Tikehau Capital exceeds its target by

reaching €42.8bn of Asset Management AuM at 31 December 2023, a 13%

growth year-over-year and a 26% CAGR since 20161

Regulatory News:

Tikehau Capital (Paris:TKO):

Dynamic and selective

deployment

€5.9bn

deployed in 2023

Robust realizations

momentum

€1.9bn

realized in 2023

Record level of AM net new

money

€6.5bn

raised in 2023

- Record level of net new money at €6.5bn for 2023, an

amount 37% above the 2017-2022 average, reflecting the strength of

the Group’s asset management platform and the relevance of its

investment strategies in the current context.

- Cumulative net new money reaches a total of €19bn over

the last 3 years and €35bn since IPO.

- Tikehau Capital is reaping the benefits of its expansion

strategy with:

- Complementary asset classes, serving a variety of

evolving client needs and efficiently navigating the current

cycle;

- An increasingly global LP base, driven by many successes

recorded in 2023 across Asia, Europe, Middle East and North

America, with international investors2 representing 54%

of net inflows3;

- A pioneer position in the democratization of alternatives,

driven by attractive and well-suited offerings across asset

classes, with private investors accounting for 29% of net

inflows in 20234.

- Sound deployment activity with €5.9bn invested,

leveraging Tikehau Capital’s multi-local platform, with a strong

focus on asset selectivity, long-term megatrends and downside

protection.

- Sustained realizations at €1.9bn in 2023, with

value-creating exits carried out across asset classes.

- Solid and compounding balance sheet with a €3.9bn

granular and diversified investment portfolio, generating strong

alignment of interests and attractive returns.

- Continued progress in expanding the Group’s

sustainability-themed and impact platform across asset

classes, a core priority embedded in the firm’s DNA.

Tikehau Capital will report earnings for the

full year 2023 on 6 March 2024 prior to the opening of the Paris

Stock Exchange. The press release will be made available at 6:30am

GMT / 7:30am CET and a webcast presentation will take place on the

same day at 9:00am GMT / 10:00am CET.

Antoine Flamarion and Mathieu

Chabran, co-founders of Tikehau Capital, said:

“In 2023, Tikehau Capital remained focused on

executing on its long-term growth plan and surpassed its AuM

target. Our successful innovative mindset, our commitment to

delivering sustainable value to our stakeholders and our growing

global franchise contributed to achieving a record-breaking year in

fundraising.

As our entrepreneurial journey approaches its

20th-anniversary milestone in 2024, we take pride in consistently

delivering on our commitments. The enduring confidence from our

clients not only underscores the relevance of our product range but

also reflects the long-term relationships we have forged along the

way, further fuelling our ambition to innovate and set new

standards. We extend our heartfelt gratitude to all teams for their

hard work and unwavering dedication.”

“Our successful innovative mindset, our

commitment to delivering sustainable value to our stakeholders and

our growing global franchise contributed to achieving a

record-breaking year in fundraising.”

SELECTIVE DEPLOYMENT DRIVEN BY PRIVATE DEBT

Building on its multi-local platform and its solid deal sourcing

capabilities, Tikehau Capital’s closed-end funds deployed

€5.9bn in 2023, with an acceleration in the second half of

the year. Capital deployment reached €1.7bn in Q4 2023, a

stable level compared to Q3 2023. Discipline remained a core focus

for the investment teams in a market which has not yet

stabilized.

- Private Debt accounted for 66% of total deployment,

driven by the firm’s European and US CLO platform, as well as its

flagship Direct Lending and Secondaries strategies. In a context of

liquidity drying up, Tikehau Capital’s Direct Lending strategies

have benefited from an active deal flow, attributed to the firm’s

pioneer positioning, and established track record coupled with the

scarcity experienced in other sources of mid-market financing.

Capital deployment remained highly selective and was carried out

without compromising documentation to preserve the credit quality

of portfolios. Additionally, the firm continued to structure

financing solutions to facilitate bolt-on acquisitions for existing

portfolio companies. In Private Debt Secondaries, the firm is well

positioned to seize attractive investment opportunities,

capitalizing on its early mover positioning in a context marked by

active portfolio management and LPs seeking liquidity.

- Private Equity accounted for 22% of total deployment,

driven by thematic investments across long-term growth trends such

as decarbonization, regenerative agriculture, cybersecurity and

aerospace.

- The firm’s special opportunities strategy recorded a

solid deployment momentum over the year, navigating a diverse range

of situations and transactions, including acquisition and growth

capex financing and refinancing. Beside the high level of activity,

the strategy remained particularly selective with portfolio

construction focusing on defensive sectors benefiting from secular

trends (business services, data centers, aerospace and prime real

estate). Most transactions in the portfolio also present a high

degree of downside protection, illustrated by the nature of

instruments and the transaction structures.

- Capital deployment across the firm’s Real Assets

strategies accounted for 13% of total deployment and was spread

across the firm’s European sale and leaseback practice, its

European Value-Add strategy as well as granular investments for

Sofidy and IREIT, the firm’s Singapore-listed REIT. Tikehau Capital

has adopted a cautious and focused approach in capital deployment

in Real Assets, while capitalizing on attractive investment

opportunities arising from a dislocated market.

- At 31 December 2023, Tikehau Capital had €6.9bn of dry

powder5 (+13% compared to 31 December 2022), allowing

the funds managed by the firm to capture attractive investment

opportunities. Dry powder was mainly located within the firm’s

Private Debt strategies, amounting to €2.7bn and representing 39%

of the total.

ROBUST LEVEL OF VALUE-CREATING EXITS

Realizations within Tikehau Capital’s closed-end funds amounted

to €1.9bn in 2023 (of which €0.4bn in the fourth quarter), a

5% growth year-over-year, driven by a higher level of realizations

in the second half of the year. Realizations were driven by Private

Debt (51% of total exits) followed by Real Assets (26%) and Private

Equity (24%).

- Within Private Debt, more than 75% of 2023 realizations were

carried out by the firm’s Direct Lending and Corporate Lending

strategies, corresponding to financing repayments. The fourth

quarter was notably marked by the repayment of c.€90m unitranche

financing to Neoapotek, an independent Italian chain of over

130 retail pharmacies, to support this company in its buy-and-build

strategy. This transaction generated a gross exit multiple of 1.2x

and a gross IRR of 13%.

- Realizations in Real Assets were mainly driven by

ongoing asset disposals from the firm’s European Real Estate

vehicles and US infrastructure funds. 2023 was mainly marked by the

first exit of the Group’s European value-add strategy with the

disposal of two boutique hotels located in Paris. The

transaction generated a gross exit multiple of 2.4x, exceeding

target. In addition, the Group continued to dispose units from a

granular residential portfolio of assets located in Portugal

and successfully conducted a refinancing process for this

portfolio.

- Private Equity accounted for 24% of realizations in

2023, driven by value-creating exits crystallizing solid realized

performance supporting future fundraising. This performance is a

testament to the firm’s relevant positioning across secular

megatrends. In 2023, Tikehau Capital notably successfully carried

out two value-creating exits with the disposal by the firm’s

private equity secondary fund of its stake in Total Eren to

TotalEnergies6 and the disposal by the firm’s growth equity fund of

its stake in the Italian company Ecopol to SK Capital,

generating gross exit multiples of 2.0x and 3.1x respectively.

RECORD LEVEL OF NET NEW MONEY, REACHING €6.5BN IN

2023

In 2023, Tikehau Capital recorded an unprecedented level of

client demand in an environment marked by continued uncertainty.

This success reflects the firm’s robust commercial activity, driven

by its multi-local and diversified platform. The firm’s capacity to

offer a wide range of investment strategies, each addressing the

needs of its investor-clients, has played a pivotal role in

successfully accommodating allocation shifts across asset classes

and fostering sustained growth.

Tikehau Capital attracted record levels of gross and net

inflows for its Asset Management business reaching €8.8bn of

gross new money, representing a 17% growth compared to the

average 2020-22 level and €6.5bn of net new money (of which

€1.8bn in the fourth quarter), a 37% growth compared to the

average 2017-22 level.

This level of client demand was mainly driven by the firm’s

“Yield” strategies. These strategies are principally

characterized by floating-rate instruments, which offer largely

predictable, inflation-hedged regular returns.

A relevant asset class mix and product

positioning

Net new money in 2023 was driven by the following successes:

- Solid development for the firm’s “Yield” strategies

across fund types and expertise driven by:

− The launch of Tikehau Capital’s sixth

vintage of Direct Lending strategy. Capitalizing on a

leadership position in Europe and a solid track-record, the firm’s

Direct Lending strategy has attracted c. €1bn of commitments since

the closing of the predecessor vintage,

− The launch of the firm’s second vintage

of Private Debt Secondaries strategy, attracting over $200m of

commitments at 31 December 2023, capitalizing on the robust returns

delivered by the first vintage,

− The continued solid momentum for the firm’s

CLO business, which reached €6.3bn of AuM at 31 December

2023 (up 40% year-over-year),

− Third-party commitments for the firm’s

strategic adjacencies with the launch of a Real Estate

Credit strategy, in partnership with Altarea7, building on

Tikehau Capital’s long-standing expertise across real estate and

private credit. AuM reached c. €200m at 31 December 2023 for this

strategy,

− Increasing demand within Capital Markets

Strategies for the firm's fixed income and dated funds,

which benefit from robust performance. These funds drive the firm's

outreach to private investors who are attracted to the level of

visibility and returns they provide. In particular, following the

launch in November 2023 of Tikehau 2029, a new 2029 fixed

maturity product composed of Investment Grade issuers8, the firm’s

dated funds expertise exceeded the €1bn AuM mark at 31 December

2023.

- Additional commitments for the firm’s “Value-Add”

strategies, which are positioned on megatrends and themes

poised for sustainable growth, were driven by:

− The launch of the second vintage of

Private Equity Decarbonization strategy, which attracted over

€600m of commitments at 31 December 2023;

− The launch of the fourth vintage of

Private Equity Cybersecurity strategy, with already more than

€200m of secured commitments9;

− Continued inflows for the third vintage

of Special Opportunities strategy, benefitting from a good

level of additional commitments from investors exposed to the

previous vintage as well as a broader investor base;

− Additional inflows for its impact platform

through its Private Equity Regenerative Agriculture

strategy, launched in partnership with AXA Climate and

Unilever, bringing AuM to over €400m at 31 December 2023.

Acceleration in client base

internationalization

- Tikehau Capital recorded major progress in the globalization

of its franchise, strengthening existing global relationships

and forging new connections in key areas of growth, particularly

Asia and the Middle East. International investors10 accounted for

54% of net inflows in 2023 and 39% (i.e, €16.9bn) of

Asset Management AuM at 31 December 2023.

- On 18 December 2023, Tikehau Capital announced having entered

into advanced discussion with Nikko Asset Management11, one

of Asia’s largest asset managers, with a view to form a business

and capital alliance. The contemplated strategic partnership would

involve both firms entering into distribution agreements in Japan

and elsewhere in Asia, as well as establishing a joint venture

dedicated to Asian private markets investment strategies. Within

this partnership, Nikko Asset Management would also acquire an

equity stake in Tikehau Capital.

Additional progress in democratizing

private markets

- Tikehau Capital benefitted from continued robust momentum for

its Private Debt unit-linked products launched with MACSF,

Société Générale Assurances and Suravenir, which attracted c.€1bn

since inception and approximately €450m for the year 2023.

- Since its inception, Opale Capital, an innovative

digital platform allowing private investors to access private

markets investment products, has raised over €80m offering a wide

range of alternative strategies, including private equity,

secondaries and opportunistic credit.

- With the objective to further address private investors’ demand

to access private markets, Tikehau Capital launched in Q4 2023 a

Private Equity fund of funds providing private wealth

investors and high-net worth individuals with the opportunity to

invest in the firm’s Private Equity strategies and the firm’s

ecosystem. This new initiative aims for €400m of total

commitments.

- Across asset classes and leveraging on the innovative

initiatives the firm launched over the past few years, Tikehau

Capital raised a total of €1.6bn from private investors

since 1 January 2023, representing 29% of third-party net new

money during the year.

At 31 December 2023, Tikehau Capital’s Asset Management AuM

reached €42.8bn, representing a 13% year-over-year growth.

Including the Investment Activity AuM, total AuM reached €43.2bn, a

11% year-over-year growth.

ROBUST BALANCE SHEET COMPOUNDING FUTURE GROWTH

In 2023, Tikehau Capital continued to use its flexible and

compounding balance sheet to support the expansion of its Asset

Management activity while ensuring alignment of interests with its

shareholders and LPs. In particular, amid a more challenging

environment, initial commitments from the firm’s balance sheet

allowed Tikehau Capital to:

- Launch strategic adjacencies (Real Estate Credit) and

new initiatives (Private Equity fund of funds);

- Launch new vintages of more established and scaling

strategies (such as Direct Lending, Cybersecurity,

Decarbonization, Credit Secondaries and CLOs).

In addition, the firm’s balance sheet played a facilitating role

in executing milestone transactions, particularly within the credit

secondaries space, leading to the successful onboarding of its

second Chinese LP for an investment totalling approximately c.$100m

in 2023.

In July 2023, Tikehau Capital announced a strategic partnership

with Whistler Capital Partners, a Nashville-based private

equity firm specializing in growth buyouts within the healthcare

industry and related tech-enabled services in North America. In

January 2024, Whistler Capital Partners successfully completed the

first investment of its latest strategy by investing in an

innovative veterinary and multi-service pet care platform focused

on modernizing the pet healthcare experience.

At 31 December 2023, Tikehau Capital’s balance sheet

investment portfolio reached €3.9bn, compared to €3.5bn at

31 December 2022. This variation resulted from:

- €0.9bn of investments, of which €0.8bn

were into the firm’s asset management strategies (mainly CLOs,

Credit Secondaries, Private Equity and Special Opportunities) and

co-investments alongside its strategies;

- €(0.6)bn of exits, including returns of capital

driven by the firm’s Growth Equity, Secondaries strategies and

CLOs;

- Fair value changes were essentially neutral, notably

driven by solid performance for the firm’s Private Equity

strategies being offset by market effects linked to its listed

REITs.

At 31 December 2023, the firm’s investment portfolio broke down

as follows:

- The firm’s investment portfolio is primarily comprised of

investments in the Asset Management strategies developed and

managed by the firm for €3.1bn (79% of total portfolio12),

generating a high alignment of interests with its investor-clients.

At 31 December 2023, Tikehau Capital’s investment portfolio is c.

65% exposed to its own “Yield” strategies, allowing the firm to

benefit from increased risk-adjusted returns in the current rising

rate environment.

- 21% of the portfolio or €0.9bn, is invested in ecosystem

and direct investments, notably direct private equity investments,

co-investments or investments in third-party funds, complementary

to the Group’s asset management strategies. These investments aim

at generating strong returns for the firm while serving its asset

management franchise globally.

Tikehau Capital’s investment portfolio benefits from a high

level of diversification and granularity with more than 300

investments spread across several industry sectors and geographies,

thus complementing the firm’s asset management activity exposure.

On top of generating continued alignment of interests with

investor-clients, the firm’s investment portfolio also allows the

firm to foster opportunities and long-term relationships with

partners.

REINFORCED COMMITMENT TOWARD SUSTAINABILITY AND IMPACT

INVESTING

- Following its commitment set in 2021 to support the goal of

achieving net zero greenhouse gas emissions by 2050 or sooner, in

line with global efforts to limit global warming to 1.5°C, Tikehau

Capital finalized its Net Zero Asset Manager targets in

March 2023. The firm has made an initial commitment to manage close

to 40% of its AuM in line with this net zero goal. For Real

Estate assets, the Group aims at improving energy and carbon

intensity, with a focus on its assets in France. With regards to

Private Equity, Private Debt and Capital Markets Strategies,

the commitment involves financing companies that are setting

decarbonization commitments and making progress towards their

low-carbon transition. The proportion of AuM to be managed in line

with net zero is intended to increase over time as new funds are

launched with net zero strategies.

- In addition, Tikehau Capital has been actively developing

dedicated sustainability-themed and impact strategies to finance

companies contributing to address key structural issues such as

decarbonization, nature & biodiversity, cyber security and

resilience. At 31 December 2023, the AuM for Tikehau Capital’s

sustainability-themed and impact platform dedicated to

investments in companies amounted to €4.3bn, of which €3.0bn was

specifically allocated to climate and biodiversity to enable

transition at scale. This puts Tikehau Capital on track to reach

its target of exceeding €5bn by 2025. Additionally, over the past

two years, the firm’s real estate investment and ESG teams

collaborated closely to launch and fortify a platform, amounting to

€7.4bn in funds earmarked for sustainable cities.

- In September 2023, Tikehau Capital successfully priced a new

sustainable bond issue for €300m maturing in March 203013. This

issue of senior unsecured sustainable bond is associated with a

fixed annual coupon of 6.625%. The issuance of this second

sustainable bond reinforces the position of Tikehau Capital as a

pioneer in sustainability. The net proceeds of this issuance are

used to carry out investments as part of Tikehau Capital’s

sustainable bond framework. At 31 December 2023, 78% of the

firm’s debt is linked to sustainability criteria.

CALENDAR

6 March 2024

FY 2023 results (before market open)

Management presentation to be held

in-person in London (and webcast)

23 April 2024

Q1 2024 announcement (after market

close)

6 May 2024

Annual General Meeting

30 July 2024

2024 half-year results (after market

close)

Management presentation to be held via

audiocast

22 October 2024

Q3 2024 announcement (after market

close)

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management group

with €43.2 billion of assets under management (at 31 December

2023).

Tikehau Capital has developed a wide range of expertise across

four asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€3.1 billion of shareholders’ equity at 30

June 2023), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 758 employees (at 31 December 2023)

across its 15 offices in Europe, Middle East, Asia and North

America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com.

DISCLAIMER

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties, actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

APPENDIX

Key operating metrics

In €m, AM perimeter

2019

2020

2021

2022

2023

Capital deployment

3,639

2,773

5,545

6,886

5,858

Realizations

n.a

1,352

1,531

1,832

1,926

Net new money (NNM)

4,074

4,185

6,365

6,390

6,498

AuM evolution

AuM at 31-12-2023

YoY change

QoQ change

Amount (€m)

Weight (%)

In %

In €m

In %

In €m

Private Debt

18,193

42%

+23%

+3,400

+6%

+1,000

Real Assets

13,464

31%

(2%)

(275)

(3%)

(461)

Capital Markets Strategies

4,649

11%

+12%

+503

+5%

+220

Private Equity

6,508

15%

+26%

+1,346

+10%

+616

Asset Management

42,814

99%

+13%

+4,974

+3%

+1,375

Investment activity

342

1%

(64%)

(612)

(34%)

(176)

Total AuM

43,156

100%

+11%

+4,362

+3%

+1,198

YoY evolution, in €m

AuM at 31-12-2022

Net new money

Distributions

Market effects

Change in scope

AuM at 31-12-2023

Private Debt

14,793

+4,191

(878)

+87

-

18,193

Real Assets

13,739

+723

(544)

(453)

-

13,464

Capital Markets Strategies

4,146

+224

(7)

+317

(32)

4,649

Private Equity

5,162

+1,361

(453)

+438

-

6,508

Total Asset Management

37,841

+6,498

(1,882)

+389

(32)

42,814

Q4 2023, in €m

AuM at 30-09-2023

Net new money

Distributions

Market effects

Change in scope

AuM at 31-12-2023

Private Debt

17,193

+1,155

(131)

(24)

-

18,193

Real Assets

13,925

(46)

(141)

(274)

-

13,464

Capital Markets Strategies

4,429

+71

(1)

+150

-

4,649

Private Equity

5,892

+603

(141)

+153

-

6,508

Total Asset Management

41,439

+1,783

(413)

+5

-

42,814

1 Figures have been rounded for presentation purposes,

which in some cases may result in aggregate differences. 2

International investors refer to non-French investors. 3

Third-party net new money excluding Sofidy. 4 Third-party

net new money. 5 Amounts available for investment at the

level of the funds managed by the Group. 6 Please refer to

press release dated 25 July 2023. 7 Please refer to press

release dated 1 June 2023. 8 Issuers belonging to the

“Investment Grade” category at the date of the investment. Please

refer to press release dated 23 November 2023. 9 Please

refer to press release dated 25 October 2023. 10

International investors refer to non-French investors. 11

Pleser refer to press release dated 18 December 2023. 12

Includes investments in funds managed by Tikehau Capital,

co-investments alongside Tikehau Capital asset management

strategies and SPAC sponsoring. 13 Please refer to press

release dated 8 September 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206001944/en/

PRESS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30 UK –

Prosek Partners: Philip Walters – +44 (0) 7773 331 589 USA – Prosek

Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR: Louis Igonet – +33 1 40 06 11 11

Théodora Xu – +33 1 40 06 18 56 shareholders@tikehaucapital.com

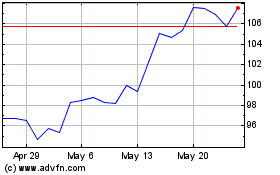

Tko (NYSE:TKO)

Historical Stock Chart

From May 2024 to Jun 2024

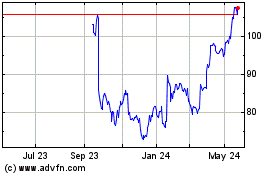

Tko (NYSE:TKO)

Historical Stock Chart

From Jun 2023 to Jun 2024