| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

FORM 6-K

|

|

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 AND 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the month of:

| April 2015

|

|

SEC File No. 000-31204

|

|

GOLDEN GOLIATH RESOURCES LTD.

|

(Exact name of registrant as specified in its charter)

|

|

675 West Hastings St., #711, Vancouver, British Columbia, Canada V6B 1N2

|

(Address of principal executive offices)

|

1. Interim Financial Statements: Six Months Ended February 28, 2015

Managements’ Discussion and Analysis

Form 52-109FV2, CEO Certification

Form 52-109FV2, CFO Certification

|

|

Indicate by check mark whether the Registrant files annual reports under cover of Form 20-F or Form 40-F. Form 20-F xxx Form 40-F ___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ___

Indicate by check mark whether the Registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under Securities Exchange Act of 1934.

Yes ___ No xxx

|

SIGNATURE

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Form 6-K to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Golden Goliath Resources Ltd. -- SEC File No. 000-31204

(Registrant)

|

| |

Date: July 7, 2015

| /s/ J. Paul Sorbara

|

| J. Paul Sorbara, President/CEO/Director

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTH ENDED FEBRUARY 28, 2015 and 2014

(Expressed in Canadian Dollars)

(Unaudited)

NOTICE TO READERS

The attached condensed consolidated interim financial statements for the six months periods ended February 28, 2015 have been prepared by and are the responsibility of the Company’s management and have been approved by the Board of Directors of the Company. The Company’s independent auditor has not performed a review of these interim financial statements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Expressed in Canadian Dollars)

(Unaudited)

| | | | | | | | |

| FEBRUARY 28,

| AUGUST 31,

|

| 2014

| 2014

(Audited)

|

| | | | |

ASSETS

| | | | |

| | | | |

Current Assets

| | | | |

Cash

| $

| 9,272

| $

| 105,407

|

Marketable securities (Note 3)

| | 4,250

| | 12,750

|

Accounts receivable (Note 4)

| | 24,520

| | 23,016

|

Due from related parties (Note 12)

| | 39,572

| | 39,091

|

Prepaid expenses

| | 25,901

| | 26,241

|

Total Current Assets

| | 103,515

| | 206,505

|

| | | | |

Non-current Assets

| | | | |

Value-added taxes recoverable

| | 100,845

| | 100,074

|

Exploration and evaluation assets (Notes 5 and 13)

| | 3,420,307

| | 3,318,611

|

Property and equipment (Note 6)

| | 67,744

| | 77,116

|

| | | | |

Total Assets

| $

| 3,692,411

| $

| 3,702,306

|

| | | | |

LIABILITIES

| | | | |

| | | | |

Current Liabilities

| | | | |

Accounts payable and accrued liabilities

| $

| 272,011

| $

| 45,280

|

Due to related parties (Note 12)

| | 133,000

| | -

|

Total Current Liabilities

| | 405,011

| | 45,280

|

Non-current Liabilities

| | | | |

Employment benefit obligations

| | -

| | 69,339

|

| | | | |

Total Liabilities

| | 405,011

| | 114,619

|

| | | | |

EQUITY

| | | | |

| | | | |

Share capital (Note 7)

| | 26,044,652

| | 26,044,652

|

Share-based payments reserves

| | 2,758,145

| | 2,758,145

|

Accumulated other comprehensive loss

| | (79,013)

| | (70,513)

|

Deficit

| | (25,436,384)

| | (25,144,597)

|

Total Equity

| | 3,287,400

| | 3,587,687

|

| | | | |

Total Liabilities And Equity

| $

| 3,692,411

| $

| 3,702,306

|

|

|

Going Concern (Note 1)

|

These consolidated financial statements were authorized for issue by the Board of Directors on April 29, 2015. They are signed on behalf of the Company by:

|

| | |

“J. Paul Sorbara”

| | “Stephen W. Pearce”

|

Director

| | Director

|

See accompanying notes to consolidated financial statements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

Condensed Interim Consolidated Statement of Operations and Comprehensive Loss

(Expressed in Canadian Dollars)

(Unaudited)

| | | | | | | | |

| Three Months Ended

February 28

| Six Months Ended

February 28

|

| 2015

| 2014

| 2015

| 2014

|

| | | | | | | | |

Expenses

| | | | | | | | |

Amortization

| $

| 4,079

| $

| 5,663

| $

| 9,374

| $

| 11,267

|

Automobile

| | -

| | 592

| | -

| | 1,134

|

Consulting (Note 13)

| | 31,500

| | 16,583

| | 64,500

| | 33,333

|

Foreign exchange loss (gain)

| | 2,820

| | (10,086)

| | 3,694

| | (11,059)

|

Investor relations

| | 937

| | 8,498

| | 947

| | 14,528

|

Management fees (Note 13)

| | 30,000

| | 30,000

| | 60,000

| | 60,000

|

Office and general

| | 2,523

| | 36,137

| | 11,226

| | 66,062

|

Professional fees

| | 41,600

| | 40,970

| | 41,600

| | 49,810

|

Rent and utilities

| | 6,706

| | 9,920

| | 13,364

| | 19,421

|

Transfer agent and filing fees

| | 8,427

| | 925

| | 9,623

| | 1,820

|

Travel

| | -

| | 9,784

| | 163

| | 10,619

|

Wages and benefits (Note 13)

| | 5,726

| | 67,135

| | 80,686

| | 124,504

|

Loss Before Other Income

| | 134,318

| | 216,121

| | 295,177

| | 381,439

|

| | | | | | | | |

Other Income

| | | | | | | | |

Interest income

|

| -

| | 1,445

| | 3,390

| | 3,729

|

Other income

| | 3,390

| | 922

| | -

| | 6,190

|

Net Loss for the Period

| | 130,928

| | 213,754

| | 291,787

| | 371,520

|

| | | | | | | | |

Comprehensive Loss for the Period

| | | | | | | | |

Unrealized Gain (loss) on marketable securities

| | (4,250)

| | -

| | (8,500)

| | (31,875)

|

Comprehensive Loss for the Period

| $

| 135,178

| $

| 213,754

| $

| 300,287

| $

| 403,395

|

Loss Per Share – Basic and Diluted

| $

| (0.01)

| $

| (0.01)

| $

| (0.01)

| $

| (0.01)

|

| | | | | | | | |

Weighted Average Number Of Shares Outstanding – Basic and diluted

|

| 106,660,889

| | 106,660,889

|

| 106,660,889

| | 106,660,889

|

See accompanying notes to consolidated financial statements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Expressed in Canadian Dollars)

(Unaudited)

| | | | | | | | | | | | | | | |

| COMMON SHARES

| SHARE-BASED PAYMENTS RESERVE

| ACCUMULATED

OTHER

| |

| WITHOUT PAR VALUE

| |

| SHARES

| AMOUNT

| COMPREHENSIVE INCOME(LOSS)

| DEFICIT

| TOTAL EQUITY

|

Balance, August 31, 2013

| 106,660,889

| | 26,044,652

| | 2,758,145

| | (34,388)

| | (21,596,079)

| | 7,172,330

|

Other comprehensive income

| -

| | -

| | -

| | (36,125)

| | -

| | (36,125)

|

Net loss for the year

| -

| | -

| | -

| | -

| | (3,548,518)

| | (3,548,518)

|

Balance, August 31, 2014

| 106,660,889

| | 26,044,652

| | 2,758,145

| | (70,513)

| | (25,144,597)

| | 3,587,687

|

| | | | | | | | | | | |

Other comprehensive loss

| -

| | -

| | -

| | (8,500)

| | -

| | (8,500)

|

Net loss for the period

| -

| | -

| | -

| | -

| | (291,787)

| | (291,787)

|

Balance, February 28, 2015

| 106,660,889

| $

| 26,044,652

| $

| 2,758,145

| $

| (79,013)

| $

| (25,436,384)

| $

| 3,287,400

|

See accompanying notes to consolidated financial statements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in Canadian Dollars)

(Unaudited)

| | | | |

| Six months ended February 28,

|

| 2015

| 2014

|

| | | | |

Operating Activities

| | | | |

Net loss for the year

| $

| (291,787)

| $

| (371,520)

|

Adjustments to reconcile loss to net cash used in operating activities:

| | | | |

Amortization

| | 9,374

| | 11,267

|

Interest income

| | -

| | (3,729)

|

Change in non-cash operating assets and liabilities:

| | | | |

Accounts receivable and VAT recoverable

| | (2,275)

| | (21,463)

|

Accounts due from related parties

| | (481)

| | -

|

Prepaid expenses

| | 340

| | 11,799

|

Accounts payable and accrued liabilities

| | 226,731

| | (1,410)

|

Accounts due to related parties

| | 133,000

| | -

|

Employment benefit obligation

| | (69,339)

| | -

|

| |

| |

|

Cash Used In Operating Activities

| | 5,563

| | (375,056)

|

| | | | |

Investing Activities

| | | | |

Expenditures on mineral properties

| | (101,698)

| | (150,173)

|

Proceeds from redemption of short term investments

| | -

| | 500,000

|

Purchase of property and equipment

| | -

| | (2,556)

|

Interest income

| | -

| | 3,729

|

| |

| |

|

Cash Provided By (Used In) Investing Activities

| | (101,698)

| | 351,000

|

| | | | |

(Decrease) Increase In Cash During the Period

| | (96,135)

| | (24,056)

|

| | | | |

Cash, Beginning Of Period

| | 105,407

| | 297,429

|

| | | | |

Cash, End Of Period

| $

| 9,272

| $

| 273,373

|

See accompanying notes to consolidated financial statements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

1.

NATURE OF OPERATIONS AND GOING CONCERN

Golden Goliath Resources Ltd. (the “Company”) was incorporated on June 12, 1996 under the Business Corporations Act of British Columbia, Canada. The Company is a public company listed on the TSX Venture Exchange (the “TSX.V”), trading under the symbol “GNG”. The address of the Company’s corporate office and principal place of business is Suite 711, 675 West Hastings Street, Vancouver, British Columbia, Canada. The Company’s principal business activity is the acquisition and exploration of resource properties.

The Company is in the exploration stage and is in the process of evaluating its Mexican resource properties and has not yet determined whether these properties contain reserves that are economically recoverable. The recoverability of amounts shown for exploration and evaluation assets are dependent upon the discovery of economically recoverable reserves, confirmation of the Company’s interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the development of the properties and upon future profitable production or proceeds from the disposition thereof. Managements’ plan in this regard is to secure additional funds through future equity financings, which either may not be available or may not be available on reasonable terms.

The consolidated interim financial statements have been prepared on the basis of accounting principles applicable to a going concern. This assumes the Company will operate for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. Accordingly, they do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities, contingent obligations and commitments other than in the normal course of business and at amounts different from those in the financial statements. The Company has incurred operating losses since inception, has no source of operating cash flow, minimal income from short-term investments, and there can be no assurances that sufficient funding, including adequate financing, will be available to complete the exploration of its mineral properties and to cover general and administrative expenses necessary for the maintenance of a public company. The ability of the Company to arrange additional financing in the future depends in part, on the prevailing capital market conditions and mineral property exploration success. These factors cast substantial doubt on the Company’s ability to continue as a going concern. Accordingly, the financial statements do not give effect to adjustments that would be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and liquidate its liabilities, contingent obligations and commitments other than in the normal course of business and at amounts different from those in the financial statements.

2.

BASIS OF PRESENTATION

a) Statement of Compliance

These consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) which the Company has adopted in its annual consolidated financial statements as at and for the year ended August 31, 2012. The significant accounting policies presented in this note have been consistently applied in each of the years presented.

b)

Basis of Preparation

These consolidated interim financial statements have been prepared on a historical cost basis except for financial instruments that have been measured at fair value. These consolidated interim financial statements have also been prepared using the accrual basis of accounting, except for cash flow information. In the opinion of management, all adjustments (including normal recurring accruals), considered necessary for a fair presentation have been included.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

2.

BASIS OF PRESENTATION (Continued)

c)

Foreign Currencies

The Company’s reporting currency and functional currency is the Canadian dollar. Transactions in United States (“US”) and Mexican (“MXN”) foreign currencies have been translated into Canadian dollars as follows:

·

Monetary items at the rate prevailing at the balance sheet date;

·

Non-monetary items at the historical exchange rate;

·

Revenues and expenses at the average rate in effect during the applicable accounting period; and

·

Gains or losses arising on foreign currency translation are included in the statements of operations and comprehensive loss.

d)

Significant Accounting Judgments and Estimates

The preparation of these consolidated interim financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period. Actual outcomes could differ from these estimates. The consolidated financial statements include estimates which, by their nature, are uncertain. The impacts of such estimates are pervasive throughout the consolidated financial statements, and may require accounting adjustments based on future occurrences. Revisions to accounting estimates are recognized in the period in which the estimate is revised and may affect both the period of revision and future periods.

Significant assumptions about the future and other sources of estimation uncertainty that management has made at the statement of financial position date, that could result in a material adjustment to the carrying amounts of assets and liabilities, in the event that actual results differ from assumptions made, relate to, but are not limited to, the following:

Intangible Exploration and Evaluation Assets

Management is required to assess impairment in respect of intangible exploration and evaluation assets. Note 13 discloses the carrying value of such assets. The triggering events for exploration and evaluation assets are defined in IFRS 6 Exploration and evaluation of mineral resources and are as follows:

·

the period for which the entity has the right to explore in the specific area has expired during the period or will expire in the near future;

·

substantive expenditure on further exploration for and evaluation of mineral resources in the specific area is neither budgeted nor planned;

·

exploration for and evaluation of mineral resources in the specific area have not led to the discovery of commercially viable quantities of mineral resources, and the entity has decided to discontinue such activities in the specific area;

·

sufficient data exists to indicate that, although a development in the specific area is likely to proceed, the carrying amount of the exploration and evaluation asset is unlikely to be recovered in full from successful development or by sale.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

2.

BASIS OF PRESENTATION (Continued)

d)

Significant Accounting Judgments and Estimates (Continued)

Intangible Exploration and Evaluation Assets (Continued)

In making the assessment, management is required to make judgments on the status of each project and the future plans towards finding commercial reserves. The nature of exploration and evaluation activity is such that only a proportion of projects are ultimately successful and some assets are likely to become impaired in future periods.

Management’s assumption that there are currently no decommissioning liabilities is based on the facts and circumstances that exist during the period.

3.

MARKETABLE SECURITIES

Marketable securities consist of 425,000 (August 31, 2014 – 425,000) common shares of Comstock Metals Ltd. with a fair value of $4,250 (August 31, 2014 - $12,750).

Marketable securities are measured at fair value with changes in fair value recorded in other comprehensive income (loss) until the investment is derecognized or impaired, at which time, the gain (loss) would be recorded in net income.

4.

ACCOUNTS RECEIVABLE

Accounts receivable consists of the following:

| | | |

| | February 28,

| August 31,

|

| | 2015

| 2014

|

| | | |

| Sales taxes recoverable

| $ 1,508

| $ 1,765

|

| Other receivable

| 23,012

| 21,251

|

| | $ 24,520

| $ 23,016

|

5.

EXPLORATION AND EVALUATION ASSETS

Detailed exploration and evaluation expenditures incurred in respect to the Company’s mineral property interests owned, leased or held under option are disclosed in Note 17. Property payments made on the Company’s mineral property interests are included in the property descriptions below. Acquisition costs paid through February 28, 2015 are as follows:

| | | |

| San Timoteo, Oro Leon, Nueva Union, La Reforma

| $

| 69,257

|

| Oteros, La Esperanza, La Hermosa

| | -

|

| Bufalo, La Barranca

| | -

|

| Los Hilos, Las Bolas, El Manto, Don Lazaro, La Verde

| | 187,123

|

| Nopalera, Flor de Trigo

| | 78,393

|

| Corona, Beck, El Chamizal, El Canario, La Cruz

| | -

|

| Las Trojas, La Gloria, Todos los Santos, Los Cantiles

| | -

|

| | $

| 334,773

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

5.

EXPLORATION AND EVALUATION ASSETS (Continued)

The Company has an extensive property portfolio of mining concessions, acquired mainly through staking, in the Uruachic District of Mexico covering approximately 10,000 hectares. The Company has various net smelter returns on specific claims forming a part of the Company’s properties. The net smelter returns range from 1% to 3%, which have buyouts ranging from US$250,000 to US$2,000,000.

In May 2007 and amended April 2011, the Company optioned to Comstock Metals Ltd. (“Comstock”) the right to earn up to a 75% and 60% interest respectively in the Corona and El Chamizal properties in exchange for Comstock spending $500,000 and $200,000 on the respective properties before February 8, 2014, and issuing 300,000 (300,000 common shares received) and 150,000 (25,000 common shares received) common shares respectively to the Company over a period of two years. In order to keep the option in good standing, Comstock paid $50,000 and issued an additional 200,000 common shares to the Company.

The Company has received notice from Comstock that it has spent in excess of $1,000,000 at Corona and effective April 9, 2013 the Company and Comstock entered into a joint venture agreement to further explore the property whereby Comstock shall act as the operator. The Company is responsible for 40% of all exploration costs going forward.

Comstock has advised the Company that it will no longer proceed with the El Chamizal option and has returned a 100% interest in the property back to the Company.

In December 2011,and as amended January 25, 2012, the Company signed an Earn-in and Shareholders Agreement with Agnico-Eagle Mines Limited (“Agnico”) for the exploration and development of the Company’s Las Bolas/Los Hilos property. Under the terms of the agreement, Agnico has the right to earn a 51% interest in the property by spending $5,000,000 on the property over a period of 5 years. The first year’s work commitment is a firm commitment of $500,000 with expenditure requirements increasing each year thereafter. Upon fulfilling the commitments for 51% interest, they will have deemed to acquire 71% interest without further consideration.

In August 2013 Agnico has elected to terminate the agreement.

During the year ended August 31, 2014, $2,883,086 (2013 - $2,178,691) in deferred expenditures related to certain mineral claims were written down, mainly related to the Company’s Las Bolas/Los Hilos Property. A number of smaller claims were written off which the Company will continue to hold but which are not viewed as priorities and management does not currently intend to conduct any exploration activities on these non core claims in the next year.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

6.

PROPERTY AND EQUIPMENT

| | | | | | | | | |

| COST

| EQUIPMENT

| VEHICLES

| LAND

| TOTAL

|

| Balance August 31, 2013

| $

| 154,768

| $

| 101,610

| $

| 18,917

| $

| 275,295

|

| Additions

| | 2,557

| | -

| | -

| | 2,557

|

| Disposal

| | -

| | (10,795)

| | -

| | (10,795)

|

| Balance August 31, 2014

| | 157,325

| | 90,815

| | 18,917

| | 267,057

|

| Balance February 29, 2015

| $

| 157,325

| $

| 90,815

| $

| 18,917

| $

| 267,057

|

| | | | | | | | | |

| ACCUMULATED AMORTIZATION

| EQUIPMENT

| VEHICLES

| LAND

| TOTAL

|

| Balance August 31, 2013

| $

| 96,346

| $

| 81,916

| $

| -

| $

| 178,262

|

| Amortization

| | 19,899

| | 2,574

| | -

| | 22,473

|

| Disposal

| | -

| | (10,795)

| | -

| | (10,795)

|

| Balance August 31, 2014

| | 116,245

| | 73,695

| | -

| | 189,940

|

| Amortization

| | 8,514

| | 859

| | -

| | 9,373

|

| Balance February 29, 2015

| $

| 124,759

| $

| 74,554

| $

| -

| $

| 199,313

|

| | | | | | | | | |

| CARRYING AMOUNTS

| | | | | | | | |

| As at August 31, 2014

| $

| 41,080

| $

| 17,120

| $

| 18,917

| $

| 77,117

|

| As at February 29, 2015

| $

| 32,566

| $

| 16,261

| $

| 18,917

| $

| 67,744

|

7.

SHARE CAPITAL AND RESERVES

Authorized

The authorized share capital of the Company consists of an unlimited number of common shares without par value.

Issued and Fully Paid

As at February 28, 2015, the Company had 106,660,889 (August 31, 2014 – 106,660,889) common shares issued and fully paid.

Warrants

As at February 28, 2015, the following share purchase warrants issued on March 28, 2013 in connection with private placements were outstanding:

| | | |

| NUMBER OF WARRANTS

| EXERCISE PRICE

| EXPIRY DATES

|

| 10,833,333

| 0.12

| March 26, 2016

|

| 1,155,555

| 0.09

| March 26, 2016

|

| 11,988,888

| | |

Stock Options

The Company has a 10% rolling stock option plan for its directors, officers, employees and consultants to acquire common shares of the Company at a price determined by the fair market value of the shares at the date of grant. The Company’s stock option plan provides for immediate vesting, or vesting at the discretion of the Board at the time of the option grant and are exercisable for a period of up to 5 years. Stock options granted to investor relations’ consultants vest over a twelve month period, with one quarter of such options vesting in each three month period.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

7.

SHARE CAPITAL AND RESERVES (Continued)

Stock Options (Continued)

On December 21, 2011, the Company granted 2,825,000 incentive stock options to directors and officers of the Company and 1,215,000 incentive stock options to employees and consultants of the Company, at a price of $0.25 per share, exercisable for a period of five years.

On July 16, 2012, the Company granted 1,375,000 incentive stock options to directors and officers of the Company and 300,000 incentive stock options to employees and consultants of the Company, at a price of $0.20 per share, exercisable for a period of five years.

The fair value of the stock options granted during the year ended August 31, 2012 was estimated at the date of grant using a Black-Scholes option pricing model with the following weighted average assumptions:

| | | |

| | December 21, 2011

| July 16, 2012

|

| Stock based compensation

| $553,675

| $ 223,672

|

| Risk-free interest rate

| 1.18%

| 1.12%

|

| dividend yield of nil, volatility factor

| 102.71%

| 102.49%

|

| weighted average expected life of the options

| 5 years

| 5 years

|

A summary of changes in stock options is presented below:

| | | |

| | | WEIGHTED

|

| | NUMBER

| AVERAGE

|

| | OF

| EXERCISE

|

| | SHARES

| PRICE

|

| | | |

| Balance, August 31, 2013

| 8,190,000

| 0.23

|

| Cancelled

| (815,000)

| 0.25

|

| Expired

| (625,000)

| 0.10

|

| | | |

| Balance, August 31, 2014 and February 28, 2015

| 6,750,000

| $ 0.24

|

The weighted average remaining contractual life of options outstanding at February 28, 2015 was 1.49 years (August 31, 2014 – 1.98 years).

Nature and Purpose of Reserves

The reserves recorded in equity on the Company’s Statements of Financial Position is comprised of ‘Share-based Payment Reserves’ and is used to recognize the fair value of stock option grants prior to exercise, expiry or cancellation and the fair value of other share-based consideration paid at the date of payment.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

8.

LOSS PER SHARE

The Company calculates the basic and diluted loss per common share using the weighted average number of common shares outstanding during each period and the diluted loss per share assumes that the outstanding vested stock options and share purchase warrants had been exercised at the beginning of the year.

To compute diluted earnings per share, the average number of shares outstanding is adjusted for the number of all potentially dilutive shares. As of February 28, 2015 the Company had a total of 6,750,000 (August 31, 2014 6,750,000) stock options outstanding. As of February 28, 2015 the Company also had a total of 11,988,888 warrants outstanding out of which 1,155,555 were potentially dilutive. Dilutive options and warrants were not included in the Company’s loss per common share calculation because the result was anti-dilutive.

| | | | | |

| | SIX MONTH ENDED FEBRUARY 28,

|

| | 2015

| 2014

|

| Basic weighted average common shares

| | 106,660,889

| | 106,660,889

|

9.

SEGMENTED INFORMATION

The Company has one operating segment, which is mineral exploration. All mineral properties are located in Mexico. All option proceeds are attributable to the Mexican mineral properties. Assets by geographic segment, at cost, are as follows:

| | | | | | | |

| | CANADA

| MEXICO

| TOTAL

|

| | | | | | | |

| February 28, 2015

| | | | | | |

| | | | | | | |

| Current assets

| $

| 81,450

| $

| 22,065

| $

| 103,515

|

| Equipment

| $

| 14,771

| $

| 52,973

| $

| 67,744

|

| Exploration and evaluation assets

| $

| -

| $

| 3,420,307

| $

| 3,420,307

|

| VAT Recoverable

| $

| -

| $

| 100,845

| $

| 100,845

|

| Total assets

| $

| 96,221

| $

| 3,596,190

| $

| 3,692,411

|

| Accounts payable and accrued liabilities

| $

| 96,972

| $

| 160,211

| | 257,183

|

| Net loss and comprehensive loss

| $

| 249,542

| $

| 46,495

| $

| 296,037

|

| | | | | | | |

|

August 31, 2014

| | | | | | |

| | | | | | | |

| Current assets

| $

| 184,869

| $

| 21,636

| $

| 206,505

|

| Equipment

| $

| 21,771

| $

| 55,345

| $

| 77,116

|

| Exploration and evaluation assets

| $

| -

| $

| 3,318,611

| $

| 3,318,611

|

| VAT Recoverable

| $

| -

| $

| 100,074

| $

| 100,074

|

| Total assets

| $

| 206,640

| $

| 3,495,666

| $

| 3,702,306

|

| Accounts payable and accrued liabilities

| $

| 19,147

| $

| 26,133

| | 45,280

|

| Employment benefit obligations

| $

| -

| $

| 62,339

| $

| 69,339

|

| Interest income

| $

| 4,149

| $

| 7

| $

| 4,156

|

| Net loss and comprehensive loss

| $

| -

| $

| -

| $

| 3,548,518

|

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

10.

FINANCIAL INSTRUMENTS

As at February 28, 2015 and August 31, 2014, the carrying value of the Company’s financial instruments approximates their fair value. Cash and cash equivalents and short term investments are recorded at fair value and the Company’s other financial instruments are recorded at amortized cost, which approximates fair value due to their short term nature. The Company’s financial instruments are classified into the following categories:

| | | | | | | | | | |

| | | |

| | | February 28, 2015

| AUGUST 31, 2014

|

| | LEVEL

| CARRYING

VALUE

| FAIR

VALUE

| CARRYING

VALUE

| FAIR VALUE

|

| Held for Trading

| | | | | | | | | |

| Cash

| 1

| $

| 9,272

| $

| 9,272

| $

| 105,407

| $

| 105,407

|

| Available for sale

| | | | | | | | | |

| Marketable Securities

| 1

| $

| 4,250

| $

| 4,250

| $

| 12,750

| $

| 12,750

|

| Loans and receivables

| | | | | | | | | |

| Accounts receivable

| 2

| $

| 24,520

| $

| 24,520

| $

| 23,016

| $

| 23,016

|

| Due from related parties

| 2

| $

| 39,572

| $

| 39,572

| $

| 39,091

| $

| 39,091

|

| Other Financial Liabilities

| | | | | | | | | |

| Accounts payable and accrued liabilities

| 2

| $

| 272,011

| $

| 272,011

| $

| 45,280

| $

| 45,280

|

| Due from related parties

| 2

| $

| 133,000

| $

| 133,000

| $

| -

| $

| -

|

| Employee benefits obligations

| 2

| $

| -

| $

| -

| $

| 69,339

| $

| 69,339

|

There have been no transfers between levels 1 and 2, or transfers in or out of level 3 for the period ended February 28, 2015 and the year ended August 31, 2014.

Financial Instrument Risk Exposure and Risk Management

The Company is exposed in varying degrees to a variety of financial instrument related risks. The Board of Directors approves and monitors the risk management process. The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Company’s competitiveness and flexibility. The types of risk exposure and the way in which such exposure is managed is provided as follows:

Credit Risk

Credit risk is the risk that one party to a financial instrument will fail to fulfil an obligation and cause the other party to incur a financial loss. The Company’s credit risk to its financial asset is summarized below:

| | | | | |

| | February 28, 2015

| August 31, 2014

|

| Cash

| $

| 9,272

| $

| 105,407

|

| Short term investments

| $

| -

| $

| -

|

| Marketable securities

| $

| 4,250

| $

| 12,750

|

| Accounts receivable

| $

| 24,520

| $

| 23,016

|

| Due from related parties

| $

| 39,572

| $

| 39,091

|

| VAT recoverable

| $

| 100,845

| $

| 100,074

|

The credit risk of cash, and short-term investments, is assessed as nominal as the counter party is major Canadian financial institutions. The credit risk of accounts receivable and marketable securities is assessed as low. The carrying amount of these financial assets is their maximum exposure to credit risk. The Company does not invest in asset–backed commercial papers.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

10.

FINANCIAL INSTRUMENTS (continued)

Liquidity Risk

Liquidity risk is the risk that the Company will encounter difficulties in meeting its financial obligations associated with its financial liabilities as they fall due. The Company ensures that there is not sufficient capital in order to meet short term business requirements, after taking into account the Company’s holdings of cash.

As of February 28, 2015 the Company does not have sufficient cash and highly liquid investment on hand to meet current liabilities and its expected administrative requirements for the coming year. The Company has cash of $9,272 (August 31, 2014 - $105,407), highly liquid investments of $nil (August 31, 2014 - nil) and total liabilities of $405,011 (August 31, 2014 - $109,498). Accounts payable and accrued liabilities of $405,011 (August 31, 2014 $45,280) are due within three months. Management has assessed liquidity risk as high.

Market Risk

The significant market risk exposures to which the Company is exposed are foreign exchange risk, interest rate risk, and commodity price risk.

Foreign Currency Risk

The Company has operations in Canada and Mexico subject to foreign currency fluctuations. The Company’s operating expenses are incurred in Canadian dollars and Mexican pesos, and the fluctuation of the Canadian dollar in relation to this other currency will have an impact upon the profitability of the Company and may also affect the value of the Company’s assets and the amount of shareholders’ equity. The Company has not entered into any agreements or purchased any instruments to hedge possible currency risks.

Foreign Currency Risk (Continued)

Financial assets and liabilities denominated in Mexican Pesos and U.S. dollars were as follows:

| | | | | |

| | FEBRUARY 28, 2015

| AUGUST 31, 2014

|

| U.S. Dollars

| | | | |

| Financial assets

| $

| -

| $

| 12

|

| Financial Liabilities

| $

| 9,500

| $

| -

|

| Mexican Pesos

| | | | |

| Financial assets

| $

| 114,508

| $

| 160,070

|

| Financial Liabilities

| $

| 175,038

| $

| 179,918

|

Based on the above net exposures as at February 28, 2015, and assuming that all other variables remain constant, a 10% change in the value of the Mexican peso against the Canadian dollar would result in an increase/decrease of approximately $6,000 in the loss from operations. Based on the above net exposures as at February 28, 2015, and assuming that all other variables remain constant, a 10% change in the value of the US dollar against the Canadian dollar would result in an increase/decrease of approximately $950 in the loss from operations.

Interest Rate Risk

As at February 28, 2015, the Company has no significant exposure to interest rate risk through its financial instruments.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

10.

FINANCIAL INSTRUMENTS (continued)

Interest Rate Risk (Contilued)

The Company's operations are in northern Mexico and are subject to various levels of political, economic and other risks and uncertainties unique to Mexico. These risks and uncertainties may include: extreme fluctuations in currency exchange rates; high rates of inflation; labor unrest; risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; corruption; restrictions on foreign exchange and repatriation; hostage taking; and changing political conditions and currency controls. In addition, the Company may have to comply with multiple and potentially conflicting regulations in Canada and Mexico, including export requirements, taxes, tariffs, import duties and other trade barriers, as well as health, safety and environmental requirements. Changes, if any, in mining or investment policies or shifts in political attitude in Mexico may adversely affect the Company's operations. Operations may be affected in varying degrees by government regulations with respect to matters including restrictions on production, price controls, export controls, currency controls or restrictions, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights applications and tenure could result in loss, reduction or expropriation of entitlements or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

11.

CAPITAL DISCLOSURES

The Company was formed for the purpose of acquiring exploration and development stage natural resource properties. The directors determine the Company’s capital structure and make adjustments to it based on funds available to the Company, in order to support the acquisition, exploration and development of mineral properties. The directors have not established quantitative return on capital criteria for capital management.

The Company is dependent upon external financing to fund future exploration programs and its administrative costs. The Company will spend existing working capital and raise additional amounts as needed. The Company will continue to assess new properties and to seek to acquire an interest in additional properties if management feels there is sufficient geologic or economic potential provided it has adequate financial resources to do so.

The directors review the Company’s capital management approach on an ongoing basis and believe that this approach, given the relative size of the Company, is reasonable. The Company’s objective when managing capital is to safeguard the Company’s ability to continue as a going concern.

The Company considers the items included on the balance sheet in shareholders’ equity as capital. The Company manages the capital structure and makes adjustments to it in the light of changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Company may issue new shares through private placements, sell assets to reduce debt or return capital to shareholders. There were no changes to the Company’s approach to capital management during the year. Neither the Company nor its subsidiaries are subject to externally imposed capital requirements.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

12.

RELATED PARTY BALANCES AND TRANSACTIONS

Key Management Compensation

| | | | | |

| | SIX MONTH ENDED

|

| | FEBRUARY 28

|

| | 2015

| 2014

|

| | | | | |

| Golden Goliath Resources Ltd.

| | | | |

| Management fees

| $

| 30,000

| $

| 30,000

|

| Consulting fees

| | 30,000

| | 30,000

|

| Minera Delta S.A. de C.V.

| | | | |

| Wages and benefits

| | 6,000

| | 2,574

|

| | | | | |

| Total

| $

| 66,000

| $

| 62,574

|

Payments to key management personnel including the President, Chief Financial Officer, directors and companies directly controlled by key management personnel, and a former director, are directly related to their position in the organization.

Other Related Party Transactions

The Company entered into the following transactions and had the following balances payable with related parties. The transactions were recorded at the exchange amount agreed to by the related parties. Balances outstanding are non-interest bearing, unsecured and had no specific terms for collection or repayment.

a)

Due from related parties consists of $39,531 (August 31, 2014 - $35,091) due from companies controlled by common directors.

b)

Due to related parties consists of $65,500 (August 31, 2014 - $nil) due to directors and companies controlled by common directors.

GOLDEN GOLIATH RESOURCES LTD.

(An Exploration Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED FEBRUARY 28, 2015 AND 2014

(Expressed in Canadian Dollars)

(Unaudited)

13.

EXPLORATION AND EVALUATION ASSETS

| | | | | | | | | | |

| | San Timoteo

Oro Leon

Nueva Union

La Reforma

| Oteros

La Esperanza

La Hermosa

| Bufalo

La Barranca

| Los Hilos

Las Bolas

El Manto

Don Lazaro

La Verde

|

Nopalera

Flor de Trigo

| Corona Beck

El Chamizal

El Canario

La Cruz

|

Las Trojas

La Gloria

Todos los Santos

Los Cantiles

| Yudit

| Total

|

| | | | | | | | | | |

| Balance, August 31, 2013

| $ 2,120,498

| $ -

| $ 291,041

| $ 2,047,489

| $ 899,322

| $ 4,003

| $ 187,312

| $ --

| $ 5,549,665

|

| | | | | | | | | | |

| Incurred during the year

| | | | | | | | | |

| Assaying

| 1,760

| --

| --

| --

| --

| --

| 49

| --

| 1,809

|

| Geology and mapping

| 145

| --

| --

| --

| --

| 101

| (1,376)

| --

| (1,130)

|

| Property taxes and passage rights

| 21,727

| 10,709

| 56,546

| 9,016

| 28,011

| 11,423

| 3,524

| --

| 140,956

|

| Salaries

| 24,453

| --

| --

| --

| --

| 6,770

| --

| --

| 31,223

|

| Travel

| 5,538

| --

| --

| --

| --

| 984

| 669

| --

| 7,191

|

| Road construction and site preparation

| --

| --

| --

| --

| --

| --

| --

| --

| --

|

| Facilities and other

| 37,459

| --

| 670

| --

| --

| 34,356

| 62,658

| 2,067

| 137,210

|

| Write down

| (2,211,580)

| (10,709)

| (348,257)

| --

| --

| (57,637)

| (252,836)

| (2,067)

| (2,883,086)

|

| Balance, August 31, 2014

| --

| --

| --

| 2,056,505

| 927,333

| --

| --

| --

| 2,983,838

|

| | | | | | | | | | |

| Incurred during the year

| | | | | | | | | |

| Geology and mapping

| --

| --

| --

| 340

| --

| --

| --

| --

| 340

|

| Property rights

| 14,530

| 6,343

| 40,948

| 7,253

| 15,590

| 16,504

| 188

| | 101,356

|

| Balance, February 28, 2015

| $ 14,530

| $ 6,343

| $ 40,948

| $ 2,064,098

| $ 942,923

| $ 16,504

| $ 188

| $ --

| $ 3,085,534

|

Management Discussion and Analysis

For

Golden Goliath Resources Ltd.

For the Quarter ending February 28, 2015

The following management discussion and analysis has been prepared as of April 29, 2015. The selected financial information set out below and certain comments which follow are based on and derived from the management prepared condensed interim consolidated financial statements of Golden Goliath Resources Ltd. (the “Company” or “Golden Goliath”) for the second quarter ended February 28, 2015 and should be read in conjunction with them.

Forward Looking Information

Certain statements contained in the following Management’s Discussion and Analysis constitutes forward looking statements. Such forward looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from actual future results and achievements expressed or implied by such forward looking statements. Readers are cautioned not to place undue reliance on these forward looking statements, which speak only as of the date the statements were made. Readers are also advised to consider such forward looking statements while considering the risks set forth below.

General

Golden Goliath is a Canadian listed public company with its shares traded on the TSX Venture Exchange under the symbol “GNG” as a Tier 2 company.

Golden Goliath is a junior exploration company with no revenues from mineral producing operations. The Company’s properties are all located in the State of Chihuahua, Mexico. Activities include acquiring mineral properties and conducting exploration programs. The mineral exploration business is risky and most exploration projects will not become mines. The Company may offer to a major mining company the opportunity to acquire an interest in a property in return for funding by the major mining company, of all or part of the exploration and development of the property. For the funding of property acquisitions and exploration that the Company conducts, the Company does not use long term debt. Rather, it depends on the issue of shares from the treasury to investors. Such stock issues in turn depend on numerous factors, important among which are a positive mineral exploration climate, positive stock market conditions, a company’s track record and the experience of management.

Overall Performance

During the quarter ended February 28, 2015 no significant field work was conducted on the Company’s properties. Presentations about the Company’s properties as well as field tours and discussions about possible options and/or partnerships were conducted.

Cost cutting measures continued company-wide due to market conditions. The Company looks to advance the properties by way of partnerships, strategic alliances and possible future equity financings depending on market conditions. Discussions with a major company regarding possible option agreements were initiated and continued into the due diligence phase.

Other Properties

During the quarter ended February 28, 2015, Golden Goliath personnel conducted site visits by other parties on several of the Company’s properties in the Uruachic district. No significant new work was conducted on the Company’s other properties.

Results of Operation

For the quarter ended February 28, 2015, the Company incurred a comprehensive loss $135,178 compared to $165,109 in the prior quarter and a comprehensive loss of $213,754 in the second quarter of the last fiscal year. The significant differences between these periods include:

·

Consulting fees the past quarter were $31,500 in the past quarter compared to $16,583 in the prior year as director fees were accrued for the quarter. The Board believed director fees were appropriate due to their efforts and increased work load.

·

Travel costs were nil in the past quarter compared to $9,784 in the prior year as the Company continues to minimize costs.

·

Wages and benefits decreased to $5,726 in the past quarter from $74,960 in the prior quarter and $67,135 in the second quarter of last year as the Company reduced the number of employees in Mexico.

As of February 28, 2015, deferred mineral property exploration costs totalled $3,420,307 compared to $3,318,611 at August 31, 2014. During the six month period ending February 28, 2015, the Company incurred a total of $101,696 in exploration expenditures.

Summary of Quarterly Results

The following table sets forth selected quarterly financial information for each of the last eight (8) quarters prepared in accordance with IFRS.

| | | |

Quarter Ending

| Revenue

| Comprehensive Loss

| Net Loss per Share

|

| | | |

February 28, 2015

| 3,390

| 130,928

| 0.01

|

November 30, 2014

| Nil

| 165,109

| 0.00

|

August 31, 2014

| 4,982

| 3,028,817

| 0.03

|

May 31, 2014

| 1,996

| 152,431

| 0.00

|

February 28, 2014

| 2,367

| 213,754

| 0.00

|

November 30, 2013

| 7,552

| 189,641

| 0.00

|

August 31, 2013

| 3,289

| 2,372,282

| 0.02

|

May 31, 2013

| 3,276

| 172,806

| 0.00

|

NOTE: The revenue relates to interest earned or option payments received consisting of cash and shares. There were no discontinued operations or extraordinary items on the Company’s financial statements during the above mentioned periods. The large increase in comprehensive losses in the fourth quarters ended August 31, 2013 and 2014 were a result of property write downs during those quarters of $2,178,691 and $2,883,086, respectively.

Liquidity and Capital Resources

The Company has financed its operations almost exclusively through the sale of its common shares to investors and will be required to continue to do so for the foreseeable future.

The Company had working capital (deficit) of ($301,496) at February 28, 2015 compared to of $161,225 at August 31, 2014. The Company’s cash and short-term investment position at February 28, 2015 was $16,074.

In the third quarter of 2013, the Company closed a private placement for $1,300,000. The financing consisted of 14,444,444 units being issued at a price of $0.09 per unit. Each unit consisted of one share and three-quarters of one share purchase warrant. Each whole warrant is exercisable at $0.12 for a period of three years. In addition, the Company issued 1,155,555 finder’s warrants exercisable at $0.09 for three years.

Capital Resources

Other than property taxes which are approximately $240,000 per year, the Company does not have any capital resource commitments.

Transactions with Related Parties

Key Management Compensation

| | | | | | |

| | SIX MONTHS ENDED

|

| | FEBRUARY 28,

|

| | 2014

| 2013

|

| | | | | |

| Golden Goliath Resources Ltd.

| | | | |

| Management fees

| $

| 30,000

| $

| 30,000

|

| Consulting fees

| | 30,000

| | 30,000

|

| Minera Delta S.A. de C.V.

| | | | |

| Wages and benefits

| | 6,000

| | 2,574

|

| | | | | |

| Total

| $

| 66,000

| $

| 62,574

|

Payments to key management personnel including the President, Chief Financial Officer, directors and companies directly controlled by key management personnel, and a former director, are directly related to their position in the organization.

Other Related Party Transactions

The Company entered into the following transactions and had the following balances payable with related parties. The transactions were recorded at the exchange amount agreed to by the related parties. Balances outstanding are non-interest bearing, unsecured and had no specific terms for collection or repayment.

a)

Due from related parties consists of $39,531 (August 31, 2014 - $35,091) due from companies controlled by common directors.

b)

Due to related parties consists of $65,500 (August 31, 2014 - $Nil) due to directors and companies controlled by common directors.

Critical Accounting Estimates

Exploration and Evaluation Assets

Exploration and evaluation expenditures include the costs associated with exploration and evaluation activity. Exploration and evaluation expenditures are capitalized as incurred. Costs incurred before the Company has obtained the legal rights to explore an area are recognized in profit or loss.

Exploration and evaluation assets are assessed for impairment if (i) sufficient data exists to determine technical feasibility and commercial viability, and (ii) facts and circumstances suggest that the carrying amount exceeds the recoverable amount.

Once the technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable, which management has determined to be indicated by a feasibility study, exploration and evaluation assets attributable to that area of interest are first tested for impairment and then reclassified to mining property and development assets.

Recoverability of the carrying amount of any exploration and evaluation assets is dependent on successful development and commercial exploitation, or alternatively, sale of the respective areas of interest.

It is management’s judgment that none of the Company’s exploration and evaluation assets have reached the development stage and as a result are all considered to be exploration and evaluation assets.

Although the Company has taken steps to verify title to mineral properties in which it has an interest, in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the Company’s title. Property may be subject to unregistered prior agreements and non-compliance with regulatory requirements. The Company is not aware of any disputed claims of title.

Changes in Accounting Policy

There were no changes in accounting policy in the past quarter.

Financial Instruments and Other Instruments

The Company has not entered into any specialized financial agreements to minimize its investment risk, currency risk or commodity risk. As of the date hereof, the Company’s investment in resource properties has full exposure to commodity risk, both upside and downside. As the metal prices move so too does the underlying value of the Company’s metal projects.

Outstanding Share Data

The authorized share capital consists of an unlimited number of common shares. As of February 28, 2015 and the date hereof, an aggregate of 106,660,889 common shares were issued and outstanding.

The Company has 10,833,333 share purchase warrants exercisable at $0.12 and 1,155,555 finder’s warrants exercisable at $0.09 outstanding as of November 30, 2014 and the date hereof.

As of February 28, 2015, the Company had 6,750,000 incentive stock options outstanding with a weighted average remaining contractual life of 1.49 years at a weighted average exercise price of $0.24.

Disclosure Controls and Procedures

Disclosure controls and procedures (“DC&P”) are intended to provide reasonable assurance that information required to be disclosed is recorded, processed, summarized and reported within the time periods specified by securities regulations and that information required to be disclosed is accumulated and communicated to management. Internal controls over financial reporting (“ICFR”) are intended to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purpose in accordance with Canadian generally accepted accounting principles.

TSX Venture listed companies are not required to provide representations in the annual filings relating to the establishment and maintenance of DC&P and ICFR, as defined in Multinational Instrument 52-109. In particular, the CEO and CFO certifying officers do not make any representations relating to the establishment and maintenance of (a) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation, and (b) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer’s GAAP. The issuer’s certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in their certificates regarding the absence of misrepresentations and fair disclosure of financial information. Investors should be aware that inherent limitation on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in Multinational Instrument 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

Additional information relating to the Company can be found on SEDAR at www.sedar.com and also on the Company’s website at www.goldengoliath.com.

CERTIFICATION OF INTERIM FILINGS

VENTURE ISSUER BASIC CERTIFICATE

I, J. Paul Sorbara, Chief Executive Officer of Golden Goliath Resources Ltd., certify the following:

1. Review: I have reviewed the interim financial report and interim MD&A (together the interim filings) of Golden Goliath Resources Ltd. (the issuer) for the interim period ended February 28, 2015.

2. No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

3. Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial report together with the other financial information included in the interim filings fairly present in all material respects the financial condition, financial performance and cash flows of the issuer, as for the date of and for the periods presented in the interim filings.

Date: April 29, 2015

”J. Paul Sorbara”

______________________

Chief Executive Officer

NOTE TO READER

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of:

i) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

ii) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer's GAAP.

The issuer's certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate.

Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

CERTIFICATION OF INTERIM FILINGS

VENTURE ISSUER BASIC CERTIFICATE

I, Stephen Pearce, Chief Financial Officer of Golden Goliath Resources Ltd., certify the following:

1. Review: I have reviewed the interim financial report and interim MD&A (together the interim filings) of Golden Goliath Resources Ltd. (the issuer) for the interim period ended February 28, 2015.

2. No misrepresentations: Based on my knowledge, having exercised reasonable diligence, the interim filings do not contain any untrue statement of a material fact or omit to state a material fact required to be stated or that is necessary to make a statement not misleading in light of the circumstances under which it was made, with respect to the period covered by the interim filings.

3. Fair presentation: Based on my knowledge, having exercised reasonable diligence, the interim financial report together with the other financial information included in the interim filings fairly present in all material respects the financial condition, financial performance and cash flows of the issuer, as of the date of and for the periods presented in the interim filings.

Date: April 29, 2015

”Stephen Pearce”

______________________

Chief Financial Officer

NOTE TO READER

In contrast to the certificate required for non-venture issuers under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109), this Venture Issuer Basic Certificate does not include representations relating to the establishment and maintenance of disclosure controls and procedures (DC&P) and internal control over financial reporting (ICFR), as defined in NI 52-109. In particular, the certifying officers filing this certificate are not making any representations relating to the establishment and maintenance of:

i) controls and other procedures designed to provide reasonable assurance that information required to be disclosed by the issuer in its annual filings, interim filings or other reports filed or submitted under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation; and

ii) a process to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with the issuer's GAAP.

The issuer's certifying officers are responsible for ensuring that processes are in place to provide them with sufficient knowledge to support the representations they are making in this certificate.

Investors should be aware that inherent limitations on the ability of certifying officers of a venture issuer to design and implement on a cost effective basis DC&P and ICFR as defined in NI 52-109 may result in additional risks to the quality, reliability, transparency and timeliness of interim and annual filings and other reports provided under securities legislation.

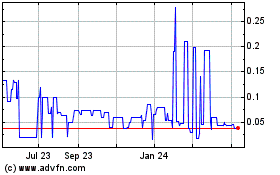

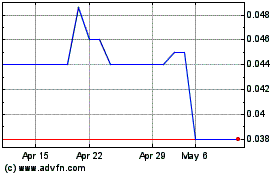

Golden Goliath Resources (PK) (USOTC:GGTHF)

Historical Stock Chart

From May 2024 to Jun 2024

Golden Goliath Resources (PK) (USOTC:GGTHF)

Historical Stock Chart

From Jun 2023 to Jun 2024