SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

FOR IMMEDIATE RELEASE - São Paulo, November 7, 2019 – Gafisa S.A. (B3: GFSA3; OTC: GFASY), a leading Brazilian homebuilder focused on the upper-middle and high-income segments, announced today its operational and financial results for the third quarter ended September 30, 2019.

GAFISA ANNOUNCES

3Q19 RESULTS

|

WITH ALL CONSTRUCTION WORKS UNDERWAY, GAFISA REBALANCES ITS RESULTS AND WILL RESUME LAUNCHES IN 2020

Since the end of March this year, Gafisa has been working on its restructuring process with the goal of giving new directions to the Company. This period has been marked by hard work, dedication, discipline, and transparency—all key values of our brand and our team of professionals. We are confident that the changes we have implemented will soon generate positive results for the company with an eye on falling interest rates and an upturn in the Brazilian economy.

On October 23, 2019, the second tranche of capital increase was ratified: 48,986,124 shares were issued and approximately R$272 million were raised with the entry of new institutional investors in the Company’s shareholder base. Combined with the first tranche of capital increase in the first half of the year, the Company’s total capitalization stood at R$405 million. In addition, the Company approved the hiring of a financial institution to structure the issue of mandatory debentures, until the limit of USD150 million to be appropriately submitted to resolution of the shareholders’ meeting on eventual issue of these debentures. The proceeds raised by these transactions will be set aside for new projects to sustain the Company’s recovery of growth.

Our new businesses and development areas are focused on developing and approving pipeline projects for 2020. In October, we concluded the acquisition of a land on Rua Cotovia in the district of Moema, an upmarket area of the city of São Paulo. This project will mark the start of launches during the first half of 2020. In addition, two non-binding memorandums of understanding were executed for valuation studies for future projects in the cities of Rio de Janeiro and Osasco, São Paulo.

The sales team has been strengthened with the arrival of a new market director, and we are reviewing the entire sales process to implement a new model.

All construction sites have already had their works resumed, thus marking the stabilization of the Company and our greater commitment to our customers. Currently we have 17 sites.

There was also the important signing of the disinvestment agreement at Alphaville Urbanismo S.A, for R$ 100 million, to be paid by offsetting credits and delivery of assets.

In the international scenario, we are still analyzing a relisting process at the New York Stock Exchange (NYSE) that is designed to provide greater visibility to the Company and access to new markets.

With our team of focused, disciplined, and dedicated professionals, we are confident that we are on the path to consolidating a new Gafisa, occupying an outstanding position in the Brazilian real estate market.

André Luis Ackermann

Chief Financial and Investor Relations Officer

|

1

OPERATIONAL RESULTS

Table 1 – Operational Performance (R$

000)

|

|

3Q19

|

2Q19

|

Q/Q (%)

|

3Q18

|

Y/YA (%)

|

9M19

|

9M18

|

Y/Y (%)

|

|

Launches

|

-

|

-

|

-

|

71,144

|

-

|

-

|

609,734

|

-

|

|

Gross Sales

|

39,963

|

87,893

|

(54.5%)

|

188,125

|

(78.8%)

|

219,127

|

887,443

|

(75.3%)

|

|

Dissolutions

|

(10,210)

|

(31,672)

|

(67.8%)

|

(51,661)

|

(80.2%)

|

(83,245)

|

(169,276)

|

(50.8%)

|

|

Pre-sales

|

29,753

|

56,221

|

(47.1%)

|

136,464

|

(78.2%)

|

135,881

|

718,167

|

(81.1%)

|

|

Speed of Sales (SoS)

|

3.0%

|

5.0%

|

(2 p.p.)

|

9.4%

|

(6.4 p.p.)

|

11.6%

|

35.3%

|

(23.6 p.p.)

|

|

Delivered PSV

|

-

|

91,317

|

n.a.

|

346,009

|

n.a.

|

171,648

|

647,001

|

(73.5%)

|

Table 2 – Financial Performance (R$

000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q186

|

Y/Y (%)

|

9M19

|

9M186

|

Y/Y(%)

|

|

Net Revenue

|

89,212

|

99,659

|

(10.5%)

|

237,180

|

(62.4%)

|

284,292

|

753,058

|

(62.2%)

|

|

Adjusted Gross Profit¹

|

45,251

|

48,862

|

(7.4%)

|

91,341

|

(50.5%)

|

111,878

|

261,649

|

(57.2%)

|

|

Adjusted Gross Margin¹

|

50.72%

|

49.03%

|

1.7 p.p.

|

38.51%

|

12.2 p.p.

|

39.35%

|

34.74%

|

4.6 p.p.

|

|

Adjusted EBITDA²

|

31,051

|

13,923

|

123.0%

|

31,546

|

(1.6%)

|

21,969

|

70,762

|

(69.0%)

|

|

Adjusted EBITDA Margin²

|

34.81%

|

13.97%

|

20.8 p.p.

|

13.30%

|

21.5 p.p.

|

7.73%

|

9.40%

|

-1.7 p.p.

|

|

Net Income

|

(1,668)

|

(12,724)

|

(86.9%)

|

(26,214)

|

(93.6%)

|

(60,746)

|

(104,689)

|

(42.0%)

|

|

Revenue Backlog

|

465,102

|

506,418

|

(8.2%)

|

587,344

|

(20.8%)

|

465,102

|

587,344

|

(20.8%)

|

|

Backlog Results3 4

|

166,149

|

177,847

|

(6.6%)

|

215,778

|

(23.0%)

|

166,149

|

215,778

|

(23.0%)

|

|

Backlog Results Margin4

5

|

35.72%

|

35.12%

|

0.6 p.p.

|

36.74%

|

(1 p.p.)

|

35.72%

|

36.74%

|

(1 p.p.)

|

|

Net Debt

|

356,611

|

587,898

|

(39.3%)

|

765,898

|

(53.4%)

|

356,611

|

765,898

|

(53.4%)

|

|

Cash and Cash

Equivalents5

|

394,216

|

182,817

|

115.6%

|

194,446

|

102.7%

|

394,215

|

194,446

|

102.7%

|

|

Equity + Minority Shareholders

|

782,074

|

575,353

|

35.9%

|

862,309

|

(9.3%)

|

782,074

|

862,309

|

(9.3%)

|

|

(Net Debt, – Proj. Fin.) / (Equity +

Minority)

|

(40.8%)

|

21.24%

|

(62.8 p.p.)

|

22.9%

|

(63.8 p.p.)

|

(40.8%)

|

22.99%

|

(63.8

p.p.)

|

¹ Adjusted by capitalized interest.

² Adjusted by capitalized interest with stock

option plan (non-cash) and minority shareholders.

³ Backlog

results net of PIS/COFINS taxes (3.65%), excluding the impact of the PVA

(Present Value Adjustment) method according to Law No. 11.638.

4 Backlog results comprise the projects restricted by a condition precedent.

5 Cash and

cash-equivalents and marketable securities.

6 Restatement

due to the adoption of IFRS

15.

Launches

Throughout 2019, the Company made the strategic

decision not to make launches to maintain the focus on the restructuring

process.

2

Sales

Gross sales totaled R$40.0 million in 3Q19, down

54.5% q-o-q and 78.8% y-o-y. In 9M19, gross sales totaled R$219.1 million.

Y-o-y, such low performance is due to higher volume of launches during 2018

(R$609.7 million).

However, Gafisa reiterates its efforts to

conclude its turnaround process, which directly affected sales performance in

the first nine months of the year, besides no new projects launched.

We are optimistic that the reinforcement of the

sales team and the adjustments of some processes being implemented will

materialize a better sales continuity from next quarter and more effectively

from 2020 onwards, when we will present a new cycle of launches.

Dissolutions reached R$10.2 million in 3Q19,

67.8% lower than in 2Q19, result of renegotiations with our clients. Compared to

the 3Q18, it was down 80.2%.

The graph below shows the downward trend of

dissolution volume over the past 2 years.

¹ Reflects year-to-date.

Net pre-sales totaled R$29.7 million in 3Q19,

47.1% lower than in 2Q19. In 9M19, net pre-sales came to R$135.9

million.

3

Sales Over Supply (SoS)

SoS was 3.0% in 3Q19, down 2,0 p.p. compared to

the previous quarter.

Inventory (Property for Sale)

Inventory at market value totaled R$966.5

million in 3Q19, down 9.1% q-o-q. This is mainly due to a revaluation of

inventory market value during the quarter.

Table 3 – Inventory at Market Value 2Q19 x 3Q19

(R$ 000)

|

|

Inventories2Q19

|

Launçhes

|

Dissolutions

|

Gross Sales

|

Adjustments

|

Inventories 3Q19

|

Q/Q (%)

|

|

São Paulo

|

859,554

|

-

|

8,940

|

(36,349)

|

(68,774)

|

763,370

|

(11.2%)

|

|

Rio de Janeiro

|

138,196

|

-

|

1,270

|

(3,614)

|

1,435

|

137,287

|

(0.7%)

|

|

Other Markets

|

64,939

|

-

|

-

|

-

|

868

|

65,807

|

1.3%

|

|

Total

|

1,062,689

|

-

|

10,210

|

(39,963)

|

(66,471)

|

966,464

|

(9.1%)

|

¹ Adjustments in the period reflect

the updates related to the project scope, launch date, and pricing.

Gafisa reiterates that is concentrated on the

sales process and inventory monetization and is well positioned to capture an

improvement in Brazil’s economy upturn. Note that nearly 66% of our inventory is

composed of residential units located in the State of São Paulo, thus, ensuring

higher liquidity than units in other regions of the country.

4

Table 4 – Inventory at Market Value – Financial

Progress – POC - (R$ 000)

|

|

Not Initiated

|

Up to 30% built

|

30% to 70% built

|

More than 70% built

|

Finished Units

|

Total 3Q19

|

|

São Paulo

|

-

|

-

|

424,871

|

123,207

|

215,291

|

763,370

|

|

Rio de Janeiro

|

-

|

-

|

-

|

-

|

137,287

|

137,287

|

|

Other Markets

|

-

|

-

|

13,452

|

-

|

52,355

|

65,807

|

|

Total

|

-

|

-

|

438,323

|

123,207

|

404,934

|

966,464

|

* % % POC does not necessarily reveal the status

of construction works, but the project’s financial progress.

Table 5 – Inventory at Market Value – Commercial

x Residential Breakdown- (R$ 000)

|

GFSA Inventory %

|

Residential

|

Commercial

|

Total

|

|

São Paulo

|

635,326

|

128,044

|

763,370

|

|

Rio de Janeiro

|

29,121

|

108,166

|

137,287

|

|

Others

|

65,807

|

-

|

65,807

|

|

Total

|

730,254

|

236,211

|

966,464

|

Delivered Projects and Transfer

No projects were delivered in the third quarter

of 2019.

Table 6 – Deliveries

|

Project

|

Delivery Date

|

Launch Date

|

Location

|

% Share

|

Units 100%¹

|

PSV % R$000²

|

|

Like Aclimação

|

Feb/19

|

Mar/16

|

São Paulo/SP

|

100%

|

136

|

80,079

|

|

Choice Santo Amaro

|

May/19

|

Jun/16

|

São Paulo/SP

|

100%

|

227

|

91,317

|

|

Total 2019

|

|

|

|

|

363

|

171,396

|

¹ Number of units corresponding to a 100% share

in projects, net of swaps;

² PSV = Potential Sales Value of units, net of

brokerage and swap.

The PSV transferred in 3Q19 totaled R$49.4

million, 11.8% higher than in 2Q19. The highest volume of transfer is due to

Choice Santo Amaro project delivered at the end of May (2Q19) with a PSV of

approximately R$91.3 million. One hundred percent of the receivables portfolio

of this project was transferred in 60 days. Year-to-date, transferred PSV

totaled R$ 158.4 million.

Table 7 – Transfer and Delivery - (R$

000)

|

|

3Q19

|

2Q19

|

Q/Q (%)

|

3Q18

|

Y/Y (%)

|

9M19

|

9M18

|

Y/Y (%)

|

|

PSV Transferred¹

|

49,426

|

44,202

|

11.8%

|

238,644

|

(79.3%)

|

158,449

|

438,147

|

(63.8%)

|

|

Delivered Projects

|

-

|

1

|

-

|

3

|

-

|

2

|

8

|

(75.0%)

|

|

Delivery Units²

|

-

|

227

|

-

|

780

|

-

|

365

|

1,805

|

(79.8%)

|

|

Delivered PSV³

|

-

|

91,317

|

-

|

346,009

|

-

|

171,648

|

647,001

|

(73.5%)

|

¹ PSV transferred

refers to the effective cash inflow from units transferred to financial

institutions;

² Number of units

corresponding to a 100% share in projects, net of swaps;

³ PSV = Potential

Sales Value of units, net of brokerage and swap.

5

Landbank

With an estimated PSV of R$3.82 billion, the Company’s landbank has 33 projects/phases, totaling 6,501 units. Approximately 67% of the land was acquired through an exchange base, most of it located in the city of São Paulo.

Table 8 - Landbank (R$ 000)

|

|

PSV

(% Gafisa) ¹

|

% Swap Total ²

|

% Swap Units

|

% Swap Financial

|

Potential Units

(% Gafisa) ³

|

Potential Units Total

|

|

São Paulo

|

2,472,405

|

75.9%

|

65.6%

|

75.9%

|

4,697

|

4,985

|

|

Rio de Janeiro

|

748,745

|

60.1%

|

60.1%

|

60.1%

|

755

|

892

|

|

Others

|

594,327

|

30.0%

|

30.0%

|

30.0%

|

1,050

|

1,320

|

|

Total

|

3,815,478

|

66.6%

|

60.4%

|

3.6%

|

6,501

|

7,198

|

¹ The PSV (% Gafisa) reported is net of swap and brokerage fee.

² The swap percentage is measured compared to the historical cost of land acquisition.

³ Potential units are net of swap and refer to the Gafisa’s and/or its partners’ interest in the project.

Table 9 – Changes in the Landbank (2Q19 x 3Q19 - R$ 000)

|

|

Initial Landbank

|

Land Acquisition

|

Launches

|

Dissolutions

|

Adjustments

|

Final Landbank

|

|

São Paulo

|

2,470,906

|

-

|

-

|

-

|

1,499

|

2,472,405

|

|

Rio de Janeiro

|

748,745

|

-

|

-

|

-

|

0

|

748,745

|

|

Others

|

594,327

|

-

|

-

|

-

|

0

|

594,327

|

|

Total

|

3,813,978

|

-

|

-

|

-

|

1,500

|

3,815,478

|

* The amounts reported are net swap and brokerage.

6

FINANCIAL RESULTS

Revenue

Net revenue totaled R$89.2 million in 3Q19, down 10.5% from 2Q19, result of lower net pre-sales volume during the period.

Table 10 – Revenue Recognition (R$ 000)

|

|

3Q19

|

3Q18¹

|

|

Launches

|

Pre-Sales

|

%

Sales

|

Revenue

|

% Revenue

|

Pre-Sales

|

%

Sales

|

Revenue¹

|

% Revenue

|

|

2018

|

(1,354)

|

(4.5%)

|

3,057

|

3.4%

|

26,109

|

19.1%

|

86,250

|

36.4%

|

|

2017

|

(472)

|

(1.6%)

|

13,794

|

1.5%

|

27,290

|

20.0%

|

28,506

|

12.0%

|

|

2016

|

13,091

|

44.0%

|

39,625

|

44.4%

|

29,067

|

21.3%

|

81,827

|

34.5%

|

|

2015

|

13,021

|

43.8%

|

21,488

|

24.1%

|

35,017

|

25.7%

|

46,306

|

19.5%

|

|

<2014

|

5,467

|

18.4%

|

11,247

|

12.6%

|

18,981

|

13.9%

|

(5,708)

|

(2.4%)

|

|

Total

|

29,753

|

100.0%

|

89,211

|

100.0%

|

136,464

|

100.0%

|

237,180

|

100.0%

|

|

|

|

|

|

|

|

|

|

|

¹ Restatement due to the adoption of IFRS 15.

Gross Profit & Margin

Gafisa’s adjusted gross profit reached approximately R$45.2 million in 3Q19 versus R$48.9 million in 2Q19 and R$91.3 million in 3Q18.

The adjusted gross margin stood at 50.7%, mainly driven by the labor savings earned from completed projects.

Table 11 – Gross Margin (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18²

|

Y/Y (%)

|

9M19

|

9M18²

|

Y/Y (%)

|

|

Net Revenue

|

89,212

|

99,659

|

(10.5%)

|

237,180

|

(62.4%)

|

284,292

|

753,058

|

(62.2%)

|

|

Gross Profit

|

38,104

|

36,971

|

3.1%

|

59,757

|

(36.2%)

|

81,522

|

162,252

|

(49.8%)

|

|

Gross Margin

|

42.71%

|

37.10%

|

5.6 p.p.

|

25.19%

|

17.5 p.p.

|

28.68%

|

21.55%

|

7.1 p.p.

|

|

(-) Financial Costs

|

(7,147)

|

(11,891)

|

(39.9%)

|

(31,584)

|

(77.4%)

|

(30,356)

|

(99,397)

|

(69.5%)

|

|

Adjusted Gross Profit ¹

|

45,251

|

48,862

|

(7.4%)

|

91,341

|

(50.5%)

|

111,878

|

261,649

|

(57.2%)

|

|

Adjusted Gross Margin ¹

|

50.72%

|

49.03%

|

1.7 p.p.

|

38.51%

|

12.2 p.p.

|

39.35%

|

34.74%

|

4.6 p.p.

|

¹ Adjusted by capitalized interests.

² Restatement due to the adoption of IFRS 15.

Selling, General and Administrative Expenses (SG&A)

In 3Q19, selling, general and administrative expenses totaled R$14.8 million, in line with 2Q19 and down 65% compared to the 3Q18.

Gafisa reiterates its cost reduction program seeking an improved structure fitted into the Company’s new model. Thus, selling expenses totaled R$2.2 million in 3Q19, 28% lower than in 2Q19 and 89% y-o-y, a result of reduced marketing expenses. In 9M19, selling expenses dropped 84% to R$11.7 million, y-o-y.

General and administrative expenses were R$12.7 million, up 12% from 2Q19, due to higher advisory and audit services expenses. In 9M19, expenses totaled R$31.9 million, down 48% from the same period last year.

7

Table 12 – SG&A Expenses (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18¹

|

Y/Y (%)

|

9M19

|

9M18¹

|

Y/Y(%)

|

|

Selling Expenses

|

(2,170)

|

(3,011)

|

(27.9%)

|

(20,653)

|

(89.5%)

|

(11,683)

|

(73,042)

|

(84.0%)

|

|

G&A Expenses

|

(12,678)

|

(11,340)

|

11.8%

|

(22,300)

|

(43.1%)

|

(31,918)

|

(61,841)

|

(48.4%)

|

|

Total SG&A Expenses

|

(14,848)

|

(14,351)

|

3.5%

|

(42,953)

|

(65.4%)

|

(43,601)

|

(134,883)

|

(67.7%)

|

¹ Restatement due to the adoption of IFRS 15.

Other Operating Income/Expenses came to R$169,000 versus an expense of R$23.6 million in 2Q19. Due to a review of contingencies, the third quarter did not record any accrual.

Table 13 – Other Operating Income/Expenses (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18¹

|

Y/Y (%)

|

9M19

|

9M18¹

|

Y/Y(%)

|

|

Litigation Expenses

|

-

|

(23,544)

|

(100.0%)

|

(17,241)

|

(100.0%)

|

(45,769)

|

(44,764)

|

2.2%

|

|

Other

|

2.444

|

(98)

|

n.a

|

(337)

|

(150.1%)

|

70

|

(2,738)

|

n.a

|

|

Total

|

2.444

|

(23,642)

|

n.a.

|

(17,578)

|

n.a.

|

(45.699)

|

(47,502)

|

(3.8%)

|

¹ Restatement due to the adoption of IFRS 15.

Adjusted EBITDA

Adjusted EBITDA totaled R$31 million in 3Q19, 123% higher than the R$13.9 million recorded in 2Q19.

Table 14 – Adjusted EBITDA (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18²

|

Y/Y (%)

|

9M19

|

9M18²

|

Y/Y(%)

|

|

Net Income (Loss)

|

(1,668)

|

(12,724)

|

(86.9%)

|

(26,214)

|

(93.6%)

|

(60,746)

|

(104,689)

|

(42.0%)

|

|

(+) Financial Results

|

21,548

|

10,469

|

105.8%

|

19,179

|

12.4%

|

41,976

|

58,211

|

(27.9%)

|

|

(+) Income Tax / Social Contribution

|

508

|

309

|

64.4%

|

670

|

(24.2%)

|

1,221

|

2,334

|

(47.7%)

|

|

(+) Depreciation and Amortization

|

3,223

|

4,143

|

(22.2%)

|

6,393

|

(49.6%)

|

11,739

|

15,518

|

(24.4%)

|

|

(+) Capitalized Interest

|

7,147

|

11,891

|

(39.9%)

|

31,584

|

(77.4%)

|

30,356

|

99,397

|

(69.5%)

|

|

(+) Expenses w/ Stock Option Plan

|

174

|

(412)

|

n,a

|

634

|

(72.6%)

|

(2,698)

|

1,912

|

n,a

|

|

(+) Minority Shareholders

|

119

|

247

|

(51.8%)

|

(700)

|

n.a.

|

121

|

(1,921)

|

n.a.

|

|

Adjusted EBITDA¹

|

31,051

|

13,923

|

123.0%

|

31,546

|

(1.6%)

|

21,969

|

70,762

|

(69.0%)

|

¹ Adjusted by capitalized interests, with stock option plan (non-cash) and minority shareholders.

² Restatement due to the adoption of IFRS 15.

Financial Result

Financial expenses increased 57% to R$24.5 million in 3Q19, due to higher appropriation of interest rates in the period. Therefore, the net financial result was negative at approximately R$21.5 million in 3Q19, versus a net loss of R$10.5 million in 2Q19 and R$19.2 million in 3Q18.

Net Result

3Q19 recorded a negative adjusted net result of R$1.6 million, compared to a net loss of R$12.7 million and R$26.2 million in 2Q19 and 3Q18, respectively.

8

Table 15 – Net Result (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18³

|

Y/Y (%)

|

9M19

|

9M18³

|

Y/Y(%)

|

|

Net Result

|

89,212

|

99,659

|

(10.5%)

|

237,180

|

(62.4%)

|

284,292

|

753,058

|

(62.2%)

|

|

Gross Result

|

38,104

|

36,971

|

3.1%

|

59,757

|

(36.2%)

|

81,522

|

162,252

|

(49.8%)

|

|

Gross Margin

|

42.71%

|

37.10%

|

5.6 p.p.

|

25.19%

|

17.5 p.p.

|

28.68%

|

21.55%

|

7.1 p.p.

|

|

(-) Financial Cost

|

(7,147)

|

(11,891)

|

(39.9%)

|

(31,584)

|

(77.4%)

|

(7,147)

|

(31,584)

|

(77.4%)

|

|

Adjusted Gross Result¹

|

45,251

|

48,862

|

(7.4%)

|

91,341

|

(50.5%)

|

111,878

|

261,649

|

(57.2%)

|

|

Adjusted Gross Margin¹

|

50.7%

|

49.0%

|

1.7 p.p.

|

38.5%

|

12.2 p.p.

|

39.4%

|

34.7%

|

4.6 p.p.

|

|

Adjusted EBITDA²

|

31,051

|

13,923

|

123.0%

|

31,546

|

(1.6%)

|

21,969

|

70,762

|

(69.0%)

|

|

Adjusted EBITDA Margin²

|

34.81%

|

13.97%

|

20.8 p.p.

|

13.30%

|

21.5 p.p.

|

7.73%

|

9.40%

|

-1.7 p.p.

|

|

Net Result

|

(1,668)

|

(12,724)

|

(86.9%)

|

(26,214)

|

(93.6%)

|

(60,746)

|

(104,689)

|

(42.0%)

|

1 Adjusted by capitalized interests.

2 Adjusted by capitalized interests, with stock option plan (non-cash) and minority shareholders.

³ Restatement due to the adoption of IFRS 15.

Revenue Backlog and Results

In 3Q19, the balance of revenue backlog according to the PoC method totaled R$166.1 million, with a margin of 35.7% to be recognized.

Table 16 – Backlog Results (REF) (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18¹

|

Y/Y (%)

|

|

Revenue Backlog

|

465,102

|

506,418

|

(8.2%)

|

587,344

|

(20.8%)

|

|

Backlog Costs (units sold)

|

(298,953)

|

(328,571)

|

(9.0%)

|

(371,566)

|

(19.5%)

|

|

Backlog Results

|

166,149

|

177,847

|

(6.6%)

|

215,778

|

(23.0%)

|

|

Backlog Margin

|

35.7%

|

35.1%

|

0.6 p.p.

|

36.7%

|

-1 p.p.

|

Notes: Backlog results net of PIS/COFINS taxes (3.65%) and excluding the impact of PVA (Present Value Adjustment) method according to Law No. 11.638.

Backlog results comprise the projects restricted by a condition precedent.

¹ Restatement due to the adoption of IFRS 15.

BALANCE SHEET

Cash, Cash Equivalents and Marketable Securities

On September 30, 2019, cash, cash equivalents and marketable securities totaled R$394.2 million, boosted by an inflow of part of the proceeds raised with the second tranche of the capital increase, which totaled approximately R$207 million.

Receivables

At the end of 3Q19, total receivables were R$1 billion, down 7.3% from 2Q19 and 22.1% y-o-y. Of this amount, R$528.9 million were already recognized in the balance sheet, estimating receivables of R$262.6 million still to be recognized in 2019.

9

Table 17 – Total Receivables (R$ 000)

|

|

3Q19

|

2Q19

|

Q/Q(%)

|

3Q18¹

|

Y/Y (%)

|

|

Receivables from developments – Backlog

|

482,721

|

525,602

|

(8.2%)

|

609,594

|

(20.8%)

|

|

Receivables from PoC - ST (on balance sheet)

|

409,212

|

449,356

|

(8.9%)

|

474,076

|

(13.7%)

|

|

Receivables from PoC - LT (on balance sheet)

|

119,765

|

116,835

|

2.5%

|

214,405

|

(44.1%)

|

|

Total

|

1,011,698

|

1,091,793

|

(7.3%)

|

1,298,075

|

(22.1%)

|

¹ Restatement due to the adoption of IFRS 15.

Notes: ST – Short term | LT- Long term | PoC – Percentage of Completion Method.

Receivables from developments: Accounts receivable not yet recognized according to PoC and BRGAAP.

Receivables from PoC: Accounts receivable already recognized according to PoC and BRGAAP.

Table 18 – Receivables Schedule (R$ 000)

|

|

Total

|

2019

|

2020

|

2021

|

2022

|

2023 – and after

|

|

Receivables Backlog

|

482,721

|

116,185

|

245,686

|

111,472

|

2,508

|

6,870

|

|

Receivables from PoC

|

528,976

|

146,469

|

268,359

|

105,101

|

2,417

|

6,630

|

|

Total

|

1,011,698

|

262,654

|

514,045

|

216,574

|

4,925

|

13,500

|

Cash Generation

The Company ended the third quarter of 2019 with a positive cash generation of R$24.4 million, excluding the effect of a R$206.9 million capital increase. It is worth mentioning that this was the fourth consecutive quarter of cash generation, a result of disciplined expense management.

Table 19 – Cash Generation (R$ 000)

|

|

1Q19

|

2Q19

|

3Q19

|

|

Availabilities 1

|

63,068

|

182,817

|

394,216

|

|

Change in Availabilities (1)

|

(74,092)

|

119,749

|

211,399

|

|

Total Debt + Investors Obligations

|

790,172

|

770,715

|

750,826

|

|

Change in Total Debt + Investors Obligations (2)

|

(99,241)

|

(19,457)

|

(19,889)

|

|

Capital Increase (3)

|

-

|

132,266

|

206,927

|

|

Cash Generation in the Period (1) - (2) - (3)

|

25,149

|

6,940

|

24,361

|

|

Final Accumulated Cash Generation²

|

25,149

|

32,089

|

56,450

|

¹ Cash and cash equivalents and marketable securities.

² Reflects year-to-date.

Liquidity

With the cash inflow of R$ 206.9 million from the second tranche of the capital increase, the Company's capital structure was optimized. Net debt decreased to R$ 356.6 million vs. R$ 587.9 million reported in the previous quarter. In 3Q19, Net Debt/Shareholders’ Equity ratio stood at 45.6%, down 56.6 p.p. from 102.18% reported in 2Q19. Considering the cash inflow of R$ 65.8 MM related to the subscription of the surplus additional to the second tranche of the capital increase, which occurred in October/19, the Net Debt/Shareholders’ Equity ratio reduced to 37%.

10

Table 20 – Debt and Investor Obligation (R$ 000)

|

|

3T19

|

2T19

|

T/T(%)

|

3T18²

|

A/A (%)

|

|

Project Financing SFH

|

267,923

|

281,605

|

(4.9%)

|

352,486

|

(24.0%)

|

|

Project Financing SFI

|

175,565

|

180,035

|

(2.5%)

|

215,210

|

(18.4%)

|

|

Debentures (Projects)

|

194,625

|

196,638

|

(1.0%)

|

233,272

|

(16.6%)

|

|

CCB (Projects)

|

37,794

|

37,791

|

0.0%

|

74,966

|

(49.6%)

|

|

Subtotal of Debt of Projects (A)

|

675,907

|

696,069

|

(2.9%)

|

875,934

|

(22.8%)

|

|

Debentures (WK)

|

49,646

|

48,448

|

2.5%

|

48,053

|

3.3%

|

|

CCB (WK)

|

14,899

|

16,585

|

(10.2%)

|

36,357

|

(59.0%)

|

|

Other Operations (WK)

|

10,374

|

9,613

|

7.9%

|

0

|

0.0%

|

|

Subtotal of Debt of WK (B)

|

74,919

|

74,646

|

0.4%

|

84,410

|

(11.2%)

|

|

Total Debt (A)+(B) = (C)

|

750,826

|

770,715

|

(2.6%)

|

960,344

|

(18.9%)

|

|

Cash and Cash Equivalents¹ (F)

|

394,215

|

182,817

|

115.6%

|

194,446

|

102.7%

|

|

Net Debt (E)-(F) = (G)

|

356,610

|

587,898

|

(39.3%)

|

765,898

|

(51.2%)

|

|

Shareholders’ Equity+ Minority Shareholders (H)

|

567,946

|

575,353

|

(1.3%)

|

862,309

|

(34.1%)

|

|

(Net Debt) / (Shareholders’ Equity) (G)/(H) = (I)

|

45.60%

|

102.18%

|

(56.6 p.p.)

|

88.82%

|

(43.2 p.p.)

|

|

(Net Debt – Project Finance) / Shareholders’ Equity ((G)-(B))/(H) = (J)

|

(40.8%)

|

21.94%

|

(62.8 p.p.)

|

22.99%

|

(63.8 p.p.)

|

¹ Cash and cash equivalents and marketable securities.

² Restatement due to the adoption of IFRS 15.

The Company ended 3Q19 with R$259.5 million of debt due this year, or 34.6% of the total debt. On September 30, 2019, the consolidated debt average cost was 11.2% per year.

Table 21 – Debt Maturity (R$ 000)

|

|

Average cost (p.a.)

|

Total

|

Until Dec/19

|

Until Dec/20

|

Until Dec/21

|

Until Dec/22

|

|

Project Financing SFH

|

TR + 8.30% a 14.20%

|

267,923

|

207,507

|

59,848

|

509

|

59

|

|

Project Financing SFI

|

Pre +13.66% / 143% CDI

|

175,565

|

4,044

|

110,477

|

61,044

|

0

|

|

Debentures (Projects)

|

CDI + 3% / CDI + 3.75% / CDI + 5.00% / CDI + 5.25%

|

194,625

|

37,231

|

138,610

|

17,522

|

1,262

|

|

CCB (Projects)

|

CDI + 3.70% / CDI + 4.25%

|

37,794

|

82

|

0

|

37,712

|

0

|

|

Subtotal of Debt of Projects (A)

|

|

675,907

|

248,864

|

308,935

|

116,787

|

1,321

|

|

Debentures (WK)

|

IPCA + 8.37%

|

49,646

|

0

|

25,905

|

23,741

|

0

|

|

CCB (WK)

|

CDI + 2.5%/ 19.56%

|

14,899

|

244

|

0

|

10,896

|

3,759

|

|

Other Operations (WK)

|

12.68%

|

10,374

|

10,374

|

0

|

0

|

0

|

|

Subtotal of Debt of WK (B)

|

|

74,919

|

10,618

|

25,905

|

34,637

|

3,759

|

|

Total Debt (A)+(B) = (C)

|

|

750,826

|

259,480

|

334,596

|

151,424

|

5,080

|

|

% of Total Maturity per period

|

|

34.6%

|

44.6%

|

20.2%

|

0.7%

|

|

Project debt maturing as % of total debt (B)/ (E)

|

|

95.9%

|

92.3%

|

77.1%

|

26.0%

|

|

Corporate debt maturing as % of total debt ((A)+(C))/ (E)

|

|

4.1%

|

7.7%

|

22.9%

|

74.0%

|

|

Ratio Corporate Debt / Mortgage

|

10% / 90%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

SUBSEQUENT EVENTS

Divestment in Alphaville Urbanismo S.A. (“Alphaville”)

On October 21, 2019 the Company announced the execution with Alphaville Urbanismo S.A. (“Alphaville”), Private Equity AE Investimentos e Participações S.A. (“PEAE”) and affiliates of PEAE, of a Purchase and Sale, Stock Redemption, Corporate Restructuring Agreement and Other Covenants, which aims at setting forth the terms and conditions to put into effect Gafisa’s divestment in Alphaville, whose investment today is 21.20%. Note that the close of this deal depends upon compliance with usual condition precedents, the obtainment of third parties’ consent and corporate approvals. This transaction totals the amount of one hundred million Reais (R$100,000,000.00), to be paid by means of credit offset and delivery of assets.

Ratification of Capital Increase

On October 23, 2019, the Board of Directors’ meeting approved the ratification of the second tranche of capital increase totaling R$272,695,895.76 by means of subscription and full payment of 48,968,124 new common shares, and 75% of the shares were subscribed during the preemptive rights.

Note that, due to capital increase ratified herein, the Company’s capital stock increases from R$2,653,584,422.38, composed of 71,031,876 non-par, registered, book-entry, common shares to R$2,926,280,318.14, divided into 120,000,000 non-par, registered, book-entry, common shares.

12

Results for the third quarter of 2019 of Alphaville Urbanismo SA.

In 3Q19, net revenue came at R$29 million and net loss totaled R$187 million.

|

|

3T19

|

3T18

|

1T19 vs. 1T18

|

|

Net Revenue

|

29

|

34

|

(15%)

|

|

Net Income

|

(187)

|

(163)

|

n.a.

|

|

|

|

|

|

For further information, please contact our Investor Relations team at ri@alphaville.com.br or +55 11 3038-7131.

13

Consolidated Income Statement

|

|

3Q19

|

2Q19

|

Q/Q (%)

|

3Q18¹

|

Y/Y (%)

|

9M19

|

9M18¹

|

Y/Y (%)

|

|

Net Revenue

|

89,212

|

99,659

|

(10.5%)

|

237,180

|

(62.4%)

|

284,292

|

753,058

|

(62.2%)

|

|

Operating Costs

|

(51,108)

|

(62,688)

|

(18.5%)

|

(177,423)

|

(71.2%)

|

(202,770)

|

(590,806)

|

(65.7%)

|

|

Gross Profit

|

38,104

|

36,971

|

3.1%

|

59,757

|

(36.2%)

|

81,522

|

162,252

|

(49.8%)

|

|

Gross Margin

|

42.7%

|

37.1%

|

5.6 p.p.

|

25.2%

|

17.5 p.p.

|

28.7%

|

21.5%

|

7.1 p.p.

|

|

Operating Expenses

|

(17,597)

|

(38,670)

|

(54.5%)

|

(66,822)

|

(73.7%)

|

(98,950)

|

(208,317)

|

(52.5%)

|

|

Selling Expenses

|

(2,170)

|

(3,011)

|

(27.9%)

|

(20,653)

|

(89.5%)

|

(11,683)

|

(73,042)

|

(84.0%)

|

|

General and Administrative Expenses

|

(12,678)

|

(11,340)

|

11.8%

|

(22,300)

|

(43.1%)

|

(31,918)

|

(61,841)

|

(48.4%)

|

|

Other Operating Revenue/Expenses

|

169

|

(23,642)

|

(100.7%)

|

(17,578)

|

(101.0%)

|

(45,699)

|

(47,502)

|

(3.8%)

|

|

Depreciation and Amortization

|

(3,223)

|

(4,143)

|

(22.2%)

|

(6,393)

|

(49.6%)

|

(11,739)

|

(15,518)

|

(24.4%)

|

|

Equity Income

|

305

|

3,466

|

(91.2%)

|

102

|

199.0%

|

2,089

|

(10,414)

|

(120.1%)

|

|

Operational Result

|

20,507

|

(1,699)

|

n.a.

|

(7,065)

|

(390.3%)

|

(17,428)

|

(46,065)

|

(62.2%)

|

|

Financial Income

|

2,942

|

5,131

|

(42.7%)

|

6,130

|

(52.0%)

|

11,676

|

15,211

|

(23.2%)

|

|

Financial Expenses

|

(24,490)

|

(15,600)

|

57.0%

|

(25,309)

|

(3.2%)

|

(53,652)

|

(73,422)

|

(26.9%)

|

|

Net Income Before Taxes on Income

|

(1,041)

|

(12,168)

|

(91.4%)

|

(26,244)

|

(96.0%)

|

(59,404)

|

(104,276)

|

(43.0%)

|

|

Income Tax and Social Contribution

|

(508)

|

(309)

|

64.4%

|

(670)

|

(24.2%)

|

(1,221)

|

(2,334)

|

(47.7%)

|

|

Net Income After Taxes on Income

|

(1,549)

|

(12,477)

|

(87.6%)

|

(26,914)

|

(94.2%)

|

(60,625)

|

(106,610)

|

(43.1%)

|

|

Minority Shareholders

|

119

|

247

|

(51.8%)

|

(700)

|

(117.0%)

|

121

|

(1,921)

|

(106.3%)

|

|

Net Income

|

(1,668)

|

(12,724)

|

(86.9%)

|

(26,214)

|

(93.6%)

|

(60,746)

|

(104,689)

|

(42.0%)

|

|

|

|

|

|

|

|

|

|

|

¹ Restatement due to the adoption of IFRS 15.

14

Consolidated Balance Sheet

|

|

3Q19

|

2Q19

|

Q/Q (%)

|

3Q18¹

|

Y/Y (%)

|

|

Current Assets

|

|

|

|

|

|

|

Cash and Cash equivalents

|

12,819

|

11,373

|

12.7%

|

7,931

|

61.6%

|

|

Securities

|

381,397

|

171,444

|

122.5%

|

186,515

|

104.5%

|

|

Receivables from clients

|

409,212

|

449,356

|

(8.9%)

|

474,076

|

(13.7%)

|

|

Properties for sale

|

820,892

|

807,992

|

1.6%

|

999,559

|

(17.9%)

|

|

Other accounts receivable

|

119,898

|

133,061

|

(9.9%)

|

104,116

|

15.2%

|

|

Prepaid expenses and other

|

2,159

|

2,318

|

(6.9%)

|

3,184

|

(32.2%)

|

|

Land for sale

|

38,681

|

38,681

|

0.0%

|

34,212

|

13.1%

|

|

Subtotal

|

1,785,057

|

1,614,225

|

10.6%

|

1,809,593

|

(1.4%)

|

|

|

|

|

|

|

|

|

Long-term Assets

|

|

|

|

|

|

|

Receivables from clients

|

119,765

|

116,835

|

2.5%

|

214,405

|

(44.1%)

|

|

Properties for sale

|

190,953

|

218,616

|

(12.7%)

|

263,937

|

(27.7%)

|

|

Other

|

145,232

|

125,705

|

15.5%

|

116,874

|

24.3%

|

|

Subtotal

|

455,950

|

461,156

|

(1.1%)

|

595,216

|

(23.4%)

|

|

Intangible. Property and Equipment

|

24,465

|

29,344

|

(16.6%)

|

43,047

|

(43.2%)

|

|

Investments

|

300,726

|

302,797

|

(0.7%)

|

465,438

|

(35.4%)

|

|

|

|

|

|

|

|

|

Ativo Total

|

2,566,198

|

2,407,522

|

6.59%

|

2,913,294

|

(11.9%)

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

Loans and financing

|

364,766

|

332,693

|

9.6%

|

170,171

|

114.4%

|

|

Debentures

|

179,423

|

170,955

|

5.0%

|

31,196

|

475.1%

|

|

Obligations for purchase of land

|

105,823

|

96,979

|

9.1%

|

145,468

|

(27.3%)

|

|

Material and service suppliers

|

129,825

|

161,722

|

(19.7%)

|

106,363

|

22.1%

|

|

Taxes and contributions

|

64,886

|

60,359

|

7.5%

|

56,822

|

14.2%

|

|

Other

|

179,681

|

176,338

|

1.9%

|

78,167

|

129.9%

|

|

Subtotal

|

207,540

|

196,279

|

5.7%

|

274,725

|

(24.5%)

|

|

|

|

|

|

|

|

|

Long-term liabilities

|

|

|

|

|

|

|

Loans and financings

|

141,789

|

192,936

|

(26.5%)

|

508,848

|

(72.1%)

|

|

Debentures

|

64,848

|

74,131

|

(12.5%)

|

250,129

|

(74.1%)

|

|

Obligations for Purchase of Land

|

147,147

|

157,582

|

(6.6%)

|

207,765

|

(29.2%)

|

|

Deferred taxes

|

49,372

|

49,372

|

0.0%

|

74,473

|

(33.7%)

|

|

Provision for Contingencies

|

110,564

|

119,559

|

(7.5%)

|

98,557

|

12.2%

|

|

Other

|

38,460

|

43,264

|

(11.1%)

|

48,301

|

(20.4%)

|

|

Subtotal

|

552,180

|

636,844

|

(13.3%)

|

1,188,073

|

(53.5%)

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

Shareholders’ Equity

|

780,159

|

573,554

|

36.0%

|

860,606

|

(9.3%)

|

|

Minority Interest

|

1,915

|

1,799

|

6.4%

|

1,703

|

12.4%

|

|

Subtotal

|

782,074

|

575,353

|

35.9%

|

862,309

|

(9.3%)

|

|

Total liabilities and Shareholders’ Equity

|

2,566,198

|

2,407,522

|

6.6%

|

2,913,294

|

(11.9%)

|

¹ Restatement due to the adoption of IFRS 15 and IFRS 9.

15

Consolidated Cash Flow

|

|

3Q19

|

3Q18¹

|

9M19

|

9M18¹

|

|

Net Income (Loss) before taxes

|

(1,041)

|

(26,243)

|

(59,404)

|

(104,275)

|

|

Expenses/revenues that do not impact working capital

|

18,023

|

20,936

|

28,398

|

38,623

|

|

Depreciation and amortization

|

3,223

|

6,393

|

11,739

|

15,518

|

|

Impairment

|

(2)

|

(14,232)

|

(28,221)

|

(39,469)

|

|

Expense with stock option plan

|

174

|

634

|

(2,698)

|

1,912

|

|

Unrealized interest and fees, Net

|

1,216

|

2,885

|

4,302

|

10,229

|

|

Equity Income

|

(305)

|

(102)

|

(2,089)

|

10,414

|

|

Provision for guarantee

|

(2,136)

|

(363)

|

(3,918)

|

(3,656)

|

|

Provision for contingencies

|

-

|

17,931

|

45,885

|

44,764

|

|

Profit Sharing provision

|

-

|

1,291

|

500

|

3,795

|

|

Provision (reversal) for doubtful accounts

|

(5,342)

|

7,242

|

(17,116)

|

(4,121)

|

|

Gain / Loss of financial instruments

|

-

|

(743)

|

-

|

(763)

|

|

Provision for fine due to construction work delay

|

1,935

|

-

|

754

|

-

|

|

Quotas assignment

|

2,759

|

-

|

2,759

|

-

|

|

Provision for contingencies

|

42,139

|

(24,860)

|

127,949

|

(117,062)

|

|

Profit Sharing provision

|

14,765

|

13,028

|

145,244

|

174,195

|

|

Provision (reversal) for doubtful accounts

|

(11,886)

|

2,262

|

(35,981)

|

(9,364)

|

|

Gain / Loss of financial instruments

|

159

|

941

|

509

|

2,351

|

|

Provision for fine due to construction work delay

|

(1,590)

|

21,974

|

(56,461)

|

44,399

|

|

Provision for contingencies

|

4,528

|

1,268

|

7,610

|

10,392

|

|

Profit Sharing provision

|

(39,327)

|

11,870

|

(2,189)

|

8,530

|

|

Provision (reversal) for doubtful accounts

|

(546)

|

2,715

|

(2,366)

|

3,080

|

|

Gain / Loss of financial instruments

|

62,090

|

(20,266)

|

(93,534)

|

(63,033)

|

|

Provision for fine due to construction work delay

|

7,765

|

(3,985)

|

26,045

|

(12,442)

|

|

Provision for contingencies

|

(508)

|

(670)

|

(1,221)

|

(2,334)

|

|

Cash used in operating activities

|

78,070

|

(1,030)

|

68,098

|

(26,940)

|

|

Acquisition of properties and equipment

|

1,656

|

(8,429)

|

(4,361)

|

(17,943)

|

|

Capital contribution to parent company

|

-

|

(1,708)

|

-

|

(3,988)

|

|

Redemption of securities, collaterals, and credits

|

2,311

|

216,482

|

50,446

|

882,542

|

|

Investment in marketable securities and restricted credits

|

(209,548)

|

(204,261)

|

(326,986)

|

(950,122)

|

|

Equity securities

|

(2,717)

|

-

|

-

|

-

|

|

Cash used in investment activities

|

(208,298)

|

2,084

|

(280,901)

|

(89,511)

|

|

Increase in Addition of loans and financing

|

37,885

|

167,511

|

89,672

|

377,841

|

|

Amortization of loans and financing

|

(58,990)

|

(174,822)

|

(232,561)

|

(532,624)

|

|

Loan operations

|

(759)

|

(688)

|

(10,117)

|

(843)

|

|

Sale of treasury shares

|

-

|

715

|

148

|

715

|

|

Proceeds from sale of treasury shares

|

(53,390)

|

-

|

6,984

|

-

|

|

Capital Increase

|

1

|

-

|

132,266

|

167

|

|

Subscription and payment of common shares

|

0

|

0

|

0

|

250,599

|

|

Net cash from financing activities

|

(75,253)

|

(7,284)

|

(13,608)

|

95,855

|

|

Increase (decrease) in cash and cash equivalents

|

(205,481)

|

(6,230)

|

(226,412)

|

(20,596)

|

|

Beginning of the period

|

11,373

|

14,161

|

32,304

|

28,527

|

|

End of the period

|

12,819

|

7,931

|

12,819

|

7,931

|

|

Increase (decrease) in cash and cash equivalents

|

1,446

|

(6,230)

|

(19,485)

|

(20,596)

|

¹ Restatement due to the adoption of IFRS 15 and IFRS 9.

16

|

This release contains forward-looking statements about business prospects, estimates for operating and financial results, and Gafisa’s growth prospects. These are merely projections and, as such, are based exclusively on the expectations of management concerning the future of the business and its continued access to capital to fund the Company’s business plan. Such forward-looking statements depend, substantially, on changes in market conditions, government regulations, competitive pressures, the performance of the Brazilian economy, and the industry, among other factors; therefore, they are subject to change without prior notice.

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 7, 2019

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: André Luis Ackermann

Title: Chief Financial Officer

|

17

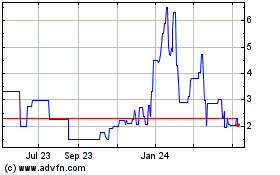

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Jun 2024 to Jul 2024

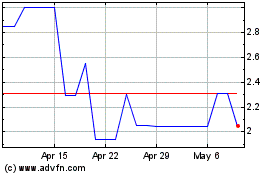

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Jul 2023 to Jul 2024