Report of Foreign Issuer (6-k)

October 15 2019 - 1:08PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2019

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425- 070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b): N/A

GAFISA S.A.

CNPJ 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

Minutes of the Board of Directors’ Meeting

held on October 8, 2019

I – DATE, TIME AND PLACE: On October 8, 2019, at 11:00 a.m., via conference call, as authorized by the Company’s Bylaws.

II – CALL NOTICE AND ATTENDANCE: Members of the Board of Directors were duly called. The Board members Antônio Carlos Romanoski, Eduardo Laranjeira Jácome, Leo Julian Simpson, Nelson Sequeiros Rodriguez Tanure, Roberto Luz Portella, Thomas Cornelius Azevedo Reichenheim and Denise dos Passos Ramos attended the meeting, therefore, the quorum of installation and approval was verified. Mrs. Denise dos Passos Ramos served as secretary of the meeting.

III – COMPOSITION OF THE BOARD: Chairman: Leo Julian Simpson. Secretary: Denise dos Passos Ramos.

IV – AGENDA: approve and authorize: (1) the ratification of execution of the “Private Instrument of Fiduciary Assignment of Collateral Property and Other Covenants” (“Real Estate Fiduciary Assignment Agreement”), entered into between the Company and Habitasec Securitizadora S.A., a corporation headquartered in the City and State of São Paulo, at Avenida Brigadeiro Faria Lima, nº 2.894, 5º andar, cj. 52, CEP 01451-902, enrolled with the National Registry of Legal Entities (CNPJ) No. 09.304.427/0001-58 (“Securitizer”), whereby the Company fiduciarily assigns to the Securitizer the real estate properties, registration numbers 152.300, 152.301, 152.302, 152.306 and 152.308 at the 10th Real Estate Registry Office of the Judicial District of São Paulo, in the State of São Paulo (“Units Sold”), as additional and ancillary guarantee to the faithful, prompt and full payment of part

of

secured obligations assumed by the Company within the scope of the 12th

issue of debentures, as provided for in the “Private Instrument of Indenture

of the 12th Issue of Non-Convertible Debentures, with Security

Interest, in a Single Series, for Private Placement of Gafisa S.A.”, entered

into on May 21, 2018, as amended from time to time (respectively, “Debentures”

and “Indenture of Debentures”); (2) the execution of amendment to the Debentures

Indenture to foresee that proceeds deriving from the assignment of Units Sold

will be used, fully or partially, where applicable, for the extraordinary

amortization of Debentures, if product of division between outstanding balance

of Debentures by present value of Purchase and Sale Commitments of “Moov Espaço

Cerâmica” Project, less Debentures Remuneration (Loan to Value – LTV) is

equal to or lower than sixty-five percent (65.00%); (3) the ratification of guarantees

previously tendered by the Company within the scope of the 12th

Issue of Debentures; (4) the Company’s Board of Executive Officers carries out

all the complementary acts required to formalize the Real Estate Fiduciary Assignment

Agreement, the amendment to the Debentures Indenture and the formalization of

other agreements or amendments deemed necessary; and (5) the ratification of the

acts eventually already practiced by Board of Executive Officers and other

legal representatives of the Company, in accordance with resolutions mentioned

above.

V – RESOLUTIONS: After analyzing the

matters and documents included in the agenda, the Board members unanimously

resolved, without any reservations:

1. To ratify the

execution of the Real Estate Fiduciary Assignment Agreement and subsequent

fiduciary assignment of Units Sold;

2. Execute the amendment

to the Debentures Indenture to foresee that proceeds deriving from the assignment

of Units Sold will be fully or partially used, where applicable, for

extraordinary amortization of Debentures, if product of division between the

outstanding balance of Debentures by present value of Purchase and Sale

Commitments of “Moov Espaço Cerâmica” Project, less Debentures

Remuneration (Loan to Value – LTV) is equal to or lower than sixty-five percent

(65.00%);

3. Expressly

ratify the guarantees tendered by the Company to secure the 12th

Issue Debentures, namely: (a) the fiduciary assignment of current and future

receivables deriving from the sale of independent units of the “Moov Espaço

Cerâmica” Project; (b) commitment to fiduciary assignment of independent units

currently not committed to sale, also those units committed to sale, but to be

purpose of dissolutions (inventory units) referring to the “Moov Espaço

Cerâmica” Project; and (c) Performance Insurance to assure the conclusion of

construction of the “Moov Espaço Cerâmica” Project.

4. Authorize the Board of

Executive Officers to formalize and sign all the acts and take all the measures

necessary to execute the (a) Real Estate Fiduciary Assignment Agreement; (b) the

amendment to the Debentures Indenture; and (c) any other documents to be signed

or amended in order to reflect the adjustments to the 12th Issue of

Debentures;

5. Ratify (a) any acts

provided for in items above eventually already practiced by Board of Executive

Officers; and (b) any other documents to be amended in order to reflect the

inclusion of ancillary collateral approved herein and to reflect the

adjustments to the 12th Issue of Debentures, provided that within

the limit of provisions mentioned in referred instruments.

6. As requested by Board

member, Mr. Eduardo Laranjeira Jacome, the following was submitted for

resolution of all Board members, (i) the ratification of execution of the “Private

Instrument of Second Amendment to the Indenture of the 11th Issue of

Non-Convertible Debentures, with Security Interest, in a Single Series, for

Private Placement of Gafisa S.A.” (“Second Amendment to the Indenture of

11th Issue of Debentures”), referring to the amendment to the 11th

Private Issue of the Company’s Debentures (respectively, “11th

Issue Debentures” and “11th Issue of Debentures”) to

provide for the new conditions of the 11th Issue Debentures, in return

of no declaration by Securitizer (defined below), of early maturity of 11th

Issue Debentures and to ratify the cancellation of the 2nd series of

debentures issued within the scope of 11th Issue, since these debentures

were not fully paid to date; (ii) the ratification of guarantees previously

tendered by the Company within the scope of 11th Issue of Debentures

to be applied to the 11th Issue of Debentures, in accordance with

the terms of the Second Amendment to the 11th Issue of Debentures;

(iii) the ratification of execution of the “Private

Instrument of Second Amendment to the Indenture of 12th Issue of

Non-Convertible Debentures, with Security Interest, in a Single Series, for

Private Placement of Gafisa S.A.” (“Second Amendment to the Indenture of

the 12th Issue of Debentures”), which refers to amendment to the

12th Private Issue of the Company’s Debentures (respectively, “12th

Issue Debentures” and “12th Issue of Debentures”) to

provide for the new conditions of the 12th Issue Debentures, in return

of no declaration by Securitizer (defined below), of early maturity of the 12th

Issue Debentures; (iv) the ratification of guarantees previously tendered by

the Company within the scope of the 12th Issue of Debentures to be

applied to the 12th Issue of Debentures, in accordance with the

terms of the Second Amendment to the 12th Issue of Debentures; and

(v) the ratification of all required complementary acts executed by the

Company’s Board of Executive Officers to formalize the Second Amendment to the

Indenture of the 12th Issue of Debentures and the Second Amendment

to the Indenture of the 11th Issue of Debentures, especially the execution,

on the Company’s behalf, of respective instruments; and (vi) the ratification

of the acts eventually already practiced by Board of Executive Officers and

other legal representatives of the Company, in accordance with resolutions mentioned

above.

7. The following was

unanimously approved by Board members and without reservations:

(i) To ratify

the execution of the Second Amendment to the Indenture of 11th Issue

of the Company’s Debentures, including, but not limited to: (a) the

cancellation of Monthly Ordinary Amortization, from June 2019 (last payment of

monthly amortization in May 2019); (b) the obligation to settle the outstanding

balance on the Maturity Date; (c) the extension of the Maturity Date to May 20,

2020; (d) the allocation of all proceeds deposited in a Separate Equity

Account, which includes the funds referring to the Receivables fiduciarily

assigned to a specific purpose, after the payment of monthly installments of

Remuneration, of Debentures Extraordinary Amortization (“cash sweep”); and (e) the

cancellation of the 2nd series of debentures issued within the scope

of the 11th Issue, since these debentures were not fully paid to

date. Unless otherwise set forth herein, the capitalized terms in this item “1” and item “2” below, have the meaning

assigned thereto by the Second Amendment to the Indenture of 11th

Issue of Debentures;

(ii) To expressly

ratify the security interests tendered by the Company to guarantee the 11th

Issue Debentures, namely: (a) the fiduciary assignment of current and future

receivables deriving from the sale of independent units of the “Square Ipiranga”

Project; (b) commitment to the fiduciary assignment over independent units

currently not committed to sale, also those units committed to sale, but to be

purpose of dissolutions (inventory units) referring to the “Square Ipiranga”

Project; and (c) the Performance Insurance assuring the conclusion of

construction of the “Square Ipiranga” Project;

(iii) To ratify

the execution of the Second Amendment to the Indenture of 12th Issue

of the Company’s Debentures, including but not limited to (a) the cancellation

of the Monthly Ordinary Amortization from June 2019 (last payment of monthly

amortization in May 2019); (b) the obligation to settle the outstanding balance

on the Maturity Date; (c) the extension of the Maturity Date to December 20,

2020; and (d) the allocation of all proceeds deposited in a Separate Equity

Account, which includes the funds referring to the Receivables fiduciarily

assigned to a specific purpose, after the payment of monthly installments of

Remuneration, of the 12th Issue Debentures Extraordinary Amortization

(“cash sweep”). Unless otherwise set forth herein, the capitalized terms

in this item “3” and item “4” below have the meaning assigned thereto by the

Second Amendment to the Indenture of the 12th Issue of Debentures;

(iv) To expressly

ratify the guarantees tendered by the Company to secure the 12th

Issue Debentures, namely: (a) the fiduciary assignment of current and future

receivables deriving from the sale of independent units of the “Moov

Espaço Cerâmica” Project; (b) commitment to the fiduciary assignment over

independent units currently not committed to sale, also those units committed

to sale, but to be purpose of dissolutions (inventory units), of the “Moov

Espaço Cerâmica” Project;

and (c) Performance Insurance to assure the conclusion of construction of the “Moov Espaço Cerâmica” Project;

(v) To ratify the execution of the following instruments (a) the Second Amendment to the Indenture of the 11th Issue of Debentures; (b) the Second Amendment to the Fiduciary Assignment Agreement relating to the 11th Issue of Debentures; (c) the Second Amendment to the Commitment to Fiduciary Assignment relating to the 11th Issue of Debentures; (d) the Second Amendment to the Indenture of 12th Issue of Debentures; (e) the First Amendment to the Fiduciary Assignment Agreement relating to the 12th Issue of Debentures; (f) the First Amendment to the Fiduciary Assignment Commitment relating to the 12th Issue of Debentures; and (g) any other documents to be amended in order to reflect the adjustments to the 11th Issue of Debentures and the 12th Issue of Debentures;

(vi) To ratify (a) any acts provided for in items above eventually practiced by Board of Executive Officers and (b) any other documents to be amended to reflect the adjustments to the 11th Issue of Debentures and to the 12th Issue of Debentures, provided that within the limit of provisions included in referred instruments; and

(vii) To ratify the acts eventually already practiced by the Board of Executive Officers and other legal representatives of the Company, in accordance with resolution mentioned in item 7 above.

VI - CLOSING: With no further matters to be discussed, these minutes were read, approved and signed by attending board members.

These minutes are a faithful copy of the original minutes drawn up in the Company’s records.

Denise dos Passos Ramos

Secretary

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 15, 2019

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: André Luis Ackermann

Title: Chief Executive Officer

|

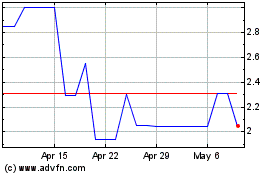

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2024 to May 2024

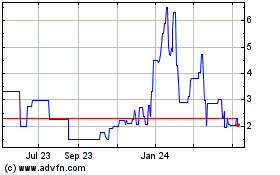

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From May 2023 to May 2024