Stock Market News for September 22, 2011 - Market News

September 22 2011 - 5:06AM

Zacks

The Federal Reserve lived up to market expectations, delivering the

economic stimulus package termed ‘Operation Twist.’ But its

acknowledgement of “significant downside risks” to the economy

pulled the benchmarks down to their biggest drop this month. It was

during the final 45 minutes of trading that the markets plunged

sharply with the Dow losing almost 200 points. Traders also

attributed the final-hours fall to investors exiting bets they made

last week and looking for new short positions.

The Dow Jones Industrial

Average (DJIA) slid 283 points or 2.5% to settle at 11,124.84. The

Standard & Poor 500 (S&P 500) plunged 2.9% to finish the

day at 1,166.76. The Nasdaq Composite Index dropped 2% and settled

at 2,538.19. It was a relatively busy day for the Street as

consolidated volumes on the New York Stock Exchange, Amex and

Nasdaq clocked in at 9.12 billion shares, well above the daily

average of 7.91 billion. On the NYSE, decliners outnumbered

advancing stocks by a ratio of 5:1.

As expected, the central

bank announced its plan to swap the short-term debt in its

portfolio with long-term Treasury bonds, mirroring similar measures

in the 1960s. The move that is aimed to cut down on borrowing costs

will have the central bank purchasing $400 billion of Treasury

bonds that range between 6 and 30 years and selling an equal amount

of short-term maturities. Additionally, in a bid to boost the

housing sector, the Fed announced that it would not modify the size

of its mortgage-backed securities portfolio.

However, investors seemed to

have little faith in these plans and believe they will hardly have

an effect on borrowing in a flagging economy. The economy has not

yet been able to recover completely from 2008’s economic collapse

and with domestic and global economies looming large; investor

fears of difficult times ahead seem justified. The Federal Reserve

itself acknowledged the economic weakness saying that is working in

view of “significant downside risks to the economic outlook,

including strains in global financial markets”.

Banking stocks were among

the ones to feel most of the pinch and the Financial Select Sector

SPDR (XLF) fund slid 5.0%. Among the bellwethers, Bank of America

Corporation (NYSE:BAC), The Goldman Sachs Group, Inc. (NYSE:GS),

Morgan Stanley (NYSE:MS), JPMorgan Chase & Co. (NYSE:JPM),

Citigroup, Inc. (NYSE:C), Wells Fargo & Company (NYSE:WFC) and

U.S. Bancorp (NYSE:USB) plunged 7.5%, 4.6%, 8.6%, 5.9%, 5.2%, 3.9%

and 5.1%, respectively. Amidst these tensions, Moody's Corp.

(NYSE:MCO) downgraded Bank of America, Wells Fargo and Citigroup’s

debt ratings. On the European front, Italian banks also faced

trouble after Standard & Poor’s downgraded seven Italian banks’

credit rating on Wednesday.

Insurers also received a

battering yesterday, as the historically low interest rate is

likely to hurt their investment portfolios. Among the decliners

were Lincoln National Corp. (NYSE:LNC), National Western Life

Insurance Company (NASDAQ:NWLI), StanCorp Financial Group Inc.

(NYSE:SFG) and Protective Life Corp. (NYSE:PL) and they declined by

8.4%, 2.3%, 5.4% and 4.1%, respectively.

While all eyes remained

fixed on the Federal Reserve’s announcement, data about a surge in

the existing-home sales in August was hardly factored in. According

to the National Association of Realtors: “Total existing-home

sales1, which are completed transactions that include

single-family, townhomes, condominiums and co-ops, rose 7.7 percent

to a seasonally adjusted annual rate of 5.03 million in August from

an upwardly revised 4.67 million in July, and are 18.6 percent

higher than the 4.24 million unit level in August 2010”. “Some of

the improvement in August may result from sales that were delayed

in preceding months, but favorable affordability conditions and

rising rents are underlying motivations,” noted Lawrence Yun, NAR

chief economist.

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

GOLDMAN SACHS (GS): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

LINCOLN NATL-IN (LNC): Free Stock Analysis Report

MOODYS CORP (MCO): Free Stock Analysis Report

MORGAN STANLEY (MS): Free Stock Analysis Report

PROTECTIVE LIFE (PL): Free Stock Analysis Report

STANCORP FNL CP (SFG): Free Stock Analysis Report

US BANCORP (USB): Free Stock Analysis Report

WELLS FARGO-NEW (WFC): Free Stock Analysis Report

Zacks Investment Research

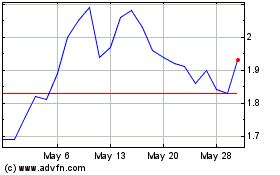

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2024 to Jun 2024

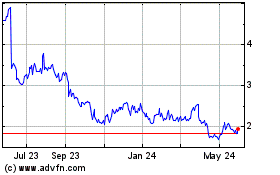

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2023 to Jun 2024