Current Report Filing (8-k)

April 07 2023 - 5:17PM

Edgar (US Regulatory)

false

0001031029

0001031029

2023-04-03

2023-04-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 3, 2023

StarTek, Inc.

(Exact name of registrant as specified in charter)

|

Delaware

|

|

1-12793

|

|

84-1370538

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

4610 South Ulster Street, Suite 150

Denver, CO 80237

(Address of Principal Executive Offices) (Zip Code)

(303) 262-4500

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

SRT

|

New York Stock Exchange, Inc.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

CCC Sale Transaction

On April 3, 2023, an indirect subsidiary of Startek, Inc. (the “Company”) completed its previously announced sale of the Company’s indirect 51 percent ownership interest in Contact Center Company (“CCC”) to Arabian Internet and Communications Services Company (“Solutions”). CCC was the Company’s joint venture that operated in the Kingdom of Saudi Arabia. The sale transaction was consummated pursuant to that certain Sale and Purchase Agreement dated as of January 11, 2023 (the “Sale and Purchase Agreement”). At the closing of the transactions contemplated by the Sale and Purchase Agreement, Solutions also acquired the remaining 49 percent ownership interest in CCC held by Saudi Telecom Company (“STC”). At closing, the Company received cash proceeds of approximately $68.9 million. Under the Purchase Agreement, the Company will act as a guarantor for the obligations of its indirect subsidiary that owns the Company’s interests in CCC.

The foregoing description of the Sale and Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated into this Item 2.01 by reference. A copy of the Agreement has been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about the parties. In particular, the Agreement contains representations, warranties and covenants that were made as of specific dates and only for the benefit of the parties to the Agreement and are qualified by information included in confidential disclosure schedules. Moreover, certain representations, warranties and covenants in the Agreement were made for the purpose of allocating risk between the parties rather than establishing matters as facts. Accordingly, the representations, warranties and covenants in the Agreement should not be relied upon as characterizations of the actual state of facts about the parties to the agreement.

|

Item 7.01

|

Regulation FD Disclosure

|

On April 3, 2023, the Company issued a press release announcing the completion of the transactions contemplated by the Sale and Purchase Agreement. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(b) Pro Forma Financial Information

On April 3, 2023, an indirect subsidiary of the Company completed its previously announced sale of the Company’s indirect 51 percent ownership interest in CCC to Solutions. The sale transaction was consummated pursuant to the Sale and Purchase Agreement. The Sale and Purchase Agreement provides for a transaction based on an enterprise value for CCC of $120 million (SAR 450 million), on a debt free and cash free basis, to be paid in cash at closing, subject to the adjustments set forth in the Sale and Purchase Agreement. As on April 3, 2023, the Company received cash proceeds of $68.9 million subject to true-up working capital adjustments to the amount paid on the closing date.

The Company’s financial statements included in its Annual Report (Form 10-K) for the year ended December 31, 2022, present the reclassification of CCC’s business as discontinued operations for all periods reported. Accordingly, Net assets of CCC’s business as of December 31,2022 and December 31, 2021 were classified as ‘held for sale’ in the balance sheet and operations of CCC’s business for the year ended December 31, 2022, and December 31, 2021 were classified as ‘discontinued operations’ in Statement of income (loss). The details relating to net assets and operations of CCC’s business were reported separately in note no 3A (on Page no. 38-40) in the Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2023. EPS attributable to Startek shareholders for the year 2022 and 2021 were $(0.06) and $0.04 respectively. After giving the impact of disposal of CCC and pro forma adjustments, EPS attributable to Startek shareholders for the year 2022 and 2021 would have been $(0.11) and $(0.08) respectively.

As a result of this disposition, the Company expects to recognize a pre-tax gain on sale of approximately $15.5 million, subject to true-up working capital adjustments, which would have been recognized in retained earnings in a pro forma balance sheet as of December 31, 2022. The estimated tax impact is approximately $6.6 million, calculated using the applicable statutory income tax rates in effect which are subject to change, which would have been recognized in retained earnings, income taxes payable, and deferred tax liabilities. The Company will apply $55 million of the proceeds received from the disposition towards prepayment of the Company’s senior term loan facility in accordance with the requirements of the facilities agreement governing such senior term loan.

(d) Exhibits

|

Exhibit Number

|

Exhibit Description

|

|

2.1

|

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* Annexes and schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally to the SEC a copy of any omitted annexes and schedules upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

STARTEK, INC.

|

| |

|

| |

|

|

Date: April 7, 2023

|

By:

|

/s/ Nishit Shah

|

| |

|

Nishit Shah

|

| |

|

Chief Financial Officer

|

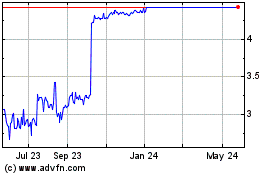

StarTek (NYSE:SRT)

Historical Stock Chart

From Jul 2024 to Aug 2024

StarTek (NYSE:SRT)

Historical Stock Chart

From Aug 2023 to Aug 2024