Ready Capital Announces 103% Increase in SBA 7(a) Loans Year to Date and Names Gary Taylor as CEO of ReadyCap Lending

May 21 2024 - 4:15PM

Ready Capital Corporation (NYSE:RC) (“Ready Capital”) proudly

announces a significant milestone for its non-bank SBA 7(a)

subsidiary, ReadyCap Lending (RCL), as it closed $265.7 million of

SBA 7(a) loans in the first four months of 2024. This achievement

represents a remarkable 103% increase from the same period in the

previous year, underscoring the success of its dual strategy

catering to both large and small loans per SBA guidelines.

In addition to this milestone, RCL is pleased to announce the

appointment of Gary Taylor as its new CEO. With over 25 years of

extensive experience in SBA lending and operations, Mr. Taylor

brings a wealth of knowledge to his new role. He has held senior

positions at reputable institutions such as Lehman Brothers, CIT,

and Newtek. Mr. Taylor's primary focus in his new capacity will be

to spearhead the ongoing growth initiatives at RCL. Notably, RCL

currently holds the prestigious position as the largest non-bank

lender and ranks fourth overall in the industry in terms of both

units and dollars.

Tom Capasse, CEO of Ready Capital, expressed his enthusiasm for

the future, stating, "RC is committed to becoming the most

cost-effective and borrower-friendly originator of SBA loans. We

have set an ambitious yearly volume goal of $1 billion over the

next 12 months and are undergoing some organizational, people, and

process improvements throughout ReadyCap Lending that are critical

to enabling this goal. These strategic changes have been in the

works for some time, and we are now starting to realize the

results."

Furthermore, Mr. Capasse emphasized the strategic importance of

expanding the SBA lending business through additional capital

investment. "Delivering capital efficiently to small businesses is

an essential part of the U.S. economy and serving underserved

borrowers is a key objective of ours. We are continually investing

in the business and utilizing the technology and process efficiency

of our self-contained affiliate, iBusiness Funding, which pursuant

to a Lender Service Provider (LSP) agreement provides lending as a

service as well as its advanced technology platform, LenderAI."

In summary, these developments underscore Ready Capital's

commitment to excellence in SBA lending and its dedication to

driving scalable, cost-effective continued growth and value for its

stakeholders. In a separate development, Ready Capital will

announce the acquisition of Madison One, a leading USDA and SBA

originator.

About Ready Capital CorporationReady Capital

Corporation (NYSE: RC) is a multi-strategy real estate finance

company that originates, acquires, finances and services small- to

medium-sized balance commercial loans. Ready Capital specializes in

loans backed by commercial real estate, including agency

multifamily, investor and bridge as well as U.S. Small Business

Administration loans under its Section 7(a) program. Headquartered

in New York, New York, Ready Capital employs over 600 lending

professionals nationwide.

About iBusiness FundingiBusiness Funding is a

leading provider of lending solutions for banks and lenders of all

sizes with a specialization in SBA lending. The company is

dedicated to streamlining the business lending process to allow

lenders to efficiently deliver capital to small and medium-sized

businesses. iBusiness Funding has processed over $6 billion in SBA

loans to date, and the team processes over 1,200 business loan

applications through its platform daily.

ContactInvestor RelationsReady Capital

Corporation212-257-4666InvestorRelations@readycapital.com

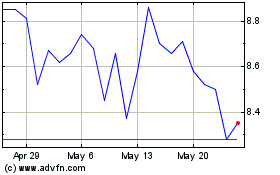

Ready Capital Corporatio... (NYSE:RC)

Historical Stock Chart

From May 2024 to Jun 2024

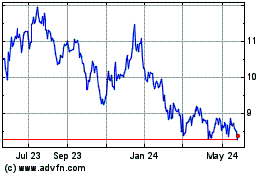

Ready Capital Corporatio... (NYSE:RC)

Historical Stock Chart

From Jun 2023 to Jun 2024