

producing gas properties are not subject to purchase contracts or that any such

contracts terminate and other parties do not purchase our gas production, there

is assurance that we will be able to enter into purchase contracts with any

transmission companies or other purchasers of natural gas and there can be no

assurance regarding the price which such purchasers would be willing to pay for

such gas. There may, on occasion, be an oversupply of gas in the marketplace or

in pipelines, the extent and duration may affect prices adversely. Such

oversupply may result in reductions of purchases and prices paid to producers by

principal gas pipeline purchasers. (See "Our Business and Competition, Markets,

Regulation and Taxation.")

WE BELIEVE INVESTORS SHOULD CONSIDER CERTAIN NEGATIVE ASPECTS OF OUR OPERATIONS.

DRY HOLES: We may expend substantial funds acquiring and potentially

participating in exploring properties which we later determine not to be

productive. All funds so expended will be a total loss to us.

TECHNICAL ASSISTANCE: We will find it necessary to employ technical assistance

in the operation of our business. As of the date of this Prospectus, we have not

contracted for any technical assistance. When we need it such assistance is

likely to be available at compensation levels we would be able to pay.

UNCERTAINTY OF TITLE: We will attempt to acquire leases or interests in leases

by option, lease, farmout or by purchase. The validity of title to oil and gas

property depends upon numerous circumstances and factual matters (many of which

are not discoverable of record or by other readily available means) and is

subject to many uncertainties of existing law and our application. We intend to

obtain an oil and gas attorney's opinion of valid title before any significant

expenditure upon a lease.

GOVERNMENT REGULATIONS: The area of exploration of natural resources has become

significantly regulated by state and federal governmental agencies, and such

regulation could have an adverse effect on our operations. Compliance with

statutes and regulations governing the oil and gas industry could significantly

increase the capital expenditures necessary to develop our prospects.

-9-

NATURE OF OUR BUSINESS: Our business is highly speculative, involves the

commitment of high-risk capital, and exposes us to potentially substantial

losses. In addition, we will be in direct competition with other organizations

which are significantly better financed and staffed than we are.

GENERAL ECONOMIC AND OTHER CONDITIONS: Our business may be adversely affected

from time to time by such matters as changes in general economic, industrial and

international conditions; changes in taxes; oil and gas prices and costs; excess

supplies and other factors of a general nature.

OUR BUSINESS IS SUBJECT TO SIGNIFICANT WEATHER INTERRUPTIONS.

Our activities may be subject to periodic interruptions due to weather

conditions. Weather-imposed restrictions during certain times of the year on

roads accessing properties could adversely affect our ability to benefit from

production on such properties or could increase the costs of drilling new wells

because of delays.

WE ARE SUBJECT TO SIGNIFICANT OPERATING HAZARDS AND UNINSURED RISK IN THE ENERGY

INDUSTRY.

Our proposed operations will be subject to all of the operating hazards and

risks normally incident to exploring, drilling for and producing oil and gas,

such as encountering unusual or unexpected formations and pressures, blowouts,

environmental pollution and personal injury. We will maintain general liability

insurance but we have not obtained insurance against such things as blowouts and

pollution risks because of the prohibitive expense. Should we sustain an

uninsured loss or liability, or a loss in excess of policy limits, our ability

to operate may be materially adversely affected.

WE ARE SUBJECT TO FEDERAL INCOME TAX LAWS AND CHANGES THEREIN WHICH COULD

ADVERSELY IMPACT US.

Federal income tax laws are of particular significance to the oil and gas

industry in which we engage. Legislation has eroded various benefits of oil and

gas producers and subsequent legislation could continue this trend. Congress is

continually considering proposals with respect to Federal income taxation which

could have a material adverse effect on our future operations and on our ability

to obtain risk capital which our industry has traditionally attracted from

taxpayers in high tax brackets.

WE ARE SUBJECT TO SUBSTANTIAL GOVERNMENT REGULATION IN THE ENERGY INDUSTRY WHICH

COULD ADVERSELY IMPACT US.

The production and sale of oil and gas are subject to regulation by state and

federal authorities, the spacing of wells and the prevention of waste. There are

both federal and state laws regarding environmental controls which may

necessitate significant capital outlays, resulting in extended delays,

materially affect our earnings potential and cause material changes in the in

our proposed business. We cannot predict what legislation, if any, may be passed

by Congress or state legislatures in the future, or the effect of such

legislation, if any, on us. Such regulations may have a significant affect on

our operating results.

RISK FACTORS RELATED TO OUR STOCK

THE REGULATION OF PENNY STOCKS BY SEC AND FINRA MAY DISCOURAGE THE TRADABILITY

OF OUR SECURITIES.

We are a "penny stock" company. Our securities are subject to a Securities and

Exchange Commission rule that imposes special sales practice requirements upon

broker-dealers who sell such securities to persons other than established

customers or accredited investors. For purposes of the rule, the phrase

"accredited investors" means, in general terms, institutions with assets in

excess of $5,000,000, or individuals having a net worth in excess of $1,000,000

or having an annual income that exceeds $200,000 (or that, when combined with a

spouse's income, exceeds $300,000). For transactions covered by the rule, the

broker-dealer must make a special suitability determination for the purchaser

and receive the purchaser's written agreement to the transaction prior to the

sale. Effectively, this discourages broker-dealers from executing trades in

penny stocks. Consequently, the rule will affect the ability of purchasers in

this offering to sell their securities in any market that might develop

therefore because it imposes additional regulatory burdens on penny stock

transactions.

In addition, the Securities and Exchange Commission has adopted a number of

rules to regulate "penny stocks". Such rules include Rules 3a51-1, 15g-1, 15g-2,

15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange

Act of 1934, as amended. Because our securities constitute "penny stocks" within

the meaning of the rules, the rules would apply to us and to our securities. The

rules will further affect the ability of owners of shares to sell our securities

in any market that might develop for them because it imposes additional

regulatory burdens on penny stock transactions.

-10-

Shareholders should be aware that, according to Securities and Exchange

Commission, the market for penny stocks has suffered in recent years from

patterns of fraud and abuse. Such patterns include (i) control of the market for

the security by one or a few broker-dealers that are often related to the

promoter or issuer; (ii) manipulation of prices through prearranged matching of

purchases and sales and false and misleading press releases; (iii) "boiler room"

practices involving high-pressure sales tactics and unrealistic price

projections by inexperienced sales persons; (iv) excessive and undisclosed

bid-ask differentials and markups by selling broker-dealers; and (v) the

wholesale dumping of the same securities by promoters and broker-dealers after

prices have been manipulated to a desired consequent investor losses. Our

management is aware of the abuses that have occurred historically in the penny

stock market. Although we do not expect to be in a position to dictate the

behavior of the market or of broker-dealers who participate in the market,

management will strive within the confines of practical limitations to prevent

the described patterns from being established with respect to our securities.

WE WILL PAY NO FORESEEABLE DIVIDENDS IN THE FUTURE.

We have not paid dividends on our common stock and do not ever anticipate paying

such dividends in the foreseeable future.

OUR INVESTORS MAY SUFFER FUTURE DILUTION DUE TO ISSUANCES OF SHARES FOR VARIOUS

CONSIDERATIONS IN THE FUTURE.

There may be substantial dilution to our shareholders purchasing in this

Offering as a result of future decisions of the Board to issue shares without

shareholder approval for cash, services, or acquisitions.

At March 12, 2012, we have warrants issued and outstanding exercisable into

6,700,000 shares of our common stock at ranges from $0.50 to $3.00 per share. We

intend to register 2,000,000 shares underlying our $0.50 Warrants in a separate

registration statement. We do not intend to register the warrants held by our

officers and directors. The warrants are exercisable in whole or in part. The

exercise of the warrants into shares of our common stock could have a dilutive

effect to the holdings of our existing shareholders.

The Company does intend to file a Registration Statement on Form S-1 pursuant to

Rule 429 of the Securities Act of 1933 to register 4,758,080 shares of the

Company's common stock held by existing shareholders and 2,000,000 shares

underlying warrants exercisable for shares of the Company's common stock at

$0.50 per share. The Company expects to file such Registration Statement in the

next 30 days.

RULE 144 SALES IN THE FUTURE MAY HAVE A DEPRESSIVE EFFECT ON OUR STOCK PRICE.

All of the outstanding shares of common stock held by our present officers,

directors, and affiliate stockholders are "restricted securities" within the

meaning of Rule 144 under the Securities Act of 1933, as amended. As restricted

Shares, these shares may be resold only pursuant to an effective registration

statement or under the requirements of Rule 144 or other applicable exemptions

from registration under the Act and as required under applicable state

securities laws. We are registering all of our outstanding shares so officers,

directors and affiliates will be able to sell their shares if this Registration

Statement becomes effective. Rule 144 provides in essence that a person who has

held restricted securities for six months, under certain conditions, sell every

three months, in brokerage transactions, a number of shares that does not exceed

the greater of 1.0% of a company's outstanding common stock or the average

weekly trading volume during the four calendar weeks prior to the sale. There is

no limit on the amount of restricted securities that may be sold by a

nonaffiliate after the owner has held the restricted securities for a period of

six month. A sale under Rule 144 or under any other exemption from the Act, if

available, or pursuant to subsequent registration of shares of common stock of

present stockholders, may have a depressive effect upon the price of the common

stock in any market that may develop.

OUR COMMON STOCK MAY BE VOLATILE, WHICH SUBSTANTIALLY INCREASES THE RISK THAT

YOU MAY NOT BE ABLE TO SELL YOUR SHARES AT OR ABOVE THE PRICE THAT YOU MAY PAY

FOR THE SHARES.

Because of the limited trading market for our common stock and because of the

possible price volatility, you may not be able to sell your shares of common

stock when you desire to do so. The inability to sell your shares in a rapidly

declining market may substantially increase your risk of loss because of such

illiquidity and because the price for our Securities may suffer greater declines

because of our price volatility.

The price of our common stock that will prevail in the market after this

offering may be higher or lower than the price you may pay. Certain factors,

some of which are beyond our control, that may cause our share price to

fluctuate significantly include, but are not limited to the following:

o Variations in our quarterly operating results;

o Loss of a key relationship or failure to complete significant

transactions;

-11-

o Additions or departures of key personnel; and

o Fluctuations in stock market price and volume.

Additionally, in recent years the stock market in general, and the

over-the-counter markets in particular, have experienced extreme price and

volume fluctuations. In some cases, these fluctuations are unrelated or

disproportionate to the operating performance of the underlying company. These

market and industry factors may materially and adversely affect our stock price,

regardless of our operating performance. In the past, class action litigation

often has been brought against companies following periods of volatility in the

market price of those companies common stock. If we become involved in this type

of litigation in the future, it could result in substantial costs and diversion

of management attention and resources, which could have a further negative

effect on your investment in our stock.

ANY SALES OF OUR COMMON STOCK, IF IN SIGNIFICANT AMOUNTS, ARE LIKELY TO DEPRESS

THE MARKET PRICE OF OUR SECURITIES.

Assuming all of the shares of common stock, under this Post-Effective Amendment

No. 8 are sold and all of the shares of common stock held by the selling

security holders registered hereby are sold, we would have 1,030,000 shares that

are freely tradable. Even our officers and directors are registering a portion

of their shares for sale under this amended prospectus.

Unrestricted sales of 1,030,000 shares of stock by our selling stockholders

could have a huge negative impact on our share price, and the market for our

shares.

ANY NEW POTENTIAL INVESTORS WILL SUFFER A DISPROPORTIONATE RISK AND THERE WILL

BE IMMEDIATE DILUTION OF EXISTING INVESTOR'S INVESTMENTS.

Our present shareholders have acquired their securities at a cost significantly

less than that which the investors purchasing pursuant to shares will pay for

their stock holdings or at which future purchasers in the market may pay.

Therefore, any new potential investors will bear most of the risk of loss.

OUR BUSINESS IS HIGHLY SPECULATIVE AND THE INVESTMENT IS THEREFORE RISKY.

Due to the speculative nature of our business, it is probable that the

investment in shares offered hereby will result in a total loss to the investor.

Investors should be able to financially bear the loss of their entire

investment. Investment should, therefore, be limited to that portion of

discretionary funds not needed for normal living purposes or for reserves for

disability and retirement.

ITEM 4. USE OF PROCEEDS

We have conducted a Private Offering of shares of our restricted Common Stock

for capital. We intend to raise up to $5,000,000 in the next twelve months with

a structure not yet determined in debt or equity. As of March 12, 2012, the

Company had sold approximately 830,000 shares, raising a total of $415,000. We

cannot give any assurances that we will be able to raise the full $5,000,000 to

fund the budget. Further, we will need to raise additional funds to support not

only our expected budget, but our continued operations. We cannot make any

assurances that we will be able to raise such funds or whether we would be able

to raise such funds with terms that are favorable to us.

Our lack of funds could and would severely limit our operations, and might

render us unable to carry out our business plan with resulting business failure.

ITEM 5. DETERMINATION OF OFFERING PRICE

The Common Stock is presently thinly traded on the over-the-counter market on

the OTC Bulletin Board maintained by the Financial Industry Regulatory Authority

(the "FINRA"). The OTCBB symbol for the Common Stock is "HENI." The Company's

stock began trading on the OTC Bulletin Board on December 31, 2010.

The offering price of the Common Stock being registered on behalf of the

selling shareholders was determined using a 5-day average of the closing market

price. We will not receive any proceeds from the sale of our stock by our

selling shareholders.

-------------------------- ----------------------------------------------------

TITLE PER SECURITY

-------------------------- ----------------------------------------------------

Common Stock $0.10

-------------------------- ----------------------------------------------------

|

-12-

We have arbitrarily determined our offering price for shares to be sold pursuant

to this offering at $0.10. The 480,000 shares of stock already purchased by

original officers and directors at $.003 and other shareholders were sold for

$.0025 per Share. We issued 3,500,000 shares at $.001 to Sharon K. Fowler in

2006 for the farmout of the mineral lease in Wyoming. The additional major

factors that were included in determining the initial sales price to our

founders and private investors were the lack of liquidity since there was no

present market for our stock and the high level of risk considering our lack of

operating history.

The share price bears no relationship to any criteria of goodwill value, asset

value, market price or any other measure of value and were arbitrarily

determined in the judgment of our Board of Directors.

ITEM 6. DILUTION

We are registering shares of existing shareholders who hold 1,030,000. Other

shareholders purchased shares at $.0025 per share in 1998. Since our inception

on February 13, 1997, our original officers and directors purchased 480,000

shares at $0.003 per share. Sharon K. Fowler was issued 3,500,000 shares of our

common stock at $.001 per share for the farmout of the mineral lease in Natrona

County, Wyoming.

The following table sets forth with respect to existing shareholders, the number

of our shares of common stock purchased the percentage ownership of such shares,

the total consideration paid, the percentage of total consideration paid and the

average price per share. All percentages are computed based upon cumulative

shares and consideration assuming sale of all shares in the line item as

compared to maximum in each previous line.

Shares Purchased Total Consideration

----------------- -------------------- Average

Number Percent Amount Percent Price/Share

1) Existing Shareholders 1,030,000 100% $1,339 <1% $0.0013

"Net tangible book value" is the amount that results from subtracting the total

liabilities and intangible assets from the total assets of an entity. Dilution

occurs because we determined the offering price based on factors other than

those used in computing book value of our stock. Dilution exists because the

book value of shares held by existing stockholders is lower than the offering

price offered to new investors.

As at September 30, 2011, the net tangible book value of our stock was $(0.06)

per share. If we are successful in achieving exercise of the warrants at the

exercise price, that would represent an immediate increase in net tangible book

value per share and per share dilution to new investors as shown in chart above,

assuming the warrants are exercised at a price of $0.50 for 2,000,000 shares.

The exercise of the warrants by the holders thereof could result in a further

dilution of the book value of our Common Stock. Furthermore, the holders of the

warrants might be expected to exercise them at a time when we would, in all

likelihood, be able to obtain any needed capital by a new offering of securities

on terms more favorable than those provided for by the warrants.

ITEM 7. SELLING SECURITY HOLDERS

The selling shareholders, including officers and directors, obtained their

shares of our stock in the following transactions:

(a) A private placement of 480,000 shares occurring at inception in 1997

to founders at $.003 per share;

(b) A private placement in early 1998 of 300,000 shares at $0.0025 per

share;

(c) Sharon K. Fowler contributed a farmout of lease acreage for 3,500,000

shares at $.001 per share;

(d) Pursuant to Amended Share Exchange Agreement, dated January 23, 2012,

the shareholders of South Uintah were issued 11,446,931 shares of

common stock on a one for one basis for their shares of South Uintah;

and

(e) A private placement from October 2011 through January 2012 for 780,000

shares at $0.50 per share.

Other than the stock transactions discussed above, we have not entered into any

transaction nor are there any proposed transactions in which any founder,

director, executive officer, significant shareholder of our company or any

member of the immediate family of any of the foregoing had or is to have a

direct or indirect material interest, except the following,

Sharon K. Fowler, founder and shareholder granted a farmout of the

lease in Section 16, T38N, R81W in Natrona County, Wyoming, to us at

$.001 per share for 3,500,000 shares of our common stock in 1998.

-13-

On July 11, 2011, prior to entering into the Share Exchange Agreement,

South Uintah had purchased 3,000,000 shares of the Company from its

then majority shareholder Ms. Sharon Fowler. After such purchase, South

Uintah held approximately 70% of the issued and outstanding common

stock of the Company. Prior to closing of the acquisition of South

Uintah, South Uintah transferred 300,000 shares to an unrelated third

party as partial consideration for the acquisition of the gas prospect

in Utah. As part of the Share Exchange Agreement, South Uintah has

agreed to return the remaining 2,700,000 shares of common stock to the

Company. We have retired such shares to treasury, concurrent with the

transaction.

No person who may, in the future, be considered a promoter of this offering,

will receive or expect to receive assets, services or other considerations from

us except those persons who are our salaried employees or directors. No assets

will be, nor expected to be, acquired from any promoter on behalf of us. We have

not entered into any agreements that require disclosure to the shareholders.

All of the securities listed below are being registered in this Registration

Statement, which include all of the securities outstanding as of date hereof.

------------------------------------- ------------------ ---------------- --------------- -----------------

NAME COMMON SHARES

HELD BY EACH TOTAL SHARES % SHARES OWNED

SHARE-HOLDER TO BE OWNED BEFORE AFTER OFFERING

BEFORE OFFERING REGIST-ERED OFFERING (1) (2)

------------------------------------- ------------------ ---------------- --------------- -----------------

John E. Bradley 61,500 11,500 0.44% 11,500

------------------------------------- ------------------ ---------------- --------------- -----------------

Brandy Butler 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Jessica L. Butler 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Michael R. Butler 140,000 140,000 1.00% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Linda J. Cheney 12,000 12,000 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Percy S. Chopping, Jr. 5,500 5,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Leslie J. Cotton 17,500 17,500 0.12% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Bret A. Erickson 300 300 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Eric C. Erickson 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

G. Todd Erickson 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Robert C. Erickson 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Family Fire Protections, LLC 6,500 6,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Lourie J. Fleet 17,000 17,000 0.12% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Sherry L. Foate 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Everett M. Fowler 5,500 5,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Guy E. Fowler 7,800 7,800 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Michael E. Fowler 16,000 16,000 0.11% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Robert G. Fowler 170,000 170,000 1.22% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Robert D. Fowler 17,000 17,000 0.12% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Sharon K. Fowler 510,000 260,000 3.66% 250,000

------------------------------------- ------------------ ---------------- --------------- -----------------

Kenneth D. Freemole 1,500 1,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

April A. Frost 12,700 12,700 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Grant Glazier 11,000 11,000 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Warren N. Golligher, M.D. 8,500 8,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Everett M. Gordon 12,800 12,800 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Philip G. Hinds 5,750 5,750 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Thomas M. Hockaday 10,750 10,750 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Andrea K. Hunt 16,500 16,500 0.11% 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Rashelle L. Hunt 11,500 11,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

Michael Johnson 5,000 5,000 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

John L. Lee or Patricia J. Lee 13,500 13,500 * 0

------------------------------------- ------------------ ---------------- --------------- -----------------

-14-

|

------------------------------------- ------------------- --------------- --------------- -----------------

NAME COMMON SHARES

HELD BY EACH TOTAL SHARES % SHARES OWNED

SHARE-HOLDER TO BE OWNED BEFORE AFTER OFFERING

BEFORE OFFERING REGIST-ERED OFFERING (1) (2)

------------------------------------- ------------------- --------------- --------------- -----------------

Z.S. Merritt 10,750 10,750 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Lesha J. Morrison 18,500 18,500 0.13% 0

------------------------------------- ------------------- --------------- --------------- -----------------

William Rittahler 500 500 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Ralph Schauss 13,000 13,000 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Barbara S. Schmidt 1,500 1,500 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Harlan A. Schmidt 63,000 63,000 0.45% 0

------------------------------------- ------------------- --------------- --------------- -----------------

Ronald A. Shogren 40,000 40,000 0.28% 0

------------------------------------- ------------------- --------------- --------------- -----------------

Roy C. Smith 50,000 50,000 0.35% 0

------------------------------------- ------------------- --------------- --------------- -----------------

Jamie L. Vig 1,900 1,900 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Roger W. Wesnitzer 11,500 11,500 * 0

------------------------------------- ------------------- --------------- --------------- -----------------

Dale A. Wood 14,250 14,250 0.10% 0

------------------------------------- ------------------- --------------- --------------- -----------------

TOTAL 1,330,000 1,030,000 9.55%

------------------------------------- ------------------- --------------- --------------- -----------------

|

*Less than 1%

MATERIAL RELATIONSHIPS

(1) Based upon 13,925,931shares of common stock issued and outstanding.

(2) Assumes the sale of all shares being registered.

ITEM 8. PLAN OF DISTRIBUTION

Upon effectiveness of this amendment to the registration statement, of which

this prospectus is a part, our existing selling shareholders may sell their

securities at market prices or at any price in privately negotiated

transactions.

Our selling shareholders may be deemed underwriters in this offering.

The selling shareholders are not paying any of the offering expenses and we will

not receive any of the proceeds from the sale of the shares by the selling

shareholders.

ITEM 9. DESCRIPTION OF SECURITIES

The securities being registered and/or offered by this Prospectus are common

shares.

COMMON STOCK

We are presently authorized to issue fifty million (50,000,000) shares of our

common stock. A total of Thirteen Million, Nine Hundred Twenty-Five Thousand and

Nine Hundred and Thirty-One (13,925, 931) common shares are issued and

outstanding.

COMMON SHARES

All shares are equal to each other with respect to voting, liquidation, and

dividend rights. Special shareholders' meetings may be called by the officers or

director, or upon the request of holders of at least one-tenth (1/10th) of the

outstanding shares. Holders of shares are entitled to one vote at any

shareholders' meeting for each share they own as of the record date fixed by the

board of directors. There is no quorum requirement for shareholders' meetings.

Therefore, a vote of the majority of the shares represented at a meeting will

govern even if this is substantially less than a majority of the shares

outstanding. Holders of shares are entitled to receive such dividends as may be

declared by the board of directors out of funds legally available therefore, and

upon liquidation are entitled to participate pro rata in a distribution of

assets available for such a distribution to shareholders. There are no

conversion, pre-emptive or other subscription rights or privileges with respect

to any shares. Reference is made to our Articles of Incorporation and our

By-Laws as well as to the applicable statutes of the State of Wyoming for a more

complete description of the rights and liabilities of holders of shares. It

should be noted that the board of directors without notice to the shareholders

may amend the By-Laws. Our shares do not have cumulative voting rights, which

means that the holders of more than fifty percent (50%) of the shares voting for

election of directors may elect all the directors if they choose to do so. In

-15-

such event, the holders of the remaining shares aggregating less than fifty

percent (50%) of the shares voting for election of directors may not be able to

elect any director.

PREFERRED SHARES

We are authorized to issue twenty-five million (25,000,000) shares of preferred

stock. At the time of this filing there are no classes of preferred stock

designated, nor are there any preferred shares issued and outstanding.

The Board of Directors will have complete discretion to authorize Series and

Classes, and to negotiate and set the rights, privileges, and preferences of the

classes and series. Management will have also the discretion, subject to Board

of Director approval of how, when, and for what consideration the Preferred

Shares may be issued.

WARRANTS

We have a total of 6,700,000 warrants issued and outstanding, which entitle the

holder to purchase one Share of Common Stock at an exercise prices ranging from

$0.50 to $3.00 per share. We intend to register 2,000,000 shares underlying our

$0.50 Warrants, in a separate registration statement.

Our officers and directors hold warrants exercisable for 2,700,000 shares with

exercise prices ranging from $1.00 to $3.00 per share, which we are not

registering as part of this Offering. Of which, warrants exercisable for

1,000,000 shares have an exercise price of $2.00 per share and will expire in

July 2016. Such warrants will vest at a rate of 1/3 per year throughout the term

of the warrants and will expire 2 years after vesting. Warrants exercisable for

1,100,000 shares have an exercise price of $1.00 per share have a term of 3

years and will expire in July 2014 through November 2014. Warrants exercisable

for 600,000 shares have an exercise price of $3.00 per share and have a term of

3 years and will expire from July 2014 through September 2014.

Certain affiliates of the Company hold warrants exercisable of 2,000,000 shares

with an exercise price of $2.00 per share and will expire in July 2016, and have

a vesting rate of 1/3 per year throughout the term of the warrants and will

expire two years after vesting.

Such warrants are not held by any officers or directors of the Company. The

$0.50 Warrants have an exercise price of $0.50 per share and have a term of 2

years with a maximum expiration date of July 2013.

TRANSFER AGENT

The transfer agent for our securities is Continental Stock Transfer & Trust

Company, 17 Battery Place, New York City, NY 10004; phone number (212) 845-3274.

ITEM 10. INTEREST OF NAMED EXPERTS AND COUNSEL

We have not hired or retained any experts or counsel on a contingent basis, who

would receive a direct or indirect interest in us, or who is, or was, our