Mutual Fund Summary Prospectus (497k)

February 27 2014 - 3:58PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

Summary Prospectus

|

|

February 28, 2014

|

|

PCEF

|

|

PowerShares CEF Income Composite Portfolio

|

|

|

|

|

|

|

|

NYSE Arca, Inc.

|

|

|

Before you invest, you may wish to review the

Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.invescopowershares.com/prospectus. You can also get this information at

no cost by calling Invesco Distributors, Inc. at

(800) 983-0903

or by sending an

e-mail

request to info@powershares.com. The Fund’s prospectus and statement of

additional information, both dated February 28, 2014 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus.

Investment Objective

The PowerShares CEF Income Composite Portfolio (the “Fund”) seeks investment results that generally correspond (before fees and

expenses) to the price and yield of the S-Network Composite Closed-End Fund Index

SM

(the “Underlying Index”).

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund (“Shares”). Investors may pay brokerage commissions on

their purchases and sales of Shares, which are not reflected in the table or the example below.

|

|

|

|

|

|

|

Annual Fund Operating Expenses

|

|

|

|

(expenses that you pay each year as a percentage of the value of

your investment)

|

|

|

Management Fees

|

|

|

0.50%

|

|

|

Other Expenses

|

|

|

0.00%

|

|

|

Acquired Fund Fees and Expenses

(1)

|

|

|

1.27%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

1.77%

|

|

|

(1)

|

Acquired Fund Fees and Expenses are indirect fees and expenses that the Fund incurs from investing in the shares of Underlying Funds (as defined herein). The actual Acquired

Fund Fees and Expenses will vary with changes in the allocations of the Fund’s assets. These expenses are based on the total expense ratio of the Underlying Funds disclosed in each Underlying Fund’s most recent shareholder report. Please

note that the amount of Total Annual Fund Operating Expenses shown in the above table may differ from the ratio of expenses to average net assets included in the “Financial Highlights” section of this Prospectus, which reflects the

operating expenses of the Fund and does not include indirect expenses such as Acquired Fund Fees and Expenses.

|

Example

This example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other funds.

This example assumes that you invest $10,000 in the Fund for the

time periods indicated and then sell all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. This example does not include

the brokerage commissions that investors may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

|

|

|

|

|

|

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

$180

|

|

$557

|

|

$959

|

|

$2,084

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional

transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund’s performance. During the most

recent fiscal year, the Fund’s portfolio turnover rate was 33% of the average value of its portfolio, excluding the value of portfolio securities received or delivered as a result of the Fund’s in-kind creations and redemptions.

Principal Investment Strategies

The Fund generally will invest at least 90% of its total assets in securities of U.S.-listed closed-end funds that comprise the Underlying Index. The Fund is a

“fund of funds,” as it invests its assets in the common shares of funds included in the Underlying Index rather than in individual securities (the “Underlying Funds”). S-Network Global Indexes, LLC (the “Index

Provider”) compiles, maintains and calculates the Underlying Index, which tracks the overall performance of a global universe of U.S.-listed closed-end funds that are organized under the laws of the United States, which may be invested in

taxable investment grade fixed-income securities, taxable high yield fixed-income securities and taxable equity options. The Underlying Index may include closed-end funds that are advised by an affiliate of Invesco PowerShares Capital Management LLC

(the “Adviser”). The Fund generally invests in all of the securities comprising its Underlying Index in proportion to their weightings in the Underlying Index.

Concentration Policy.

The Fund will concentrate its investments (i.e., invest 25% or more of the value of its total assets) in securities of issuers in any one industry or sector only to the extent that the

Underlying Index reflects a concentration in that industry or sector. The Fund will not otherwise concentrate its investments in securities of issuers in any one industry or sector.

Principal Risks of the Fund

The following summarizes the principal risks of the Fund.

Fund of Funds Risk.

Because the Fund is a fund of funds, its investment performance largely depends on the investment

|

|

|

|

|

|

|

|

|

1

|

|

|

|

PCEF PowerShares CEF Income Composite Portfolio

|

P-PCEF-SUMPRO-1

performance of the Underlying Funds in which it invests. An investment in the Fund is subject to the risks associated with the Underlying Funds that comprise the Underlying Index. The Fund will

pay indirectly a proportional share of the fees and expenses of the Underlying Funds in which it invests, including their investment advisory and administration fees, while continuing to pay its own unitary management fee. As a result, shareholders

will absorb duplicate levels of fees with respect to investments in the Underlying Funds. In addition, at times certain segments of the market represented by constituent Underlying Funds in the Underlying Index may be out of favor and underperform

other segments.

Investments in Closed-End Investment Companies.

The shares of closed-end investment companies may trade at a discount or premium

to, or at, their net asset value (“NAV”). The securities of closed-end investment companies in which the Fund may invest may be leveraged. As a result, the Fund may be exposed indirectly to leverage through an investment in such

securities. An investment in securities of closed-end investment companies that use leverage may expose the Fund to higher volatility in the market value of such securities and the possibility that the Fund’s long-term returns on such

securities (and, indirectly, the long-term returns of the Shares) will be diminished.

The Fund is permitted to invest in Underlying Funds beyond the

limits set forth in Section 12(d)(1) subject to certain terms and conditions set forth in an exemptive order that the SEC has issued to the Trust. To comply with provisions of the Investment Company Act of 1940, as amended (the ”1940

Act”), on any matter upon which the Underlying Fund shareholders are solicited to vote, the Adviser will vote Underlying Fund shares in the same general proportion as shares held by other shareholders of the Underlying Fund.

Underlying Funds Risk.

The Fund may be subject to the following risks as a result of its investment in the Underlying Funds:

Interest Rate Risk.

Fixed-income securities’ prices generally fall as interest rates rise; conversely, fixed-income securities’ prices generally

rise as interest rates fall.

Credit Risk.

Credit risk is the risk that issuers or guarantors of debt instruments or the counterparty to a

derivatives contract, repurchase agreement or loan of portfolio securities is unable or unwilling to make timely interest and/or principal payments or to otherwise honor its obligations. Debt instruments are subject to varying degrees of credit

risk, which may be reflected in credit ratings. There is the chance that any of an Underlying Fund’s portfolio holdings will have its credit ratings downgraded or will default (fail to make scheduled interest or principal payments), potentially

reducing the fund’s income level and share price.

Non-Investment Grade Securities Risk.

Non-investment grade securities and unrated

securities of comparable credit quality are subject to the increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to such factors as specific

corporate developments, interest rate sensitivity, negative perceptions of the non-investment grade securities markets generally, real or perceived adverse economic and competitive

industry conditions and less secondary market liquidity. If the issuer of non-investment grade securities defaults, an Underlying Fund may incur additional expenses to seek recovery.

Options Risk.

A decision as to whether, when and how to use options involves the exercise of skill and judgment, and even a well-conceived transaction may be

unsuccessful to some degree because of market behavior or unexpected events. Because the exercise of an index option is settled in cash, sellers of index call options cannot provide in advance for their potential settlement obligations by acquiring

and holding the underlying securities. An Underlying Fund will lose money if it is required to pay the purchaser of an index option the difference between the cash value of the index on which the option was written and the exercise price and such

difference is greater than the premium received by the Underlying Fund for writing the option.

Derivatives Risk.

A derivative instrument often

has risks similar to its underlying instrument and may have additional risks, including imperfect correlation between the value of the derivative and the underlying instrument, risks of default by the counterparty to certain derivative transactions,

magnification of losses incurred due to changes in the market value of the securities, instruments, indices or interest rates to which the derivative relates, and risks that the derivative instruments may not be liquid.

Leverage Risk.

Leverage may result from ordinary borrowings, or may be inherent in the structure of certain Underlying Fund investments such as derivatives.

If the prices of those investments decrease, or if the cost of borrowing exceeds any increase in the prices of those investments, the net asset value of the Underlying Fund’s Shares will decrease faster than if the Underlying Fund had not used

leverage. To repay borrowings, an Underlying Fund may have to sell investments at a time and at a price that is unfavorable to the Underlying Fund. Interest on borrowings is an expense the Underlying Fund would not otherwise incur. Leverage

magnifies the potential for gain and the risk of loss. If an Underlying Fund uses leverage, there can be no assurance that the Underlying Fund’s leverage strategy will be successful.

Counterparty Risk.

To the extent that an Underlying Fund engages in derivative transactions, it will be subject to credit risk with respect to the counterparties. The Underlying Fund may obtain only a

limited or no recovery or may experience significant delays in obtaining recovery under derivative contracts if a counterparty experiences financial difficulties and becomes bankrupt or otherwise fails to perform its obligations under a derivative

contract.

Senior Loans Risk.

Investments in senior loans typically are below investment grade and are considered speculative because of the

credit risk of their issuers. Such companies are more likely to default on their payments of interest and principal owed, and such defaults could reduce an Underlying Fund’s NAV and income distributions. In addition, an Underlying Fund may have

to sell securities at lower prices than it otherwise would to meet cash needs or it may have to maintain a greater portion of its assets in cash equivalents than it otherwise would because of impairments and limited liquidity of the collateral

supporting a senior loan, which could negatively affect the Underlying Fund’s performance.

|

|

|

|

|

|

|

|

|

2

|

|

|

|

PCEF PowerShares CEF Income Composite Portfolio

|

Foreign and Emerging Market Securities Risk.

Fluctuations in the value of the U.S. dollar relative to the

values of other currencies may adversely affect investments in foreign and emerging market securities. Foreign and emerging market securities may have relatively low market liquidity, decreased publicly available information about issuers, and

inconsistent and potentially less stringent accounting, auditing and financial reporting requirements and standards of practice comparable to those applicable to domestic issuers. Foreign and emerging market securities are subject to the risks of

expropriation, nationalization or other adverse political or economic developments and the difficulty of enforcing obligations in other countries. Investments in foreign and emerging market securities also may be subject to dividend withholding or

confiscatory taxes, currency blockage and/or transfer restrictions. Emerging markets are subject to greater market volatility, lower trading volume, political and economic instability, uncertainty regarding the existence of trading markets and more

governmental limitations on foreign investment than more developed markets. In addition, securities in emerging markets may be subject to greater price fluctuations than securities in more developed markets.

Liquidity Risk.

Closed-end funds are not limited in their ability to invest in illiquid securities. Securities with reduced liquidity involve greater risk

than securities with more liquid markets. Market quotations for securities not traded on national exchanges may vary over time, and if the credit quality of a fixed-income security unexpectedly declines, secondary trading of that security may

decline for a period of time. In the event that an Underlying Fund voluntarily or involuntarily liquidates portfolio assets during periods of infrequent trading, it may not receive full value for those assets.

Industry Concentration Risk.

An Underlying Fund from time to time may be concentrated to a significant degree in securities of issuers located in a single

industry or a sector. To the extent that the Underlying Funds concentrate in the securities of issuers in a particular industry or sector, the Fund will also concentrate its investments to approximately the same extent on a pro rata basis. By

concentrating its investments in an industry or sector, the Fund faces more risks than if it were diversified broadly over numerous industries or sectors. Such industry-based risks, any of which may adversely affect the companies in which the Fund

invests, may include, but are not limited to, the following: general economic conditions or cyclical market patterns that could negatively affect supply and demand in a particular industry; competition for resources, adverse labor relations,

political or world events; obsolescence of technologies; and increased competition or new product introductions that may affect the profitability or viability of companies in an industry. In addition, at times, such industry or sector may be out of

favor and underperform other industries or the market as a whole.

Inflation Risk.

The value of assets or income from investment will be worth

less in the future as inflation decreases the value of money.

Deflation Risk.

Prices throughout the economy may decline over time, which may have

an adverse effect on the market valuation of companies, their assets and revenues. In addition, deflation may have an adverse effect on the creditworthiness of issuers and may make issuer default more likely, which may result in a decline in the

value of an Underlying Fund’s portfolio.

Mortgage-Backed and Asset-Backed Securities Risk.

Investments in mortgage- and asset-backed securities are

subject to prepayment or call risk, which is the risk that payments from the borrower may be received earlier than expected due to changes in the rate at which the underlying loans are prepaid. Securities may be prepaid at a price less than the

original purchase value.

Small and Medium Capitalization Company Risk.

Investing in securities of small and medium capitalization companies

involves greater risk than customarily is associated with investing in larger, more established companies. These companies’ securities may be more volatile and less liquid than those of more established companies.

Developments in Financial Markets.

Developments in recent years in the global financial markets illustrate that the current environment is one of

extraordinary and possibly unprecedented uncertainty. Conditions in markets in the U.S. and abroad over the past few years have caused firms in the financial services sector to take significant losses. The economic conditions have resulted, and may

continue to result, in an unusually high degree of volatility in the financial markets. Instability in the financial markets over the past several years has led governments and regulators around the world to take a number of unprecedented actions

designed to support financial institutions and segments of the financial markets that have experienced extreme volatility, and in some cases a lack of liquidity. A significant decline in the value of an Underlying Fund’s portfolio likely would

result in a significant decline in the value of an investment in the Underlying Fund.

Anti-Takeover Provisions Risk.

The organizational documents

of certain of the Underlying Funds include provisions that could limit the ability of other entities or persons to acquire control of the Underlying Fund or to change the composition of its board, which could limit the ability of shareholders to

sell their shares at a premium over prevailing market prices by discouraging a third party from seeking to obtain control of the Underlying Fund.

See

“Additional Information About the Funds’ Strategies and Risks—Risks of Investing in Underlying Funds.”

Market Risk.

The

Underlying Funds are subject to market fluctuations. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the securities in the Underlying Funds.

Market Trading Risk.

The Fund faces numerous market trading risks, including the potential lack of an active market for the Shares, losses from trading in

secondary markets, and disruption in the creation/redemption process of the Fund. Any of these factors may lead to the Shares trading at a premium or discount to the Fund’s NAV.

Non-Correlation Risk.

The Fund’s return may not match the return of the Underlying Index for a number of reasons. For example, the Fund incurs operating expenses not applicable to the Underlying Index,

and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Underlying Index. In addition, the performance of the Fund and the Underlying Index may

vary due to asset valuation differences and differences between the Fund’s portfolio and the Underlying Index resulting from legal restrictions, costs or liquidity constraints.

|

|

|

|

|

|

|

|

|

3

|

|

|

|

PCEF PowerShares CEF Income Composite Portfolio

|

Index Risk.

Unlike many investment companies, the Fund does not utilize an investing strategy that seeks

returns in excess of its Underlying Index. Therefore, it would not necessarily buy or sell a security unless that security is added or removed, respectively, from the Underlying Index, even if that security generally is underperforming.

Issuer-Specific Changes.

The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform

differently from the value of the market as a whole.

Commodity Pool Risk.

Certain investments by the Underlying Funds in which the Fund invests

may cause the Fund to be deemed to be a commodity pool, thereby subjecting the Fund to regulation under the Commodity Exchange Act and CFTC rules. The Adviser is registered as a Commodity Pool Operator (“CPO”), and the Fund will be

operated in accordance with CFTC rules. Registration as a CPO subjects the adviser to additional laws, regulations and enforcement policies, all of which could increase compliance costs and may affect the operations and financial performance of

funds whose adviser is required to register as a CPO. Registration as a commodity pool may have negative effects on the ability of the Fund to engage in its planned investment program.

The Shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objective.

Performance

The bar chart below shows how the Fund has performed. The table below the bar

chart shows the Fund’s average annual total returns (before and after taxes). The bar chart and table provide an indication of the risks of investing in the Fund by showing how the Fund’s total return has varied from year to year and by

showing how the Fund’s average annual total returns compared with a broad measure of market performance. Although the information shown in the bar chart and the table gives you some idea of the risks involved in investing in the Fund, the

Fund’s past performance (before and after taxes) is not necessarily indicative of how the Fund will perform in the future. Updated performance information is available online at www.InvescoPowerShares.com.

Annual Total Returns—Calendar Years

|

|

|

|

|

Best Quarter

|

|

Worst Quarter

|

|

8.42% (1st Quarter 2012)

|

|

(11.01)% (3rd Quarter 2011)

|

Average Annual Total Returns for the Periods Ended December 31, 2013

After-tax returns in the table below are calculated using the historical highest individual federal marginal income tax rates and do

not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant

to investors who hold Shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

Since

Inception

(02/19/10)

|

|

|

Return Before Taxes

|

|

|

4.21

|

%

|

|

|

7.38

|

%

|

|

Return After Taxes on Distributions

|

|

|

1.71

|

%

|

|

|

4.98

|

%

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

2.59

|

%

|

|

|

4.84

|

%

|

S-Network Composite Closed-End Fund Index

SM

(reflects no deduction for fees, expenses or taxes)

|

|

|

4.77

|

%

|

|

|

7.91

|

%

|

Management of the Fund

Investment Adviser.

Invesco PowerShares Capital Management LLC (the “Adviser”).

Portfolio

Managers.

The following individuals are responsible jointly and primarily for the day-to-day management of the Fund’s portfolio:

|

|

|

|

|

|

|

Name

|

|

Title with Adviser/Trust

|

|

Date Began

Managing

the Fund

|

|

Peter Hubbard

|

|

Vice President and Director of Portfolio Management of the Adviser and Vice President of the Trust

|

|

Since inception

|

|

Michael Jeanette

|

|

Vice President and Senior Portfolio Manager of the Adviser

|

|

Since inception

|

|

Brian Picken

|

|

Vice President and Portfolio Manager of the Adviser

|

|

October 2010

|

|

Theodore Samulowitz

|

|

Vice President and Portfolio Manager of the Adviser

|

|

February 2014

|

|

Tony Seisser

|

|

Vice President and Portfolio Manager of the Adviser

|

|

February 2014

|

Purchase and Sale of Shares

The Fund issues and redeems Shares at NAV only with authorized participants (“APs”) and only in large blocks of 50,000 Shares (each block of Shares is called a “Creation Unit”), or multiples

thereof (“Creation Unit Aggregations”), in exchange for the deposit or delivery of a basket of securities. Except when aggregated in Creation Units, the Shares are not redeemable securities of the Fund.

Individual Shares may be purchased and sold only on a national securities exchange through brokers. Shares are listed for trading on NYSE Arca, Inc. (“NYSE

Arca” or the “Exchange”) and because the Shares will trade at market prices rather than NAV, Shares may trade at prices greater than NAV (at a premium), at NAV, or less than NAV (at a discount).

Tax Information

The Fund’s

distributions will generally be taxable as ordinary income or capital gains. A sale of Shares may result in capital gain or loss.

|

|

|

|

|

|

|

|

|

4

|

|

|

|

PCEF PowerShares CEF Income Composite Portfolio

|

P-PCEF-SUMPRO-1

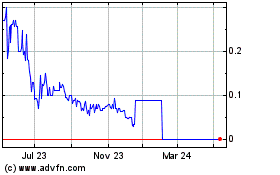

BioPower Operations (CE) (USOTC:BOPO)

Historical Stock Chart

From May 2024 to Jun 2024

BioPower Operations (CE) (USOTC:BOPO)

Historical Stock Chart

From Jun 2023 to Jun 2024