Capital Financial Global Engages Securities Counsel to File SEC Registration Statement

August 23 2013 - 8:00AM

Marketwired

Capital Financial Global, Inc. (OTC Pink: CFGX), announced today

that it has selected the veteran securities firm Kruse, Landa,

Maycock & Ricks, Salt Lake City, to assist in preparing a

registration statement to be filed with the SEC by Capital

Financial Global .

Once the registration is filed and effective, Global Capital

Financial will be required to file quarterly and annual SEC

reports, which is a requirement for its common stock to be eligible

for quotation and trading on higher-level OTC markets.

"I'm proud to announce our selection of Kruse Landa and consider

it a huge compliment that they are willing to team up with us,

since they are selective in who they are willing to represent,"

said Mr. Paul Norat, CEO of Capital Financial Global, Inc. "This

move means we can now continue to move forward with our SEC filings

to become fully reporting, up-list, and start raising more

capital."

"As I've stated previously, taking steps to becoming fully

reporting with the SEC is very significant for the success of our

Company because it will allow us to access capital in ways that

have been inaccessible to us for the last several years," added Mr.

Norat. "These are crucial milestones for us to hit."

More information about the securities firm Kruse, Landa, Maycock

& Ricks can be found on their website at

http://klmrlaw.com/

About Capital Financial Global, Inc.

Capital Financial Global, Inc. (CFGX) is a specialty finance

company that provides asset-based financing and loan advisory

services to insurance trusts & pension funds, owners of

commercial real estate, owners of residential real estate

portfolios, and owners of mining & precious metals assets.

Our Market Positioning &

Differentiation

Unlike traditional banking models, CFGX helps organizations

obtain needed liquidity by using an asset-backed approach rather

than a traditional credit approach to originating new loans, buying

and selling existing loans, and converting distressed collateral

into cash or trade-able form. We are the preferred alternative to

traditional bank financing.

Our Revenue Model

We make money by charging loan fees, making interest rate

spreads on loans we hold, and by buying & selling loans in

whole or in part to institutional investors, hedge funds, or other

secondary market participants. We also make money by charging loan

servicing fees and by selling distressed assets that we acquire for

our own investment or through some type of foreclosure.

Forward-looking statements:

Statements in this press release relating to plans, strategies,

economic performance and trends, projections of results of specific

activities or investments, and other statements that are not

descriptions of historical facts may be forward-looking statements.

Forward-looking information is inherently subject to risks and

uncertainties, and actual results could differ materially from

those currently anticipated due to a number of factors, which

include but are not limited to, risk factors inherent in doing

business. Forward-looking statements may be identified by terms

such as "may," "will," "should," "could," "expects," "plans,"

"intends," "anticipates," "believes," "estimates," "predicts,"

"forecasts," "potential," or "continue," or similar terms or the

negative of these terms. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or

achievements. The company has no obligation to update these

forward-looking statements.

For more information please contact: Capital Financial Global,

Inc. Investor Relations Tel: 888-801-9715 Email: ir@capfiglobal.com

www.capfiglobal.com Twitter: @CFGX Facebook: "Capital Financial

Global, Inc. Ticker: CFGX"

Capital Financial Global (CE) (USOTC:CFGX)

Historical Stock Chart

From Apr 2024 to May 2024

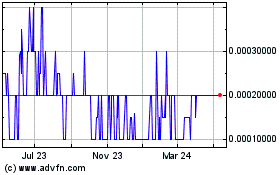

Capital Financial Global (CE) (USOTC:CFGX)

Historical Stock Chart

From May 2023 to May 2024