UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-40210

Tuya Inc.

10/F, Building A,

Huace Center

Xihu District, Hangzhou

City

Zhejiang, 310012

People’s Republic

of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXPLANATORY NOTE

We made two announcements, both dated May 14, 2024, with

The Stock Exchange of Hong Kong Limited (the “HKEX”) in accordance with the Rules Governing the Listing of Securities

on the HKEX relating to certain past and proposed acquisitions of U.S. treasury securities. For details, please refer to exhibits 99.1

and 99.2 to this current report on Form 6-K.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Name | : |

Yao

(Jessie) Liu |

| | Title | : |

Chief

Financial Officer |

Date: May 14, 2024

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Tuya Inc.

塗鴉智能*

(A company controlled through

weighted voting rights and incorporated in the Cayman Islands with limited liability)

(HKEX Stock Code: 2391)

(NYSE Stock Ticker: TUYA)

PROPOSED

MAJOR TRANSACTION MANDATE

IN

RELATION TO THE POTENTIAL TREASURY SECURITIES ACQUISITIONS

THE

ACQUISITION MANDATE

The

Group proposed to conduct the Potential Treasury Securities Acquisitions during the Mandate Period, and accordingly, the Company proposed

to seek for an approval of the Acquisition Mandate from the Shareholders in advance such that the Board are authorized and empowered

to conduct the Potential Treasury Securities Acquisition in the open market during the Mandate Period. The Acquisition Mandate shall

authorize and empower the Board to acquire (and in association with the Acquisition Mandate, redeem upon maturity) Treasury Securities

within the Maximum Acquisition Amount of US$400,000,000.

LISTING

RULES IMPLICATIONS

As

the highest applicable percentage ratio in respect of the Maximum Acquisition Amount is expected to exceed 25% but is less than 100%,

the Potential Treasury Securities Acquisitions, if materialized, may constitute a major transaction of the Company subject to the reporting,

announcement and Shareholders’ approval requirements under Chapter 14 of the Listing Rules.

The

Potential Treasury Securities Acquisitions will be conducted at the open market and on a continuing basis. It is a common market practice

for independent buyers or sellers to trade (buy or sell) Treasury Securities in the open market through licensed banks or securities

brokerage firms. In light of the number of tranches, the sizable quantity of Treasury Shares held by the Group and the Group’s

working capital needs from time to time, the Company considers that it is necessary and appropriate for the proposed Acquisition Mandate

to cover any acquisition of Treasury Securities.

A

circular containing, among other things, further details of the Acquisition Mandate and the Potential Treasury Securities Acquisition(s),

the notice of the AGM and other information as required under the Listing Rules is expected to be despatched to the Shareholders,

if necessary, and published on the respective websites of the Stock Exchange and the Company on or before May 21, 2024.

INTRODUCTION

Reference is made to the announcement

of the Company on May 14, 2024, pursuant to which, Tuya HK (a wholly-owned subsidiary of the Company) acquired the Previous Securities

primarily with short-term in nature from CICC HK Securities in the open market at an aggregate cash consideration of approximately US$120.9

million, which upon aggregated as a series of transactions constituted a discloseable transaction of the Company.

The Board is pleased to announce

that, the Group proposed to conduct the Potential Treasury Securities Acquisitions during the Mandate Period, and accordingly, the Company

proposed to seek for an approval of the Acquisition Mandate from the Shareholders in advance such that the Board are authorized and empowered

to conduct the Potential Treasury Securities Acquisition in the open market during the Mandate Period.

THE ACQUISITION MANDATE

The Acquisition Mandate to be

sought from the Shareholders will be on the following terms:

| (a) | Type of Treasury Securities |

The Acquisition Mandate

to be sought covers any acquisition (and any redemption upon maturity) of Treasury Securities, being U.S. treasury bills and treasury

notes which are short- term to medium-term in nature.

The Acquisition Mandate

is for the Mandate Period, i.e., a period of twelve (12) months from the date on which an ordinary resolution in relation to the Acquisition

Mandate and the Potential Treasury Securities Acquisitions having been duly passed by the Shareholders at the AGM.

| (c) | Maximum Acquisition Amount |

The Acquisition Mandate

shall authorize and empower the Board to acquire (and in association with the Acquisition Mandate, redeem upon maturity) Treasury Securities

within the Maximum Acquisition Amount of US$400,000,000. The Maximum Acquisition Amount was determined with reference to the following

key factors:

| (i) | the anticipated needs of the Group for treasury management in the

forthcoming year, having considered (1) the net cash generated from operating activities

during the year ended December 31, 2023 of approximately US$36.4 million; and (2) the

total cash, cash equivalents, time deposits and U.S. treasury securities recorded as short-term

and long-term investments of approximately US$984.3 million held by the Group as at December 31,

2023; and |

| (ii) | the strategy of the Group in terms of asset allocation and treasury

management. The Board believes that the acquisition and holding of Treasury Securities plays

a crucial role in the Group’s asset allocation and treasury management, as allocating

a portion of the Group’s idle reserve cash in Treasury Securities can serve as a diversification

to holding cash and/or deposits in banks, and a measure to balance investment risks and returns

and facilitate the Group’s future business operations. In addition, the Company believes

that Treasury Securities, as means of preserving value, are akin to cash in terms of substance,

liquidity and risk profile, and relatively low-risk investments which are backed by the U.S.

Department of the Treasury, and therefore have the potential to resist inflation in the long

run and appreciate the value stored and retain long-term value. |

The acquisition amount

of the Treasury Securities acquired by the Group during each of the three years ended December 31, 2023, and from January 1,

2024 and up to the date of this announcement, were as follows:

| |

|

For

the year ended December 31 |

From January 1,

2024 and up to

the date of this |

| |

|

2021 |

2022 |

2023 |

announcement |

| |

Acquisition

amount of the Treasury Securities during the year/period |

Nil |

Nil |

US$10.23 million |

US$110.68 million |

Having considered the

above, the Company proposes to set the Maximum Acquisition Amount at US$400,000,000 for the Mandate Period.

| (d) | Scope of Authorization |

The Board shall be

authorized and empowered to determine, decide, execute and/or implement with its full discretion at in all manners in relation to the

Potential Treasury Securities Acquisitions, including but not limited to the number of tranches to which the Potential Treasury Securities

Acquisitions shall take place, the type of Treasury Securities to be acquired, the timing of the Potential Treasury Securities Acquisitions,

and the terms of Potential Treasury Securities Acquisitions (including the purchase price, and coupon rate per annum, etc.).

The principal

parameters of the Potential Treasury Securities Acquisitions shall be as follows:

| Issuer |

: |

U.S. Department of the Treasury |

| |

|

|

| Maximum

Acquisition Amount |

: |

Up to US$400,000,000 during the Mandate Period; and for the avoidance of doubt, such Maximum Acquisition

Amount excludes any amount of the Treasury Securities acquired by the Group prior to the approval of the Acquisition Mandate by the

Shareholders at the AGM |

| |

|

|

| |

|

The acquisition amount of the Treasury Securities in

each Potential Treasury Securities Acquisition is the purchase price of such Treasury Securities quoted in the open market at the

time of each Potential Treasury Securities Acquisition |

| |

|

|

| Expected

annualized rate of return (the yield to maturity) at the time of the relevant Acquisition(s) |

: |

No less than the National Deposit Rates for Savings

announced by the FDIC at the time of the relevant Acquisition(s) |

| |

|

|

| |

|

For illustrative purpose, the following formula sets

forth the relationship between the acquisition amount, the principal amount, the periodic coupon payment and the expected annualized

rate of return (the yield to maturity) of the Treasury Securities in each Potential Treasury Securities Acquisition: |

| |

|

|

| |

|

|

| |

|

|

| |

|

A = the acquisition amount of the Treasury Securities |

| |

|

|

| |

|

F = the principal amount of the Treasury Securities |

| |

|

|

| |

|

YTM = the expected annualized rate of return (the yield to maturity) of the Treasury

Securities |

| |

|

|

| |

|

C = the amount of each periodic coupon payment |

| |

|

|

| |

|

p = the length of period between the date of each periodic

coupon payment and the date of the relevant Potential Treasury Securities Acquisition |

| |

|

|

| |

|

n = the total number of periodic coupon payment before

maturity of the Treasury Securities after the relevant Potential Treasury Securities Acquisition. For the avoidance of doubt, the

maturity date is the date of the last periodic payment |

| |

|

|

| |

|

t = the first period for periodic coupon payment of

the Treasury Securities after the relevant Potential Treasury Securities Acquisition |

| |

|

|

| Maturity Date |

: |

Up to 5 years from the date of Acquisition |

In the event that any acquisition

of Treasury Securities is undertaken outside of the parameters set for the Acquisition Mandate, or the Group sells or disposes of any

Treasury Securities, the Company will ensure that each of those transaction(s) complies with the requirements under Chapter 14 of

the Listing Rules on an individual or aggregated basis.

| (e) | Manner of the Potential Treasury Securities Acquisitions |

The Company proposed that, during

the Mandate Period, the Group shall be authorized to acquire (and in association with the Acquisition Mandate, redeem upon maturity)

Treasury Securities in the open market through reputable licensed banks or securities brokerage firms within the Maximum Acquisition

Amount of US$400,000,000.

In the past, the Group has been

purchasing Treasury Securities from CICC HK Securities, a licensed corporation, in respect of the Previous Acquisitions, and will consider

factors such as market trend, yield rate, risk assessment, liquidity, capital management and professional investments advice with considering

making any further acquisition of Treasury Securities. To the best knowledge, information and belief of the Directors and having made

all reasonable enquiries, each of CICC HK Securities and its ultimate beneficial owner(s) was an Independent Third Party as at the

date of this announcement.

As the Potential Treasury Securities

Acquisitions are expected to be purchased from Sellers in the open market, the identity of such Seller(s) cannot be ascertained

as at the date of this announcement. In this connection, the Company endeavours to undertake all appropriate measures available to it

to ensure that the counterparties and their respective ultimate beneficial owner(s) (if any) to the Potential Treasury Securities

Acquisitions shall be Independent Third Parties.

REASONS FOR AND BENEFITS OF

THE POTENTIAL TREASURY SECURITIES ACQUISITIONS AND THE ACQUISITION MANDATE

To preserve and achieve stable

returns on the principal amount and in order to maximize the utilization of cash generated from business operations and fundraising activities,

the Group purchases, amongst others, short-term deposits and Treasury Securities (including the Previous Securities) from time to time

as part of its treasury management.

Taking into account the regulatory

environment applicable to dual listed issuer in the U.S. and Hong Kong, the expected rate of return and the low level of risks from the

Treasury Securities, the Company anticipates that the Group may generate more stable and satisfactory return from the Treasury Securities,

compared to those from short-term or long-term time deposits offered by licensed banks or financial institutions.

Having considered the aforementioned

factors, the Directors consider that the terms of the Potential Treasury Securities Acquisitions and the Acquisition Mandate are on normal

commercial terms which are fair and reasonable, and the Acquisitions are in the interests of the Company and the Shareholders as a whole.

INFORMATION ON THE GROUP AND THE POSSIBLE COUNTERPARTIES

The Company

The Group is a global leading

IoT cloud development platform with a mission to build an IoT developer ecosystem and enable everything to be smart. The Company has

pioneered a purpose- built IoT cloud development platform that delivers a full suite of offerings, including platform-as- a-service (PaaS),

Software-as-a-service (SaaS), and smart solutions for IoT devices, to business and developers. Through its IoT cloud development platform,

Tuya has enabled developers to activate a vibrant IoT ecosystem of brands, OEMs, partners and end users to engage and communicate through

a broad range of smart devices.

Tuya HK

Tuya HK is a wholly-owned subsidiary

of the Company, and is principally engaged in investment holding and business development.

CICC HK Securities

CICC HK Securities is a licensed

corporation under the SFO, licensed to carry out Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 4 (advising

on securities), Type 5 (advising on futures contracts) and Type 6 (advising on corporate finance) regulated activities under the SFO.

CICC HK Securities is wholly-owned subsidiary of China International Capital Corporation Limited, whose H shares are listed on the Stock

Exchange (stock code: 3908) and A shares are listed on the Shanghai Stock Exchange (stock code: 601995).

U.S. Department of Treasury

According to the public information

available to the Directors, the U.S. Department of the Treasury is the executive agency responsible for promoting economic prosperity

and ensuring the financial security of the United States. It is responsible for a wide range of activities such as advising the president

of the United States on economic and financial issues, encouraging sustainable economic growth, and fostering improved governance in

financial institutions.

LISTING RULES IMPLICATIONS

As the highest applicable percentage

ratio in respect of the Maximum Acquisition Amount is expected to exceed 25% but is less than 100%, the Potential Treasury Securities

Acquisitions, if materialized, may constitute a major transaction of the Company subject to the reporting, announcement and Shareholders’

approval requirements under Chapter 14 of the Listing Rules.

The Potential Treasury Securities

Acquisitions will be conducted at the open market and on a continuing basis. It is a common market practice for independent buyers or

sellers to trade (buy or sell) Treasury Securities in the open market through licensed banks or securities brokerage firms. In light

of the number of tranches, the sizable quantity of Treasury Shares held by the Group and the Group’s working capital needs from

time to time, the Company considers that it is necessary and appropriate for the proposed Acquisition Mandate to cover any acquisition

of Treasury Securities.

Furthermore, the Company considered

that the Acquisition Mandate, if approved by the Shareholders, would provide the Board with flexibility in acquiring the Treasury Securities

thereby enabling the Group to react promptly to changing market conditions (which are reflected, among others, in the National Deposit

Rates for Savings announced by the FDIC from time to time). Where the Treasury Securities were to be acquired in an open market, the

transactions would need to be completed in a very short period. The procedure for convening the Company’s general meeting as a

company with a dual primary listing in the U.S. and Hong Kong requires global coordination among parties, including among others, the

principal and Hong Kong share registrars, the Depositary and the HKSCC. Such procedure would require the Company, with the help of its

Depositary and the Hong Kong share registrar to gather the mailing details of all the securities holders, prepare and print the notice

and proxy forms, and mail physical copies to, and collect vote cards from, securities holders and ADS holders. This will take preparation

time of one to two months for the Company and the relevant parties to organize a general meeting, including complying with various timing

requirements in the U.S. and Hong Kong which generally requires at least 30 days from the notice of general meeting to the date of general

meeting. Hence, it is impracticable, if not impossible, to make any such acquisitions conditional on Shareholders’ approval. Under

the proposed parameters of the Acquisition Mandate, the acquisitions (and redemption upon maturity) of Treasury Securities shall be conducted

through reputable banks or securities brokerage firms, and if the Treasury Securities will be held by the Group up to its maturity date,

the Company believed that the Group is not expected to suffer foreseeable loss and the Acquisition Mandate is unlikely to result in any

undue risks to the Shareholders. There are also sufficient safeguard in the proposed Acquisition Mandate and information for the Shareholders

to make an informed assessment as to the Potential Treasury Securities Acquisitions.

Pursuant to the Listing Rules,

where a Shareholder is considered to have material interest in the Potential Treasury Securities Acquisitions (including the grant of

the Acquisition Mandate), such Shareholder together with his/her/its close associate(s) must abstain from voting on the relevant

resolution. To the best of the Directors’ knowledge, information and belief having made all reasonable enquiries, no Shareholders

was considered to have material interest in the Potential Treasury Securities Acquisitions (including the grant of the Acquisition Mandate).

Accordingly, it is expected that no Shareholder is required to abstain from voting at the AGM.

A circular containing, among

other things, further details of the Acquisition Mandate and the Potential Treasury Securities Acquisition(s), the notice of the AGM

and other information as required under the Listing Rules is expected to be despatched to the Shareholders, if necessary, and published

on the respective websites of the Stock Exchange and the Company on or before May 21, 2024.

DEFINITIONS

In this announcement, the following

expressions shall have the following meanings unless the context requires otherwise:

| “Acquisition Mandate” |

an advanced specific mandate proposed by the Directors in order to seek Shareholders’

approval to authorize and empower the Board during the Mandate Period to conduct the Potential Treasury Securities Acquisitions (and

in association with such Acquisition Mandate, redemption of Treasury Securities upon maturity) upon the terms set out in this announcement

provided that the Maximum Acquisition Amount shall not be exceeded |

| |

|

| “Acquisitions” |

collectively, the Previous Acquisitions and the Potential Treasury Securities Acquisitions |

| |

|

| “ADS(s)” |

American Depositary Shares, each representing one Class A Ordinary Share, as amended from time to time |

| |

|

| “AGM” |

the upcoming annual general meeting of the Company, of which a circular will be

published in due course |

| |

|

| “Board” |

the board of Directors |

| |

|

| “CICC HK Securities” |

China International Capital Corporation Hong Kong Securities Limited, a licensed corporation under

the SFO, licensed to carry out Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 4 (advising on securities),

Type 5 (advising on futures contracts) and Type 6 (advising on corporate finance) regulated activities under the SFO |

| |

|

| “Company” |

Tuya Inc., an exempted company with limited liability incorporated in the Cayman Islands on August

28, 2014 |

| |

|

| “connected person(s)” |

has the meaning ascribed to it under the Listing Rules |

| |

|

| “Depositary” or “The Bank of New York Mellon” |

The Bank of New York Mellon, the depositary of our ADSs |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “FDIC” |

the Federal Deposit Insurance Corporation, an independent agency created by the

U.S. Congress |

| |

|

| “Group” |

the Company, its subsidiaries and the consolidated affiliated entities from time

to time |

| |

|

| “HKSCC” |

the Hong Kong Securities Clearing Company Limited |

| |

|

| “HK$” |

Hong Kong dollars, the lawful currency of Hong Kong |

| “Hong Kong” |

the Hong Kong Special Administrative Region of the People’s Republic of China |

| |

|

| “Independent Third Party(ies)” |

third party(ies) independent of the Company and its connected persons (as defined

under the Listing Rules) |

| |

|

| “IoT” |

the connection of physical objects, or “things,”

that are embedded with communication modules, software, and other technologies for the purpose of connecting and exchanging information

with other devices and systems over the internet or other communications networks |

| |

|

| “Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange

of Hong Kong Limited |

|

|

| “Mandate Period” |

the period from the passing of an ordinary resolution in relation to the Potential Treasury Securities

Acquisitions (including the grant of the Acquisition Mandate) by the Shareholders at the AGM until the earlier of: |

| |

|

|

(i) the expiration of the twelve (12) months period; and |

| |

|

|

(ii) the date on which the authority set out in the ordinary

resolution has been revoked or varied by an ordinary resolution of the Shareholders in a general meeting |

| |

|

| “Maximum Acquisition Amount” |

US$400,000,000, being the maximum amount of the Treasury

Securities to be acquired by the Group pursuant to the Acquisition Mandate; and for the avoidance of doubt, excludes any amount of

the Treasury Securities acquired by the Group prior to the approval of the Acquisition Mandate by the Shareholders at the AGM |

| |

|

| “Potential Treasury Securities Acquisition(s)” |

the potential acquisition(s) of the Treasury Securities subject to the Maximum Acquisition Amount in the open market

transactions by the Group during the Mandate Period |

| |

|

| “Previous Acquisition(s)” |

the acquisition(s) of the Previous Securities |

| |

|

| “Previous Securities” |

the U.S. treasury securities acquired by Tuya HK on December 28, 2023, January 4, 2024 and January 8, 2024 in the open market

with an aggregate acquisition amount of approximately US$120.9 million |

| |

|

| “Seller(s)” |

the ultimate seller(s) of Treasury Securities, which shall be Independent Third Party(s) |

| |

|

| “SFO” |

Securities and Futures Ordinance (Chapter 571 of the

Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time |

| |

|

| “Shareholder(s)” |

holder(s) of Shares and, where the context requires, ADSs |

| “Shares” |

the Class A Ordinary Share(s) and Class B Ordinary Share(s) in the share capital of the Company, as the

context so requires |

| |

|

| “Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “Treasury Securities” |

U.S. treasury securities |

| |

|

| “Tuya HK” |

Tuya (HK) Limited, a limited liability company incorporated under the laws of Hong Kong on September 12, 2014 and a subsidiary

of the Company |

| |

|

| “United States” or “U.S.” |

United States of America, its territories, its possessions and all areas subject to its jurisdiction |

| |

|

| “US$” |

U.S. dollars, the lawful currency of the United States of America |

| |

|

| “%” |

per cent |

| | By

order of the Board

Tuya Inc.

WANG Xueji

Chairman

|

Hong Kong, May 14, 2024

As

at the date of this announcement, the Board comprises Mr. WANG Xueji, Mr. CHEN Liaohan, Mr. YANG Yi and Ms. LIU Yao

as executive Directors; and Mr. HUANG Sidney Xuande, Mr. QIU Changheng, Mr. KUOK Meng Xiong (alias GUO Mengxiong) and

Mr. YIP Pak Tung Jason as independent non-executive Directors.

* For identification purpose

only

Exhibit 99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Tuya Inc.

塗鴉智能*

(A company controlled through

weighted voting rights and incorporated in the Cayman Islands with limited liability )

(HKEX Stock Code: 2391)

(NYSE Stock Ticker: TUYA)

DISCLOSEABLE TRANSACTION

ACQUISITIONS OF TREASURY SECURITIES

THE PREVIOUS ACQUISITIONS

On December 28, 2023, January 4,

2024 and January 8, 2024, Tuya HK, a wholly-owned subsidiary of the Company, acquired the Previous Securities from CICC HK Securities

in the open market with an aggregate acquisition amount of approximately US$120.9 million.

LISTING RULES IMPLICATIONS

Given that the Previous Acquisitions

were made by Tuya HK for Treasury Securities within a 12-month period, the Previous Acquisitions would be required to be aggregated as

a series of transactions pursuant to Rules 14.22 and 14.23 of the Listing Rules.

As the highest relevant applicable

percentage ratio (as defined under the Listing Rules) in respect of the Previous Acquisitions on an aggregated basis exceeds 5% but is

less than 25%, the Previous Acquisitions constitute a disclosable transaction of the Company and is subject to the notification and announcement

requirements under Chapter 14 of the Listing Rules.

THE PREVIOUS ACQUISITIONS

On December 28, 2023, January 4,

2024 and January 8, 2024, Tuya HK, a wholly-owned subsidiary of the Company, acquired the Previous Securities from CICC HK Securities

in the open market with an aggregate acquisition amount of approximately US$120.9 million.

Major Terms of the Previous Securities

| Issuer |

: |

U.S. Department of the Treasury |

| Seller |

: |

CICC HK Securities |

| Trade date |

: |

December 28, 2023 |

December 28, 2023 |

January 4, 2024 |

January 8, 2024 |

| Principal amount |

: |

US$5,000,000 |

US$5,000,000 |

US$10,000,000 |

US$103,000,000 |

| Coupon rate |

: |

4.625% |

5% |

4.625% |

0% |

| Acquisition amount |

: |

US$5,127,660.7 |

US$5,100,482.9 |

US$10,238,163.6 |

US$100,445,126.2 |

| Expected annualized rate of return (the yield to maturity) at the time of the relevant Previous Acquisition(s) |

: |

4.01% |

4.31% |

4.105% |

5.23% |

| Maturity date |

: |

October 15, 2026 |

October 31, 2025 |

October 15, 2026 |

July 5, 2024 |

| Interest payment date |

: |

Semiannually

starting from the issue date, except the final interest payment to be made on maturity date |

N/A |

The Group purchased the Treasury

Securities from CICC HK Securities in the Previous Acquisitions. To the best knowledge, information and belief of the Directors and having

made all reasonable enquiries, each of CICC HK Securities and its ultimate beneficial owner(s) was an Independent Third Party as

at the respective trade date of the Previous Acquisitions and as of the date of this announcement. The Previous Acquisitions were funded

from the Group’s internal resources.

REASONS FOR AND BENEFITS OF

THE PREVIOUS ACQUISITIONS

To preserve and achieve stable

returns on the principal amount and in order to maximize the utilization of cash generated from business operations and fundraising activities,

the Group purchases, amongst others, short-term deposits and Treasury Securities from time to time as part of its treasury management.

Taking into account the regulatory

environment applicable to dual listed issuer in the U.S. and Hong Kong, the expected rate of return and the low level of risks from the

Treasury Securities, the Company anticipates that the Group may generate more stable and satisfactory return from the Treasury Securities,

compared to those from short-term or long-term time deposits offered by licensed banks or financial institutions.

Having considered the aforementioned

factors, the Directors consider that the terms of the Previous Acquisitions are on normal commercial terms which are fair and reasonable,

and the Previous Acquisitions are in the interests of the Company and the Shareholders as a whole.

GENERAL INFORMATION

The Company

The Group is a global leading

IoT cloud development platform with a mission to build an IoT developer ecosystem and enable everything to be smart. The Group has pioneered

a purpose-built IoT cloud development platform that delivers a full suite of offerings, including platform-as-a- service (PaaS), software-as-a-service

(SaaS), and smart solutions for IoT devices, to businesses and developers. Through its IoT cloud development platform, the Group has enabled

developers to activate a vibrant IoT ecosystem of brands, OEMs, partners and end users to engage and communicate through a broad range

of smart devices.

Tuya HK

Tuya HK is a wholly-owned subsidiary

of the Company, and is principally engaged in investment holding and business development.

CICC HK Securities

CICC HK Securities is a licensed

corporation under the SFO, licensed to carry out Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 4 (advising

on securities), Type 5 (advising on futures contracts) and Type 6 (advising on corporate finance) regulated activities under the SFO.

CICC HK Securities is wholly owned subsidiary of China International Capital Corporation Limited, whose H Shares are listed on the Stock

Exchange (Stock Code: 3908) and A Shares are listed on the Shanghai Stock Exchange (Stock Code: 601995).

U.S. Department of Treasury

According to the public information

available to the Directors, the U.S. Department of the Treasury is the executive agency responsible for promoting economic prosperity

and ensuring the financial security of the United States. It is responsible for a wide range of activities such as advising the president

of the United States on economic and financial issues, encouraging sustainable economic growth, and fostering improved governance in financial

institutions.

BASIS OF CONSIDERATION

The Directors confirm that the

acquisition amount of the Previous Acquisitions was based on the purchase price quoted by the seller for the Treasury Securities in the

open market at the time of the Previous Acquisitions, primarily with reference to (i) principal amount at which the U.S. Department

of the Treasury issued the Treasury Securities, (ii) the interests which have accrued on the relevant Treasury Securities at the

time of the Previous Acquisitions and (iii) the expected annualized rate of return (the yield to maturity) of the Treasury Securities.

LISTING RULES IMPLICATIONS

Given that the Previous Acquisitions

were made by Tuya HK for Treasury Securities within a 12-month period, the Previous Acquisitions would be required to be aggregated as

a series of transactions pursuant to Rules 14.22 and 14.23 of the Listing Rules.

As the highest relevant applicable

percentage ratio (as defined under the Listing Rules) in respect of the Previous Acquisitions on an aggregated basis exceeds 5% but is

less than 25%, the Previous Acquisitions constitute a disclosable transaction of the Company and is subject to the notification and announcement

requirements under Chapter 14 of the Listing Rules.

The Company was of the view that

the nature of the Treasury Securities was akin to cash, the acquisitions of which would not constitute transactions as defined under Chapter

14 of the Listing Rules, taking into account the substance, liquidity and low level of risk profile of the Treasury Securities. Therefore,

the Company did not classify the Previous Acquisitions as transactions as defined under Chapter 14 of the Listing Rules. Recently, upon

the Company’s internal discussion for potential future acquisition of the Treasury Securities, relevant business units revisited

the relevant transaction and sought advice from the Board and professional advisers on the Listing Rules implications. Accordingly,

the Company is advised to reclassify the Previous Acquisitions as transactions as defined under Chapter 14 of the Listing Rules and

hereby comply with the relevant reporting and announcement requirements under Rule 14.34 of the Listing Rules in respect of

the Previous Acquisitions.

IMPROVEMENT ACTIONS

As the Company was aware of

the need to reclassify the Previous Acquisitions as transactions as defined under Chapter 14 of the Listing Rules, it conducted a

comprehensive review of the Group’s acquisitions of Treasury Securities. The Company will continue to enhance its internal

control management and strictly monitor the compliance of the relevant business units to better comply with the relevant

requirements under the Listing Rules. In particular, the Company has enhanced the communication, coordination and reporting

arrangements for notifiable transactions among business units to closely monitor the transaction amounts of any transactions subject

to Chapter 14 of the Listing Rules, and designated the relevant business units to regularly perform size test analysis, and review

and check the size test calculations of transactions. The Company will continue to work closely with its legal advisers and

compliance adviser on compliance with the Listing Rules and consult the Stock Exchange on the proper treatment of any potential

transaction, as and when appropriate and necessary. The Company will arrange trainings of regulatory compliance matters relating to

notifiable transactions on a regular basis.

DEFINITIONS

In this announcement, the following expressions shall

have the following meanings unless the context requires otherwise:

| “Board” |

the board of Directors |

| “CICC HK Securities” |

China International Capital Corporation Hong Kong Securities Limited, a licensed corporation under the SFO, licensed to carry out Type 1 (dealing in securities), Type 2 (dealing in futures contracts), Type 4 (advising on securities), Type 5 (advising on futures contracts) and Type 6 (advising on corporate finance) regulated activities under the SFO |

| “Company” |

Tuya Inc., an exempted company with limited liability incorporated in the Cayman Islands on August 28, 2014 |

| “connected person(s)” |

has the meaning ascribed to it under the Listing Rules |

| “Director(s)” |

the director(s) of the Company |

| “Group” |

the Company, its subsidiaries and the consolidated affiliated entities from time to time |

| “Hong Kong” |

the Hong Kong Special Administrative Region of the People’s Republic of China |

| “Independent Third Party(ies)” |

third party(ies) independent of the Company and its connected persons (as defined under the Listing Rules) |

| “IoT” |

the connection of physical objects, or “things,” that are embedded with communication modules, software, and other technologies for the purpose of connecting and exchanging information with other devices and systems over the internet or other communications networks |

| “Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited |

| “Previous Acquisition(s)” |

the acquisition(s) of the Previous Securities |

| “Previous Securities” |

the

U.S. treasury securities acquired by Tuya HK on December 28, 2023, January 4, 2024 and January 8, 2024 in the open market

with an aggregate acquisition amount of approximately US$120.9 million |

| “SFO” |

Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong), as amended, supplemented or otherwise modified from time to time |

| “Shareholder(s)” |

holder(s) of Shares and, where the context requires, American Depositary Shares, each representing one Class A Ordinary Share in the share capital of the Company as amended from time to time |

| “Shares” |

the Class A Ordinary Share(s) and Class B Ordinary Share(s) in the share capital of the Company, as the context so requires |

| “Stock Exchange” |

The Stock Exchange of Hong Kong Limited |

| “Treasury Securities” |

U.S. treasury securities |

| “Tuya HK” |

Tuya (HK) Limited, a limited liability company incorporated under the laws of Hong Kong on September 12, 2014 and a subsidiary of the Company |

| “United States” or “U.S.” |

United States of America, its territories, its possessions and all areas subject to its jurisdiction |

| “US$” |

U.S. dollars, the lawful currency of the United States of America |

| “%” |

per cent |

| |

By order of the Board |

| |

Tuya Inc. |

| |

WANG Xueji |

| |

Chairman |

Hong Kong, May 14, 2024

As

at the date of this announcement, the Board comprises Mr. WANG Xueji, Mr. CHEN Liaohan, Mr. YANG Yi and Ms. LIU Yao

as executive Directors; and Mr. HUANG Sidney Xuande, Mr. QIU Changheng, Mr. KUOK Meng Xiong (alias GUO Mengxiong) and Mr. YIP

Pak Tung Jason as independent non-executive Directors.

* For identification purpose only

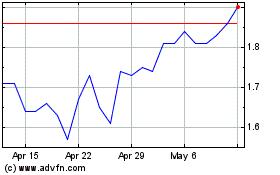

Tuya (NYSE:TUYA)

Historical Stock Chart

From Apr 2024 to May 2024

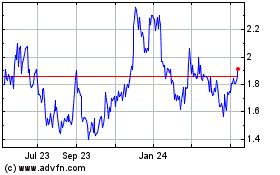

Tuya (NYSE:TUYA)

Historical Stock Chart

From May 2023 to May 2024