Weak Comps Trend Persists at Bebe - Analyst Blog

January 08 2013 - 8:40AM

Zacks

The weak sales and same-store sales trend continues for

Bebe Stores Inc. (BEBE), as the company posted

weaker-than-expected retail sales results for the second quarter of

fiscal 2013 ended December 29, 2012. The company will announce

further details with the second-quarter earnings release on January

31.

Total retail sales of $124.6 million for the quarter declined 11.7%

from $141.1 million in the prior-year quarter. Comps declined 10.5%

for the quarter compared with an increase of 9.6% in the year-ago

period. Last quarter, the company’s total retail sales were down

9.4%, while comps declined 8.7%.

Year-to-date, Bebe’s total retail sales dipped 10.7% to $229.7

million from $257.1 million reported in the prior-year period.

Moreover, during the period, the company registered a 9.7% decline

in its comps compared with a rise of 8.4% achieved in the year-ago

period.

The decline in retail sales and comps were primarily due to 15%

decline in traffic at the company’s stores, especially in December.

Additionally, the shift of the New Year’s Eve into fiscal January

coupled with the impact of Hurricane Sandy weighed on the company’s

same-store sales, inducing a 2% contraction.

As of December 29, 2012, the company registered 27.5% growth in

average inventory per square foot. The increase was mainly due to

the shift of New Year’s Eve into the next fiscal quarter, rise in

average unit costs for important products, supplementary spring

returns and other localization plans.

Based on the preliminary sales results, the company now expects net

loss for the quarter to be at or below the lower end of its former

guidance of 1 cent per share, which excludes one-time expenses

related to store impairment and write-off, recruiting expenses and

probable settlement costs.

Bebe competes with other upper segment apparel retailers, such as

Nordstrom Inc. (JWN) and Guess’

Inc. (GES). Currently, the company has a Zacks #3 Rank

that translates to a short-term ‘Hold’ rating.

We are maintaining a long-term ‘Neutral’ recommendation on the

stock as we believe that the company’s sustained focus on the

development of a multi-channel retail format through the

enhancement of its e-commerce capabilities, along with expanding

international business, will certainly help it fight waning retail

sales.

Bebe Stores design, develop and produce a distinctive line of

contemporary women's apparel and accessories. They market their

products under the bebe, bebe moda and bbsp brand names through

their retail stores located in Canada and the United Kingdom.

BEBE STORES INC (BEBE): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

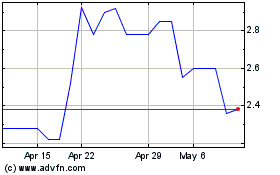

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jun 2024 to Jul 2024

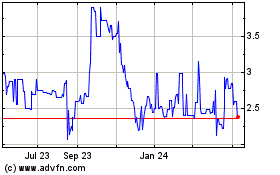

Bebe Stores (PK) (USOTC:BEBE)

Historical Stock Chart

From Jul 2023 to Jul 2024