CNO Financial Group Inc. (CNO) announced its

third-quarter 2011 net operating income of $46.5 million or 17

cents per share, at par with the Zacks Consensus Estimate.

Operating earnings for the year-ago quarter were $47.1 million or

16 cents per share.

The reduced income was the result of poor top-line performance

in most business segments. EPS increased due to reduced number of

outstanding shares.

CNO Financial’s net income jumped to $196.0 million or 66 cents

per share, showing an astounding hike from $49.4 million or 17

cents per share in the prior-year quarter.

The results in the reported quarter included a $7.0 million loss

on extinguishment of debt, net of income taxes, on account of

prepayment of $39.5 million under the senior secured credit

agreement and a $9.4 million decrease in earnings due to an

increase in the estimated fair value of embedded derivative

liabilities related to fixed index annuities, net of related

amortization and income taxes.

CNO Financial’s revenues decreased 5.8% to $992.3 million from

$1.1 billion in the prior-year quarter, primarily due to a $54.9

million investment loss from policyholder and re-insurer accounts

and other special purpose portfolios. However, the revenues

exceeded the Zacks Consensus Estimate of $1.03 billion.

Meanwhile, earnings before net realized investment gains,

corporate interest and taxes (EBIT) increased 2% year over year to

$96.1 million, while corporate interest expense decreased to $18.7

million from $20.0 million in the prior year quarter.

Segment-wise, pre-tax operating earnings in the

Bankers Life segment declined 4% to $91.4

million.

Pre-tax earnings for the reported quarter include $14 million of

favorable reserve development in the long-term care business and

Medicare supplement blocks, while that for the year-ago quarter

include $10 million of favorable reserve developments in the

long-term care and Medicare supplement blocks and $6.5 million of

favorable claim developments from PFFS business assumed through

reinsurance agreements with Coventry Health Care

Inc. (CVH).

Washington National’s pre-tax

operating earnings decreased 19% or $5.1 million to $22.1 million,

mainly due to a $6.0 million out-of-period adjustment. Meanwhile

pre-tax operating earnings of Colonial

Penn showed a 4% increase from the prior year

quarter.

However, other CNO businesses reported

earnings of $2.0 million, up $26.4 million from the prior-year

quarter, primarily due to a $13 million improvement in margins in

the interest-sensitive life block, $4.0 million of reduced legal

costs and a $6.0 million write-off of the present value of future

profits related to the segment's long-term care insurance block

taken in 3Q10.

Besides, Corporate Operations, which

include investment advisory subsidiary and corporate expenses,

recorded a $15.2 million increase in expenses from the prior year

quarter, mainly due to the impact of reduced interest rates and

market value fluctuations.

Additionally, net realized investment gains of CNO Financial

stood at $16.6 million (net of related amortization and taxes) in

the reported quarter, which included other-than-temporary

impairment losses of $2.9 million. This compared favorably to net

realized investment gains of $2.3 million (net of related

amortization and taxes) in the prior-year quarter, which included

other-than-temporary impairment losses of $22.8 million.

Financial Update

During the quarter, the consolidated statutory risk-based

capital ratio of CNO Financial’s insurance subsidiaries increased 8

percentage points to 359%, driven by improved asset quality and

statutory earnings of $65.5 million, but partially offset by

dividend payments of $27.4 million to the holding company.

In addition, unrestricted cash and investments held by the

non-insurance subsidiaries decreased $65.1 million to $168.9

million, mainly due to share repurchases, prepayment of debt and

early repayment of senior health note, partly offset by debenture

interest and management and investment fees.

As of September 30, 2011, debt-to-total capital ratio reduced to

18.0% from 20.0% at the end of December 31, 2010. Book value per

common share, excluding accumulated other comprehensive income

(loss) increased to $17.89 from $16.28 at the end of December 31,

2010.

As of September 30, 2011, total assets of CNO Financial were

$32.9 billion and shareholders’ equity was $4.9 billion.

Stock Repurchase Update

During the reported quarter, CNO Financial repurchased 6.6

million shares at an average price of $6.01 under the share

repurchase program announced on May 16, 2011. Under the repurchase

program, CNO Financial can repurchase shares for up to $100 million

over the next two years. The total purchase price amounted to $39.5

million.

Loan Prepayment

During the reported quarter, CNO Financial prepaid $39.5 million

towards the outstanding principal under the Senior Secured Credit

Agreement (SSCA). The terms of SSCA state that principal

pre-payment should be made for an amount equivalent to the amount

spent on share repurchases if the debt-to-total capitalization

ratio is greater than 17.5%.

Additionally, CNO Financial prepaid $25.0 million towards the

amortization of senior health note.

Our Take

While the top-line performance of CNO Financial deteriorated in

most segments, top-line showed substantial growth in the reported

quarter on the basis of investment gains and favorable reserve and

claims releases. Moreover, the financial position of the company

strengthened, as reflected in the improved ratios.

We believe that CNO Financial is fundamentally strong and

efficient deployment of capital is further improving its ratios.

However, the company needs to improve its bottom-line performance

in the coming quarters.

Protective Life Corp. (PL), a competitor of CNO

Financial is expected to announce its second quarter earnings

before the market opens on November 2, 2011.

Currently, CNO Financial carries a Zacks #3 Rank, implying a

short term Hold rating.

CNO FINL GRP (CNO): Free Stock Analysis Report

COVENTRY HLTHCR (CVH): Free Stock Analysis Report

PROTECTIVE LIFE (PL): Free Stock Analysis Report

Zacks Investment Research

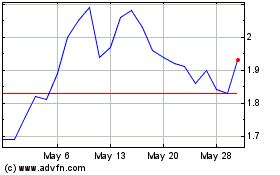

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2024 to Jul 2024

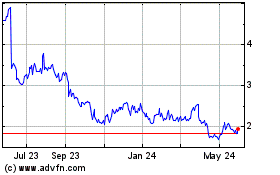

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jul 2023 to Jul 2024