UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): November 6, 2014

FXCM Inc.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34986 |

|

27-3268672 |

| (State or Other Jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

| Incorporation) |

|

|

|

Identification No.) |

55 Water Street, FL 50 New York, NY,

10041

(Address of Principal Executive Offices)

(Zip Code)

(646) 432-2986

(Registrant’s

Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and

Financial Condition

On November 6, 2014, FXCM Inc. (“the Company”) issued

a press release announcing financial results for its third quarter ended September 30, 2014. The Company also released its monthly

business metrics for October 2014. A copy of this press release is furnished as Exhibit 99.1 to this Form 8-K and is

hereby incorporated by reference in this Item 2.02.

The information in this Current Report on Form 8-K and the Exhibit

attached hereto is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

The information set forth under Item 2.02, “Results of

Operations and Financial Condition”, is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

| (a) |

Financial statements of businesses acquired: None |

| (b) |

Pro forma financial information: None |

| (c) |

Shell company transactions: None |

| (d) |

Exhibits: Press release, dated November 6, 2014 issued by FXCM Inc. |

| Exhibit No. |

Exhibit Description |

| |

|

| 99.1** |

Press Release dated November 6, 2014 |

| |

|

** Furnished herewith.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

FXCM INC. |

| |

|

| |

By: |

/s/Robert Lande |

| |

|

Name: |

Robert Lande |

| |

|

Title: |

Chief Financial Officer |

Date: November 6, 2014

Exhibit Index

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press Release dated as of November 6, 2014 |

Exhibit 99.1

FXCM Inc. Announces Third Quarter 2014

Results

Releases October 2014 Operating Metrics

Record Month of Retail and Institutional

Volume

Third Quarter 2014 Highlights:

| · | U.S. GAAP revenues of $116.1 million, up 3% versus the same period

in 2013 and 19% from the second quarter 2014 |

| · | U.S. GAAP net income attributable to FXCM Inc. of $2.4 million or

$0.05 per fully diluted share versus a loss of $0.15 per fully diluted share for the same period in 2013 and a loss of $0.08 per

fully diluted share in the second quarter 2014 |

| · | Adjusted EBITDA of $28.4 million, down 14% versus the same period

in 2013 and up 112% from the second quarter 2014 |

| · | Net income on an adjusted basis of $8.4 million or $0.11 per fully

exchanged, fully diluted share down 13% and 15% respectively versus the same period in 2013 and versus a loss of $1.5 million or

$0.02 per share in the second quarter 2014 |

| · | Adding back tax-effected amortization and stock based compensation,

net income on an adjusted basis would have been $0.17 per share for the quarter |

| · | Strong growth in client equity to $1.33 billion - up 12% year-to-date

and up 2% from June 30, 2014 |

October 2014 Operating Metrics Highlights:

| · | Retail customer trading volume of $509 billion, 62% higher than October

2013 and a record for FXCM |

| · | Institutional customer trading volume of $393 billion, 123% higher

than October 2013 and a record for FXCM |

NEW YORK – November 6, 2014 – FXCM

Inc. (NYSE:FXCM), a leading online provider of foreign exchange, or FX, trading and related services, today announced for

the quarter ended September 30, 2014, U.S. GAAP revenues of $116.1 million, compared to $113.2 million for the quarter ended September

30, 2013, an increase of 3%. U.S. GAAP net income attributable to FXCM Inc. was $2.4 million for the Third Quarter 2014 or $0.05

per diluted share, compared to U.S. GAAP net loss of $5.1 million or $0.15 per diluted share for the Third Quarter 2013.

For the nine months ended September 30, 2014, U.S. GAAP revenues

were $329.1 million, compared to $376.2 million for the nine months ended September 30, 2013, a decrease of 13%. U.S. GAAP net

income attributable to FXCM Inc. was $1.4 million for the nine months ended September 30, 2014 or $0.03 per diluted share, compared

to U.S. GAAP net income of $11.9 million or $0.37 per diluted share for the nine months ended September 30, 2013, a decrease of

88% and 92% respectively.

“At the beginning of this quarter, volatility in the currency

markets hit all-time lows but conditions notably improved in September,” said Drew Niv, Chief Executive Officer. “The

improvement continued into October and we are pleased to announce that October is our second consecutive month of record retail

and institutional volumes.”

“With our client equity increasing by 12% year-to-date

to over $1.3 billion and with overwhelming positive feedback from clients on our new retail forex pricing model which we recently

announced,” continued Niv, “we believe we are well positioned for the future even if trading conditions were to moderate.”

Adjusted EBITDA for the Third Quarter 2014 was $28.4 million,

compared to $33.0 million for the Third Quarter 2013, a decrease of 14%. Net income on an adjusted basis was $8.4 million or $0.11

per diluted, fully exchanged share for the Third Quarter 2014, compared to Net income on an adjusted basis of $9.7 million or $0.13

per diluted, fully exchanged share for the Third Quarter 2013, a decrease of 13% and 15% respectively.

Adjusted EBITDA for the nine months ended September 30, 2014

was $66.5 million, compared to $131.2 million for the nine months ended September 30, 2013, a decrease of 49%. Net income on an

adjusted basis was $12.1 million or $0.15 per diluted, fully exchanged share for the nine months ended September 30, 2014, compared

to $50.5 million or $0.66 per diluted, fully exchanged share for the nine months ended September 30, 2013, a decrease of 76% and

77% respectively.

Adjusted EBITDA, Net income on an adjusted basis and Net income

on an adjusted basis per diluted, fully exchanged share are Non-GAAP financial measures. These measures do not represent and should

not be considered as a substitute for net income, net income attributable to FXCM Inc. or net income per Class A share or as a

substitute for cash flow from operating activities, each as determined in accordance with U.S. GAAP, and our calculations of these

measures may not be comparable to similarly entitled measures reported by other companies. See “Non-GAAP Financial Measures”

beginning on A-3 of this release for additional information regarding these Non-GAAP financial measures and for reconciliations

of such measures to the most directly comparable measures calculated in accordance with U.S. GAAP.

FXCM Inc. today announced certain key operating metrics for

October 2014 for its retail and institutional foreign exchange businesses. Monthly activities included:

October 2014 Operating Metrics

Retail Trading Metrics

| · | Retail customer trading volume(1) of $509 billion in October

2014, 23% higher than September 2014 and 62% higher than October 2013. |

| · | Average retail customer trading volume(1) per day of $22.1

billion in October 2014, 18% higher than September 2014 and 61% higher than October 2013. |

| · | An average of 584,080 retail client trades per day in October 2014,

21% higher than September 2014 and 54% higher than October 2013. |

| · | Tradeable accounts(2) of 220,180 as of October 31, 2014,

an increase of 8,161, or 4%, from September 2014, and an increase of 31,366,or 17%, from October 2013. |

Institutional Trading Metrics

| · | Institutional customer trading volume(1) of $393 billion

in October 2014, 9% higher than September 2014 and 123% higher than October 2013. |

| · | Average institutional trading volume(1) per day of $17.1

billion in October 2014, 4% higher than September 2014 and 122% higher than October 2013. |

| · | An average of 41,098 institutional client trades per day in October

2014, 4% higher than September 2014 and 41% higher than October 2013. |

More information, including historical results for each of the

above metrics, can be found on the investor relations page of the Company's corporate website www.fxcm.com.

This operating data is preliminary and subject to revision and

should not be taken as an indication of the financial performance of FXCM Inc. FXCM undertakes no obligation to publicly update

or review previously reported operating data. Any updates to previously reported operating data will be reflected in the historical

operating data that can be found on the Investor Relations page of the Company’s corporate website www.fxcm.com.

(1) Volume that FXCM customers traded in period

is translated into US dollars.

(2) A Tradeable Account is an account with sufficient

funds to place a trade in accordance with FXCM trading policies.

Selected Operating Metrics

| | |

(Unaudited) | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

% Change | | |

2014 | | |

2013 | | |

% Change | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Total retail trading volume ($ in billions) | |

$ | 977 | | |

$ | 980 | | |

| 0 | % | |

$ | 2,683 | | |

$ | 3,173 | | |

| -15 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total institutional trading volume ($ in billions) | |

$ | 881 | | |

$ | 576 | | |

| 53 | % | |

$ | 2,023 | | |

$ | 1,507 | | |

| 34 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total active accounts | |

| 184,003 | | |

| 182,146 | | |

| 1 | % | |

| 184,003 | | |

| 182,146 | | |

| 1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Trading days in period | |

| 66 | | |

| 66 | | |

| 0 | % | |

| 194 | | |

| 194 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily average retail trades | |

| 406,190 | | |

| 417,845 | | |

| -3 | % | |

| 389,478 | | |

| 457,620 | | |

| -15 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Daily average trades per active account | |

| 2.2 | | |

| 2.3 | | |

| -4 | % | |

| 2.1 | | |

| 2.5 | | |

| -16 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Retail trading revenue per million traded | |

$ | 90 | | |

$ | 89 | | |

| 1 | % | |

$ | 91 | | |

$ | 89 | | |

| 2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total customer equity ($ in millions) | |

$ | 1,332 | | |

$ | 1,264 | | |

| 5 | % | |

$ | 1,332 | | |

$ | 1,264 | | |

| 5 | % |

Declaration of Quarterly Dividend

The company also announced today that its board of directors

has declared a quarterly dividend of $0.06 per share on its outstanding Class A common stock. The dividend is payable on December

31, 2014 to Class A stockholders of record at the close of business on December 19, 2014.

Share Repurchase Program

FXCM Inc. today announced that its board of directors increased

its share repurchase program from $80 million to $130 million of its Class A common stock and/or FXCM Holdings, LLC units. Under

this program, shares may be repurchased from time to time in open market transactions, in privately negotiated transactions or

otherwise. This leaves approximately $67.4 million under the plan for future purchases, given the shares the company has already

acquired to date.

Conference Call

As previously announced, the Company will host a conference

call to discuss the results at 4:45 p.m. (EDT). This conference call will be available to domestic participants by dialing 877.445.4603

and 443.295.9270 for international participants. The conference ID number is 19312585.

A live audio webcast, a copy of FXCM's earnings release, and

presentation slides for this conference call will be available at http://ir.fxcm.com/.

Disclosure Regarding Forward-Looking Statements

In addition to historical information, this earnings release

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, which reflect FXCM Inc.’s current views with respect to, among other things, its operations and financial

performance for the future. You can identify these forward-looking statements by the use of words such as “outlook,”

“believes,” “expects,” “potential,” “continues,” “may,” “will,”

“should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking

statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause

actual outcomes or results to differ materially from those indicated in these statements. FXCM Inc. believes these factors include

but are not limited to evolving legal and regulatory requirements of the FX industry, the limited operating history of the FX industry,

risks related to the protection of its proprietary technology, risks related to its dependence on FX market makers, market conditions

and those other risks described under “Risk Factors” in FXCM Inc.’s Annual Report on Form 10-K and other SEC

filings, which are accessible on the SEC website at sec.gov.

These factors should not be construed as exhaustive and should

be read in conjunction with the other cautionary statements that are included in this presentation and in our SEC filings. FXCM

Inc. undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law.

Visit www.fxcm.com and follow

us on Twitter @FXCM, Facebook FXCM, Google+ FXCM

or YouTube FXCM.

About FXCM Inc.

FXCM Inc. (NYSE:FXCM) is a

global online provider of foreign exchange, or FX, trading and related services to retail and institutional customers world-wide.

At the heart of FXCM's client offering is No Dealing Desk FX

trading. Clients benefit from FXCM's large network of forex liquidity providers enabling FXCM to offer competitive spreads on major

currency pairs. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. FXCM's

U.K. subsidiary, Forex Capital Markets Limited, offers Contract for Difference (“CFD”) products with no re-quote trading

and allows clients to trade oil, gold, silver and stock indices along with FX on one platform. In addition, FXCM offers educational

courses on FX trading and provides free news and market research through DailyFX.com.

Trading foreign exchange and CFDs on margin carries a high level

of risk, and may not be suitable for all. Read full disclaimer.

Contacts

For Media:

FXCM Inc.

Jaclyn Klein, 646-432-2463

Vice-President, Corporate Communications

jklein@fxcm.com

ANNEX I

| Schedule |

|

Page Number |

| |

|

|

| U.S. GAAP Results |

|

|

| Unaudited U.S. GAAP Condensed Consolidated Statements of Operations for the Three and Nine Months Ended September 30, 2014 and 2013 |

|

A-1 |

| Unaudited U.S. GAAP Condensed Consolidated Statements of Financial Condition As of September 30, 2014 and December 31, 2013 |

|

A-2 |

| |

|

|

| Non-GAAP Financial Measures |

|

A-3 |

| Reconciliation of U.S. GAAP Reported to Non-GAAP Adjusted Financial Measures |

|

A-5 |

| Reconciliation of Non-GAAP Adjusted Net Income to EBITDA |

|

A-8 |

| Reconciliation of Non-GAAP Measures to Non-GAAP Adjusted Net Income Excluding Other Stock Compensation and Amortization |

|

A-9 |

| FXCM Inc. | |

| | |

| | |

| |

| Condensed Consolidated Statements of Operations | |

| | |

| | |

| |

| (In thousands, except per share amounts) | |

| | |

| | |

| |

| (Unaudited) | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Revenues | |

| | | |

| | | |

| | | |

| | |

| Retail trading revenue | |

$ | 87,826 | | |

$ | 86,974 | | |

$ | 244,222 | | |

$ | 282,296 | |

| Institutional trading revenue | |

| 24,417 | | |

| 22,856 | | |

| 72,354 | | |

| 82,204 | |

| Trading revenue | |

| 112,243 | | |

| 109,830 | | |

| 316,576 | | |

| 364,500 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 637 | | |

| 537 | | |

| 1,893 | | |

| 1,886 | |

| Brokerage interest expense | |

| (199 | ) | |

| (63 | ) | |

| (459 | ) | |

| (187 | ) |

| Net interest income | |

| 438 | | |

| 474 | | |

| 1,434 | | |

| 1,699 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other income | |

| 3,466 | | |

| 2,944 | | |

| 11,072 | | |

| 10,046 | |

| Total net revenues | |

| 116,147 | | |

| 113,248 | | |

| 329,082 | | |

| 376,245 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits | |

| 27,572 | | |

| 28,809 | | |

| 86,283 | | |

| 78,929 | |

| Allocation of net income to Lucid members for services provided | |

| 1,483 | | |

| 2,996 | | |

| 6,771 | | |

| 18,000 | |

| Total compensation and benefits | |

| 29,055 | | |

| 31,805 | | |

| 93,054 | | |

| 96,929 | |

| Referring broker fees | |

| 20,998 | | |

| 20,709 | | |

| 56,615 | | |

| 64,481 | |

| Advertising and marketing | |

| 5,071 | | |

| 6,305 | | |

| 18,652 | | |

| 19,813 | |

| Communication and technology | |

| 13,434 | | |

| 10,111 | | |

| 37,684 | | |

| 28,231 | |

| Trading costs, prime brokerage and clearing fees | |

| 8,021 | | |

| 6,809 | | |

| 24,257 | | |

| 23,708 | |

| General and administrative | |

| 17,219 | | |

| 27,949 | | |

| 48,898 | | |

| 53,843 | |

| Depreciation and amortization | |

| 15,041 | | |

| 12,849 | | |

| 40,793 | | |

| 37,304 | |

| Total operating expenses | |

| 108,839 | | |

| 116,537 | | |

| 319,953 | | |

| 324,309 | |

| Total operating income (loss) | |

| 7,308 | | |

| (3,289 | ) | |

| 9,129 | | |

| 51,936 | |

| Other Expense | |

| | | |

| | | |

| | | |

| | |

| Loss on equity method investments, net | |

| 376 | | |

| 183 | | |

| 910 | | |

| 728 | |

| Interest on borrowings | |

| 3,028 | | |

| 2,869 | | |

| 9,121 | | |

| 4,976 | |

| Income (loss) before income taxes | |

| 3,904 | | |

| (6,341 | ) | |

| (902 | ) | |

| 46,232 | |

| Income tax provision | |

| 1,144 | | |

| 2,444 | | |

| 1,648 | | |

| 16,793 | |

| Net income (loss) | |

| 2,760 | | |

| (8,785 | ) | |

| (2,550 | ) | |

| 29,439 | |

Net income (loss) attributable to non-controlling interest in

FXCM Holdings, LLC | |

| 1,538 | | |

| (3,133 | ) | |

| 1,756 | | |

| 21,190 | |

Net loss attributable to other non-controlling

interests | |

| (1,170 | ) | |

| (530 | ) | |

| (5,697 | ) | |

| (3,613 | ) |

| Net income (loss) attributable to FXCM Inc. | |

$ | 2,392 | | |

$ | (5,122 | ) | |

$ | 1,391 | | |

$ | 11,862 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average Class A shares outstanding - Basic | |

| 42,963 | | |

| 33,718 | | |

| 40,108 | | |

| 30,983 | |

| Weighted average Class A shares outstanding - Diluted | |

| 43,819 | | |

| 34,469 | | |

| 42,367 | | |

| 32,009 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net lncome (loss) per Class A Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.06 | | |

$ | (0.15 | ) | |

$ | 0.03 | | |

$ | 0.38 | |

| Diluted | |

$ | 0.05 | | |

$ | (0.15 | ) | |

$ | 0.03 | | |

$ | 0.37 | |

| FXCM Inc. | |

| | |

| |

| Condensed Consolidated Statements of Financial Condition | |

| | |

| |

| As of September 30, 2014 and December 31, 2013 | |

| | |

| |

| (Amounts in thousands except share data) | |

| | |

| |

| | |

(Unaudited) | | |

| |

| | |

September 30, | | |

December 31, | |

| |

| |

2014 | | |

2013 | |

| | |

| | | |

| | |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 326,730 | | |

$ | 365,245 | |

| Cash and cash equivalents, held for customers | |

| 1,332,399 | | |

| 1,190,880 | |

| Restricted time deposits | |

| 3,648 | | |

| - | |

| Trading securities | |

| 633 | | |

| - | |

| Due from brokers | |

| 32,960 | | |

| 5,450 | |

| Accounts receivable and other receivables, net | |

| 20,344 | | |

| 19,806 | |

| Deferred tax asset | |

| 5,215 | | |

| 11,910 | |

| Total current assets | |

| 1,721,929 | | |

| 1,593,291 | |

| | |

| | | |

| | |

| Restricted time deposits | |

| 5,472 | | |

| - | |

| Deferred tax asset | |

| 174,309 | | |

| 166,576 | |

| Office, communication and computer equipment, net | |

| 48,438 | | |

| 49,165 | |

| Goodwill | |

| 326,100 | | |

| 307,936 | |

| Other intangible assets, net | |

| 66,224 | | |

| 76,713 | |

| Notes receivable | |

| 9,608 | | |

| 5,950 | |

| Other assets | |

| 32,329 | | |

| 24,316 | |

| Total assets | |

$ | 2,384,409 | | |

$ | 2,223,947 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Customer account liabilities | |

$ | 1,332,399 | | |

$ | 1,190,880 | |

| Accounts payable and accrued expenses | |

| 56,773 | | |

| 69,697 | |

| Credit agreement | |

| 30,000 | | |

| - | |

| Notes payable | |

| 7,460 | | |

| 9,800 | |

| Due to brokers | |

| 916 | | |

| 8,652 | |

| Securities sold, not yet purchased | |

| 3,815 | | |

| - | |

| Deferred tax liability | |

| 218 | | |

| - | |

| Due to related parties pursuant to tax receivable agreement | |

| 20,276 | | |

| 18,588 | |

| Total current liabilities | |

| 1,451,857 | | |

| 1,297,617 | |

| Deferred tax liability | |

| 3,078 | | |

| 3,687 | |

| Due to related parties pursuant to tax receivable agreement | |

| 131,562 | | |

| 131,670 | |

| Senior convertible notes | |

| 150,236 | | |

| 146,303 | |

| Other liabilities | |

| 6,052 | | |

| 9,289 | |

| Total liabilities | |

| 1,742,785 | | |

| 1,588,566 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' Equity | |

| | | |

| | |

| Class A common stock, par value $0.01 per share; | |

| 462 | | |

| 447 | |

| 3,000,000,000 shares authorized, 46,204,590 and 44,664,884 shares issued | |

| | | |

| | |

| and outstanding as of September 30, 2014 and December 31, 2013, respectively | |

| | | |

| | |

| Class B common stock, par value $0.01 per share; | |

| 1 | | |

| 1 | |

| 1,000,000 shares authorized, 34 and 41 shares issued and outstanding | |

| | | |

| | |

| as of September 30, 2014 and December 31, 2013, respectively | |

| | | |

| | |

| Additional paid-in capital | |

| 260,231 | | |

| 245,426 | |

| Retained earnings | |

| 9,485 | | |

| 16,352 | |

| Accumulated other comprehensive loss | |

| (7,487 | ) | |

| (5,344 | ) |

| Total stockholders' equity, FXCM Inc. | |

| 262,692 | | |

| 256,882 | |

| Non-controlling interests | |

| 378,932 | | |

| 378,499 | |

| Total stockholders' equity | |

| 641,624 | | |

| 635,381 | |

| Total liabilities and stockholders' equity | |

$ | 2,384,409 | | |

$ | 2,223,947 | |

Non-GAAP Financial Measures

We use Non-GAAP financial measures to evaluate

our operating performance, as well as the performance of individual employees. Management believes that the disclosed Non-GAAP

measures when presented in conjunction with comparable U.S. GAAP measures are useful to investors to compare FXCM's results across

several periods and facilitate an understanding of FXCM's operating results. These measures do not represent and should not be

considered as a substitute for net income, net income attributable to FXCM Inc. or net income per Class A share or as a substitute

for cash flow from operating activities, each as determined in accordance with U.S. GAAP, and our calculations of these measures

may not be comparable to similarly entitled measures reported by other companies.

Adjusted Non-GAAP results begin with information

prepared in accordance with U.S. GAAP, adjusted to exclude certain items and reflects the conversion of all units of Holdings for

shares of Class A common stock of FXCM Inc. These measures should not be considered a substitute for, or superior to, measures

of financial performance prepared in accordance with U.S. GAAP. The differences between Adjusted Non-GAAP and U.S. GAAP results

are as follows:

| 1. | Assumed Exchange of Units of Holdings for FXCM Inc. Class A Shares. As a result of the exchange of Holdings units,

the non-controlling interest related to these units is converted to controlling interest. The Company’s management believes

that it is useful to provide the per-share effect associated with the assumed exchange of all Holdings units. |

| 2. | Compensation Expense. Adjustments have been made to eliminate expense relating to stock based compensation relating

to the Company’s IPO as well as costs associated with the acquisition of V3 Markets, LLC. Given the nature of these expenses,

they are not viewed by management as expenses incurred in the ordinary course of business and management believes it is useful

to provide the effects of eliminating these expenses. |

| 3. | Lucid Minority Interest/Compensation Expense. Our reported U.S. GAAP results reflect the portion of the 49.9% of Lucid

earnings allocated among the non-controlling members of Lucid based on services provided as a component of compensation expense

under Allocation of net income to Lucid members for services provided. Adjustments have been made to reclassify this allocation

of Lucid's earnings attributable to non-controlling members to “Net (loss) income attributable to other non-controlling interests”.

The Company's management believes that this reclassification provides a more meaningful view of the Company's operating expenses

and the Company's economic arrangement with Lucid's non-controlling members. This adjustment has no impact on net income as reported

by the Company. |

| 4. | Acquisition Costs/Income. Adjustments have been made to eliminate certain acquisition related costs/income.

Given the nature of these items, they are not viewed by management as expenses/income incurred in the ordinary course of business

and management believes it is useful to provide the effects of eliminating these items. |

| 5. | Regulatory Costs. Adjustments have been made to eliminate certain costs (including client reimbursements)

associated with ongoing discussions and settling certain regulatory matters. Given the nature of these expenses, they are not viewed

by management as expenses incurred in the ordinary course of business and management believes it is useful to provide the effects

of eliminating these expenses. |

| 6. | Income Taxes. Prior to the IPO, FXCM was organized as a series of limited liability companies and foreign

corporations, and even following the IPO, not all of the Company's income is subject to corporate-level taxes. As a result, adjustments

have been made to assume that the Company has adopted a conventional corporate tax structure and is taxed as a C corporation in

the U.S. at the prevailing corporate rates. This assumption is consistent with the assumption that all of Holdings units are exchanged

for shares of FXCM Inc. Class A common stock, as discussed in Item 1 above, as the assumed exchange would change the tax structure

of the Company. In addition, adjusted income tax provision reflects the tax effect of any Non-GAAP adjustments. |

| | |

Reconciliation of U.S. GAAP Reported to Non-GAAP Adjusted Financial Measures(1) | |

| | |

Three Months Ended September 30, | |

| | |

2014 | | |

2013 | |

| | |

GAAP Basis As Reported | | |

Non-GAAP Adjustments | | |

Non-GAAP Measures | | |

GAAP Basis As Reported | | |

Non-GAAP Adjustments | | |

Non-GAAP Measures | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net revenues(2) | |

$ | 116,147 | | |

$ | (360 | ) | |

$ | 115,787 | | |

$ | 113,248 | | |

$ | - | | |

$ | 113,248 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits(3) | |

$ | 29,055 | | |

$ | (3,715 | ) | |

$ | 25,340 | | |

$ | 31,805 | | |

$ | (8,611 | ) | |

$ | 23,194 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative(4) | |

$ | 17,219 | | |

$ | (3,116 | ) | |

$ | 14,103 | | |

$ | 27,949 | | |

$ | (15,000 | ) | |

$ | 12,949 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization(5) | |

$ | 15,041 | | |

$ | (1,097 | ) | |

$ | 13,944 | | |

$ | 12,849 | | |

$ | - | | |

$ | 12,849 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total operating income (loss) | |

$ | 7,308 | | |

$ | 7,568 | | |

$ | 14,876 | | |

$ | (3,289 | ) | |

$ | 23,611 | | |

$ | 20,322 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

$ | 3,904 | | |

$ | 7,568 | | |

$ | 11,472 | | |

$ | (6,341 | ) | |

$ | 23,611 | | |

$ | 17,270 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax provision(6) | |

$ | 1,144 | | |

$ | 1,567 | | |

$ | 2,711 | | |

$ | 2,444 | | |

$ | 2,692 | | |

$ | 5,136 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 2,760 | | |

$ | 6,001 | | |

$ | 8,761 | | |

$ | (8,785 | ) | |

$ | 20,919 | | |

$ | 12,134 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to non-controlling interest in FXCM Holdings, LLC(7) | |

$ | 1,538 | | |

$ | (1,538 | ) | |

$ | - | | |

$ | (3,133 | ) | |

$ | 3,133 | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income attributable to other non-controlling interests(8) | |

$ | (1,170 | ) | |

$ | 1,483 | | |

$ | 313 | | |

$ | (530 | ) | |

$ | 2,996 | | |

$ | 2,466 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to FXCM Inc. | |

$ | 2,392 | | |

$ | 6,056 | | |

$ | 8,448 | | |

$ | (5,122 | ) | |

$ | 14,790 | | |

$ | 9,668 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted weighted average shares outstanding as reported and Non-GAAP fully exchanged, fully diluted weighted average shares outstanding(9) | |

| 43,819 | | |

| | | |

| 79,611 | | |

| 34,469 | | |

| | | |

| 76,374 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted net income (loss) per share as reported and adjusted Non-GAAP net income per fully exchanged, fully diluted weighted average shares outstanding | |

$ | 0.05 | | |

$ | 0.06 | | |

$ | 0.11 | | |

$ | (0.15 | ) | |

$ | 0.28 | | |

$ | 0.13 | |

| | |

Reconciliation of U.S. GAAP Reported to Non-GAAP Adjusted Financial Measures(1) | |

| | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | |

| | |

GAAP Basis As Reported | | |

Non-GAAP Adjustments | | |

Non-GAAP Measures | | |

GAAP Basis As Reported | | |

Non-GAAP Adjustments | | |

Non-GAAP Measures | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Net revenues(2) | |

$ | 329,082 | | |

$ | (4,032 | ) | |

$ | 325,050 | | |

$ | 376,245 | | |

$ | - | | |

$ | 376,245 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Compensation and benefits(3) | |

$ | 93,054 | | |

$ | (13,410 | ) | |

$ | 79,644 | | |

$ | 96,929 | | |

$ | (27,736 | ) | |

$ | 69,193 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Communication and technology(10) | |

$ | 37,684 | | |

$ | (206 | ) | |

$ | 37,478 | | |

$ | 28,231 | | |

$ | - | | |

$ | 28,231 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| General and administrative(4) | |

$ | 48,898 | | |

$ | (7,860 | ) | |

$ | 41,038 | | |

$ | 53,843 | | |

$ | (15,000 | ) | |

$ | 38,843 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation and amortization(5) | |

$ | 40,793 | | |

$ | (1,097 | ) | |

$ | 39,696 | | |

$ | 37,304 | | |

$ | - | | |

$ | 37,304 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total operating income | |

$ | 9,129 | | |

$ | 18,541 | | |

$ | 27,670 | | |

$ | 51,936 | | |

$ | 42,736 | | |

$ | 94,672 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (Loss) income before income taxes | |

$ | (902 | ) | |

$ | 18,541 | | |

$ | 17,639 | | |

$ | 46,232 | | |

$ | 42,736 | | |

$ | 88,968 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income tax provision(6) | |

$ | 1,648 | | |

$ | 2,516 | | |

$ | 4,164 | | |

$ | 16,793 | | |

$ | 7,303 | | |

$ | 24,096 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (2,550 | ) | |

$ | 16,025 | | |

$ | 13,475 | | |

$ | 29,439 | | |

$ | 35,433 | | |

$ | 64,872 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to non-controlling interest in FXCM Holdings, LLC(7) | |

$ | 1,756 | | |

$ | (1,756 | ) | |

$ | - | | |

$ | 21,190 | | |

$ | (21,190 | ) | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income attributable to other non-controlling interests(8) | |

$ | (5,697 | ) | |

$ | 7,061 | | |

$ | 1,364 | | |

$ | (3,613 | ) | |

$ | 18,000 | | |

$ | 14,387 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income attributable to FXCM Inc. | |

$ | 1,391 | | |

$ | 10,720 | | |

$ | 12,111 | | |

$ | 11,862 | | |

$ | 38,623 | | |

$ | 50,485 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted weighted average shares outstanding as reported and Non-GAAP fully exchanged, fully diluted weighted average shares outstanding(9) | |

| 42,367 | | |

| | | |

| 78,899 | | |

| 32,009 | | |

| | | |

| 75,952 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted net income per share as reported and adjusted Non-GAAP net income per fully exchanged, fully diluted weighted average shares outstanding | |

$ | 0.03 | | |

$ | 0.12 | | |

$ | 0.15 | | |

$ | 0.37 | | |

$ | 0.29 | | |

$ | 0.66 | |

(1) The presentation includes Non-GAAP financial measures. These

Non-GAAP financial measures are not prepared under any comprehensive set of accounting rules or principles, and do not reflect

all of the amounts associated with the Company's results of operations as determined in accordance with U.S. GAAP.

(2) Represents the elimination of a $0.4 million benefit in Q3 2014 attributable to the remeasurement of our tax receivable agreement

liability to reflect a revised effective tax rate and the elimination of a $3.7 million benefit recorded to reduce the contingent

consideration related to the Faros acquisition.

(3) Represents the elimination of stock-based compensation associated

with the IPO, expense of $3.5 million connected to the termination of an employment contract in Q3 2013, the elimination of V3

acquisition costs in Q1 2014 and the reclassification of the 49.9% of Lucid’s earnings allocated among the non-controlling

interests recorded as compensation for U.S. GAAP purposes to Net (loss) income attributable to other non-controlling interests.

(4) Represents the net expense relating to pre-August 2010 trade

execution practices and other regulatory fees and fines in 2014 & 2013, the charge related to put option payments for Online

Courses in 2014 (Q2 2014 $1.3 million and Q3 2014 $2.3 million) and the elimination of V3 acquisition costs in Q1 2014.

(5) Represents a $1.1 million impairment charge to write down

the value of an electronic foreign exchange trading platform in Q3 2014.

(6) Represents an adjustment to reflect the assumed effective

corporate tax rate of approximately 23.6% and 29.7% for the three months ended September 30, 2014 and 2013, respectively, and 23.6%

and 27.1% for the nine months ended September 30, 2014 and 2013, respectively, which includes a provision for U.S. federal income

taxes and assumes the highest statutory rates apportioned to each state, local and/or foreign jurisdiction. The adjustment assumes

full exchange of existing unitholders FXCM Holdings, LLC ("Holdings") units for shares of Class A common stock of the

Company and reflects the tax effect of any Non-GAAP adjustments.

(7) Represents the elimination of the non-controlling interest

associated with the ownership by existing unitholders of Holdings (excluding FXCM, Inc.), as if the unitholders had fully exchanged

their Holdings units for shares of Class A common stock of the Company.

(8) Represents the reclassification of the 49.9% of Lucid’s

earnings allocated among the non-controlling interests recorded as compensation for U.S. GAAP purposes to Net (loss) income attributable

to other non-controlling interests and the impact of other Non-GAAP adjustments impacting non-controlling interests.

(9) Assumed exchange of units of Holdings for FXCM Inc. Class

A shares. As a result of the exchange of Holdings units, the non-controlling interest related to these units is converted to controlling

interest.

(10) Represents the elimination of V3 acquisition costs in Q1

2014. A-4

| FXCM Inc. | |

| | |

| | |

| | |

| |

| Reconciliation of Non GAAP Adjusted Net Income to EBITDA | |

| | |

| | |

| | |

| |

| (In thousands) | |

| | |

| | |

| | |

| |

| (Unaudited ) | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Non-GAAP adjusted net income | |

$ | 8,448 | | |

$ | 9,668 | | |

$ | 12,111 | | |

$ | 50,485 | |

| Depreciation and amortization | |

| 13,944 | | |

| 12,849 | | |

| 39,696 | | |

| 37,304 | |

| Interest on borrowings | |

| 3,028 | | |

| 2,869 | | |

| 9,121 | | |

| 4,976 | |

| Income tax provision | |

| 2,711 | | |

| 5,136 | | |

| 4,164 | | |

| 24,096 | |

| Net income attributable to other non-controlling interests | |

| 313 | | |

| 2,466 | | |

| 1,364 | | |

| 14,387 | |

| EBITDA | |

$ | 28,444 | | |

$ | 32,988 | | |

$ | 66,456 | | |

$ | 131,248 | |

| FXCM Inc. | |

| | |

| | |

| | |

| |

| Reconciliation of Non-GAAP Measures to Non GAAP Adjusted Net Income Excluding Other Stock Compensation and Amortization | |

| | |

| | |

| | |

| |

| (In thousands) | |

| | |

| | |

| | |

| |

| (Unaudited ) | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Non-GAAP adjusted net income | |

$ | 8,448 | | |

$ | 9,668 | | |

$ | 12,111 | | |

$ | 50,485 | |

| All other stock compensation | |

| 1,303 | | |

| 1,263 | | |

| 3,869 | | |

| 3,661 | |

| Amortization of intangibles | |

| 7,559 | | |

| 7,000 | | |

| 21,927 | | |

| 20,996 | |

| Amortization of debt discount | |

| 1,335 | | |

| 1,254 | | |

| 3,933 | | |

| 1,644 | |

| Non-Controlling interest adjustment related to the above adjustments | |

| (3,358 | ) | |

| (3,053 | ) | |

| (9,999 | ) | |

| (9,111 | ) |

| Tax adjustments related to the above | |

| (1,522 | )(1) | |

| (1,811 | )(1) | |

| (4,550 | )(1) | |

| (4,463 | )(1) |

| Non-GAAP adjusted net income excluding other stock compensation and amortization | |

$ | 13,765 | | |

$ | 14,321 | | |

$ | 27,291 | | |

$ | 63,212 | |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP Weighted average Class A shares outstanding - Diluted | |

| 43,819 | | |

| 34,469 | | |

| 42,367 | | |

| 32,009 | |

| FXCM Holdings Conversion | |

| 35,792 | (2) | |

| 41,905 | (2) | |

| 36,532 | (2) | |

| 43,943 | (2) |

| Non-GAAP Weighted average shares outstanding - Diluted | |

| 79,611 | | |

| 76,374 | | |

| 78,899 | | |

| 75,952 | |

| | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net income per Adjusted Non GAAP share - diluted | |

$ | 0.11 | | |

$ | 0.13 | | |

$ | 0.15 | | |

$ | 0.66 | |

| Non-GAAP Adjusted Net Income excluding other stock compensation and amortization per Adjusted Non GAAP Share - Diluted | |

$ | 0.17 | | |

$ | 0.19 | | |

$ | 0.35 | | |

$ | 0.83 | |

(1) Represents an adjustment to reflect the assumed effective

corporate tax rate of approximately 23.6% and 29.7% for the three months ended September 30, 2014 and 2013, respectively, and 23.6%

and 27.1% for the nine months ended September 30, 2014 and 2013, respectively, which includes a provision for U.S. federal income

taxes and assumes the highest statutory rates apportioned to each state, local and/or foreign jurisdiction. The adjustment assumes

full exchange of existing unitholders FXCM Holdings, LLC ("Holdings") units for shares of Class A common stock of the

Company and reflects the tax effect of any Non GAAP adjustments.

(2) Diluted shares assuming all unitholders had fully exchanged

their Holdings units for shares of Class A common stock of the Company.

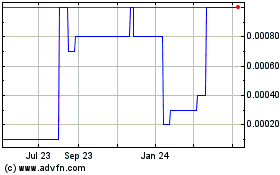

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Jul 2023 to Jul 2024