UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

____________________________________________________

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): November 4, 2009

EGPI

FIRECREEK, INC.

(Exact

name of registrant as specified in its charter)

Nevada

(State or

other jurisdiction of incorporation or organization)

|

000-32507

(Commission

File Number)

|

88-0345961

(IRS

Employer Identification No.)

|

|

|

|

|

3400

Peachtree Road, Suite 111, Atlanta, Georgia

(principal

executive offices)

|

30326

(Zip

Code)

|

(404)

421-1844

(Registrant’s

telephone number, including area code)

6564

Smoke Tree Lane Scottsdale, Arizona 85253

(Former

address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

¨

Written

communications pursuant to Rule 425 under the Securities Act

¨

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act

¨

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

¨

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

Item

1.01. Entry

into a Material Definitive Agreement.

A.

On

November 4, 2009, EGPI Firecreek, Inc., a Nevada corporation (”EGPI” or the

“Company”),

entered

into a Stock Purchase Agreement (the "Agreement"), to be effective as of October

1, 2009, by and among itself, Bob Joyner, a Florida resident ("Joyner"), Stewart

Hall, a North Carolina resident ("Hall"), Hunter Intelligent Traffic Systems,

LLC, a Georgia limited liability company located at 1021 Golf Estates Drive,

Woodstock Georgia 30189 (“Hunter”) and together with Joyner and Hall,

hereinafter sometimes referred to individually as a "Seller" and collectively

as, (the "Sellers"), and South Atlantic Traffic Corporation, a Florida

corporation located at 2295 Towne Lake Pkwy., Suite 116 PMB 305, Woodstock,

Georgia, 30189 ( “SATCO”), (the Sellers, the Purchaser, the Corporation

collectively referred to as the "Parties"), and whereas the Registrant shall

acquire all of the outstanding stock and interests held in SATCO from the

Sellers.

The

Agreement calls for the following material terms:

I.

Purchase of Stock, Purchase

Price:

1.

The Company agreed to pay to the Sellers aggregate consideration of

$2,326,300 (the "PURCHASE PRICE") by delivery of:

(a) Cash

in available funds equal to the greater of: (i) sum of Fifty Percent (50%)

of SATCO’s available cash balance at Closing plus Twenty-Five Percent

(25%) of SATCO’s trade accounts receivables aged less than Ninety (90) days past

due at Closing with an additional amount to be negotiated for the outstanding

retainage and imminent collections of receivables over 90 days old as negotiated

prior to Closing; which was (ii) $600,000.

(b) Promissory

notes issued to each Seller in the aggregate principal amount of Five Hundred

Sixty Three Thousand One Hundred US Dollars ($563,100.00) (the “PROMISSORY

NOTES”). The Promissory Notes will accrue interest at a rate of Nine Percent

(9%) per annum and will amortize with a principal and interest payment at the

First Anniversary Date of the Transaction of Twenty-Five Percent (25%) of the

Promissory Notes plus accrued interest, a principal and interest payment at the

Second Anniversary Date of the Transaction of Twenty-Five Percent (25%) of the

Promissory Notes plus accrued interest and a Final Payment of the Outstanding

Balance of the Promissory Notes plus any unpaid interest on the Third

Anniversary Date of the Transaction.

(c) 2,908,000

shares of the Company’s common stock issued to the Sellers pro rata based on

their ownership in SATCO representing $1,163,200.00 in value at a price per

share of $0.40 ("STOCK CONSIDERATION").

(d) Principal

and interest on the Promissory Notes will be allocated to the Sellers pro rata

based on their equity ownership SATCO. The Promissory Notes carry a cumulative

claw-back feature (the “Claw Back”) for the term of the Promissory Notes listed

in the agreement.

(e) Stock

consideration shall be issued at closing as follows: The Purchaser shall

issue to the Sellers an aggregate of

2,908,000 shares of its Common Stock (“the “STOCK CONSIDERATION”) the

total Stock Consideration to be paid to the Sellers based upon a share price

of Forty Cents ($0.40) per share.

(f) Stock

Consideration issued at Closing will carry a make whole provision (the “Make

Whole”). It is the parties’ intention that the Proposed Transaction

will be structured as a tax-free reorganization under Section 368(a) of the

Internal Revenue Code of 1986, as amended. The Make Whole provides down-side

protection against a decline in the Company’s common share price. The Make Whole

is available only for shares held from the Stock Consideration by the Seller for

a period of one year following Closing.

In the event that the

Market Price Per Share of the Stock Consideration during the thirty (30)

consecutive trading days immediately prior to the first anniversary of the

Closing (the “Make Whole Date”) is less than $.40, the Company would, at the

Company’s option, either issue to Sellers that number of additional shares of

EGPI common stock equal to (1) the number of shares of EGPI common stock

comprising the Stock Consideration held at the Make Whole Date,

multiplied by

$.40,

less

(2) the

number of shares of EGPI common stock comprising the Stock Consideration held at

the Make Whole Date,

multiplied by

the

Market Price Per Share of the Stock Consideration on the Make Whole

Date. Notwithstanding the foregoing, the Company’s obligation to make

any adjustment pursuant to the preceding sentence shall terminate in the event

that, at any time prior to the Make Whole Date, the aggregate Market Price Per

Share of the Company’s common stock during any twenty consecutive trading days

exceeds $.75. The termination of the Make Whole mechanism will only apply if the

Sellers’ shares are registered during the entire twenty consecutive trading days

period, during which the Market Price Per Share of the Company’s common stock

exceeds $.75, by virtue of eligibility and effectiveness of either i)

144 legend removal or ii) self imposed registration process by the

Company.

II.

Purchase Price Adjustment

Mechanism:

1. The

Stock Consideration for each of the Sellers will be adjusted based on the final

Unaudited Financial Statements for the period the purchase price was calculated

and the impact on calculated earnings before interest, taxes, depreciation and

amortization (“EBITDA”) used in the original formula. The

determinations of EBITDA and other financial results for purposes of any

post-closing adjustment of the sales price must be made in accordance with

generally accepted accounting principles (“GAAP”), using the same methods of

accounting, accounting principles and practices utilized in the preparation of

SATCO's financial statements for the periods preceding the Closing, and other

factors determined in the Agreement.

(a) The

aggregate Stock Consideration to be paid by the Company to the Sellers is

subject to a one-time adjustment based upon SATCO's final audited financial

statements, as described in Agreement and Schedule 1.3.3 thereto

(b)

Within sixty (60) days after the closing date, the Company, at the

Company’s expense, will cause SATCO to prepare and deliver to the Sellers,

special purpose financial statements prepared in accordance with GAAP, applied

on a consistent basis in accordance with the Corporations historical accounting

policies Agreementshowing results of SATCO operations as of the Closing Date

(the "DETERMINATION DATE FINANCIAL STATEMENTS"). The Determination Date

Financial Statements will be prepared for the sole purpose of determining

adjustments to the Purchase Price and may not reflect the actual financials of

SATCO used in preparing the Company’s consolidated financial statements due to

the Company’s reporting requirements under GAAP.

(c) The Sellers

will have thirty (30) days from the date the

Determination Date Financial Statements are delivered by

the Company to review the Determination Date Financial

Statements and propose

any adjustments for the purpose of determining

adjustments to the Purchase Price.

(d)

The "ADJUSTED PURCHASE PRICE" for the Shares shall be the

greater of (x) 4.5 times the difference in the Corporation's EBIDTA for the

Determination Period, as calculated from the Determination Date Financial

Statements and the EBITDA used for the 24 month trailing period in the purchase

price calculation. The “Determination Period” shall be for the trailing 24

months from May 1

st

, 2007

to April 30

th

,

2009.The adjusted purchase price shall be applied against the Stock

Consideration. The Sellers will deliver any shares of Common Stock required to

pay any shortage between the Purchase Price and the Adjusted Purchase Price,

free and clear of all Liens.

III.

Sellers Earn

Out:

1. In

addition to the Purchase Price, the Sellers will,

for a period of thirty six (36) months

following the Closing Date (the "EARNOUT TERM"),

(a) Be

entitled to earn incentive compensation payable in cash (the “Earnout Provision”

or “Earnout”) based upon the final performance of SATCO, as defined in EXHIBIT A

to the Agreement, according to the formula set forth on EXHIBIT A,

and,

(b) Be

entitled to earn additional equity compensation based upon the financial

performance of acquired companies, determined in accordance with the provisions

of EXHIBIT A to the Agreement.

IV.

Option To

Repurchase:

1. If

the average Market Price for the Common Stock is less than Forty Cents ($0.40)

per share for the fifteen (15) consecutive Trading Days ending on the Second

Anniversary Date, then the Sellers shall have the option, but not the

obligation, to repurchase all, but not less than all, of the Shares from the

Purchaser. The Sellers shall have thirty (30) days from the Second Anniversary

Date to notify the Purchaser of its intent to exercise its purchase option. In

the event that the Sellers exercise their option to acquire the Shares, then the

Sellers shall be obligated to purchase the Shares at an aggregate purchase price

of $2,326,300 payable in $1,163,100 in cash and balance of any note and

2,908,000 shares of the Purchaser’s common stock.

2. Notwithstanding

the foregoing, the Sellers shall not have an

option to repurchase the Shares pursuant to

Section 1.5.1 of the Agreement in

the event that any of the

following has occurred:

(a) projected, pro forma,

combined, consolidated revenue run rate for the

Purchaser for the twelve (12)

month period ending on the Second

Anniversary Date exceeds $50,000,000;

(b) the

Market Price for the Common Stock is equal

to or greater than One Dollar

($1.00) per share (on an adjusted basis taking

into consideration any capital

reorganization, reclassification, or otherwise) for three (3) consecutive

trading days occurring between the Closing Date and the Second

Anniversary Date;

(c)

consolidated net income before taking into

account federal and any state or local income taxes for the Purchaser

for the twelve (12) month period ending on the Second Anniversary

Date exceeds $13,000,000;

(d) as of the Second Anniversary Date

the Common Stock is listed for

trading on the National Association of Securities

Dealers' Automated Quotation Small Cap

Market;

(e) the Corporation's EBIDTA is

less than $400,000 for the twelve (12) month period ending on the

Second Anniversary Date or

(f) the Corporation's

revenue is less than $12,000,000 for the twelve

(12) month period ending on the

Second Anniversary Date.

V.

Purchaser Stock Issued To

The Seller:

1. No

fractional shares of Common Stock shall be issued to the Sellers hereunder, and

the number of shares of Common Stock to be issued shall

be rounded down to the nearest whole share. If a

fractional share interest

arises pursuant to any calculation in Section

1.3 or elsewhere herein, the

Purchaser shall eliminate such fractional share

interest by paying the Seller

the amount computed by multiplying

the fractional interest by the price of a

full share (with such price being the same

price used to determine the shares

then being issued).

2. The Sellers shall be granted registration rights,

with respect to all shares of Common Stock issued to the

Sellers hereunder, as more

specifically set forth in that certain Registration Rights

Agreement (the

"REGISTRATION RIGHTS AGREEMENT") in the form attached

hereto as EXHIBIT B.

3. Shares of Common Stock, when

issued and

delivered to the Seller in accordance with the

terms hereof, will be duly

authorized, validly issued, fully-paid and non-assessable.

4. The

stock certificates evidencing the Shares of Common Stock issued to

Sellers hereunder will bear the following legend:

THIS

SHARES OF STOCK EVIDENCED BY THIS STOCK CERTIFICATE HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES LAWS OF ANY

STATE AND MAY NOT BE SOLD, TRANSFERRED, OR OTHERWISE DISPOSED OF EXCEPT PURSUANT

TO AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT AND APPLICABLE STATE

SECURITIES LAWS OR PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION

REQUIREMENTS OF SUCH ACT AND SUCH LAWS.

VI.

Employee Bonus

Pool:

1. A

pool of shares of the Purchaser’s common stock (500,000 shares) shall be made

available for distribution to employees of the Corporation at the first

anniversary of the Closing in an incentive stock option plan for the benefit of

certain employees of the Companies designated by the Sellers, with an exercise

price not to exceed one hundred and ten percent market price on date of

issuance.

VII.

Initial Financing And Line

Of Credit Clause:

1. The

Purchaser acknowledges that the Factoring Transaction associated with Creative

Capital Associates is an initial financing and the Purchaser is bound by this

agreement to obtain an additional traditional Line of Credit, or other

traditional form of debt, as soon as possible, as stipulated in the original

Letter of Intent. The Purchaser agrees to obtain a conventional Line of Credit

Financing Facility, or other traditional form of debt, within forty-five (45)

days of closing with an option by the Purchaser to extend this deadline to

January 31, 2010. In addition, the Purchaser will reimburse the interest charges

for the existing financing to the Corporation.

VIII.

Personal

Guaranties:

1. The

Agreement provides (i) that the Purchaser will fully indemnify the Sellers for

any amounts the Sellers are required to pay pursuant to such guarantees, and

(ii) that the Purchaser will offer to replace the Sellers’ personal guaranties

with its corporate guaranty, or otherwise take any action required to remove the

guaranties, as soon as possible following the Closing.

IX.

Condition To

Closing:

1. A

cash payment in the amount of $600,000 will be made to the Sellers, and a cash

payment of $100,000, which will be applied toward the working capital

requirement, will be made to the Corporation within forty-eight (48) hours of

the signature date of the Agreement.

X

Directors and Officers

of the Newly Acquired Corporation, SATCO:

(a)

Following the

Merger Brandon D Ray

shall serve as the board of directors of

SATCO, along with its present Directors Mr. Bob Joyner, Mr. Michael Hunter, and

Mr. Stewart Hall. Thereafter, the number of directors of SATCO shall be

appointed by the Registrant, its shareholder(s), to serve until such time as

their successors have been elected and qualified.

(a) If

a vacancy shall exist on the board of directors of SATCO Corporation on the

Effective Date, such vacancy may be filled by the board of directors of the

Surviving Corporation as provided in the Bylaws of the Surviving

Corporation.

(b) All

persons who, on the Effective Date, are executive or administrative officers of

SATCO Corporation shall be the officers of the acquired corporation until the

board of directors of the acquired corporation shall otherwise

determine. The board of directors of the acquired corporation may

elect or appoint such additional officers as it may deem necessary or

appropriate.

1.

Articles of

Incorporation

. The Articles of Incorporation of the

wholly owned Subsidiary SATCO existing on the Effective Date, shall continue in

full force as the Articles of Incorporation of the acquired corporation, until

altered, amended, or repealed as provided therein or as provided by

law.

2.

Bylaws

. The

Bylaws of the wholly owned Subsidiary SATCO existing on the Effective Date,

shall continue in full force as the Bylaws of the acquired corporation until

altered, amended, or repealed as provided therein or as provided by

law.

3.

Directors and Officers of

EGPI

. On the Effective Date, the present Officers and

Directors of EGPI shall serve.

4.

Copies of the Plan of

Merger

. A copy of this Plan of Merger is on file at 3400

Peachtree Road, Suite 111, Atlanta, Georgia 30326, the principal offices of M3,

and at 6564 Smoke Tree Lane, Scottsdale, Arizona 85253, the principal offices of

EGPI and Energy Producers, Inc. A copy of this Stock Purchase

Agreement will be furnished to any stockholder of SATCO, or EGPI, on written

request and without cost.

Conditions

Subsequent

. As soon as practicable following the Effective

Date, the conditions above herein contained in Section I-IX, and subsections, as

applicable one or more, shall be active.

The Plan of Merger closed on May 21,

2009 and the Effective Date of the Merger was May 22, 2009, with the filing of

Articles of Merger in the States of Nevada and Georgia.

A copy of

the Stock Purchase Agreement (Agreement) and its related attachments, are

attached as exhibits to this report.

Accounting

Treatment;

The

acquisition of SATCO is being accounted for as a purchase. The stockholders of

SATCO will own 2,908,000 shares of the outstanding shares of EGPI Common Stock

immediately following the closing, and subject to make whole provisions in the

Agreement. The Registrant is deemed to be the acquirer in the

acquisition. Consequently, the assets and liabilities and the

historical operations of SATCO prior to the Acquisition will be reflected in the

financial statements and will be recorded at the historical cost basis of

SATCO. Our consolidated financial statements after completion of the

SATCO acquisition will include the assets and liabilities of both EGPI and its

subsidiaries and interests including SATCO, historical operations of SATCO and

our EGPI operations from the Effective Date of the Merger. As a

result of the issuance of the shares of our EGPI Common Stock pursuant to the

acquisition, we believe a change in control of EGPI has not occurred on the

Effective Date of the SATCO acquisition. Except as described herein,

no arrangements or understandings exist among present or former controlling

stockholders with respect to the election of members of our board of directors

and, to our knowledge, no other arrangements exist that might result in a future

change of control of EGPI. EGPI, for the foreseeable future, will

continue to be a “smaller reporting company,” as defined under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), following the Acquisition

of SATCO.

On the

Effective Date of the Merger, there were approximately 10,651,619 shares of the

EGPI Common Stock outstanding owned by the EGPI Stockholders who were not

“affiliates” as defined in the Securities Act. These approximate

10,651,619 shares constituted the “public float” of EGPI prior to the Merger and

will continue to represent the only shares of the EGPI Common Stock that are

currently eligible for resale under Rule 144, unless otherwise determined in

accordance with such Rule.

Prior to

the Merger, there were no material relationships between EGPI or SATCO, or any

of their respective affiliates, directors or officers, or any associates of

their respective officers or directors.

EGPI

intends to carry on the business of our new wholly owned Subsidiary, South

Atlantic Traffic Corporation at 2295 Towne Lake Pkwy., Suite 116 PMB 305,

Woodstock, Georgia, 30189. EGPI has offices located for its M3

Lightning, Inc. operations located at 3400 Peachtree Road, Suite 111, Atlanta,

Georgia 30326, and has a telephone number of (404) 421-1844. EGPI Parent and

Energy Producers, Inc. subsidiary operations are located at 6564 Smoke Tree

Lane, Scottsdale, Arizona 85253, and has a telephone number of (480)

948-6581.

South Atlantic Traffic Corporation

(SATCO)

:

SATCO has

been in business since 2001 and has several offices throughout the Southeast

United States. They carry a variety of products and inventory geared primarily

towards the transportation industry, which reportedly generate nearly $15

million in annual revenues. SATCO's products range from traffic signal

equipment, traffic and light poles, data/video systems and ITS surveillance

systems. South Atlantic Traffic Corporation (SATCO) offers a comprehensive

selection of the finest transportation products available. SATCO works closely

with DOT agencies, local traffic engineers, contractors, and consultants to

customize high quality traffic control systems.

SATCO’s

representatives have 120 years of collective experience distributing traffic

products throughout the Southeastern U.S. The company’s success in the industry

is a direct result of SATCO’s dedication to providing quality products, at

competitive prices, with service after the sale. SATCO’s products range from

loop sealant, traffic and light poles, data/video systems, ITS surveillance

systems, and most things in between. In addition, SATCO’s ongoing relationships

within the traffic industry allow the company to procure and provide specialty

items on an as needed basis.

SATCO has

recently entered into an exclusive Distributor Agreement with a manufacturer of

industrial wireless data radio modem communication networks with optional

embedded GPS radio location monitoring technologies. SATCO has also entered into

an agreement with a company that manufactures spun concrete poles, high quality

decorative outdoor lighting fixtures, fabricated metal poles, arms, and site

furnishings. The additional lines will augment and align with SATCOs existing

products offering of traffic and intelligent transportation products currently

represented.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

In this

Current Report, we make a number of statements, referred to as “forward-looking

statements” which are intended to convey our expectations or predictions

regarding the occurrence of possible future events or the existence of trends

and factors that may impact our future plans and operating

results. We note, however, that these forward-looking statements are

derived, in part, from various assumptions and analyses we have made in the

context of our current business plan and information currently available to us

and in light of our experience and perceptions of historical trends, current

conditions and expected future developments and other factors we believe to be

appropriate in the circumstances.

You can

generally identify forward-looking statements through words and phrases such as

“seek,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

“budget,” “project,” “may be,” “may continue,” “may likely result,” and similar

expressions. When reading any forward-looking statement you should

remain mindful that all forward-looking statements are inherently uncertain as

they are based on current expectations and assumptions concerning future events

or future performance of SATCO, and that actual results or developments may vary

substantially from those expected as expressed in or implied by that statement

for a number of reasons or factors, including those relating to:

|

|

|

|

·

|

Whether

or not markets for our products develop and, if they do develop, the pace

at which they develop;

|

|

|

|

|

·

|

Our

ability to attract and retain the qualified personnel to implement our

growth strategies;

|

|

|

|

|

·

|

Our

ability to fund our short-term and long-term financing

needs;

|

|

|

|

|

·

|

Competitive

factors;

|

|

|

|

|

·

|

General

economic conditions;

|

|

|

|

|

·

|

Changes

in our business plan and corporate strategies; and

|

|

|

|

|

·

|

Other

risks and uncertainties discussed in greater detail in the sections of

this Current Report.

|

Each

forward-looking statement should be read in context with, and with an

understanding of, the various other disclosures concerning SATCO and our

business made elsewhere in this Current Report as well as other pubic reports

filed with the SEC. You should not place undue reliance on any

forward-looking statement as a prediction of actual results or

developments. We are not obligated to update or revise any

forward-looking statement contained in this Current Report to reflect new events

or circumstances unless and to the extent required by applicable

law.

DIRECTORS

AND EXECUTIVE OFFICERS

Following

the Effective Date of the Acquisition, our Directors and Executive Officers

are:

|

Name

|

|

Age

|

|

Position(s)

|

|

Position(s)

Held Since

|

|

Robert

S. Miller, Jr.

|

|

26

|

|

Director

and Executive Vice President

|

|

2009

|

|

Michael

Kocan

|

|

41

|

|

Director

and President and Chief Operating Officer

|

|

2009

|

|

David

H. Ray

|

|

31

|

|

Director

and Executive Vice President and Treasurer

|

|

2009

|

|

Brandon

D. Ray

|

|

28

|

|

Director

and Executive Vice President of Finance

|

|

2009

|

|

Dennis

R. Alexander

|

|

55

|

|

Director

and Chief Executive Officer and Chief Financial Officer

|

|

1999

|

|

Larry

W. Trapp

|

|

67

|

|

Director

and Executive Vice President

|

|

2008

|

|

Michael

Trapp

|

|

42

|

|

Director

|

|

2008

|

|

Melvena

Alexander

|

|

75

|

|

Secretary

and Comptroller

|

|

1999

|

|

Michael

D. Brown

|

|

|

|

Director

|

|

2009

|

|

Garrett

Sullivan

|

|

|

|

Director

|

|

2009

|

|

|

|

|

|

|

|

|

The

members of our board of directors are subject to change from time to time by the

vote of the stockholders at special or annual meetings to elect

directors. The number of the directors may be fixed from time to time

by resolution duly passed by our board. Our board has fixed the

number of our directors at nine.

Robert S.

Miller, Jr., Michael Kocan, David H. Ray, Brandon D. Ray, Dennis R. Alexander,

Larry W. Trapp, Michael Trapp, Garrett M. Sullivan, and Michael D. Brown, shall

serve as the board of directors of EGPI.

Vacancies

and newly created directorships resulting from any increase in the number of

authorized directors may generally be filled by a majority of the directors then

remaining in office. The directors elect officers

annually. David H. Ray and Brandon D. Ray are

brothers. Dennis R. Alexander is the son of Melvena

Alexander. Michael Trapp is the son of Larry W. Trapp.

We may

employ additional management personnel, as our board of directors deems

necessary. We have not identified or reached an agreement or

understanding with any other individuals to serve in management positions, but

do not anticipate any problem in employing qualified staff.

A

description of the business experience during the past several years for our

directors and executive officer is set forth below.

Dennis R.

Alexander has served as Chairman, President and Chief Financial Officer of EGPI

and Firecreek Petroleum, Inc. since February 10, 2007. He served as

Chairman and Chief Financial Officer of EGPI and Firecreek Petroleum, Inc. since

July 1, 2004 through February 9, 2007 having served as the President and

Director of EGPI from May 18, 1999 to June 30, 2004. In September

1998 he was a founder, and from January 19, 1999 through its acquisition with

EGPI served as President and Director of Energy Producers Group,

Inc. From April 1997 through March 1998, served as CEO, Director,

Consultant of Miner Communications, Inc., a media communications

company. From April 26, 1997 through March, 1998 he was a director of

Rockline, Inc., a private mining, resource company, and a founder of World Wide

Bio Med, Inc., a private health-bio care, start up company. Since

March 1996 to the present he has owned Global Media Network USA, Inc., which has

included management consulting, advisory services. Mr. Alexander

devotes approximately 60 to 80 hours per week minimum, and more as required, to

the business of EGPI.

Michael

Kocan, since 1999, has been president and owner of Traffic & Lighting Corp.

in Roswell, Georgia. From 1997 to 1999, Mr. Kocan was a Sales Manager

at Southeastern Transportation Products in Winter Park,

Florida. Prior to that, he acted as Managing Director for United

Lighting Standards in Warren, Michigan from 1995 until 1997. Mr.

Kocan graduated from Oral Roberts University with a Bachelor of Science degree

in Business Management in 1991.

Robert S.

Miller, Jr. has been a partner in M3 since August 2007. From March

2006 until July 2007, he was Lighting Project Manager for Power Design Resources

in Atlanta, Georgia. He obtained a Bachelor of Science Degree in

Consumer Economics from the University of Georgia in December 2005.

David H.

Ray became a managing member of Strategic Partners Consulting, LLC in September

2008. From June 2006 until September 2008, Mr. Ray worked as the

Manager of Financial Reporting and Budgeting for Charys Holding Company, Inc., a

publicly-traded company. From May 2003 until June 2006, Mr. Ray

worked at Cumulus Media, Inc. as an Accounting Manager, Senior Accountant and

Staff Accountant. Mr. Ray graduated Summa Cum Laude and received a

B.S. Degree in Accounting with a concentration in Finance from North Carolina

State University in May 2003.

Brandon

D. Ray became a managing member of Strategic Partners Consulting LLC in

September 2008. Before joining Strategic Partners, he had worked as a

financial analyst and general accountant for Charys Holding Company, Inc., a

publicly-traded company. While at Charys, Mr. Ray was also

responsible for the cash management and financial reporting of the Charys

subsidiary Ayin Tower Management, a cellular/communication tower management

group. Mr. Ray has also gained experience in the financial/accounting

industry while working as a staff accountant with Cumulus Media Inc., based in

Atlanta, Georgia. Mr Ray earned his Bachelor’s of Science degree in

Business Management with a concentration in Finance from North Carolina State

University in 2003.

Larry W.

Trapp was appointed as a Director, Executive Vice President, and Treasurer of

EGPI on December 3, 2008. Previously he has served in various

capacities as Chief Financial Officer, Vice President, and Director through

January 26, 2004 and is one of the original founders in 1998 through the

acquisition processes with EGPI, serving as Director of Energy Producers Group,

Inc. Mr. Trapp earned a BS in Business Administration with emphasis

in Finance from Arizona State University. Prior business experience

includes Vice President of Escrow Administration for a major Title Insurance

Company where he was directly responsible for the Management and performance of

22 branches and supervised an administration staff of 125

Employees.

Michael

Trapp was appointed as a Director of EGPI on December 3, 2008. A

graduate of Rice Aviation he earned honors and honed his skills as a Airframe

and Power Plant licensee working in the airline industry for many

years. He recently owned his own mortgage company and is now a Senior

Loan Officer for a multi-state lender in Mesa, Arizona. His strong

technical and analytical skills will be a bonus in analyzing prospective

projects which will enhance EGPI’s growth and asset base.

Melvena Alexander has served as

Co-Treasurer, Secretary and Comptroller of EGPI and Firecreek Petroleum, Inc.

since February 10, 2007 having served as Secretary and Comptroller of EGPI and

Firecreek Petroleum, Inc. since July 1, 2004 through February 9,

2007. She served as Secretary since March 15, 2003 to June 30, 2004

having been Secretary and Comptroller of EGPI since May 18, 1999. In

September 1998 she was a founder, and from January 19, 1999 through the

acquisition processes with EGPI served as Secretary of Energy Producers Group,

Inc. She is founder and President of Melvena Alexander CPA since

1982, which prepares financial statements and tax reports. Mrs.

Alexander graduated Arizona State University with a B.S. in Accounting, received

CPA Certificate, State of Arizona. She is a prior member of AICPA and

the American Society of Women Accountants through June 2008. Mrs.

Alexander devotes a minimum of 40-60 hours per week, and more as required, to

the business of EGPI.

Michael

D. Brown was appointed to the board of directors on July 6, 2009. Mr. Brown was

nominated by President George W. Bush as the first Under Secretary of Emergency

Preparedness and Response (EP&R) in the newly created Department of Homeland

Security in January 2003. Mr. Brown coordinated federal disaster

relief activities including implementation of the Federal Response Plan, which

authorized the response and recovery operations of 26 federal agencies and

departments as well as the American Red Cross. Mr. Brown also

provided oversight of the National Flood Insurance Program and the U.S. Fire

Administration and initiated proactive mitigation activities. Prior to joining

the Federal Emergency Management Agency, Mr. Brown practiced law in Colorado and

Oklahoma, where he served as a Bar Examiner on Ethics and Professional

Responsibility for the Oklahoma Supreme Court and as a Hearing Examiner for the

Colorado Supreme Court. Mr. Brown had been appointed as a Special

Prosecutor in police disciplinary matters. While attending law

school, Mr. Brown was appointed by the Chairman of the Senate Finance Committee

of the Oklahoma Legislature as the Finance Committee Staff Director, where he

oversaw state fiscal issues. Mr. Brown’s background in state and

local government also includes serving as an Assistant City Manager with

Emergency Services Oversight and as a City Councilman. Mr. Brown holds a B.A. in

Public Administration/Political Science from Central State University,

Oklahoma. Mr. Brown received his J.D. from Oklahoma City University’s

School of Law. He was an Adjunct Professor of Law for Oklahoma City

University.

Garrett

M. Sullivan was apponted to the Board of Directors of EGPI Firecreek, Inc. on

September 10, 2009. Over the years, Mr. Sullivan held various

positions with DuPont Chemicals and UniRoyal on both national and international

levels. His experience includes running a textile and paper manufacturing

facility and serving as President of HT&T a hospital television and call

system company owned by Philips of Holland. Mr. Sullivan served as both as

President and then Vice Chairman of Applied Digital Solutions Inc. through 2001.

Mr. Sullivan earned a Bachelor of Arts degree from Boston University, and an MBA

from Harvard University.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

Other

than as described herein, none of our directors or executive officers, nor any

person who beneficially owns, directly or indirectly, shares carrying more than

five percent of the voting rights attached to all of our outstanding shares, nor

any members of the immediate family (including spouse, parents, children,

siblings, and in-laws) of any of the foregoing persons has any material

interest, direct or indirect, in any transaction over the last two years or in

any presently proposed transaction which, in either case, has or will materially

affect us.

PRINCIPAL

STOCKHOLDERS

The

following table sets forth, as of the date of this Current Report, information

concerning ownership of our securities by:

|

·

|

Each

person who beneficially owns more than five percent of the outstanding

shares of our common stock;

|

|

·

|

Each

person who beneficially owns shares of our outstanding preferred

stock;

|

|

·

|

Each

of our named executive officers;

and

|

|

·

|

All

directors and officers as a

group.

|

|

|

|

Common

Stock Beneficially

Owned

(2)

|

|

|

Preferred

Stock Beneficially

Owned

(2)

|

|

|

Name

and Address of Beneficial Owner (1)

|

|

Number

|

|

|

Percent

|

|

|

Number

|

|

|

Percent

|

|

|

Robert

S. Miller, Jr.

|

|

|

535,889

|

|

|

|

1.54

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Michael

Kocan

|

|

|

2,457,265

|

|

|

|

7.04

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

David

H. Ray (3)

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Brandon

D. Ray (4)

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Dennis

R. Alexander (5)

|

|

|

3,472,278

|

|

|

|

9.95

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Larry

W. Trapp (6)

|

|

|

320,906

|

|

|

|

.92

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Michael

Trapp (7)

|

|

|

2,000

|

|

|

|

0.0057

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Melvena

Alexander (8)

|

|

|

204,075

|

|

|

|

0.59

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Red

Quartz Development, L.L.C. (9)

|

|

|

-0-

|

|

|

|

-0-

|

|

|

|

5,000

|

|

|

|

100

|

|

|

Michael

Hanlon

|

|

|

2,129,629

|

|

|

|

6.11

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Steve

Keaveney

|

|

|

2,129,629

|

|

|

|

6.11

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Garrett

Sulliavan

|

|

|

655,271

|

|

|

|

1.88

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Tom

Davis

|

|

|

3,276,353

|

|

|

|

9.39

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Amanda

Corcoran

|

|

|

126,360

|

|

|

|

0.36

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Kelly

Davis

|

|

|

272,610

|

|

|

|

.78

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Paddy

Kelly

|

|

|

351,000

|

|

|

|

1.00

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

All

directors and officers as a group (16 persons)

|

|

|

15,933,265

|

|

|

|

54.00

|

|

|

|

5,000

|

|

|

|

100

|

|

|

Strategic

Partners Consulting, L.L.C. (3)(4)(10)

|

|

|

2,386,802

|

|

|

|

6.84

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

Billy

V. Ray Jr. (11)

|

|

|

3,000,000

|

|

|

|

8.60

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

SATCO

Sellers Group (12)

|

|

|

2,908,000

|

|

|

|

8.34

|

|

|

|

-0-

|

|

|

|

-0-

|

|

|

(1)

|

Unless

otherwise indicated, the address for each of these shareholders other than

(5), (6), (7), and (8) c/o EPGI Firecreek, Inc. and Energy Producers,

Inc., located at 6564 Smoke Tree Lane, Scottsdale Arizona 85254, is c/o

EGPI Firecreek, Inc., (M3) located at 3400 Peachtree Road, Suite 111,

Atlanta, Georgia 30326. Also, unless otherwise indicated, each

person named in the table above has the sole voting and investment power

with respect to his shares of our common stock beneficially

owned.

|

|

(2)

|

Beneficial

ownership is determined in accordance with the rules of the

SEC.

|

|

(3)

|

David

H. Ray and Brandon D. Ray are brothers. Messrs. David H. Ray

and Brandon D. Ray each owns 1/3 of Strategic Partners Consulting, L.L.C.,

which owns 2,386,802 shares of our common stock. The other 1/3

owner of Strategic Partners Consulting, L.L.C. is Lynn Myers Investments,

L.L.C., a Mississippi limited liability company, having an address of 202

Ashton Place, Madison, Mississippi 39110.

|

|

(4)

|

See

note 3, above.

|

|

(5)

|

Dennis

R. Alexander is the son of Melvena Alexander.

|

|

(6)

|

Larry

W. Trapp is the father of Michael

Trapp.

|

|

(7)

|

See

not 6, above.

|

|

(8)

|

See

note 5, above.

|

|

(9)

|

Each

share of Series C preferred stock shall have 21,200 votes on the election

of our directors and for all other purposes.

|

|

(10)

|

See

notes 3 and 4, above.

|

|

(11)

|

Billy

V. Ray Jr. is the Father of David H. Ray and Brandon D.

Ray.

|

|

(12)

|

SATCO

Sellers Group, see first paragraph, this Item 1.01, and I. 1. (e) there

under first paragraph, and elsewhere referenced

herein.

|

As

indicated in the table above, our executive officers and directors beneficially

own, in the aggregate, approximately 74.97 percent of our outstanding common

stock, along with additional votes and voting power through issuance of 5,000

shares of the EGPI Series C Preferred Stock as described in

Schedule 15(p)

attached to the Plan of Merger. As a result these stockholders may,

as a practical matter, be able to influence all matters requiring stockholder

approval including the election of directors, merger or consolidation and the

sale of all or substantially all of our assets. This concentration of

ownership may delay, deter or prevent acts that would result in a change of

control, which in turn could reduce the market price of our common

stock.

Other

than as stated herein, there are no arrangements or understandings, known to us,

including any pledge by any person of our securities:

|

·

|

The

operation of which may at a subsequent date result in a change in control

of the registrant; or

|

|

·

|

With

respect to the election of directors or other

matters.

|

MARKET

PRICE OF AND DIVIDENDS ON

THE

REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

We became

available for quotation on the over-the-counter, NASDAQ NQB Pink Sheets

initially on January 20, 2000. As of March 14, 2003, we moved to the

over-the-counter market, NASDAQ OTC Electronic Bulletin Board quotation medium

system, under the symbol “EFIR.OB,” and is presently dually quoted on both Pink

Sheets and Bulletin Board.

The

following table sets forth the high and low bid prices for our common stock on

the OTCBB as reported by various Bulletin Board market makers. The

quotations do not reflect adjustments for retail mark-ups, mark-downs, or

commissions and may not necessarily reflect actual transactions.

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

Quarter

Ended:

|

|

|

|

|

|

|

|

30-Sep-07

|

|

$

|

0.78

|

|

|

$

|

0.50

|

|

|

31-Dec-07

|

|

$

|

0.48

|

|

|

$

|

0.36

|

|

|

31-Mar-08

|

|

$

|

0.20

|

|

|

$

|

0.20

|

|

|

30-June-08

|

|

$

|

0.46

|

|

|

$

|

0.40

|

|

|

30-Sep-08

|

|

$

|

0.10

|

|

|

$

|

0.10

|

|

|

Quarter

Ended:

|

|

|

|

|

|

|

|

|

|

31-Dec-08

|

|

$

|

0.17

|

|

|

$

|

0.06

|

|

|

31-Mar-09

|

|

$

|

0.06

|

|

|

$

|

0.06

|

|

|

30-Jun-09

|

|

$

|

0.20

|

|

|

$

|

0.12

|

|

|

30-Sep-09

|

|

$

|

0.10

|

|

|

$

|

0.08

|

|

The last

reported sales price per share of our common stock as reported by the OTC

Bulletin Board on November 4, 2009, was $0.06. Immediately before the

Effective Date of the Merger, we had 31,405,386 shares of our common stock

issued and outstanding. Immediately after the Effective Date of the

Merger we had 34,313,386 shares of our common stock issued and outstanding,

which are held of record and beneficially owned by approximately 750

persons.

Dividends

We have

not paid or declared any dividends on our common stock, nor do we anticipate

paying any cash dividends or other distributions on our common stock in the

foreseeable future. Any future dividends will be declared at the

discretion of our board of directors and will depend, among other things, on our

earnings, if any, our financial requirements for future operations and growth,

and other facts as our board of directors may then deem

appropriate.

SATCO is,

and has always been a privately-held company and is now our wholly-owned

subsidiary. There is not, and never has been, a public market for the

securities of SATCO. SATCO has never declared or paid any cash

dividends on its capital stock. In addition, there has never been a

trading market for the SATCO Common Stock.

Securities

Authorized for Issuance under Equity Compensation Plans

We do not

have any equity compensation plans as of the date of this Current

Report.

ADDITIONAL

INFORMATION

We are

obligated to file reports with the SEC pursuant to the Exchange

Act. The public may read and copy any materials that we file with the

SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C.

20549. The public may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC

maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically

with the SEC. The address of that site is

http://www.sec.gov.

We intend

to furnish our security holders with an annual report that contains audited

financial statements.

B.

See Item 2.03 below.

On November 3, 2009, SATCO, a wholly

owned subsidiary of the Registrant, and the Registrant by its further entry into

a Continuing Guarantee and Waiver, entered into an accounts receivable based

credit facility (Loan) (also known as Factor and Security Agreement) with

Creative Capital Associates, Inc., Silver Spring Maryland (proposal and term

sheet), in conjunction with Benefactor Funding Corp. a Colorado corporation

(factor lender). The Factor and Security Agreement was procured by the

Registrant through introduction from the Small Business Money Store located in

Maine, for SATCO and in behalf of the terms of the Acquisition Stock Purchase

Agreement. The Factor and Security Agreement, along with the

Continuing Guarantee and Waiver is furnished with this Report on Exhibit 10.9.

Terms include providing up to $1 million dollars initial accounts receivable

based finance (factoring), with an additional $500,000 per month accessible

according to terms of the Loan Agreement, up to $4 million dollars. The Company

approved SATCO for an initial take down of approximately $700,000 backed by its

accounts receivable that were approved in underwriting to secure the closing

requirements in behalf of the Stock Purchase Agreement.

Item

2.01. Completion

of Acquisition or Disposition of Assets.

See Item

1.01, above.

Item

2.03

Creation

of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet

Arrangement of a Registration

See Item

1.01 above, and,

On

November 3, 2009, SATCO, a wholly owned subsidiary of the Registrant, and the

Registrant by its further entry into a Continuing Guarantee and Waiver, entered

into an accounts receivable based credit facility (Loan) (also known as Factor

and Security Agreement) with Creative Capital Associates, Inc., Silver Spring

Maryland (proposal and term sheet), in conjunction with Benefactor Funding Corp.

a Colorado corporation (factor lender). The Factor and Security Agreement was

procured by the Registrant through introduction from the Small Business Money

Store located in Maine, for SATCO and in behalf of the terms of the Acquisition

Stock Purchase Agreement. The Factor and Security Agreement, along

with the Continuing Guarantee and Waiver is furnished with this Report on

Exhibit 10.9. Terms include providing up to $1 million dollars initial accounts

receivable based finance (factoring), with an additional $500,000 per month

accessible according to terms of the Loan Agreement, up to $4 million dollars.

The Company approved SATCO for an initial take down of approximately $700,000

backed by its accounts receivable that were approved in underwriting to secure

the closing requirements in behalf of the Stock Purchase Agreement.

Material

Terms of the Factor Funding:

Factoring

Line: One Millions Dollars ($1,000,000)

Advance

Rate: 80% of invoice face value

Reserve:

Each week paid invoices will have the fees deducted from its

reserve

Discount

Fee: 1

.

88% of face value

of invoice for the initial 30 days

Ongoing

Fee: Beyond the initial 30 days add 0

.

63 % for each 10 day period

(31-40, 41-50 etc)

Closing

Costs: One time $750.00 deducted from first funding or upon demand at CCA’s

option

Documents

required: Factoring and Security Agreement

UCC-1

Financing Statement, 1

st

position on A/R

Corporate

Guaranty by EGPI Firecreek

The rates

are based on a 6 month commitment to fund $ 500,000 each month. Only invoices

from customers deemed

creditworthy

are acceptable. Customer accounts being financed must have all payments made to

our lockbox. Each

customer

account cannot exceed its credit limit. Invoices will be verified through

customer contact. Ninety day buy

back

condition on overdue invoices dated from our funding date.

Item

3.02. Unregistered

Sales of Equity Securities.

As a

result of the Merger, subject to adjustment as described in Item 1.01, the SATCO

Stockholders shall be entitled to receive, in exchange for all of their SATCO

Common Stock, the aggregate total of 2,908,000 shares of the EGPI Common Stock

subject to adjustment and herein above listed make whole

provisions.

See Item

1.01, above.

The

shares were issued in reliance upon an exemption from registration pursuant to

Section 4(2) of the Securities Act and Rule 506 of Regulation D promulgated

under the Securities Act. All of the SATCO Stockholders hold their

securities for investment purposes without a view to distribution and had access

to information concerning EGPI and our business prospects, as required by the

Securities Act. In addition, there was no general solicitation or

advertising for the purchase of the shares of EGPI Common Stock. Our

securities were issued only to accredited investors or sophisticated investors,

as defined in the Securities Act with whom we had a direct personal preexisting

relationship, and after a thorough discussion. Finally, our stock

transfer agent has been instructed not to transfer any of such shares, unless

such shares are registered for resale or there is an exemption with respect to

their transfer.

All of

the SATCO Stockholders were provided with access to the filings of EGPI with the

SEC, including the following:

|

·

|

EGPI’s

annual report to stockholders for the most recent fiscal

year, and, if requested by SATCO Stockholders in writing, a

copy of EGPI’s most recent Form 10-K under the Exchange

Act.

|

|

·

|

The

information contained in an annual report on Form 10-K under the Exchange

Act.

|

|

·

|

The

information contained in any reports or documents required to be filed by

EGPI under sections 13(a), 14(a), 14(c), and 15(d) of the Exchange Act

since the distribution or filing of the reports specified

above.

|

|

·

|

A

brief description of the securities being offered, and any material

changes in EGPI’s affairs that are not disclosed in the documents

furnished.

|

Item

3.03. Material

Modification to Rights of Security Holders.

See Item

1.01, above.

Item

5.01. Changes

in Control of Registrant.

See Item

1.01, above.

Item

8.01. Other

Events

Effective on November 4, 2009, by

unanimous consent, the Board of Directors of the Company approved, reconfirmed,

and made certain changes to certain committees.

The directors approved the confirmation

and or reinstatement of the following committees of the Company: The Audit

Committee and a combined Nominating and Compensation and Stock Option

Committee.

The Audit

Committee shall consist of the following:

(1) The Audit Committee is composed

initially of three members: Ms. Joanne Sylvanus (*), its Chairman, Dennis

Alexander and Melvena Alexander, members.

i) The responsibilities of the Audit

Committee include: (1) the recommendation of the selection and retention of the

Company’s independent public accountants; (2) the review of the independence of

such accountants; (3) to review and approve any material accounting policy

changes affecting the Company’s operating results; (4) the review of the

Company’s internal control system; (5) the review of the Company’s annual

financial report to stockholders; and (6) the review of applicable interested

party transactions.

The combined Nomination and the

Compensation and Stock Option Committee shall consist of the

following:

(2) The combined Nomination and the

Compensation and Stock Option Committee are composed initially of three members:

Mr. Michael Brown, its Chairman, David Ray, and Dennis Alexander,

members.

i) The function of the Nominating

Committee is to seek out qualified persons to act as members of the Company’s

Board of Directors, and provide for compliance standards. The Nominating

Committee seeks to identify director candidates based on input provided by a

number of sources, including (a) the Nominating Committee members, (b) our other

Directors, (c) our stockholders, and (d) third parties such as professional

search firms. In evaluating potential candidates for director, the Nominating

Committee considers the merits of each candidate’s total

credentials.

ii) The function of the Compensation

and Stock Option Committee is to review and recommend along with the Board of

Directors, compensation and benefits for the executives of the Company,

consultants, and administers and interprets the Company Stock Option Plan and

the Directors Stock Option Plan and are authorized to grant options pursuant to

the terms of these plans.

(*) A summary of Ms. Sylvanus’s

work experience can be found in a Current Report on Form 8-K filed on January

23, 2007, incorporated herein by reference.

|

Item

9.01

|

Financial

Statements and Exhibits.

|

(a)

Financial Statements of

Business Acquired

.

It is not

practicable to file the required historical financial statements of EGPI

Firecreek, Inc., a Nevada corporation (the “registrant”), and South Atlantic

Traffic Corporation, (SATCO), a Florida corporation (the newly acquired

“Subsidiary”) at this time. Accordingly, pursuant to Item 9.01(a)(4)

of Form 8-K, the registrant will file such financial statements under cover of

Form 8-K/A as soon as practicable, but not later than the date required by

applicable law.

(b)

Pro forma financial

information

.

It is not

practicable to file the required pro forma financial statements of EGPI

Firecreek, Inc., a Nevada corporation (the “registrant”), and South Atlantic

Traffic Corporation, (SATCO), a Florida corporation (the newly acquired

“Subsidiary”) at this time. Accordingly, pursuant to Item 9.01(b)(2)

of Form 8-K, the registrant will file such financial statements under cover of

Form 8-K/A as soon as practicable, but not later than the date required by

applicable law.

(c)

Shell company

transaction

. Not applicable.

(d)

Exhibits

.

The

following exhibits are filed herewith:

|

Exhibit No.

|

|

Identification of

Exhibit

|

|

10.1

|

|

Stock

Purchase Agreement with South Atlantic Traffic Corporation as of November

4, 2009.

|

|

10.2

|

|

Earnout

Provision, Exhibit A to the Stock Purchase Agreement with South Atlantic

Traffic Corporation, as of November 4, 2009

|

|

10.3

|

|

Mike

Hunter Promissory Note Agreement to the Stock Purchase Agreement with

South Atlantic Traffic Corporation, as of November 4,

2009

|

|

10.4

|

|

Bob

Joyner Promissory Note Agreement to the Stock Purchase Agreement with

South Atlantic Traffic Corporation, as of November 4,

2009

|

|

10.5

|

|

Stuart

Hall Promissory Note Agreement to the Stock Purchase Agreement with South

Atlantic Traffic Corporation, as of November 4, 2009

|

|

10.6

|

|

Mike

Hunter Employment Agreement to the Stock Purchase Agreement with South

Atlantic Traffic Corporation, as of November 4, 2009

|

|

10.7

|

|

Bob

Joyner Employment Agreement to the Stock Purchase Agreement with South

Atlantic Traffic Corporation, as of November 4, 2009

|

|

10.8

|

|

Stuart

Hall Employment Agreement to the Stock Purchase Agreement with South

Atlantic Traffic Corporation, as of November 4, 2009

|

|

10.9

|

|

Factor

and Security Agreement between Benefactor Funding Corp. and South Atlantic

Traffic Corporation, with Continuing Guarantee and Waiver between

Benefactor Funding Corp. and EGPI Firecreek,

Inc.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Date:

November 10, 2009.

|

EGPI

FIRECREEK, INC.

|

|

|

|

|

By

|

/s/ Dennis R. Alexander

|

|

|

Dennis

R. Alexander, Chief Executive

Officer

|

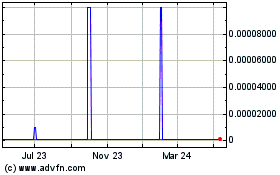

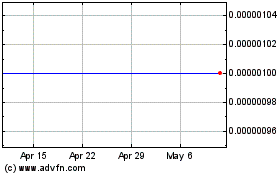

EGPI Firecreek (CE) (USOTC:EFIR)

Historical Stock Chart

From May 2024 to Jun 2024

EGPI Firecreek (CE) (USOTC:EFIR)

Historical Stock Chart

From Jun 2023 to Jun 2024