UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

| FCCC, Inc. |

| (Name of Issuer) |

| Common Stock, $0.001 par value |

| (Title of Class of Securities) |

|

| 30246C104 |

| (CUSIP Number) |

|

| Huijun He |

| 725 Fifth Ave 15th Floor New York, NY 10022 (917) 624-8888 |

| (Name, Address and Telephone Number of Person Authorized to |

| Receive Notices and Communications) |

|

| 3/29/2023 |

| (Date of Event which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Section 240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP NO: 30246C104 | 13D | 2 |

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Huijun He |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (see instructions) (a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS* (see instructions) PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: | 7 | SOLE VOTING POWER 221,565 |

| 8 | SHARED VOTING POWER 33,235 |

| 9 | SOLE DISPOSITIVE POWER 221,565 |

| 10 | SHARED DISPOSITIVE POWER 33,235 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 254,800 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* (see instructions) ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 7.36% |

| 14 | TYPE OF REPORTING PERSON* (see instructions) IN |

(1) Represents 33,235 shares of common stock held by American Public Investment Co. (“API”), of which Huijun He owns thirty percent (30%) ownership interests.

(2) The percentage calculation is based on 3,461,022 shares of common stock, $0.001 par value, outstanding of the Issuer as reported on the Issuer’s Annual Report Form 10-K filed with the SEC on March 31, 2022,

| CUSIP NO: 30246C104 | 13D | 3 |

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Fnu Oudom |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (see instructions) (a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 3 | SOURCE OF FUNDS* (see instructions) PF |

| 4 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 5 | CITIZENSHIP OR PLACE OF ORGANIZATION United States |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: | 7 | SOLE VOTING POWER 1,550,957 |

| 8 | SHARED VOTING POWER 77,548 |

| 9 | SOLE DISPOSITIVE POWER 1,550,957 |

| 10 | SHARED DISPOSITIVE POWER 77,548 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 1,628,505 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* (see instructions) ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 47.05% |

| 14 | TYPE OF REPORTING PERSON* (see instructions) IN |

(1) Represents 77,548 shares of common stock held by American Public Investment Co. (“API”), of which Fnu Oudom owns seventy percent (70%) ownership interests.

(2) The percentage calculation is based on 3,461,022 shares of common stock, $0.001 par value, outstanding of the Issuer as reported on the Issuer’s Annual Report Form 10-K filed with the SEC on March 31, 2022,

| CUSIP NO: 30246C104 | 13D | 4 |

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) American Public Investment Co. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (see instructions) (a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS* (see instructions) PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: | 7 | SOLE VOTING POWER 0 |

| 8 | SHARED VOTING POWER 110,783 |

| 9 | SOLE DISPOSITIVE POWER 0 |

| 10 | SHARED DISPOSITIVE POWER 110,783 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 110,783 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* (see instructions) ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 3.2% |

| 14 | TYPE OF REPORTING PERSON* (see instructions) CO |

| CUSIP NO: 30246C104 | 13D | 5 |

| 1 | NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) William L. He |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (see instructions) (a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS* (see instructions) PF |

| 5 | CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION United States |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH: | 7 | SOLE VOTING POWER 332,347 |

| 8 | SHARED VOTING POWER 0 |

| 9 | SOLE DISPOSITIVE POWER 332,347 |

| 10 | SHARED DISPOSITIVE POWER 0 |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 332,347 |

| 12 | CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* (see instructions) ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 9.6% |

| 14 | TYPE OF REPORTING PERSON* (see instructions) IN |

| CUSIP NO: 30246C104 | 13D | 6 |

Item 1. Security and Issuer

This statement relates to the shares of common stock, no par value, (the “Common Stock”) of FCCC, Inc., a Nevada corporation (the “Issuer”). The Issuer’s principal executive offices are located at 725 Fifth Ave, 15th Floor, New York, NY 10022.

Item 2. Identity and Background

This statement is being filed on behalf of American Public Investment Co. (“API”), Mr. Fnu Oudom, and Mr. Huijun He, (together with API and Mr. Oudom, the “Reporting Persons”):

1. API.

(a) API is a corporation organized under the laws of the state of California engaged as a holding company.

(b) The principal office for API is located at 7700 Irvine Centre Drive, Suite 800, Irvine, CA 92618.

(c) Within the last five years, API has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(d) During the last five years, API has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction, which as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, United States federal or state securities laws or finding any violation with respect to such laws.

2. Mr. Fnu Oudom.

Mr. Fnu Oudom is an officer, director and seventy percent (70%) shareholder of API. Mr. Oudom disclaims benenficial ownership of any securities beneficially owned by API, except to the extent of his pecuniary interest.

(a) Mr. Fnu Oudom, an individual.

(b) Mr. Fnu Oudom’s business address is 725 Fifth Ave, 15th Floor, New York, NY 10022.

(c) Mr. Fnu Oudom’s present principal occupation is the director, chairman and president of the Issuer, but is also a director of API.

(d) Within the last five years, Mr. Fnu Oudom has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, Mr. Fnu Oudom has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction, which as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, United States federal or state securities laws or finding any violation with respect to such laws.

(f) Mr. Fnu Oudom is a citizen of the United States.

| CUSIP NO: 30246C104 | 13D | 7 |

3. Mr. Huijun He.

Mr. Huijun He is an officer, director and thirty percent (30%) shareholder of API. Mr. He disclaims benenficial ownership of any securities beneficially owned by API, except to the extent of his pecuniary interest.

(a) Mr. Hujun He, an individual.

(b) Mr. Huijun He’s business address is 725 Fifth Ave, 15th Floor, New York, NY 10022.

(c) Mr. Huijun He’s present principal occupation is the director, CEO and secretary of the Issuer, but is also a director of API.

(d) Within the last five years, Mr. Huijun He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, Mr. Huijun He has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction, which as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, United States federal or state securities laws or finding any violation with respect to such laws.

(f) Mr. Huijun He is a citizen of the United States.

4. Mr. William L. He.

(a) Mr. William L. He, an individual.

(b) Mr. William L. He’s business address is 725 Fifth Ave, 15th Floor, New York, NY 10022.

(c) Mr. William L. He’s present principal occupation is a director of the Issuer.

(d) Within the last five years, Mr. William L. He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, Mr. William L. He has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction, which as a result of such proceeding, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, United States federal or state securities laws or finding any violation with respect to such laws.

(f) Mr. William L. He is a citizen of the United States.

Item 3. Source and Amount of Funds or Other Consideration

March, 22, 2023, pursuant to a Board of Director’s Resolution (the “Director’s Resolution”) of FCCC, Inc. (the Company), dated March 22, 2023, by and among, Huijun He, FNU Oudom and American Public Investment Co. (APIC) pursuant to which the Board of Directors re-assigned shares to incoming Directors.

Prior to the Director’s Resolution and in the most recent audited financial statement, APIC, Irvine, California, and Huijun He collectively owned 62.9% of common shares in FCCC, Inc. (the Control Block.) APIC reported ownership of 70% of the control block of common shares in FCCC, Inc registered and reported on April 26, 2021. APIC is beneficially owned 70% by FNU Oudom, the initial provider of funds and financing for acquiring above shares in the Company. FNU Oudom is also the current Chairman of the Company. Otherwise, APIC is 30% beneficially owned by Huijun He, who is also the current CEO of the Company. Additionally, Huijun He personally owns 30% of the control block of common shares in FCCC Inc.

Following FCCC Inc’s, Director’s Resolution:

| | 1. | Given, APIC owns 70% of the control block, APIC, through a Director’s Resolution on March 22, 2023, to assign, transfer, and register shares in the Company to the amount of 65% of the control block to FNU Oudom. This resolution is effective April 1, 2023. |

| | | |

| | 2. | Given, Huijun He personally owns 30% of the control block of common shares in FCCC Inc., Huijun He will assign, transfer, and register 15% of the control block from his own holdings to William L. He, and 5% to FNU Oudom. Huijun He will retain 10% shareholding in the control block. |

| | | |

| | 3. | In summary, after the effect of the FCCC, Inc. Director’s Resolution on April 1, 2023, the shares in the control block as well as right to future stock issuances should reflect: 70% to FNU Oudom, 15% to William L. He, 10% to Huijun He, and 5% in APIC. |

| CUSIP NO: 30246C104 | 13D | 8 |

Item 4. Purpose of the Transaction

The Reporting Persons acquired the Issuer’s shares of Common Stock for investment purposes.

Other than as described above, none of the Reporting Persons currently has any plans or proposals that relate to, or would result in, any of the matters listed below, although the Reporting Persons may, at any time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto:

(a) The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

(b) An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

(c) A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

(d) Any change in the present Board of Directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board;

(e) Any material change in the present capitalization or dividend policy of the Issuer;

(f) Any other material change in the Issuer’s business or corporate structure including, but not limited to, if the Issuer is a registered closed-end investment company, any plans or proposals to make any changes in its investment policy for which a vote is required by Section 13 of the Investment Company Act of 1940;

(g) Changes in the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person;

(h) Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

(i) A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, or

(j) Any action similar to any of those enumerated above.

| CUSIP NO: 30246C104 | 13D | 9 |

Item 5. Interest in Securities of the Issuer

(a) As of the date hereof, API beneficially owns an aggregate of 110,783 shares of Common Stock. Mr. Oudom is deemed to beneficially own 1,628,505, of which (i) 77,548 shares of Common Stock held by API, of which Mr. Oudom holds seventy percent (70%) ownership interests and another (ii) 1,550,957 shares of common stock through the Director’s Resolution. Mr. He is deemed to beneficially own 245,800 shares of Common Stock, of which (i) 33,235 shares are held by API, of which Mr. He holds thirty percent (30%) ownership interests, and another (ii) 221,565 shares of common stock. Through the Director’s Resolution, Mr. William L. He now beneficially owns 332,347 of common stock.

(b) The following table sets forth the number of shares of Common Stock as to which the Reporting Persons have (i) the sole power to vote or direct the vote, (ii) shared power to vote or to direct the vote, (iii) sole power to dispose or to direct the disposition, or (iv) shared power to dispose or to direct disposition:

| Reporting Person | | Sole Voting Power | | | Shared Voting Power* | | | Sole Dispositive Power | | | Shared Dispositive Power* | |

| API | | | 0 | | | | 110,783 | | | | 0 | | | | 110,783 | |

| Mr. Fnu Oudom | | | 1,550,957 | | | | 77,548 | | | | 1,550,957 | | | | 77,548 | |

| Mr. Huijun He | | | 221,565 | | | | 33,235 | | | | 221,565 | | | | 33,235 | |

| Mr. William L. He | | | 332,347 | | | | 0 | | | | 332,347 | | | | 0 | |

(c) Except as set forth herein, none of the Reporting Persons have effected any transactions in the Common Stock during the last 60 days.

(d) No other person is known to have the right to receive or the power to direct the receipt of dividends from, or any proceeds from the sale of, the Common Stock beneficially owned by any of the Reporting Persons

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The content of the foregoing Items is hereby incorporated herein by reference in entirety.

Item 7. Materials to be Filed as Exhibits

Exhibit A – Joint Filing Agreement*

* Attached herewith

| CUSIP NO: 30246C104 | 13D | 10 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 4, 2023

| | Huijun He | |

| | | |

| | /s/ Huijun He | |

| | Huijun He, an individual | |

| | Fnu Oudom | |

| | | |

| | /s/ Fnu Oudom | |

| | Fnu Oudom, an individual | |

| | | |

| | American Public Investment Co., a California company | |

| | | |

| | /s/ Huijun He | |

| | Huijun He,Chief Executive Officer | |

Attention - Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

| CUSIP NO: 30246C104 | 13D | 11 |

EXHIBIT A

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned hereby acknowledge and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to this statement shall be filed on behalf of each of the undersigned without the necessity of filing additional joint filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy of the information concerning him, her or it contained therein, but shall not be responsible for the completeness and accuracy of the information concerning the other, except to the extent that he, she or it knows or has reason to believe that such information is not accurate. The undersigned each expressly authorize each other to file any and all amendments to such statement on their behalf. The undersigned agree that this joint filing agreement may be signed in counterparts.

Dated: May 4, 2023

| | | Huijun He | |

| | | | |

| | | /s/ Huijun He | |

| | | Huijun He, an individual | |

| | | | |

| | | Fnu Oudom | |

| | | | |

| | | /s/ Fnu Oudom | |

| | | Fnu Oudom, an individual | |

| | | | |

| | | American Public Investment Co., a California company | |

| | | | |

| | | /s/ Huijun He | |

| | | Huijun He, Chief Executive Officer | |

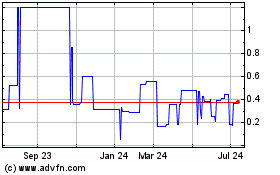

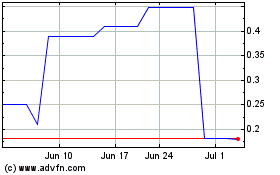

FCCC (PK) (USOTC:FCIC)

Historical Stock Chart

From Apr 2024 to May 2024

FCCC (PK) (USOTC:FCIC)

Historical Stock Chart

From May 2023 to May 2024