Amended Report of Foreign Issuer (6-k/a)

October 25 2019 - 7:40AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

GAFISA S.A.

CNPJ/MF 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

Minutes of the Board of Directors’ Meeting of Gafisa S.A. (“Company”)

held on October 23, 2019

1. Date, Time and Place: On October 23, 2019, at 11:00 a.m., at the Company’s headquarters, in the City and State of São Paulo, at Av. Pres. Juscelino Kubitschek, 1830, cj. 32, Bloco 2, Cond. Ed. São Luiz, Vila Nova Conceição, CEP: 04543-900 and by conference call.

2. Call Notice and Attendance: All members of the Company’s Board of Directors, as identified below, except Mr. Roberto Luz Portella, attended the meeting, therefore, the quorum of installation and approval of matters of the agenda was verified.

3. Composition of the Board: Chairman, Mr. Leo Julian Simpson; and Secretary, Mrs. Renata Monteiro Azevedo Melo.

4. Agenda: Discuss and deliberate on: (i) the ratification of the capital increase – 2nd Tranche, and restatement of the Company’s Bylaws; (ii) the engagement of Planner Trustee DTVM to outline the issue of mandatory debentures; and (iii) the execution by the Company’s Board of Executive Officers of all complementary acts necessary to formalize the subject-matters of this Agenda.

5. Resolutions: After discussing the matters of the agenda, the Company’s board members unanimously resolved on the following, except as provided in item 5.2 below:

5.1. To ratify the Company’s capital increase in the total amount of two hundred, seventy-two million, six hundred, ninety-five thousand, eight hundred, ninety-five Reais and seventy-six centavos (R$272,695,895.76) by means of subscription and full payment of forty-eight million, nine hundred, sixty-eight thousand, one hundred and twenty-four (48,968,124) new common shares, of which: (i) thirty-seven million, eighty-three thousand, seven hundred and seventy-one (37,083,771) common shares, subscribed and fully paid by shareholders who exercised their preemptive right at the price of five Reais and fifty-eight centavos (R$5.58), in the total amount of two hundred, six million, nine hundred, twenty-seven thousand, four hundred, forty-two Reais and eighteen centavos (R$206,927,442.18); (ii) eight million, four hundred and seventy thousand, three hundred and seventy-seven (8,470,377) common shares, subscribed and fully paid by shareholders who subscribed the unsold shares of capital increase at the unit value of five Reais and fifty-eight centavos (R$5.58), totaling forty-seven million, two hundred, sixty-four thousand, seven hundred, three Reais and sixty-six centavos (R$47,264,703.66); and (iii) three million, four hundred, thirteen thousand, nine hundred and seventy-six (3,413,976) common shares, subscribed and fully paid by shareholders who subscribed additional unsold shares of capital increase at the unit value of five Reais and forty-two centavos (R$5.42), totaling eighteen million, five hundred, three thousand, seven hundred, forty-nine Reais and ninety-two centavos (R$18,503,749.92).

5.1.1. As a result of the Capital Increase ratified herein, the Company’s paid-up capital stock increases from current two billion, six hundred, fifty-three million, five hundred, eighty-four thousand, four hundred, twenty-two Reais and thirty-eight centavos (R$2,653,584,422.38), composed of seventy-one million, thirty-one

|

(This is an integral part of the minutes of the Board of Directors’ Meeting of Gafisa S.A. held on October 23, 2019)

|

1/2

|

thousand, eight hundred and seventy-six (71,031,876) non-par, registered, book-entry, common shares to two billion, nine hundred, twenty-six million, two hundred, eighty thousand, three hundred, eighteen Reais and fourteen centavos (R$2,926,280,318.14), divided into one hundred and twenty million (120,000,000) non-par, registered, book-entry, common shares.

5.2. To approve, with board member Mr. Antonio Carlos Romanoski abstaining from voting, the engagement of Planner Trustee DTVM S.A. (“Planner”) which will elaborate a study, negotiate and outline the funding of securities to be placed in the domestic or international market, until the limit of one hundred and fifty million US dollars (USD150,000,000.00), among them, bonds, convertible/mandatory debentures and/or other usual market instruments for real estate projects, in light of the Company’s long-term planning.

5.2.1. Referred transactions shall be submitted to the Company’s Shareholders’ Meeting to be properly summoned.

5.3. To authorize the Company’s Board of Executive Officers: (i) to take all the measures as to the capital increase process, also the publication of a notice to shareholders containing the information referring to the ratification approved herein; and (ii) to take all the measures necessary to engage Planner, as well as provide information, sign agreements, discuss structures, engage appraisals, reports, opinions and advisors, as necessary for the full compliance with resolution approved herein.

5.4. The attending Directors ratify the receipt, on October 18, 2019, of the call for this meeting of the Board, in compliance with the provisions of art. 18 of the Company's Bylaws.

6. Closing: With no further matters to be discussed, these minutes were read, approved and signed by all Board members. Signatures (undersigned) Leo Julian Simpson, Chairman, Renata Monteiro Azevedo Melo, Secretary, Board members: Antonio Carlos Romanoski, Eduardo Larangeira Jácome, Leo Julian Simpson, Nelson Sequeiros Rodriguez Tanure, and Thomas Cornelius Azevedo Reichenheim and Denise dos Passos Ramos.

These minutes are a faithful copy of the original minutes drawn up in the Company’s records.

|

|

|

Renata Monteiro Azevedo Melo

Secretary

|

|

(This is an integral part of the minutes of the Board of Directors’ Meeting of Gafisa S.A. held on October 23, 2019)

|

2/2

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 25, 2019

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: André Luis Ackermann

Title: Chief Financial Officer

|

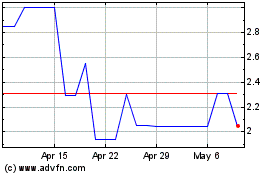

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2024 to May 2024

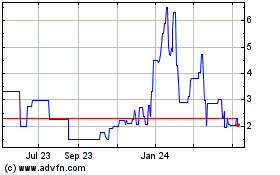

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From May 2023 to May 2024