Proxy Statement - Other Information (preliminary) (pre 14c)

November 18 2021 - 4:16PM

Edgar (US Regulatory)

SCHEDULE 14C

(Rule 14c-101)

INFORMATION REQUIRED IN INFORMATION STATEMENT

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

|

|

[x]

|

Preliminary Information Statement [ ] Confidential, for use of the Commission only

|

|

|

[ ]

|

Definitive Information Statement

|

Healthtech Solutions, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

[x]

|

No fee required.

|

|

|

|

|

[ ]

|

Fee computed on table below

per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

..................................................................

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

..................................................................

|

|

3)

|

Price per unit or other underlying value of transaction pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing

fee is calculated and state how it was determined.)

|

..................................................................

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

...................................................................

...................................................................

[ ] Fee paid previously with preliminary

materials.

[ ] Check box if any part of the fee is

offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

......................................

2) Form, Schedule or Registration

Statement No.:

......................................

3) Filing Party:

......................................

4) Date Filed:

......................................

HEALTHTECH SOLUTIONS, INC.

181 Dante Avenue

Tuckahoe, NY 10707

INFORMATION STATEMENT

To the Holders of Our Voting Stock:

The purpose of this Information Statement is

to notify you that the holders of shares representing a majority of the voting power of Healthtech Solutions, Inc. and the holders of

shares representing a majority of the outstanding shares of Series A Preferred Stock have given their written consent to a resolution

adopted by the Board of Directors of Healthtech Solutions, Inc. to amend the articles of incorporation of Healthtech Solutions, Inc. so

as to modify the privileges of holders of the Series A Preferred Stock.

Utah corporation law permits holders of a majority

of the voting power to take shareholder action by written consent. Utah corporation law also permits the holders of a majority of a class

of preferred stock to approve a modification of the privileges of that class by written consent. Accordingly, Healthtech Solutions, Inc.

will not hold a meeting of its shareholders to consider or vote upon the amendment to Healthtech Solutions, Inc.’s Articles of Incorporation.

WE ARE NOT ASKING YOU FOR A PROXY.

YOU ARE REQUESTED NOT TO SEND US A PROXY.

|

November 30, 2021

|

Manuel E. Iglesias, President

|

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

We determined the shareholders of record for

purposes of this shareholder action at the close of business on November 12, 2021 (the “Record Date”). At that date, there

were two classes of voting stock of Healthtech Solutions, Inc. outstanding:

|

|

·

|

62,963,023 shares of common stock, each of which entitled the holder thereof to one vote.

|

|

|

·

|

110,520 shares of Series A Preferred Stock, each of which entitled the holder thereof to two thousand

(2,000) votes.

|

The following table sets forth the number of

shares of each class of voting stock owned by each person who, as of the Record Date, owned beneficially more than 5% of either class

of voting stock, as well as the ownership of such shares by each member of the Healthtech Solutions, Inc. Board of Directors and the shares

beneficially owned by its officers and directors as a group.

|

|

Common

Stock

|

Series

A Preferred

|

|

|

Name

ofBeneficial Owner

|

Amount

and Nature of

Beneficial

Ownership(1)

|

Percentage

of Class

|

Amount

and Nature of

Beneficial

Ownership(1)

|

Percentage

of Class

|

Total

Voting

Power

|

|

Manuel Iglesias(2)

|

129,309

|

0.2%

|

3,137

|

2.8%

|

2.3%

|

|

Steven Horowitz(3)

|

836,199

|

1.3%

|

17,252

|

16.6%

|

12.4%

|

|

Paul Mann(4)

|

--

|

--

|

--

|

--

|

--

|

|

All officers and directors as a group (4 persons)

|

965,508

|

1.5%

|

20,389

|

18.4%

|

14.7%

|

|

Richard F. Parker & Charlotte B. Parker Revocable Living Trust(5)

|

7,122,270

|

11.3%

|

--

|

--

|

2.5%

|

|

Jonathan Leinwand(6)

|

--

|

--

|

43,946

|

39.7%

|

30.9%

|

|

Exeter Life LLC(7)

|

711,199

|

1.1%

|

17,252

|

15.6%

|

12.4%

|

|

CAI Family Trust(8)

|

6,425,272

|

10.2%

|

4,791

|

4.3%

|

5.6%

|

|

MAI Family Trust(9)

|

6,425,272

|

10.2%

|

4,791

|

4.3%

|

5.6%

|

|

Conestoga Revocable Family Trust(10)

|

6,360,618

|

10.1%

|

3,222

|

2.9%

|

4.5%

|

|

Millersville Revocable Trust Declaration(11)

|

6,360,618

|

10.1%

|

3,222

|

2.9%

|

4.5%

|

|

BSD Trust 1 2021(12)

|

4,802,982

|

7.6%

|

--

|

--

|

1.7%

|

|

BSD Trust 2 2021(13)

|

4,802,982

|

7.6%

|

--

|

--

|

1.7%

|

_________________________________________

(1) Ownership is of record

and beneficial unless otherwise noted.

|

|

(2)

|

Shares attributed to Manuel Iglesias are owned by Manuel E. Iglesias Trust, of which Mr. Iglesias is beneficiary. The Table does not

reflect 500,000 shares of restricted stock units issued to Mr. Iglesias, which will vest during the first three years of his employment.

|

|

|

(3)

|

Includes 711,199 shares of common stock and 17,252 shares of Series A Preferred Stock owned by Exeter Life, LLC., of which Mr. Horowitz

serves as Manager. Also includes 125,000 shares of common stock owned by Horowitz & Rubenstein, LLC, of which Mr. Horowitz is a Managing

Member. The Table does not reflect 500,000 shares of restricted stock units issued to Mr. Horowitz, which will vest during the first three

years of his tenure on the Board.

|

|

|

(4)

|

The Table does not reflect (a) 500,000 shares of restricted stock units issued to Mr. Mann, which will vest during the first three

years of his tenure on the Board, or (b) 1,000,000 performance stock units which will vest on July 13, 2024

|

|

|

(5)

|

Richard F. Parker has voting and dispositional control over shares owned by the Trust.

|

|

|

(6)

|

Mr. Leinwand controls the Series A shares as voting trustee appointed by Keystone Capital Partners.

|

|

|

(7)

|

Steven Horowitz has voting control over shares owned by Exeter Life LLC.

|

|

|

(8)

|

Voting and dispositional control over the shares owned by the CAI Family Trust is held by Carlos Trueba, as Trustee of the Trust.

|

|

|

(9)

|

Voting and dispositional control over the shares owned by the MAI Family Trust is held by Leonardo Miyares, as Trustee of the Trust.

|

|

|

(10)

|

Voting and dispositional control over the shares owned by the Conestoga Revocable Family Trust is held by Leyiset Crespo, as Trustee

of the Trust.

|

|

|

(11)

|

Voting and dispositional control over the shares owned by the Millersville Revocable Trust Declaration is held by Victor Klingelhofer,

as Trustee of the Trust.

|

|

|

(12)

|

Voting and dispositional control over the shares owned by the BSD Trust 1 2021 is held by Pavel Rubinov, as Trustee of the Trust.

|

|

|

(13)

|

Voting and dispositional control over the shares owned by the BSD Trust 2 2021 is held by Emma Rubinov, as Trustee of the Trust.

|

AMENDMENT OF THE ARTICLES OF INCORPORATION

TO MODIFY THE TERMS OF THE SERIES A PREFERRED

STOCK

On November 10, 2021, the Healthtech Solutions,

Inc. Board of Directors approved an amendment to Healthtech Solutions, Inc.’s Articles of Incorporation to modify the rights and

privileges of holders of the Series A Preferred Stock. On November 12, 2021 shareholders with a majority of the voting power in Healthtech

gave their written consent to the modification of the Series A Preferred Stock, as did the holders of a majority of the outstanding Series

A Preferred Stock.

The Articles of Amendment of the Articles of

Incorporation, which was filed with the Utah Secretary of State on November 12, 2021, modified the rights and privileges of the holders

of Series A Preferred Stock by (i) providing that the shares of Series A Preferred Stock are not convertible until May 31, 2024 and (ii)

providing that each share of Series A Preferred Stock may thereafter be converted into fifty shares of Healthtech Common Stock. The Articles

of Amendment also eliminated the Series B Preferred Stock and the Series C Preferred Stock, none of either class being outstanding, and

reclassified those shares to undesignated preferred stock.

The Board of Directors recommended to the Shareholders

the modification of terms of the Series A Preferred Stock to assist management in attracting investors to Healthtech. The effect of the

change in the conversion rate applicable to the Series A Preferred Stock was to reduce the fully diluted number of outstanding shares

of common stock from 284,003,023 to 68,489,023. That 76% reduction in the fully diluted number of outstanding shares increases the per

share value of Healthtech common stock proportionately and, it is hoped, will make the shares more attractive to investors. The imposition

of a delay before holders of Series A Preferred Stock may convert their shares to common share likewise is intended to make the common

stock more attractive to potential investors, who need not be concerned that sales of common stock following conversion of Series A shares

will exert downward pressure in the near terms on the market for Healthtech common stock.

No Dissenters Rights

Under Utah law, shareholders

are not entitled to dissenters’ rights with respect to the amendment of the Articles of Incorporation to modify the terms of the

Series A Preferred Stock.

* * * * *

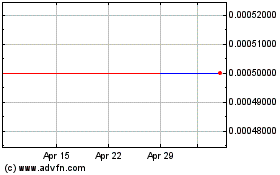

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From May 2024 to Jun 2024

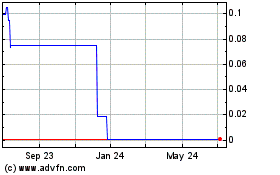

HealthTech Solutions (CE) (USOTC:HLTT)

Historical Stock Chart

From Jun 2023 to Jun 2024