A.M. Best Revises Outlook to Stable for Protective Life Corporation and Its Subsidiaries

December 21 2010 - 2:47PM

Business Wire

A.M. Best Co. has revised the outlook to stable from

negative and affirmed the financial strength rating (FSR) of A+

(Superior) and issuer credit ratings (ICR) of “aa-” of the primary

life/health subsidiaries of Protective Life Corporation

(Protective) (Wilmington, DE) (NYSE: PL), led by Protective Life

Insurance Company (PLIC) (Brentwood, TN). Additionally, A.M.

Best has revised the outlook to stable from negative and affirmed

the ICR of “a-” of Protective, as well as the debt ratings of

Protective and PLIC. (See link below for a detailed listing of the

companies and ratings.)

The revised outlook reflects the significant improvement in

Protective’s risk-adjusted capitalization and net earnings during

2009 and into 2010 after experiencing a significant decline in

2008, concurrent with the financial market crisis. Historically,

Protective has relied on capital market securitizations to fund

excess statutory reserves. Due to global financial stresses, which

effectively shut down the securitization markets in 2008,

Protective was forced to internally fund the excess reserves that

suppressed its regulatory capital ratio and limited its growth. As

the credit markets have reopened, Protective has financed virtually

all of its term insurance reserves as of year-end 2010. Going

forward, Protective has designed alternative universal life

products.

The ratings reflect Protective’s diversified revenue and profit

sources, broad distribution capabilities and strong track record of

effectively integrating acquired insurance companies and blocks of

business. The ratings also acknowledge Protective’s seasoned block

of traditional life insurance as a stabilizing factor for its

earnings.

Protective reported GAAP net income of $181.6 million for the

period ending September 30, 2010, after reporting net income of

$271.5 million for 2009. Although Protective reported a GAAP net

loss of approximately $42 million for 2008, A.M. Best notes that

Protective’s business mix of primarily traditional life insurance

provides for greater earnings stability than other companies with

large equity market exposures. The stable, recurring premiums

associated with Protective’s seasoned block of life business are a

source of strength, and the block contains significant embedded

profits. In addition, Protective’s acquisitions have increased its

earnings and have allowed the company to enter new markets and

realize certain operating efficiencies.

Protective recently announced that it has agreed to terms on two

acquisitions (purchase of United Investors and coinsurance of

Liberty Life), in which it will invest a total of more than $500

million of internal capital. The acquisitions will be immediately

accretive to earnings and provide $60-$80 million per year in

incremental pre-tax income. Initially, the internal capital

invested to acquire the businesses will lower Protective’s

risk-adjusted capitalization. However, A.M. Best projects that

Protective’s capitalization ratio post-closing will be supportive

of its ratings and that the new earnings stream will return

approximately 40% of the invested capital within two years.

Offsetting these positive rating factors is Protective’s level

of below investment grade holdings in its fixed income portfolio.

As a result of rating downgrades, below investment grade holdings

have increased from 5.4% as of year-end 2008 to 13.6% as of

September 30, 2010. In particular, 54% of Protective’s $3.4 billion

residential mortgaged-backed securities (RMBS) portfolio was rated

below investment grade as of September 30, 2010. However, A.M. Best

notes that over 99% of the RMBS portfolio is invested in super

senior or senior tranches that possess significant credit

enhancement within the deal structure. Also, the RMBS portfolio is

supported almost entirely by fixed-rate loan collateral, has a

relatively short average life (the weighted average life is less

than 2.5 years) and has limited or no exposure to subprime,

hybrids, option-arms and subordinated RMBS tranches. In addition,

Protective’s overall investment portfolio was in a $1.3 billion net

unrealized gain position as of September 30, 2010 (GAAP basis,

before tax and deferred acquisition costs), and credit impairment

losses (recognized in income) have fallen to $35 million for the

first nine months of 2010 from $312 million during 2008.

While Protective’s interest coverage ratio remains more than

adequate for its ratings, the ratio has decreased from its

historical range of 8 times to 10 times as a result of the current

level of financial leverage. Protective’s all-in financial

leverage—senior debt plus hybrids—is approximately 40% (excluding

other comprehensive income). However, Protective’s financial

leverage falls to 29% (excluding other comprehensive income) after

applying operating leverage treatment to the $800 million of senior

notes issued in October of 2009 for purposes of refinancing one of

its existing securitization transactions (see related press release

dated October 9, 2009).

For a complete listing of Protective Life Corporation and its

subsidiaries’ FSRs, ICRs and debt ratings, please visit

www.ambest.com/press/122115protective.pdf.

The principal methodology used in determining these ratings is

Best’s Credit Rating Methodology -- Global Life and Non-Life

Insurance Edition, which provides a

comprehensive explanation of A.M. Best’s rating process and

highlights the different rating criteria employed. Additional key

criteria utilized include: “Risk Management and the Rating Process

for Insurance Companies”; “Understanding BCAR for Life and Health

Insurers”; “Review of BCAR Treatment for XXX Captives”; “A.M.

Best’s Perspective on Operating Leverage”; “Rating Members of

Insurance Groups”; “A.M. Best’s Ratings & the Treatment of

Debt”; and “Rating Funding Agreement-Backed Securities.”

Methodologies can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world's oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2010 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

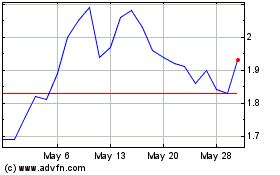

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Apr 2024 to May 2024

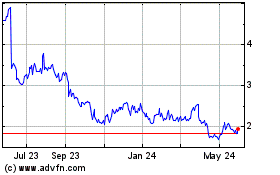

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2023 to May 2024